Module 2.pdf

- 1. Nitte School of Architecture planning and design Subject Code: 18ENG85 Subject Code: 18ENG85 Subject Title: CONSTRUCION AND PROJECT MANAGEMENT Semester: VIII Section: A & B Faculty Name: SUMANTA PATIL, SUPTHA RAO

- 2. Feasibility study Feasibility studies are primary studies undertaken in the early stage of a project. They tend to be carried out when the project is large or complex and the investment is high. Every construction project must give benefits for the investor. These benefits includes of profit, business development, etc. The profits are achieved in a long period and one must have an accurate forecast of the investment so that the investors still have willingness to invest their money. Feasibility study analysis also provides information about the value of investment and the benefits that investors may get. The return on investment can be seen from feasibility study. Generally, Cost benefit analysis through Generally, Cost benefit analysis through Net Present Value (NPV), Internal Rate of Return (IRR) Are the tools that are used by investors to consider this project is feasible or not. Risks can influence the profits and it will decrease the feasibility for investing in the project. Hence risks must be anticipated and counter actions must be planned and calculated in the feasibility analysis.

- 3. Project Feasibility study In project management, a project feasibility study evaluates the following areas: • Technical Capability: Is the organization equipped with the necessary technical resources to complete the project • Budget: Does the organization have the financial resources to carry out the project, and does the cost-benefit analysis justify moving forward? • Legality: What is the project's legal requirements, and can the company meet them? • Risk: What are the risks involved in completing this project? Is the risk worth the • Risk: What are the risks involved in completing this project? Is the risk worth the company's money and time based on the expected benefits? • Operational feasibility: Does the project, in its intended scope, address the organization's needs through fixing problems and/or seizing opportunities? • Time: How much time would it take for completion? Importance of Feasibility Study: The value of a feasibility study stems from the desire of an organization to “get it right” before investing resources, time, or money. A feasibility study may discover fresh ideas that alter the scope of a project. It's preferable to make these decisions ahead of time rather than rushing into a project only to discover that it won't work. A feasibility study is usually advantageous to a project since it provides you and other stakeholders with a clear picture of what is being planned.

- 4. Following are the major benefits that project feasibility study offers: • Improves the attention of project teams • Discovers fresh possibilities • Provides relevant information that helps in making the judgment regarding whether to proceed or not. • Eliminates (unwanted) options • Identifies a compelling reason for pursuing the project. • By examining several parameters, it improves the success rate. • By examining several parameters, it improves the success rate. • Assists in project decision-making • Determines why it's not a good idea to go ahead.

- 5. Project Appraisal Project appraisal: Appraisal consists of an evaluation of all of the feasibility studies to determine the ability of the project to succeed. Thus, feasibility analysis and appraisal form the critical juncture in the integrated project cycle. Generally mega projects involve large investments. Lending institutions before executing credits to borrowers will take up project appraisal considering the following aspects • The social aspect though unquantifiable aims at visible progress in quality of life and to the advancement of local conditions. • The technical aspects relating to design engineering and realistic implementation • The technical aspects relating to design engineering and realistic implementation schedule. • The institutional aspect dealing with creation of a sound and viable institution for operation and management. • The economic aspect to review justification for the project • Financial aspect dealing with the manner by which costs incurred are recovered from the beneficiaries. • Environmental aspects for protection of environment and natural resources.

- 6. DECISION MAKING IN PROJECT MANAGEMENT In project management, decisions need to be made on a frequent basis. Decisions can be important unimportant, or critical if critical then decision taken will cause the project to be successful or to fail. Decision-making is the act of choosing between two or more alternative options. In the wider process of problem-solving, decision-making involves choosing between possible solutions to a problem. The final decisions can be made through either an intuitive or reasoned process, or a combination of the two, depending on the nature of the decision. Examples of decisions : • Selection of project manager • Whether services of a consultant is to be availed and if so, scope of services and • Whether services of a consultant is to be availed and if so, scope of services and method of selection. • Mode of execution of project works – through contractor, direct execution by owner or a combination of both • If the work is to be executed through a contractor, the decision to be taken by the owner on the advice of consultant before approval of tender document. © Acharya's NRV School of Architecture

- 7. Decision making approach Identify the problem Gather/ collect information Monitor and Evaluate the result Identify the alternatives/ other possible solutions Assess the possible solutions and the their feasibility Select the best option Implement the solution

- 8. Decision making tools Project managers often use some extra methods that can support the correctness of their decisions. While the basic principles might be the same, there are many different techniques and tools that can be used. They can also be used as combination of these techniques to arrive at the final decisions. So, in that case, a skill that it would be an advantage for the project managers to have is to select which of the below are appropriate and relevant at any case. • Decision tree • Decision matrix • Swot analysis • Swot analysis • Cost benefit analysis Investment criteria: NPV Payback period ARR IRR • Voting - A decision-making technique that can be used includes voting. Voting can facilitate making decisions based on unanimity, majority, or plurality. © Acharya's NRV School of Architecture

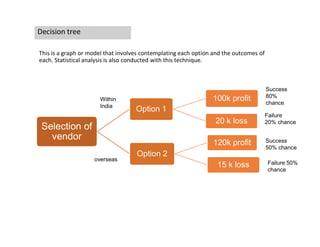

- 9. Decision tree This is a graph or model that involves contemplating each option and the outcomes of each. Statistical analysis is also conducted with this technique. Selection of Option 1 100k profit 20 k loss Within India Success 80% chance Failure 20% chance Selection of vendor 20 k loss Option 2 120k profit 15 k loss overseas 20% chance Success 50% chance Failure 50% chance

- 10. Swot Analysis SWOT stands for strengths, weaknesses, opportunities and threats, which is exactly what this planning tool assesses. Internal to project Internal to project External to the project

- 11. Decision Matrix A decision matrix is similar to a pros/cons list, but it allows you to place a level of importance on each factor. That way, you can more accurately weigh the different options against each other. List your decision alternatives as rows List relevant factors as columns Establish a consistent scale to assess the value of each combination of alternatives and factors Determine how important each factor is towards making your final decision and assign weights accordingly Multiply your original ratings by the weighted rankings Add up the factors under each decision alternative The option that scores the highest wins

- 12. Cost-benefit Analysis A cost-benefit analysis involves comparing the explicit and implicit costs of taking an action versus expected benefits. The process of gathering that information may be enlightening in itself because it may require the business to assign monetary value to factors that don’t have explicit costs. The resulting analysis allows decision-makers to weigh all information and make rational choices. As a pros-and-cons evaluation tool, CBAs are most closely associated with public-sector decision-making. But they’re also used when it comes time for project planning around adding employees, purchasing technology or equipment, expanding facilities and more. A CBA can weigh the benefits of taking an action over maintaining the status quo or help a business compare two or more options to see which one makes the most sense. Advantages of (CBA): Advantages of (CBA): Cost-benefit analyses help businesses weigh pros and cons in a data-driven way so they can make complex decisions in a systematic manner. For a successful CBA, leaders need to identify and project the explicit and implicit costs and benefits of a proposed action or investment. It’s also a good idea to assign someone to make the case for the status quo as a way to compare the opportunity cost of doing nothing and investing cash versus proposed actions. A cost-benefit analysis is based on the data on which it is based, so companies with more mature financial reporting have a higher likelihood of success.

- 13. In general most of the companies go for CBA for major decisions in the 5 areas: 1. Capital investments 2. Business process change 3. Organizational change 4. Adjusting pricing or introducing new product or service 5. Entering into a merger, acquisition or divestiture Investment criteria: Investment criteria: Payback period NPV ARR IRR

- 14. Investment Criteria of Capital Budgeting: Payback Period: is the traditional method which is simple and most widely used method of ascertaining economic viability. It is a measure in terms of time, it will take to recover initial cash investment from proposed operations. Salvage value is ignored. Time value of money is ignored. PB in years = Original investment Annual income if investment on a project is 150 lakhs. And annual income is 30 lakhs, PB = 150/30 = 5 years PB = 150/30 = 5 years NPV (Net Present Value): NPV – Net Present Value the Time Value of Money concept is the recognised method. this is a widely used economic method of evaluating investment proposals. NPV = Today's value of the expected cash flows − Today's value of invested cash.

- 15. If analyzing a longer-term project with multiple cash flows, then the formula for the NPV of the project is as follows: If PV = Present value R1, R2, R3 are cash flows at the end of 1st year 2nd year and 3rd year etc. and I is the R1, R2, R3 are cash flows at the end of 1 year 2 year and 3 year etc. and I is the initial investment. Let r = rate of interest/discount rate/opportunity cost of capital PV = Present Value = R1 + R2 + R3 +………. Rt - Initial investment (1+i)1 (1+i)2 (1+i)3 (1+r)n i.e Where, Rt - Net cash flow – out flows during a single time period t i - Discount rates or return that could be earned through alternative investments t - Number of time periods

- 16. IRR (Internal Rate of Returns ): The internal rate of return (IRR) is the discount rate for which the net present value of a project is zero. In other words, the sum of discounted costs is equal to the sum of discounted benefits when discounted by the IRR. This method is appropriate when there is only one alternative to the status quo. • The internal rate of return (IRR) is the annual rate of growth that an investment is expected to generate. • IRR is calculated using the same concept as net present value (NPV), except it sets the NPV equal to zero. • The ultimate goal of IRR is to identify the rate of discount, which makes the present value of the sum of annual nominal cash inflows equal to the initial net cash outlay for the investment. the investment. • IRR is ideal for analyzing capital budgeting projects to understand and compare potential rates of annual return over time. • In addition to being used by companies to determine which capital projects to use, IRR can help investors determine the investment return of various assets. NPV and internal rate of return (IRR) are closely related concepts, in that the IRR of an investment is the discount rate that would cause that investment to have an NPV of zero. Another way of thinking about this is that NPV and IRR are trying to answer two separate but related questions. For NPV, the question is, “What is the total amount of money I will make if I proceed with this investment, after taking into account the time value of money?” For IRR, the question is, “If I proceed with this investment, what would be the equivalent annual rate of return that I would receive?”

- 17. ARR (Accounting rate of return) : this method uses accounting information, as revealed by financial statements to measure the profitability of investment proposals. It is found out by dividing the average income after taxes by the average investment. The average investment would be equal to the original investment plus salvage value (if any) divided by two. ARR = Average income/ Average investment Criteria for acceptance of proposal: Accept all the proposals whose ARR is higher than the minimum rate established by the management and reject the proposals with ARR lesser than the minimum rate. ARR does not consider the time value of money

- 18. Value Engineering What is Value engineering… ? • is a systematic and organized approach to providing the necessary functions in a project at the lowest cost. Value engineering promotes the substitution of materials and methods with less expensive alternatives, without sacrificing functionality. • Value Engineering is used in construction projects to provide a clear and detailed analysis of how best to meet the goals of the construction project. • Value Engineering, when used with cost estimating, allows for an independent review of the entire construction project. This review process, typically completed within a Value Engineering workshop, is focused on one common goal: to provide the highest Value Engineering workshop, is focused on one common goal: to provide the highest value at the lowest cost. • However, this does not mean that Value Engineering is all about cost-cutting. • Rather through an established set of industry guidelines and procedures, Value Engineering gives all parties involved the confidence that the maximum performance and highest value is possible. • Value Engineering (VE) is not a design/peer review or cost-cutting exercise. VE is a creative, organized effort, which analyzes the requirements of a project for the purpose of achieving the essential functions at the lowest total costs (capital, staffing, energy, maintenance) over the life of the project. • Through a group investigation, using experienced, multi-disciplinary team, value and economy are improved through a study of alternate design concepts, materials, and methods without compromising the functional and value objectives of the client.

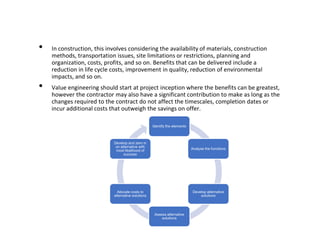

- 19. • In construction, this involves considering the availability of materials, construction methods, transportation issues, site limitations or restrictions, planning and organization, costs, profits, and so on. Benefits that can be delivered include a reduction in life cycle costs, improvement in quality, reduction of environmental impacts, and so on. • Value engineering should start at project inception where the benefits can be greatest, however the contractor may also have a significant contribution to make as long as the changes required to the contract do not affect the timescales, completion dates or incur additional costs that outweigh the savings on offer. Identify the elements Analyse the functions Develop alternative solutions Assess alternative solutions Allocate costs to alternative solutions Develop and zero in on alternative with most likelihood of success

- 20. Ultimate goal of Value Engineering: optimum value for both initial and long-term investment, a three stage Value Engineering process is used Planning Designing Methodology and Approach Why Value engineering….? With Value Engineering it s possible to eliminate stressors identify potential barriers bring new and novel design and materials to the project limit environmental risks, and keep future maintenance costs of the project low.

- 21. Roles & responsibility of Project manager/construction manager A project manager collaborates with the client throughout the entire project, from the initial budget and planning stage to the final building. A construction manager may begin working during the budgeting stage, but they're primarily involved in the construction stage. Roles & responsibility of Project manager/construction managerProject managers are owners representatives, his responsibilities can be summarised the following way: The role and responsibilities of project managers would vary depending on the agency he represents. If he represents the owner, his focus is on highest productivity of capital investment. If he represents contractor his objective would be completion of work as per agreement and earn a fair return on investment. earn a fair return on investment. As owners representative he controls resources within time, cost and performance perspective. Construction projects are multi skilled operations, hence the project managers are expected to have all the basic knowledge of all the processes and activities involved, along with good experience to anticipate critical areas and solve likely problems that would arise in the process of managing such projects.

- 22. The project manager should have ability to manage changes which may affect the project activities. He should possess skills in the following areas : Organizational planning Coordination including liaisons with owner, consultant and contractor. Operations scheduling Financial management and costing Monitoring and reporting skills Projecting and managing projections periodically during project execution stage.

- 23. Roles & responsibility of Project manager/construction manager Project manager should motivate people to work towards the better performance of the project. Should focus on team building activities which can achieve positive synergy in the project team so as to achieve targeted level of performance. Should have an in-depth knowledge human behaviour and the dynamics of their behaviours. An ideal project manager should recognise change, identifies its effects and makes use of change to manage change. With respect to changes in the project the role of project manager is to • Plan the project activities and manage planned activities accordingly. • Recognise change and its impacts (both positive ad negative impact) and make use of the identified factors to manage change (make use of change to manage change). • Recognise change and its impacts (both positive ad negative impact) and make use of the identified factors to manage change (make use of change to manage change). • Responsible for periodic monitoring and effective coordination • Keeps up schedule, controls and updates budget expenditure. • Chairs site meetings • In totality he is responsible to complete the project as planned. • Project manager should recognise that motivation and job satisfaction are 2 dimensions That influence and affects the productivity of employees (team members). Identify motivated employees as those who work willingly and give their best. • Under assignment, over assignment buck master ship, coercive type of control are some of the factors that demotivate the team members, which should be avoided by a project manager for betterment of project. SP1

- 24. Slide 23 SP1 Sumanta Patil, 5/11/2022

- 25. Roles and responsibilities of Construction manager • Implements general conditions of contract • Manages sub-contractors • Determines sequence of work • Plays a vital role in project implementation • Certifies payments

- 26. Project manager/construction manager Construction Manager: A construction manager may have the following responsibilities: • Supervising a construction team and delegating tasks • Overseeing the daily construction process on the job site • Collaborating with contractors and material suppliers • Maintaining material inventory and ordering new items • Checking local construction guidelines to ensure the project meets all requirements • Creating schedules for the team members • Writing cost estimates for the construction tasks • Writing cost estimates for the construction tasks • Observing the building project's progress and updating the project manager Project Manager: A project manager's duties can include: • Meeting with a client to discuss a new project design • Creating a project budget and plan • Selecting a project location and working to secure the land for a new building • Designing a project timeline with deadlines for each stage • Recruiting and hiring team members, including the construction manager • Writing cost estimates for all elements of a project, including the marketing and hiring process • Managing a project's paperwork, including the initial plans and zoning documents

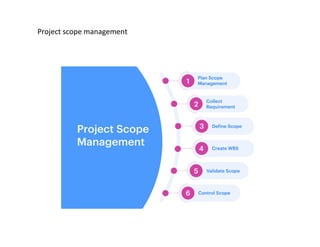

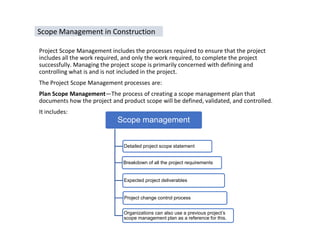

- 28. Scope Management in Construction Project Scope Management includes the processes required to ensure that the project includes all the work required, and only the work required, to complete the project successfully. Managing the project scope is primarily concerned with defining and controlling what is and is not included in the project. The Project Scope Management processes are: Plan Scope Management—The process of creating a scope management plan that documents how the project and product scope will be defined, validated, and controlled. It includes: Scope management Scope management Detailed project scope statement Expected project deliverables Breakdown of all the project requirements Organizations can also use a previous project’s scope management plan as a reference for this. Project change control process

- 29. Collect Requirements—The process of determining, documenting, and managing stakeholder needs and requirements to meet project objectives. will be required to document all the project requirements, expectations, budgets, and deliverables through interviews, surveys, and focus groups. This is a rather important step because more often than not, stakeholders can have unrealistic requirements or expectations and the project managers would be required to step in to find a solution that is acceptable by everyone from avoiding project delays. At the end of the collection requirements stage, you should have the following: Functional as well as non-functional requirements Stakeholder requirements Business requirements Support and training requirements Project requirements

- 30. Define Scope—The process of developing a detailed description of the project and product. This process will turn requirements into a well-detailed description of the service or product that project team is trying to deliver through the project. It will then have a project scope statement that can then be referred to throughout the project. While it is important to list what is in the scope of the project, it is just as important to note down what is out of the project scope. Any kind of inclusions to the scope would then have to go through the entire change control process to ensure the team is only working on things that they are supposed to work on. With a defined scope, you get a reference point for your project team and anyone else involved. In case there is something that is not involved in the scope, it doesn’t need to be completed by the team.

- 31. Create WBS—The process of subdividing project deliverables and project work into smaller, more manageable components. A project breakdown structure is a document that breaks down all the work which needs to be done in the project and then assigns all the tasks to the team members. It lists the deliverables that need to be completed and their respective deadlines as well. You can use project management software for this step of the process to assign and prioritize project tasks which will make it easier to track the entire progress of the project and avoid any unnecessary bottlenecks. Validate Scope—The process of formalizing acceptance of the completed project Validate Scope—The process of formalizing acceptance of the completed project deliverables. In this step, the scope and deliverables that you have recorded need to be sent to project executives and stakeholders to get the necessary approvals. Scope validation needs to be done before starting the project to ensure that if something goes wrong then it is easy to find where it went wrong. Control Scope—The process of monitoring the status of the project and product scope and managing changes to the scope baseline. Project managers need to ensure that as the project begins, it always stays within the defined scope. In case there are some things that need to change, then the proper change control process should be followed.