Hadad Muliaman D. - 2015 Symposium on Financial Education in Tokyo

- 1. OECD/Japan High-level Global Symposium: Promoting better lifetime planning through financial education Muliaman D. Hadad Chairman of Board Commissioners Financial Inclusion, Financial Regulation and Financial Education in Asia: Case of Indonesia Tokyo, 22-23 January 2015

- 2. 2 Three Objectives of The Establishment of Indonesia FSA Market ConductPrudential OJK has three objectives as stipulated in the Law. Assuring that activities in the financial services sector are conducted in an orderly, fair, transparent, and accountable manner Creating a sustainable and stable financial services sector Protecting the interests of consumers and the public 1 2 3

- 3. 3 There Objectives of The Establishment of Indonesia FSA Being the unified regulator, OJK has considerable advantages to stimulate financial inclusion programs: First, financial inclusion programs and performance monitoring can be conducted more comprehensively and integrated in the matters of supply, demand, and infrastructure. Secondly, in line with our role in education and protection over financial consumers and society, OJK has the breadth of policy options to improve the overall financial inclusion, especially in the stimulating the demand side of the market.

- 4. 4 The National Strategy - Indonesia VISION PILLARS PRINCIPLE Support the realization of well literate society and increase the use of financial products to improve the welfare of the community. Collaboration w/ Stakeholders National Strategy on Financial Literacy Launched by the President as a guidelines for financial authorithy, financial institutions and other stakeholders INCLUSIVE SYSTEMATIC AND MEASURABLE EASY ACCESS COLLABORATION

- 5. 5 2015 20162014 TARGET Well Literate Society Professional Employee MSMEs Housewives Students Pensioners The National Strategy - Indonesia Housewives MSMEs Students Professional Employee Pensioners

- 6. 6 The National Strategy for Financial Inclusion To Achieve a Financial System that is Accessible by All Layers of the Community and to Promote Economic Growth, Poverty Reduction and Income Equality FOSTERING ECONOMIC GROWTH AND ACCELERATING POVERTY REDUCTION Financial Education Financial Eligibility Financial Information Mapping Supporting Policy/ Regulation Distribution and Institutional Facilities Consumer Protection

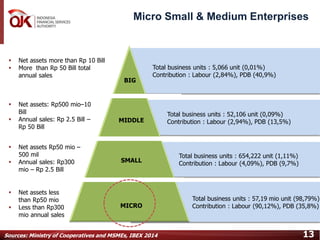

- 7. 7 The High Potential Demand for Financial Products & Services The overall potential for Growth, Indonesia has a lot to offer and with it the potential for the overall increase in income for the nation. As such, it is natural to expect a stimulated demand for financial products and services. Economic growth is expected to increase from 5.1% in 2014 to 8% in 2019 GDP per capita, which in 2014 amounted to Rp43,403 million targeted to increase to Rp72,217 million in 2019 Population is about 250 million people. Equivalent to 40% of the population of ASEAN countries 5,066 large-sized enterprises, 52.106 medium-sized enterprises, 654.222 small-sized enterprises s and 57.19 million micro-enterprises

- 8. 8 Only 49% of households in Indonesia have access to formal financial institutions 52% of Indonesia's population lives in rural areas and about 60% of them do not have access to formal financial services World Bank Survey Low income levels Complicated operational procedures of financial institutions Lack of financial education High administrative fees Limited access due to geographical

- 9. 9 Indonesia Literacy Level 2013 Baseline Financial Literacy Survey Only 21.84% of Indonesia's population classified as well literate The Utilities Index Products and Financial Services in Indonesia was 59.74%

- 10. 10 Consumer Education & Protection Initiatives Consumer Education & Protection Establishing Financial Consumer Care (FCC). Enacting OJK Regulations concerning consumer protection. Establishing Alternative Dispute Resolution (ADR). Implementing market intelligence activities. Conducting education and socialization programs through various communication & publication media. Conducting National Survey on Financial Literacy in 2013. Launching Blueprint of National Strategy on Financial Literacy. Launching financial education website & financial literacy cars.

- 11. 11 Three issues to achieve a financially inclusive Asia 1. First is the quality of regulatory policies. Evidence is limited on which policies work best in each country. These need to be verified to ensure that policies are indeed addressing the right problems of financial access in the country. 2. Second, it is also important to have a positive enabling environment for promoting financial inclusion. Policies that support financial inclusion have to be closely connected with the pursuit of macroeconomic stability. Financial access is impossible without increasing the capacity of individuals and firms to access higher income levels. 3. Third, greater financial inclusion is only possible if undertaken responsibly. In as much as inclusion is about increasing the capability to use financial services, it is crucial that those who are directly affected are financially literate and capable. Aladdin D. Rillo, “Overview of Financial Inclusion in Asia

- 12. 12 Financial Literacy through Life Cycle Financial education programmes should provide materials that match : Financial education programmes should create creative method to deliver material due to difference in level of income, age, education and other characteristics of the participants. Coordination among Government, Authorities & Agencies the participants needs the participants characteristics Financial Education is a life-long process that begins in childhood and continues through to old age. Stage 1Stage 0 Stage 2 Stage 3

- 13. 13 Micro Small & Medium Enterprises BIG MIDDLE SMALL MICRO Net assets less than Rp50 mio Less than Rp300 mio annual sales Net assets Rp50 mio – 500 mil Annual sales: Rp300 mio – Rp 2.5 Bill Net assets more than Rp 10 Bill More than Rp 50 Bill total annual sales Net assets: Rp500 mio–10 Bill Annual sales: Rp 2.5 Bill – Rp 50 Bill Total business units : 5,066 unit (0,01%) Contribution : Labour (2,84%), PDB (40,9%) Total business units : 52,106 unit (0,09%) Contribution : Labour (2,94%), PDB (13,5%) Total business units : 654,222 unit (1,11%) Contribution : Labour (4,09%), PDB (9,7%) Total business units : 57,19 mio unit (98,79%) Contribution : Labour (90,12%), PDB (35,8%) Sources: Ministry of Cooperatives and MSMEs, IBEX 2014

- 14. 14 Five Standards for financially literate SME 1. First, has an adequate level of personal entrepreneurial competencies, personal finance skills, and business management skills; has an appropriate level of understanding of functional financial management systems; 2. Second, has an appropriate level of understanding of SME life-cycle funding and other financial services needs and options and knows where and how to source and negotiate those funding and service requirements; 3. Third, understands and can manage financial risks or seek relevant advice to manage such risks; 4. Fourth, understands legal, regulatory and tax issues as they relate to financial matters; and 5. The last one is understands the range of legal recourses it can resort to when necessary, and namely, in case of bankruptcy or other situations of financial distress.

- 15. 15 Challanges Require Long-term Changes Require Committed Engagement of Diverse Stakeholders Promoting the advancement of financial inclusion and financial education as a path towards the overall reduction of poverty and a more equitable and sustainable economic growth Significant research is needed. ADB Institute, JFSA Institute and OECD can play a critical role The role of private sectors which are active in various jurisdiction The Technological Developments - Delivery Channels Regulators: - must be abreast with the latest developments in the markets from all angles and be able to identify the need to correct market imbalances by deploying a structured and comprehensive intervention plans to promote the overall literacy and education; - maintaining a conducive and facilitative regulatory systems that promotes greater equitable access to finance, improving the access frontier strategically for the target demography; and - maintaining overall financial stability by ensuring that significant build-up of exposures are identified.

- 16. Thank You