Payments Opportunity/Strategy

- 1. Payments: The Opportunity Barbara Desoer, Chief Technology & Operations Officer

- 2. Forward Looking Statements This presentation contains forward-looking statements, including statements about the financial conditions, results of operations and earnings outlook of Bank of America Corporation. The forward- looking statements involve certain risks and uncertainties. Factors that may cause actual results or earnings to differ materially from such forward-looking statements include, among others, the following: 1) projected business increases following process changes and other investments are lower than expected; 2) competitive pressure among financial services companies increases significantly; 3) general economic conditions are less favorable than expected; 4) political conditions including the threat of future terrorist activity and related actions by the United States abroad may adversely affect the company’s businesses and economic conditions as a whole; 5) changes in the interest rate environment reduce interest margins and impact funding sources; 6) changes in foreign exchange rates increases exposure; 7) changes in market rates and prices may adversely impact the value of financial products; 8) legislation or regulatory environments, requirements or changes adversely affect the businesses in which the company is engaged; 9) changes in accounting standards, rules or interpretations, 10) litigation liabilities, including costs, expenses, settlements and judgments, may adversely affect the company or its businesses; 11) mergers and acquisitions and their integration into the company; and 12) decisions to downsize, sell or close units or otherwise change the business mix of any of the company. For further information regarding Bank of America Corporation, please read the Bank of America reports filed with the SEC and available at www.sec.gov. 2

- 3. Why Talk About Payments? Payments Any financial transaction used to transfer value between two parties in exchange for goods or services Consumers BAC Payments Small Wholesale Businesses Customers 3

- 4. Payments are Big Business for Banks Payments drive more revenue for banks than any other business U.S. Banking Market Revenue Pools 2005 Estimates ($B) $224 $120 $102 $75 $60 Payments Mortgage Capital Brokerage Asset Markets Mgmt 4 Source: McKinsey Global Concepts, Mercer Oliver Wyman, BAC Finance, BCG

- 5. Payments Activity at Bank of America 2006 Revenue from Payments Businesses ($B) Payments Revenue by Activity ($B) +14% 12% 4% 11% Non- Other* Interchange 10% +12% Payments +11% 16% Treasury +8% Services 48% Fee 33% 35% 36% Consumer 30% DDA -1% +1% Payments Net Interest 57% 54% 52% 52% Income 49% Credit Card Total Payment 2005 2006 2007 Products Source: Payments revenue data is managed revenue -2005, 2006 data are Actuals 5 -2007 Forecast data are as of 11/1/06 * Other: Includes ATM and Merchant Acquiring

- 6. Bank of America is the Payments Leader • Leads in the fastest growing payment businesses Industry Consumer Transaction Volumes 2005 - 2007 CAGR – #1 debit card (signature & PIN) – #1 Online banking – #1 ACH receipts PIN Debit 18% – #1 Credit card – #2 Merchant card acceptance Sig. Debit 18% • Leverages scale to drive low cost ACH 13% position • Targets strategic initiatives to Credit Card 5% address slow growth pay types – #1 Check Image Exchange Cash* 0% – #1 Remote Deposit Capture -9% Check – Investments in Enterprise Cash Logistics Source: McKinsey Global Concepts Payments Map 6 * Cash estimates from BAC, McKinsey estimates at -3% Total payment transaction trends are expected to be similar to the Consumer trends above

- 7. How did we get Here? • Payments growth through mergers and acquisitions – A number of our acquisitions fill gaps in our capability • Fleet – Northeast distribution • National Processing Company – mid-market & larger corporation merchant services • MBNA – card scale and affinity products • Strong understanding of the mechanics of the payments business – Robust, end-to-end view of payments – Use of Six Sigma tools to exploit opportunities for cost savings and revenue enhancement • Established Payments Leadership Council – driving integration, innovation and execution across the enterprise Result: We’re the number one retail and wholesale payments franchise in the world, with more scale than our competitors – and we’re focused on leveraging our assets to drive even more value. 7

- 8. What Differentiates Bank of America’s Approach? Enterprise view of payments provides insight that focuses on the highest impact cost opportunities, revenue opportunities, and product and service innovation Innovation Service Excellence Operational Excellence 8

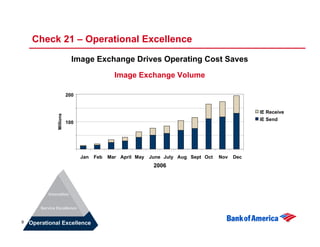

- 9. Check 21 – Operational Excellence Image Exchange Drives Operating Cost Saves Image Exchange Volume 200 IE Receive Millions IE Send 100 Jan Feb Mar April May June July Aug Sept Oct Nov Dec 2006 Innovation Service Excellence 9 Operational Excellence

- 10. Check 21 – Service Excellence Remote Deposit Product Drives Revenue and Client Delight Client Side Capture Growth 1400 18 14 1000 Millions Account 10 Volume 600 6 200 2 Jan Feb Mar April May June July Aug Sept Oct Nov Dec 2006 Innovation Service Excellence 10 Operational Excellence

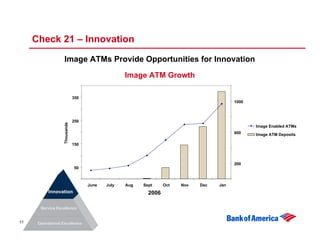

- 11. Check 21 – Innovation Image ATMs Provide Opportunities for Innovation Image ATM Growth 350 1000 250 Thousands Image Enabled ATMs 600 Image ATM Deposits 150 200 50 June July Aug Sept Oct Nov Dec Jan Innovation 2006 Service Excellence 11 Operational Excellence

- 12. Image ATM – A Future of Possibilities Cash deposits are Deposit displayed Receipts are Images sent to validated and on screen printed with the Universal given immediate images of checks Landing Zone™ credit 12

- 13. Enhancing Value Through Payments – Retail Fuel Example Fuel Payment Business System • Enterprise view helps us focus on critical industries with greatest value creation potential • Retail fuel is one of those industries • Scale and scope in specific segments help us better serve all our customers • Leader in merchant card acceptance in retail fuel sector • National footprint matches most major fuel retailers • Leadership in cash processing • 17,000 ATMs, with more than 1,000 at fuel retailers like ExxonMobil and Valero Our leadership and integrated approach allow us to better meet the needs of all our customers 13

- 14. Bank of America – Positioned for Payments Growth • Diversity and scale of payments channels, products and customers • Track record of using efficiency as an advantage • Intense focus on integration, innovation, information, investment – and execution – within our payments business – Innovation is critical to our success – Innovation drives value • Giving customers more choices deepens relationships Bank of America has all of the pieces in place to drive unmatched growth in payments 14