Mobile Research - Stepping Ahead

- 1. Mobile Research - Stepping Ahead Simon Wainwright Fiona Blades everything Senior Insight Manager, EE everywhere Chief Experience Officer – MESH

- 2. T-Mobile Milestones…from the early days of One2One first for Picture Messaging & SMS, before becoming T-Mobile everything everywhere

- 3. Through to the launch of Data, Flext, Network sharing with 3, Android and the JV with Orange… everything everywhere

- 4. Brand Tracking at T-Mobile followed a traditional route pre 2010… Objective: Understand Brand Health and the impact from Comms Pre 2009: Brand & Ad Tracking combined 2009+: Removed Ad Tracking, Track Brand Health only (But Ads still pre-tested) But issues with linking the two: •TV Over-claim •The assumption that nothing else drives Brand Health everything everywhere

- 5. And every month felt like information overload… everything everywhere

- 6. Leaving us with tough decisions to make each month… everything everywhere

- 7. KPI setting & measurement = too many cooks… Which customers • New or Existing? • Which market • PAYM or PAYG? • Which Metric • & How often? everything everywhere

- 8. In 2010 we set Quarterly objectives… TWO lead measures ONLY • Brand Consideration • VFM Use relative position vs. the market • Challenger position means we need to keep track of the market • Accounts for Market Dynamics: Not ATL, you’re forgotten Business focussed on these • We needed to understand how best to monitor these and provide clear direction on performance everything everywhere

- 9. Hence a new approach was required for how we bridge the gap between Brand Health & Comms Our Challenges: 1. Equip us with richer insights to help us understand campaign impacts and actions to take 2. Help us understand campaign cut-through & wear-out by media 3. Provide a measure of emotional and functional performance for our communications • Demonstrate the impact on brand health Over-arching: Stop the reactive fire-fighting we’ve adopted when following traditional brand tracking everything everywhere

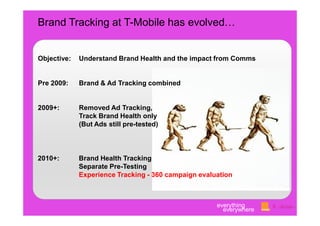

- 10. Brand Tracking at T-Mobile has evolved… Objective: Understand Brand Health and the impact from Comms Pre 2009: Brand & Ad Tracking combined 2009+: Removed Ad Tracking, Track Brand Health only (But Ads still pre-tested) 2010+: Brand Health Tracking Separate Pre-Testing Experience Tracking - 360 campaign evaluation everything everywhere

- 11. Introducing Experience Tracking everything everywhere

- 12. The Experience Tracking Approach Legacy Brand Health Current Brand Experience Future Brand Direction Participants complete a Legacy Brand Experience tracking Traditional Participants text the brands Every other day After 7 days of texting and a final visit to the Health questionnaire in advance of starting the real-time texting process. This contains the usual tracking Tracking starts and experiences they come across during their stops here… week in field. We agree the participants are required to visit their SMS diary to embellish the diary participants complete a Future Brand Direction questionnaire before exiting the survey. This is a good place to look into measures plus other metrics. brand and experiences experiences they have specific ad recall and diagnostics in more together. here… already texted about. detail. everything everywhere

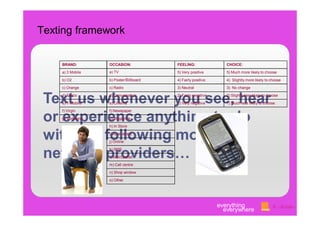

- 13. Texting framework BRAND: OCCASION: FEELING: CHOICE: a) 3 Mobile a) TV 5) Very positive 5) Much more likely to choose b) O2 b) Poster/Billboard 4) Fairly positive 4) Slightly more likely to choose c) Orange c) Radio 3) Neutral 3) No change Text us whenever you see, hear d) Tesco e) T-Mobile d) Conversation e) Cinema 2) Fairly negative 1) Very negative 2) Slightly less likely to choose 1) Much less likely to choose f) Virgin f) Newspaper or experience anything to do g) Vodafone g) Magazine h) In Store with the following mobile i) At an event j) Online network providers… k) SMS l) Mail/Leaflet m) Call centre n) Shop window o) Other everything everywhere

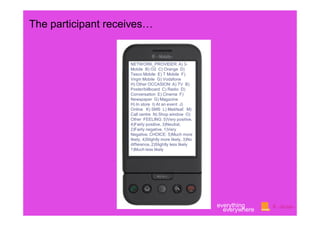

- 14. The participant receives… NETWORK_PROVIDER: A) 3- Mobile B) O2 C) Orange D) Tesco Mobile E) T Mobile F) Virgin Mobile G) Vodafone H) Other OCCASION: A) TV B) Poster/billboard C) Radio D) Conversation E) Cinema F) Newspaper G) Magazine H) In store I) At an event J) Online K) SMS L) Mail/leaf. M) Call centre N) Shop window O) Other FEELING: 5)Very positive, 4)Fairly positive, 3)Neutral, 2)Fairly negative, 1)Very Negative. CHOICE: 5)Much more likely, 4)Slightly more likely, 3)No difference, 2)Slightly less likely 1)Much less likely everything everywhere

- 15. The participant experiences… T-Mobile, Newspaper, Very Positive, Much more likely to choose next time BRAND: OCCASION: FEELING: CHOICE: a) 3 Mobile a) TV 5) Very positive 5) Much more likely to choose b) O2 b) Poster/Billboard 4) Fairly positive 4) Slightly more likely to choose c) Orange c) Radio 3) Neutral 3) No change d) Tesco d) Conversation 2) Fairly negative 2) Slightly less likely to choose e) T-Mobile e) Cinema 1) Very negative 1) Much less likely to choose f) Virgin f) Newspaper g) Vodafone g) Magazine h) In Store i) At an event e f 55 j) Online k) SMS l) Mail/Leaflet m) Call centre n) Shop window o) Other everything everywhere

- 16. And complete their diary everything everywhere

- 17. Challenge 1: everything Provide richer insights to help useverywhere take decisions

- 18. At the end of 2009 and the start of 2010 we experienced a decline in Consideration for Pay-Monthly… And we very quickly needed to understand if this was going to worsen or be turned around by the forthcoming campaign… everything everywhere

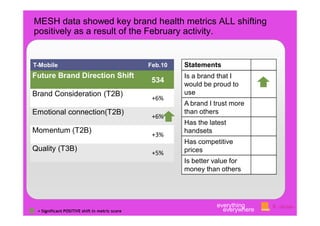

- 19. MESH data showed key brand health metrics ALL shifting positively as a result of the February activity. T-Mobile Feb.10 Statements Future Brand Direction Shift Is a brand that I 534 would be proud to Brand Consideration (T2B) use +6% A brand I trust more Emotional connection(T2B) than others +6% Has the latest Momentum (T2B) handsets +3% Has competitive Quality (T3B) prices +5% Is better value for money than others everything = Significant POSITIVE shift in metric score everywhere

- 20. This was driven by the new Smartphones for Everyone campaign launched in Mid Feb “Seen on Five player online. The advert with the geese again, the 2nd time I've seen this. Made more sense seeing it a second time, and good that they are making smart phones available to everyone. The advert makes sense now.” T-Mobile, TV, Ad from network provider, Fairly Positive, Slightly more likely to choose everything everywhere

- 21. Experience Tracking convinced us our performance was likely to recover… Uplift in Consideration for PM was the strongest we have seen in over a year… everything everywhere

- 22. Challenge 2: everything Understand Wear-out & Cut through by media everywhere

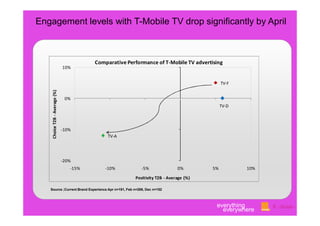

- 23. Engagement levels with T-Mobile TV drop significantly by April Comparative Performance of T-Mobile TV advertising 10% TV-F Choice T2B - Average (%) 0% TV-D -10% TV-A -20% -15% -10% -5% 0% 5% 10% Positivity T2B - Average (%) Source ;Current Brand Experience Apr n=191, Feb n=269, Dec n=152 everything everywhere

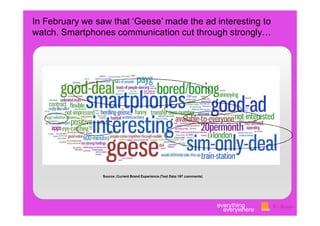

- 24. In February we saw that ‘Geese’ made the ad interesting to watch. Smartphones communication cut through strongly… Source ;Current Brand Experience (Text Data 197 comments) everything everywhere

- 25. By April, people are starting to get fed up with it Source ;Current Brand Experience (Text Data 191 comments) everything everywhere

- 26. Media placement exacerbated wear-out as ad becomes irritating and people switch off to message “The 'geese' ad again! It’s not just that it is a patronising ad in the first place but it is on such heavy rotation that it rapidly becomes extremely irritating.” T-Mobile, TV. Ad from network provider, Very Negative, Put me off “A TV ad with geese going through streets of London. I have seen it far too often (in the ad breaks during ipl) and so haven't really listened to the message it's trying to tell.” T-Mobile, TV. Ad from network provider, Fairly Negative, No difference everything everywhere

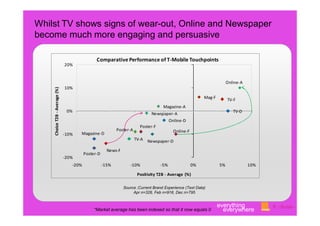

- 27. Whilst TV shows signs of wear-out, Online and Newspaper become much more engaging and persuasive Comparative Performance of T-Mobile Touchpoints 20% Online-A 10% Choice T2B - Average (%) Mag-F TV-F Magazine-A 0% TV-D Newspaper-A Online-D Poster-F Poster-A Online-F -10% Magazine-D TV-A Newspaper-D News-F Poster-D -20% -20% -15% -10% -5% 0% 5% 10% Positivity T2B - Average (%) Source ;Current Brand Experience (Text Data) Apr n=328, Feb n=918, Dec n=795 everything *Market average has been indexed so that it now equals 0 everywhere

- 28. Eye-catching colour, good handsets and good offers are attracting attention in print Eye-catching, picture symbolizes that this network is for ''normal'' people, good variety of handsets T-Mobile, Newspaper, Fairly Positive, Slightly more likely to choose This advert was in the Sun on Tuesday and really caught my attention. I really liked this advert and the deal on offer and it gave you a lot of variety which I liked. This ad would definitely make me consider them in the future. T-Mobile, Newspaper, Fairly Positive, Slightly more likely to choose everything everywhere

- 29. The majority of Online experiences for T-Mobile were through own ads and own website. It is the content people find particularly persuasive Source ;Current Brand Experience Base size: 64 texts everything everywhere

- 30. As in press, the smartphone ads, particularly Blackberry were appealing to a range of people “I was looking at the t-mobile website at their deals for smartphone and blackberry. I found their deals interesting and their prices competitive. They offered smartphone/blackberry which came with minutes. I am likely to consider their offers.” T-Mobile, Online. Fairly Positive, Slightly more likely to choose. Orange customer “It was advertising the new blackberry at a good rate” T-Mobile, Online. Fairly Positive, Slightly Tesco customer more likely to choose. everything everywhere

- 31. Challenge 3: Understand the functional and emotional response to Welcome Home – is it effective at driving consideration for TMUK? Engagement levels with T-Mobile TV drop significantly by April everything everywhere

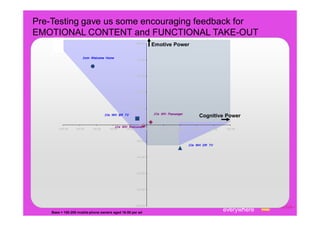

- 32. Pre-Testing gave us some encouraging feedback for EMOTIONAL CONTENT and FUNCTIONAL TAKE-OUT 100.00 Emotive Power 3min Welcome Home 80.00 60.00 40.00 20.00 30s WH BR TV 20s WH Passenger Cognitive Power 0.00 -100.00 -80.00 -60.00 20s WH Welcome 0.00 -40.00 -20.00 20.00 40.00 60.00 80.00 100.00 -20.00 30s WH DR TV -40.00 -60.00 -80.00 -100.00 everything Base = 150-200 mobile phone owners aged 16-50 per ad everywhere

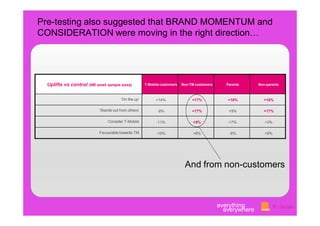

- 33. Pre-testing also suggested that BRAND MOMENTUM and CONSIDERATION were moving in the right direction… Uplifts vs control (NB small sample sizes) T-Mobile customers Non-TM customers Parents Non-parents ‘On the up’ +14% +17% +16% +16% ‘Stands out from others’ -8% +17% +9% +17% Consider T-Mobile -11% +9% +7% +3% Favourable towards TM -10% +6% -6% +9% And from non-customers everything everywhere

- 34. Welcome Home contributes towards T-Mobile’s best-in- class engagement performance. Brand Experience Map - Welcome Home (25th October to 26th November) 60 Choice T2B % 55 50 45 40 35 30 25 20 30 35 40 45 50 55 60 Orange O2 Vodafone T Mobile Virgin 3 Tesco Other Positivity T2B % Significant shifts in Momentum, Quality, Value for Money with high Reach and good quality experiences. Source: Current Brand Experience (Text Data) n for Welcome Home (25th Oct to 26th Nov) = 4231 / Market average: 45% (Positivity); 40% (Choice) everything everywhere

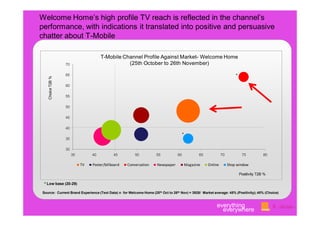

- 35. Welcome Home’s high profile TV reach is reflected in the channel’s performance, with indications it translated into positive and persuasive chatter about T-Mobile T-Mobile Channel Profile Against Market- Welcome Home 70 (25th October to 26th November) 65 * Choice T2B % 60 55 50 45 40 * 35 30 35 40 45 50 55 60 65 70 75 80 TV Poster/billboard Conversation Newspaper Magazine Online Shop window Positivity T2B % * Low base (20-29) Source: Current Brand Experience (Text Data) n for Welcome Home (25th Oct to 26th Nov) = 3928/ Market average: 45% (Positivity); 40% (Choice) everything everywhere

- 36. As intended, the TV ad is not only engaging but persuasive too “Quite possibly the best TV advert ever. This is the one set in the airport. It catches your attention every time. Fantastic advert by t-mobile. Seen on Channel 4” T-Mobile, TV, Ad from network provider, Consumers, Very positive, Much more likely to choose “Tremendous Advert. Had everything that should tempt consumers to seek out new deals with T-Mobile” T-Mobile, TV, Ad from network provider, Both, Very positive, Much more likely to choose everything everywhere

- 37. And is being spread well virally through YouTube and Facebook “Showed the latest t-mobile viral commercial to my parents who thought it was incredible” T-Mobile, Online, Viral Video on Video Sharing site e.g. You Tube, Very positive, Much more likely to choose “T-Mobile Welcome back advert linked from a friend's facebook page. I clicked and watched the video on youtube - good video” T-Mobile, Online, Viral Video on Video Sharing site e.g. You Tube, Very positive, Slightly more likely to choose everything everywhere

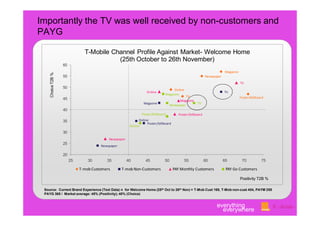

- 38. Importantly the TV was well received by non-customers and PAYG T-Mobile Channel Profile Against Market- Welcome Home (25th October to 26th November) 60 Magazine Choice T2B % 55 Newspaper TV 50 Online Online TV Magazine TV Poster/billboard 45 Magazine Magazine TV Newspaper 40 Poster/billboard Poster/billboard 35 Online Poster/billboard Online 30 Newspaper 25 Newspaper 20 25 30 35 40 45 50 55 60 65 70 75 T-mob Customers T-mob Non-Customers PAY Monthly Customers PAY Go Customers Positivity T2B % Source: Current Brand Experience (Text Data) n for Welcome Home (25th Oct to 26th Nov) = T-Mob Cust 169, T-Mob non-cust 454, PAYM 255 PAYG 365 / Market average: 45% (Positivity); 40% (Choice) everything everywhere

- 39. The popularity of T-Mobile amongst non-customers and PAYG shifted positively Welcome Home Brand Image Shift Pre-Post (Non T-Mobile Customers) Is a popular brand 8% 6% Has good customer service 1% They treat their customers fairly 4% 5% Reward their customers 5% 4% PAYG Customers Deal with customers in an open and honest way 2% 1% Has a reliable network 4% Non T-Mobile 1% Customers Is better value f or money than others 3% 5% Has competitive prices 5% 4% Has the latest handsets 4% 2% Has straightf orward pricing 1% 4% Is a brand that I would be proud to use 4% 6% A brand I trust more than others 3% Acts upon advice f rom its customers 5% 2% Listens to and takes advice from its customers 4% 3% Source: Pre and Post questionnaires Welcome Home (25th Oct- 26th Nov) everything everywhere

- 40. WH Performance (As of 17th Jan) 6.6m views on Youtube 23,036 ratings from users ( 98% positive / 2% negative) 40k Facebook fans PayG Sales Performance Dec achieved 99% of target From Mid Dec exceeded weekly target by 30% PayM Sales Performance Dec achieved 98% of targets Retail achieved 104% of its target everything everywhere

- 41. Experience Tracking helps gives us make more Insightful Decisions… Media scheduling/laydown How to optimise Creative When to rotate copy everything everywhere

- 42. Future client challenges 360 campaign evaluation Advanced analytics Level of execution Faster response Purchase window impact Calibrating against external data Integrated research programmes Proposition v creative vehicle Transition from Brand to Experience Tracking everything everywhere