Nielsen Digital Consumer Report Q3-Q4 2011

- 1. STATE OF THE MEDIA: U.S. DIGITAL CONSUMER REPORT Q3-Q4 2011

- 2. DIGITAL 274 MILLION AMERICANS HAVE INTERNET ACCESS MORE THAN DOUBLE THE NUMBER WITH INTERNET ACCESS IN 2000 REVOLUTION 81 BILLION MINUTES SPENT ON SOCIAL NETWORKS/BLOGS 64%OF MOBILE PHONE TIME IS SPENT ON APPS 42% OF TABLET OWNERS USE THEM DAILY WHILE WATCHING TV THE LAST NUMBER OF LAPTOPS SURPASSES DESKTOPS WITHIN TV HOMES 10 YEARS 2011 2009 SOCIAL NETWORKS/BLOGS BECOME TOP ONLINE DESTINATION Accounted for 9.2% of Internet time. Passed former top category, Email. 2008 Americans averaged 1 hour, 50 minutes watching video online 132.2 MILLION 2000 11 million Americans watched video on their mobile phones AMERICANS HAD INTERNET ACCESS DVD OVERTAKES 2007 NEARLY 30 MILLION 2002 AMERICANS ACCESSED VHS AS PREDOMINANT THE MOBILE WEB HOME VIDEO FORMAT DVD represented 2/3 of all units sold 2006 6.6 BILLION MINUTES SPENT ON 2005 3.2% OF MOBILE SUBSCRIBERS OWNED A SMARTPHONE MEMBER COMMUNITY SITES (NOW KNOWN AS SOCIAL NETWORKS/BLOGS) DEBUT OF BLU-RAY Top Member Community was MSN Spaces Discs offer increased storage capacity, (2 million unique U.S. visitors) high definition video and audio Source: Nielsen 2

- 3. TV VIEWERS AN IN-DEPTH LOOK AT THE U.S. 49% MALE 51% FEMALE 23% 2 - 17 DIGITAL CONSUMER 23% 18 - 34 21% 35 - 49 20% 50 - 64 14% 65+ 16% HISPANIC 73% WHITE 13% BLACK, AFRICAN-AMERICAN 6% ASIAN OR PACIFIC ISLANDER TABLETS ARE THE ONLY DIGITAL CATEGORY TABLET OWNERS MALE 53% WHERE MALES MAKE ONLINE VIDEO VIEWERS UP THE MAJORITY FEMALE 47% 13 - 17 11% 47% MALE 18 - 34 33% 53% FEMALE 35 - 49 29% 14% 2 - 17 50 - 64 21% 27% 18 - 34 65+ 7% 28% 35 - 49 HISPANIC 15% 22% 50 - 64 WHITE 60% 10% 65+ BLACK, AFRICAN-AMERICAN 11% 12% HISPANIC ASIAN OR PACIFIC ISLANDER 9% 78% WHITE 11% BLACK, AFRICAN-AMERICAN 3% ASIAN OR PACIFIC ISLANDER SMARTPHONE OWNERS MALE 50% SOCIAL NETWORK/BLOG VISITORS FEMALE 50% 13 - 17 6% 46% MALE 39% 18 - 34 54% FEMALE 30% 35 - 49 13% 2 - 17 20% 50 - 64 27% 18 - 34 6% 65+ 28% 35 - 49 17% HISPANIC 22% 50 - 64 61% WHITE 9% 65+ 12% BLACK, AFRICAN-AMERICAN 12% HISPANIC ASIAN OR PACIFIC ISLANDER 6% 79% WHITE 10% BLACK, AFRICAN-AMERICAN 3% ASIAN OR PACIFIC ISLANDER Audience Composition % Audience Composition % Read as: Forty-nine percent of U.S. TV viewers are male Read as: Fifty-three percent of U.S. tablet owners are male Source: Nielsen 3

- 4. PLATFORMS FOR 274.2 DIGITAL ACCESS Consumers have more choices than ever for accessing their digital content. MILLION AMERICANS As more devices become increasingly connected, the ability to access the HAVE INTERNET same pictures, videos or music files across multiple devices has become a valuable feature. ACCESS 165.9 MILLION PEOPLE 117.6 MILLION 169.6 WATCHED VIDEO ON A COMPUTER MOBILE INTERNET 12 VISITORS MILLION VISITORS TO 9 3 SOCIAL NETWORKS/BLOGS 5PM 6 APP USAGE AMONG 44% OF U.S. MOBILE SUBSCRIBERS OWN 76.6 ADULTS PEAKS A SMARTPHONE MILLION 58.6 TV HOMES ARE TIME SPENT USING TABLETS AT HOME MILLION TV 70% (30% OF TIME SPENT ON-THE-GO) HD CAPABLE (67%) HOMES HAVE DIGITAL CABLE (51%) CONTENT ACCESSED DAILY: �% OF TABLET OWNERS� 39% NEWS 34% SPORTS 47.4 MILLION MILLION TV HOMES HAVE 31% BOOKS TV HOMES 35.9 4 OR MORE TV SETS (31%) Source: Nielsen HAVE A DVR (41%) 4

- 5. CROSS-PLATFORM MONTHLY TIME VIDEO ENGAGEMENT SPENT IN HOURS:MINUTES ASIAN RACE/ 5:47 With an array of online video content to choose from, consumers increased ETHNICITY their monthly online video time in 3Q 2011 by 7 percent from the same 9:28 period last year. 95:55 WHITE Watching Traditional TV Watching Video on Internet 3:37 AFRICAN- HISPANIC Mobile Subscribers Watching Video on a Mobile Phone 3:52 AMERICAN 142:05 5:30 4:20 6:11 6:29 116:46 109:15 113:46 205:56 125:48 2:24 4:25 7:33 125:55 N/A 6:30 5:25 6:30 4:20 143:22 12-17 2-11 18-24 4:35 25-34 3:19 MONTHLY TIME SPENT IN HOURS:MINUTES— 35-49 178:29 PER USER 2+ OF EACH MEDIUM 3:22 2:53 Q3 11 % Diff YOY 1 4 6:4 5 50-64 0.9% WATCHING TV IN THE HOME 203:50 1:48 2:35 4 :3 1 MONTHLY TIME 65+ SPENT IN 7.1% WATCHING VIDEO ON INTERNET HOURS:MINUTES 4 :2 0 2+ AGE 4:20 4:31 MOBILE SUBSCRIBERS WATCHING 146:45 VIDEO ON A MOBILE PHONE 0% Source: Nielsen 5

- 6. DIGITAL DIVERSITY A look at digital across four distinct groups of U.S. consumers in October 2011 The YBF—Social Network with the highest concentration of this demo Reed Between the Lines (BET)—Top Primetime Cable Program 812 million total video streams AFRICAN- AMERICAN FEMALES 25-54 Spent 2.4 billion minutes watching video online 35.4 million total video streams Top Gaming App by Total Minutes: Words with Friends (211.8 million minutes) 29% downloaded games on their mobile phone 62% visited Facebook ASIAN FEMALES 12-17 57% accessed their mobile phone’s Web browser 20% accessed their mobile phone’s Web browser Spent 106.9 million minutes watching video online Spent 3.2 billion minutes watching video online 34% more likely than average to visit LinkedIn NCIS (CBS)—Top Primetime Broadcast Program 13.6 million total video streams Spent 2.2 billion minutes watching video online 164.2 million total video streams 69% own a smartphone 63% more likely than average to visit Myspace.com HISPANIC MALES 18-34 WHITE MALES 55+ 46% download apps on their mobile phone Source: Nielsen 6

- 7. Other Apps 55.8% A BREAKDOWN OF SHARE OF MOBILE DIGITAL TIME BY DEVICE PHONE TIME BY Text During October 2011, YouTube was the top destination for online video Messaging Camera 1.1% FUNCTION 13.4% content, accounting for nearly half (45%) of Americans’ total streaming time, while Social Networks/Blogs garnered the most Internet time overall. The majority of mobile phone time was consumed by app usage with Social Networking apps accounting for the nearly 6 percent of Music/Video Apps Browser mobile time. 2.3% 11.1% Email/IM Dialer Social Networking Apps 5.3% 5.4% 5.5% AOL Media Network CBS VEVO 1.3% Social Networks/Blogs Hulu Entertainment 3.0% Websites 1.3% 21.3% Online Games 6.9% 7.7% E-mail Netflix 10.7% 6.5% Videos/Movies SHARE OF ONLINE SHARE OF INTERNET 4.3% VIDEO TIME BY TIME BY Portals 3.8% BRAND CATEGORY YouTube Other 44.7% Other 32.2% Source: Nielsen 56.5% 7

- 8. 1 SCREEN, WHAT ARE TABLET AND SMARTPHONE OWNERS DOING WHILE WATCHING TV? 2 SCREENS, 57%EMAIL CHECKED BIG SCREENS, 44% UNRELATED INFO DURING PROGRAM SMALL SCREENS SURFED FOR 44% NETWORKING SITE VISITED SOCIAL More and more, consumers are multi-tasking across their various screens. Fifty-seven percent of smartphone and tablet owners checked email while watching a TV program—their top activity—and 44 percent visited a social networking site. 59%EMAIL CHECKED Advertisers wondering if consumers might miss their message should note that 19 percent of smartphone and tablet owners searched for product information and 16 percent looked up 44% UNRELATED INFO SURFED FOR DURING COMMERCIAL coupons or deals while the television was on. TOP WEBSITES VISITED WHILE WATCHING TV 44% NETWORKING SITE VISITED SOCIAL 45% USED A DOWNLOADED APPLICATION 1. Facebook 2. YouTube 6. Craigslist 7. eBay 34%SPORT SCORES CHECKED 3. Zynga 4. Google Search 8. Electronic Arts (EA) Online 9. MSN/WindowsLive/Bing 29% INFORMATION RELATED TO THE TV LOOKED UP 5. Yahoo! Mail 10. Yahoo! Homepage PROGRAM I WAS WATCHING 19% PRODUCT INFORMATION FOR AN AD I SAW LOOKED UP 16% COUPONS OR DEALS RELATED TO LOOKED UP Source: Nielsen AN ADVERTISEMENT I SAW ON TV 8

- 9. SOCIAL NETWORKING METHODS USED TO ACCESS SOCIAL NETWORKING BY AGE BY DEVICE 18-34 35-54 55+ While nearly all social media users (97%) access social networking sites from their computers, NM Incite, a Nielsen McKinsey company, found that females are more likely than men to read social media content from their eReaders and men are more likely than women to access their social content from an Internet-enabled TV or gaming console. Mobile Phone 58.8% 36.3% 12.6% METHODS USED TO ACCESS SOCIAL NETWORKING eReader 2.9% 1.4% 0.6% BY GENDER iPad 4.5% 2.9% 2.4% Computer 95.7% 97.0% 97.0% 34.4% Mobile Phone 38.5% Internet-enabled TV 3.9% 1.2% 1.0% 0.8% eReader 2.3% Gaming Console 5.3% 2.9% 0.2% 3.4% iPad 3.1% 96.4% Computer 96.8% Handheld Music 2.4% 1.1% n/a Player 2.9% Internet-enabled TV 1.2% Other 1.0% 0.7% 1.3 3.6% Gaming Console 2.3% 0.8% Handheld Music Player 1.5% 1.1% Other 0.8% Source: NM Incite 9

- 10. TO THINK IT SHARE OF SOCIAL MEDIA BUZZ AMONG SELECT OVER-THE-TOP VIDEO DEVICES IS TO BLOG IT (3Q 2011) READ AS: During 3Q 2011, Apple TV accounted for 29.3 percent of buzz mentions among the select group of over-the-top devices By the end of 2011, NM Incite, a Nielsen/McKinsey company, tracked over 181 million blogs around the world, up from 36 million in 2006. Three of the top Apple TV Roku ten social networks in the U.S. during October were true blogs (Blogger, WordPress.com, Tumblr), with a combined 80 million unique visitors. Among 29.3% 35.3% the top social networks, Tumblr has shown the strongest growth in visitors, more than doubling its audience from last year. Emerging Social Network: Pinterest • 4.5 million unique U.S. visitors during Oct 2011 – 37 times its size at the beginning of 2011 • Consumers ages 25-34 – most likely out of all age groups to view pages on Pinterest Boxee • 92 percent of Pinterest’s audience also visited a Mass Merchandiser site 7.6% during Oct 2011 MeeGo NUMBER OF BLOGS TRACKED BY NM INCITE 13.2% Google TV 14.7% Oct -11 173,000,000 TOP 10 U.S. SOCIAL NETWORKS/BLOGS BY UNIQUE AUDIENCE Oct -09 (Oct 2011, Home & Work Computers) 127,035,018 Oct -10 139.1M Facebook 6% Oct -08 148,452,047 46.3M Blogger 4% 78,703,197 UNIQUE VISITORS 26.0M Twitter.com 41% YOY % Change Oct-06 20.4M WordPress.com 13% 35,771,454 19.3M LinkedIn 63% Oct -07 61,353,334 13.8M Tumblr 128% 13.4M Myspace.com -63% 9.5M Google+ N/A 7.6M Wikia 28% Source: Nielsen and NM Incite 7.0M Squidoo 14% 10

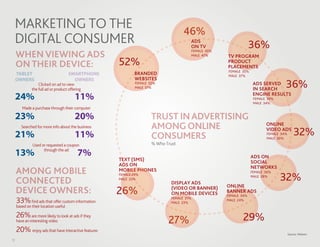

- 11. MARKETING TO THE 46% DIGITAL CONSUMER ADS ON TV 36% WHEN VIEWING ADS FEMALE 45% MALE 47% TV PROGRAM ON THEIR DEVICE: 52% PRODUCT PLACEMENTS FEMALE 35% TABLET SMARTPHONE BRANDED MALE 37% OWNERS OWNERS WEBSITES Clicked on ad to view the full ad or product offering FEMALE 52% MALE 51% ADS SERVED IN SEARCH 36% 24% 11% ENGINE RESULTS FEMALE 39% MALE 34% Made a purchase through their computer 23% 20% TRUST IN ADVERTISING Searched for more info about the business AMONG ONLINE ONLINE 21% 11% CONSUMERS VIDEO ADS FEMALE 34% MALE 30% 32% Used or requested a coupon % Who Trust 13% through the ad 7% ADS ON TEXT (SMS) SOCIAL ADS ON NETWORKS AMONG MOBILE MOBILE PHONES FEMALE 36% CONNECTED FEMALE 29% MALE 22% DISPLAY ADS MALE 28% 32% ONLINE DEVICE OWNERS: 26% (VIDEO OR BANNER) ON MOBILE DEVICES BANNER ADS FEMALE 34% 33% find ads that offer custom information FEMALE 31% MALE 23% MALE 24% based on their location useful 26% 29% 27% are more likely to look at ads if they have an interesting video 20% enjoy ads that have interactive features Source: Nielsen 11

- 12. MOBILE SHOPPING ACTIVITIES IN THE PAST 30 DAYS THE INCREASING POWER OF MOBILE �% OF MOBILE SHOPPERS� Comparing prices online while shopping in a store 38% Browsing products through websites or apps 38% COMMERCE Reading online reviews Mobile is transforming into a powerful commerce tool, facilitating of products 32% consumer transactions and access to real-time information and deals. Searching for/using Twenty-nine percent of smartphone owners use their phone for online coupons 24% shopping-related activities and more than half of mobile users are repeat visitors to daily deal sites. The Groupon app is the 10th most popular app Purchasing products 22% on the iOS platform and ranks 22nd on Android devices. Scanning a barcode for price/product information 22% UNIQUE AUDIENCE FOR in millions Android Using location-based services DAILY DEAL APPS �OCT 2011� iOS to find a retail location 18% Placing a bid through an online auction 15% Groupon 4.8 6.1 Purchasing tickets to events 12% Visits per person: 11 Visits per person: 6 Purchasing music or video content 10% Paying for goods or services at point of sale 9% LivingSocial 1.2 2.4 Visits per person: 7 Visits per person: 4 Source: Nielsen 27% of male and 22% of female online consumers would use their mobile phones to make payments in restaurants 12 or shops if they could

- 13. THE IN-HOME STREAMING EXPERIENCE 33% OF CONSUMERS STREAMED A MOVIE OR TV SHOW FROM THE INTERNET THROUGH A SUBSCRIPTION SERVICE The home entertainment landscape is becoming increasingly complex LIKE NETFLIX OR HULU PLUS as consumers are presented with a greater variety of ways to consume content, especially with the addition of digital streaming and movie downloads via the Internet. AUDIENCE COMPOSITION % FROM HOME COMPUTERS FEMALES ACCOUNT FOR 64% OF TOTAL TIME SPENT Male 43 WATCHING VIDEO CONTENT ON NETFLIX AND HULU 41 Female 57 59 HISPANICS ARE MUCH MORE LIKELY NETFLIX 2 - 17 18 9 TO WATCH VIDEO ON 18 - 34 40 31 THAN ON HULU 26 35 - 49 26 ASIANS 13 50 - 64 23 NETFLIX 4 STREAM MORE VIDEOS ON HULU 65+ 11 HULU Hispanic 16 THAN ON NETFLIX 11 76 HULU White 79 Black or African- 10 VIEWERS ARE MORE LIKELY American 11 Asian or Pacific Islander 3 3 BACHELOR'S OR TO HAVE A POST-GRAD DEGREE 18% THAN NETFLIX VIEWERS PAID TO DOWNLOAD downloaded to rent 14% downloaded MORE THAN A THIRD A MOVIE OR TV SHOW to own OF HULU'S AUDIENCE IS OVER THE AGE OF 50 FROM THE INTERNET �% OF CONSUMERS� Source: Nielsen 13

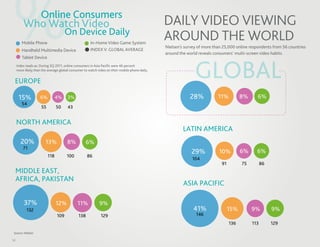

- 14. % Mobile Phone Online Consumers Who Watch Video Handheld Multimedia Device On Device Daily In-Home Video Game System INDEX V. GLOBAL AVERAGE DAILY VIDEO VIEWING AROUND THE WORLD Nielsen’s survey of more than 25,000 online respondents from 56 countries around the world reveals consumers’ multi-screen video habits. GLOBAL Tablet Device Index reads as: During 3Q 2011, online consumers in Asia Pacific were 46 percent more likely than the average global consumer to watch video on their mobile phone daily. EUROPE 15% 6% 4% 3% 28% 11% 8% 6% 54 55 50 43 NORTH AMERICA LATIN AMERICA 20% 13% 8% 6% 71 29% 10% 6% 6% 118 100 86 104 91 75 86 MIDDLE EAST, AFRICA, PAKISTAN ASIA PACIFIC 37% 12% 11% 9% 132 41% 15% 9% 9% 109 138 129 146 136 113 129 Source: Nielsen 14

- 15. THE GLOBAL SWITZERLAND US ONLINE # 1 GOOGLE 2 3 4 Facebook YouTube MSN/WindowsLive/Bing 1 # GOOGLE 2 Facebook 3 4 Yahoo! MSN/WindowsLive/Bing 5 YouTube PERSPECTIVE 5 Microsoft 6 Bluewin 6 Microsoft 7 Wikipedia 7 AOL Media Network 8 Apple 8 Wikipedia 1 9 Apple TOP 10 WEB BRANDS BY UNIQUE 9 Local.ch 10 Ask Search Network 10 search.ch AUDIENCE (Oct 2011, Home & Work Computers ) # GOOGLE YOUTUBE is a top ten GERMANY BRAZIL online destination in all 2 Facebook 2 MSN/WindowsLive/Bing of the countries 1 3 YouTube # 4 5 eBay Microsoft 3 4 Facebook UOL JAPAN 1 GOOGLE 5 YouTube 1 6 Amazon 2 Google 6 Microsoft 3 FC2 7 MSN/WindowsLive/Bing 7 Terra 8 Wikipedia 8 Globo.com # GOOGLE # YAHOO! 4 YouTube 9 T-Online 5 Rakuten 9 Orkut 6 Wikipedia 10 Web.de 10 Yahoo! 7 Microsoft AUSTRALIA 8 goo 1 FACEBOOK is among the top three sites in every 2 Facebook 9 Ameba 10 Amazon 1 country except Japan (the country's top two social networking 3 NineMSN/MSN sites, FC2 and Ameba, are among the top 10 most-visited overall) 4 YouTube # GOOGLE # GOOGLE 5 Microsoft 6 7 Yahoo!7 Wikipedia SPAIN 1 8 Apple 2 MSN/WindowsLive/Bing ITALY 2 Facebook # GOOGLE 9 10 eBay Blogger 3 4 Facebook YouTube 3 YouTube 5 Microsoft 4 MSN/WindowsLive/Bing 6 Blogger 5 Virgilio 7 Yahoo! 6 Libero FRANCE UK 8 Wikipedia 1 7 Microsoft 9 Elmundo.es 2 Facebook 2 Facebook 10 WordPress.com 8 Yahoo! 3 MSN/WindowsLive/Bing 9 Wikipedia 4 Microsoft # GOOGLE 3 4 MSN/WindowsLive/Bing BBC 10 Blogger 5 YouTube 5 YouTube 6 Orange 6 Yahoo! GOOGLE is the top Web brand 7 Wikipedia 7 Amazon 8 Free 8 eBay in each country except Japan Source: Nielsen 9 PagesJaunes 9 Microsoft 10 Yahoo! 10 Wikipedia 15

- 16. SOURCES 6 • Online Video Streams and Total Minutes: VideoCensus (Total), Oct 2011 • Social Networking: NetView (Total), Oct 2011 2 • 2000: NetView (Home & Work), Jan 2000 • TV Programs: NPOWER, Oct 2011, Live+SD. Excludes Breakouts, specials, Sports, programs less than 5 minutes in duration and • 2002: VideoScan, 2002 programs with less than three telecasts • 2005: NetView (Home & Work), Oct 2005 • • 2006: Mobile Insights, 3Q 2006 2007: Mobile Insights, Jan 2007 7 • Mobile Phone: Smartphone Analytics, Oct 2011 • Online Video: VideoCensus (Total), Oct 2011 • 2008: VideoCensus (Home & Work), Jan 2008 • Internet: NetView (Total), Oct 2011 Mobile Media Marketplace, 3Q 2008 • 2009: NetView (Home & Work), May 2009 8 • Activities while watching TV: Mobile Connected Device Report, 3Q 2011 “The Switch from Analog to Digital TV,” Nov 2009 • 2011: NetView (Total), Oct 2011 • Top sites visited while watching TV: NPOWER (Cross-Platform Homes), Oct 2011 Smartphone Analytics, Oct 2011 Mobile Connected Device Report, 3Q 2011 NPOWER (NPM Sample), Aug 2011 9 • NM Incite, State of Social Media Survey, April 2011 3 • TV Viewers: National UEs and MarketBreaks 2012 10 • Top U.S. Social Networks/Blogs and Pinterest: NetView (Home & Work), Oct 2011 • Online Video Viewers: VideoCensus (Total), Oct 2011 • Blog trend: NM Incite, Oct 2006-2011 • Social Network/Blog Visitors: NetView (Total), Oct 2011 • Over-the-Top device buzz: NM Incite, 3Q 2011 • Tablet Owners: Mobile Insights, 3Q 2011 • Smartphone Owners: Mobile Insights, 3Q 2011 11 • Trust in Advertising: Nielsen Global Survey, 3Q 2011 • Among smartphone, tablet and connected mobile device owners: 4 Mobile • Mobile Internet Visitors: Mobile Insights, 3Q 2011 Mobile Connected Device Report, 3Q 2011 • Smartphone Penetration: Mobile Insights, Oct 2011 • Peak App Usage: Smartphone Analytics (Android), Oct 2011 12 • Mobile Shopping Activities: Mobile Insights, Oct 2011 • Daily Deal Apps: Smartphone Analytics, Oct 2011 Internet • Mobile Payments (red circle): Nielsen Global Survey, 3Q 2011 (U.S.) • Internet Access and Social Network/Blog Visitors: NetView (Total), Oct 2011 • Video Viewers: VideoCensus (Total), Oct 2011 13 • Netflix/Hulu: VideoCensus (Home), Oct 2011 • Downloading and streaming behaviors: New Media Tracking, Jan 2012 TV • National Media Related UEs, Nov 2011 14 • Nielsen Global Survey, 3Q 2011 5 • Cross-Platform Report 3Q 2011. Click here to download the complete report for more detailed footnotes. 15 • NetView (Home & Work), Oct 2011 Copyright © 2012 The Nielsen Company. All rights reserved. Nielsen and the Nielsen logo are trademarks or registered trademarks of CZT/ACN Trademarks, L.L.C. Other product and service names are trademarks or registered trademarks of their respective companies. 12/4377 16