Murphy Oil Corporation 2012 Analyst Day

- 1. 2012 Analyst Day El Dorado, Arkansas May 8, 2012 M U R P H Y O I L C O R P O R AT I O N

- 2. Agenda Financial Overview Kevin Fitzgerald - Executive VP & CFO Exploration & Production Roger Jenkins – Executive VP, Exploration & Production Sam Algar – VP, Worldwide Exploration Break Downstream Tom McKinlay – Executive VP, Worldwide Downstream Wrap Up MURPHY OIL CORPORATION

- 3. Financial Overview Kevin Fitzgerald Executive Vice President & CFO May 8, 2012 MURPHY OIL CORPORATION

- 4. Cautionary Note Cautionary Note to U.S. Investors - The United States Security and Exchange Commission permits oil and gas companies, in their filings with the SEC, to disclose only proved and probable reserves. We use certain terms in this presentation, such as reserve estimates, that the SEC’s rules strictly prohibit us from including in filings with the SEC. This presentation contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. These statements, which express management’s current views concerning future events or results, are subject to inherent risks and uncertainties. Factors that could cause actual results to differ materially from those expressed or implied in our forward-looking statements include, but are not limited to, the volatility and level of crude oil and natural gas prices, the level and success rate of our exploration programs, our ability to maintain production rates and replace reserves, political and regulatory instability, and uncontrollable natural hazards. For further discussion of risk factors, see Murphy’s 2011 Annual Report on Form 10-K on file with the U.S. Securities and Exchange Commission. Murphy undertakes no duty to publicly update or revise any forward-looking statements. MURPHY OIL CORPORATION

- 5. First Quarter 2012 ($ Millions)) Net Income $ 290 Cash Flow 730 Capital Expenditures 740 Long-term Debt 250 Stockholders’ Equity 9,119 L/T Debt as % of Capital Employed 2.7% MURPHY OIL CORPORATION 2

- 6. Financial Strength / Liquidity Liquidity sources Cash flow $3.4 billion in 2012 at $95.00 WTI and $3.00 Henry Hub Assumes mid-year conversion of Milford Haven refinery to a terminal Revolver $1.5 billion committed facility maturing in June 2016 Long term bond market Maintain investment grade rating (BBB, Baa3) Preparing to access market - $500 million for 10 years MURPHY OIL CORPORATION 3

- 7. Historically Low Debt $ MM Debt/Cap % 2,500 50.0 Ninian Low Contract Kikeh WCSB Prices Drilling 45.0 2,000 40.0 35.0 1,500 30.0 25.0 1,000 20.0 15.0 500 10.0 5.0 0 0.0 1970 1975 1980 1985 1990 1995 2000 2005 2010 LTD Debt/Cap MURPHY OIL CORPORATION 4

- 8. Financial Projections 2012 2013 2014 2015 Oil Price Assumption – WTI ($/bbl) 95.00 95.00 95.00 95.00 Brent Assumption ($/bbl) 110.00 105.00 100.00 95.00 Natural Gas Price Assumption – HH ($/mcf) 3.00 3.50 4.00 4.10 Oil and Gas Production – mboe/d 193 200 250 260 Cash Flow from Operations ($MM) 3,400 3,500 4,300 4,200 Capital Expenditures ($MM) 3,700 3,800 4,000 3,300 Free Cash Flow ($MM) (300) (300) 300 900 Total Long Term Debt ($MM) 950 1,450 1,350 750 MURPHY OIL CORPORATION 5

- 9. CASH FLOW vs. CAPEX E&P AND DOWNSTREAM $MM 4,000 3,000 2,000 3,700 3,500 3,400 2,900 1,000 500 200 0 E&P 2012 DS 2012 Total 2012 Cash Flow CAPEX MURPHY OIL CORPORATION 6

- 10. Capital Expenditures 2012 CAPEX BY SEGMENT E&P DS $MM 5% E&P 3,500 Downstream 200 Total 3,700 95% MURPHY OIL CORPORATION 7

- 11. Capital Expenditures Exploration & Production $MM 2012 E&P CAPEX BY TYPE Exploration 400 Exploration Development Development 3,100 Total 3,500 11% Major Dev. Projects $MM Eagle Ford 985 Kikeh, Kakap, Siakap 800 Sarawak 515 89% Seal 215 Syncrude 165 Montney 140 MURPHY OIL CORPORATION 8

- 12. Capital Expenditures Exploration & Production 2012 E&P CAPEX BY REGION $MM Other Malaysia 1,450 6% U.S. 1,200 U.S. Canada 650 34% Other 200 Malaysia 41% Total 3,500 Canada 19% MURPHY OIL CORPORATION 9

- 13. Capital Expenditures Downstream 2012 DS CAPEX BY TYPE UK Refining & Retail US Marketing $MM 15% Marketing 170 (incl Ethanol) UK Refining & Retail 30 Total 200 85% MURPHY OIL CORPORATION 10

- 14. Conclusion Operating groups continued goal to live within cash flow Financial flexibility within Capex programs Sufficient liquidity/access to markets to take advantage of multiple opportunities MURPHY OIL CORPORATION 11

- 15. Exploration & Production Roger Jenkins President Sam Algar Vice President - Worldwide Exploration May 8, 2012 MURPHY OIL CORPORATION 1

- 16. Since We Last Met 220% Reserve Replacement, Lower F&D, Higher R/P Remained Oil Weighted: 73% - Production, 75% - Reserves NA Onshore Oil - Exceeding Expectations Sanctioned 6 Offshore Oil Projects - De-Risked Block H FLNG Back to Normal Pace of Exploration New Completions at Kikeh – Problem Resolved Slowed NA Dry Gas – Shift Capital to Oil Improved Rigor in Production Forecasting Process MURPHY OIL CORPORATION 2

- 17. Since We Last Met 350 Last Year 300 250 260 250 Δ Recalibration 200 MBOEPD 193 200 150 100 50 - 2012 2013 2014 2015 MURPHY OIL CORPORATION 3

- 18. Agenda Upstream Strategy North America Dry Gas Ongoing Oil Projects Oil Focused Exploration Program Operations, Reserves, and Production Conclusions MURPHY OIL CORPORATION 4

- 19. UPSTREAM STRATEGY MURPHY OIL CORPORATION 5

- 20. Murphy Strategic Objectives Maintain Conduct Reduce Oil-Weighted Impactful Expl & Dev Resource Base Exploration Cycle Time RESULT: Invest Rationalize with GROWTH IN & Strengthen Discipline VALUE & Portfolio SCALE MURPHY OIL CORPORATION 6

- 21. Building on a Strong Foundation 2011 Production Mix 9 Oil Projects In Execution Phase 26% Oil Global Business 58% Oil Indexed Gas 16% Gas Production Growth Resumes 680 MMBOE Risked Exploration 2015 Production Mix Portfolio 20% Flexible, Substantial NA Land Oil 11% Position Oil Indexed Gas 69% Gas Brent Priced Advantage MURPHY OIL CORPORATION 7

- 22. Oil Weighted Long Range Plan 300 260 250 250 200 200 193 Oil-Indexed SK Gas NA Dry Gas MBOEPD 150 80% Oil-Weighted 100 73% Oil-Weighted 50 Oil - 2012 2013 2014 2015 MURPHY OIL CORPORATION 8

- 23. Visible, Valuable Growth Production - MBOEPD 300 More Wells, Less 250 Volatility 200 US 150 Canada 100 90% Of Growth Is Oil 50 M’sia - Oil & 2012 2013 2014 2015 Oil Indexed: 73% 77% 81% 80% Sanctioned New Projects Capital 2012 – 2015 On Track 37% Ongoing Projects 26% New Consistent Exploration Projects Base and New Venture Activity 17% Exploration 20% MURPHY OIL CORPORATION 9

- 24. NORTH AMERICA DRY GAS – VALUE-DRIVEN FLEXIBILITY MURPHY OIL CORPORATION 10

- 25. Montney – Quality Gas Resource Facilities- On Time- On Budget R21 R20 R19 R18 R17 R16 R15 R14 R13 T79 First Quartile Well Costs British Columbia Alberta T78 Groundbirch Tupper West Opex = $ 0.65/MCF T77 DD&A = $2.50/MCF T76 Brassey Tupper T75 EUR = 4.0 BCF/ Well Murphy Acreage T74 Sundown – 156,000 Acres Total Resource = T73 0 Miles 6 1,700 - 3,500 BCF X AECO Price MURPHY OIL CORPORATION 11

- 26. NA Dry Gas – Montney Flexibility Montney Net Production - MMCFD 250 Curtailing 30 MMCFD for 200 150 50 28 Remainder of 2012 44 100 50 208 130 137 123 Drilling for Land Retention 0 Only 2012 2013 2014 2015 Minimum Flexibility Curtailment Activity Driven by Price Signal Montney Wells To Be Drilled 25 Further Slowdown Possible in 20 Outer Years - Absent Price 15 Support 10 7 6 15 5 14 8 8 8 0 2012 2013 2014 2015 MURPHY OIL CORPORATION 12

- 27. ONGOING OIL PROJECTS MURPHY OIL CORPORATION 13

- 28. NORTH AMERICA ONSHORE MURPHY OIL CORPORATION 14

- 29. NA Onshore – Sustainable Growth Production – MBOEPD 125 Proven Capability 100 Montney 75 Canada A Business of Scale 50 Other 25 US - $1.7 Billion Spend Per Year 2012 2013 2014 2015 Oil: 48% 58 % 65% 67% Capital 2012 – 2015 Seal & Eagle Ford: 13% New De-Risked, Long Life Assets Projects 6% Exploration Base Reorganized Team 7% Ongoing Delivering Results 74% Projects MURPHY OIL CORPORATION 15

- 30. Eagle Ford – Premier Resource KARNES 216,000 Net Acres N TILDEN 60 % Oil 61 Producing Wells 10 Drilling Rigs 13 Facilities 2 Dedicated Frac Crews 42 MMBOE Booked TILDEN NUECES CATARINA Murphy Acreage Murphy Gas Well Oil Murphy Oil Well Oil Condensate 0 10 mi Drilled Gas MURPHY OIL CORPORATION 16

- 31. EFS: De-Risked by Industry xx 800,000 BOEPD Source: Bentek, a Platts Company MURPHY OIL CORPORATION 17

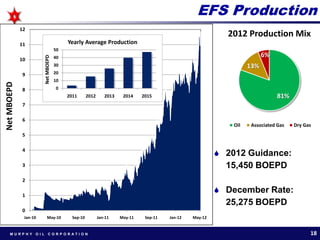

- 32. EFS Production 12 2012 Production Mix 11 Yearly Average Production 50 6% Net MBOEPD 10 40 30 13% 9 20 10 Net MBOEPD 8 0 2011 2012 2013 2014 2015 81% 7 6 Oil Associated Gas Dry Gas 5 4 2012 Guidance: 3 15,450 BOEPD 2 December Rate: 1 25,275 BOEPD 0 Jan-10 May-10 Sep-10 Jan-11 May-11 Sep-11 Jan-12 May-12 MURPHY OIL CORPORATION 18

- 33. Karnes – Continues to Exceed Expectations 1000 Current Guidance 500 MBBL EUR New Type Curve 500 730 MBBL EUR Gross BOPD 100 31 Wells Producing 14,440 Net Acres Drees 1H JOG 1H Bellah 1H Schendel A 1H Schendel C 1 H Wilson 1H Schendel B-1 JOG E-1 Cannon-1 CEF-1 Dove E-1 Dove W-1 10 0 3 6 9 12 15 18 21 24 27 30 Months 180 Locations on 80 Acre Spacing MURPHY OIL CORPORATION 19

- 34. Tilden – Major Growth Area Current Guidance Gross BOPD 380 MBO EUR: 380 MBO & 343 MMCF Months 69,500 Acres 2,650 BOPD & 380 MCFD 100% W.I. 870 Locations @ 80-Acre Spacing Except 5,200 Acres at 50% W.I. Drilling 81 Wells This Year 11 Wells Producing MURPHY OIL CORPORATION 20

- 35. Reduced Choke Production Preserves Reservoir Energy FOCUS AREA Reduces Formation Murphy Oil Well Damage Drilled 0 10 mi Rate Comparison of Average Well Enhances Frac Flow 600 500 MUR Competition Performance 400 Gross BOEPD 300 Benchmarked 230 Wells 200 100 0 Month 3 Avg Month 6 Avg Month 12 Avg MURPHY OIL CORPORATION 21

- 36. Continuous D&C Improvements Drilling Days 40 2012: 20+ Additional Wells - 32% 30 No Budget Increase 20 Drilling Records Set in Each 10 County 0 2011 2012 Fit for Purpose Rigs Frac Cost/Stage $M 340 320 16% 300 Current Target D&C Target D&C 280 D&C Costs Year End 2013 ($MM) ($MM) ($MM) 260 Karnes 8.3 7.9 7.1 240 Tilden 7.9 7.6 6.8 Catarina 7.2 6.9 6.2 2011 2012 MURPHY OIL CORPORATION 22

- 37. EFS Innovations Down Spacing Pilots in 2012 Karnes (Drilling Now) Tilden (3rd Quarter) Catarina (3rd Quarter) Frac Optimization Ongoing: Hybrid vs. Slick Water Less Short Slick Water Water 5-Cluster Slick Water Additional Optimization Tests: Packers PlusTM Zipper Fracs MURPHY OIL CORPORATION 23

- 38. EFS Oil & Gas Marketing April Net Back Prices Oil $/Bbl Rich Gas $/Mcf KARNES Karnes 110.21 5.46 Tilden 115.48 5.46 Catarina 112.76 5.27 CATARINA TILDEN Valero Energy Transfer Pipeline Harbor Island Crude Oil Pipeline Barge Terminal Crude Oil Trucks Crude Oil Truck Station NUECES Gas Pipeline Refinery Flint Hills Murphy Acreage 0 10 mi MURPHY OIL CORPORATION 24

- 39. Eagle Ford Summary Production – MBOEPD Low Cost Entry with 50 Attractive Returns 40 Other Catarina EURs Increasing 30 Tilden 20 D&C Costs Improving 10 Karnes Moving from 10 to 12 Rigs - 2012 2013 2014 2015 Early Days for Technology Oil: 81% 86% 86% 86% 275 MMBOE Resource Significant Downspacing Potential MURPHY OIL CORPORATION 25

- 40. Canada Seal Lake Murphy 100% Lands Polymer Murphy 50% W.I. Lands Thermal Successful Strat Wells CSS Pilot 70 HZ Wells in 2012 VSD Pilot CADOTTE NORTH Increased Operated Production by 20% to 8,500 BOPD Successful Polymer Pilot CLIFFDALE EAST Successful 16 Well Strat WEST CENTRAL Program SOUTH Cyclic Steam Pilot- Q4 2012 Vertical Steam Pilot – Q3 SOUTH 2013 HARMON MURPHY OIL CORPORATION 26

- 41. Well Pad Producer Seal Polymer Update Injector Injection Started Oct 2010 600 Response July 2011 Start of Polymer Injection 500 400 Incremental Production - 300 Targeted range of response 380 BOPD from 4 Wells 200 100 Commercial Polymer Project 0 Phase 1: Q2 2012 Mar-11 Apr-11 Mar-12 Jun-11 Sep-11 Jan-11 Feb-11 Jul-11 Aug-11 Jan-12 Feb-12 Oct-10 Nov-10 Dec-10 May-11 Oct-11 Nov-11 Dec-11 Phase 2: Q4 2012 Pilot Oil Production - BOPD MURPHY OIL CORPORATION 27

- 42. Seal Resources 5,850 STOIIP MMSTB Polymer / Thermal Type of Recovery Primary Polymer Thermal Total TBD 2,555 500-700 1,000-1300 1,295 – 1,795 5,850 Identified STOIIP MMSTB MMSTB MMSTB MMSTB MMSTB 200-300 45-75 190-370 50-450 485-1195 EUR Range MMSTB MMSTB MMSTB MMSTB MMSTB 210 45 110 365 YE11 Resource MMSTB MMSTB MMSTB MMSTB Reserve Group Focus- Resource Increased by 105% Current Proven Reserves: 20 MMBOE Focus on Polymer and Thermal EOR MURPHY OIL CORPORATION 28

- 43. Seal- Long Term Oil Growth MBOEPD 20 Thermal 5+ Billion Barrels in Place 18 Polymer 16 Primary Drilling Reallocation of Dry Gas 14 Capital 12 10 8 Working Plan to 6 Accelerate Production 4 2 Major Resource Adds - Ahead 2012 2013 2014 2015 MURPHY OIL CORPORATION 29

- 44. Southern Alberta - New Play 150,000 Acres Low Entry Costs Current Focus Kanai - Lower Banff 3 Forks Focus Wells 2012 Plan Lower Costs Enhanced Fracs Longer Laterals MURPHY OIL CORPORATION 30

- 45. S. Alberta Kainai Reserve GR Murphy Lands 5m Murphy Exshaw Focus Lower Mississippian Murphy Three Forks Focus Banff Fm KAINAI Upper Exshaw Kainai 14-5 Middle Exshaw Original Focus Testing Lower Exshaw 14-5 Recent Focus Devonian Three Forks 15-21 Kainai 15-21 350 BOPD IP Stettler Fm Cum Prod: 0 6 mi 24,000 BBLs MURPHY OIL CORPORATION 31

- 46. Southern Alberta - The Prize Lower Banff Middle Exshaw Lower Exshaw Upper Three Forks BTM Summary The Prize – 130 MMBO Net Oil in the System 160 Acre Spacing 42 Degree API 250 BOPD, 250 MBO per Well Search Continues for Perfect Zone 22% ROR Upside in Longer Laterals and Frac Design Resource Could Double MURPHY OIL CORPORATION 32

- 47. Southern Alberta vs. Eagle Ford Wells 600 Kainai 14-5 500 EFS Tilden 400 Gross BOPD 300 200 100 EFS Catarina 0 1 6 11 16 21 26 31 36 41 46 51 56 61 66 71 76 81 86 91 96 101 106 111 116 Days 5 per. Mov. Avg. (Kainai ) Kainai 14-5 EFS Tilden 5 per. Mov. Avg. (Jambers #1H) 5 per. Mov. Catarina EFS Avg. (Briggs #2H) MURPHY OIL CORPORATION 33

- 48. Muskwa - New Area Murphy Lands Murphy Well Targeting the Muskwa Competitor Well Shale Equivalent to Duvernay Fm Total Acres to Date: 168,000 Low Entry Cost Murphy 4-1-109 Well IP 200 BOPD IP = 150 BOPD Cum Prod 30.2 MBBL Put Well on Pump Evaluating 4 - 1 - 109 Well 0 Miles 6 MURPHY OIL CORPORATION 34

- 49. INTERNATIONAL & OFFSHORE MURPHY OIL CORPORATION 35

- 50. International/Offshore – Pillar for Growth Production – MBOEPD 175 $1.7 Billion Spend Per 150 Other Year 125 GoM 100 Srwk 75 50 Malaysia – Attractive for 25 Sabah Continued Investment - Oil & 2012 2013 2014 2015 Oil Indexed: 89% 90 % 92% 90% Capital 2012 – 2015 Back to Work in GOM 33% 40% Exploration Malaysia FLNG – New Projects Significant New Project Base 27% MURPHY OIL CORPORATION 36

- 51. Kikeh Yearly World Class Deepwater Field Production 140 MM BBLs Recovered To Date 40% 60% The Kikeh Issue - Sand/Fines Migration Upon Planned Water Deeper Reservoirs Shallow Reservoirs Production (9 wells) (11 wells) Resolved With Gravel Pack (GP) Completions Well Types 8 New Gravel Packed Wells 2 4 8 3 of 8 Produce Water as Planned - No Sand / Fines 8 No Sand Control New GP Wells Field Producing with Forecasted Old Screen Completions Shut In Water Cuts MURPHY OIL CORPORATION 37

- 52. Kikeh: Robust, Will Continue to Deliver State-of-the-Art Reservoir Monitoring Continuously Updated Simulation (1.7 mil cells, 593 layers) Sand 452m Shale 90+ Well Penetrations Tie 452m Wells Model to Reality Waterflood is Working Partner - NOC Technical Collaboration Highly Experienced Team MURPHY OIL CORPORATION 38

- 53. Kikeh Field Performance Sand/Fines Control Process 100% Success 100 Gravel Pack Completions 90 Key Issues 80 Rig Schedule 70 Gross MBOPD 60 Execution 50 GP Refinement 40 30 20 Total Field Recovery 10 0 Maintained Jan-11 Mar-11 May-11 Jul-11 Sep-11 Nov-11 Jan-12 Mar-12 May-12 MURPHY OIL CORPORATION 39

- 54. Sarawak Oil Projects Moving Forward 30 Future Fields 25 Existing Utilizes Existing Infrastructure Net MBOPD 20 15 10 Progressing on 5 Schedule 0 2003 2006 2009 2012 2015 2018 2021 2024 2027 Sanctioned Oil Projects Resource Levels Net First Oil Status MMBOE Serendah & Patricia 25 Q2 2013 Construction and Drilling South Acis 23 Q3 2013 Construction Permas & Endau 12 Q4 2013 FEED Work MURPHY OIL CORPORATION 40

- 55. Dalmatian Development 3 Well Subsea Development to Petronius 55 MMBOE Recoverable Dalmatian Gross, MBOEPD 20 Resource 15 40% Oil Mix 10 5 Robust Economics 0 2015 2017 2019 2021 2023 2025 2027 2029 Path Forward DOCD Approval June 2012 Project Sanction June 2012 Completions Mid 2013 First Oil Q1 2015 MURPHY OIL CORPORATION 41

- 56. Medusa Subsea Development Murphy 60% W.I. Existing Completions Exceeding Expectations 3 Well Subsea Net MBOEPD Development 10 16-27 MMBOE Recoverable 5 Spud 1st Well Q2 2013 1st Oil Q2 2015 0 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 MURPHY OIL CORPORATION 42

- 57. SK Gas – Major Oil Indexed Project Consistent Steady Production 300 250 Facility Upgrade 2012 Gross MMCFD 200 Working to Increase Rate 150 $7.00+/MCF Gas 100 50 P P 0 Jan-11 Apr-11 Jul-11 Oct-11 Jan-12 Apr-12 P 300 250 Phase 1 Phase 2 Phase 3 P P Gross MMCFD 200 150 PP P P P 100 PP 50 PP P 0 P -- Phase 1 Successful Delineation P - Phase 2 Successful Delineation 2009 2011 2013 2015 2017 2019 2021 2023 2025 P Phase 3 Successful Delineation MURPHY OIL CORPORATION 43

- 58. Long Term Oil Indexed Growth Malaysia FLNG Block H Gross Risked Resources: ~2,200 BCF 300 250 Discovered Drill Ready Prospects Leads Discovered 910 BCF 635 BCF 260 BCF 425 BCF 200 MMCFD 150 100 Murphy Net Entitlement = ~1,150 BCF 50 0 2016 2018 2020 2022 2024 2026 2028 2030 2032 2034 2036 2038 2040 De-Risked by Recent Exploration Success Sanction 2013 Award FEED Q3 2012 First Gas Planned 2016/17 MURPHY OIL CORPORATION 44

- 59. EXPLORATION MURPHY OIL CORPORATION 45

- 60. Exploration Value Creation Proven Track Record in Value Creation Through Exploration Last 3 Years: 9 Discoveries (39% Success) 13 Successful Delineation Wells in Malaysia (81% Success) Sanctioned 4 Projects with 88 MM Net BOE 10 Exploration Efficiency - Value Creation per Dollar Invested 9 2001 - 2010 8 7 6 5 4 MURPHY 3 2 1 0 Woodmac, 2012 PEER GROUP APC, APA, BG, BHP, BP, CVX, COP, ENI, XOM, HES, Maersk, MRO, NXY, NBL, OXY, OGX, OMV, Petrobras, PETRONAS, Repsol YPF, RWE Dea, STO, RDS, Statoil, TLM, Total, TLW, Wintershall, WPL MURPHY OIL CORPORATION 46

- 61. Exploration Drilling – More Coming Limited Recent Exploration Drilling Ramping Back-Up in 2012-13 First 3 Wells of 2012 Discoveries 20 Wells Yet to be Drilled Wildcat Dry Holes Wildcat Discoveries 15 Key Discoveries Exploration Wells 10 5 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Year MURPHY OIL CORPORATION 47

- 62. 2012-13 Exploration Program Iraq 2-4 Wells GOM 2-4 Wells Malaysia 5-7 Wells Cameroon Brunei 1-2 Wells 2-5 Wells Congo 1-3 Wells Technically Grounded, Value Driven Indonesia 2 Wells Up to 30 Wells; Oil / LNG-Scale Gas Focus Australia Leveraging Operational Expertise – Partner of Choice 1-3 Wells Balance - Frontier & Lower Risk Proven Plays 5 Billion BOE Gross; 500 Million BOE Risked Net 2012-2013 Portfolio MURPHY OIL CORPORATION 48

- 63. Exploration Program 2012 2013 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Block H Buluh-1 MALAYSIA Block H/P Bunga Lili-1 Block H Block P Julong BRUNEI CA-1 East-1 Jagus East-1 CA-2 C. Dohuk & Linnava-1 Gali IRAQ Baranan Baranan-1 CAMEROON Ntem MPN CONGO MPN/MPS MPN MPS WA-423-P Eupheme-1 AUSTRALIA ACP/36 NTP/80 Bassett Deep INDONESIA Semai II Semai II Dalmatian GOM Multiple South Exact Timing Discovery Rig Contracted Wells Shown by Spud Date TBD MURPHY OIL CORPORATION 49

- 64. MALAYSIA - Block H 2 Discoveries for 2012 Buluh-1 Bunga Lili-1 4 Discoveries/4 Wells Gas Field Block H Results Matched Low Risk Prospects Higher Risk Leads Pre-drill Predictions BULUH Multiple Low Risk Hanks Lookalike Prospects ROTAN Remain Bemban Rotan W Tembusu N& S Bates Total Resource Bunga Lili North ~1.5 - 2 TCF Saraca DOLFIN Bunga Lili South BUNGA LILI 0 5 km MURPHY OIL CORPORATION 50

- 65. BRUNEI First Discovery Made CA-1 Julong East-1 Discovery 2013 Appraisal BLOCK CA-1 (5% W.I.) Jagus East 2012 Exploration Julong BLOCK K Additional Prospects East-1 KIKEH KAKAP - BLOCK CA-2 (30% W.I.) GUMUSUT CA-2 Saga Jagus East Re-processing Seismic to Jati Semerak Locate Sand 3 Lower Risk Prospects Identified Oil Discovery Late 2012 / 2013 Drilling Prospects 0 20 km MURPHY OIL CORPORATION 51

- 66. IRAQ Drilling Next to Giants Peshkabir-1 Tawke Ber Bahr Sheik Adi Surrounded by Giant Oil Swara Tika Discoveries in Same Plays Atrush Shaikan First Well, Linnava-1, Drilling Linnava-1 Jebel Simrit WI 50% Oil Discovery 0 25km Resource Range 100-600-1500 MMBBL MURPHY OIL CORPORATION 52

- 67. CONGO – Extending Proven Plays Cretaceous Carbonate Oil Fields Nearby Play Unexplored in Deep Water New Seismic Defines Multiple Prospects 100-350 MMBO Each Yombo Loango 110 305 Zatchi 226 Pre-Salt Structures Underlie Carbonates MPN W. South Murphy - 85% Prospect Q3 2012 Well Firm Yanga 164 Sendji 263 W Africa Rig Firm Q3 2013+ Kitina 91 Tchendo W South Prospect 62 Moho Nord N’Kossa Likouala Cretaceous 358/2 TCF 127 4-Way Closure Moho 100 MPS 0 10 20 30 40 50 0 50 km Murphy - 50% Kilometers Oil Discovery - MMBO Cretaceous Prospect Pre-Salt Structure Pre-Salt Prospect Tertiary Prospect MURPHY OIL CORPORATION 53

- 68. CAMEROON– Ghana Play Extension Aseng Complex 143 MMBO Extending Play from Ghana to Cameroon Cameroon Gas Condensate Ntem - 50% WI & Oil Prospects/Leads Operatorship 3D Seismic Shot In-House Multiple 100+ MMBO Prospects First Wells 2012 / 13 Ntem Room to Grow in Play Equatorial Seal Rock Guinea Okume Complex 320 MMBO 0 40 km Cretaceous Source Rock MURPHY OIL CORPORATION 54

- 69. GoM – Back to Action LEGEND Focus on Proven Plays Murphy HBP Miocene Amplitudes Norphlet Murphy Leases Sub-Salt Structures Murphy Facilities Securing Long Term Rig Contract Oil Prospect Multiple Prospects 2 - 4 Wells in 2012 - 13; First in July Dalmatian South Hornet EGOM Play Area Mid - Lwr. Miocene Subsalt Play Trifecta Mustang Skyhawk Photo Deep Finish Blue Titanium Samurai MURPHY OIL CORPORATION 55

- 70. Gulf of Mexico Prospects Vito Skyhawk Gunflint Photo Finish 3-way Against Salt 65 - 200 MMBO 3-way Against Salt 90 - 350 MMBO Samurai-1 Subsalt 4-way 50 - 100 MMBO Photo Finish Skyhawk Samurai MURPHY OIL CORPORATION 56

- 71. AUSTRALIA Testing the Largest Undrilled Structures Bonaparte Basin 0 50 km NTP/80 NTP/80 Fulmar Fulmar Prospect Permian Reservoirs Petrel Frigate Anticlinal Trap 1.5 to 4 TCF Bonaparte FLNG 1.5 TCF Drill 2013 Tern ACP/36 Browse Basin Prospect 0 50 km ACP/36 Bassett Deep Poseidon/ Kronos ~7 TCF Prelude ~2.5 TCF Jurassic Plover Reservoir Torosa 11.5 TCF Tilted Fault Block Trap Brecknock Multi TCF Calliance 4TCF 5.3 TCF Icthys Drill 2012/13 ~13 TCF MURPHY OIL CORPORATION 57

- 72. Murphy Global Exploration Ramping Up Exploration Drilling in 2012-13 Up to 30 Wells by End 2013 5 Billion BOE Gross, 500 MMBOE Net Risked Oil or Oil Indexed Gas Focus Multiple Impactful Prospects Iraq, Congo, Cameroon, Australia Balanced With Smaller, Lower Risk Prospects Malaysia, GoM Continuing to Grow Acreage in Focused Areas MURPHY OIL CORPORATION 58

- 73. OPERATIONS, RESERVES & PRODUCTION MURPHY OIL CORPORATION 59

- 74. Murphy – A Proven Operator HSE First Ever - Flow Capture Permit No Lost Time Accidents 3 Years in Congo TRIR in Malaysia 0.22 YTD Industry Leading Uptime GOM Canada Gas Plants Kikeh FPSO - No 1 in the World Cycle Time Iraq Drilling SK Oil Projects - On Time MURPHY OIL CORPORATION 60

- 75. Production Volatility To Improve Operated Well Count Doubled Well Count in 750 Two Years Offshore 500 Operate 82% of Wells NA Onshore 250 Resource Plays – Step Change 0 2 Years Ago 1 Year Ago Today End 2012 Facilities 2012 Average Production By Well 175 4.0 Production MBOEPD 150 3.5 Gross MBOEPD Offshor Onshor 3.0 125 e e Operated Net 2.5 100 2.0 75 1.5 50 1.0 25 0.5 0 0.0 GoM EFS Montney SK Gas Kikeh Seal West Pat 2011 2012 Kikeh FPSO M'sia LNG Methanol Plant Montney Other Facilities MURPHY OIL CORPORATION 61

- 76. 2012 Worldwide Production Kikeh - SS Wells 225,000 EFS - Wells Terra Nova - Return Seal - Wells Guidance = 193,000 BOEPD 200,000 175,000 BOEPD Syncrude - TAR Medusa - PL Shut-In Terra Nova - Offline 150,000 125,000 100,000 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Actual Forecast MURPHY OIL CORPORATION 62

- 77. Reserves – Continue to Grow & Replace Total Proved – 534 MMBOE 65% Oil 65% North America Resource Play Deepwater 28% 27% 67% Developed Conventional 220% Replacement Syncrude 17% 24% 3.4 BBOE 3.3 BBOE 2.8 BBOE Heavy Oil Contingent (Unconventional) 4% Contingent (Conventional) Possible Probable Proved Reserves YE 2009 YE 2010 YE 2011 MURPHY OIL CORPORATION 63

- 78. Low Risk Non-Proved Resource Total Non-Proved – 2.9 BBOE 75% Oil Weighted Seal Msia Oil EFS Oil 12% 11% 54% Low Risk – Existing & Assoc Gas Msia Gas Development Areas 15% 10% Syncrude North America 11% Dry Gas 38% NA Onshore Oil 25% Other Oil Projects 3.4 BBOE 16% 3.3 BBOE 2.8 BBOE Contingent (Unconventional) Contingent (Conventional) Possible Probable Proved Reserves YE 2009 YE 2010 YE 2011 MURPHY OIL CORPORATION 64

- 79. Upside Potential 350 Guidance Capacity Forecast 300 250 MBOEPD 200 150 250 260 100 193 200 50 0 2012 2013 2014 2015 MURPHY OIL CORPORATION 65

- 80. Value Proposition – NAV Based on 2P/2C Resource Malaysia Oil Malaysia Malaysia Gas Incremental Resource Upside of 80% East On- Canada Syncrude Coast Shore Based on Long-term $95/Bbl Brent, $4.25/MMBTU HH Upside Eagle EFS USA GOM Ford Risked Exploration 2012 - 2015 Portfolio Discounted at 10% After-Tax 0 5 10 15 20 25 30 35 $/Share MURPHY OIL CORPORATION 66

- 81. Conclusions Strong Oil Weighted Production Growth Ahead NA Gas Growth on Hold New Production Forecasting Process in Place – Consistency to Improve NA Onshore Oil – Source of Near-term Growth with Upside Exploration – Back to Normal Activity Levels Kikeh – New Completion Success; Long Term Project Value Ahead in Malaysia Oil-Indexed Gas Oil Weighted, De-Risked Resource Base MURPHY OIL CORPORATION 67

- 82. Downstream Business Tom McKinlay Executive VP, World Wide Downstream May 8, 2012 MURPHY OIL CORPORATION 1

- 83. Agenda Refining Renewable Energy UK Marketing US Marketing MURPHY OIL CORPORATION 2

- 84. Refining MURPHY OIL CORPORATION 3

- 85. Milford Haven Refinery Highlights Continued Focus on Safety and Operational Excellence Zero Incident Rate for Last 12 Month Period Consistently High Crude Rates - Demonstrated 135,000+ Bbl/D Improved Operating Margin Capture ~$1.00/Bbl vs Q1 2011 EBITDA: 2011 - $(15.16) MM; 2012 YTD - $20.44 MM Operations Supporting the Sales Process Aided by the Dedication and Goodwill of our Team Milford Haven 12 Month Rolling Incident Rates 1.60 TRIR LTIR 1.20 Industry TRIR Avg 0.80 0.40 Industry LTIR Avg 0.00 MURPHY OIL CORPORATION Industry Average Source: OSHA 4

- 86. Renewable Energy MURPHY OIL CORPORATION 5

- 87. Ethanol Plants HANKINSON, ND Running at 120+ mmgpy Rates Best-in-Class Production Increasing to 135+ mmgpy Co-product Development Advantaged by Corn Supply HEREFORD, TX Running at 104+ mmgpy Rates 115+ mmgpy Target in 2013 Full 12 Months Operations Advantaged by Local Demand MURPHY OIL CORPORATION 6

- 88. UK Marketing MURPHY OIL CORPORATION 7

- 89. UK Marketing Today Murco % of Total Stations Operates 457 Stations in the UK Supermarkets 16% 233 Company, 224 Branded BP 14% Sells ~185 mmgpy 5% Shell Has 2.0% of UK Market Share 10% Esso Sells ~$145 Million of Texaco Merchandise Each Year % of Total Fuel Sold 2% Total Murco Jet 41% GB Oils Other 12% 15% MURPHY OIL CORPORATION Source: Energy Institute, DECC, Forecourt Trader (06/2011) 8

- 90. UK Marketing Retail EBITDA £25 £20 £15 £ Millions £10 £5 £0 2006 2007 2008 2009 2010 2011 Retail Company Stations Retail Dealer Stations MURPHY OIL CORPORATION 9

- 91. US Marketing MURPHY OIL CORPORATION 10

- 92. Gasoline Demand Trends Consumers are Driving 49 Billion Fewer Miles per Year from Peak in 2007 Automobile Efficiencies Impacting Demand 9400 260 Vehicle Miles Traveled (Billions) 9200 250 Gasoline Demand (MB/D) 9000 240 8800 230 8600 220 8400 8200 210 8000 200 Gasoline Demand (MB/D) Vehicle Miles Traveled Billions MURPHY OIL CORPORATION Source: PIRA, (VMT Peak 1/2007, Base 12/2011) 11

- 93. US Retail MURPHY OIL CORPORATION 12

- 94. Murphy USA Overview Opened First Retail Store in 1996 Operating Sites 1,400 Operate 1,137 sites in 23 states 1,175* 1,200 1,007 Murphy USAs on Walmart Lots 130 Murphy Express Stores 1,000 Provide 3% of Total US Retail 800 Gasoline (5% in Mkt Area) 600 We serve ~1.6 Million Customers 400 Every Day 200 Historically Strong Growth Model 0 91% Fee-owned Real Estate 100% Company Operated *By End 2012 MURPHY OIL CORPORATION 13

- 95. US Retail Safety Murphy USA 12 Month Rolling Incident Rates 3.50 3.00 Industry TRIR Avg 2.50 2.00 1.50 Industry 1.00 LTIR Avg 0.50 0.00 TRIR LTIR Industry Leading Performance Received National Liberty Mutual Award for OSHA Recordable Rate Significantly Lower Than National Average MURPHY OIL CORPORATION Industry Average Source: OSHA 14

- 96. 2011 Gasoline Market Share 0% - 2% US Market Share ~3% 3% - 6% (5% Mkt Area) 7% - 14% TN OK MURPHY OIL CORPORATION Source: EIA, Internal Calculations 15