Marketing project-report-on-lux-soap

- 1. Marketing Project Report on Lux Soap By: Amit Kumar Sinha PGDMRM-002 IPE, Hyderabad

- 2. Contents: Company Profile – HUL Distibution Channel - HUL Product Mix – HUL Overview – Lux Soap Marketing Mix SWOT Analysis Competitor Analysis Market Segmentation Recommendation Reference

- 3. Company Profile - HUL

- 4. Company Profile - HUL • A 52% owned subsidiary of Anglo Dutch giant Unilever. • India – 1888 • India largest FMCG company • Touching 2 out of 3 Indian consumer • 20 distinct categories – Home and personal care products, food and beverages. • HLL – HUL • 100 factories – India – Manufacturing its diverse product range • Headquarter: Mumbai • Market share – Toilet soap category – 54.3%

- 7. Distribution Channel - HUL

- 8. Distribution Channel - HUL 2000+ Suppliers and associates 4000 Redistribution stockists Covering 1 million retail outlets Reaching 250 million rural consumers

- 10. The width of the HUL Product mix: The width of the product mix refers to the number of different product line the company carries E.g: Personal wash Laundry Skin care Oral care Deodorants Colour cosmetics Ayurvedic personal and health care

- 12. The lenght of the HUL Product mix: The Lenght of the product mix refers to the total number of items in the product mix. E.g: Personal wash: Lux, Lifebuoy, Liril, Hamam, Breeze, Dove, Pears, Rexona Laundry: Surf excel, Rin, Wheel Skin care: Fair & Lovely, Ponds, Vaseline, Aviance Oral care: Pepsodent, Close up Deodorants: Axe, Rexona Colour cosmetics: Lakme Ayurvedic personal and health care: Ayush

- 13. Shampoo: Sunsilk, Clinic Tea: Broke bond, Lipton. Coffee: Bru Foods: Kissan, Annapurna, Knorr Ice cream: Kwality walls Width = 30

- 14. The Depth of the HUL Product mix: The depth of the product mix refers to the number of variants of each product offered in the line E.g: If close up toothpaste comes in three formulation and in three sizes, close up has a depth of 9 (3*3) The Consistency of the HUL Product mix: The consistency of the product mix refers to how closely related the various product lines are in the use, production requirement, distribution channel or in any other manner. HUL Product line are not consistent because of its large width.

- 15. Overview : Lux Soap 1916 – Laundry soap 1925 – Bathroom soap India – 1929 First brand ambassador: Leela Chitnis (1929) Market share is almost equal to Lifebuoy

- 16. Marketing Mix:

- 17. Product: Product Classification: Tangible Non durable good Lux and other soaps fall into the category of convenience good.

- 18. Product Life Cycle: Maturity Stage

- 19. Prominent Variants: Lux almond Lux orchid Lux fruit Lux saffron Lux sandalwood Lux rose Lux international Lux chocolate Lux aromatic extracts Lux oil and honey glow etc.

- 20. Logo: Labelling: Lux trade character or logo is present prominently in the package Female model Displayed graphically – Key ingredients

- 21. Packaging: Different colors – Different variants( Saffron – Saffron variants & Pink – Rose extracts etc. ) Package size – 100gm, 120gm, 150 gm Launched – Mini Lux – 45gm - Rs 5

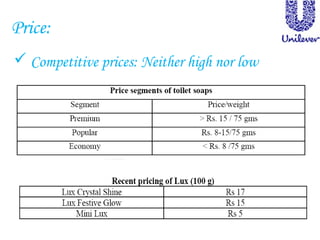

- 22. Price: Competitive prices: Neither high nor low

- 23. Place: HUL distribution network – key strength (Which helps reach out its product across the length and width of the vast country) 2000+ Suppliers & Associates 7000 Stockists Direct coverage in over 1 million retail outlets

- 24. Network: Factory – Company warehouses – Distributor – Market Factory – Wholesaler & Big retailers (Bulk orders) – 30% Sales

- 26. Featured all top actress of their times.

- 27. Idea: if it is good enough for a film star, it is good for me.

- 29. First Male Brand Ambassador:

- 30. South India: 1970 – Jayalalitha Shriya Sharan

- 31. Sales Promotion: Lux gold star offer: 22 Carat Gold coin in the Soap – First 10 caller (Extra 30 gm gold) Lux star bano, Aish karo contest: A special promotional pack of lux soap – Scratch card -50 lucky winner got the chance to meet Aishwarya rai.

- 32. SWOT Analysis

- 33. Strengths: Strong market research (Door to door sampling – once in a year – Rural and Urban area.) Many variants (Almond oil, Orchid extracts, Milk cream, Fruit extracts, Saffron sandalwood oil and Honey) Strong sales and distribution network backed by HUL Strong brand image

- 34. Dynamically continuous innovations – New variants and innovative promotions (22 carat gold coin promotion – “Chance Hai”) Strong brand promotion but relatively lower prices – Winning combination. Mass appeal/Market presence across all segments ( 15% of soap market)

- 35. Weakness: Mainly positioned as beauty soap targeted towards women, lack unisex appeal Some variation like the sunscreen, international variant did not do well in the market Not much popular in rural areas

- 36. Opportunities: Soap industry is growing by 10% in India Beauty segments compounded annual growth rate (CAGR) is very high Liquid body wash is currently in growth stage – Lux should come out with more variants in this segment Large market share – Strong hold over the market

- 37. Threats: High internal competition (Pears – Beauty segment) New entrants (Vivel) Maturity stage – threat of slipping down to decline stage – if constant reinvention is not carried out

- 39. Internal Competitor: Lifebuoy: 1895, 18% Market shares External Competitor: Godrej consumers products limited (GCPL): 2nd Largest soap maker after HUL 9.2% Market share Brands: Cinthol, Fairglow, Nikhar

- 40. Wipro: Brand: Santoor (No 1 in AP) and Chandrika ITC: 1.75% growth in initial five months Brand: Superia, Fiama di wills and Vivel Sold in six states

- 42. Market segmentation of Lux Gender: Female Age: 16-35 Income: Middle income group (Rs. 15 to 20) Highest selling beauty soap in urban area (Rural area: Lifebuoy) Expensive – Affordable, Target Area: Urban and Sub urban – Upper middle and middle class people

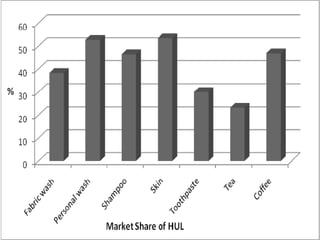

- 43. Product Positioning of Lux Created Good Position – Buyers mind – Better product attributes, price and quality Offering product in a different way Offering – improved quality of the product – affordable price with high branding – to position the product as a best quality beauty soap in buyers mind. Market share of HUL: 54.3% Market share of LUX: 15% Better Positioning – Market leader of beauty soap

- 44. Recommendation:

- 45. Recommendation: Ayurvedic variant Lux kids special soap Target rural area Target male customers

- 46. References:

- 49. Questions???