Omnichannel commerce

- 1. Retail’s changing landscape Evolving from a multi-channel to an omni-channel customer experience Presented by: Jennifer Lee March 27, 2013

- 2. Discussion items • Retail business model disruption • Implications • Shifting to an omni-channel world • Case study: Starbucks • Our team 1 Retail’s changing landscape – omni-channel customer experience © Deloitte & Touche LLP and affiliated entities.

- 3. Retail business model disruption 2 Retail’s changing landscape – omni-channel customer experience © Deloitte & Touche LLP and affiliated entities.

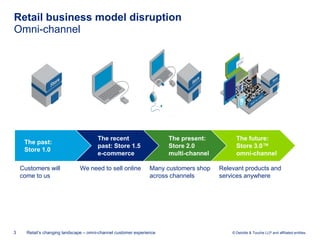

- 4. Retail business model disruption Omni-channel The recent The present: The future: The past: past: Store 1.5 Store 2.0 Store 3.0™ Store 1.0 e-commerce multi-channel omni-channel Customers will We need to sell online Many customers shop Relevant products and come to us across channels services anywhere 3 Retail’s changing landscape – omni-channel customer experience © Deloitte & Touche LLP and affiliated entities.

- 5. Deteriorating store metrics “The big box store is not the right concept for the future.” Robert Dutton, CEO We will have to start downsizing our stores over the next five years as customers shift to e-commerce. On their smaller stores: “When you combine lower rents, lower build out and a smaller total footprint with high sales per square foot, it’s a very powerful economic model.” Walter Robb, Co-CEO “We’re looking for more ways to combine our e-commerce business into our bricks- and-mortar stores to create an integrated, multichannel shopping experience for our guests.” Daniel Duty, Director of Enterprise Strategy Shoppers Drug Mart CEO has commented that shrinking the size of Shoppers stores is part of the company’s strategy going forward. “This industry is under pressure. We are facing the single worst commercial environment that the drug sector has ever faced.” Domenic Pilla, CEO 363 stores and Who’s next? growing Retail’s changing landscape – omni-channel customer experience © Deloitte & Touche LLP and affiliated entities.

- 6. Changing consumer behaviour Mobile price checking is becoming a competitive threat Makes pricing transparent Reduces the number of store to anyone trips to comparison shop Customers buy from your Reduces store transactions competitors in your store! … but it’s just the thin edge of the omni-channel wedge 5 Retail’s changing landscape – omni-channel customer experience © Deloitte & Touche LLP and affiliated entities.

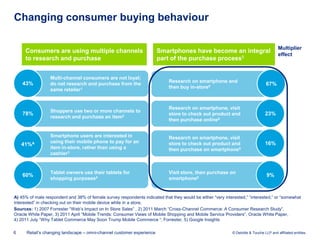

- 7. Changing consumer buying behaviour Multiplier Consumers are using multiple channels Smartphones have become an integral effect to research and purchase part of the purchase process5 Multi-channel consumers are not loyal; Research on smartphone and 43% do not research and purchase from the 67% then buy in-store5 same retailer1 Research on smartphone, visit Shoppers use two or more channels to 78% store to check out product and 23% research and purchase an item2 then purchase online5 Smartphone users are interested in Research on smartphone, visit using their mobile phone to pay for an store to check out product and 16% 41%A item in-store, rather than using a then purchase on smartphone5 cashier3 Tablet owners use their tablets for Visit store, then purchase on 60% 9% shopping purposes4 smartphone5 A) 45% of male respondent and 38% of female survey respondents indicated that they would be either “very interested,” “interested,” or “somewhat interested” in checking out on their mobile device while in a store, Sources: 1) 2007 Forrester “Web’s Impact on In Store Sales” , 2) 2011 March “Cross-Channel Commerce: A Consumer Research Study”, Oracle White Paper, 3) 2011 April “Mobile Trends: Consumer Views of Mobile Shopping and Mobile Service Providers”, Oracle White Paper, 4) 2011 July “Why Tablet Commerce May Soon Trump Mobile Commerce “, Forrester, 5) Google Insights 6 Retail’s changing landscape – omni-channel customer experience © Deloitte & Touche LLP and affiliated entities.

- 8. Implications 7 Retail’s changing landscape – omni-channel customer experience © Deloitte & Touche LLP and affiliated entities.

- 9. Purchase path was seen as traditionally linear • Social interaction • Product discovery Pre-Purchase • Marketing • Price-checking • Cashless/cardless Purchase purchase online or in-store • Self-checkout • Order management Post-Purchase • Customer service • Loyalty But there’s a new reality… 8 Retail’s changing landscape – omni-channel customer experience © Deloitte & Touche LLP and affiliated entities.

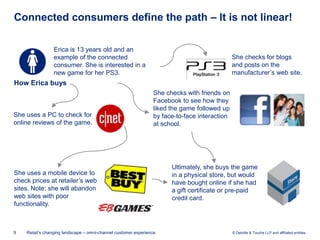

- 10. Connected consumers define the path – It is not linear! Erica is 13 years old and an example of the connected She checks for blogs consumer. She is interested in a and posts on the new game for her PS3. manufacturer’s web site. How Erica buys She checks with friends on Facebook to see how they liked the game followed up She uses a PC to check for by face-to-face interaction online reviews of the game. at school. Ultimately, she buys the game She uses a mobile device to in a physical store, but would check prices at retailer’s web have bought online if she had sites. Note: she will abandon a gift certificate or pre-paid web sites with poor credit card. functionality. 9 Retail’s changing landscape – omni-channel customer experience © Deloitte & Touche LLP and affiliated entities.

- 11. The future role of the store will be very different Present… … Future 10 Retail’s changing landscape – omni-channel customer experience © Deloitte & Touche LLP and affiliated entities.

- 12. Shifting to an omni-channel world 11 Retail’s changing landscape – omni-channel customer experience © Deloitte & Touche LLP and affiliated entities.

- 13. Retailers recognize the need to change As a result, omni-channel retailers are evolving into a more integrated business model where all channels share a common strategy for profitable growth “Technology will form the way people shop and the way retailers need to redefine their model…I think there are many developments coming down the line which will transform how we define ourselves and how customers define what a good shopping experience looks like.” Andrea McDonnell, Head of Multichannel strategy “We are now as much a media-content company as we are a design company because it is all part of the overall experience.” Christopher Bailey, Creative Director for Burberry "It's clear to me the customer has evolved and changed the way they shop and we have to change with them. There's no going back… The power of e-commerce extends far beyond the keyboard and onto the sales floor.” Terry Lundgren, Chairman, CEO, and President of Macy’s, Inc. “Much of our focus on digital is because we think the survivors in the industry are going to lead in this category.” Myron Ullman Chairman and CEO “The ability to allow our customer to take advantage of Walmart’s price leadership whenever and wherever she wants is what underpins our multi-channel strategy…In order to fully evolve into a multi-channel retailer here in the US, we need to make our organization, particularly in Merchandising and Marketing, channel agnostic.” Eduardo Castro-Wright, Vice Chairman of Walmart 12 Retail’s changing landscape – omni-channel customer experience © Deloitte & Touche LLP and affiliated entities.

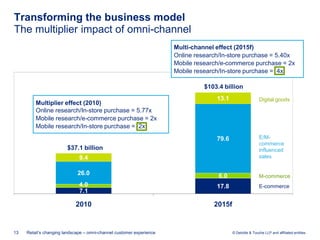

- 14. Transforming the business model The multiplier impact of omni-channel Multi-channel effect (2015f) Online research/In-store purchase = 5.40x Mobile research/e-commerce purchase = 2x Mobile research/In-store purchase = 4x $103.4 billion 13.1 Digital goods Multiplier effect (2010) Online research/In-store purchase = 5.77x Mobile research/e-commerce purchase = 2x Mobile research/In-store purchase = 2x 79.6 E/M- commerce $37.1 billion influenced 9.4 sales 26.0 6.0 M-commerce 4.0 17.8 E-commerce 7.1 2010 2015f 13 Retail’s changing landscape – omni-channel customer experience © Deloitte & Touche LLP and affiliated entities.

- 15. Transforming the business model of retailers Retailers will experience significant profit improvement and brand awareness by investing in omni-channel capabilities Omni-channel Store e/m-commerce sales Sales ($000’s) $900 $300 Gross margin 47% 47% Occupancy and labour 26% 0% Online costs 0% 15% SG&A 11% 11% EBIT ($000’s) $90 $63 Conversion 20% 3% Traffic (000’s) 90 200 14 Retail’s changing landscape – omni-channel customer experience © Deloitte & Touche LLP and affiliated entities.

- 16. Nordstrom and Macy’s are outperforming peers since the launch of their omni-channel initiatives Quarterly growth rate of Nordstrom and Macy’s vs. Department store sector 20% Quarterly Revenue Growth (YoY) 15% Nordstrom launched omni-channel initiative Nordstrom 10% Macy’s 5% Department store sector1 0% -5% -10% -15% Macy’s launched -20% omni-channel initiative Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr 2006 2007 2008 2009 2010 2011 Difference in quarterly growth rate Nordstrom 10% 15% 17% 12% 7% 7% - 1% - 1% 1% 9% 11% 16% 22% 17% 15% 15% 9% 9% Macy’s n/a 8% -2% 2% 0% 2% -2% 2% 1% 3% 2% 5% 4% 3% 6% 8% 9% 10% 4% 3% 15 Retail’s changing landscape – omni-channel customer experience © Deloitte & Touche LLP and affiliated entities.

- 17. Pure plays are realizing the economics of having physical presence • Dubbed “Chrome Zones”, Google introduced a pop-up store to introduce “Chromebook” • While sold online only, Google offered customers an opportunity to test and experience • The eBay Christmas boutique in London was stocked with 350 eBay best sellers • Customers connected with eBay via smartphones and learn about how easy it is to shop eBay with mobile • WIRED magazine introduced a pop-up store featuring gadgets, art installations and special events that embodied the “WIRED lifestyle” • The WIRED store provided a unique channel to physically interact with its consumers that WIRED had not previously met 16 Retail’s changing landscape – omni-channel customer experience © Deloitte & Touche LLP and affiliated entities.

Editor's Notes

- Omni Channel describes the blurring of boundaries between channels by the rise of the connected consumerConnected consumers interact physically and digitally concurrently Distinctions between channels fade and profitability by channel proves elusiveCustomers’ desire to interact wherever and whenever they prefer drives dramatic acceleration of digital innovationThink this is an academic exercise? Major department stores such as Macy’s and Nordstrom are winning and enhancing customer loyalty through omni channel behaviour. It was recently announced this month that Amazon will open up retail stores recognizing that customers do need to physically interact with some product categories and that using the store as a showroom will enable e-commerce sales

- Amazon has announced that it is opening a store in Seattle to allow shoppers to try its products like Kindle before they buy. Google has denied that it is opening a store, but as its online Google store expands its product range and as Apple continues to open stores, there is speculation that Google is considering a physical presence – for example, its expansion plans for its store in Dublin Ireland reportedly show a space for a retail store