Ml master class for CFA Dallas

- 1. Machine Learning and AI in Finance 2021 Copyright QuantUniversity LLC. Presented By: Sri Krishnamurthy, CFA, CAP sri@quantuniversity.com www.quantuniversity.com 04/27/2021

- 2. 2 Speaker bio • Advisory and Consultancy for Financial Analytics • Prior Experience at MathWorks, Citigroup and Endeca and 25+ financial services and energy customers. • Columnist for the Wilmott Magazine • Author of forthcoming book “The Model-Driven Enterprise” • Teaches AI/ML and Fintech Related topics in the MS and MBA programs at Northeastern University, Boston • Reviewer: Journal of Asset Management Sri Krishnamurthy Founder and CEO QuantUniversity

- 3. 3 QuantUniversity • Boston-based Data Science, Quant Finance and Machine Learning training and consulting advisory • Trained more than 1000 students in Quantitative methods, Data Science and Big Data Technologies using MATLAB, Python and R • Building a platform for AI and Machine Learning Exploration and Experimentation

- 4. 1. Key trends in AI, Machine Learning & Fintech 2. An intuitive introduction to AI and ML 3. Examples Agenda

- 5. AI and Machine Learning in Finance

- 6. 6 The 4th Industrial revolution is Here! Source: Christoph Roser at AllAboutLean.com As per Wikipedia*, “The 4th Industrial Revolution ….. marked by emerging technology breakthroughs in a number of fields, including robotics, artificial intelligence, nanotechnology, quantum computing, biotechnology, the Internet of Things, the Industrial Internet of Things (IIoT), decentralized consensus, fifth-generation wireless technologies (5G), additive manufacturing/3D printing and fully autonomous vehicles.” * https://en.wikipedia.org/wiki/Fourth_Industrial_Revolution

- 7. 7 Scientists are disrupting the way we live! Source: https://www.ladn.eu/tech-a-suivre/mobilite-2030-vehicules-volants-open-data/

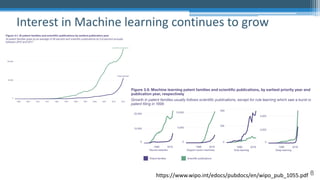

- 8. 8 Interest in Machine learning continues to grow https://www.wipo.int/edocs/pubdocs/en/wipo_pub_1055.pdf

- 9. 9 MACHINE LEARNING AND AI IS REVOLUTIONIZING FINANCE

- 10. 10 Market impact at the speed of light! 10

- 11. 11 • Machine learning is the scientific study of algorithms and statistical models that computer systems use to effectively perform a specific task without using explicit instructions, relying on patterns and inference instead1 • Artificial intelligence is intelligence demonstrated by machines, in contrast to the natural intelligence displayed by humans and animals1 Defining Machine Learning and AI 11 1. https://en.wikipedia.org/wiki/Machine_learning 2. Figure Source: http://www.fsb.org/wp-content/uploads/P011117.pdf

- 12. 12 Machine Learning & AI in finance: A paradigm shift 12 Stochastic Models Factor Models Optimization Risk Factors P/Q Quants Derivative pricing Trading Strategies Simulations Distribution fitting Quant Real-time analytics Predictive analytics Machine Learning RPA NLP Deep Learning Computer Vision Graph Analytics Chatbots Sentiment Analysis Alternative Data Data Scientist

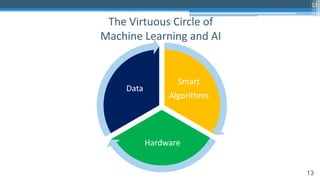

- 13. 13 The Virtuous Circle of Machine Learning and AI 13 Smart Algorithms Hardware Data

- 14. 14 The rise of Big Data and Data Science 14 Image Source: http://www.ibmbigdatahub.com/sites/default/files/infographic_file/4-Vs-of-big-data.jpg

- 15. 15 Smart Algorithms 15 Distributing Computing Frameworks Deep Learning Frameworks 1. Our labeled datasets were thousands of times too small. 2. Our computers were millions of times too slow. 3. We initialized the weights in a stupid way. 4. We used the wrong type of non-linearity. - Geoff Hinton “Capital One was able to determine fraudulent credit card applications in 100 milliseconds”* * http://go.databricks.com/hubfs/pdfs/Databricks-for-FinTech-170306.pdf

- 16. 16 Hardware Speed up calculations with 1000s of processors Scale computations with infinite compute power

- 17. 17 “Financial Technologies or “Fintech” is used to describe a variety of innovative business models and emerging technologies that have the potential to transform the financial services industry ” Technology drives finance! https://www.iosco.org/library/pubdocs/pdf/IOSCOPD554.pdf

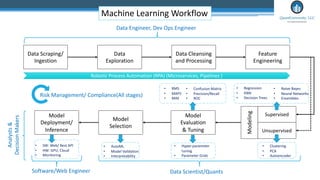

- 22. Machine Learning Workflow Data Scraping/ Ingestion Data Exploration Data Cleansing and Processing Feature Engineering Model Evaluation & Tuning Model Selection Model Deployment/ Inference Supervised Unsupervised Modeling Data Engineer, Dev Ops Engineer Data Scientist/Quants Software/Web Engineer • AutoML • Model Validation • Interpretability Robotic Process Automation (RPA) (Microservices, Pipelines ) • SW: Web/ Rest API • HW: GPU, Cloud • Monitoring • Regression • KNN • Decision Trees • Naive Bayes • Neural Networks • Ensembles • Clustering • PCA • Autoencoder • RMS • MAPS • MAE • Confusion Matrix • Precision/Recall • ROC • Hyper-parameter tuning • Parameter Grids Risk Management/ Compliance(All stages) Analysts & Decision Makers

- 24. Thank you! Sri Krishnamurthy, CFA, CAP Founder and CEO QuantUniversity LLC. srikrishnamurthy www.QuantUniversity.com Contact Information, data and drawings embodied in this presentation are strictly a property of QuantUniversity LLC. and shall not be distributed or used in any other publication without the prior written consent of QuantUniversity LLC. 24