Leverage

- 2. The concept that is used to study the effect of various mix of debt and equity on the share holder’s return and the risk in the capital structure of a firm is known as leverage. Leverage means the employment of assets or funds for which a firm pays a fixed cost or fixed return. The fixed cost or fixed return may be thought of as the fulcrum of a lever.

- 3. Operating leverage The extent of fixed cost in operating activity of a firm determines the operating leverage It is the firms ability to use fixed cost assets to magnify the effect of changes in the sales in operating profit or earning before interest or tax (EBIT)

- 4. Computation of operating leverage Operating leverage= contribution/operating profits or OL = C / EBIT OL= S – VC / C – FC Degree of operating profit (DOL) = % change in profit/ % change in sales

- 5. Characteristic Related to assets side of balance sheet Related to breakeven point Related to selling price and variable cost Business risk UTILITY OL Profit planning Capital structure planning

- 6. Financial leverage The firms ability to use fixed financial cost to magnify the effect of changes in earnings before interest and tax on firms earning per share. The principle of financial leverage analyses the effect of change in EBIT on firms EPS due to the use of fixed cost bearing sources of capital in its capital structure.

- 7. computation FL = operating profit or EBIT / Earning before tax but after interest FL = EBIT / EBT or EBIT / EBIT – I Degree of FL (DFL) = % change in EPS / % change in EBIT

- 8. Combined or composite leverage Combined leverage = OL x FL DEGREE OF COMOSITE LEVRAGE DCL = DOL x DFL

- 9. Capital structure It refers to the combination or mixed of debts and equity which a company uses to finance its long term operations

- 10. Factors influencing capital structure internal factors- Size of business Nature of business Regularity of income Assets structure Age of firm Desire to control Future plan Period & purpose of financing Operating ratio Trading on equity

- 11. External factors Capital market conditions Nature of investor Policy of financial institutions Taxation Government control Cost of capital Seasonal variances Economic fluctuations Nature of competitions

- 12. Essential of sound capital structure Minimum cost of capital Minimum risk Maximum return Maximum control Safety Simplicity Flexibility Alternative rules Legal requirement

- 13. Theories of capital structure Net income theory Net operating income theory Traditional theory Modigliani- Miller theory

- 14. Net income theory It was invented by DAVID DURAND If a firm can increase the value of the firms and reduce the overall cost of capital by increasing the proportion of debt in its capital structure to the maximum possible extent. Assumption The cost of debt is cheaper than the cost of equity Income tax has been ignored The cost of debt capital and cost of equity capital remain constant

- 15. Total value of firm = market value of equity + market value of debt Ko = earning / value of the firm Or Ko = EBIT / V

- 16. Net operating income theory It was also propounded by DAVID DURAND The total market value of the firm (v) is not affected by the change in the capital structure and the overall cost of capital (Ko) remains fixed irrespective of the debt- equity mix V = net operating income/ overall cost of capital V = EBIT / Ko

- 17. ASSUMPTION The split of total capitalization between debt and equity is not essential The business risk at all level of business remain constant Debt capitalization rate is constant The corporate income tax does not exist

- 18. Traditional theory Propound by Ezra Soloman Debt is the cheap source of fund as compared to equity. There for a firm can reduce its overall cost of capital and or increase the total value of the firm by increasing the debt proportion in its capital structure to a certain limit

- 19. Modigliani- Miller theory Franco Modigliani and Merton Miller (M-M) both Nobel prize winner in financial economic have propounded the capital structure theory

- 20. Cost of capital It is define d as the minimum rate of return a firm must earn on its investment in order to satisfy investors and to maintain its market value

- 21. Factor affecting Nature of business Requirement of the firm Attitude of management Risk free rate of interest Decision of financing mix Business risk and financial risk

- 22. Classification Historical cost and future cost Specific cost and composite cost Average cost and marginal cost Explicit cost and implicit cost

- 23. Assumptions The cost can be either explicit or implicit The financial and business risk are not affected by investing in new investment Firms capital structure remain unchanged Cost of capital is determined after tax

- 24. Cost of debt capital Net proceed= At par = par value – flotation cost At premium = par value+ premium- flotation cost At discount = par value- discount- flotation cost

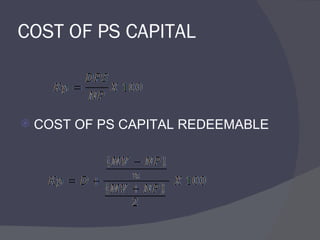

- 25. COST OF PS CAPITAL COST OF PS CAPITAL REDEEMABLE