Miga

- 1. Group Number 05 MIGA: Facilitating Investments in Conflict Affected Countries

- 2. MIGA’s Mission To promote foreign direct investment (FDI) into developing countries to help support economic growth, reduce poverty, and improve people's lives.

- 3. Introduction The Multilateral Investment Guarantee Agency (MIGA) is a member organization of the World Bank Group that offers political risk insurance. It was established to promote foreign direct investment into developing countries . MIGA was founded in 1988 with a capital base of $1 billion . the headquartered is in Washington, DC . 175 member countries comprise MIGA's shareholders.

- 4. Contd. MIGA works in all regions of the world and has provided investment guarantees for projects in more than 100 developing countries across a broad range of sectors.

- 5. Member countries Members of the MIGA include 174 members of the United Nations and the Republic of Kosovo. Non-members are : Brunei, Sao Tome and Principe, Niger, Somalia, Comoros, San Marino, Bhutan, Myanmar, Tuvalu, Kiribati, Marshall Islands, Samoa, Cuba, North Korea, Andorra, Monaco, Liechtenstein, Nauru, Cook Islands, Niue, Vatican City and the rest of states with limited recognition.

- 6. Why Promote FDI? FDI play a critical role in reducing poverty, by building roads, providing clean water and electricity, and providing jobs. By taking on these tasks, the private sector can help economies grow and avert the need for governments to use funds better spent on acute social needs, while taking advantage of the opportunity to make profitable investments.

- 7. Guarantees Deterring harmful actions Resolving disputes Accessing funding Lowering borrowing costs Increasing tenors Providing extensive country knowledge Providing environmental and social expertise

- 8. Projects Two projects in Asia and the Pacific region (both in China) received MIGA’s support with guarantees totalling $24.2 million. In Latin America and the Caribbean region, MIGA provided $18.1 million in guarantees for projects in Peru and Uruguay. MIGA’s gross exposure in the Middle East and North Africa region stands at $494.5 million; with no new guarantees issued in the region in fiscal year 2010

- 9. Annual report In the FY2010, MIGA issued $1.5 billion in investment guarantees (insurance) for 19 projects in developing countries. The agency also closed the year with an outstanding gross portfolio of $7.7 billion, surpassing last year’s record high of $7.3 billion. The highlights section includes messages from World Bank Group President Robert Zoellick and MIGA Executive Vice President, Izumi Kobayashi.

- 10. POLICY On October 1, 2007, MIGA instituted a new Policy on Disclosure of Information, as well as new Policy and Performance Safeguards on Social and Environmental Sustainability. The new policies benefited from international consultations with government officials, nongovernmental organization representatives, investors and lenders, and others.

- 11. Contd… MIGA’s anti-corruption and anti-fraud standards, which took effect in October 2006, are part of an overall World Bank Group effort to establish higher standards for sustainability and corporate governance in the projects it supports.

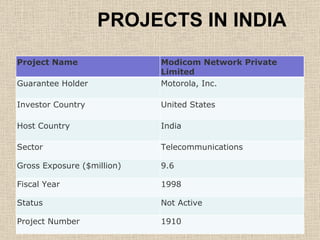

- 12. PROJECTS IN INDIA Project Name Modicom Network Private Limited Guarantee Holder Motorola, Inc. Investor Country United States Host Country India Sector Telecommunications Gross Exposure ($million) 9.6 Fiscal Year 1998 Status Not Active Project Number 1910

- 13. PROJECTS IN INFRASTRUCTURE Power Solid Waste Management Telecommunications Transportation Water Water and Wastewater

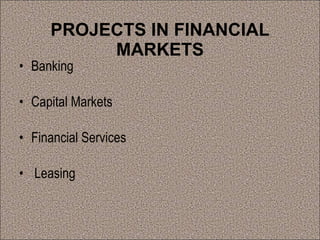

- 14. PROJECTS IN FINANCIAL MARKETS Banking Capital Markets Financial Services Leasing

- 15. PROJECTS IN EXTRACTIVE INDUSTRIES Chemicals Mining Oil and Gas

- 16. Projects in Manufacturing & Services Agribusiness Manufacturing Services Tourism

- 17. Working MIGA promotes foreign direct investment into developing countries by Insuring investors against political risk, Advising governments on attracting investment Sharing information through on-line investment information services, Mediating disputes between investors and governments. Miga's membership in the world bank group enables the organization to intervene with host governments to resolve claims before they are filed .

- 18. Eligibility Must be cross border between member countries (Cannot participate in purely local deals) Must be “new” investment, but there is considerable flexibility here -Expansion or modernization of old plant -Acquisition of existing project if there is a financial restructuring etc. Minimum term of 3 years; coverage up to 15 years, on occasion – 20 years

- 19. Investment Types: Equity, including shareholder loans and various profit sharing agreements Loans, but only if there is an equity cover Loan guarantees (could be used to cover sponsor support agreements) Non-shareholder loans Non-equity direct investment Coverage – Equity covered up to 90%, Debt up to 95% Amounts: MIGA typically can arrange cover for all amounts, either on its own books or through co/reinsurance

- 20. FT Summit Izumi Kobayashi, Executive Vice President,MIGA.

- 21. GROUP NUMBER 5:- VICKY A MATHUR (56) MANISH CHANDRA YADAV (24) POOJA CHILONGIA (39) SONALI SHIVKAR(50) NIDHI SHARMA (37) Thank You