The Path

- 1. The Path Taking your big idea from Proof-of-Concept to Growth

- 2. The Path: Critical Milestones Required to Succeed Every startup company that continues to progress will experience these stages of growth.

- 3. The Path: Critical Milestones Required to Succeed These stages typically span the first three to five years of a company’s life. • Proof of Concept: business concept developed • Seed: Product or service in early stage • Startup: Management team in place; business functions created; prototype developed • Early: Beta testing; approaching breakeven • Growth: Approaching revenue and profitable • Later Stage to Maturity: Product or service widely available; continued operation as private company, acquisition, or IPO

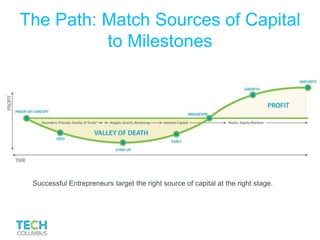

- 4. The Path: Match Sources of Capital to Milestones Successful Entrepreneurs target the right source of capital at the right stage.

- 5. The Path: The Valley of Death • The Valley of Death is the time in the life of the startup when the company is spending more money than it is taking in. • Capital is used for critical milestones—usually to build product and conduct market development. • The Valley of Death is so named because many companies don’t make it out of this stage.

- 6. The Path: Match Sources of Capital to Milestones Capital Requirements per Stage Proof of Concept: Funds incorporation, IP protection, limited prototype Seed: Capital to prove product feasibility and quantify market Startup: Funds pilot to market, verification of business plan economics Early: Funds product and market development Growth: Funds expansion and growth Later Stage to Maturity: Support expansion and growth, next generation product development, market expansion Sources of Capital • Founders, Friends, Family and “Fools”: Entrepreneur is first investor; individuals who trust the entrepreneur and have interest invest at the riskiest and most unpredictable stage. • Banks: Lines of credit, traditional borrowing, or convertible debt. The greater the entrepreneur’s personal resources, the more likely this source. • Grants: From public and private sector and not- for-profit foundations. Typically used for research. Do not require repayment. • Bootstrap: The most interesting and creative entrepreneurs figure out ways to pay as they go without outside capital. • Angel Investor: Private high net worth individuals who invest their own capital individually and in groups. • Venture Capital: Institutional investors with $2M threshold of $2M in exchange for equity.

- 7. The Path: Developing a Capital Plan • “Starting a business can take twice as long and costs twice as much as you think it will.” • There are lots of ways to progress through the early stages of building a business without raising large amounts of capital. • The entrepreneur always takes the first financial risk. • Never raise more capital than required to accomplish the milestones of the business plan. • Seek the advice and mentoring of business people, investors, and other entrepreneurs. • The SBA’s SBIR/STTR programs can be excellent sources of non-dilutive capital. • Stay tuned to state and local incentives for new company development. • Angel investors who syndicate produce larger, more efficient capital rounds. • Very little seed and startup capital comes from venture capitalists. • The investor controls the capital raising process.

- 8. The Path: Conclusion • Every company and entrepreneur is unique. • The milestones of the entrepreneur’s path are common to all. • Most startup companies do not survive the Valley of Death. • The best startup companies find ways to reduce their seed and early stage requirements for external capital. • Less than 2 percent of venture capital is invested in early stage firms. • Angel investors can be an entrepreneur’s best friends. • Matching achievable milestones with the appropriate capital source can simplify the raising capital.