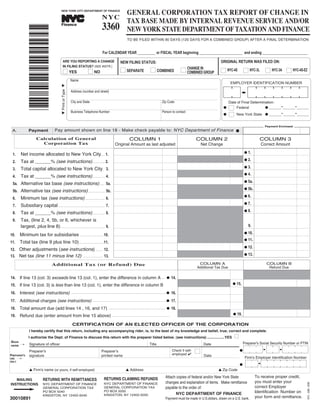

NYC-3360 General Corporation Tax Report of Change in Tax Base Made by Internal Revenue Service and/or New York State Department of Taxation and Finance

- 1. GENERAL CORPORATION TAX REPORT OF CHANGE IN 3360 NYC TAX BASE MADE BY INTERNAL REVENUE SERVICE AND/OR NEW YORK CITY DEPARTMENT OF FINANCE NEW YORK STATE DEPARTMENT OF TAXATION AND FINANCE TM Finance *30010891* TO BE FILED WITHIN 90 DAYS (120 DAYS FOR A COMBINED GROUP) AFTER A FINAL DETERMINATION For CALENDAR YEAR __________ or FISCAL YEAR beginning ________________________ and ending _________________________ ORIGINAL RETURN WAS FILED ON: NEW FILING STATUS: ARE YOU REPORTING A CHANGE CHANGE IN IN FILING STATUS? (SEE INSTR.) I SEPARATE I COMBINED I I NYC-4S I NYC-3L I NYC-3A I NYC-4S-EZ I YES I NO COMBINED GROUP Name EMPLOYER IDENTIFICATION NUMBER M Print or Type M Address (number and street) Date of Final Determination: City and State Zip Code G ______-______-______ I Federal G New York State G ______-______-______ I Business Telephone Number Person to contact G Payment Enclosed Pay amount shown on line 18 - Make check payable to: NYC Department of Finance G Payment A. Calculation of General COLUMN 1 COLUMN 2 COLUMN 3 Corporation Tax Original Amount as last adjusted Net Change Correct Amount Net income allocated to New York City..... 1. G 1. 1. Tax at ______% (see instructions)................. 2. G 2. 2. Total capital allocated to New York City .. 3. G 3. 3. Tax at ______% (see instructions)................. 4. G 4. 4. 5a. Alternative tax base (see instructions)....... 5a. G 5a. 5b. Alternative tax (see instructions)....................... 5b. G 5b. Minimum tax (see instructions) ........................... 6. G 6. 6. Subsidiary capital ................................................................ 7. G 7. 7. Tax at ______% (see instructions)................. 8. G 8. 8. Tax, (line 2, 4, 5b, or 6, whichever is 9. largest, plus line 8)............................................................. 9. 9. Minimum tax for subsidiaries G 10. 10. ........................................10. Total tax (line 9 plus line 10)..................................11. G 11. 11. 12. Other adjustments (see instructions) .......... 12. G 12. 13. Net tax (line 11 minus line 12) G 13. 13. ........................... Additional Tax (or Refund) Due COLUMN A COLUMN B Additional Tax Due Refund Due If line 13 (col. 3) exceeds line 13 (col. 1), enter the difference in column A 14. G 14. .... If line 13 (col. 3) is less than line 13 (col. 1), enter the difference in column B G 15. 15. Interest (see instructions) 16. 16. ...................................................................................................................................G Additional charges (see instructions) 17. 17. .....................................................................................................G Total amount due (add lines 14 , 16, and 17) 18. G 18. ............................................................................... Refund due (enter amount from line 15 above) ............................................................................... G 19. 19. CERTIFICATION OF AN ELECTED OFFICER OF THE CORPORATION I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete. I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions) .................YES I SIGN Preparer's Social Security Number or PTIN Signature of officer Title Date ¡ HERE I Check if self- Preparer's Preparerʼs G employed signature printed name Date PREPARER'S Firm's Employer Identification Number ¡ USE ONLY G L Firm's name (or yours, if self-employed) L Address L Zip Code To receive proper credit, Attach copies of federal and/or New York State RETURNS CLAIMING REFUNDS RETURNS WITH REMITTANCES MAILING you must enter your changes and explanation of items. Make remittance INSTRUCTIONS NYC DEPARTMENT OF FINANCE NYC DEPARTMENT OF FINANCE correct Employer payable to the order of: GENERAL CORPORATION TAX GENERAL CORPORATION TAX NYC - 3360 - 2008 Identification Number on NYC DEPARTMENT OF FINANCE PO BOX 5050 PO BOX 5040 30010891 your form and remittance. KINGSTON, NY 12402-5050 KINGSTON, NY 12402-5040 Payment must be made in U.S.dollars, drawn on a U.S. bank.

- 2. Form NYC-3360 - 2008 - Instructions Page 2 years beginning on or after July 1, 1999 (a proportionate part is deducted in (Pursuant to Title 11, Chapter 6 of the Administrative Code of the City of New York) the case of a return for less than a year); You must file Form NYC-3360 within 90 days (120 days for taxpayers filing a com- c) For tax years beginning before January 1, 2007, multiply the resulting total bined report) after any of the following occurs with respect to a taxpayer, or if the by 30%. For the tax year beginning on or after January 1, 2007, but before taxpayer is an S corporation or QSSS, a shareholder of the taxpayer: (i) a final IRS January 1, 2008, multiply the resulting total by 26.25%. For tax years begin- or New York State adjustment to taxable income or other tax base; (ii) the signing of ning on or after January 1, 2008 and before January 1, 2009, multiply the a waiver under IRC §6213(d) or NY Tax Law §1081(f); or (iii) the IRS has allowed resulting total by 22.5%. See Ad Code § 11-604(1)(H)(c). (Apply allocation a tentative adjustment based on a NOL carryback or net capital loss carryback. percentage where applicable.) Attach a copy of the final determination, waiver or notice of tentative carryback allowance to this form. See, Ad. Code §11-605.3 and 19 RCNY §11-83. File this The alternative tax base is computed based on revised entire net income (entire net form separately; do not attach it to any tax return. If you disagree with the final Fed- income per original return plus or minus change in taxable income). eral or New York State determination, complete the form showing the amount from column 1 in column 3, and attach a schedule showing the additional tax (or refund) LINE 5b - ALTERNATIVE TAX due according to the following instructions and attach a statement explaining why To determine the alternative tax, apply the appropriate tax rate shown in the sched- you believe the final determination was erroneous. If you do not attach such a state- ule above to the tax base determined in line 5a. ment, any additional New York City tax resulting from the final Federal or New York State determination is deemed assessed upon the filing of this form. LINE 12 - OTHER ADJUSTMENTS Enter on line 12, column 1 the total amounts from Form NYC-3L or NYC-3A for An amended New York City return Form NYC-3L, NYC-3A, NYC-4S or NYC-4S-EZ Sales Tax Addback, UBT Paid Credit from Form NYC-9.7, credits from Forms must be filed within 90 days after filing an amended federal or New York State return. NYC-9.5, NYC-9.6, NYC-9.8, NYC-9.9 and Energy Cost Savings Credit. Enter in If you are filing this form to report a change in filing status of the taxpayer column 2 all changes to these amounts and enter the corrected amount in column 3. from filing on a separate basis on a Form NYC-4S-EZ, NYC-4S or NYC-3L to filing as a member of a combined group on Form NYC-3A, from filing on a LINE 15 - CLAIM FOR REFUND combined basis to filing on a separate basis or a change in the composition of Where the federal or New York State change would result in a refund, Form NYC- your combined group, check the box marked “YES” on the top of the form and 3360 may be used as a claim for refund, provided it is accompanied by a complete check the appropriate box for the new filing status. copy of the federal and/or New York State Audit Report or Statement of Adjustment. For information regarding differences between Federal and City depreciation deduc- Effective for taxable years beginning on or after January 1, 1989, if this report is tions, see Finance Memorandum 99-4 “Depreciation for Property Placed in Service not filed within 90 days after the notice of the final federal (or New York State) Outside New York After 1984 and Before 1994” and Finance Memorandum 02-3 determination, no interest on the resulting refund will be paid. (Revised) “New York City Tax Consequences of Certain Retroactive Federal and LINE 16 - INTEREST New York Tax Law Changes”. See also Finance Memorandum 08-2, “Application of Enter at Line 16, Column A, interest owed on the additional tax due at the applica- IRC §280F Limits to Sport Utility Vehicles”. ble prescribed interest rate or rates from the due date of the General Corporation SPECIFIC INSTRUCTIONS Tax Return (without regard to any extension of time for payment) to the date of payment. (Section 11-675 of the Administrative Code). The applicable prescribed interest rate or rates are available from the interest rate table set forth on the Calculation of Tax Department of Finance’s internet website at: In Column 1, lines 1, 3, 5a, 7 and 12 enter amounts from the latest New York City report http://www.nyc.gov/html/dof/html/business/business_tax_interest.shtml reflecting any claim for credit or refund or New York City Department of Finance Effective September 1, 1983, interest is compounded on a daily basis at the applica- adjustment prior to the filing of this return. If you filed an amended return or if the ble rate. amounts shown on your original return were changed pursuant to a final Department of Finance adjustment, attach documentation reflecting the New York City changes and a For the rate of interest on overpayments, for a rate of interest not shown on the web- schedule showing your calculations. In Column 2 enter net reportable changes resulting site and for interest calculations, contact Customer Assistance at (212) 504-4036. from changes made by the Internal Revenue Service or the New York State Department LINE 17 - ADDITIONAL CHARGES of Taxation and Finance and submit a schedule showing calculations. In Column 3, lines 1, 3, 5 and 7, enter the difference between columns 1 and 2, as appropriate. a) A late filing penalty is assessed if you fail to file this form when due, unless the failure is due to reasonable cause. For every month or partial month that Submit schedule of allocation percentages (if any) utilized in making entries in col- this form is late, add to the tax (less any payments made on or before the due umn 2 of this report. date) 5%, up to a total of 25%. Note: For years beginning on or after July 1, 1996, a corporation without a regular b) If this form is filed more than 60 days late, the above late filing penalty cannot be place of business outside the city may allocate its income within and without the city. less than the lesser of (1) $100 or (2)100% of the amount required to be shown on Additionally, a manufacturing corporation may elect to calculate its allocation per- the form (less any payments made by the due date or credits claimed on the return). centage using a four-factor formula by double-weighting the receipts factor. Cer- c) A late payment penalty is assessed if you fail to pay the tax shown on this tain restrictions apply in the case of corporations filing a combined report. See form by the prescribed filing date, unless the failure is due to reasonable cause. Administrative Code section 11-604 (3) (a) (8) and instructions to form NYC-3L. For every month or partial month that your payment is late, add to the tax (less LINES 2, 4, 5b, 6, 8 and 10 any payments made) 1/2%, up to a total of 25%. Use the tax rate schedule to determine the applicable rates for the taxable year cov- d) The total of the additional charges in a and c may not exceed 5% for any one ered by this report. If this form is being filed with respect to a corporation filing a month except as provided for in b. combined report, on line 10 enter the total minimum tax of each corporation includ- If you claim not to be liable for these additional charges, attach a statement to your ed in the combined report with the exception of any corporation not otherwise sub- return explaining the delay in filing, payment or both. ject to the tax. SIGNATURE TAX RATE SCHEDULE This report must be signed by an officer authorized to certify that the statements contained herein are true. If the taxpayer is a publicly-traded partnership or anoth- Allocated Taxable Years Allocated Net Allocated er unincorporated entity taxed as a corporation, this return must be signed by a per- Business Beginning ...and Before Income/ Subsidiary Minimum Tax son duly authorized to act on behalf of the taxpayer. and Investment on or After... Alternative Capital Capital Tax Preparer Authorization: If you want to allow the Department of Finance to dis- cuss your return with the paid preparer who signed it, you must check the quot;yesquot; box 0.15% 7-1-89 1-1-08 8.85% $300 .075% in the signature area of the return. This authorization applies only to the individual whose signature appears in the quot;Preparer's Use Onlyquot; section of your return. It NOTE: The rate of tax on capital for cooperative housing corporations is 4/10 mill does not apply to the firm, if any, shown in that section. By checking the quot;Yesquot; (.0004). For all other corporations subject to tax on capital (other than cooperative box, you are authorizing the Department of Finance to call the preparer to answer housing corporations) the rate of tax on capital is 1 1/2 mills (.0015). any questions that may arise during the processing of your return. Also, you are LINE 5a, Column 3 - ALTERNATIVE TAX BASE authorizing the preparer to: Submit schedule showing computation of alternative tax base. To compute the Give the Department any information missing from your return, alternative tax base: G Call the Department for information about the processing of your return or the a) add to the amount of corrected allocated net income (loss), column 3, all G status of your refund or payment(s), and salaries and compensation paid to officers and to every stockholder owning Respond to certain notices that you have shared with the preparer about more than five percent of the issued capital stock. For taxable years begin- G math errors, offsets, and return preparation. The notices will not be sent to ning on or after July 1, 1996 and before July 1, 1998, the amount of officer the preparer. compensation added is reduced to 75% (50% for years beginning on or after You are not authorizing the preparer to receive any refund check, bind you to July 1, 1998 and before July 1, 1999, and 0% for years beginning after June anything (including any additional tax liability), or otherwise represent you before 30, 1999) of the salaries and compensation paid, but only if the officer was the Department. The authorization cannot be revoked, however, the authorization not a more than five percent stockholder at any time during the taxable year. will automatically expire no later than the due date (without regard to any exten- b) deduct from such total the statutory exemption amount, which is $15,000 for sions) for filing next year's return. Failure to check the box will be deemed a taxable years beginning before July 1, 1997, $30,000 for taxable years begin- denial of authority. ning on or after July 1, 1997 and before July 1, 1999, and $40,000 for taxable