Petrobras General Overview

- 2. STRATEGIC PLAN 2017-2021 BUSINESS AND MANAGEMENT PLAN —

- 3. 3 FORWARD-LOOKING STATEMENTS: DISCLAIMER The presentation may contain forward-looking statements about future events within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are not based on historical facts and are not assurances of future results. Such forward-looking statements merely reflect the Company’s current views and estimates of future economic circumstances, industry conditions, company performance and financial results. Such terms as "anticipate", "believe", "expect", "forecast", "intend", "plan", "project", "seek", "should", along with similar or analogous expressions, are used to identify such forward-looking statements. Readers are cautioned that these statements are only projections and may differ materially from actual future results or events. Readers are referred to the documents filed by the Company with the SEC, specifically the Company’s most recent Annual Report on Form 20-F, which identify important risk factors that could cause actual results to differ from those contained in the forward-looking statements, including, among other things, risks relating to general economic and business conditions, including crude oil and other commodity prices, refining margins and prevailing exchange rates, uncertainties inherent in making estimates of our oil and gas reserves including recently discovered oil and gas reserves, international and Brazilian political, economic and social developments, receipt of governmental approvals and licenses and our ability to obtain financing. Disclaimer — We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason. Figures for 2016 on are estimates or targets. All forward-looking statements are expressly qualified in their entirety by this cautionary statement, and you should not place reliance on any forward-looking statement contained in this presentation. In addition, this presentation also contains certain financial measures that are not recognized under Brazilian GAAP or IFRS. These measures do not have standardized meanings and may not be comparable to similarly-titled measures provided by other companies. We are providing these measures because we use them as a measure of company performance; they should not be considered in isolation or as a substitute for other financial measures that have been disclosed in accordance with Brazilian GAAP or IFRS. NON-SEC COMPLIANT OIL AND GAS RESERVES: CAUTIONARY STATEMENT FOR US INVESTORS We present certain data in this presentation, such as oil and gas resources, that we are not permitted to present in documents filed with the United States Securities and Exchange Commission (SEC) under new Subpart 1200 to Regulation S-K because such terms do not qualify as proved, probable or possible reserves under Rule 4-10(a) of Regulation S-X. General - February 2017

- 4. An integrated energy company focused on oil and gas that evolves with society, creating high value, with a unique technical capability OUR VISION 4

- 5. OUR VALUES Ethics and transparency Market driven Results oriented Overcoming and confidence 5 Respect for life, people and environment

- 6. Main Metrics of Strategic Plan (SP) and Business and Management Plan (BMP) — SAFETY FINANCIAL Reduction of 36%In the Total Recordable Injury Frequency Rate (TRIFR*) Reduction in LEVERAGE Net Debt/EBITDA * TRIFR = number of reportable injuries per million man- hours TO 2.5 by 2018 FROM 5.3 in 2015 TO 1.4 in 2018 FROM 2.2 in 2015 6

- 7. Highlights of the Plan — main metrics drive the strategy Unified Plan New management system with targets up to supervisory level Disciplined execution: systematic monitoring of goals with mid-course corrections New tools of cost management Meritocracy 2 (SP and BMP) 7 Engagement of the leadership

- 8. EVOLUTION 8

- 9. Main variables in the base case scenario — 48 Brent Prices (US$/bbl - base year 2016) Nominal exchange rate (R$/US$) 56 68 71 0 40 80 120 2016 2017 2018 2019 2020 2021 Source: Petrobras; IHS, PIRA, IEA, Focus report Range of estimates(IHS, PIRA and IEA) 71 45 9 Petrobras 3.48 3.55 3.71 3.72 3.74 3.78 2,20 2,70 3,20 3,70 4,20 4,70 2016 2017 2018 2019 2020 2021 Intervalo Focus Petrobras 4.70 4.20 3.70 3.20 2.70 2.20 Market forecast Range of estimates (IHS,PIRA and IEA)

- 10. Brazilian market for oil products resumes growth — 10 0 500 1000 1500 2000 2500 2017 2021 917 997 529 476 863 956 Brazilian oil products market (Million bpd) Diesel OthersGasoline 2.3 2.4 +5.2%

- 11. Cost reductions — 142 126 2015-2019 BMP 2017-2021 Estimates 2017-2021 BMP -18% 53% 37% 10% E&P RGN Demais áreas Manageable operating costs* (US$ Billion) 11 153 Other segmentsRefining & Natural Gas (RNG) * Manageable operating costs: lifting, refining, logistics and distribution costs, overhead and others

- 12. Partnerships and divestments — 2015-2016 2017-2018 19.5 15.1 Amount in US$ Billion 12 Benefits of the partnerships Risk sharing Capex reduction Increased capacity to invest along the value chain Technological exchange Strengthening of corporate governance The partnerships and divestments program of Petrobras leverages third parties investments that might surpass US$ 40 Billion* in the next 10 years. * Does not consider investment of suppliers to increase capacity

- 13. Investment spending by Petrobras (Capex) — 13 2017 Capex US$ 19.2 Billion 0,00 20,00 40,00 60,00 80,00 100,00 PNG 2015-2019 (revisão JAN 2016) PNG 2017-2021 81% 82% 17% 17% 2% 1% Comparison of total capex (US$ Billion) Exploration & Production (E&P) Other segmentsRefining & Natural Gas (RNG) 98.4 74.1 -25% 2015-2019 BMP (Jan 2016 review) 2017-2021 BMP

- 14. 72initiatives Main themes — 21strategies Implantation of Zero Based Budgeting Strengthening of internal controls Merit-based performance management Strengthening of the safety culture Streamlining decision making Improvement of risk management 14 Reinforcing prevention against corruption

- 16. Pre-Salt Post-Salt 34% 66% Production Development + Exploration Total E&P US$ 60.6 billion Upstream Capex Breakdown — Suporte Operacional Exploração 13% 11% 76% 16 Development of productionExploration Operational support Concession Transfer of Rights Production Sharing (Libra)

- 17. 17 Greater well productivity in concessions Experience acquired in well construction Fewer wells to top capacity 3 times faster Shorter well construction time in concessions 2016 2010 26 20 2016 2010 6 8 kbpd/well Until 2016 Until 2010 124 3 2016 2010 89 310 Days construction per well Efficiency gains: Santos Basin pre-salt case — + 30% productivity - 25% wells 204 wells drilled Lower capex for the same production Number of wells built (drilled and completed) Producing wells

- 18. Lula field: faster well construction and connection — 2010 2016 60% reduction in well construction and connection times 6 units in Angra dos Reis Paraty Itaguaí Mangaratiba Maricá Saquarema 1 unit in Angra dos Reis 18

- 19. Increased share of pre-salt in the portfolio, with lower lifting costs Gains from contractual renegotiations Management of drilling rig idleness Optimization of support vessel logistics Reduction in labor costs Reduction in operating costs — Lifting Cost (US$/boe) 0 2 4 6 8 10 12 14 16 2014 2015 2016 2017-2021* 14.6 12 11 9.6 * Average for the period 19

- 20. 0 250 500 750 1000 1250 1500 1750 2000 2001 2003 2005 2007 2009 2011 2013 2015 2017 2019 2021 Oil production in the Campos Basin (kbpd) Stable decline of around 9*% Opportunities in the Campos Basin — • Operations with emphasis on strategic partnerships, seeking to increase recovery • Extension of concessions • Revitalization of Marlim project *Below the industry average of 12% for deepwater wells Bacia de Campos 20

- 21. 21 0 1 2 3 4 2017 2021 Produção Óleo, LGN e Gás Oil+ NGL Brazil Oil + gas International 2.52 3.34 2.07 2.77 Natural gas Brazil 2.62 3.41 Production profile — Oil , NGL* and Gas production (million boed) * Natural Gas Liquids

- 22. LEGEND CONCESSION PSA TRANSFER OF RIGHTS 22 Start-up of new production units — 2017 2018 2019 2020 2021 TARTARUGA VERDE E MESTIÇA LULA NORTE LULA SUL TLD DE LIBRA BÚZIOS 2 BÚZIOS 1 BÚZIOS 3 BÚZIOS 4 BÚZIOS 5 PILOTO LIBRA REVIT. DE MARLIM MÓD. 1 REVIT. DE MARLIM MÓD. 2 LIBRA 2 NW ITAPU INTEGRADOPARQUE DASBALEIAS BERBIGÃO LULA EXT. SUL ATAPU 1 SÉPIA

- 24. 33% 25% 11% 24% 7% RTC - Operational continuity RTC - Capital investments G&E - Operational continuity G&E - Capital investments Others (Petrobras Distribuidora, PBIO and R&D) Total RNG U$S 12.4 Billion 24 RTC: Refining, Transportation and Commercialization; G&E: Gas & Energy; PBIO: Petrobras Biocombustível; R&D: Research & Development. Refining and Natural Gas Capex Breakdown —

- 25. 2014 2015 2016 2017-2021 0.49 0.37 0.31 0.29 Integration of common and interdependent activities among the refineries Optimization in the use of support resources Optimization of the consumption of energy, catalyzers and chemicals Optimization in maintenance expenditures Reduction of operating costs — Refining Cost (US$ thousand/UEDC1) 251. Unit of equivalent destilation capacity 2. Average for the period 2

- 26. Main Projects — 26SNOX: emission reduction unit; UTGCA: Monteiro Lobato Gas Treatment Unit . Seeking partnership Seeking partnership In final stages 100 kbpd 130 kbpd SNOX unit (under procurement) 1st Refining set (Train I) 2nd Refining set (Train II) Gas Processing Unit Refinery RNEST (Abreu e Lima) COMPERJ Expansion of UTGCA under study Route 1 Pre-salt gas flow Gas pipeline and Gas Processing Unit implementation Route 3 26

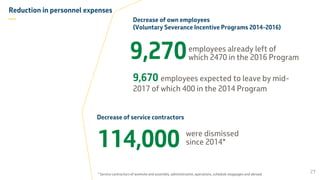

- 27. Reduction in personnel expenses — employees already left of which 2470 in the 2016 Program 9,670 employees expected to leave by mid- 2017 of which 400 in the 2014 Program 9,270 27 Decrease of own employees (Voluntary Severance Incentive Programs 2014-2016) Decrease of service contractors 114,000 were dismissed since 2014* * Service contractors of worksite and assembly, administrative, operations, schedule stoppages and abroad.

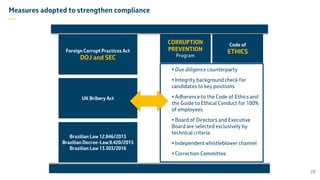

- 28. Due diligence counterparty Integrity background check for candidates to key positions Adherence to the Code of Ethics and the Guide to Ethical Conduct for 100% of employees Board of Directors and Executive Board are selected exclusively by technical criteria Independent whistleblower channel Correction Committee Foreign Corrupt Practices Act DOJ and SEC UK Bribery Act Brazilian Law 12.846/2013 Brazilian Decree-Law 8.420/2015 Brazilian Law 13.303/2016 CORRUPTION PREVENTION Program Code of ETHICS 28 Measures adopted to strengthen compliance —

- 29. Review of the decision-making process Elimination of approvals by single individuals Creation of statutory technical committees Statutory Audit Committee New Advisories Committees for the Board of Directors Alignment of guidelines for all companies in Petrobras System Definition of succession process for managerial and executive positions Reorganization of the structure of the company 29 Measures adopted to strengthen governance —

- 30. FINANCE — 30

- 31. Sources and Uses — 158 19 2 Sources 74 73 32 Uses Partnerships and divestments are essential to enable the planned capex 179 179 31 Investments Amortizations Financial Expenses Operating Cash Flow (after dividends) Use of Cash Partnerships and Divestments Sources and Uses 2017-2021 (US$ billion) No requirement for new net debt during the 2017-2021 period

- 32. Main risks* — Material changes to market conditions Divestments and partnerships below plan Judicial disputes Renegotiation of the Transfer of Rights terms Impact of Local Content on costs and timing of the projects Delays in the construction of platforms Higher than expected capex *These risks are not exhaustive Risks and mitigating activities managed by accountable people

- 34. 34 Production continues in an upward trend Production increases 2.5% in the period Production (MMboe/d) 2.14 2.12 1.98 2.13 2.22 0.10 0.10 0.09 0.09 0.08 0.57 0.56 0.55 0.58 0.57 2.80 2.78 2.62 2.80 2.87 3Q15 4Q15 1Q16 2Q16 3Q16 Oil Brazil Oil International Natural Gas +4%+8% Oil production in Brazil Oil and gas production Operated production Production Records 2.22 MMbbl/d 2.87 MMboe/d 3.17 MMboe/d Seven of the eight Pre-Salt platforms in Campos Basin have reached full capacity +2.5% +2.3%

- 35. 35 Lifting cost keeps downward trend 12.1 10.4 9M15 9M16 Lifting Cost* (US$/boe) Pre-Salt Lifting Cost Below 8 Dollars per barrel < 8.0 US$ boe 11.0 10.6 10.5 3Q15 2Q16 3Q16 Lifting Cost 3Q15 vs 3Q16 We reduced by 20% the maneageble operating costs in the same period in which production grew by 2,5% * Lifting Cost in Brazil and abroad Lifting Cost* (US$/boe) -14%

- 36. 36 Lower sales volume* due to reduced oil product demand in the domestic market Demand impacted by the slowdown in the domestic economy 953 811 804 540 541 521 789 757 763 Diesel Gasoline Others 3Q16 2,088 2Q16 2,109 3Q15 2,282 -1.0% kbbl/day -6% 928 804 550 542 776 738 9M16 -8% 2,084 9M15 2,254 * Includes Downstream and BR Distribuidora sales

- 37. 37 Net balance of oil and oil products exports of 210 kbpd in the quarter 313 122 154 365 341 419 218 237 198 145 174 143 -55-63-73 265 219 52 352 531 3Q16 210 2Q16 515 3Q153Q162Q16 359 3Q15 562 510 2Q16 156 3Q15 -21 3Q16 Imports Exports Net Balance Oil Oil Products kbbl/day

- 38. 38 Positive free cash flow for the sixth quarter in a row Operating Cash Flow Free Cash FlowInvestments2 Adjusted EBITDA1 3Q15 15.5 21.6 3Q162Q16 20.3 3Q15 18.0 11.2 3Q16 10.3 2Q16 3.8 3Q163Q15 10.8 2Q16 16.4 3Q16 26.7 2Q163Q15 21.921.8 1. Adjusted EBITDA is the sum of EBITDA, share of earning in equity-accounted investments and cumulative translation adjustments – CTA. 2. Cash basis R$ Billion 19 28 33 +11% 63.0 9M16 56.8 9M15 24 30 +8% 9M15 66.0 9M16 61.1 36.3 52.8 9M15 -31% 9M16 +256% 9M169M15 8.3 29.6 Adjusted EBITDA Margin (%)

- 39. 39 Results affected by non-recurring itens Operating Income Net IncomeNet Financial Results Gross Income 3Q16 -7.1 2Q16 -6.1 3Q15 -11.4 3Q16 -16.5 2Q16 0.4 3Q15 -3.8 3Q16 -10.0 2Q16 7.2 3Q15 6.0 3Q16 23.3 2Q16 22.8 3Q15 23.8 R$ Billion -6% 9M16 67.2 9M15 71.7 -81% 9M16 5.3 9M15 28.5 +5% 9M16 -21.9 9M15 -23.1 -925% 9M16 -17.3 9M15 2.1

- 40. 40 Main projects and reasons for impairment in 3Q16 R$ 15.7 billion in 3Q16 R$ Billion 7.00 6.00 5.00 4.00 3.00 2.00 mai/15 jul/15 set/15 nov/15 jan/16 mar/16 mai/16 jul/16 set/16mar/15jan/15 +23% 4.8 3.9 Country Risk Premium (% p.a.) 2.0 2.5 2.8 5.6 Some fields, which had already been impacted by impairment in 2015, had their cash flows more pressuredby the exchange rate and the discount rate. Uncertainty in the delivery of the hulls of FPSOs P-71, P-72 and P-73 Postponement of 2nd train of RNEST to 2023 Review of business plan’s assumptions, such as the reduction in the market for resins and exchange rate Oil and Gas Production fields in Brazil Equipmentrelated to oil and gas production activities 2nd train of Abreu and Lima refinery - RNEST Suape PetrochemicalComplex Increase in discount rate for every segment

- 41. 41 In 3Q16, Petrobras did not provision nor closed settlements related to the class action and other individual actions. The ongoing discussions encompass very complex issues and are subject to substantial uncertainties. Individual Actions – New York In October 2016, Petrobras reached an agreement to settle four individual actions, with the plaintiffs below: • Dodge & Cox Int'l Stock Fund; • Janus Overseas Fund; • PIMCO Total Return Fund; • Al Shams Investments.al. In 3Q16, Petrobras provisioned for individual actions under negotiation, for which settlements were not yet reached. Settlement in 3Q16 Provision in 3Q16 Settlement in 3Q16 Provision in 3Q16 Settlement in 3Q16 Provision in 3Q16 Individual actions (negotiated) Individual actions (under negotiation) Class action + other individual actions Provision of R$ 1.2 billion in 3Q16

- 42. 42 We announced the new diesel and gasoline pricing policy We will practice competitive prices using as a benchmark Import Parity Prices (IPP) plus a margin Import price (market alternative) Taxes Margin and risks IPP Considers the competitiveness of Petrobras’ products and the risks associated to imports operations, such as exchange rate and oil and oil products price volatility, delays and changes in quality specification. Competitiveness will be a function of commercial and financial objectives CIDE, PIS and COFINS, ICMS Refinery Gate Price

- 43. 43 Partnerships and Divestments reached 90% of the target of the 2015-16 Plan Transactions signed amount to US$ 13.6 Bi Partnerships and divestments with signed contracts Bacia Austral assets in Argentina, with Compañia General de Combustibles 49% Gaspetro with Mitsui 66.7% PESA with Pampa Energia Petrobras Chile Distribuición with Southern Cross Group 66% BM-S-8 (Carcará) with Statoil 90% of Nova Transportadora do Sudeste (NTS) with Brookfield Nansei refinery with Taiyo Liquigás with Ultrapar PetroquímicaSuape/Citepe with Alpek Guarani with Tereos Participations Master Agreement with Total Partnerships and divestments In final stages of negotiation already announced Baúna and Tartaruga Verde fields with Karoon Strategic Partnerships already announced MoU with Statoil – focus on revitalization of Post-Salt fields MoU with GALP – focus on partnerships in regions worldwide in which the companies have a shared interest, besides training and deepwater reservoir research MoU with TOTAL – focus in the E&P, Gas, Energy and Refining segments in Brazil and abroad Ongoing Divestments already announced Partnership in Petrobras Distribuidora (BR) Onshore shallow waters fields LNG Terminals Thermal power plants

- 44. 44 We reduced by 10% the Manageable Operating Costs in 2016 Sales, general and administrative expenses decreased, despite the wage readjustment due to the 2016 Collective Bargaining Agreement -6% 3Q16 19.9 2Q16 21.1 3Q15 25.2 -21% -10% 9M16 62.7 9M15 69.7 -7% 3Q16 71,152 2Q16 76,613 3Q15 79,113 -10% Petrobras Workforce Evolution Manageable Operating Costs R$ Billion -4% +9% 9M16 19.3 9M15 17.7 -2% 3Q16 6.4 2Q16 6.5 3Q15 6.6 Sales, General and Administrative Expenses R$ Billion

- 45. 45 Lower debt in line with 2017-2021 BMP targets 398,2397,8 450,0 493,0506,6 325,6332,4 369,5 392,1402,3 122,7123,9126,4126,3127,5 100,3103,6103,8100,4101,3 Net Debt (US$ billion) Total Debt (US$ billion) Net Debt (R$ billion) Total Debt (R$ billion) 2Q161Q164Q153Q15 3Q16 3Q15 2Q16 3Q16 Cost of Debt(% a.a.) 6.1 6.3 6.3 Maturity (years) 7.49 7.30 7.33 Leverage (%) 58 55 55

- 46. 46 DEBT PROFILE – AS OF SEPTEMBER 30, 2016 By Category By Currency Note: Brazilian State Banks: BNDES, Banco do Brasil and Caixa Econômica Federal 44% 24% 6% 22% 4% Brazilian State Banks Other Brazilian Banks Bond Markets Foreign Financial Institutions Foreign Development Banks and ECA 74% 19% 1%6% EUR USD BRL Others

- 47. Liability Management 3 successful liability management between May 2016 and January 2017 — US$ Bilhões 47 US$ 14 billion in issuances and US$ 15 billion in tender helped to reduce the cost of debt and to extend maturity We were awarded “Corporate Liability Management of the Year” by LatinFinance magazine. Estimated Cost of Debt per Year Maturity February 9th 1 month ago 1 year ago Max. 5 years 5.5 % 6.1% 13.6% 15.9% 10 years 6.9% 7.4% 12.9% 14.4% 30 years 8.1% 8.2% 12.4% 13.2% 6.8 Issuance 6.3 TenderBookbuilding 19.0 May 2016 3.0 Issuance 3.0 TenderBookbuilding 7.0 July 2016 4.0 Issuance 5.9 TenderBookbuilding 19.0 January 2017 US$ Billion Source: Bloomberg

- 48. Debt maturity between 2017 and 2020 Includes January 2017 tender offer — 13 23 17 12 14 18 11 8 201920182017 2020 As of Feb/2015 As of Feb/2017 US$ Billion 48

- 49. 49 2016 Cash Flow reflects divestments and debt management US$ Billion Judicial Guarantees Borrowings -9.3 1.8 Roll-overs 11.9 Divestments 6.5 Investment -14.5 Dividends, Interest and Amortizations -22.6 -3.6 Operating Cash Flow 26.5 2016 Initial Cash Position 25.8 22.5 2016 Final Balance Financial Expenses and Amortizations Tender Offer

- 50. 50 And evolving with a focus on the main metrics of the 2017-21 BMP Net Debt / EBITDA** 2Q162015 4.1 5.3 4.5 3Q16 -9% 2Q16 1.6 2.2 3Q16 -12% 1.8 2015 Total Recordable Injury Frequency Rate* SAFETY * TRIFR = Number of reportable injuries per million man-hours FINANCIAL -24% -27% ** LTM Adjusted EBITDA

- 51. STRATEGIC PLAN 2017-2021 BUSINESS AND MANAGEMENT PLAN —