PACE - Finance Presentation

- 1. Economic and Market Outlook October 2013 Niladri “Neel” Mukherjee Senior Investment Strategist Investment Management & Guidance (IMG)

- 2. Important Information The material herein is for informational purposes only and is not directed at, nor intended for distribution to or use by, any person or entity in any country where such distribution or use would be contrary to law or regulation or which would subject Bank of America Corporation or its subsidiaries, including Merrill Lynch, to any licensing or registration requirement within such country. This is not intended to be either a specific offer by any Bank of America or Merrill Lynch entity to sell or provide, or a specific invitation to apply for, any particular financial account, product or service. Bank of America and Merrill Lynch do not offer accounts, products or services in jurisdictions where they are not permitted to do so, and, therefore, the Merrill Lynch Wealth Management business is not available in all countries or markets. Neither Merrill Lynch nor its Financial Advisors provide tax, accounting or legal advice. Clients should review financial transactions or arrangements that may have tax, accounting or legal implications with their personal professional advisors. The opinions expressed in this material are strictly those of Merrill Lynch, are made as of the date of this material and are subject to change without notice. Other affiliates may have opinions that are different from and/or inconsistent with the opinions expressed herein and may have banking, lending, and/or commercial relationships with the companies that are mentioned here. This material was prepared by the Investment Management & Guidance Group (IMG) and is not a publication of BofA Merrill Lynch Global Research. The views expressed are those of IMG only and are subject to change. This information should not be construed as investment advice. It is presented for information purposes only and is not intended to be either a specific offer by any Merrill Lynch entity to sell or provide, or a specific invitation for a consumer to apply for, any particular retail financial product or service that may be available. The investments discussed have varying degrees of risk. Some of the risks involved with equities include the possibility that the value of the stocks may fluctuate in response to events specific to the companies or markets, as well as economic, political or social events in the U.S. or abroad. Bonds are subject to interest rate, inflation and credit risks. Investments in foreign securities involve special risks, including foreign currency risk and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are magnified for investments made in emerging markets. Structured Investments may not be suitable for all investors. This information should not be construed as investment advice. It is presented for informational purposes only and is not intended to be either a specific offer by any Merrill Lynch entity to sell or provide, or a specific invitation for a consumer to apply for, any particular retail financial product or service that may be available through the Merrill Lynch family of companies. Merrill Lynch Wealth Management makes available products and services offered by Merrill Lynch, Pierce, Fenner & Smith Incorporated (MLPF&S) and other subsidiaries of Bank of America Corporation. Investment products: Are Not FDIC Insured Are Not Bank Guaranteed May Lose Value MLPF&S is a registered broker-dealer, a registered investment adviser and Member SIPC. Merrill Lynch, Bank of America, N.A. and their affiliates make available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation or in which Bank of America Corporation has a substantial economic interest, including BofATM Global Capital. © 2013 Bank of America Corporation. All rights reserved. ARQ7RSYQ FOR INTERNAL USE ONLY 2

- 3. Macroeconomic themes 2013 and beyond: normalcy returns • Slowly, return to the Fundamentals • Global growth will be slow, but steady • Central Banks around the world continue easing but becoming wary of excesses • Inflation risks remain subdued for now FOR INTERNAL USE ONLY 3

- 4. Global growth likely modest in 2013 reaccelerating in 2014; eurozone still pressured but emerging markets to rebound … Source: BofA Merrill Lynch Global Research and ML GWM Investment Management & Guidance. Data as of September 10, 2013. FOR INTERNAL USE ONLY 4

- 5. Global manufacturing PMIs have started to rebound, led by developed markets; trend looks set to continue in 2H 2013… Source: Markit, Haver Analytics, BofA ML Global Research and ML Investment Management & Guidance. Data as of Aug-2013. FOR INTERNAL USE ONLY 5

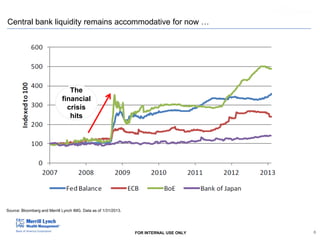

- 6. Central bank liquidity remains accommodative for now … The financial crisis hits Source: Bloomberg and Merrill Lynch IMG. Data as of 1/31/2013. FOR INTERNAL USE ONLY 6

- 7. Peaking of The Liquidity Era Means Volatility and Opportunities Implications Policy US QE tapering will be slow and gradual JAPAN Very accommodative monetary policy • Higher interest rates • Higher volatility in rates and equity markets • US dollar bullish CHINA Reforms for a higher quality growth • Risk of a policy mistake EUROPE Vigilant with „unlimited‟ bond buying program FOR INTERNAL USE ONLY 7

- 8. Global CPI Inflation will remain low at a global level Global CPI inflation has eased this year (%yoy) Source: BofA Merrill Lynch Global Research, Haver Analytics FOR INTERNAL USE ONLY 8

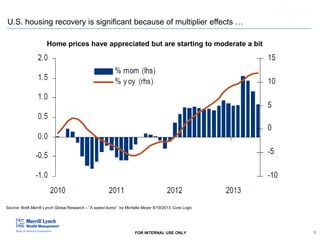

- 9. U.S. housing recovery is significant because of multiplier effects … Home prices have appreciated but are starting to moderate a bit Source: BofA Merrill Lynch Global Research – “A speed bump” by Michelle Meyer 8/19/2013, Core Logic FOR INTERNAL USE ONLY 9

- 10. U.S. housing recovery is significant because of multiplier effects … Housing starts and new home sales recovery are still in the early innings (thousands of homes) Source: BofA Merrill Lynch Global Research – “A speed bump” by Michelle Meyer 8/19/2013, Census Bureau FOR INTERNAL USE ONLY 10

- 11. Household formation and consumer confidence is critical … Retail Sales Stabilize (YoY%) Despite Higher Payroll Taxes Employment-to-population ratio for 2435 year olds Motor vehicle sales improving Source: (Top left) Bureau of Labor Statistics, BofA Merrill Lynch Global Research – “A speed bump” by Michelle Meyer 8/19/2013. (Top Right) Census Bureau, Haver Analytics, IMG. (Bottom Right) Autodata, Haver Analytics, IMG FOR INTERNAL USE ONLY 11

- 12. US energy independence is a transformative theme … Advancement in technology has boosted US energy production over the past 5 years TECHNOLOGY ADVANCEMENT BOOSTS US PROVED RESERVES Oil (billion barrels) 33 31 29 27 25 23 21 19 17 15 Natural gas (trillion cubic feet) United States Brazil Canada Biofuels Columbia India Russia UK Norway Mexico 350 300 250 200 150 100 1980 1986 1992 1998 2004 -1,000 2010 US OIL SUPPLIES FORECASTED TO RISE ~15% BY 2016… -500 0 500 1,000 1,500 ENERGY COSTS AS % OF TOTAL OPERATING COSTS (2010) 24.0 …While U.S. demand is expected to decline by 3% 23.0 8.0 22.0 7.0 21.0 6.0 20.0 5.0 19.0 4.0 Demand (billions of barrels) Supply (billions of Barrels) 10.0 9.0 US TO SUPPLY A LARGE PORTION OF NON-OPEC SUPPLY GROWTH BETWEEN 2011-2016 18.0 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Total US Oil Supplies Total US Oil Demand Source: BofA-ML Global Research, IMG. As of Jan. 2013. FOR INTERNAL USE ONLY 12

- 13. Corporate balance sheets hold the key: pent up demand is significant While US GDP growth remains tepid, US corporate profits have soared leading companies to build cash on their balance sheets CAPEX SPENDING HAS NOT KEPT PACE CORPORATE PROFITS SOAR 30% 11% 10% 9% 8% 7% 6% 5% 4% 3% 20% 10% 0% Average -10% -20% -30% 1947 1952 1957 1962 1967 1972 1977 1982 1987 1992 1997 2002 2007 2012 Recession -40% Dec-93 Dec-95 Dec-97 Dec-99 Dec-01 Dec-03 Dec-05 Dec-07 Dec-09 Dec-11 New Orders: Non-defense capital goods ex. Aircraft, YoY% Corporate Profits as % of GDP Average USE OF CASH: SHARE BUYBACKS AND DIVIDENDS AMONG S&P 500 COMPANIES M&A ACTIVITY LOWEST SINCE 2002 $180 $160 $140 $120 $100 $80 $60 $40 $20 $0 $900 $800 $700 $600 $500 $400 $300 $200 $100 $0 1997 1999 2001 2003 2005 2007 2009 2011 $31 $29 $27 $25 $23 $21 $19 $17 $15 1998 1999 2000 2001 2002 2004 2005 2006 2007 2008 2009 2011 2012 Share Buybacks (in $billions, LHS) M&A Transactions (in $bilions) Dividends per Share (12 Months, RHS) Source: BofA-ML Global Research, IMG. As of Jan. 2013. FOR INTERNAL USE ONLY 13

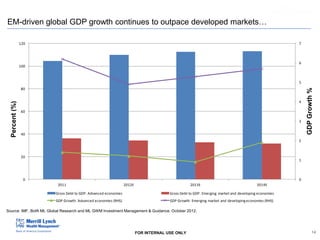

- 14. EM-driven global GDP growth continues to outpace developed markets… 120 7 6 100 Percent (%) 4 60 3 40 GDP Growth % 5 80 2 20 1 0 0 2011 2012E 2013E 2014E Gross Debt to GDP: Advanced economies Gross Debt to GDP: Emerging market and developing economies GDP Growth: Advanced economies (RHS) GDP Growth: Emerging market and developing economies (RHS) Source: IMF, BofA ML Global Research and ML GWM Investment Management & Guidance. October 2012. FOR INTERNAL USE ONLY 14

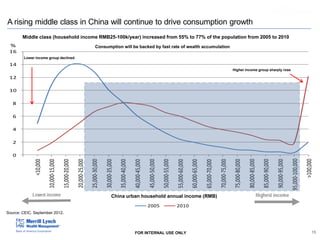

- 15. A rising middle class in China will continue to drive consumption growth Middle class (household income RMB25-100k/year) increased from 55% to 77% of the population from 2005 to 2010 2005 2010 Consumption will be backed by fast rate of wealth accumulation % 16 Lower income group declined 14 Higher income group sharply rose 12 10 8 6 4 2 >100,000 95,000-100,000 90,000-95,000 85,000-90,000 80,000-85,000 75,000-80,000 70,000-75,000 65,000-70,000 60,000-65,000 55,000-60,000 50,000-55,000 45,000-50,000 40,000-45,000 35,000-40,000 30,000-35,000 25,000-30,000 20,000-25,000 15,000-20,000 10,000-15,000 <10,000 0 China urban household annual income (RMB) % 2005 2010 16 Source: CEIC. September 2012. 14 FOR INTERNAL USE ONLY 12 15

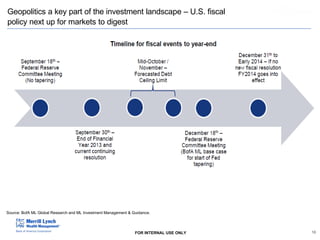

- 16. Geopolitics a key part of the investment landscape – U.S. fiscal policy next up for markets to digest Source: BofA ML Global Research and ML Investment Management & Guidance. FOR INTERNAL USE ONLY 16

- 17. However our fiscal situation has improved … Source: Strategas Research Partners. FOR INTERNAL USE ONLY 17

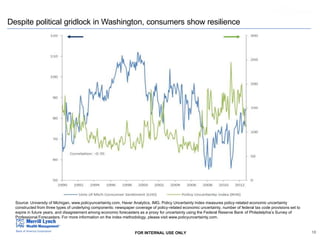

- 18. Despite political gridlock in Washington, consumers show resilience Source: University of Michigan, www.policyuncertainty.com, Haver Analytics, IMG. Policy Uncertainty Index measures policy-related economic uncertainty constructed from three types of underlying components: newspaper coverage of policy-related economic uncertainty, number of federal tax code provisions set to expire in future years, and disagreement among economic forecasters as a proxy for uncertainty using the Federal Reserve Bank of Philadelphia‟s Survey of Professional Forecasters. For more information on the index methodology, please visit www.policyuncertainty.com. FOR INTERNAL USE ONLY 18

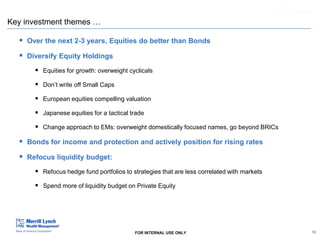

- 19. Key investment themes … Over the next 2-3 years, Equities do better than Bonds Diversify Equity Holdings Equities for growth: overweight cyclicals Don‟t write off Small Caps European equities compelling valuation Japanese equities for a tactical trade Change approach to EMs: overweight domestically focused names, go beyond BRICs Bonds for income and protection and actively position for rising rates Refocus liquidity budget: Refocus hedge fund portfolios to strategies that are less correlated with markets Spend more of liquidity budget on Private Equity FOR INTERNAL USE ONLY 19

- 20. US Equities remain a compelling asset class … Plenty of cash on corporate balance sheets (as a % of total assets of S&P 500 co. S&P 500 EPS forecasted to grow Source: BofaML Global Research. FactSet and ML Investment Management & Guidance. Data as of June 28, 2013. FOR INTERNAL USE ONLY 20

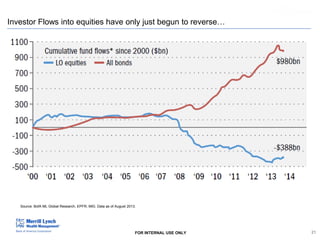

- 21. Investor Flows into equities have only just begun to reverse… Source: BofA ML Global Research, EPFR, IMG. Data as of August 2013. FOR INTERNAL USE ONLY 21

- 22. Rotate from expensive Defensives to cheap Cyclicals Cyclicals are leading equities higher Sector’s sensitivity to US GDP Growth Source: BofA ML Global Research, IMG. FOR INTERNAL USE ONLY 22

- 23. European equities offer long term growth potential European equities price to book valuation exceptionally cheap compared to the U.S. Source: ML Investment Management & Guidance.; BofA ML Global Equity Research FOR INTERNAL USE ONLY 23

- 24. Emerging Markets: go beyond the BRICs … Brazil, Russia, India and China (BRIC) 2013 GDP expectations persistently downgraded BRIC markets have lagged smaller non – BRICs since 2008 As of June 26, 2013 As of May 31, 2013 Source: FactSet. Bloomberg, IMG. FOR INTERNAL USE ONLY 24

- 25. Government bond yields have been driven down … Yields for 10 Yr Bonds for US, UK, Japan, Germany (1990 to 9/20/2013) US: 2.72% UK: 2.92% Japan: 0.695% Germany: 1.94% *Source: Bloomberg, Investment Management & Guidance FOR INTERNAL USE ONLY 25

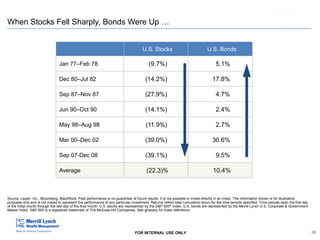

- 26. When Stocks Fell Sharply, Bonds Were Up … U.S. Stocks U.S. Bonds Jan 77–Feb 78 (9.7%) 5.1% Dec 80–Jul 82 (14.2%) 17.8% Sep 87–Nov 87 (27.9%) 4.7% Jun 90–Oct 90 (14.1%) 2.4% May 98–Aug 98 (11.9%) 2.7% Mar 00–Dec 02 (39.0%) 30.6% Sep 07-Dec 08 (39.1%) 9.5% Average (22.3)% 10.4% Source: Lipper, Inc., Bloomberg, BlackRock. Past performance is no guarantee of future results. It is not possible to invest directly in an index. The information shown is for illustrative purposes only and is not meant to represent the performance of any particular investment. Returns reflect total cumulative return for the time periods specified. Time periods span the first day of the initial month through the last day of the final month. U.S. stocks are represented by the S&P 500 ® Index. U.S. bonds are represented by the Merrill Lynch U.S. Corporate & Government Master Index. S&P 500 is a registered trademark of The McGraw-Hill Companies. See glossary for index definitions. FOR INTERNAL USE ONLY 26

- 27. Potential benefits of a diversified Fixed Income portfolio Source: IMG. *As of May 31, 2013; BofA ML Bond Indexes used to represent the various sectors of the Bond Market **Assuming a parallel shift in the yield curve. Note that changes in price return are approximate based on the investment‟s duration. FOR INTERNAL USE ONLY 27

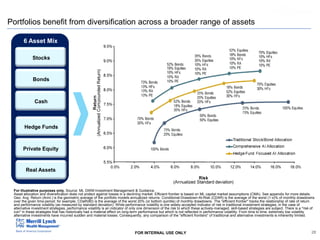

- 28. Portfolios benefit from diversification across a broader range of assets 6 Asset Mix Stocks Bonds Cash Hedge Funds Private Equity Real Assets For illustrative purposes only. Source: ML GWM Investment Management & Guidance . Asset allocation and diversification does not protect against losses in a declining market. Efficient frontier is based on ML capital market assumptions (CMA). See appendix for more details. Geo. Avg. Return (Annl.) is the geometric average of the portfolio models annualized returns. Conditional-Drawdown-At-Risk (CDAR) is the average of the worst (1-x)% of monthly drawdowns over the given time period; for example, CDaR(80) is the average of the worst 20% (or bottom quintile) of monthly drawdowns. The "efficient frontier" tracks the relationship of rate of return and performance volatility (as measured by standard deviation). While performance volatility is one widely-accepted indicator of risk in traditional investment strategies, in the case of alternative investment strategies, performance volatility is an indicator of only one dimension of the risk to which these actively-managed, skill-based strategies are subject. There is a "risk of ruin" in these strategies that has historically had a material effect on long-term performance but which is not reflected in performance volatility. From time to time, extremely low volatility alternative investments have incurred sudden and material losses. Consequently, any comparison of the "efficient frontiers" of traditional and alternative investments is inherently limited. FOR INTERNAL USE ONLY 28

- 29. Hedge Funds: Refocus hedge fund allocation; add to strategies that are less correlated with equity markets 0% Historical Drawdown (%) -10% -20% -30% -40% -50% -60% Sep-02 Sep-03 Sep-04 Sep-05 S&P 500 Total Return DJ Credit Suisse Hedge Fund DJ Credit Suisse Global Macro Sep-06 Sep-07 Sep-08 Sep-09 Sep-10 60-40 MSCI AC World-BarCap Global Agg (TR) DJ Credit Suisse Managed Futures Sep-11 Sep-12 Sources: Centralized Investment Analytics and ML GWM Investment Management & Guidance. As of September 2012. FOR INTERNAL USE ONLY 29

- 30. Appendix: Important Information This document is provided for information only and is not intended as a solicitation for any particular investment. It does not have regard to the specific investment objectives, financial situation or particular needs of any client and does not represent investment advice or a personal recommendation to any person. Exchange rate fluctuations may adversely affect the value of and income from investments. The value of investments and their income can go down as well as up and could rise or fall dramatically. Investors may not get back the full amount invested. Past performance should not be seen as an indication of future performance and no projection, representation or warranty is made regarding future performance. Information included herein was obtained from sources we believe are reliable, but we have not verified and cannot ensure its accuracy. This document is only for your use and must not be given or shown to anyone else without our consent. Some of the products and services referred to in this presentation may not be suitable for all investors. Investors with any questions regarding the suitability of any of the products or services referenced in this presentation should consult their financial advisor. Some products and services may not be available in all jurisdictions or to all clients. Definitions: Volatility: Measured by standard deviation, volatility is the amount that returns devotion from their mean. Sharpe Ratio: Measure of an investment‟s risk-return tradeoff, calculated by subtracting the risk-free rate from the rate of return of the investment and dividing the result by the standard deviation returns. Capital Market Assumptions: Merrill Lynch Capital Market Assumptions (return, volatility and correlation) include the following assets: Equity, Fixed Income, Cash, Hedge Funds, Private Equity and Real Assets. The assumptions continue to reflect conservative outlook that future market returns are more likely to be lower than their historical averages. Index proxies for asset classes are as follows: Equities, S&P 500 Total Return; Fixed Income, 60% Ibbotson‟s US Long Term Government Bond Index and 40% Ibbotson‟s US Long Term Corporate Bond Index; Cash, Ibbotson's 30-Day T-Bill Total Return Index; Hedge Funds, CS Tremont Hedge Fund Total Return Index; Private Equity, 50% Thomson US All Private Equity; 50% Thomson Europe All Private Equity; Real Assets: (3/1997 to 12/2009): 55% FTSE-NAREIT Global Total Return Index; 35% DJ UBS Commodity Total Return Index; 10% ML US Treasury Inflation-Linked Total Return Index.; (1/2010 to 12/2010): 46% FTSE-NAREIT Global Total Return Index; 36% DJ AIG Commodity Total Return Index; 18% ML US Treasury Inflation-Linked Total Return Index. See additional appendix pages for index definitions. Past performance is no guarantee of future results. You cannot invest directly in an index. As part of our ongoing process, we consider the current market environment, industry and competitive outlooks, and historical data. We review these assumptions periodically and make adjustments as appropriate. FOR INTERNAL USE ONLY 30

Editor's Notes

- Economic conditions around the world are also improving. BofA-ML’s Economic Conditions Index (ECI), a broad measure of business conditions around the world, has been trending up steadily and uniformly across regions. The world economy, outside of the U.S., is expected to grow around 4% annually between now and 2014. Stress in financial markets is now at the lowest levels since 2007.Europe slipped back into recession in 2012, with the peripheral countries suffering the worst losses in jobs and declines in living standards. The continent is expected to experience a tepid recovery in 2013.However, more positively, investors’ worst case fears-the break of the euro-did not materialize. Spreads on Greek govt bonds have dropped markedly. With the probability of a tail risk event receding, volatility in European equity markets fell to multi-year lows and was the impetus for the risk-off rally around the world.Bond spreads on other troubled countries, such as Spain, Portugal, Ireland and Italy have all fallen sharply after credible steps were taken by the ECB and Europe’s leaders in 2H 2012.Despite the recent rebound in European stocks, valuations remain attractive.

- Economic conditions around the world are also improving. BofA-ML’s Economic Conditions Index (ECI), a broad measure of business conditions around the world, has been trending up steadily and uniformly across regions. The world economy, outside of the U.S., is expected to grow around 4% annually between now and 2014. Stress in financial markets is now at the lowest levels since 2007.Europe slipped back into recession in 2012, with the peripheral countries suffering the worst losses in jobs and declines in living standards. The continent is expected to experience a tepid recovery in 2013.However, more positively, investors’ worst case fears-the break of the euro-did not materialize. Spreads on Greek govt bonds have dropped markedly. With the probability of a tail risk event receding, volatility in European equity markets fell to multi-year lows and was the impetus for the risk-off rally around the world.Bond spreads on other troubled countries, such as Spain, Portugal, Ireland and Italy have all fallen sharply after credible steps were taken by the ECB and Europe’s leaders in 2H 2012.Despite the recent rebound in European stocks, valuations remain attractive.

- Various housing fundamentals such as household formation, home prices, housing starts, housing inventory, etc. point to an improvement in the sector. Existing home sales increased 5.9% in November from the previous month, representing an annual rate of 5 million units. Home prices are projected to increase 5% year over year in 2012 compared to 3.7% decline in 2011. Residential homebuilding is expected to contribute 0.3 percentage point to US GDP growth in 2012 and 0.4 percentage points in 2013. Housing was at the center of the recent global financial crisis. It may now hold the key to a sustainable U.S. recovery.Housing sales are on the rise across the country and in most markets home values are increasing.Residential homebuilding is forecasted to add 0.4% to GDP growth in 2013. The first positive contribution since 2005.Homebuilding helps create jobs. Each new home built help create three new full-time jobs (source: NAHB). Improvements in the housing sector is expected to benefit not just the real estate sector, but also materials, financials, consumer discretionary sectors.

- Various housing fundamentals such as household formation, home prices, housing starts, housing inventory, etc. point to an improvement in the sector. Existing home sales increased 5.9% in November from the previous month, representing an annual rate of 5 million units. Home prices are projected to increase 5% year over year in 2012 compared to 3.7% decline in 2011. Residential homebuilding is expected to contribute 0.3 percentage point to US GDP growth in 2012 and 0.4 percentage points in 2013. Housing was at the center of the recent global financial crisis. It may now hold the key to a sustainable U.S. recovery.Housing sales are on the rise across the country and in most markets home values are increasing.Residential homebuilding is forecasted to add 0.4% to GDP growth in 2013. The first positive contribution since 2005.Homebuilding helps create jobs. Each new home built help create three new full-time jobs (source: NAHB). Improvements in the housing sector is expected to benefit not just the real estate sector, but also materials, financials, consumer discretionary sectors.

- Various housing fundamentals such as household formation, home prices, housing starts, housing inventory, etc. point to an improvement in the sector. Existing home sales increased 5.9% in November from the previous month, representing an annual rate of 5 million units. Home prices are projected to increase 5% year over year in 2012 compared to 3.7% decline in 2011. Residential homebuilding is expected to contribute 0.3 percentage point to US GDP growth in 2012 and 0.4 percentage points in 2013. Housing was at the center of the recent global financial crisis. It may now hold the key to a sustainable U.S. recovery.Housing sales are on the rise across the country and in most markets home values are increasing.Residential homebuilding is forecasted to add 0.4% to GDP growth in 2013. The first positive contribution since 2005.Homebuilding helps create jobs. Each new home built help create three new full-time jobs (source: NAHB). Improvements in the housing sector is expected to benefit not just the real estate sector, but also materials, financials, consumer discretionary sectors.

- Advancement in technology has boosted US energy production over the past 5 years. US is on track to supply a large portion of Non-OPEC supply growth in the near future. Harnessing these reserves gives the US a significant competitive advantage that will grow in year to come, with Commodity Strategist Francisco Blanch estimating that the US enjoys a $700mn per day “energy carry” relative advantage.What does the Index means?

- While US GDP growth remains tepid, US corporate profits have soared leading companies to build cash on their balance sheets. However, capex has not kept pace after years of underinvestment. Mergers and acquisitions activity can also rise given strong balance sheets, low interest rates, and attractive equity valuations. In lieu of M&A, idle cash has resulted in increased dividend payouts and share buybacks.Capital expenditure spending is cyclical (and mean reverting). We also find it to be a good coincidental market indicator: a rise in capex is generally associated with gains in the equity markets. Capex levels appear to have troughed and are reverting back towards their historical level, which should be supportive of equity markets.M&A activity has yet to recover from the global financial crisis. M&A levels are at their lowest since 2002 and more than 60% below the historical average, despite a rising stock market, comparatively inexpensive corporate debt and record levels of corporate cash. So far, companies have used their increasing cash levels to buy back shares and distribute dividends.The good news: from these levels, M&A should rise, particularly as the economy continues to improve.

- The Troika (European Commission (EC), International Monetary Fund (IMF) and European Central Bank (ECB)) could make a few concessions to Greece on the extent of its austerity, by cutting interest rates on loans and supporting infrastructure spending, but is unwilling to pledge additional fundsFull debt monetization remains a possibility for the ECB as the crisis has spread to Spain and Italy. Near-term focus will be on whether the ECB sticks to its previous comments by purchasing short-dated peripheral debt to reduce these country’s funding pressuresA more expanded role by the ECB, including full use of its balance sheet, is needed to supplement the current European crisis management tools (the European Stability Mechanism continues to be delayed). Without a commitment from the ECB to use its balance sheet, investors will likely remain skeptical as to whether the current “firewalls” are sufficientEurozone banks are still at the early stages of deleveraging - an “orderly deleveraging” is required to reduce economic risks to the global economy. Policies will likely be focused to reduce the flow of capital from peripheral banks to outside of their respective countryWhile many European equities look attractive in the medium-term (extreme defensive positioning, attractive valuations), the recent rally could be coming to an end without decisive policy action. We remain cautious and patience is warranted before investing in risk assets. Markets will likely remain macro-driven through 2012