Oracle hrms basic features and functionalities(for R11i and R12)

- 1. Oracle HRMS

- 2. AGENDA Overview – Oracle HRMS product family, Business Processes, Information Model Work Structures Defining Common Data People Assignment Payroll/Compensation Self Service Human Resources

- 3. NEED FOR HRMS IN AN ORGANIZATION What is Human Resource Management? What are the typical functionalities of an HR system in an Organization?

- 4. ORACLE HUMAN RESOURCES Oracle Human Resources (HR) is a proactive management solution that helps control costs while developing and supporting an effective workforce. Among the many features of Oracle HR is the ability to: Manage the entire recruitment cycle Design organizational models that match current and future business strategies and objectives Perform position management by defining and recording required skills, competencies, experience and qualifications for positions, jobs and organizations Perform career management functions. Administer and maintain benefits plans, coverage levels and contribution allocations Manage salary proposals and approve these by component Oracle Human Resources provides the shortest route to fast, smart human resource management.

- 5. HRMS – BASIC INFORMATION MODEL With Oracle HRMS you create an information model to represent your own enterprise - Work - Pay - People

- 6. HRMS – BASIC INFORMATION MODEL People Work Pay Employment Work Details Entries Links

- 7. OVERVIEW OF FLEXFIELDS Flexfield = Customizable Field that opens in a window Key Flexfield: On specific predefinied places in the application Is required in the Application Functionality integrated into application Example: Grade, Job, Position, Cost Allocation Stored in segment(n) in the database

- 8. OVERVIEW OF FLEXFIELDS Descriptive Flexfields Optional to set up or not Additional fields in Apps tables in which you might want to store additional info Context Sensitive descriptive flexfields Stored in Attribute1 to Attribute15 of the table (Max attributes is 30 but only on certain forms)

- 9. • Job - HR • Position - HR • Grade - HR • Competencies - HR • People Group - PAY • Cost Allocation - PAY • Bank Details - PAY • Personal Analysis (Special Information Type) - HR • Training Resources – OTA HR – Human Resources, PAY – Payroll, OTA – Training Administration OVERVIEW OF FLEX FIELDS

- 10. The Job is one possible component of the Employee Assignment in Oracle Human Resources. The Job is used to define the working roles which are performed by your employees. Jobs are independent of Organizations. With Organizations and Jobs you can manage employee assignments in which employees commonly move between Organizations but keep the same Job. You use the Job Flexfield to create Job Names which are a unique combination of segments. You can identify employee groups using the individual segments of the Job. A JOB is a generic ‘role’ within a Business Group, which is independent of any single organization. For example, the job “Manager” and “Consultant” can occur in many organizations. In many enterprises, the basic management units are roles, not employees. Thus a job is a structured way to define the nature of the work performed by a group of employees. Jobs are grouped or ‘categorized’ to facilitate specific business requirements such as Workers Compensation. Some enterprises may want to define jobs that denote the proficiency level of the employee or employees holding the job. For example: a job may be titled Senior Consultant and another as Associate Consultant. This would allow the enterprise to differentiate the two jobs. Other clients may simply want to define the job as ‘Consultant’ and let the job grade, that is assigned to the employee, determine the distinguishing factors. JOB

- 11. Positions, like Jobs, are used to define employee roles within Oracle Human Resources. Like Jobs, a Position is an optional component of the Employee Assignment. However, unlike Jobs, a Position is defined within a single Organization and belongs to it. Positions are independent of the employees who are assigned to those positions. You can record and report on information which is directly related to a specific position rather than to the employee. A POSITION (POS) is a specific occurrence of one’s job fixed within an organization (e.g., represents a specific ‘role’ or slot in the organization). For example, the position ‘Finance Manager’ would be an instance of the job ‘Manager’ in the ‘Finance’ organization. The position belongs to the organization of ‘Finance’. There may be one-to-many incumbents in this position or none. A position can have a pre-defined position hierarchy to show reporting lines. A position will normally define the type or work to be performed by the incumbent or incumbents holding the position. In some companies, position may be shared by more than one employee; also, an employee may occupy more than one position. Generally positions are subject to change with frequent additions and expirations, creating significant maintenance. Positions are normally used in role-based enterprise structures where clearly defined rules largely determine the ways employees work, and the compensation and benefits they receive. POSITION

- 12. Grades are used to represent relative status of employees within an enterprise, or work group. They are also used as the basis of many Compensation and Benefit policies. GRADE

- 13. Competencies A competency is a specific work task performed on the job. It is a large enough task to have value in-and-of-itself and is measurable and observable. In order to assess the various levels of employees objectively, competencies will have to be defined. Once the competencies are defined, they can be used to manage both the competence requirements and also the competence profile of a person (Employee and or applicant). COMPETENCIES

- 14. People Group The People Group flexfield lets you add your own key information to the Employee Assignment. You use each segment to define the different groups of employees which exist within your own enterprise. These may be groups which are not identified by your definitions of other Work Structures. PEOPLE GROUP

- 15. Cost Allocation You must be able to get information on labor costs from your payrolls, and send this information to other systems. Payroll costs must of course go to the general ledger. Additionally, you may need to send them to labor distribution or project management systems. The Cost Allocation Flexfield lets you record, accumulate and report your payroll costs in a way which meets the needs of your enterprise. COST ALLOCATION

- 16. Bank Details The Bank Details KeyFlexfield holds legislation specific bank account information. The Bank Details structure that you see is determined by the legislation of your Business Group. BANK DETAILS

- 17. The Personal Analysis Key Flex field lets you add any number of Special Information Types for people. Each Special Information Type is defined as a separate flex field structure for the Personal Analysis Flex field. Some common types of information you might want to hold are: – Passport Details. – Labour Card Details. Each structure can have up to 30 different segments of information. PERSONAL ANALYSIS (SPECIAL INFORMATION TYPE - SIT)

- 18. Training Resources Training resources are defined as part of the Training module in order to identify the various resources that are used for managing Training. The possible resources that can be defined are: a. Trainers / Instructors. b. Venues. c. Class Rooms. d. Projectors……. TRAINING RESOURCES

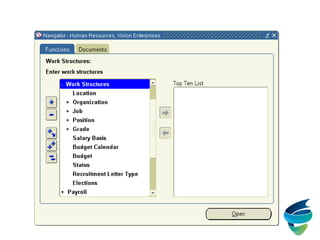

- 19. Business Group HR Organization Ext Organization Position Job Grade WORK STRUCTURES

- 20. WORK STRUCTURES In Oracle HR, work structures are used to define the work related entities like organization structure, jobs, positions, grades, reporting structures etc. The work structures provide the framework for defining the work assignments of your employees.The work structure defined in Oracle HR is one integrated set of work structure for all other HR suite of applications. These include: Enterprise / Employer structure e.g. Business Group and legal entities Work roles for employees e.g. Jobs and position Grade structures & pay scales

- 21. KFF Organization Location Job Position Valid Grades DFF KFF KFF Location is independent. Organization is associated to Location. Job is independent. Position is always associated to a Job and an Organization. Grade can be associated to both Job and Position to identify the valid grades. KFF – Key Flex field, DFF – Descriptive Flex field Work StructureStructure WORK STRUCTURES

- 23. WS - BUSINESS GROUP The top most organizational unit in the organization hierarchy that is set up in an enterprise is called Business Group. A Business Group (BG) defines a complete set of data for operations and processing A BG may be one operating company, holding company or corporation with separate organizations By default, all the employees entered in Oracle HRMS receive an assignment to their Business Group. Single and Multiple Business Groups.

- 25. WS – LOCATION In Oracle HRMS, each physical site where the employees work is set up as a Location. Global Locations :These are available in all Business Groups. Business Group Locations :These can only be used in one Business Group. E.g. Each physical site where employees work Can be used for external entities such as Tax authorities, Insurance or benefit Carriers etc. It is used in determining taxability in some legislations

- 26. Navigation: Work Structures Location

- 27. WS – ORGANIZATIONS Organizations define reporting sub-groups in a business group These include Companies Departments / Divisions Management groups

- 28. Navigation: Work Structures Organization Description

- 29. WS – JOB It is a unique role or function that exists in an enterprise It is part of the employee assignment record It is a Key Flex field

- 30. Navigation: Work Structures Job Description

- 31. WS – POSITION It is a unique role that exists in one, and only one, Organization Position definition includes Job and Organization It is a key flex field Position hierarchy shows more management reporting details than organization Can be used to control user access to records

- 32. Navigation: Work Structures Position Description

- 33. Finance Director Alasdair MacIntosh Production Director Michael Fiengold Director, Sales and Marketing Duncan McDonald Director, Research and Development David Anderson Personnel Director Geoffrey Cox Management Information Director **No Holders** Plant Personnel Mgr. Sheelagh Campbell Systems Manager Kaz Raghu Plant Manager Wendy Rawlins Department Head **2 Holders** Production Engineering Manager Geoffrey Cox Managing Director David Anderson

- 34. WS – GRADES Grades represent relative levels of management or seniority within an enterprise Grades can be grouped as Managerial,Technical, administrative etc. It is a key flex field Often related to Pay, Job, Position, Union Groups

- 35. Navigation: Work Structures Grade Description

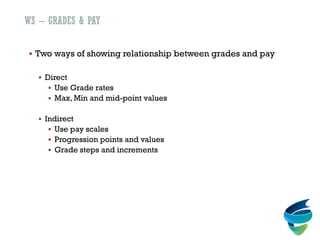

- 36. WS – GRADES & PAY Two ways of showing relationship between grades and pay Direct Use Grade rates Max, Min and mid-point values Indirect Use pay scales Progression points and values Grade steps and increments

- 37. Navigation: Work Structures Grade Grade Rate

- 38. DATE TRACKING Hired Relocated Promoted Today Jan 1, 2001 Aug 6, 2003Jan 1, 1991Jan 1,1981

- 39. DATE TRACKING Use ‘Alter Effective Date’ screen to set effective date forward of backward. Enter changes in future or past Date Tracking guarantees correct sequencing of changes. All validation and processing uses effective date information.

- 41. DATE TRACKING Date Tracking – UPDATE. UPDATE – Updated values are written to the database as a new row, effective from today until 31–DEC–4712.The old values remain effective up to and including yesterday. UPDATE CHANGE INSERT (Insert) UPDATE OVERRIDE (Replace) CORRECTION – The updated values override the old record values and inherit the same effective dates.

- 42. DATE TRACKING Date Tracking – DELETE DELETE (End Date) ZAP (Purge) FUTURE CHANGE (All) DELETE NEXT CHANGE (Next Change) Examples of Date Tracking Forms People Form,Assignment Form Examples Of Date Tracking Tables Per_all_people_f, per_all_assignments_f

- 43. Person Assignment Multiple HR Organization Job Position People Group Payroll (Salary Admin) Grade (Grade Step) Assignment Status Assignment CategoryGRE

- 44. PEOPLE Enter & Maintain information about any person associated with the enterprise Employee record creation Information about current and former employees, applicants, external contacts such as contractors, and employee contacts such as relatives and dependents. Lot of pre-defined information in HRMS: Demographics Address Skills Qualifications Facility to add additional types of information

- 46. ASSIGNMENT It represents the work record for an employee Assignment information: When the employee record is saved, a default assignment record is automatically created with default values, this needs to be updated with actual assignment details. In Oracle HR, the assignment places the employees within the enterprise work structure i.e. the organization for which they work, their role, grade, location, and so on.The changes to the assignment information for an employee are automatically captured as work history. Assignments can also be used to identify major employee groups within the enterprise for management, reporting and for compensation & benefits planning and administration More than one assignment for an employee at the same time

- 48. PAYROLL OVERVIEW • A Payroll is a group of employees with common pay frequency. • Oracle Payroll is that part of the HRMS software which calculates the amounts of pay and deductions for each of the enterprise employees. It uses a number of tables to hold the required data and runs processes to carry out the calculations. It then uses other tables to hold the results of the Payroll run. • Permitted frequency varies by legislation. – Monthly, Weekly in UK – Semi Monthly, Bi-week in US • Frequency determines number of pay period in each tax year.

- 49. KEY AREA IN PAYROLL Define a Payroll Set up Compensation and Benefits Write basic Oracle Fast Formula Set up People and their Assignments Run a Payroll Process corrections to a Payroll Manage Post Run Processes

- 50. PAYROLL IMPLEMENTATION STEPS Define Key and Descriptive Flex Fields Enable Currencies Define Work Structure Define Payroll Define Elements Define Fast Formula Define Balances Salary Administration Setup Define Person and Assignments Define Element sets and Assignment sets Payroll Run Processes

- 51. PAYMENT METHODS Oracle HRMS provides three possible payment method types. Within these payment method types, you can define as many payment methods as you require for your enterprise. Payment Methods BACS Cheque Cash Third party

- 52. Navigation: Payroll Payment Methods

- 53. CREATING A PAYROLL Set your effective date to a date early enough to handle any historical information you want to enter. Your effective date must be on or before the first period start date of the payroll calendar. Enter the payroll’s name and select its period type from the list of values. Enter the end date of the payroll’s first period, and the number of years for which the system should initially generate the payroll’s calendar.You can increase this number later to generate additional years.

- 54. • Enter any date offsets you require for the payroll. Offsets are calculated from the last day of the payroll period. your choice can be between a negative integer, such as -2, and zero • Select a default payment method for employees who have no valid personal payment method • Select a default consolidation set for this payroll. One consolidation set is created automatically when you define your Business Group • In the Costing region, you can enter information about the set of books and suspense account holding costing information for this payroll • The information you enter here depends on the setup of your Cost Allocation key flex field. Creating a Payroll (Cont….)

- 56. Navigation: Payroll Description Period Dates

- 57. Navigation: Payroll Description Valid Payment Methods

- 58. Balances Element LinksFormulas Elements Design Methodology Payroll Design Methodology There are fundamental setup steps within Total Compensation Elements Setup for Payroll. They link together to create effective payroll definitions.

- 59. Compensation Plans Taxation Benefit Plans Element Link Assignment Link Factors 1. Payroll 2. HR Organization 3. Job 4. Position 5. People Group 6. Location 7. Salary Basis 8. Costing OTL Element Related – 1. Classification 2. Input Values 3. Pay Value 4. Recurring / Non 5. Termination Rule 6. Skip Rule 7. Frequency Rule

- 60. Three Steps to setup an element : 1 Element Definition • Define the information to hold • Define how to validate entries • Define how to process entries 2 Element Link 3 Element Entry • Put the element on record for all employees who should receive it • Automatic or manual entry • Define who is eligible for the element • Define costing • Define how to validate entries Element: Overview

- 61. Elements are the structured units of information used by Oracle HRMS to represent the compensation and benefit types you give to your employees. All types of earnings, deductions, employer charges, and non payroll payments that go through the payroll are called elements. Eg. Salary, Wages,Bonus, Holiday, Health Insurance,Education and Training, Pension Benefits, Union, Company Car, Tools and Equipment, Compensation and Benefit Types You can also define elements to represent direct payments to employees that are not part of their pay (such as expense reimbursements) or employer payments on behalf of employees (such as pension contributions). A further use of elements is to hold information that is non-payment type. Element: Overview (Cont…)

- 62. • Set your effective date early enough to handle any historical element entries you want to make. • Enter a unique name, reporting name, and description for the element. The reporting name is a short identifier for reports and pay slips. If you do not enter a reporting name the system will automatically use the first six characters of the element name. • Primary Classifications Primary element classifications are supplied as startup data, and you cannot delete or update them as they are designed to meet local legislative requirements. e.g. – Earnings Direct Payment – Pre-Tax Deductions Voluntary Deductions – NI PAYE – Court Orders Employer Charges – Information Balance Initialization Defining Element

- 63. Navigation: Compensation & Benefits Element Description

- 64. DEFINING ELEMENT (CONT…) Processing Types A processing type is either Recurring or Nonrecurring. Some entries are relevant to one pay period only, while others represent payments to be made every pay period. For example, when you enter salary for an employee you probably expect to continue payment of this until you change or end the entry. In contrast, you would probably expect an entry of overtime hours to be dealt with as a single payment in the period in which it is entered. When you define an element in Oracle HRMS, you specify whether its entries are recurring or nonrecurring. Recurring —every pay period Non-recurring —single pay period

- 65. DEFINING ELEMENT (CONT…) Termination Rules The element termination rule will determine how entries of the element are processed after an employee has been terminated. Before selecting a termination rule you need to remember that it is only the element entries that exist on the pay period end date that will be processed. In this window there are a number of date fields which can be entered, in particular: Actual Final Process Last Standard Process. The dates entered in these fields control how an element entry will behave when the employee is terminated

- 66. DEFINING ELEMENT (CONT…) Check Box Multiple Entries Allowed Additional Entry Allowed Closed for Entry Process in Run Explanation Select this to be able to give an employee more than one entry of the element at the same time Select this to be able to make occasional one-off entries of a recurring element. Select this to prevent any new entries being made for the element without affecting existing entries. For example, a long service payment element, is not available to newly qualifying employees but continues to exist for the employees already receiving it. Select this if you want the element to process in payroll runs

- 67. DEFINING ELEMENT (CONT…) Indirect Results Adjustment Only Third Party Payments Select this if you want the element only to accept entries from indirect formula results. Leave the check box clear if you want to accept entries both from indirect formula results and from manual entries in the Element Entries window. Select this to use the element only for creating balance adjustments. Select this to use the element only for creating third party payments.

- 68. DEFINING ELEMENT (CONT…) Processing Priority The processing priority of an element affects the order in which elements are processed. The lower the number the earlier the element entry will be processed. If you want to determine the order in which the element processes within its classification range, you can overwrite the default priority number in the Priority field. Lower numbers process before higher ones. If the order of processing within the element classification is not important, you can accept the default priority number, which is the midpoint of the range.

- 69. Element Input Values • When you define an element, you can define up to 15 input values for it. • You decide which values you want to record and what limits, or validation, to apply to those values. • Input values can be numbers, text, dates, times, hours, or monetary values. You also decide whether each input is required or optional when an entry of the element is made for an employee. DEFINING ELEMENT (CONT…)

- 70. DEFINING ELEMENT INPUT VALUES Set your effective date early enough to handle any historical element entries you want to make. Enter or query the element in the Element window and choose the Input Values button. Enter the name of the first input value. Remember that if you want to define a pay value, you must name it Pay Value. Select the unit type of your input value (money, hours, character, date, number, or time). A Pay Value must have the unit type Money if the element is in a payments type classification.

- 71. Navigation: Compensation & Benefits Element Description Input Values

- 72. DEFINING ELEMENT INPUT VALUES (CONT…) You can use the Sequence field to change the order in which the input values appear in the Element Entries window. Select the Required check box if all entries of the element must have a value for this input. Select the User Enterable check box if users can enter a value for this input. Clear it if you want to ensure that the default value is entered for all employees. Select the Database Item check box if the value can be used as a Database Item in formulas or Quick Paint inquiries.

- 73. ELEMENT LINKS : OVERVIEW Employee Eligibility Rules Employees can be eligible for the element in a number of different ways, e.g. You may have a union group, with negotiated rates of pay. All members of the union are entitled to a fixed rate of pay dependent on their grade and step. You might have group of salaried employees where you negotiate the level of salary with each employee personally. In both cases you are dealing with similar type of compensation, but the rules that govern actual values, as well as eligibility and review, are different. In Oracle HRMS we define these rules using element links.

- 74. ELEMENT LINKS : OVERVIEW (CONT…) Employee Eligibility Rules An eligibility rule for an element is defined as a link between the element and the component of the employee assignment. Each link defines a group of employees who are eligible to receive the element. Salary Wages Bonus Company Car Perks Holidays Organizations Locations Jobs Grades Payrolls Groups Employment Categories Salary Bases Element Links

- 75. Navigation: Compensation & Benefits Link

- 76. DEFINING ELEMENT LINKS Set your effective date to the date you want the eligibility criteria to come into effect. In the Element Name field, select the Element for which you are defining a link. Check the Standard check box if you want all employees who are made eligible by the link to receive the element automatically. You can only create a standard link if the element is recurring and multiple entries are not allowed by the element definition. In the Eligibility Criteria region, select the assignment components that constitute this eligibility rule. If you want to link to all employees, do not enter any eligibility criteria. You can link to all payrolls or to a specific payroll.

- 77. DEFINING ELEMENT LINK (CONT..) Costing Information for the link • There are four costable types : – Not Costed – Costed – Fixed Costed – Distributed • For deduction elements enter: – The account code you want to credit in the costing field. – The account code you want to debit in the balancing field. • For the elements in al other classification enter: – The account code you want to debit in the costing field. – The account code you want to credit in the balancing field. • Select the Transfer to GL check box if you want Oracle HRMS to transfer cost totals to General ledger on completion of each payroll run.

- 78. DEFINING ELEMENT LINK (CONT..) Qualifying conditions for the link • There are two qualifying conditions: – Age – Length of service • You can add or change age or length of service condition for the eligibility group. • System checks these conditions when you make an entry to the element. If the employee does not meet the qualifying conditions, a warning is displayed.

- 79. DEFINING SALARY BASIS : OVERVIEW • Once a salary element is created, you can define a salary basis allowing the use of the salary administration window to enter and validate a salary. • The salary basis establishes the duration for which a salary is quoted, e.g. hourly, monthly or annually. • An employee’s salary basis is not necessarily the same as the pay periods of his/her payroll. An employee with an hourly pay rate has the salary basis Hourly salary, but can have an assignment to a weekly payroll. • You can associate an element with one salary basis. When an element is associated with a salary basis, you can not create or maintain entries for the element on the element entries window. You must use the Salary Administration window to enter and maintain employee salaries.

- 80. Navigation: Work Structures Salary Basis

- 81. DEFINING SALARY BASIS (CONT...) • Enter a name and select a basis from the list of values. • Select the name of salary element and input value associated with the salary basis. • Optionally, select a grade rate to associate with the salary basis. • If grade rate is selected, select the basis (Hourly, Monthly, Annual or Period) for the rate. • If either the Basis or the Grade rate basis is Hourly Salary (but not the both), you must enter a value in the Annualized hours field. This records the number of working hours in a year. System uses this figure to convert salary entries and grade rate values to the same basis when it validates a new salary entry. • Save the work.

- 82. ENTERING ELEMENT ENTRIES Element entries will exist in a pay period because they have either been manually or automatically entered. Automatic Element Entries: – Entries can be made automatically when an employee satisfies the eligibility criteria of the standard element link that was created for the element. e.g. by Salary administration, Elements with standard links, PAYE details etc. Manual Element Entries: – Entries can be made manually by selecting from a list in the Element entry window of employee assignment. The list will only contain elements that the employee is eligible for, i.e. they satisfy the eligibility criteria of the element link.

- 83. Navigation: People Enter and Maintain Assignment Entries

- 84. • You can use the Batch Header and Batch Lines window of MIX’s BEE (Batch Element Entry) facility for rapid entry of batches of information held as element entries. This information might include compensation information, timecard data etc. • You can enter information in a batch for as many elements and assignments as you require. • You can enter defaults for any value to speed up data entry, and can change the defaults as you work through batch. USING MIX FOR BATCH ELEMENT ENTRY

- 85. PAYROLL LIFE CYCLE Preparing & initiating a Payroll Run Viewing Payroll Process Results Running the Costing and Transfer to Oracle General Ledger Quick Pay Starters/Leavers Managing Post-Run Processes Processing corrections to Run Results Quick Pay Starters/Leavers Managing other Payroll Processes

- 86. PREPARING & INITIATING A PAYROLL RUN • Before you start a payroll run, you must first define the payroll you want to use. • You may also need to make changes to replace a calculated amount, add or subtract from a calculated amount. • You can also define element sets, or define an assignment set, if you want to process a group of employee at a different time. • You are then ready to run the standard payroll.

- 87. Payroll Run Quick Pay Pre Payment Cheque Writer Direct Deposit Costing Transfer to GL 1. Organizational Payment Method 2. Personal Payment Method Assignment Set Element Set