Managing Through COVID-19

- 1. 4/3/2020 1 Webinar Audio: You can dial the telephone numbers located on your webinar panel. Or listen in using your headphones or computer speakers. Coping with COVID-19 - Keeping the workplace moving We will begin shortly. Welcome! Live Webinar: • Presentation is roughly an hour and a half • All phone lines are muted • If anyone has any questions during this webinar – please type them in your Questions Box located at the bottom of your webinar panel Webinar Details 1 2

- 2. 4/3/2020 2 Lynda Dixon, CPA, CGMA Net at Work| Business Analyst Employer Solutions Presenters Stephanie Leimeister Net at Work | Business Analyst Employer Solutions Why we are here today? The COVID-19 virus All of us will be affected in some way whether it is our jobs, a family member’s job or how we live day to day. 3 4

- 3. 4/3/2020 3 • All Businesses large and small are feeling the strain • Many employees in your company will be affected • Make sure you are prepared for the coming weeks • Payroll Continuity is a non-negotiable action • We at Net at Work are here for you Agenda Agenda: • Telework – Best Practices for a Remote Workforce • New Legislative Updates • FFCRA • CARES • HR Regulations – ADA / FMLA / I-9 • Employee Data and Reporting 5 6

- 4. 4/3/2020 4 Telework Best Practices for a Remote Workforce Harold G. Ford III SHRM-SCP, SPHR Consulting Manager Employer Solutions Net at Work Presenters Tyler Bower Director of Cloud and Hosting Services Cloud at Work Ralph Serzo IT Service and Operations Manager Net at Work 7 8

- 5. 4/3/2020 5 Best Practices for a Remote Workforce • Agenda: • HR Best Practices • Strategies to Secure Your Team • Cloud vs. On-Premise • Five Tips for Employees HR Best Practices • Review Policies and Procedures • Changes due to COVID-19 • Employee Guidelines • Review HR Regulations • FLSA • ADA • FMLA • OSHA • Review Regulatory Changes • FFCRA • CARES Act • State/Local 9 10

- 6. 4/3/2020 6 HR Best Practices • Align Employees with Business Strategy • Reiterate Mission & Vision • Share Goals/Objectives • Short and Long Term • Identify Employee’s Role in Strategy • Productivity • Engagement HR Best Practices • Review Job Duties / Tasks • Assess Team for Telework Traits • Independent Worker • Well-Organized • Self-Motivated • Ability to Prioritize • Adaptable • Collaborative • Results-Oriented • Provide Training • Cross-Train • Knowledge Transfer 11 12

- 7. 4/3/2020 7 HR Best Practices • Address Challenges • Anxiety & Stress • Culture Shift • Telework Adoption • Conflict • Provide Proactive Communication • Accurate, Credible Information • Updates from Leadership team • Announce Successes • Keep Positive Culture HR Best Practices • Partner with IT to ensure World Class Telework • Hardware • Software • Accessibility • Security • Virtual Presence • Training • Helpdesk Support 13 14

- 8. 4/3/2020 8 Telework Securing Remote Workforce Securing Remote Workforce Volume and sophistication of socially engineered attacks increasing—playing on fears, panic, and emotional stress Technology departments are losing control of end-user environments—workstations missing critical software, patches, and proactive toolsets found on most corporate equipment Home-based users may not have company issued devices with sophisticated security configurations Ready or not: BYOD devices must connect to your network and your sensitive data Cybersecurity unpreparedness catching many off-guard Privacy implications now front and center as more employee- owned devices connect to business networks 15 16

- 9. 4/3/2020 9 10 Strategies to Secure your Team 1. Remind your team about email scams: Check twice before clicking a link Be suspicious of all unexpected attachments 2. Implement Multifactor Authentication 3. Standardize your password policy and require complexity 4. Educate employees on the types of company data that should be secured or encrypted 10 Strategies to Secure your Team 5. Run a risk assessment on your employee’s home setup: Security Patches Up to Date Antivirus Installed Firewall Configured 6. Secure privileged user accounts on all systems 7. Provide telework users with security tools for their home devices and networks 17 18

- 10. 4/3/2020 10 Cloud Five Tips to Telework April 6th, 2pm ET To help protect your privacy, PowerPoint has blocked automatic download of this picture. To help protect your privacy, PowerPoint has blocked automatic download of this picture. Tyler Bower Director of Cloud and Hosting Services Cloud at Work Ralph Serzo IT Service and Operations Manager Net at Work To help protect your privacy, PowerPoint has blocked automatic download of this picture. Rob Levin Chairman Work Better Now 19 20

- 11. 4/3/2020 11 Telework Five Tips for Employees Telework – Five Tips for Employees 1. Separate your Living Space and Workspace • Define your Workspace • Privacy • Webcam Background • Optimize your Workspace • Hardware/Software • Communication • Office Supplies • Make it Comfortable! • Have Boundaries • Time Block without Interruptions • Green Light / Red Light 21 22

- 12. 4/3/2020 12 Telework – Five Tips for Employees 2. Technology • Great Internet Connectivity • Programs, Utilities, Tools • Communication / Collaboration • Time Tracking • BYOD • Security • Technology Training Telework – Five Tips for Employees 3. Prioritize Work • Organize Your Day • Set Daily Goals • Focus on Results • Important vs. Urgent • Manage Your Time • Be Consistent • Understand Manager Expectations • Daily Pulse Check • Monitor Performance • Evaluate Success • Share Progress 23 24

- 13. 4/3/2020 13 Telework – Five Tips for Employees 4. Communicate Constantly • Rely on Always-On Technology • Increase One-on-One’s • Participate in Virtual Team Huddles • Establish Agenda • Keep Minutes • Record Meetings • Document and Share • Be Transparent Telework – Five Tips for Employees 5. Take Break • Telework Wellness • Take Breaks • Eye Rest (20-20-20) • Stand, Stretch • Go Outside • Pulse Check with your “Home Team” • Know When to End the Day • Have Virtual Water Cooler Meetings 25 26

- 14. 4/3/2020 14 Telework – Five Tips for Employees Legislative Update 27 28

- 15. 4/3/2020 15 FFCRA Families First Coronavirus Response Act (H.R. 6201) – Quick Review “…provides small and midsize employers refundable tax credits that reimburse them, dollar-for-dollar, for the cost of providing paid sick and family leave wages to their employees for leave related to COVID-19.” • Passed in House 03/14/20 • Three Employer Requirements/Provisions: • Emergency Paid Sick Leave Act • Emergency Family and Medical Leave Expansion Act • Future Government Tax Credits for Paid Sick and Paid FMLA Act https://www.netatwork.com/resource/?rc=hrms-2 FFCRA • Emergency Paid Sick Leave • Employers with fewer than 500 employees • Some employers under 50 employees exempt • COVID-19 Related Leave • Personal • Family • Up to two weeks paid sick leave • Full-Time – 80 hours • Part-Time – hours the employee works in 2 weeks * Employers are not permitted to modify existing paid leave policies to avoid providing additional sick time. 29 30

- 16. 4/3/2020 16 FFCRA • Emergency Family and Medical Leave Expansion Act • Up to an additional 10 weeks of paid leave • All Employers with fewer than 500 employees • Including under 50 employees • Amends FMLA to include Public Health Emergency • Eligible after 30 days of hire • Paid Leave – No less than 2/3rds regular rate • Expands definition of family member • Job restoration provisions • Over 25 employees – full restoration • Under 25 employees – see provisions FFCRA • Qualifying Reasons - Employee is unable to work or telework 1. is subject to a Federal, State, or local quarantine or isolation order related to COVID-19; 2. has been advised by a health care provider to self-quarantine related to COVID-19; 3. is experiencing COVID-19 symptoms and is seeking a medical diagnosis; 4. is caring for an individual subject to an order described in (1) or self- quarantine as described in (2); 5. is caring for a child whose school or place of care is closed (or child care provider is unavailable) for reasons related to COVID-19; or 6. is experiencing any other substantially-similar condition specified by the Secretary of Health and Human Services, in consultation with the Secretaries of Labor and Treasury. 31 32

- 17. 4/3/2020 17 FFCRA • New Earning Codes are needed • EFMLA • EPSLA • EPSLO • Handout in Webinar Resources – Creating Codes in Sage HRMS and Abra Suite for COVID-19 Sage HRMS – New Earnings Codes for Tax Credits • New Tax Codes are needed • CVIDSS • CVIDMD • Set up in Local Taxes • Handout in Webinar Resources – HR6201 Families First Coronavirus Response Act SS and Medicare Taxes.docx Sage HRMS – New Taxes for Tax Credits 33 34

- 18. 4/3/2020 18 Links to IRS and Department of Labor FAQ pages https://www.irs.gov/newsroom/covid-19-related-tax-credits-for- required-paid-leave-provided-by-small-and-midsize-businesses- faqs https://www.dol.gov/agencies/whd/pandemic/ffcra-questions FFCRA FFCRA What Businesses are Affected? • Businesses and Tax-Exempt Organizations with fewer than 500 employees (IRS FAQ 16) • At the time the leave will be taken • Full and part time (DOL FAQ 2) • Includes employees on leave • Temporary employees • Employees supplied by a temporary agency • Does not include independent contractors • Integrated Employer Test under FMLA 35 36

- 19. 4/3/2020 19 FFCRA Businesses with fewer than 50 employees (DOL FAW 58 & 59) • Child care-related paid leave and expanded FMLA • Jeopardize the viability of business as a going concern exemption Authorized officer of the business must determine • Result in expenses exceeding revenue and cause business to cease operating at a minimal capacity, • The specialized skills, business knowledge, responsibilities of this/these employee(s) are required to support the operational capacities, or • Not sufficient workers available to operate at a minimum capacity Intermittent Leave & Telework (DOL FAQ 17-22) • As the employer, you do not have to agree to flexible arrangements and intermittent leave • However • The Department encourages employers and employees to collaborate to achieve flexibility and meet mutual needs, and the Department is supportive of such voluntary arrangements that combine telework and intermittent leave. FFCRA 37 38

- 20. 4/3/2020 20 Substantiation of Eligibility for Sick Leave or Family Leave Credits Employee Written Request (IRS-FAQ 44) • Employee Name • Date/Dates for which leave is requested • Statement of the COVID-19 reason with written support for that reason • Statement that the employee is unable to work, or telework based on that reason • Name and relation to employee • School and age of child(ren) if applicable • Statement that no other person will provide care • If over age 14 statement of special circumstances • For Quarantine related leave - Statement from Agency or Health Professional FFCRA Additional Employer documentation (IRS-FAQ 45) • How the leave wages were computed • Records of work, telework • Calculations for Qualified Health Plan Expenses • Copies of submitted Forms 7200, Advance of Employer Credits Due to COVID-19 • Copies of submitted Forms 941 Document Retention • Four Years after tax due or paid (whichever comes later) (IRS-FAQ 46) • Both approved and unapproved requests FFCRA 39 40

- 21. 4/3/2020 21 Qualified Health Plan Expenses (IRS FAQ 31) • Employer Cost • Employee Cost Paid with Pre-Tax salary reduction contributions • Cost paid with after tax contribution is not eligible • HRA/ health FSA - amount specific to a particular employee • Does not include employer contributions to HSAs, Archer MSA, QSEHRA • Compute Qualified Costs for each plan separately FFCRA Fully-Insured - any reasonable method to determine & allocate plan expenses (IRS- FAQ 33) Options for Calculations • COBRA premium applicable for the employee • One Average premium rate for all employees • Substantially similar method taking into account employee only vs other than employee only coverage FFCRA 41 42

- 22. 4/3/2020 22 Example: An Eligible Employer sponsors an insured group health plan that covers 400 employees, some with self-only coverage and some with family coverage. Each employee is expected to have 260 work days a year. (Five days a week for 52 weeks.) The employees contribute a portion of their premium by pre-tax salary reduction, with different amounts for self-only and family. The total annual premium for the 400 employees is $5.2 million. (This includes both the amount paid by the Eligible Employer and the amounts paid by employees through salary reduction.) FFCRA For an Eligible Employer using one average premium rate for all employees, the average annual premium rate is $5.2 million divided by 400, or $13,000. For each employee expected to have 260 work days a year, this results in a daily average premium rate equal to $13,000 divided by 260, or $50. That $50 is the amount of qualified health expenses allocated to each day of paid sick or family leave per employee. FFCRA 43 44

- 23. 4/3/2020 23 Self Insured Plans - any reasonable method to determine & allocate plan expenses (IRS-FAQ 34) • COBRA • Any reasonable actuarial method FFCRA How to claim the credits (IRS FAQ 37) Total qualified leave wages and related credits reported on Form 941 • Reduce amount of Federal Tax Deposit • Tax deposit reduced does not have to include these wages (IRS FAQ 38) • Must be in the same quarter • No Double Benefit Allowed (IRS FAQ 52) • Example • $5000 Leave wages paid • Tax Deposit Due = $8000 • Employer keeps $5000 • Employer makes Tax Deposit for $3000 FFCRA 45 46

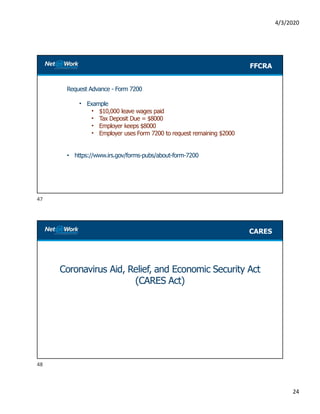

- 24. 4/3/2020 24 Request Advance - Form 7200 • Example • $10,000 leave wages paid • Tax Deposit Due = $8000 • Employer keeps $8000 • Employer uses Form 7200 to request remaining $2000 • https://www.irs.gov/forms-pubs/about-form-7200 FFCRA Coronavirus Aid, Relief, and Economic Security Act (CARES Act) CARES 47 48

- 25. 4/3/2020 25 Specific industries • Air Carriers, Cargo Air Carriers, businesses critical to national security • Federal Reserve Activities • Mid-Sized Businesses • Between 500-10,000 employees • Six month grace with interest cap of 2% • Government Relief CARES • Healthcare Emergency Fund • Public Health and Social Services Emergency Fund • Health care related expense or lost revenues • Construction of temporary structures, leasing properties, medical supplies and equipment including PPE and testing supplies, increased workforce and trainings, emergency operation centers, retrofitting facilities, surge capacity • Medicare Reimbursements • Medical Supplies as related to national stockpile CARES 49 50

- 26. 4/3/2020 26 Paycheck Protection Program (PPP) Small Business Act section 7(a) • Provide loans to small businesses from participating banks • Community Banks • Also online Funding Payroll, Rent, Mortgages, Utilities, Debt Obligations Loan size lesser of $10 million and 250% of average monthly payroll CARES SBA defined "small business concerns" and other businesses with 500 or fewer employees (includes both full and part time workers SBA employer affiliation rules apply No personal guarantees or collateral support Loans may be forgiven when used for period February 15 through June 30, 2020 Subject to decreases in employee headcount and wages (greater than 25%) Employee's compensation in excess of $100,000 is excluded from forgiveness Portion not forgiven repaid over term up to 10 years with an interest cap of 4% Restrictions on share repurchases, dividend payments, and executive compensation CARES 51 52

- 27. 4/3/2020 27 Grant $10,000 Grant - SBA Economic Injury Disaster Loan (EIDL) program Do not have to receive EIDL funding CARES Early Distributions from Retirement Plans • Waiving the 10% penalty up to $100,000 distributions • Qualified plan loans increased from $50,000 to $100,000 and from 50% of vested balance to 100% • Repayments on outstanding loans may be delayed for up to a year • Required Minimum Distributions for 2020 are not required CARES 53 54

- 28. 4/3/2020 28 Taxes Payroll tax credits • FFRCA • Employee Retention Credit Payroll Tax Payment Delay Delay paying the Employer's share of Social Security • One-half can be delayed until December 31, 2021 • The other half can be delayed until December 31, 2022 NOLs - carryback rules Excess Business Loss caps CARES Employment Pandemic Emergency Unemployment Compensation • Additional $600 per week until July 31, 2020 • Expands to include (not exhaustive list) • GIG workers • Self-employed • Part-time • Those without sufficient work history CARES 55 56

- 29. 4/3/2020 29 Employee Retention Credit for Employer Subject to Closure Due to COVID-19 Credit against employer portion of social security 50% of qualified wages plus qualified health plan expenses Available to all employers regardless of size Exceptions - state & local government Business who take Small Business Loans • https://www.irs.gov/newsroom/irs-employee-retention-credit-available-for-many-businesses- financially-impacted-by-covid-19 • https://home.treasury.gov/news/press-releases/sm962 CARES Due to Government closure order resulting in partial or full suspension of business, or Gross receipts for 1st Quarter 2020 are reduced by 50% over same quarter last year and continuing until the calendar quarter in which the business' gross receipts are greater than 80% year over year. Cap of $5000 per employee (50% of qualified wages of $10,000 Wages paid after March 12, 2020 and before January 1, 2021 are eligible CARES 57 58

- 30. 4/3/2020 30 Based on average employees in 2019 Less than 100, credit based on all employees whether or not they worked More than 100, credit is based on wages paid to non-working employees Reduce federal payroll tax deposit or request advance on Form 7200, Advance Payment of Employer Credits Due to COVID-19 This is instead of the SBA EIDL If you take the forgivable loan you don't get this credit Calculated each quarter No double dipping for the same wages CARES HR Regulations ADA / FMLA / I-9 59 60

- 31. 4/3/2020 31 • Americans with Disabilities Act – March 19th Updates The EEOC has provided guidance in a publication entitled Pandemic Preparedness in the Workplace and the Americans With Disabilities Act, that can help employers implement strategies to navigate the impact of COVID- 19 in the workplace. It has been updated to address examples and focus on implementing strategies for keeping workplaces safes during the COVID-19 pandemic. Some of the updates include: • Employers can send an employee home with COVID-19 or symptoms associated with it. • Employers may ask employees who report feeling ill questions about their symptoms to determine if they may have COVID-19. • Employers may measure employees’ body temperature. ADA • Americans with Disabilities Act – March 19th Updates • Employers should continue to provide reasonable accommodations for employees and address new requests as soon as possible. • Employers may screen job applicants for symptoms of COVID-19 after making a conditional job offer. • Employers are allowed to take an applicant’s temperature as part of a post-offer • Employers may delay the start date of an applicant who has COVID-19 or associated symptoms. The job offer may also be withdrawn if the start date needs to be immediate and the individual cannot safely begin working due to COVID-19. ADA 61 62

- 32. 4/3/2020 32 FMLA/FFCRA • Emergency Family and Medical Leave Expansion Act • Up to an additional 10 weeks of paid leave • All Employers with fewer than 500 employees • Including under 50 employees • Amends FMLA to include Public Health Emergency • Eligible after 30 days of hire • Paid Leave – Not less than 2/3 regular rate, $200/day cap • Expands definition of family member • Job restoration provisions • Over 25 employees – full restoration • Under 25 employees – see provisions I-9 Review Requirement Changes - Effective March 20th The U.S. Department of Homeland Security (DHS) has announced that it will relieve employers from having to review Form I-9 documents in-person with new employees. The change applies to employers and workplaces that are operating completely remotely. Physical Documentation review will not be excused if the employee is working onsite. Make sure to document the reason for the physical inspection delay as “COVID-19” in the Section 2 additional information field . Once normal operations start up again all employees onboarded using remote verification must report to their employer within three business days for in-person verification of their identity and eligibility documentation. When the documents have been physically inspected, make sure to update the files to read "documents physically examined" with the date of inspection in the Section 2 additional information field. These changes may be implemented by employers for a period of 60 days or within 3 days of the National Emergency being lifted. I-9 Review 63 64

- 33. 4/3/2020 33 Employee Data & Reporting • Employee Data Considerations • Will employees be placed on LOA, reduced hours, or listed as terminated? • Who qualifies as Part time vs Full Time? • Have new earnings codes for leaves been defined? • How will you determine critical positions and functions? • How will backup staff skilled for specific jobs be identified in the system? • How will employees working remotely be identified? Employee Data 65 66

- 34. 4/3/2020 34 • Reporting Needs • Tax Credits - paid sick leave/EMFLA, ER Federal taxes, ER medical insurance • SBA Loans – FTE employees & wages paid • Part Time workers - calculations for average hours and wages • Tracking employees – leaves of absence, furloughed, employee types • Unemployment - filing for attached workers • Management – employee job titles, skills, seniority Reporting • Employee Earnings/Deductions/Taxes Report Reporting 67 68

- 35. 4/3/2020 35 • Summary Earnings/Deductions/Taxes Report Reporting • Employee Earnings/Deductions/Taxes Export to Excel Reporting Empno Employee Name Ck Date Ck Num Cat Code Hrs/Qty EEAmt EEWages ERAmt ERWages TxWages TxWagLim 021 Kahill, Nancy 2 HOLH 1,600.00 17,089.30 0.00 0.00 0.00 0.00 0.00 021 Kahill, Nancy 2 REG 1,600.00 18,782.70 0.00 0.00 0.00 0.00 0.00 021 Kahill, Nancy 4 401K 0.00 259.20 18,782.70 259.20 18,782.70 0.00 0.00 021 Kahill, Nancy 4 ADD 0.00 12.90 0.00 65.50 0.00 0.00 0.00 021 Kahill, Nancy 4 GTL 0.00 6.30 0.00 28.60 0.00 0.00 0.00 021 Kahill, Nancy 4 LIFE 0.00 5.60 0.00 31.30 0.00 0.00 0.00 021 Kahill, Nancy 4 LTD 0.00 6.90 0.00 69.20 0.00 0.00 0.00 021 Kahill, Nancy 7 USFIT 0.00 7,043.10 35,612.80 0.00 0.00 35,612.80 0.00 021 Kahill, Nancy 7 USFUTA 0.00 0.00 0.00 140.00 7,000.00 35,872.00 7,000.00 021 Kahill, Nancy 7 USMED 0.00 520.10 35,872.00 520.10 35,872.00 35,872.00 0.00 021 Kahill, Nancy 7 USSS 0.00 2,224.10 35,872.00 2,224.10 35,872.00 0.00 35,872.00 021 Kahill, Nancy 8 CASIT 0.00 2,417.20 35,872.00 0.00 0.00 35,872.00 0.00 021 Kahill, Nancy 8 CASUTA 0.00 0.00 0.00 238.00 7,000.00 35,872.00 7,000.00 021 Kahill, Nancy 10 CA0001 0.00 0.00 0.00 5.40 35,872.00 35,872.00 35,872.00 69 70

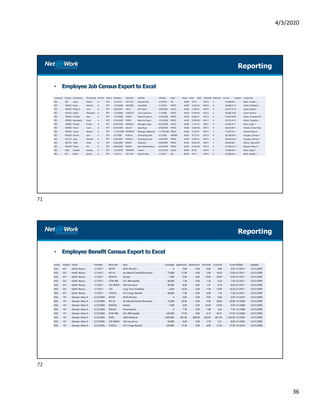

- 36. 4/3/2020 36 • Employee Job Census Export to Excel Reporting Company Empno Last Name First Name Act/Ter Status Hiredate JobCode JobTitle JobDate Dept Hours Rate Shift SalGrade Sal/Hour Annual Exempt Supervisor DEC 042 Jones Adrian A RFT 1/1/2010 PAY CLK Payroll Clerk 1/1/2010 HR 80.00 19.75 EW15 S 41,080.00 Y Black, Joseph L DEC 100020 Bryan Marilyn A RFT 1/10/2008 ASSEMB Assembler 1/1/2010 PROD 40.00 12.82 M1 NH15 H 26,668.51 N Dolite, Theodore DEC 100050 Haley III John A RFT 3/28/2007 APCL1 A/P Clerk I 3/28/2007 SALES 40.00 11.80 A2 NH14 H 24,537.57 N Lamar, Nelson DEC 100100 Dolite Theodore A RFT 1/10/2008 LINESUP Line Supervisor 1/1/2008 PROD 40.00 27.40 M1 NH15 S 56,986.18 N Lamar, Nelson DEC 100200 O'Dade Alan A RFT 1/10/2008 OPER2 Machine Oper II 1/10/2008 PROD 40.00 24.84 A1 NH13 S 51,660.96 N Dolite, Theodore M DEC 100300 MacHeath Fetch A RFT 1/10/2008 OPER1 Machine Oper I 1/10/2008 PROD 40.00 19.00 M2 NH11 H 39,525.41 N Dolite, Theodore DEC 100400 Plumlin Ernest A RFT 6/25/2009 MGRSAL Manager, Sales 6/25/2009 SALES 40.00 11.76 A2 EW21 H 24,462.05 Y Allen, Hugh F DEC 100500 Toore Conn A RFT 9/30/2009 SALES1 Sales Rep I 9/30/2009 PROD 40.00 14.64 M2 EW15 H 30,444.96 Y Plumlin, Ernest Mac DEC 100700 Lamar Nelson A RFT 11/10/2008 MGRMAT Manager, Materials 11/10/2008 PROD 40.00 37.26 A1 EW17 S 77,502.05 Y Stewart, Mary A DEC 200200 Donne Jane A RFT 3/1/2008 PURCLK Purchasing clerk 3/1/2008 ADMIN 40.00 19.13 A1 NH13 H 39,780.00 N Douglas, Shirley P DEC 201210 Jang Richard A RFT 2/28/2007 PURCLK Purchasing clerk 2/28/2007 PROD 40.00 12.90 A1 NH13 H 26,838.24 N Douglas, Shirley P DEC 300100 Tailor Strab A RFT 2/28/2009 ENGR1 Engineer I 2/28/2009 PROD 40.00 28.56 M1 EW17 S 59,404.80 Y Wilson, Samual M DEC 300200 Tinker Bill A RFT 6/30/2009 BUYER Raw Materials Buy 6/30/2009 PROD 40.00 15.94 M2 NH15 H 33,160.61 N Stewart, Mary A DEC 5563 Smythe Audrey A RFT 12/7/2010 TRAINER Trainer 12/7/2010 SALES 80.00 35.00 EW19 S 72,800.00 Y Allen, Hugh F DEU 021 Kahill Nancy A RFT 1/1/2011 PAY CLK Payroll Clerk 1/1/2011 HR 80.00 19.75 EW15 S 41,080.00 Y Black, Joseph L • Employee Benefit Census Export to Excel Reporting comp empno name hiredate bencode desc coverage epremium dpremium econtrib ccontrib tcost effdate expdate DEU 021 Kahill, Nancy 1/1/2011 401KP 401K Percent 0 0.00 0.00 0.00 0.00 0.00 1/1/2011 12/31/2099 DEU 021 Kahill, Nancy 1/1/2011 AD+D Accidental Death/Dismembr 75,000 17.00 0.00 2.80 14.20 17.00 5/1/2011 12/31/2099 DEU 021 Kahill, Nancy 1/1/2011 DENTAL Dental 1,500 0.00 0.00 10.00 -10.00 0.00 5/1/2011 12/31/2099 DEU 021 Kahill, Nancy 1/1/2011 GTW-BW GTL-BW taxable 84,000 7.56 0.00 1.36 6.20 7.56 2/1/2011 12/31/2099 DEU 021 Kahill, Nancy 1/1/2011 LIFE-BW01 Life Insurance 50,000 8.00 0.00 1.21 6.79 8.00 2/1/2011 12/31/2099 DEU 021 Kahill, Nancy 1/1/2011 LTD Long Term Disability 2,054 16.50 0.00 1.50 15.00 16.50 2/1/2011 12/31/2099 DEU 021 Kahill, Nancy 1/1/2011 TAXGTL GTL Fringe Benefit 84,000 7.56 0.00 0.00 7.56 7.56 2/1/2011 12/31/2099 DEU 101 Stewart, Mary A 2/12/2004 401KP 401K Percent 0 0.00 0.00 0.00 0.00 0.00 1/1/2010 12/31/2099 DEU 101 Stewart, Mary A 2/12/2004 AD+D Accidental Death/Dismembr 75,000 20.00 0.00 0.00 20.00 20.00 1/1/2008 12/31/2099 DEU 101 Stewart, Mary A 2/12/2004 DENTAL Dental 1,500 0.00 0.00 25.00 -25.00 0.00 1/1/2008 12/31/2099 DEU 101 Stewart, Mary A 2/12/2004 DRUGS Prescriptions 0 7.50 0.00 1.88 5.62 7.50 1/1/2008 12/31/2099 DEU 101 Stewart, Mary A 2/12/2004 GTW-BW GTL-BW taxable 250,000 37.50 0.00 6.75 30.75 37.50 1/1/2000 12/31/2099 DEU 101 Stewart, Mary A 2/12/2004 HMO HMO Medical 1,000,000 603.00 600.00 402.00 801.00 1,203.00 1/1/2003 12/31/2099 DEU 101 Stewart, Mary A 2/12/2004 LIFE-BW01 Life Insurance 50,000 8.00 0.00 2.79 5.21 8.00 1/1/2003 12/31/2099 DEU 101 Stewart, Mary A 2/12/2004 TAXGTL GTL Fringe Benefit 250,000 37.50 0.00 0.00 37.50 37.50 1/1/2010 12/31/2099 71 72

- 37. 4/3/2020 37 Resources • DOL site • https://www.dol.gov/agencies/whd/pandemic/ffcra-employee-paid-leave • CDC COVID-19 site • https://www.cdc.gov/coronavirus/2019-ncov/cases-updates/summary.html • Homeland Security site for Disaster Recovery • www.Ready.gov • SHRM COVID-19 Resource Page • https://www.shrm.org/ResourcesAndTools/Pages/communicable-diseases.aspx • Employment Law, Leaves of Absence • Link to FFCRA Information • Johns Hopkins School of Public Health • http://www.centerforhealthsecurity.org/resources/COVID-19/index.html COVID-19 Webinars and Payroll Assistance Weekly Learning Sessions on Fridays throughout the crisis • Including topics such as: • SBA Loans • Legislative Updates & Guidance • Work Opportunity Tax Credit (WOTC) • https://www.netatwork.com/online-emails/hrms-webinar-schedule/ Complimentary Recorded Sessions for your team • COVID-19 and Sage HRMS Payroll Processing • https://www.netatwork.com/resource/covid-19-and-sage-hrms-payroll-processing/ • COVID-19 and Abra Suite Payroll Processing • https://www.netatwork.com/resource/covid-19-and-abra-suite-payroll-processing/ 73 74

- 38. 4/3/2020 38 SHRM Certification Credit 20-MVGR6 Net at Work is recognized by SHRM to offer SHRM-CP or SHRM-SCP professional development credits (PDCs). For more information about certification or recertification, please visit shrmcertification.org. This is to certify attendance of the webinar “Weekly Webcast Series for HR/Payroll: COVID-19 (Coronavirus) Updates” Presented by Net at Work and attendee has earned 1.5 Professional Development Credits (PDCs) for today’s session. Please type in your questions Any Questions? 75 76

- 39. 4/3/2020 39 Lynda Dixon, CPA, CGMA Net at Work | Business Analyst Phone: 212.997.5200 ext. 8792 Direct: 919.714.8792 ldixon@netatwork.com www.netatwork.com Connect with Net at Work 800-719-3307 www.netatwork.com netatwork.com/blog Net at Work YouTube Follow us on Twitter: @netatwork_corp Follow Net at Work on LinkedIn Follow Net at Work on Google+ Follow Net at Work on Facebook Contact your Net at Work Account Manager for any questions or concerns. Or you can reach out to us via the information below! Thank You For Attending! Stephanie Leimeister Net at Work | Business Analyst Phone: 800.719.3307 ext. 7126 Direct: 646.517.7126 sleimeister@netatwork.com www.netatwork.com 77