Rise of the Apps Culture - Pew Internet Project

- 1. The Rise of Apps Culture 35% of U.S. adults have cell phones with apps, but only 24% of adults actually use them September 15, 2010 Kristen Purcell, Associate Director for Research, Pew Internet Project Roger Entner, Senior Vice President, Head of Research and Insights, Telecom Practice, The Nielsen Company Nichole Henderson, Director of Consumer Insights for the Nielsen Telecom Group http://pewinternet.org/Reports/2010/The-Rise-of-Apps-Culture.aspx Pew Research Center’s Internet & American Life Project 1615 L St., NW – Suite 700 Washington, D.C. 20036 202-419-4500 | pewinternet.org 1

- 2. Overview Cell phone use in the U.S. has increased dramatically over the past decade. Fully eight in ten adults today (82%) are cell phone users, and about one-quarter of adults (23%) now live in a household that has a cell phone but no landline phone. Along with the widespread embrace of mobile technology has come the development of an “apps culture.” As the mobile phone has morphed from a voice device to a multi- channel device to an internet-accessing mini-computer, a large market of mobile software applications, or “apps,” has arisen. Among the most popular are apps that provide some form of entertainment (games, music, food, travel and sports) as well as those that help people find information they need and accomplish tasks (maps and navigation, weather, news, banking). With the advent of the mobile phone, the term “app” has become popular parlance for software applications designed to run on mobile phone operating systems, yet a standard, industry-wide definition of what is, and is not, an “app” does not currently exist. For the purpose of this report, apps are defined as end-user software applications that are designed for a cell phone operating system and which extend the phone’s capabilities by enabling users to perform particular tasks. The most recent Pew Internet Project survey asked a national sample of 1,917 cell phone-using adults if they use apps and how they use them. Broadly, the results indicate that while apps are popular among a segment of the adult cell phone using population, a notable number of cell owners are not yet part of the emerging apps culture. 35% of adults have cell phones with apps, but only two-thirds of those who have apps actually use them Of the 82% of adults today who are cell phone users, 43% have software applications or “apps” on their phones. When taken as a portion of the entire U.S. adult population, that equates to 35% who have cell phones with apps. This figure includes adult cell phone users who: have downloaded an app to their phone (29% of adult cell phone users), and/or have purchased a phone with preloaded apps (38% of adult cell phone users) Yet having apps and using apps are not synonymous. Of those who have apps on their phones, only about two-thirds of this group (68%) actually use that software. Overall, that means that 24% of U.S. adults are active apps users. Older adult cell phone users in particular do not use the apps that are on their phones, and one in ten adults with a cell phone (11%) are not even sure if their phone is equipped with apps. 2

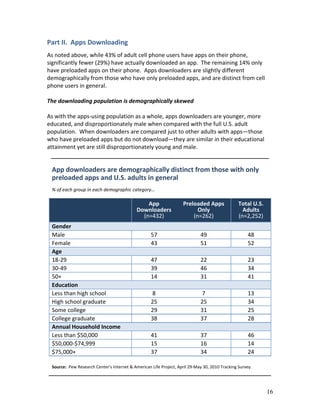

- 3. Apps users are younger, more educated, and more affluent than other cell phone users When compared with other cell phone using adults, and the entire U.S. adult population, the apps user population skews male, and is much younger, more affluent, and more educated than other adults. Overall, the apps-using population also skews slightly Hispanic when compared with other adult cell phone users. App use still ranks relatively low when compared with other uses of cell phones While 24% of adults, 29% of adults with cell phones, use applications on their phones, apps use still ranks relatively low when compared with other non-voice cell phone activities. Taking pictures and texting are far and away the most popular non-voice cell phone data applications, with more than seven in ten adult cell phone users embracing these features of their phones. App use ranks low on a list of non-voice cell phone activities % of adult cell phone users who do each of the following on their phone… Take a picture 76% Send or receive text messages 72 Access the internet 38 Play a game 34 Send or receive email 34 Record a video 34 Play music 33 Send or receive instant messages 30 Use an app 29 Source: Pew Research Center's Internet & American Life Project, April 29-May 30, 2010 Tracking Survey. N=1,917 adult cell phone users. 29% of adult cell phone users have downloaded an app to their phone As with the apps-using population as a whole, downloaders are younger, more educated, and disproportionately male when compared with the total U.S. adult population. And while they resemble adults who only have preloaded apps in terms of education, they are still disproportionately young and male even when compared with this group. 3

- 4. One in ten adult cell phone users (10%) had downloaded an app in the past week; 20% of cell phone users under age 30 download apps this frequently Those who download apps do so fairly frequently. Among apps downloaders, roughly half (53%) say their most recent download was in the past 30 days, including one third (33%) who say their last download was within the past week. As a fraction of all cell phone-using adults, that equates to 15% who have downloaded apps in the past month, and 10% who have downloaded apps in the past week. Among cell phone users under age 30, 20% have downloaded an app in the past week. One in eight adult cell phone users (13%) has paid to download an app Among the 29% of adult cell phone users who download apps, just under half (47%) have paid for an app, with the remainder saying they only download apps that are free. Put in broader context, that means that 13% of all adult cell phone users have paid to download an app to their phone. There are few notable demographic differences between downloaders who pay for apps and those who do not. Among cell phone users with apps, the average adult has 18 apps on his or her phone Among adult cell phone users who have software applications on their cell phones, the mean number of apps is 18. However, the median number of apps is 10, indicating there are heavy apps users on the high end of the response scale who have a disproportionate number of apps on their phones. This is particularly true among the youngest adults. Again, there is some uncertainty among cell phone users, particularly older cell phone users, about what software they have on their phones. Fully 18% of cell phone users with apps on their phones do not know how many they have. That figure doubles to 36% among cell phone users age 50 and older. Findings from the Nielsen Apps Playbook Survey Nielsen data indicate that games are the most popular apps, followed by news/weather, maps/navigation, social networking, and music. In addition to drawing on results from the Pew Internet Project’s own nationwide probability sample of 2,252 adults, this report also presents findings from The Nielsen Company's Apps Playbook, a December 2009 survey of a nonprobability sample of 3,962 adult cell phone subscribers who had downloaded an app in the previous 30 4

- 5. days.1 Although the Nielsen survey cannot be projected to the population of all app downloaders with a known degree of accuracy, it provides an extensive snapshot of the types of apps people are downloading and a broad sense of how they are using them. Among the recent downloaders Nielsen surveyed, game apps were the most downloaded apps overall in terms of both volume and the percent of adults who had downloaded them.2 In terms of actual apps use, six in ten of Nielsen’s recent downloaders (60%) said they had used a game app in the past 30 days, and roughly half said they had used a news/weather app (52%), a map/navigation app (51%), or a social networking app (47%) in that same timeframe. While music apps ranked second on the most downloaded list, they ranked fifth on the most used list. 1 In probability sampling, all individuals in the population have some opportunity of being included in the sample, and the mathematical probability that any one of them will be selected can be calculated. In nonprobability sampling, individuals are selected on the basis of their availability (e.g., volunteering for an online panel) and an unknown portion of the population is excluded (e.g., those who did not volunteer). Because Nielsen’s Mobile Insights survey is administered to a nonprobabilty sample, the results cannot be projected to the entire population of recent apps downloaders and the findings reported here should be considered descriptive. When compared to the Pew Internet probability sample, the Nielsen sample of recent-downloaders is similar in racial/ethnic and gender makeup, but overrepresents high income adults and college graduates. It also skews younger than the Pew sample. 2 For more on the popularity of games and other apps among mobile subscribers, see Nielsen’s September 9, 2010 report “Games Dominate America’s Growing Appetite for Mobile Apps.” Available at: http://blog.nielsen.com/nielsenwire/online_mobile/games-dominate-americas-growing-appetite-for- mobile-apps/ 5

- 6. What are the most popular types of apps? % of Nielsen recent downloaders who have used each category of apps in the past month… Games 60% News/Weather 52% Maps/Navigation/Sea… 51% Social Networking 47% Music 43% Entertainment/Food 34% Banking/Finance 28% Sports 27% Productivity 26% Shopping/Retail 24% Video/Movies 22% Communication 21% Travel/Lifestyle 18% Other 3% Source: The Nielsen App Playbook, December 2009. N=3,962 adults who have downloaded an app in the 30 days prior to the survey. In the Nielsen survey, most recent apps downloaders said they used their apps daily but for short periods of time, and used them in a variety of situations Some 57% of the recent apps downloaders in the Nielsen study said they use their apps daily. While one quarter of these recent apps downloaders (24%) said they use their apps for more than 30 minutes a day, the vast majority said they spend less time using their apps each day. Asked where they use their apps most frequently, 71% of the Nielsen sample said they frequently used their apps when they were alone, and about half said they frequently 6

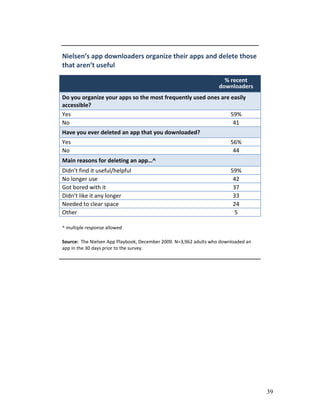

- 7. used their apps while waiting for someone or something (53%) or while at work (47%). One in three (36%) said they frequently used apps while commuting. The Nielsen survey indicates that different people may use apps in different ways There were several notable differences among the Nielsen recent-downloader sample in terms of which apps they favored and how frequently they used them. For instance: Women in the sample were more likely than men to have used a social networking app in the past 30 days (53% v. 42%), and women who used the Facebook app were also more likely to use that app everyday (64% v. 55%) Women in the sample were more likely than men to have a used a game app in the past 30 days (63% v. 58%), while men were more likely to have used a productivity app (29% v. 21%) or a banking/finance app (31% v. 25%) Among the Nielsen sample of recent downloaders, whites (53%) and Hispanics (47%) were more likely than African-Americans (36%) to have used a map/navigation/search app in the month prior to the survey Hispanics, on the other hand, were the most likely to have used a music app recently (48% of Hispanics v. 42% of whites and 42% of African-Americans) In the Nielsen sample, 75% of 18-24 year-old Twitter app users reported using that app every day, compared with 52% of the 25-34 year-olds and 48% of the Twitter users age 35 and older In contrast, among Nielsen’s Facebook app users, 25-34 year-olds were more likely than both younger and older Facebook app users to report using their Facebook app daily The African-Americans and Hispanics in the Nielsen sample were significantly more likely than whites to be daily users of their Youtube apps (33% of African- Americans v. 24% of Hispanics v. 12% of whites) and their Pandora music apps (33% of African-Americans v. 27% of Hispanics v. 14% of whites) The Nielsen study indicates that cell phone screen real estate is valuable Slight majorities of Nielsen’s recent app downloaders said they organize their apps so that the most frequently used are easily accessible (59%), and that they delete apps from their phones that are not useful or helpful (56%). And this culling process happens relatively quickly; among those who had deleted an app, 62% said they usually do it within two weeks of downloading the software. The men in the Nielsen sample deleted apps more quickly than women; 40% of the male recent-downloaders said they delete apps they did not find useful within a week, compared with 29% of the women. 7

- 8. About Pew Internet Project Findings The figures from the Pew Internet Project survey were gathered in a telephone survey of a representative sample of 2,252 U.S. adults age 18 and older between April 29 and May 30, 2010. The sample included 1,917 adult cell phone users, 744 of whom were contacted on their cell phones. The margin of error is +/- 2.4 percentage points for results based on the total sample of adults, and +/- 2.7 for results based on cell phone users. The Nielsen data are from an online, self-administered survey with a nonprobability sample of 4,265 recent apps downloaders originally identified in Nielsen’s Mobile Insights survey of cell phone subscribers. Because the survey is not based on a probability sample, no margin of error can be computed and the results cannot be generalized to the population of recent app downloaders with a known degree of precision. The Mobile Insights sample is drawn from a combination of online panels and is augmented by a Spanish language phone survey in highly concentrated Hispanic markets using a residential phone list sample frame for improved coverage of Hispanics. The Apps Playbook follow-up survey was conducted in December of 2009, and screened for “recent downloaders”—those who had downloaded an app in the past 30 days. The Apps Playbook data includes teen as well as adult cell phone subscribers, but for this report, percentages are based only on the 3,962 adults ages 18 and older who had downloaded an app in the past 30 days. 8

- 9. Part I. The Apps Landscape Cell phones now permeate American culture. As they become more powerful as connected, multi-media, handheld devices, a new ecosystem of computing applications is being created around them. The emergence of this pervasive mobile connectivity is changing the way people interact, share creations, and exploit the vast libraries of material that are generated for the internet. The newest national phone survey of the Pew Research Center’s Internet & American Life Project shows that 82% of adults are cell phone users, and about one-quarter of adults (23%) now live in cell phone only households – that is, households with no landline phone. According to Pew Internet survey data, as of September 2009, three- quarters of 12-17 year-olds had cell phones, and a 2010 Kaiser Family Foundation study indicated almost a third of 8 to 10 year-olds in the U.S. have cell phones today.3 The widespread embrace of mobile technology has spawned the development of an “apps culture.” As the mobile phone has morphed from a voice device to a multi- channel device to an internet-accessing mini-computer, a large market of mobile software applications designed specifically for cell phones has developed alongside it. Currently, the cell phone industry lacks a standard, widely shared definition of what is and is not considered an “app.” Traditionally the term “app” has been used as shorthand for any software application. With the advent of the mobile phone, the term “app” has become popular parlance for software applications designed to run on mobile phone operating systems. For the purpose of this report, apps are defined as end-user software applications that are designed for a cell phone operating system and which extend the phone’s capabilities by enabling users to perform particular tasks. Assuming this definition, cell phone apps as discussed here are distinct from cell phone functions, which are hardware-enabled activities such as taking pictures and recording video and/or which run on systems software. Cell phone apps as defined here rely on or require certain systems software and/or hardware features to function, and may be thought of as being layered on top of them. To understand whether and how U.S. adults have jumped into the emerging apps market, and how apps use compares to the use of other cell phone features, the Pew Internet Project recently conducted a national survey of adults age 18 and older that included 1,917 cell phone users. Broadly, results indicate that while apps are popular among a young, tech-hungry segment of the adult cell phone using population, a notable number of adult cell phone users are not part of apps culture. Many adults who have apps on their phones, 3 2 Kaiser Family Foundation, Generation M : Media in the Lives of 8 to 18 year-olds, January 2010. Available at: http://www.kff.org/entmedia/upload/8010.pdf. 9

- 10. particularly older adults, do not use them, and one in ten adults with a cell phone (11%) are not even sure if their phone is equipped with apps. Moreover, apps use ranks fairly low when compared with the use of other cell phone functions such as taking pictures and texting.4 35% of adults have cell phones with apps Of the 82% of adults today who are cell phone users, 43% have apps on their phones. When taken as a portion of the entire U.S. adult population, that means that 35% have cell phones with apps. This figure includes adult cell phone users who: have downloaded an app to their phone (29% of adult cell phone users), and/or have purchased a phone with preloaded apps (38% of adult cell phone users) A “yes” answer to either question was sufficient to include someone in the apps population. Of course, many cell owners (23%) have both pre-loaded and downloaded apps on their cell phones. One in ten adult cell phone users do not know if they have apps on their phone While 38% of adults cell phone users report having a phone that came preloaded with apps, another 11% of cell phone users said they did not know if their phone came with any software applications. This uncertainty about cell phone features is most pronounced among cell phone users age 50 and older, 15% of whom did not know if their phone came with apps. Just 4% of cell phone users under age 30 could not say if their phone came with software applications. Adult cell phone users are more confident when asked whether they have ever downloaded an app, with 29% saying yes, 70% saying no, and less than one half of one percent saying they did not know. Two-thirds of adult cell phone users who have apps actually use them While 35% of adults have apps on their phones, only about two-thirds (68%) of adults who have apps report actually using them. That means that 24% of all adults in the U.S. use apps. 4 Aaron Smith, Mobile Access 2010, July 7, 2010. Available at: http://pewinternet.org/Reports/2010 /Mobile-Access-2010.aspx. 10

- 11. All adults 82% use cell phones 35% have apps 24% use apps Figure 1: 24% of Adults use cell phone apps Among those who actively use their apps, the vast majority (91%) have used them within the past 30 days. Just 9% of apps users say it has been more than 30 days since the last time they used the apps on their phone. Apps users are younger, more educated, and more affluent than other cell phone users Apps users have a distinct demographic profile when compared with other cell phone using adults, and when compared with the entire U.S. adult population. Apps users skew male, and they are much younger than the broader population. Overall, they are also more educated and more affluent than other cell phone users or the adult population as a whole. The apps-using population also skews slightly Hispanic when compared with other cell phone users and all adults. 11

- 12. App users are disproportionately male, young, educated and affluent % of each group in each demographic category Adult Cell Phone Users Total U.S. App Users Who Do Not Use Apps Adults (n=460) (n=1,457) (n=2,252) Gender Male 57 46 48 Female 43 54 52 Age 18-29 44 18 23 30-49 41 34 34 50+ 14 46 41 Race/Ethnicity White (non-Hispanic) 64 70 69 Black (non-Hispanic) 14 12 12 Hispanic (English-speaking) 14 11 11 Education Less than high school 8 12 13 High school graduate 24 35 34 Some college 29 24 25 College graduate 39 28 28 Annual Household Income Less than $50,000 41 43 46 $50,000-$74,999 15 15 14 $75,000+ 36 24 24 Source: Pew Research Center's Internet & American Life Project, April 29-May 30, 2010 Tracking Survey. Among adults who have apps, age is the strongest predictor of apps use It is clear that young adult cell phone users are the most eager apps adopters. While 79% of 18-29 year-olds who have apps on their phones say they use them, that figure drops to 67% among 30-49 year-olds and just 50% among adults age 50 and older. 12

- 13. Cell phone only adults (those who have a cell phone but no landline phone) are also especially likely to use the apps on their phone. Some 75% of this group who have apps say they use them. This may be due in part to a disproportionate number of cell only adults relying on their phones for internet access and participation in online activities.5 It is not surprising that adults who are heavy cell users in general (heavy texters and heavy voice users) are much more likely than other adults to use their apps and to have used them in the past 30 days. The relationship between apps use and the use of other cell phone features/technologies is discussed in detail in Part III of this report. Overall, adults who have more apps on their phone, those who have downloaded apps (as opposed to purchasing a phone that is preloaded with apps), those who have downloaded an app recently (within the past 30 days), and those who have paid for an app download are significantly more likely than other adults to actually use the software on their phones. Adults with more apps, those who download, and those who pay are most likely to use them % within each group who use the apps on their phone… 100% 80% 93% 90% 85% 60% 68% 40% 20% 0% All cell users Download apps Have more than Pay for apps with apps (n=432) 10 apps (n=200) (n=694) (n=472) Source: Pew Research Center's Internet & American Life Project, April 29-May 30, 2010 Tracking Survey. 5 In the current Pew Internet Project survey, adult cell phone users who either only have a cell phone or who have a landline but rely mainly on their cell phone to make calls are significantly more likely than other adults to be wireless internet users (74% of cell only adults and 86% of dual phone users who rely mainly on their cell are wireless internet users, compared with just 47% of other adults). 13

- 14. Among those who have apps, the average number of apps is fairly high at 18 Among adult cell phone users who have software applications on their cell phones, the mean number of apps is 18. However, the median number of apps is 10, indicating there are heavy apps users on the high end of the response scale who have a disproportionate number of apps on their phones. This is particularly true among the youngest adults. Again, there is some uncertainty among cell phone users, particularly older cell phone users, about what software they have on their phones. Fully 18% of cell phone users with apps on their phones do not know how many they have. That figure doubles to 36% among cell phone users age 50 and older. Looking just at those who know how many apps they have, young adult cell phone users on average have a greater number of apps on their phones. The mean number of apps for 18-29 year-olds is 22, compared with a mean of 16 for 30-49 year-olds, and 13 for adult cell phone users age 50 and older. However, the medians show considerably less variation, with young adults having a median of 12 apps on their phone and those over age 50 having a median of 8. The average adult with apps has 18 on their phone, and young adults have more Mean and median number of apps for each group… Median Mean All adults with apps 10 18 Age 18-29 12 22 Age 30-49 10 16 Age 50+ 8 13 Source: Pew Research Center's Internet & American Life Project, April 29-May 30, 2010 Tracking Survey. N=694 adult cell phone users with apps. Apps use ranks relatively low when compared with other cell phone activities While 24% of adults, or 29% of adult cell phone users, report using apps on their phones, apps use is not the most popular feature of cell phones when compared with other non-voice cell phone activities. Taking pictures and texting are far and away the most popular cell phone activities, with apps use ranking lowest among the various activities Pew Internet has asked about. 14

- 15. App use ranks low on a list of non-voice cell phone activities % of adult cell phone users who do each of the following on their phone… Take a picture 76% Send or receive text messages 72 Access the internet 38 Play a game 34 Send or receive email 34 Record a video 34 Play music 33 Send or receive instant messages 30 Use an app 29 Source: Pew Research Center's Internet & American Life Project, April 29- May 30, 2010 Tracking Survey. N=1,917 adult cell phone users. These data may reveal again, however, some uncertainty among adult cell phone users about when they are, and are not, using apps. Many of the activities in the above table, such as playing a game and sending and receiving email, often make use of software applications, and therefore constitute apps use. Thus, one would expect the percent who say they use apps to be higher. Yet, apps use garners a slightly lower percentage of “yes” responses from cell phone users than do other app-enabled activities. One might infer from these figures that adults are not always aware when engaging in various activities using their phones that they are, in fact, using an app or software application. This may be due, in part, to confusion among the public over whether the different software that comes preloaded on their phone are “apps,” or whether an app is something that must be purchased separately or downloaded from the internet. 15

- 16. Part II. Apps Downloading As noted above, while 43% of adult cell phone users have apps on their phone, significantly fewer (29%) have actually downloaded an app. The remaining 14% only have preloaded apps on their phone. Apps downloaders are slightly different demographically from those who have only preloaded apps, and are distinct from cell phone users in general. The downloading population is demographically skewed As with the apps-using population as a whole, apps downloaders are younger, more educated, and disproportionately male when compared with the full U.S. adult population. When downloaders are compared just to other adults with apps—those who have preloaded apps but do not download—they are similar in their educational attainment yet are still disproportionately young and male. App downloaders are demographically distinct from those with only preloaded apps and U.S. adults in general % of each group in each demographic category… App Preloaded Apps Total U.S. Downloaders Only Adults (n=432) (n=262) (n=2,252) Gender Male 57 49 48 Female 43 51 52 Age 18-29 47 22 23 30-49 39 46 34 50+ 14 31 41 Education Less than high school 8 7 13 High school graduate 25 25 34 Some college 29 31 25 College graduate 38 37 28 Annual Household Income Less than $50,000 41 37 46 $50,000-$74,999 15 16 14 $75,000+ 37 34 24 Source: Pew Research Center's Internet & American Life Project, April 29-May 30, 2010 Tracking Survey. 16

- 17. One in ten adults with a cell phone has downloaded an app in the past week; one in five 18-29 year-old cell phone users has done so In the Pew Internet survey, respondents who had downloaded apps were asked when their most recent download had occurred. About half (53%) say their most recent apps download was in the past 30 days, including 33% who say their last download was within the past week. As a fraction of all cell phone-using adults, that equates to 15% who have downloaded an app in the past month, including 10% who have downloaded an app in the past week. Thus, even among downloaders, the portion who is very actively engaged in apps culture is relatively small. A significant percentage of downloaders, 43%, say they have not downloaded an app in more than a month. When was your most recent app download? % of downloaders whose last download was… 1 to 3 months ago 14% Within the past week 33% More than 3 months ago 29% Within the past month 20% No answer 4% Source: Pew Research Center's Internet & American Life Project, April 29-May 30, 2010 Tracking Survey. N=432 adult app downloaders. Again, it is the youngest adult cell phone users leading the way, with 62% of 18-29 year- old apps downloaders having downloaded software to their phone in the past month (including 39% in the past week). That equates to 20% of adult cell phone owners under age 30 who had downloaded an app to their phone in the past week. 17

- 18. One in eight adults with a cell phone has paid to download an app Among the one-third of adult cell phone users who download apps, just under half (47%) have paid for an app, with the remainder saying they only download apps that are free. Put in broader context, that means that 13% of all adult cell phone users have paid to download an app to their phone. The more apps someone has on her phone, the more likely she is to have paid for one at some point. There are very few notable demographic differences between downloaders who pay for apps and those who do not. Only one subgroup of downloaders stands out in this regard, and that is heavy cell voice users. Downloaders who make more than 30 calls on their phone per day are significantly more likely than other downloaders to have paid for an app (61% v. 45%). For more on what types of apps downloaders pay for, and how much they spend, see Part IV of this report. 18

- 19. Part III. Mobile Computing The rise of “apps culture” reflects the transition of cell phones from voice communication devices to mobile computing devices. As cell phone use in general increases, wireless internet use is also on the rise, particularly among Hispanic and African-American adults.6 Fully 59% of adults are now mobile internet users, meaning they access the internet wirelessly via a laptop or cell phone. As mobile computing and internet use become the norm, cell phones are increasingly taking on functions once served by desktops and laptops. And for a significant portion of low income and nonwhite adults, cell phones represent their only means of accessing the internet and engaging in some online activities. Thus, many adults today expect (and need) their phones to serve a wide range of functions. As one might expect, adult cell phone users who embrace “apps culture” also tend to embrace other cell features and other technologies in general. These patterns are difficult to disentangle, as there are circular relationships between apps use and the use of the internet and other technologies. For instance, social media users (adults who use either social network sites such as Facebook or status update sites such as Twitter) are twice as likely as other cell phone users to have apps on their phones (59% v. 24%). Yet many cell phone apps enable social media use, and these apps are in fact among the most popular (see Part IV of this report). Likewise, wireless internet users are more likely than other online adults to be apps users. Yet downloading an application in and of itself requires wireless internet access, which would mean that apps downloaders are wireless internet users by default. Moreover, these relationships are even further complicated by the fact that not all cell-using adults recognize activities they engage in on their phones as app-enabled, when in fact they might be. Therefore, rather than pinpoint causal direction in these relationships, in this section we simply show the strong correlations between apps use and various online activities, cell phone activities, and technology use in general. Heavy technology users are particularly likely to have apps on their phones and to use the apps they have As noted earlier in the report, 38% of cell phone users have purchased a phone with preloaded apps and 29% have downloaded an app themselves. About a quarter of adult cell phone users (23%) have both paid and preloaded apps on their phones. Not surprisingly, heavy technology users are more likely than other adults to both download apps and to purchase phones with apps. 6 Aaron Smith, Mobile Access 2010, July 7, 2010. Available at: http://pewinternet.org/Reports/2010 /Mobile-Access-2010.aspx. 19

- 20. Heavy phone and internet users are more likely to have apps, download apps, and buy phones equipped with apps % of each group who has apps, downloads apps, and purchases phones with apps… Purchase app- Have Download equipped apps apps phones Total cell phone users (n=1,917) 43 29 38 Internet use Daily internet users (n=1,222) 54 38 48 Home broadband users (n=1,321) 51 35 45 Premium broadband users (n=479) 61 43 53 Social network site users (n=929) 59 43 51 Twitter users (n=238) 71 56 63 Phone use Texters (n=1,189) 56 39 48 Heavy texters (51+ texts per day) (n=144) 75 63 62 Heavy cell voice users (31+ calls per day) (n=94) 76 57 60 Dual phone users who rely mainly on their cell 62 42 55 (n=330) Cell phone only adults (n=278) 50 37 41 Source: Pew Research Center's Internet & American Life Project, April 29-May 30, 2010 Tracking Survey. As the above table indicates, adult cell phone users who use the text features on their phones, and particularly heavy texters (those who send more than 50 texts on a typical day), are significantly more likely than other cell phone users to download apps. About four in ten texters (39%) have downloaded an app, a figure that drops to just 4% among adult cell phone users who do not text. Among the heaviest texters, those who send and receive more than 50 texts a day, 63% have downloaded an app to their phone. Heavy technology users on average have more apps on their phones As one might expect, heavy technology users in general tend to have more apps on their phones than cell phone users who do not embrace other technologies. The table below shows that some of the highest reported mean numbers of apps are among heavy cell voice users and heavy texters. Cell-using adults who have premium broadband at home, those who use status update sites such as Twitter and adults who go online from their 20

- 21. phones on a daily basis also report a higher average number of apps on their phones. These groups are also especially likely to report using the apps they have. The mean number of apps is 18; heavy tech users have more and are more likely to use them % who use Median Mean the apps they have All adults with apps (n=694) 10 18 68% Premium broadband at home (n=260) 12 21 67% Twitter users (n=160) 10 23 80% Access internet via phone daily 15 24 88% Cell phone only 11 20 75% Heavy texters (51+ texts per day) (n=106) 11 27 79% Heavy cell voice users (31+ call per day) (n=69) 20 32 81% Source: Pew Research Center's Internet & American Life Project, April 29-May 30, 2010 Tracking Survey. App users are more likely to take advantage of all of their phone’s features Overall, apps users are significantly more likely than other adult cell phone users to take advantage of every feature of their cell phone asked about in the survey, including email, texting, taking pictures, playing music, instant messaging, recording a video, playing a game, accessing the internet, purchasing a product online, and accessing social networking sites from their phone. Again, it is important to note that apps use and use of these other cell phone features are not mutually exclusive. Many of these activities make use of apps, and apps that enable these activities are among the most popular downloads (see Part IV of this report). It is also important to note that these figures include adults whose phones may not be equipped to perform some of these tasks. Apps users are likely to have phones that are able to perform more of these functions, which explains, in part, their higher reported use of different phone features. 21

- 22. App users are more likely to embrace other phone features as well % of each group who use their phone to… App Other cell phone users users (n=460) (n=1,457) Take a picture 97 67 Text 96 61 Access the internet 86 18 Send or receive email 76 16 Play music 72 17 Play a game 71 19 Access a social network site 64 28 Send or receive instant messages 57 19 Record a video 62 22 Post a photo or video online 44 16 Purchase a product 31 11 Access Twitter or another status update site 30 8 Source: Pew Research Center's Internet & American Life Project, April 29-May 30, 2010 Tracking Survey. Apps users are more engaged in a wide range of online activities Due in part to the web accessibility and increased engagement many apps provide, it is logical that apps users are more likely than other adults to engage in almost every online activity asked about in the survey. They are particularly likely to use social network sites such as Facebook and status update sites such as Twitter when compared with internet users as a whole. 22

- 23. What do apps users do online? % of each group who use the internet to… Apps users (n=460) All internet users (n=1,756) 90% Get news online 75% 80% Watch a video on a video-sharing site 66% 75% Buy a product online 66% 81% Use a social network site 61% 74% Do any banking online 58% 66% Use online classified ads like Craigslist 53% 68% Look for info on Wikipedia 53% 46% Get financial info online 37% 37% Look for religious or spiritual information 32% 32% Make a donation to a charity online 22% 28% Use Twitter or another status update service 17% 0% 20% 40% 60% 80% 100% Source: Pew Research Center's Internet & American Life Project, April 29-May 30, 2010 Tracking Survey. 23

- 24. Part IV. The Nielsen Apps Playbook As part of its ongoing research into telecom trends, the Nielsen Company conducts a quarterly tracking survey of more than 80,000 mobile subscribers age 13 and older sampled from a combination of online panels and augmented with listed Hispanic telephone sample. Among other measures, the Mobile Insights survey identifies mobile subscribers who have downloaded an app to their phone. In the fourth quarter of 2009, Nielsen found that 13% of their adult (age 18 and older) mobile subscribers had downloaded an app in the past 30 days. As noted earlier, the current Pew Internet survey finds that as of April 2010, 15% of cell-phone using U.S. adults age 18 and older had downloaded an app to their phone in the past 30 days. In December 2009, Nielsen completed online, self-administered surveys with 4,265 apps downloaders originally identified in the Mobile Insights survey. This follow-up survey (The Nielsen Apps Playbook) asked “recent downloaders”—those who had downloaded apps in the past 30 days—more detailed questions about the types of apps they download, in what contexts they use their apps, and whether and how much they pay for apps. The results reported here are based on the 3,962 adults ages 18 and older in the Nielsen sample who had downloaded an app in the past 30 days. It should be noted that because Nielsen’s Mobile Insights survey is administered to a nonprobabilty sample, it is not representative of all recent apps downloaders and the findings reported here should be considered descriptive. However, the Nielsen data produce overall estimates of adult apps downloading rates comparable to the most recent Pew Internet survey. As the table below indicates, after weighting, the two samples are similar in terms of sex and race/ethnicity, though the Nielsen sample is skewed slightly toward white non-Hispanics and away from African-Americans. The two samples diverge more notably on education and income, with the Nielsen sample overrepresenting college graduates and the highest income categories. In terms of age, the Pew probability sample produces a recent-downloader population that is slightly older than the Nielsen sample. 24

- 25. Weighted demographic profiles of recent apps downloaders from the Pew Internet and Nielsen surveys % of each group in each demographic category… Pew Internet Nielsen Survey Survey Sample Sample (n=221) (n=3,692) Gender Male 59 57 Female 41 43 Age 18-24 14 15 25-34 17 32 35-54 36 41 55+ 31 13 Education Less than high school 9 2 High school graduate 27 8 Some college 25 22 College graduate 38 59 Race/Ethnicity White, non-Hispanic 58 65 Black, non-Hispanic 15 7 Hispanic 19 18 Annual Household Income Less than $50,000 41 26 $50,000-$74,999 15 21 $75,000+ 34 47 Adult apps users are hooked on games As indicated by the Pew Internet survey data, apps downloading and apps use are not synonymous. Some adults may download apps that they do not actually use. Thus, the Nielsen App Playbook asks about both recent downloading behavior, as well as which apps recent-downloaders have used in the past 30 days, how frequently they use them, and in what contexts. 25

- 26. As the table below indicates, the adult downloaders in the Nielsen sample are hooked on games. Six in ten of these recent downloaders said that they had used a game app in the past 30 days. By comparison, roughly half said they had used a news/weather app, map/navigation app, or social networking app in that same timeframe. While music apps ranked second in terms of total downloads, they ranked fifth on the most used list for this group. What are the most popular types of apps? % of Nielsen recent downloaders who have used each category of apps in the past month… Games 60% News/Weather 52% Maps/Navigation/Search 51% Social Networking 47% Music 43% Entertainment/Food 34% Banking/Finance 28% Sports 27% Productivity 26% Shopping/Retail 24% Video/Movies 22% Communication 21% Travel/Lifestyle 18% Other 3% Source: The Nielsen App Playbook, December 2009. N=3,962 adults who downloaded an app in the 30 days prior to the survey. In the Nielsen sample, some demographic groups were more likely than others to use particular categories of apps. For instance, men in that sample were more likely than women to have used banking/finance, sports, productivity, and video/movie apps in the past 30 days. Women recent-downloaders in the sample, on the other hand, were more likely to have used games, social networking, music, and entertainment/food apps. The tables below show rates of use for the major categories of apps across demographic groups. 26

- 27. The percentage of Nielsen recent downloaders in each group who have used each kind of app in the past month Games Social Networking All 60% All 47% Men 58% Men 42% Women 63% Women 53% < Age 35 64% < Age 35 52% Age 35+ 58% Age 35+ 41% News/Weather Maps/Navigation/Search All 52% All 51% Hispanic 42% Hispanic 47% White 56% White 53% Black 35% Black 36% < $50,000 45% < $50,000 43% $50,000+ 57% $50,000+ 55% < Age 35 45% < Age 35 46% Age 35+ 60% Age 35+ 56% Entertainment/Food Music All 34% All 43% Men 32% Men 40% Women 36% Women 47% < $50.000 30% Hispanic 48% $50,000+ 36% White 42% < Age 35 37% Black 42% Age 35+ 33% Banking/Finance Productivity All 28% All 26% Men 31% Men 29% Women 21% Women 25% Hispanic 21% Hispanic 32% White 27% White 27% Black 15% Black 23% < $50,000 20% $50,000+ 28% < $50,000 26% < Age 35 22% $50,000+ 30% Age 35+ 29% Source: The Nielsen App Playbook, December 2009. N=3,962 adults who downloaded an app in the 30 days prior to the survey. 27

- 28. Within the different categories of software applications, some apps stood out as particularly popular among the Nielsen sample. Asked which specific apps they had used in the past 30 days, puzzle/strategy games ranked highest in the games category, while the Weather Channel was far and away the most used news/weather app for this group. Google applications comprised three of the top four map/navigation/search apps, while Facebook topped the list of social networking apps used by Nielsen’s adult downloaders. The percentage of Nielsen recent downloaders who used each type of app in the past month Games News/Weather Puzzle/Strategy 36% Weather Channel 32% Card/Casino 25% Weatherbug 10% CNN Mobile 9% Classic/Arcade 22% Accuweather 9% Trivia/Word/Numb… 18% USA Today 8% Board Games 13% New York Times 7% Fox News 7% Social Networking Maps/Navigation/Search Facebook 42% Google Map 35% Twitter 11% Google Search 18% MySpace 8% Mapquest 15% LinkedIn 5% Google Earth 13% Yahoo 8% Entertainment/Food Music UrbanSpoon 9% Pandora 19% Food Network 7% Youtube 18% Open Table 6% iPod/iTunes 13% All Recipes 6% Shazam 8% TMZ 5% Yahoo Music 6% Source: The Nielsen App Playbook, December 2009. N=3,962 adults who downloaded an app in the 30 days prior to the survey. 28

- 29. Frequency of Apps Use More than half of the Nielsen recent apps downloaders (57%) reported using their apps daily, yet the vast majority said they spend less than 30 minutes per day using their apps. Just one quarter of Nielsen’s downloaders (23%) said they use their apps for at least a half an hour a day. 57% of Nielsen’s recent downloaders say they use their apps daily, but most use them for less than 30 minutes a day % of recent downloaders who use apps… Less often 7% Once a week 8% Multiple times a day Several times a 42% week 28% Once a day 15% More than 1 hour 7% Less than 10 31-60 min/day min/day 16% 28% 10-30 min/day 48% Source: The Nielsen App Playbook, December 2009. N=3,962 adults who downloaded an app in the 30 days prior to the survey. 29

- 30. Somewhat surprising is the fact that the youngest apps downloaders in the Nielsen sample, those age 18-24, were not the most frequent apps users. While 29% of this age group said they use their apps multiple times a day, the same was true of 44% of the 25- 34 year-olds and 44% of those age 35 and older. Nielsen’s young apps users were also more likely than their older counterparts to say they use their apps for less than 30 minutes per day (84% of the 18-24 year-olds v. 74% of the 25-34 year-olds v. 75% of those age 35 and older). Among Nielsen’s sample of downloaders, the frequency of apps use varied by race as well, with the white and Hispanic downloaders more likely than the African-Americans to use their apps daily (57% whites v. 54% Hispanics v. 48% African-Americans). However, Nielsen’s white apps downloaders were also the most likely to say that they use their apps for less than 10 minutes a day (30% whites v. 25% Hispanics v. 23% African-Americans). How often are some of the most popular apps used? % of Nielsen downloaders with each app who use it daily… Twitter Facebook All 55% All 59% Ages 18-24 75% Men 55% Women 64% Ages 25-34 52% Ages 18-24 57% Ages 35+ 48% Ages 25-34 69% Ages 35+ 54% YouTube Pandora All 17% All 18% Hispanic 24% Hispanic 27% White 14% White 12% Black 33% Black 33% Source: The Nielsen App Playbook, December 2009. N=3,962 adults who downloaded an app in the 30 days prior to the survey. 30

- 31. Adult downloaders in the Nielsen sample reported using their apps in a variety of contexts. Asked in which situations they most frequently use their apps, seven in ten (71%) said they frequently use their apps when they are alone, and about half said they frequently use their apps while they are waiting for someone or something (53%) or while at work (47%). Roughly one in three Nielsen downloaders (36%) said they frequently use their apps while commuting. Overall, the adults in the Nielsen sample reported using their apps for a mix of entertainment and instrumental purposes. When and where Nielsen’s adult downloaders are using their apps In which of the following situations do you most frequently use your apps? While alone/by myself 71% While waiting for something/someone 53% At work 47% While commuting 36% To improve what I'm currently doing 29% While socializing with friends 27% While finding a place to eat 24% While shopping 23% At school 13% Other 2% Source: The Nielsen App Playbook, December 2009. N=3,962 adults who downloaded an app in the 30 days prior to the survey. In the Nielsen sample, men were more likely to report using apps at work (52% v. 40% of women), while women were slightly more likely to report using apps while alone (73% v. 70% of men) and while waiting for someone (59% v. 52%). Nielsen’s Hispanic and African-American downloaders were more likely than the whites in the sample to report using their apps at school (17% Hispanics v. 17% African-Americans v. 6% whites) and while socializing with friends (33% Hispanics v. 33% African-Americans v. 22% whites). The Hispanics in the sample were also more likely than whites to report using their apps while commuting, while finding a place to eat, and while shopping. 31

- 32. The Nielsen sample also produced some interesting situational use differences across age groups. The table below shows that young adult apps users in the Nielsen sample (those age 18-24) were the most likely to report using their apps while socializing with friends, while Nielsen’s middle-age users were the most likely to report using their apps while at work, commuting, shopping or finding a place to eat. App users age 55 and older in the Nielsen sample were the most likely to report using their apps while alone, while waiting for someone/something, and to help in an activity they are currently doing. Among Nielsen’s downloaders, apps use varied by age % of Nielsen downloaders in each age group who reported frequently using apps in each situation All 18-24 25-34 35-54 55+ While alone/by myself 71 69 70 73 77 While waiting for someone/something 53 45 53 55 62 While at work 47 44 52 46 31 While commuting 36 37 41 34 29 To improve/help what I am currently doing 29 25 30 29 35 While socializing with friends 27 36 33 22 17 While finding a place to eat 24 21 26 20 21 While shopping 23 23 26 20 21 While at school 13 42 13 5 2 Source: The Nielsen App Playbook, December 2009. N=3,962 adults who downloaded an app in the 30 days prior to the survey. What kinds of apps are being downloaded most often by this group? Among Nielsen’s recent adult downloaders, game apps were the most downloaded apps overall in terms of sheer volume, followed distantly by music and entertainment/food. Overall, apps that are used for personal entertainment made up a greater portion of this group’s recent downloads than those that are used for instrumental purposes, such as productivity, navigation, and finance apps. For the Nielsen sample, games and music were the most popular in terms of the percent of downloaders who have downloaded each type in the past 30 days. Games were far and away the most popular, with almost half of Nielsen’s recent-downloaders saying they had downloaded at least one paid or free game app in the previous month. Roughly equal percentages of Nielsen recent-downloaders (about one in five) said they 32

- 33. had downloaded a music app, a news/weather app, a social networking app, a map/navigation app, or a food/entertainment app in the 30 days prior to the survey. Games and music were also the most commonly downloaded paid apps for this group, as measured by the percent of Nielsen recent-downloaders who had purchased at least one of these types of apps in the past month. The most frequently downloaded types of apps by the Nielsen sample % of Nielsen recent downloaders who downloaded each type of app in the past month… Any Paid Free download download download Games 45 16 34 Music 25 10 17 News/Weather 22 3 20 Social Networking 21 3 19 Maps/Navigation/Search 21 4 17 Entertainment/Food 20 4 18 Productivity 16 4 13 Sports 15 4 12 Banking/Finance 13 2 11 Shopping/Retail 13 2 11 Video/Movies 12 4 8 Travel/Lifestyle 11 2 10 Communication 10 2 8 Other 5 1 5 Source: The Nielsen App Playbook, December 2009. N=3,962 adults who downloaded an app in the 30 days prior to the survey. The Nielsen sample produced some interesting downloading differences across age group, race/ethnic groups, and income categories, yet these differences only occurred in the case of free downloads. For instance, Nielsen downloaders between the ages of 25 and 44 had a higher mean number of free game downloads in the past 30 days (2.0) than both the younger (1.4) and the older (1.7) adults in the sample. Similarly, downloaders ages 25-34 in the Nielsen sample had the highest mean number of free social networking apps downloads in the month prior to the survey (.9 for the 25-34 year-olds v. .5 for the younger adults and .7 for the older adults). The tables below show some demographic differences that emerged in the Nielsen sample in the mean number of free downloads for major categories of apps. 33

- 34. Mean number of free apps downloads by Nielsen’s sample in each category in the past 30 days Games News/Weather All adults 1.8 All adults .7 Age 18-24 1.4 Men .8 Age 25-34 2.0 Women .6 Age 35-44 2.0 Hispanic .6 Age 45-54 1.5 White .8 Age 55+ 1.8 Black .4 Age 18-24 .4 Social Networking Age 25-34 .7 All adults .7 Age 35-44 .8 Age 18-24 .5 Age 45-54 .8 Age 25-34 .9 Age 55+ 1.1 Age 35-44 .7 <$25,000 .4 Age 45-54 .6 $25,000-$49,999 .5 Age 55+ .7 $50,000-$99,999 .7 $100,000-$149,999 .8 Entertainment/Food $150,000+ 1.1 All adults .8 Age 18-24 .5 Productivity Age 25-34 .9 All adults .7 Age 35-44 .9 Men .8 Age 45-54 .8 Women .6 Age 55+ 1.1 Hispanic .7 White .8 Maps/Navigation/Search Black .4 All adults .6 <$25,000 .6 Men .7 $25,000-$49,999 .6 Women .5 $50,000-$99,999 .7 Age 18-24 .4 $100,000-$149,999 .9 Age 25-34 .6 $150,000+ 1.0 Age 35-44 .7 Age 45-54 .6 Source: The Nielsen App Playbook, December 2009. Age 55+ .8 N=3,962 adults who downloaded an app in the 30 <$25.000 .4 days prior to the survey. $150,000+ 1.1 34

- 35. Consistent with the Pew Internet survey data, the Nielsen sample produced few notable demographic differences between recent-downloaders who have paid to download an app and those who have not. Nielsen’s youngest apps downloaders, those age 18-24, and adults with incomes below $50,000 were only slightly less likely than the older and more affluent downloaders in the sample to have paid for apps. What do Nielsen’s downloaders report paying for apps? In the Nielsen Apps Playbook, 37% of the recent-downloaders said they had paid for an app in the past 30 days. As noted earlier, games accounted for the highest percentage of paid apps by this group, followed by music apps. Asked if they had ever converted from a free/lite trial version to a full paid version of an app, one in three (33%) Nielsen downloaders said they had done so. To determine what the recent-downloaders are paying for apps, the Apps Playbook asked respondents how many of the total apps they had downloaded in the past 30 days fell into each of eight different price categories. Responses indicate that among this sample of downloaders, most paid downloads were between $0 and $2.99. Fully 60% of paid downloads from the month prior to the survey fell in this price range. What do Nielsen downloaders report paying for apps? % of paid downloads from the month prior to the survey in each price range… Less than $1 $5 or more 15% 23% $1 - $1.99 $3 - $4.99 28% 17% $2 - $2.99 17% Source: The Nielsen App Playbook, December 2009. N=3,962 adults who downloaded an app in the 30 days prior to the survey. 35

- 36. When they did pay for an app, about a third (34%) of the downloaders in the Nielsen sample said their preference was to have it billed directly by their cell phone provider, while just under a third (29%) said they preferred to put it on a credit card. Asked what factors drive those preferences, eight in ten Nielsen downloaders (80%) said that convenience was a factor, while roughly six in ten said they take into account bill consolidation (63%) and security (57%). When paying for apps, Nielsen downloaders prefer to be billed by their provider % of recent downloaders % of Nielsen recent downloaders who prefer to pay for apps by… Billing from their cell phone provider 34% Credit card 29 PayPal 18 iTunes 12 Amazon 1-click 2 Google checkout * Other 5 % of Nielsen recent downloaders who say their preference is based on…^ Convenience 80% Security 43 Bill consolidation 37 Other 4 ^ multiple response allowed Source: The Nielsen App Playbook, December 2009. N=3,962 adults who downloaded an app in the 30 days prior to the survey. Where do downloaders say they learn about apps? Asked how they discover the apps they download, the two most common responses from downloaders in the Nielsen sample were searching an apps store on their phone and relying on recommendations from friends and family. About half (49%) of this group said they discover apps by browsing an apps store on their phones, and about one in three (34%) said they hear about them from friends and family. 36

- 37. The women in the sample were slightly more likely than the men to say they learn about apps from friends and family (39% v. 33%), while the men were twice as likely to say they learn about apps from third party websites (25% v. 12%). Nielsen’s older apps downloaders, those age 55+, were also particularly likely to say they hear about apps from friends and family (42% v. 34%), and were twice as likely as the younger apps downloaders in the sample to discover apps through newspapers, magazines and radio (15% v. 7%). How do Nielsen’s downloaders learn about apps? % of Nielsen’s recent downloaders who discovered apps from each source in the past 30 days… Searching apps store on… 49% Friend/Family member 34% Third party website 18% Device's homepage 17% Carrier's homepage 14% Sync software (iTunes, etc.) 14% TV advertisement 9% Newspaper/Magazine/Radio 8% Email tips from carrier 8% Through another app 8% Other 5% Source: The Nielsen App Playbook, December 2009. N=3,962 adults who downloaded an app in the 30 days prior to the survey. In the Nielsen sample, apps downloaders in the highest income categories, those earning $100,000 or more annually, were particularly likely to say they discover apps by searching the apps store on their phones and through sync software, while those in the lower income categories were more likely to say they hear about apps through their carrier’s homepage. The African-American and Hispanic downloaders in the sample were also particularly likely to say they find apps through their carrier’s homepage (25% African-American v. 18% Hispanic v. 12% white) and their device homepage (24% African-American v. 19% Hispanic v. 15% white). 37

- 38. Nielsen’s downloaders reported not only relying on the recommendations of friends and family in downloading apps, but also relying on the recommendations of strangers. The Nielsen App Playbook asked recent-downloaders how important user reviews and ratings are in their decision to download an app. Almost nine in ten downloaders in this survey (88%) said that user reviews are at least somewhat important, including 19% who said they are extremely important. The importance of user ratings for this group in choosing downloads How important are user reviews and ratings when making the decision to download an app? Slightly important 8% Somewhat important Not at all 32% important 4% Extremely important Very important 19% 37% Source: The Nielsen App Playbook, December 2009. N=3,962 adults who downloaded an app in the 30 days prior to the survey. Cell phone real estate is valuable Most apps users in the Nielsen sample report organizing their apps so that the most frequently used are most easily accessible. They also report deleting apps from their phones. The most common reasons given by this group for deleting an app is that it is not useful. And they report that this culling process happens relatively quickly; among those who had deleted an app, the majority (62%) said they usually did it within two weeks of downloading the software. The men in the sample tended to delete apps they did not find useful more quickly than the women did; 40% of the male recent- downloaders said they deleted apps they do not like within a week of getting them, while only 29% of the women said they delete apps that quickly. 38

- 39. Nielsen’s app downloaders organize their apps and delete those that aren’t useful % recent downloaders Do you organize your apps so the most frequently used ones are easily accessible? Yes 59% No 41 Have you ever deleted an app that you downloaded? Yes 56% No 44 Main reasons for deleting an app…^ Didn’t find it useful/helpful 59% No longer use 42 Got bored with it 37 Didn’t like it any longer 33 Needed to clear space 24 Other 5 ^ multiple response allowed Source: The Nielsen App Playbook, December 2009. N=3,962 adults who downloaded an app in the 30 days prior to the survey. 39

- 40. Methodology Pew Internet Project Survey This report is based on the findings of a daily tracking survey on Americans' use of the Internet. The results in this report are based on data from telephone interviews conducted by Princeton Survey Research Associates International between April 29 and May 30, 2010, among a sample of 2,252 adults, age 18 and older. Interviews were conducted in English. For results based on the total sample, one can say with 95% confidence that the error attributable to sampling and other random effects is plus or minus 2.4 percentage points. For results based on cell phone users (n=1,917), the margin of sampling error is plus or minus 2.7 percentage points. In addition to sampling error, question wording and practical difficulties in conducting telephone surveys may introduce some error or bias into the findings of opinion polls. A combination of landline and cellular random digit dial (RDD) samples was used to represent all adults in the continental United States who have access to either a landline or cellular telephone. Both samples were provided by Survey Sampling International, LLC (SSI) according to PSRAI specifications. Numbers for the landline sample were selected with probabilities in proportion to their share of listed telephone households from active blocks (area code + exchange + two-digit block number) that contained three or more residential directory listings. The cellular sample was not list-assisted, but was drawn through a systematic sampling from dedicated wireless 100-blocks and shared service 100-blocks with no directory-listed landline numbers. New sample was released daily and was kept in the field for at least five days. The sample was released in replicates, which are representative subsamples of the larger population. This ensures that complete call procedures were followed for the entire sample. At least 7 attempts were made to complete an interview at a sampled telephone number. The calls were staggered over times of day and days of the week to maximize the chances of making contact with a potential respondent. Each number received at least one daytime call in an attempt to find someone available. For the landline sample, half of the time interviewers first asked to speak with the youngest adult male currently at home. If no male was at home at the time of the call, interviewers asked to speak with the youngest adult female. For the other half of the contacts interviewers first asked to speak with the youngest adult female currently at home. If no female was available, interviewers asked to speak with the youngest adult male at home. For the cellular sample, interviews were conducted with the person who answered the phone. Interviewers verified that the person was an adult and in a safe place before administering the survey. Cellular sample respondents were offered a post- paid cash incentive for their participation. All interviews completed on any given day were considered to be the final sample for that day. 40

- 41. Non-response in telephone interviews produces some known biases in survey-derived estimates because participation tends to vary for different subgroups of the population, and these subgroups are likely to vary also on questions of substantive interest. In order to compensate for these known biases, the sample data are weighted in analysis. The demographic weighting parameters are derived from a special analysis of the most recently available Census Bureau’s March 2009 Annual Social and Economic Supplement. This analysis produces population parameters for the demographic characteristics of adults age 18 or older. These parameters are then compared with the sample characteristics to construct sample weights. The weights are derived using an iterative technique that simultaneously balances the distribution of all weighting parameters. 41

- 42. Following is the full disposition of all sampled telephone numbers: Table 1:Sample Disposition Landline Cell 20,895 12,699 Total Numbers Dialed 1,160 251 Non-residential 982 18 Computer/Fax 12 --- Cell phone 8,886 4,906 Other not working 1,675 176 Additional projected not working 8,180 7,348 Working numbers 39.1% 57.9% Working Rate 558 59 No Answer / Busy 870 2,054 Voice Mail 68 13 Other Non-Contact 6,684 5,222 Contacted numbers 81.7% 71.1% Contact Rate 521 740 Callback 4,305 3016 Refusal 1,858 1,466 Cooperating numbers 27.8% 28.1% Cooperation Rate 284 235 Language Barrier --- 460 Child's cell phone 1,574 771 Eligible numbers 84.7% 52.6% Eligibility Rate 66 27 Break-off 1,508 744 Completes 95.8% 96.5% Completion Rate 21.8% 19.3% Response Rate The disposition reports all of the sampled telephone numbers ever dialed from the original telephone number samples. The response rate estimates the fraction of all eligible respondents in the sample that were ultimately interviewed. At PSRAI it is calculated by taking the product of three component rates: 42

- 43. Contact rate – the proportion of working numbers where a request for interview was made Cooperation rate – the proportion of contacted numbers where a consent for interview was at least initially obtained, versus those refused Completion rate – the proportion of initially cooperating and eligible interviews that were completed Thus the response rate for the landline sample was 21.8 percent. The response rate for the cellular sample was 19.3 percent. The Nielsen Apps Playbook The Nielsen Company conducts a quarterly attitude and behavior survey of more than 80,000 mobile subscribers in the U.S. ages 13 and older. The Mobile Insights survey covers multiple research topics, measuring the attitudes and behaviors of both wireless subscribers and non-subscribers, and including questions about: – Subscriber Usage – Brand Awareness – Customer Satisfaction – Network Performance Perceptions – Switching Behavior Mobile Insights surveys over 25,000 panelists every month—over 300,000 consumers a year. The Mobile Insights survey is fielded during the first half of each month. The Mobile Insights panel includes a subset of 2,500 Hispanic panelists every month—over 30,000 Hispanic consumers a year. Within this Hispanic panel subset, each month at least 1,000 respondents complete an online survey and 1,500 complete a phone survey. Because the survey is not based on a probability sample, no margin of error can be computed and the results cannot be generalized to the population of recent app downloaders with a known degree of precision. Sampling Survey respondents are selected at random within Consolidated Metropolitan Statistical Areas/Metropolitan Statistical Areas (CSMA/MSA) markets from the panel rolls of five or more different online panel source companies in order to attain a diverse sample of persons age 13 and older in the US. The Mobile Insights survey sample is selected from internet sample frames constructed and maintained for general population surveys by such companies as Harris Interactive, Market Tools, Survey Sampling International, e- Rewards and Lightspeed Research. The Hispanic portion of the online sample described above is augmented by a Spanish language phone survey in highly concentrated 43

- 44. Hispanic markets using a residential phone list sample frame for improved coverage of unacculturated Hispanics. Each month, a sample of web-enabled online panelists is sent invitations to participate in the Mobile Insights survey via email. The study is described to survey participants as one about “cell phones” and respondents are asked to share their opinions “regardless of whether you use a cell phone.” In the survey email invitation, potential participants are directed to the Mobile Insights survey website. Initial double and/or triple opt-in recruiting practices by the sample providing companies are conducted through a wide variety of sources including: opt-in recruiting during online personalization registration, banner and/or text advertising on selected websites, follow-on recruiting for panelists at the end of ad-hoc surveying and direct mail recruiting through opt-in electronic mail accounts. In order to maintain reliability and integrity in the sample, the following procedures are used: 1. Unique URL protection: Each invitation contains a unique website address assigned to the targeted email address. This unique address allows for only the invited participant to access the survey website and the survey can be completed only once with a single credential. 2. Only cell phone users can respond to user questions: Only primary users of mobile technology are designated to complete the specific usage, consumption and attitudinal sections of the survey. As a precaution, each respondent is re- qualified as a mobile user. Only primary cell phone users are responsible for providing data about their personal and business usage of mobile services. 3. Second invitations: In order to maximize the survey sample, second follow-up email invitations are mailed to all nonresponding invitees, reminding them of the opportunity to participate in the survey. The supplemental Spanish language sample is recruited using random digit dialing (RDD) in Puerto Rico. In the continental US, sample is recruited from a listed household sample frame that has been filtered using a Hispanic surname database derived from the US Census Bureau. This Hispanic surname database of listed households is the criterion for the random selection of records across phone directories in 30 residential ZIP code areas that are known to have a high density Hispanic population. Sample design The adult (over age 18) Mobile Insights sample is stratified by metropolitan area including 102 markets and the remaining “white space” (non-metropolitan areas). Systematic (unduplicated random) sampling is conducted within each metropolitan area and white space. Outcomes are weighted according to market-specific demographic 44