March 2020 Investor Meetings

- 1. Investor Meetings March 3-6, 2020

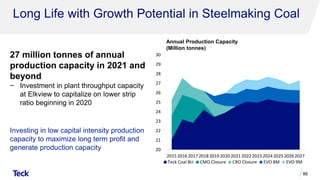

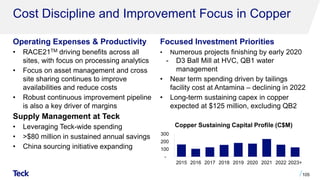

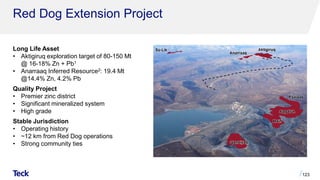

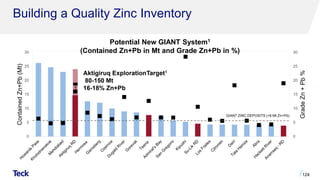

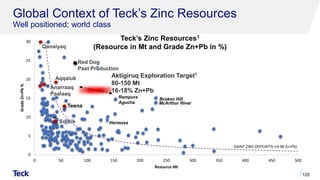

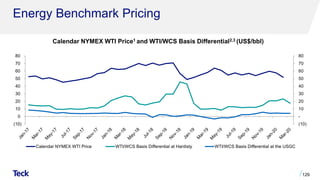

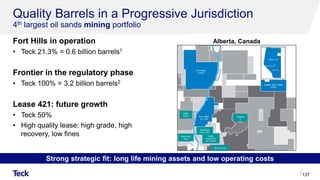

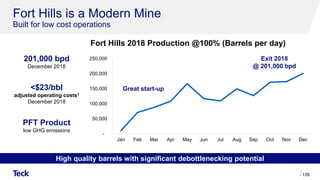

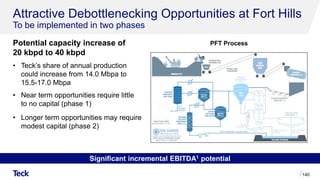

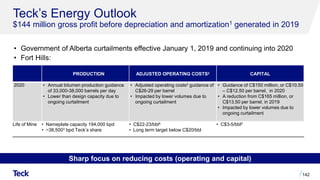

- 2. Caution Regarding Forward-Looking Statements 2 Both these slides and the accompanying oral presentations contain certain forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of the Securities Act (Ontario) and comparable legislation in other provinces (collectively referred to herein as forward-looking statements). Forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variation of such words and phrases or state that certain actions, events or results “may”, “could”, “should”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Teck to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These forward-looking statements include, but are not limited to, statements concerning: the goals, targets and future expectations stated in the slide titled "Our Key Priorities"; EBITDA and other benefits and value to be generated from our RACE21TM innovation-driven efficiency program and the associated implementation costs and timing; our intention to implement certain RACE21TM programs more broadly across other operations and to identify and implement additional RACE21TM projects; expectations regarding the Neptune Bulk Terminals facility upgrade including costs, benefits and timing thereof; targeted cost reduction amounts and timing; all projections and expectations regarding QB2 and QB3, including, but not limited to, those set out in the "QB2 Value Creation" and “Quebrada Blanca” Appendix (including, but not limited to, statements that QB2 will be a world class, low cost copper opportunity, statements and expectations regarding the value and amount of contingent consideration, timing of first production, long-life and expansion potential, projected IRR, QB2 throughput, mine life, projected copper production including Teck’s pro-forma copper exposure estimates, strip-ratios, costs (including C1 and AISC), reserves and resources, construction schedule and ownership of pipelines and port facilities, expansion and extension potential, all economic and financial projections regarding the QB2 project including expected EBITDA from the project); Teck’s share of remaining equity capital and timing of contributions relating to our QB2 project; Teck's goal to be a carbon neutral operator by 2050; availability of funding from our credit facilities; potential growth options; production, sales, unit costs and other cost guidance, expectations and forecasts for our products, business units and individual operations and our expectation that we will meet that guidance; capital expenditure guidance and expectations; capitalized stripping guidance; mine lives and duration of operations at our various mines and operations; our ability to extend the lives of certain mines and to increase production to offset the closure of other operations; objectives of Teck's capital allocation framework, including with respect to its dividend policy (including a base $0.20 per share annual dividend), potential share repurchases and/or supplemental dividends, and maintenance of investment grade metrics; supply, demand and outlook regarding coal, copper, zinc and energy for Teck and global markets generally; our reserve and resource estimates; all guidance including but not limited to production guidance, sales and unit cost guidance and capital expenditures guidance; future commodity prices; the benefits of our innovation strategy and initiatives described under the “Technology and Innovation” Appendix and elsewhere, including regarding smart shovels, autonomous haul trucks and artificial intelligence, and the savings potential associated therewith; the coal market generally; growth potential for our steelmaking coal production, including our expectation that our coal reserves support approximately 27+ million tonnes of production in 2020 and beyond; strip ratios; capital expenditures in coal; West Coast port capacity increases and access; capital costs for water treatment; the copper market generally; copper growth potential and expectations regarding the potential production profile of our various copper projects; the zinc market generally; anticipated zinc production, capital investments and costs; our potential zinc projects, including but not limited to the Red Dog extension project; benefits and timing of the Red Dog VIP2 project; the energy market generally; the potential for significant EBITDA upside potential in our Energy unit and steady cash flow; anticipated Fort Hills production and cost estimates and debottlenecking opportunities; potential benefits and capacity increase from debottlenecking opportunities at Fort Hills and costs associated with debottlenecking; production estimates and timing for regulatory approvals at Frontier; potential for longer term expansion opportunities at Fort Hills and associated costs; Teck’s energy outlook; and the low carbon intensity of Fort Hills. The forward-looking statements are based on and involve numerous assumptions, risks and uncertainties and actual results may vary materially. These statements are based on assumptions, including, but not limited to, general business and economic conditions, interest rates, the supply and demand for, deliveries of, and the level and volatility of prices of, zinc, copper, coal, blended bitumen, and other primary metals, minerals and products as well as steel, oil, natural gas, petroleum, and related products, the timing of the receipt of regulatory and governmental approvals for our development projects and other operations and new technologies, our costs of production and production and productivity levels, as well as those of our competitors, power prices, continuing availability of water and power resources for our operations, market competition, the accuracy of our reserve estimates (including with respect to size, grade and recoverability) and the geological, operational and price assumptions on which these are based, conditions in financial markets, the future financial performance of the company, our ability to successfully implement our technology and innovation strategy, the performance of new technologies in accordance with our expectations, our ability to attract and retain skilled staff, our ability to procure equipment and operating supplies, positive results from the studies on our expansion projects, our coal and other product inventories, our ability to secure adequate transportation for our products, our ability to obtain permits for our operations and expansions, our ongoing relations with our employees and business partners and joint venturers, our expectations with respect to the carbon intensity of our operations, assumptions regarding returns of cash to shareholders include assumptions regarding our future business and prospects, other uses for cash or retaining cash. Reserve and resource life estimates assume the mine life of longest lived resource in the relevant commodity is achieved, assumes production at planned rates and in some cases development of as yet undeveloped projects. Assumptions are also included in the footnotes to various slides. Assumptions regarding the costs and benefits of the Neptune Bulk Terminals expansion and other projects include assumptions that the relevant project is constructed and operated in accordance with current expectations. Our Guidance tables include footnotes with further assumptions relating to our guidance. Our anticipated RACE21TM related EBITDA improvements and associated costs assume that the relevant projects are implemented in accordance with our plans and budget and that the relevant projects will achieve the

- 3. Caution Regarding Forward-Looking Statements 3 expected production and operating results, and are based on current commodity price assumptions and forecast sale volumes. Payment of dividends is in the discretion of the board of directors. Assumptions regarding QB2 include current project assumptions and assumptions regarding the final feasibility study. Assumptions are also included in the footnotes to the slides. Assumptions regarding our potential reserve and resource life assume that all resources are upgraded to reserves and that all reserves and resources could be mined. Our estimated profit and EBITDA and EBITDA sensitivity estimates are based on the commodity price and assumptions stated on the relevant slide or footnote, as well as other assumptions including foreign exchange rates. Cost statements are based on assumptions noted in the relevant slide or footnote. Statements regarding future production are based on the assumption of project sanctions and mine production. Factors that may cause actual results to vary materially include, but are not limited to, changes in commodity and power prices, changes in market demand for our products, changes in interest and currency exchange rates, acts of governments and the outcome of legal proceedings, inaccurate geological and metallurgical assumptions (including with respect to the size, grade and recoverability of mineral reserves and resources), unanticipated operational difficulties (including failure of plant, equipment or processes to operate in accordance with specifications or expectations, cost escalation, unavailability of materials and equipment, government action or delays in the receipt of government approvals, industrial disturbances or other job action, adverse weather conditions and unanticipated events related to health, safety and environmental matters), union labour disputes, political risk, social unrest, failure of customers or counterparties (including logistics suppliers) to perform their contractual obligations, changes in our credit ratings, unanticipated increases in costs to construct our development projects, difficulty in obtaining permits, inability to address concerns regarding permits of environmental impact assessments, and changes or further deterioration in general economic conditions. Certain operations and projects are not controlled by us; schedules and costs may be adjusted by our partners, and timing of spending and operation of the operation or project is not in our control. Current and new technologies relating to our Elk Valley water treatment efforts may not perform as anticipated, and ongoing monitoring may reveal unexpected environmental conditions requiring additional remedial measures. EBITDA improvements may be impacted by the effectiveness of our projects, actual commodity prices and sales volumes, among other matters. We assume no obligation to update forward-looking statements except as required under securities laws. Further information concerning risks and uncertainties associated with these forward-looking statements and our business can be found in our Annual Information Form for the year ended December 31, 2018, filed under our profile on SEDAR (www.sedar.com) and on EDGAR (www.sec.gov) under cover of Form 40-F, as well as subsequent filings that can also be found under our profile. QB2 Project Disclosure All economic analysis with respect to the QB2 project based on a development case which includes inferred resources within the life of mine plan, referred to as the Sanction Case, which is the case on which Teck is basing its development decision for the QB2 project. Inferred resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. Inferred resources are subject to greater uncertainty than measured or indicated resources and it cannot be assumed that they will be successfully upgraded to measured and indicated through further drilling. Nonetheless, based on the nature of the mineralization, Teck has used a mine plan including inferred resources as the development mine plan for the QB2 project. The economic analysis of the Sanction Case, which includes inferred resources, may be compared to economic analysis regarding a hypothetical mine plan which does not include the use of inferred resources as mill feed, referred to as the Reserve Case, and which is set out in Appendix slides “QB2 Project Economics Comparison” and “QB2 Reserves and Resources Comparison” and is further discussed in our 2018 Annual Information Form filed under our profile on SEDAR (www.sedar.com) and on EDGAR (www.sec.gov). We are developing a new baseline schedule and updated capital cost estimate, which is expected to be completed in the first quarter of 2020. The scientific and technical information regarding the QB2 project and Teck's other material properties was prepared under the supervision of Rodrigo Marinho, P. Geo, who is an employee of Teck. Mr. Marinho is a qualified person, as defined under National Instrument 43-101.

- 4. Our Key Priorities 4Forecast results. Scale not necessarily representative of EBITDA1 results or impact. 2019 Adjusted EBITDA1 $4.3 billion QB22 Neptune • Our Neptune facility upgrade secures a long term, low cost and reliable supply chain for our steelmaking coal business • Helps us deliver on our commitments to shareholders and customers • Company-wide cost reduction program underway • Increased target for total reductions to ~$610 million through the end of 2020 • Accelerating RACE21TM our innovation-driven business transformation program • Targeting ~$1 billion in ongoing annualized EBITDA1 improvements by end of 2021 • QB2 is a long-life, low-cost operation with major expansion potential • Rebalances our portfolio over time • QB3 has potential to become a top five global copper producer Focus on health and safety and sustainability leadership Cost Reduction Program4 RACE21TM 3

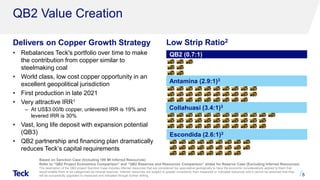

- 5. QB2 Value Creation Delivers on Copper Growth Strategy • Rebalances Teck's portfolio over time to make the contribution from copper similar to steelmaking coal • World class, low cost copper opportunity in an excellent geopolitical jurisdiction • First production in late 2021 • Very attractive IRR1 ‒ At US$3.00/lb copper, unlevered IRR is 19% and levered IRR is 30% • Vast, long life deposit with expansion potential (QB3) • QB2 partnership and financing plan dramatically reduces Teck’s capital requirements 5 Based on Sanction Case (Including 199 Mt Inferred Resources) Refer to “QB2 Project Economics Comparison” and “QB2 Reserves and Resources Comparison” slides for Reserve Case (Excluding Inferred Resources) The description of the QB2 project Sanction Case includes inferred resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. Inferred resources are subject to greater uncertainty than measured or indicated resources and it cannot be assumed that they will be successfully upgraded to measured and indicated through further drilling. Low Strip Ratio2 QB2 (0.7:1) Antamina (2.9:1)3 Collahuasi (3.4:1)3 Escondida (2.6:1)3

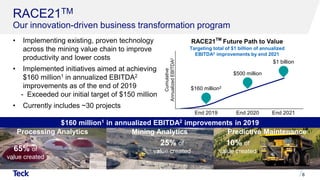

- 6. • Implementing existing, proven technology across the mining value chain to improve productivity and lower costs • Implemented initiatives aimed at achieving $160 million1 in annualized EBITDA2 improvements as of the end of 2019 - Exceeded our initial target of $150 million • Currently includes ~30 projects - operations 6 RACE21TM Our innovation-driven business transformation program $160 million2 End 2019 $500 million End 2020 $1 billion End 2021 Targeting total of $1 billion of annualized EBITDA2 improvements by end 2021 RACE21TM Future Path to Value Cumulative AnnualizedEBITDA2 10% of value created Predictive MaintenanceProcessing Analytics Mining Analytics 25% of value created65% of value created $160 million1 in annualized EBITDA2 improvements in 2019

- 7. • Secures a long term, low cost and reliable supply chain for our steelmaking coal business • Facilitates market access through all cycles • Significant returns generated from lower operating costs and increased flexibility to respond to market opportunities • Expected completion in Q1 2021 7 Neptune Facility Upgrade

- 8. Cost Reduction Program Implemented in Q3 2019 in response to global economic uncertainty • Increased our total targeted reductions to ~$610 million of previously planned spending through the end of 2020, vs. the previous target of $500 million - In Q4 2019, achieved ~$210 million of capital and operating reductions, exceeding our target of $170 million - For 2020, expect ~$400 million of capital and operating reductions • Expect to eliminate ~500 full-time equivalent positions by the end of 2020 8 Does not include initiatives that would reduce production volumes or that could adversely affect the environment or health and safety

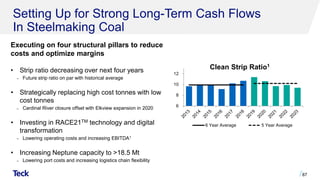

- 9. Preparing for the Future in Steelmaking Coal 1 . on-GAAP financial measures. on-GAAP financial measure. 1. Forecast results. Scale not necessarily representative of results or impact. Expectations for 2021 production show the three-year average production guidance for 2021-2023. 2. Steelmaking coal unit costs are reported in Canadian dollars per tonne N See “Non-GAAP Financial Measures” slides and “Use of Non-GAAP Financial Measures” section of Teck’s Q4 2019 news release for further information. 3. 2021 adjusted site cost of sales are currently not expected to exceed $60 per tonne. Teck plans to issue official guidance for 2021 unit costs with its Q4 2020 report in February 2021. N See “Non-GAAP Financial Measures” slides and “Use of Non-GAAP Financial Measures” section of Teck’s Q4 2019 news release for further information. Expect to be well positioned in production and unit site costs from Q4 2020 25.7 2019A 23.0-25.0 2020E 26.0-27.0 2021-2023E Production1 (Million tonnes) Adjusted Site Cost of Sales1,2 (C$/tonne) Unit costs expected to fall with higher production from Q4 2020 2020 guidance reflects rail and port constraints, Neptune shutdown, extreme weather, and record site inventories $65 2019A $63-67 2020E <$60 2021E 3

- 10. Focus on Sustainability Leadership Teck’s performance on top ESG ratings 9 • Top-ranked mining company 2019 World & North American Indices • In the index for 10 consecutive years • “A” rating since 2013 (scale of CCC – AAA) • Outperforming all 10 of our largest industry peers • Tied for 2nd in mining & metals category • Ranked in the 100th percentile • 2020 Global 100 Most Sustainable Corporations list ─ Corporate Knights • Only mining company • Environment and Social Scores top 10% out of all industries • Listed on Index Series • 91% percentile rank in mining and metals industry

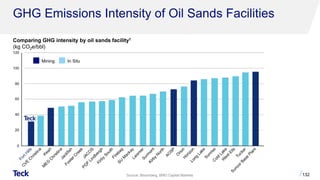

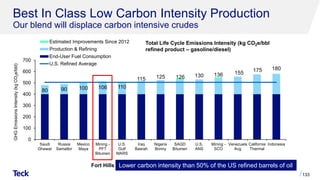

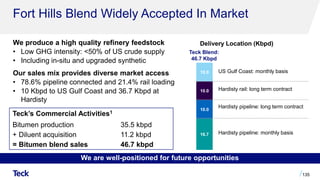

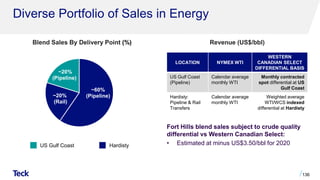

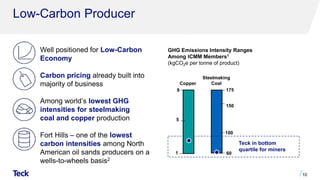

- 11. Low-Carbon Producer 10 GHG Emissions Intensity Ranges Among ICMM Members1 (kgCO2e per tonne of product) Teck in bottom quartile for miners Copper Steelmaking Coal Well positioned for Low-Carbon Economy Carbon pricing already built into majority of business Among world’s lowest GHG intensities for steelmaking coal and copper production Fort Hills – one of the lowest carbon intensities among North American oil sands producers on a wells-to-wheels basis2 5 9 150 100 175 601

- 12. Carbon Neutral Operator by 2050 • Demonstrates Teck’s support of the transition to a low-carbon economy and worldwide efforts to meet the goal of the Paris Agreement to limit global temperature increase • Aligns with commitments by Canada and Chile to be carbon neutral by 2050 • Teck has set out an initial roadmap to achieve carbon neutrality by first avoiding emissions and then eliminating or minimizing emissions • Announced a long-term renewable power purchase agreement with AES Corporation for approximately half the power required for operation of QB2 11

- 13. Global Tailings Review: • Co-convened by ICMM, UN Environment Programme & Principles for Responsible Investment • Goal of establishing an international standard for safe management of tailings facilities • Discussions on draft standard with expert panel and co-convenors ongoing 12 International Council on Mining & Metals 1. What are ICMM’s Mining Principles? - Define what good practice in environmental, social and governance looks like for industry - 10 principles backed up by a comprehensive set of performance expectations - Required for all ICMM member companies 2. How are they implemented? - Robust site-level validation - Public disclosure of validation activities and outcomes 3. What is the value? - Demonstrate ESG performance at the asset level ICMM Mining Principles Launched

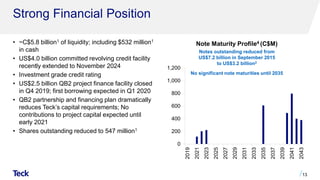

- 14. 0 200 400 600 800 1,000 1,200 2019 2021 2023 2025 2027 2029 2031 2033 2035 2037 2039 2041 2043 Strong Financial Position • ~C$5.8 billion1 of liquidity; including $532 million1 in cash • US$4.0 billion committed revolving credit facility recently extended to November 2024 • Investment grade credit rating • US$2.5 billion QB2 project finance facility closed in Q4 2019; first borrowing expected in Q1 2020 • QB2 partnership and financing plan dramatically reduces Teck’s capital requirements; No contributions to project capital expected until early 2021 • Shares outstanding reduced to 547 million1 13 Note Maturity Profile4 (C$M) Notes outstanding reduced from US$7.2 billion in September 2015 to US$3.2 billion2 No significant note maturities until 2035

- 15. A Perfect Storm 14 • Coronavirus • QB2 project update • Neptune facility upgrade • Lower coal production in H1 2020 • Q1 2020 logistics challenges • Frontier • ESG: Climate change and steelmaking coal

- 16. Our Key Priorities 15Forecast results. Scale not necessarily representative of EBITDA1 results or impact. 2019 Adjusted EBITDA1 $4.3 billion QB22 Neptune • Our Neptune facility upgrade secures a long term, low cost and reliable supply chain for our steelmaking coal business • Helps us deliver on our commitments to shareholders and customers • Company-wide cost reduction program underway • Increased target for total reductions to ~$610 million through the end of 2020 • Accelerating RACE21TM our innovation-driven business transformation program • Targeting ~$1 billion in ongoing annualized EBITDA1 improvements by end of 2021 • QB2 is a long-life, low-cost operation with major expansion potential • Rebalances our portfolio over time • QB3 has potential to become a top five global copper producer Focus on health and safety and sustainability leadership Cost Reduction Program4 RACE21TM 3

- 17. Appendix

- 18. Notes Slide 4: Our Key Priorities 1. EBITDA and adjusted EBITDA are non-GAAP financial measures. See “Non-GAAP Financial Measures” slides. 2. Scale suggests Teck’s potential attributable share of the first 5 full years of annual EBITDA, assuming a C$/US$ exchange rate of 1.33. Annual EBITDA for the project based on the first five full years of copper equivalent production is US$1.1 billion to US$1.4 billion based on feasibility price assumptions and production plans. Copper equivalent production calculated assuming US$3.00/lb copper, US$10.00/lb molybdenum and US$18.00/oz silver without adjusting for payability. EBITDA is a non-GAAP financial measure. See “Non-GAAP Financial Measures” slides. 3. Targeting total of $1 billion annualized EBITDA improvements by end of 2021. EBITDA is a non-GAAP financial measure. See “Non-GAAP Financial Measures” slides. 4. Targeting reductions of approximately $610 million of previously planned spending through the end of 2020. Slide 5: QB2 Value Creation 1. As at January 1, 2019. Assumes optimized funding structure. Does not include contingent consideration. Assumes US$10.00/lb molybdenum and US$18.00/oz silver. 2. 1 truck = a strip ratio of 0.1. 3. Source: Wood Mackenzie over 2021-2040. Slide 6: RACE21TM 1. Based on commodity prices at December 31, 2019 and assumed to remain in effect through 2020: steelmaking coal US$136.50 per tonne, copper US$2.79 per pound, zinc US$1.04 per pound and a C$/US$ exchange rate of $1.30. 2. EBITDA is a non-GAAP financial measure. See “Non-GAAP Financial Measures” slides and “Use of Non-GAAP Financial Measures” section of the Q4 2019 news release for further information. Slide 10: Low-Carbon Producer 1. Source: ICMM Report “The cost of carbon pricing: competitiveness implications for the mining and metals industry”, April 2013. 2. Source: IHS Energy Special Report “Comparing GHG Intensity of the Oil Sands and the Average US Crude Oil” May 2014. SCO stands for Synthetic Crude Oil. Slide 13: Strong Financial Position 1. As at February 20, 2020. 2. Public notes outstanding as at December 31, 2019. Slide 15: Our Key Priorities 1. EBITDA and adjusted EBITDA are non-GAAP financial measures. See “Non-GAAP Financial Measures” slides. 2. Scale suggests Teck’s potential attributable share of the first 5 full years of annual EBITDA, assuming a C$/US$ exchange rate of 1.33. Annual EBITDA for the project based on the first five full years of copper equivalent production is US$1.1 billion to US$1.4 billion based on feasibility price assumptions and production plans. Copper equivalent production calculated assuming US$3.00/lb copper, US$10.00/lb molybdenum and US$18.00/oz silver without adjusting for payability. EBITDA is a non-GAAP financial measure. See “Non-GAAP Financial Measures” slides. 3. Targeting total of $1 billion annualized EBITDA improvements by end of 2021. EBITDA is a non-GAAP financial measure. See “Non-GAAP Financial Measures” slides. 4. Targeting reductions of approximately $610 million of previously planned spending through the end of 2020. 17

- 20. QB2 Project Disclosure All economic analysis with respect to the QB2 project based on a development case which includes inferred resources within the life of mine plan, referred to as the Sanction Case, which is the case on which Teck is basing its development decision for the QB2 project. Inferred resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. Inferred resources are subject to greater uncertainty than measured or indicated resources and it cannot be assumed that they will be successfully upgraded to measured and indicated through further drilling. Nonetheless, based on the nature of the mineralization, Teck has used a mine plan including inferred resources as the development mine plan for the QB2 project. The economic analysis of the Sanction Case, which includes inferred resources, may be compared to economic analysis regarding a hypothetical mine plan which does not include the use of inferred resources as mill feed, referred to as the Reserve Case, and which is set out in Appendix slides “QB2 Project Economics Comparison” and “QB2 Reserves and Resources Comparison” and is further discussed in our Annual Information Form filed under our profile on SEDAR (www.sedar.com) and on EDGAR (www.sec.gov). We are developing a new baseline schedule and updated capital cost estimate, which is expected to be completed in the first quarter of 2020. The scientific and technical information regarding the QB2 project was prepared under the supervision of Rodrigo Marinho, P. Geo, who is an employee of Teck. Mr. Marinho is a qualified person, as defined under National Instrument 43-101. 19

- 21. Workforce1,2 ~7,500 QB2 Project Update SAG Mill #1 Shell Lift, January 2020 Progress1 25% Overall 20 Earthworks1 47% Concrete1 29% Engineering, Procurement & Contract Formation1 >95%

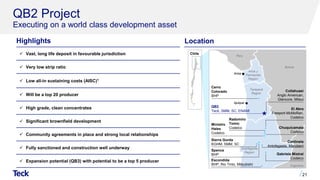

- 22. Vast, long life deposit in favourable jurisdiction Very low strip ratio Low all-in sustaining costs (AISC)1 Will be a top 20 producer High grade, clean concentrates Significant brownfield development Community agreements in place and strong local relationships Fully sanctioned and construction well underway Expansion potential (QB3) with potential to be a top 5 producer Highlights Chile Peru Bolivia Tarapacá Region Arica y Parinacota Region Antofagasta Region Arica Iquique QB2 Teck, SMM, SC, ENAMI Collahuasi Anglo American, Glencore, Mitsui El Abra Freeport-McMoRan, Codelco Radomiro Tomic Codelco Chuquicamata Codelco Ministro Hales Codelco Cerro Colorado BHP Spence BHP Centinela Antofagasta, Marubeni Gabriela Mistral Codelco Escondida BHP, Rio Tinto, Mitsubishi Argentina Sierra Gorda KGHM, SMM, SC Location QB2 Project Executing on a world class development asset 21

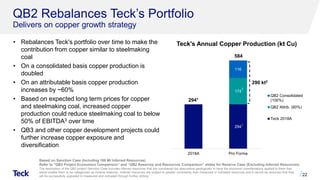

- 23. QB2 Rebalances Teck’s Portfolio Delivers on copper growth strategy • Rebalances Teck's portfolio over time to make the contribution from copper similar to steelmaking coal • On a consolidated basis copper production is doubled • On an attributable basis copper production increases by ~60% • Based on expected long term prices for copper and steelmaking coal, increased copper production could reduce steelmaking coal to below 50% of EBITDA3 over time • QB3 and other copper development projects could further increase copper exposure and diversification 22 Based on Sanction Case (Including 199 Mt Inferred Resources) Refer to “QB2 Project Economics Comparison” and “QB2 Reserves and Resources Comparison” slides for Reserve Case (Excluding Inferred Resources) The description of the QB2 project Sanction Case includes inferred resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. Inferred resources are subject to greater uncertainty than measured or indicated resources and it cannot be assumed that they will be successfully upgraded to measured and indicated through further drilling. 294 174 116 2018A Pro Forma QB2 Consolidated (100%) QB2 Attrib. (60%) Teck 2018A 2 Teck's Annual Copper Production (kt Cu) 290 kt2 1 2941 584

- 24. QB2 is a World Class Copper Opportunity 23 Based on Sanction Case (Including 199 Mt Inferred Resources) Refer to “QB2 Project Economics Comparison” and “QB2 Reserves and Resources Comparison” slides for Reserve Case (Excluding Inferred Resources) The description of the QB2 project Sanction Case includes inferred resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. Inferred resources are subject to greater uncertainty than measured or indicated resources and it cannot be assumed that they will be successfully upgraded to measured and indicated through further drilling. Project Metrics1 (100%) US$2.4-$4.2B After-Tax NPV8% 2,3 14%-18% Unlevered After-Tax IRR2,3 US$1.1-$1.4B First 5 Full Years Annual EBITDA2 316 kt First 5 Full Years Annual CuEq Production4 US$1.28/lb First 5 Full Years C1 Cash Cost (net of by-products)5 US$1.38/lb First 5 Full Years AISC (net of by-products)6 QB2 Uses <25% of R&R Continuing to Grow US$4.7B Capital Cost (100%)7 Transaction Metrics1 ~US$3B Implied Value of Teck's 90% Ownership Prior to Sumitomo Transaction8 30%-40% Teck's Levered After-Tax IRR Post Transaction2,3,9

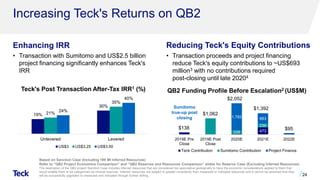

- 25. 473228 236 1,782 683 2019E Pre Close 2019E Post Close 2020E 2021E 2022E Teck Contribution Sumitomo Contribution Project Finance Increasing Teck's Returns on QB2 Enhancing IRR Reducing Teck's Equity Contributions 24 Based on Sanction Case (Including 199 Mt Inferred Resources) Refer to “QB2 Project Economics Comparison” and “QB2 Reserves and Resources Comparison” slides for Reserve Case (Excluding Inferred Resources) The description of the QB2 project Sanction Case includes inferred resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. Inferred resources are subject to greater uncertainty than measured or indicated resources and it cannot be assumed that they will be successfully upgraded to measured and indicated through further drilling. Teck's Post Transaction After-Tax IRR1 (%) 19% 30% 21% 35% 24% 40% Unlevered Levered US$3 US$3.25 US$3.50 • Transaction with Sumitomo and US$2.5 billion project financing significantly enhances Teck's IRR • Transaction proceeds and project financing reduce Teck's equity contributions to ~US$693 million3 with no contributions required post-closing until late 20204 QB2 Funding Profile Before Escalation2 (US$M) Sumitomo true-up post closing $138 $1,062 $2,052 $1,392 $95

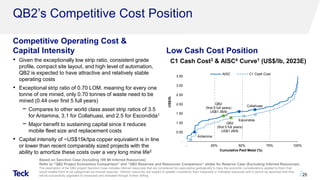

- 26. QB2’s Competitive Cost Position Competitive Operating Cost & Capital Intensity Low Cash Cost Position 25 Based on Sanction Case (Including 199 Mt Inferred Resources) Refer to “QB2 Project Economics Comparison” and “QB2 Reserves and Resources Comparison” slides for Reserve Case (Excluding Inferred Resources) The description of the QB2 project Sanction Case includes inferred resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. Inferred resources are subject to greater uncertainty than measured or indicated resources and it cannot be assumed that they will be successfully upgraded to measured and indicated through further drilling. C1 Cash Cost3 & AISC4 Curve1 (US$/lb, 2023E)• Given the exceptionally low strip ratio, consistent grade profile, compact site layout, and high level of automation, QB2 is expected to have attractive and relatively stable operating costs • Exceptional strip ratio of 0.70 LOM, meaning for every one tonne of ore mined, only 0.70 tonnes of waste need to be mined (0.44 over first 5 full years) − Compares to other world class asset strip ratios of 3.5 for Antamina, 3.1 for Collahuasi, and 2.5 for Escondida1 − Major benefit to sustaining capital since it reduces mobile fleet size and replacement costs • Capital intensity of ~US$15k/tpa copper equivalent is in line or lower than recent comparably sized projects with the ability to amortize these costs over a very long mine life2 Antamina Escondida Collahuasi - 0.50 1.00 1.50 2.00 2.50 3.00 3.50 - 25% 50% 75% 100% US$/lb Cumulative Paid Metal (%) AISC C1 Cash Cost QB2 (first 5 full years) US$1.38/lb QB2 (first 5 full years) US$1.28/lb

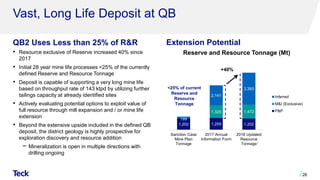

- 27. Vast, Long Life Deposit at QB QB2 Uses Less than 25% of R&R Extension Potential • Resource exclusive of Reserve increased 40% since 2017 • Initial 28 year mine life processes <25% of the currently defined Reserve and Resource Tonnage • Deposit is capable of supporting a very long mine life based on throughput rate of 143 ktpd by utilizing further tailings capacity at already identified sites • Actively evaluating potential options to exploit value of full resource through mill expansion and / or mine life extension • Beyond the extensive upside included in the defined QB deposit, the district geology is highly prospective for exploration discovery and resource addition − Mineralization is open in multiple directions with drilling ongoing 26. 1,202 1,259 1,202 1,325 1,472 199 2,141 3,393 Sanction Case Mine Plan Tonnage 2017 Annual Information Form 2018 Updated Resource Tonnage Inferred M&I (Exclusive) P&P 1 +40% Reserve and Resource Tonnage (Mt) <25% of current Reserve and Resource Tonnage

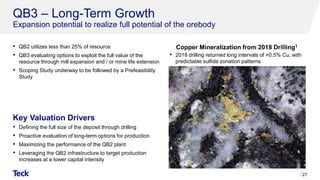

- 28. QB3 – Long-Term Growth Expansion potential to realize full potential of the orebody • QB2 utilizes less than 25% of resource • QB3 evaluating options to exploit the full value of the resource through mill expansion and / or mine life extension • Scoping Study underway to be followed by a Prefeasibility Study 27. • 2018 drilling returned long intervals of +0.5% Cu, with predictable sulfide zonation patterns Key Valuation Drivers • Defining the full size of the deposit through drilling • Proactive evaluation of long-term options for production • Maximizing the performance of the QB2 plant • Leveraging the QB2 infrastructure to target production increases at a lower capital intensity Copper Mineralization from 2018 Drilling1

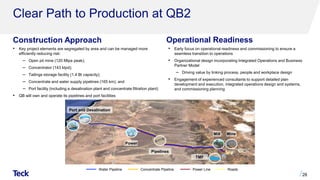

- 29. Clear Path to Production at QB2 Construction Approach Operational Readiness • Key project elements are segregated by area and can be managed more efficiently reducing risk: – Open pit mine (120 Mtpa peak); – Concentrator (143 ktpd); – Tailings storage facility (1.4 Bt capacity); – Concentrate and water supply pipelines (165 km); and – Port facility (including a desalination plant and concentrate filtration plant) • QB will own and operate its pipelines and port facilities 28 • Early focus on operational readiness and commissioning to ensure a seamless transition to operations • Organizational design incorporating Integrated Operations and Business Partner Model – Driving value by linking process, people and workplace design • Engagement of experienced consultants to support detailed plan development and execution, integrated operations design and systems, and commissioning planning Port and Desalination Power Pipelines TMF Mill Mine Water Pipeline Concentrate Pipeline Power Line Roads

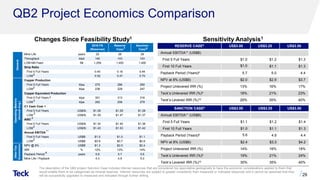

- 30. QB2 Project Economics Comparison 29 The description of the QB2 project Sanction Case includes inferred resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. Inferred resources are subject to greater uncertainty than measured or indicated resources and it cannot be assumed that they will be successfully upgraded to measured and indicated through further drilling. Mine Life years 25 28 28 Throughput ktpd 140 143 143 LOM Mill Feed Mt 1,259 1,400 1,400 Strip Ratio First 5 Full Years 0.40 0.16 0.44 LOM 0.52 0.41 0.70 Copper Production First 5 Full Years ktpa 275 286 290 LOM ktpa 238 228 247 Copper Equivalent Production First 5 Full Years ktpa 301 313 316 LOM ktpa 262 256 279 C1 Cash Cost First 5 Full Years US$/lb $1.28 $1.29 $1.28 LOM US$/lb $1.39 $1.47 $1.37 AISC First 5 Full Years US$/lb $1.34 $1.40 $1.38 LOM US$/lb $1.43 $1.53 $1.42 Annual EBITDA First 5 Full Years US$B $1.0 $1.0 $1.1 LOM US$B $0.8 $0.7 $0.9 NPV @ 8% US$B $1.3 $2.0 $2.4 IRR % 12% 13% 14% Payback Period years 5.8 5.7 5.6 Mine Life / Payback 4.3 4.9 5.0 Sanction Case Reserve Case 2016 FS (Reserves) After-Tax Economics General OperatingMetrics (AnnualAvg.) 4 6 5 2 2 2 2 2 7 8 3 2 11 Sensitivity Analysis1Changes Since Feasibility Study1 RESERVE CASE8 US$3.00 US$3.25 US$3.50 Annual EBITDA11 (US$B) First 5 Full Years $1.0 $1.2 $1.3 First 10 Full Years $1.0 $1.1 $1.3 Payback Period (Years)6 5.7 5.0 4.4 NPV at 8% (US$B) $2.0 $2.9 $3.7 Project Unlevered IRR (%) 13% 16% 17% Teck’s Unlevered IRR (%)9 18% 21% 23% Teck’s Levered IRR (%)10 29% 35% 40% SANCTION CASE8 US$3.00 US$3.25 US$3.50 Annual EBITDA11 (US$B) First 5 Full Years $1.1 $1.2 $1.4 First 10 Full Years $1.0 $1.1 $1.3 Payback Period (Years)6 5.6 4.9 4.4 NPV at 8% (US$B) $2.4 $3.3 $4.2 Project Unlevered IRR (%) 14% 16% 18% Teck’s Unlevered IRR (%)9 19% 21% 24% Teck’s Levered IRR (%)10 30% 35% 40%

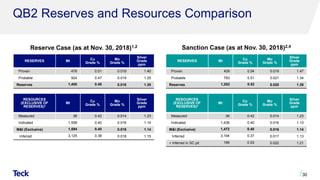

- 31. QB2 Reserves and Resources Comparison Reserve Case (as at Nov. 30, 2018)1,2 Sanction Case (as at Nov. 30, 2018)2,4 30 RESERVES Mt Cu Grade % Mo Grade % Silver Grade ppm Proven 409 0.54 0.019 1.47 Probable 793 0.51 0.021 1.34 Reserves 1,202 0.52 0.020 1.38 RESOURCES (EXCLUSIVE OF RESERVES)5 Mt Cu Grade % Mo Grade % Silver Grade ppm Measured 36 0.42 0.014 1.23 Indicated 1,436 0.40 0.016 1.13 M&I (Exclusive) 1,472 0.40 0.016 1.14 Inferred 3,194 0.37 0.017 1.13 + Inferred in SC pit 199 0.53 0.022 1.21 RESERVES Mt Cu Grade % Mo Grade % Silver Grade ppm Proven 476 0.51 0.018 1.40 Probable 924 0.47 0.019 1.25 Reserves 1,400 0.48 0.018 1.30 RESOURCES (EXCLUSIVE OF RESERVES)3 Mt Cu Grade % Mo Grade % Silver Grade ppm Measured 36 0.42 0.014 1.23 Indicated 1,558 0.40 0.016 1.14 M&I (Exclusive) 1,594 0.40 0.016 1.14 Inferred 3,125 0.38 0.018 1.15

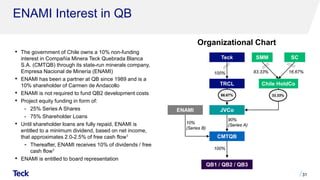

- 32. ENAMI Interest in QB Organizational Chart • The government of Chile owns a 10% non-funding interest in Compañía Minera Teck Quebrada Blanca S.A. (CMTQB) through its state-run minerals company, Empresa Nacional de Minería (ENAMI) • ENAMI has been a partner at QB since 1989 and is a 10% shareholder of Carmen de Andacollo • ENAMI is not required to fund QB2 development costs • Project equity funding in form of: - 25% Series A Shares - 75% Shareholder Loans • Until shareholder loans are fully repaid, ENAMI is entitled to a minimum dividend, based on net income, that approximates 2.0-2.5% of free cash flow1 - Thereafter, ENAMI receives 10% of dividends / free cash flow1 • ENAMI is entitled to board representation 31. CMTQB TRCL ENAMI Teck 10% (Series B) 100% 90% (Series A) JVCo SMM 66.67% 100% 33.33% SC 83.33% 16.67% Chile HoldCo QB1 / QB2 / QB3

- 33. Quebrada Blanca Accounting Treatment Balance Sheet Cash Flow • 100% of project spending included in property, plant and equipment • Debt includes 100% of project financing • Total shareholder funding to be split between loans and equity approximately 75%/25% over the life of the project • Sumitomo (SMM/SC)1 contributions will be shown as advances as a non-current liability and non-controlling interest as part of equity • Teck contributions, whether debt or equity eliminated on consolidation • 100% of project spending included in capital expenditures • In 2019, Sumitomo1 contribution recorded within financing activities and split approximately 50%/50% as: ‒ Loans recorded as “Advances from Sumitomo” ‒ Equity recorded as “Sumitomo Share Subscriptions” • 100% of draws on project financing included in financing activities • After start-up of operations ‒ 100% of profit in cash flow from operations ‒ Sumitomo’s1 30% and ENAMI’s 10% share of distributions included in non-controlling interest 32 Income Statement • Teck’s income statement will include 100% of QB’s revenues and expenses • Sumitomo’s1 30% and ENAMI’s 10% share of profit will show as profit attributable to non-controlling interests

- 34. Notes - Appendix: Quebrada Blanca Slide 20: QB2 Project Update 1. Project progress as at January 31, 2020. 2. Number of active workers versus employees on payroll. Slide 21: QB2 Project 1. All-in sustaining costs (AISC) are net cash unit costs (also known as C1 cash costs) plus sustaining capital expenditures. Net cash unit costs are calculated after cash margin by-product credits assuming US$10.00/lb molybdenum and US$18.00/oz silver. Net cash unit costs for QB2 include stripping costs during operations. AISC, Net cash unit cost and cash margins for by-products are non-GAAP financial measures which do not have a standardized meanings prescribed by International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles in the United States. These measures may differ from those used by other issuers and may not be comparable to such measures as reported by others. These measures are meant to provide further information about our financial expectations to investors. These measures should not be considered in isolation or used in substitute for other measures of performance prepared in accordance with IFRS. For more information on our calculation of non-GAAP financial measures please see our Management’s Discussion and Analysis for the year ended December 31, 2018, which can be found under our profile on SEDAR at www.sedar.com. Slide 22: QB2 Rebalances Teck’s Portfolio 1. We include 100% of the production and sales from QB and Carmen de Andacollo mines in our production and sales volumes because we fully consolidate their results in our financial statements. We include 22.5% of production and sales from Antamina, representing our proportionate equity interest in Antamina. Copper production includes cathode production at QB. 2. Based on QB2 Sanction Case first five full years of copper production. 3. EBITDA is a non-GAAP financial measure. See “Non-GAAP Financial Measures” slides. Slide 23: QB2 is a World Class Copper Opportunity 1. All-in sustaining costs (AISC) are net cash unit costs (also known as C1 cash costs) plus sustaining capital expenditures. Net cash unit costs are calculated after cash margin by-product credits assuming US$10.00/lb molybdenum and US$18.00/oz silver. Net cash unit costs for QB2 include stripping costs during operations. AISC, Net cash unit cost and cash margins for by-products are non-GAAP financial measures. See “Non-GAAP Financial Measures” slides. 2. Range based on US$3.00-$3.50/lb copper price. EBITDA is a non-GAAP financial measure. See “Non-GAAP Financial Measures” slides. 3. As at January 1, 2019. Assumes optimized funding structure. 4. Copper equivalent production calculated assuming US$3.00/lb copper, US$10.00/lb molybdenum and US$18.00/oz silver without adjusting for payability. 5. C1 cash costs (also known as net cash unit costs) are presented after by-product credits assuming US$10.00/lb molybdenum and US$18.00/oz silver. C1 cash costs for QB2 include stripping costs during operations. Net cash unit costs and C1 cash costs are non-GAAP financial measures. See “Non-GAAP Financial Measures” slides. 6. All-in sustaining costs (AISC) are net cash unit costs (also known as C1 cash costs) plus sustaining capital expenditures. Net cash unit costs are calculated after cash margin by-product credits assuming US$10.00/lb molybdenum and US$18.00/oz silver. Net cash unit costs for QB2 include stripping costs during operations. AISC, Net cash unit cost and cash margins for by-products are non-GAAP financial measures. See “Non-GAAP Financial Measures” slides. 7. The valuation of approximately ~US$3 billion for Teck’s 90% interest prior to the Sumitomo transaction is based on a transaction value of US$1 billion comprising an earn-in contribution of US$800 million and assumed contingent consideration proceeds with a present value of approximately US$200 million. The undiscounted contingent consideration is estimated at US$300 million and comprises: (a) US$50 million relating to achieving the mill throughput optimization target, assumed to be received in 2024; and (b) 8% of the net present value of the QB3 expansion at sanction, assuming an expansion sanctioned in 2024 which doubles QB2 throughput with further tailings facility construction deferred. At a real copper price of US$3.00/lb, the payment is estimated at approximately US$250 million. Using a real discount rate of 8%, the present value of the contingent consideration, based on the above assumptions is estimated at approximately US$200 million. This estimate is based on a number of significant assumptions in addition to those described above. There can be no assurance that the contingent consideration will approximate the amounts outlined above, or that it will be received at all. 8. Does not include contingent consideration. 9. Assumes US$2.5 billion in project finance loans without deduction of fees and interest during construction, and US$1.2 billion contribution from Sumitomo. Does not include contingent consideration. Slide 24: Increasing Teck's Returns on QB2 1. As at January 1, 2019. Assumes optimized funding structure. Does not include contingent consideration. Assumes US$10.00/lb molybdenum and US$18.00/oz silver. 2. On a 100% go forward basis from January 1, 2019 in constant Q2 2017 dollars and a CLP:USD exchange rate of 625, not including escalation (estimated at US$300 - $470 million based on 2 - 3% per annum inflation), working capital or interest during construction. Includes approximately US$500 million in contingency. At a spot CLP/USD rate of approximately 675 capital would be reduced by approximately US$270 million. 3. On a go forward basis from January 1, 2019. 4. Assumes US$1.2 billion of Sumitomo contributions associated with purchase price spent before first draw of project finance facility. Thereafter, project finance facility used to fund all capital costs until target debt : capital ratio achieved on a cumulative basis, after which point project finance and equity contributions are made ratably based on this same debt : capital ratio. 33

- 35. Notes - Appendix: Quebrada Blanca Slide 25: QB2’s Competitive Cost Position 1. Source: Wood Mackenzie. 2. Based on first five full years of copper equivalent production. Copper equivalent production calculated assuming US$3.00/lb copper, US$10.00/lb molybdenum and US$18.00/oz silver without adjusting for payability. 3. C1 cash costs (also known as net cash unit costs) are presented after by-product credits assuming US$10.00/lb molybdenum and US$18.00/oz silver. C1 cash costs for QB2 include stripping costs during operations. Net cash unit costs and C1 cash costs are non-GAAP financial measures. See “Non-GAAP Financial Measures” slides. 4. All-in sustaining costs (AISC) are net cash unit costs (also known as C1 cash costs) plus sustaining capital expenditures. Net cash unit costs are calculated after cash margin by-product credits assuming US$10.00/lb molybdenum and US$18.00/oz silver. Net cash unit costs for QB2 include stripping costs during operations. AISC, Net cash unit cost and cash margins for by-products are non-GAAP financial measures. See “Non-GAAP Financial Measures” slides. Slide 26: Vast, Long Life Deposit at QB 1. Resources figures as at November 30, 2018. Resources are reported separately from, and do not include that portion of resources classified as reserves. See “QB2 Reserves and Resources Comparison” slide for further details. Slide 27: QB3 – Long-Term Growth 1. DDH-756 @176.6m, Field of view 2cm. Slide 29: QB2 Project Economics Comparison 1. All metrics on 100% basis and assume US$3.00/lb copper, US$10.00/lb molybdenum and US$18.00/oz silver unless otherwise stated. NPV, IRR and payback on after-tax basis. 2. Life of Mine annual average figures exclude the first and last partial years of operations. 3. Copper equivalent production calculated assuming US$3.00/lb copper, US$10.00/lb molybdenum and US$18.00/oz silver without adjusting for payability. 4. C1 cash costs are presented after by-product credits assuming US$10.00/lb molybdenum and US$18.00/oz silver. Net cash unit costs are consistent with C1 cash costs. C1 cash costs for QB2 include stripping costs during operations. Net cash unit costs and C1 cash costs are non-GAAP financial measures. See “Non-GAAP Financial Measures” slides. 5. All-in sustaining costs (AISC) are net cash unit costs (also known as C1 cash costs) plus sustaining capital expenditures. Net cash unit costs are calculated after cash margin by-product credits assuming US$10.00/lb molybdenum and US$18.00/oz silver. Net cash unit costs for QB2 include stripping costs during operations. AISC, Net cash unit cost and cash margins for by-products are non-GAAP financial measures. See “Non-GAAP Financial Measures” slides. 6. Payback from first production. 7. Based on go-forward cash flow from January 1, 2017. Based on all equity funding structure. 8. Based on go-forward cash flow from January 1, 2019. Based on optimized funding structure. 9. Does not consider contingent consideration. 10. Includes impact of US$2.5 billion project financing. Does not consider contingent consideration. 11. EBITDA is a non-GAAP financial measure. See “Non-GAAP Financial Measures” slides. Slide 30: QB2 Reserves and Resources Comparison 1. Mineral reserves are constrained within an optimized pit shell and scheduled using a variable grade cut-off approach based on NSR cut-off US$13.39/t over the planned life of mine. The life-of-mine strip ratio is 0.41. 2. Both mineral resource and mineral reserve estimates assume long-term commodity prices of US$3.00/lb Cu, US$9.40/lb Mo and US$18.00/oz Ag and other assumptions that include: pit slope angles of 30–44º, variable metallurgical recoveries that average approximately 91% for Cu and 74% for Mo and operational costs supported by the Feasibility Study as revised and updated. 3. Mineral resources are reported using a NSR cut-off of US$11.00/t and include 23.8 million tonnes of hypogene material grading 0.54% copper that has been mined and stockpiled during existing supergene operations. 4. Mineral reserves are constrained within an optimized pit shell and scheduled using a variable grade cut-off approach based on NSR cut-off US$18.95/t over the planned life of mine. The life-of-mine strip ratio is 0.70. 5. Mineral resources are reported using a NSR cut-off of US$11.00/t outside of the reserves pit. Mineral resources include inferred resources within the reserves pit at a US$ 18.95/t NSR cut-off and also include 23.8 million tonnes of hypogene material grading 0.54% copper that has been mined and stockpiled during existing supergene operations. 34

- 36. Notes - Appendix: Quebrada Blanca Slide 31: ENAMI Interest in QB2 1. EBITDA is a non-GAAP financial measure. See “Non-GAAP Financial Measures” slides. Slide 32: Quebrada Blanca Accounting Treatment 1. Sumitomo Metal Mining Co. Ltd. and Sumitomo Corporation are collectively referred to as Sumitomo. 35

- 38. Consistent Long-Term Strategy 37 • Diversification • Long life assets • Low cost • Appropriate scale • Low risk jurisdictions

- 39. Attractive Portfolio of Long-Life Assets Low risk jurisdictions 38

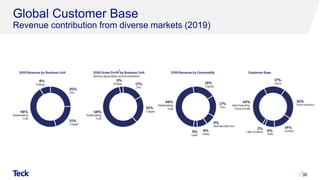

- 40. Global Customer Base Revenue contribution from diverse markets (2019) 39 1 1

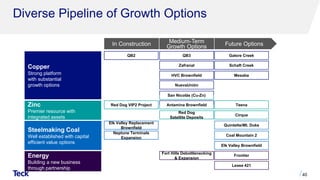

- 41. Diverse Pipeline of Growth Options 40 In Construction Energy Building a new business through partnership Frontier Lease 421 Future OptionsMedium-Term Growth Options Zinc Premier resource with integrated assets Red Dog Satellite Deposits Cirque Red Dog VIP2 Project Teena Steelmaking Coal Well established with capital efficient value options Elk Valley Replacement Brownfield Quintette/Mt. Duke Elk Valley Brownfield Neptune Terminals Expansion Coal Mountain 2 Copper Strong platform with substantial growth options San Nicolás (Cu-Zn) QB2 Zafranal Mesaba NuevaUnión HVC Brownfield Schaft Creek Antamina Brownfield Galore Creek Fort Hills Debottlenecking & Expansion QB3

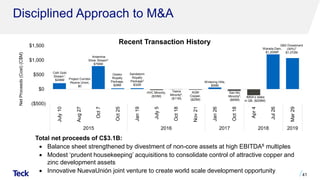

- 42. Disciplined Approach to M&A 41 CdA Gold Stream1, $206M Project Corridor /Nueva Union, $0 Antamina Silver Stream2 $795M Osisko Royalty Package, $28M Sandstorm Royalty Package3 $32M HVC Minority, ($33M) Teena Minority4, ($11M) AQM Copper, ($25M) Wintering Hills, $59M San Nic Minority5, ($65M) IMSA’s stake in QB, ($208M) Waneta Dam, $1,200M6 QB2 Divestment (30%)7 $1,072M ($500) $0 $500 $1,000 $1,500 July10 Aug27 Oct7 Oct25 Jan19 July5 Oct18 Nov21 Jan26 Oct18 Apr4 Jul26 Mar29 2015 2016 2017 2018 2019 Total net proceeds of C$3.1B: • Balance sheet strengthened by divestment of non-core assets at high EBITDA8 multiples • Modest ‘prudent housekeeping’ acquisitions to consolidate control of attractive copper and zinc development assets • Innovative NuevaUnión joint venture to create world scale development opportunity Recent Transaction History NetProceeds(Cost)(C$M)

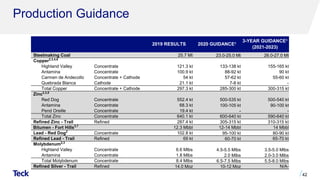

- 43. Production Guidance 42 2019 RESULTS 2020 GUIDANCE1 3-YEAR GUIDANCE1 (2021-2023) Steelmaking Coal 25.7 Mt 23.0-25.0 Mt 26.0-27.0 Mt Copper2,3,4,6 Highland Valley Concentrate 121.3 kt 133-138 kt 155-165 kt Antamina Concentrate 100.9 kt 88-92 kt 90 kt Carmen de Andecollo Concentrate + Cathode 54 kt 57-62 kt 55-60 kt Quebrada Blanca Cathode 21.1 kt 7-8 kt - Total Copper Concentrate + Cathode 297.3 kt 285-300 kt 300-315 kt Zinc2,3,5 Red Dog Concentrate 552.4 kt 500-535 kt 500-540 kt Antamina Concentrate 68.3 kt 100-105 kt 90-100 kt Pend Oreille Concentrate 19.4 kt - - Total Zinc Concentrate 640.1 kt 600-640 kt 590-640 kt Refined Zinc - Trail Refined 287.4 kt 305-315 kt 310-315 kt Bitumen - Fort Hills3,7 12.3 Mbbl 12-14 Mbbl 14 Mbbl Lead - Red Dog2 Concentrate 102.8 kt 95-100 kt 80-90 kt Refined Lead - Trail Refined 69 kt 60-70 kt 65-70 kt Molybdenum2,3 Highland Valley Concentrate 6.6 Mlbs 4.5-5.5 Mlbs 3.5-5.0 Mlbs Antamina Concentrate 1.8 Mlbs 2.0 Mlbs 2.0-3.0 Mlbs Total Molybdenum Concentrate 8.4 Mlbs 6.5-7.5 Mlbs 5.5-8.0 Mlbs Refined Silver - Trail Refined 14.0 Moz 10-12 Moz N/A-

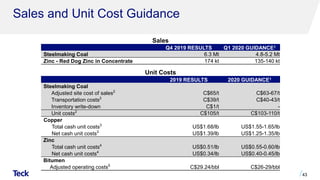

- 44. Sales and Unit Cost Guidance 43 2019 RESULTS 2020 GUIDANCE1 Steelmaking Coal Adjusted site cost of sales2 C$65/t C$63-67/t Transportation costs2 C$39/t C$40-43/t Inventory write-down C$1/t - Unit costs2 C$105/t C$103-110/t Copper Total cash unit costs3 US$1.68/lb US$1.55-1.65/lb Net cash unit costs3 US$1.39/lb US$1.25-1.35/lb Zinc Total cash unit costs4 US$0.51/lb US$0.55-0.60/lb Net cash unit costs4 US$0.34/lb US$0.40-0.45/lb Bitumen Adjusted operating costs5 C$29.24/bbl C$26-29/bbl Unit Costs Sales Q4 2019 RESULTS Q1 2020 GUIDANCE1 Steelmaking Coal 6.3 Mt 4.8-5.2 Mt Zinc - Red Dog Zinc in Concentrate 174 kt 135-140 kt

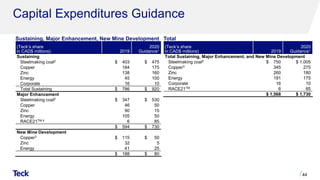

- 45. Capital Expenditures Guidance 44 (Teck’s share in CAD$ millions) 2019 2020 Guidance1 Sustaining Steelmaking coal2 $ 403 $ 475 Copper 184 175 Zinc 138 160 Energy 45 100 Corporate 16 10 Total Sustaining $ 786 $ 920 Major Enhancement Steelmaking coal2 $ 347 $ 530 Copper 46 50 Zinc 90 15 Energy 105 50 RACE21TM 4 6 85 $ 594 $ 730 New Mine Development Copper3 $ 115 $ 50 Zinc 32 5 Energy 41 25 $ 188 $ 80 Sustaining, Major Enhancement, New Mine Development (Teck’s share in CAD$ millions) 2019 2020 Guidance1 Total Sustaining, Major Enhancement, and New Mine Development Steelmaking coal2 $ 750 $ 1,005 Copper3 345 275 Zinc 260 180 Energy 191 175 Corporate 16 10 RACE21TM 6 85 $ 1,568 $ 1,730 Total

- 46. (Teck’s share in CAD$ millions) 2019 2020 Guidance1 QB2 Capital Expenditures $ 1,220 $ 2,420 Total capex, before SMM/SC contribution $ 2,788 $ 4,150 Estimated SMM/SC contributions2 (1,035) (660) Estimated QB2 project financing draw - (1,760) Total Teck spend $ 1,753 $ 1,730 Quebrada Blanca Phase 2 (Teck’s share in CAD$ millions) 2019 2020 Guidance1 Capitalized Stripping Steelmaking coal $ 443 $ 370 Copper 192 200 Zinc 45 55 $ 680 $ 625 Capitalized Stripping Capital Expenditures Guidance (continued) 45

- 47. Commodity Price Leverage1 46 MID-POINT OF 2020 PRODUCTION GUIDANCE2 CHANGE ESTIMATED EFFECT ON ANNUALIZED PROFIT3 ESTIMATED EFFECT ON ANNUALIZED EBITDA3 $C/$US C$0.01 C$37M /$0.01∆ C$58M /$0.01∆ Coal [24] Mt US$1/tonne C$18M /$1∆ C$28M /$1∆ Copper 292.5 kt US$0.01/lb C$5M /$0.01∆ C$8M /$0.01∆ Zinc4 930 kt US$0.01/lb C$10M /$0.01∆ C$13M /$0.01∆ WCS5 13 Mbbl US$1/bbl C$12M /$1∆ C$17M /$1∆ WTI6 - US$1/bbl C$9M /$1∆ C$12M /$1∆

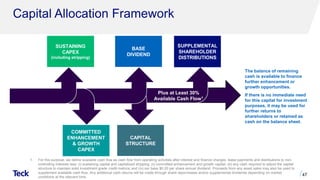

- 48. Capital Allocation Framework 47 1. For this purpose, we define available cash flow as cash flow from operating activities after interest and finance charges, lease payments and distributions to non- controlling interests less: (i) sustaining capital and capitalized stripping; (ii) committed enhancement and growth capital; (iii) any cash required to adjust the capital structure to maintain solid investment grade credit metrics; and (iv) our base $0.20 per share annual dividend. Proceeds from any asset sales may also be used to supplement available cash flow. Any additional cash returns will be made through share repurchases and/or supplemental dividends depending on market conditions at the relevant time. BASE DIVIDEND COMMITTED ENHANCEMENT & GROWTH CAPEX CAPITAL STRUCTURE SUSTAINING CAPEX (including stripping) SUPPLEMENTAL SHAREHOLDER DISTRIBUTIONS Plus at Least 30% Available Cash Flow1 The balance of remaining cash is available to finance further enhancement or growth opportunities. If there is no immediate need for this capital for investment purposes, it may be used for further returns to shareholders or retained as cash on the balance sheet.

- 49. Strong Track Record of Returning Cash to Shareholders ~$6.5 billion returned from January 1, 2003 to December 31, 2019 48 Dividends • $4.4 billion since 2003, representing ~28% of free cash flow1 Share Buybacks • $2.1 billion since 2003, representing ~14% of free cash flow1

- 50. Tax-Efficient Earnings in Canada ~C$3.4 billion in available tax pools1 • Includes: ‒ $2.6 billion in net operating loss carryforwards ‒ $0.5 billion in Canadian Development Expenses (30% declining balance p.a.) ‒ $0.3 billion in allowable capital loss carryforwards • Applies to cash income taxes in Canada • Does not apply to: ‒ Resource taxes in Canada ‒ Cash taxes in foreign jurisdictions 49

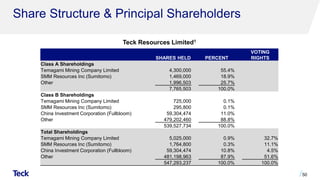

- 51. Share Structure & Principal Shareholders 50 SHARES HELD PERCENT VOTING RIGHTS Class A Shareholdings Temagami Mining Company Limited 4,300,000 55.4% SMM Resources Inc (Sumitomo) 1,469,000 18.9% Other 1,996,503 25.7% 7,765,503 100.0% Class B Shareholdings Temagami Mining Company Limited 725,000 0.1% SMM Resources Inc (Sumitomo) 295,800 0.1% China Investment Corporation (Fullbloom) 59,304,474 11.0% Other 479,202,460 88.8% 539,527,734 100.0% Total Shareholdings Temagami Mining Company Limited 5,025,000 0.9% 32.7% SMM Resources Inc (Sumitomo) 1,764,800 0.3% 11.1% China Investment Corporation (Fullbloom) 59,304,474 10.8% 4.5% Other 481,198,963 87.9% 51.6% 547,293,237 100.0% 100.0% Teck Resources Limited1

- 52. Notes: Appendix – Strategy and Overview Slide 39: Global Customer Base 1. Gross profit before depreciation and amortization is a non-GAAP financial measure. See “Non-GAAP Financial Measures” slides. Slide 41: Disciplined Approach to M&A 1. Carmen de Andacollo gold stream transaction occurred in USD at US$162 million. 2. Antamina silver stream transaction occurred in USD at US$610 million. 3. Sandstorm royalty transaction occurred in USD at US$22 million. 4. Teena transaction occurred in AUD at A$10.6 million. 5. San Nicolàs transaction occurred in USD at US$50 million. 6. Waneta Dam transaction closed July 26, 2018 for C$1.2 billion. 7. QB2 Partnership (sale of 30% interest of project to Sumitomo; SMM and SC) for total consideration of US$1.2 billion, including US$800 million earn-in and US$400 million matching contribution; converted at FX of 1.34 on March 29, 2019. 8. EBITDA is a non-GAAP financial measure. See “Non-GAAP Financial Measures” slides. Slide 42: Production Guidance 1. As at February 20, 2020. See Teck’s Q4 2019 press release for further details. 2. Metal contained in concentrate. 3. We include 100% of production and sales from our Quebrada Blanca and Carmen de Andacollo mines in our production and sales volumes because we fully consolidate their results in our financial statements. We include 22.5% and 21.3% of production and sales from Antamina and Fort Hills, respectively, representing our proportionate ownership interest in these operations. 4. Copper production includes cathode production at Quebrada Blanca and Carmen de Andacollo. 5. Total zinc includes co-product zinc production from our 22.5% proportionate interest in Antamina. 6. Excludes production from QB2 for three-year guidance 2021–2023. 7. The 2021–2023 bitumen production guidance does not include potential near-term debottlenecking opportunities. See energy business unit in quarterly press releases for more information. Slide 43: Sales and Unit Cost Guidance 1. As at February 20, 2020. See Teck’s Q4 2019 press release for further details. 2. Steelmaking coal unit costs are reported in Canadian dollars per tonne. Adjusted site cost of sales includes site costs, transport costs, and other and does not include deferred stripping or capital expenditures. Adjusted site cost of sales is a non-GAAP financial measure. See “Non-GAAP Financial Measures” slides. 3. Copper unit costs are reported in U.S. dollars per payable pound of metal contained in concentrate. Total cash unit costs are before co-product and by-product margins. Copper net cash unit costs are after by-product margins and include adjusted cash cost of sales and smelter processing charges, less cash margin for by-products including co-products. Assumes a zinc price of US$1.05 per pound, a molybdenum price of US$11 per pound, a silver price of US$16.00 per ounce, a gold price of US$1,300 per ounce and a Canadian/U.S. dollar exchange rate of $1.32. See “Non-GAAP Financial Measures” slides. 4. Zinc unit costs are reported in U.S. dollars per payable pound of metal contained in concentrate. Total cash unit costs are before co-product and by-product margins. Zinc net cash unit costs are after by-product margins and are mine costs including adjusted cash cost of sales and smelter processing charges, less cash margin for by-products. Assumes a lead price of US$0.90 per pound, a silver price of US$16.00 per ounce and a Canadian/U.S. dollar exchange rate of $1.32. By-products include both by-products and co-products. See “Non-GAAP Financial Measures” slides. 5. Bitumen unit costs are reported in Canadian dollars per barrel. Adjusted operating costs represent costs for the Fort Hills mining and processing operations and do not include the cost of diluent, transportation, storage and blending. See “Non-GAAP Financial Measures” slides. 51

- 53. Notes: Appendix – Strategy and Overview Slide 44: Capital Expenditures Guidance 1. As at February 20, 2020. See Q4 2019 press release for further information. 2. Steelmaking coal sustaining capital guidance includes $290 million of water treatment capital. 2019 includes $176 million of water treatment capital. Steelmaking coal major enhancement capital guidance includes $390 million relating to the facility upgrade at Neptune Bulk Terminals. 3. Copper new mine development guidance for 2020 includes studies for QB3, Zafranal, San Nicolás and Galore Creek. 4. RACE21TM capital expenditures for 2020 include $65 million relating to steelmaking coal, $5 million relating to copper, $5 million relating to zinc and the remainder relating to corporate projects. We also expect to spend approximately $70 million on RACE21TM for research and innovation expenses and intangible assets in 2020. Slide 45: Capital Expenditures Guidance (Continued) 1. As at February 20, 2020. See Q4 2019 press release for further information. 2. Total estimated contributions from Sumitomo Metal and Mining (SMM) and Sumitomo Corporation (SC) were $1.7 billion. Slide 46: Commodity Price Leverage 1. As at February 20, 2020. Before pricing adjustments, based on our current balance sheet, our expected 2020 mid-range production estimates, current commodity prices and a Canadian/U.S. dollar exchange rate of $1.32. See Teck’s Q4 2019 press release for additional information. 2. All production estimates are subject to change based on market and operating conditions. 3. The effect on our profit attributable to shareholders and on EBITDA of commodity price and exchange rate movements will vary from quarter to quarter depending on sales volumes. Our estimate of the sensitivity of profit and EBITDA to changes in the U.S. dollar exchange rate is sensitive to commodity price assumptions. EBITDA is a non-GAAP financial measure. See “Non-GAAP Financial Measures” slides. 4. Zinc includes 310,000 tonnes of refined zinc and 620,000 tonnes of zinc contained in concentrate. 5. Bitumen volumes from our energy business unit. 6. Our WTI oil price sensitivity takes into account our interest in Fort Hills for respective change in revenue, partially offset by the effect of the change in diluent purchase costs as well as the effect on the change in operating costs across our business units, as our operations use a significant amount of diesel fuel. Slide 48: Strong Track Record of Returning Cash to Shareholders 1. From January 1, 2003 to December 31, 2019. Free cash flow is a non-GAAP financial measure. See “Non-GAAP Financial Measures” slides. Slide 49: Tax-Efficient Earnings In Canada 1. As at December 31, 2019. Slide 50: Share Structure & Principal Shareholders 1. As at December 31, 2019. 52

- 54. Sustainability

- 55. Focus on Sustainability Leadership Sustainability strategy • Sustainability reporting for 19 years • Established ambitious sustainability strategy and goals in 2010 • Strategy focused on developing opportunities and managing risks • Implementing a sustainability strategy with short-term, five-year goals and long-term goals stretching out to 2030 • New goal on climate action launched and other strategic sustainability priorities to be launched in March 2020 54 Our People Biodiversity Energy and Climate Change Air Community Water

- 56. Why Sustainability Matters 55 • Increased access to capital at a lower cost • Increased cost savings and productivity • Higher financial returns • Brand value and reputation • Reduced risk of operations disruption • Efficient project and permit approvals • Meet rising supply chain and societal expectations • Employee retention and recruitment Driving growth and managing risk

- 57. Health and Safety Performance • Safety performance in 2018 - 28% reduction in High-Potential Incidents - 21% decrease in Lost-Time Injury Frequency • Conducted Courageous Safety Leadership training with 97% of employees • Two fatalities in 2018: one at Fording River Operations and one at Elkview Operations. Carried out in-depth investigations into the incidents to learn as much as possible and implement measures to prevent a reoccurrence 56 0 0.1 0.2 0.3 0.4 0.5 0.6 2015 2016 2017 2018 High-Potential Incident Frequency Serious High-Potential Incident Frequency Potentially Fatal Occurrence Frequency Incident Frequency (per 200,000 hours worked) 62% reduction in High-Potential Incident Frequency rate over past four years

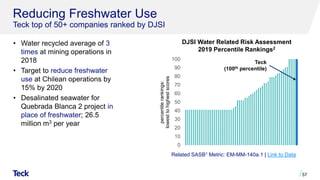

- 58. Reducing Freshwater Use Teck top of 50+ companies ranked by DJSI • Water recycled average of 3 times at mining operations in 2018 • Target to reduce freshwater use at Chilean operations by 15% by 2020 • Desalinated seawater for Quebrada Blanca 2 project in place of freshwater; 26.5 million m3 per year 57 Related SASB1 Metric: EM-MM-140a.1 | Link to Data DJSI Water Related Risk Assessment 2019 Percentile Rankings2 0 10 20 30 40 50 60 70 80 90 100 percentilerankings: lowesttohighestscores Teck (100th percentile)

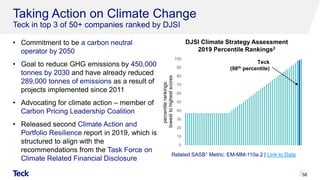

- 59. Taking Action on Climate Change Teck in top 3 of 50+ companies ranked by DJSI • Commitment to be a carbon neutral operator by 2050 • Goal to reduce GHG emissions by 450,000 tonnes by 2030 and have already reduced 289,000 tonnes of emissions as a result of projects implemented since 2011 • Advocating for climate action – member of Carbon Pricing Leadership Coalition • Released second Climate Action and Portfolio Resilience report in 2019, which is structured to align with the recommendations from the Task Force on Climate Related Financial Disclosure 58 Related SASB1 Metric: EM-MM-110a.2 | Link to Data DJSI Climate Strategy Assessment 2019 Percentile Rankings2 0 10 20 30 40 50 60 70 80 90 100 percentilerankings: lowesttohighestscores Teck (98th percentile)

- 60. Low-Carbon Producer 59 Scope 1+2 emissions per copper equivalent ranking1 (tCO2e/t CuEq, 2017) CO2 emissions per unit of energy consumed1 (CO2t/GJ)

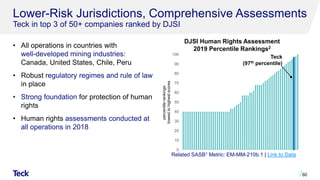

- 61. Lower-Risk Jurisdictions, Comprehensive Assessments Teck in top 3 of 50+ companies ranked by DJSI • All operations in countries with well-developed mining industries: Canada, United States, Chile, Peru • Robust regulatory regimes and rule of law in place • Strong foundation for protection of human rights • Human rights assessments conducted at all operations in 2018 60 Related SASB1 Metric: EM-MM-210b.1 | Link to Data Teck (97th percentile) DJSI Human Rights Assessment 2019 Percentile Rankings2 0 10 20 30 40 50 60 70 80 90 100 percentilerankings: lowesttohighestscores

- 62. • Agreements in place at all mining operations within or adjacent to Indigenous Peoples’ territories • Achieved agreements with all Indigenous communities near the QB2 project ‒ 8 of 8 agreements with Indigenous communities; 7 of 7 agreements with fishermen’s unions • Achieved agreements with 14 out of 14 potentially affected Indigenous groups near our Frontier project • Working with UN Women in Chile to advance economic opportunities for Indigenous women 61 Strengthening Relationships with Indigenous Peoples Related SASB1 Metric: EM-MM-210a.3 | Link to Data

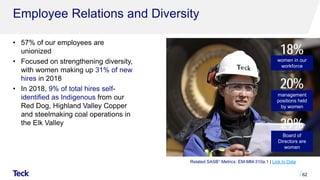

- 63. • 57% of our employees are unionized • Focused on strengthening diversity, with women making up 31% of new hires in 2018 • In 2018, 9% of total hires self- identified as Indigenous from our Red Dog, Highland Valley Copper and steelmaking coal operations in the Elk Valley 62 Employee Relations and Diversity 18% women in our workforce 29% Board of Directors are women Related SASB1 Metrics: EM-MM-310a.1 | Link to Data 20% management positions held by women

- 64. Collective Agreements OPERATION EXPIRY DATES Line Creek May 31, 2019 Elkview October 31, 2020 Fording River April 30, 2021 Antamina July 31, 2021 Highland Valley Copper September 30, 2021 Trail Operations May 31, 2022 Cardinal River June 30, 2022 Quebrada Blanca January 31, 2022 March 31, 2022 November 20, 2022 Carmen de Andacollo September 30, 2022 December 31, 2022 63

- 65. Notes: Sustainability Slide 57: Reducing Freshwater Use 1. Sustainability Accounting Standards Board Standards. https://www.sasb.org/ 2. SAM Corporate Sustainability Assessment 2018. Slide 58: Taking Action on Climate Change 1. Sustainability Accounting Standards Board Standards. https://www.sasb.org/ 2. SAM Corporate Sustainability Assessment 2018. Slide 59: Low Carbon Producer 1. Source: Barclays Research, Teck. Slide 60: Lower-Risk Jurisdictions, Comprehensive Assessments 1. Sustainability Accounting Standards Board Standards. https://www.sasb.org/ 2. SAM Corporate Sustainability Assessment 2018. Slide 61: Strengthening Relationships with Indigenous Peoples 1. Sustainability Accounting Standards Board Standards. https://www.sasb.org/ Slide 62: Employee Relations and Diversity 1. Sustainability Accounting Standards Board Standards. https://www.sasb.org/ 64

- 67. RACE21TM Our innovation-driven business transformation program 66 • Implementing existing, proven technology across the mining value chain to improve productivity and lower costs • Initial target of $150 million in annualized EBITDA1 improvements by the end of 2019; focused on delivering significant value by 2021 • More than 40 different projects implemented across our operations Renew Automate Connect Empower

- 68. RACE21TM 67 • Unify and modernize Teck’s core systems • Establish technology foundation that facilitates deployment of Connect and Automate reliably and at scale • For example: Wireless site infrastructure to support automation, sensing, site communications, information access, pit-to-port integration and advanced analytics • Accelerate and scale autonomy program • Transformational shift in safety • Reduce per-tonne mining costs with smaller fleets • Provide innovation platform to enable implementation of advanced analytics to drive cycle time improvement & predictive maintenance Renew Automate

- 69. RACE21TM 68 • Link disparate systems into a collaborative digital platform with powerful tools for sensing and analyzing in real time • For example: Dynamic and predictive models to reduce variability, leading to significant improvements in throughput and recovery • The natural implication of Renew, Automate, and Connect is we can re-imagine what it means to work at Teck and re-design our operating model to attract, recruit, train and retain the workforce of the future Connect Empower

- 70. Significant Value To Be Captured 69 COST Reduced operational costs by achieving manufacturing levels of variability PROFITABILITY Step-change impact to profitability SAFETY Transformational safety impact with fewer people in high risk environments PRODUCTIVITY Increased productivity through new technologies and internal innovation Example value capture areas: Autonomy, Integrated Operations, Advanced Analytics, Real Time Data Systems A Sustainable Future

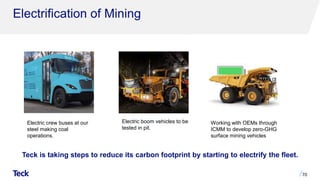

- 71. Electrification of Mining Teck is taking steps to reduce its carbon footprint by starting to electrify the fleet. 70 Electric crew buses at our steel making coal operations. Electric boom vehicles to be tested in pit. Working with OEMs through ICMM to develop zero-GHG surface mining vehicles

- 72. Notes: Technology and Innovation Slide 66: RACE21TM 1. EBITDA is a non-GAAP financial measure. See “Non-GAAP Financial Measures” slides and “Use of Non-GAAP Financial Measures” section of the Q4 2019 news release for further information. 71

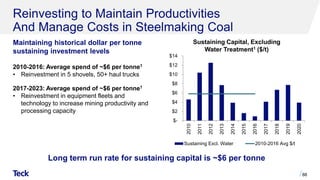

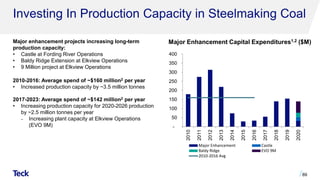

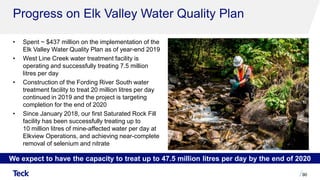

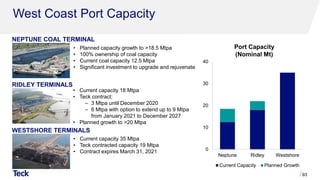

- 73. Steelmaking Coal Business Unit & Markets

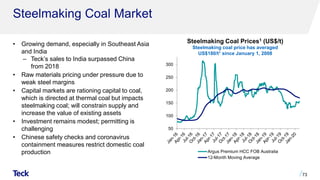

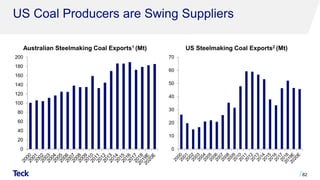

- 74. Steelmaking Coal Market • Growing demand, especially in Southeast Asia and India ‒ Teck’s sales to India surpassed China from 2018 • Raw materials pricing under pressure due to weak steel margins • Capital markets are rationing capital to coal, which is directed at thermal coal but impacts steelmaking coal; will constrain supply and increase the value of existing assets • Investment remains modest; permitting is challenging • Chinese safety checks and coronavirus containment measures restrict domestic coal production 73 50 100 150 200 250 300 Argus Premium HCC FOB Australia 12-Month Moving Average Steelmaking Coal Prices1 (US$/t) Steelmaking coal price has averaged US$180/t1 since January 1, 2008

- 75. Our market is seaborne hard coking coal2: ~205 million tonnes Steelmaking Coal Facts Global Coal Production1: ~7.8 billion tonnes Steelmaking Coal Production2: ~1,150 million tonnes Export Steelmaking Coal2: ~355 million tonnes Seaborne Steelmaking Coal2: ~315 million tonnes 74 • ~0.7 tonnes of steelmaking coal is used to produce each tonne of steel3 • Up to 100 tonnes of steelmaking coal is required to produce the steel in the average wind turbine4

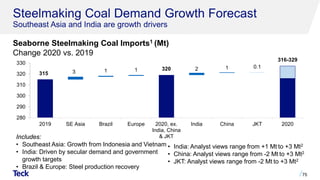

- 76. Steelmaking Coal Demand Growth Forecast Southeast Asia and India are growth drivers Seaborne Steelmaking Coal Imports1 (Mt) Change 2020 vs. 2019 75 Includes: • Southeast Asia: Growth from Indonesia and Vietnam • India: Driven by secular demand and government growth targets • Brazil & Europe: Steel production recovery • India: Analyst views range from +1 Mt to +3 Mt2 • China: Analyst views range from -2 Mt to +3 Mt2 • JKT: Analyst views range from -2 Mt to +3 Mt2 315 320 316-329 3 1 1 2 1 0.1 280 290 300 310 320 330 2019 SE Asia Brazil Europe 2020, ex. India, China & JKT India China JKT 2020

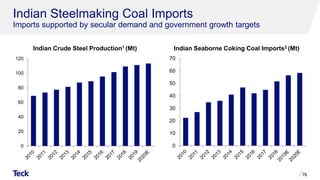

- 77. Indian Steelmaking Coal Imports Imports supported by secular demand and government growth targets 76 Indian Seaborne Coking Coal Imports2 (Mt)Indian Crude Steel Production1 (Mt) 0 20 40 60 80 100 120 0 10 20 30 40 50 60 70

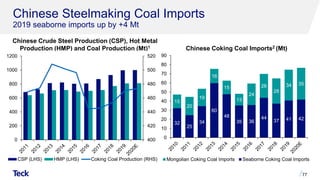

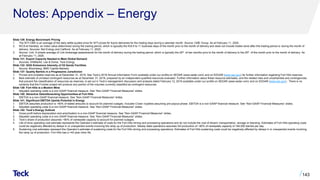

- 78. Chinese Steelmaking Coal Imports 2019 seaborne imports up by +4 Mt 77 Chinese Coking Coal Imports2 (Mt) Chinese Crude Steel Production (CSP), Hot Metal Production (HMP) and Coal Production (Mt)1 400 420 440 460 480 500 520 0 200 400 600 800 1000 1200 CSP (LHS) HMP (LHS) Coking Coal Production (RHS) 32 25 34 60 48 35 36 44 37 41 42 15 20 19 16 15 13 24 26 28 34 35 0 10 20 30 40 50 60 70 80 90 Mongolian Coking Coal Imports Seaborne Coking Coal Imports