Long term debt

- 1. Long Term Debt Presented By: Adwitiya Gupta MBA 3rd Semester

- 2. The Capital Markets • A Place for trade of financial securities like bonds, stocks, etc. by individuals and institutions. • Helps • Consists of primary markets and secondary markets • Another important division is based on nature of securities traded, i.e. stock market and bond market.

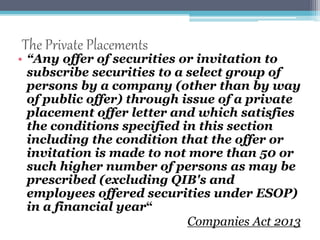

- 3. The Private Placements • “Any offer of securities or invitation to subscribe securities to a select group of persons by a company (other than by way of public offer) through issue of a private placement offer letter and which satisfies the conditions specified in this section including the condition that the offer or invitation is made to not more than 50 or such higher number of persons as may be prescribed (excluding QIB's and employees offered securities under ESOP) in a financial year“ Companies Act 2013

- 4. Contd.. • The issue is sold directly to a small number of banks, insurance companies, or other investment institutions. • Privately placed bonds cannot be resold to individual but only to other qualified institutional investors. • Custom Tailored debt issues and significantly less cost

- 5. Commercial Papers • Large well-known companies issue their own short-term unsecured notes known as commercial paper (CP). • Financial institutions, such as bank holding companies and finance companies, also issue commercial paper, sometimes in very large quantities. • Maximum maturity is of nine months though most paper is for 60 days or less. • There is also a market for asset-backed commercial paper here the company sells its assets to a special-purpose vehicle that then issues the paper.

- 6. Corporate Bonds • It is a bond that a corporation issues to raise money effectively in order to expand its business • Longer-term debt instruments, generally with a maturity date falling at least a year after their issue date. • Often listed on major exchanges so these are also called listed bonds • Have a higher risk of default

- 7. Medium term Notes • A debt note that usually matures in 5–10 years, but the term may be less than one year or as long as 100 years. • Unsecured promissory notes placed through dealer and have fixed rate of interest • These are the hybrids of commercial papers and corporate bonds- they are relatively long-term instruments like bonds and like bonds these are not underwritten but are sold on a regular basis either through dealers.

- 9. THANK YOU