Pf act, 1952

- 1. Presented by: Shalu Saraf CS Trainee

- 2. A PF Act is created with a purpose of providing financial security and stability to elderly people. It‟s purpose is to help employees save a fraction of their salary every month, to be used in an event that the employee is temporarily or no longer fit to work or at retirement. EPFO is one of the largest society security organization in the world in terms of members and volume of financial transactions undertaken. EPFO is a statutory body of the Indian govt. under labor & employment ministry.

- 3. Provides that: The state shall within the limits of its economic capacity make effective provision for securing the right to work, to education, and to public assistance in cases of unemployment, oldage, sickness & disablement and undeserved want.

- 4. The Act consist of: Employees‟ Provident Fund, 1952 (EPF) Employees‟ Pension Scheme, 1995 (EPS) Employees‟ Deposit linked Insurance Scheme, 1976 (EDLI)

- 5. THE EMPLOYEE‟S PROVIDENT FUND ACT, 1952 INTRODUCTION ELIGIBILITY ELIGIBILITY AND ENTITLEMENT CALCULATION BENEFITS INTEREST NOMINATION ANNUAL STATEMENT OF ACCOUNTS FULL SETTLEMENTS ADVANCES/WITHDRAWALS EMPLOYER‟S ROLE AND RESPONSIBILITY i. MONTHLY RETURNS ii. ANNUAL RETURNS iii. PENALITY iv. EXEMPTION EMPLOYEE‟S ROLE AND RESPONSIBILITY

- 6. EMPLOYEES PENSION SCHEME, 1995 INTRODUCTION PENSION BENEFITS ELIGIBILITY CONTRIBUTION IN EPF & EPS APPLICATION & FACTS THE EMPLOYEES DEPOSIT-LINKED INSURANCE SCHEME, 1976 (EDLI) APPLICATION CALCULATION ELIGIBLE EXEMPTION LIST OF FORMS FORMS & CHALLAN DESCRIPTION

- 8. The employee’s provident funds act 1952 • • • • • INTRODUCTION: Salary consist of two parts i.e. earnings and deductions It is one of the statutory deduction done by the employer at the time of payment of salary This act has come into force to give better future to employees on their retirement or to his dependents in case of his death during employment It is the compulsory contributory fund for the future of an employee after retirement or for his dependents in case of early death This act is applicable to all state except J&K.. ** As per the new 2012 rules issued recently, the EPFO has made amendments to the way in which employee and employer contribution would be calculated hereon. For employees, this amendment is particularly important as it impacts his/her take home salary and income tax liability as well. A quick look at the amendments: Change in Salary definition:Previously the term 'Salary' for computing EPF contribution included basic DA. AS per new rules, 'SALARY' will include Basic DA allowance that are ordinarily, necessarily and uniformly paid to employees.

- 9. ELIGIBILITY: • every industry employing 20 or more persons (180 industries are specified in schedule 1 of the act) • every industry employing 20 or more persons which the central govt. may notify • any other establishment notify by the central govt. even if employed person are less than 20

- 10. ELIGIBILITY AND ENTITLEMENT: • Every employee employed directly/through a contractor who is in receipt of wages are eligible of become the member of this fund (exception- apprentice under the apprentice act and casual worker) • Irrespective of permanent/probationary employees, every other employee is eligible for joining the PF scheme from the date of joining of service • minimum 10% of basic pay for establishment employed less than 20 persons; sick industries declared by necessary authority; beedi, jute, brick, coir, guar gum factories/industries • other industries maximum 12% of basic pay • a member can contribute voluntarily more than the statutorily prescribed rate (up to 100% of basic pay) which is transferred to his PF A/c

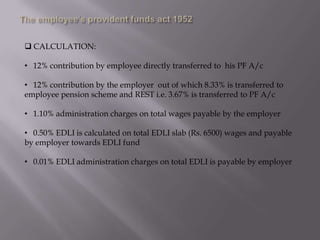

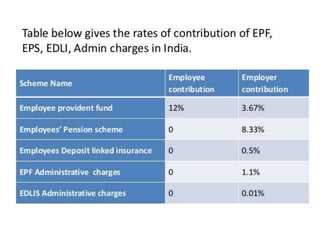

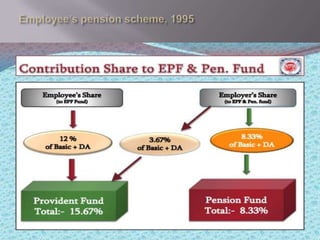

- 11. CALCULATION: • 12% contribution by employee directly transferred to his PF A/c • 12% contribution by the employer out of which 8.33% is transferred to employee pension scheme and REST i.e. 3.67% is transferred to PF A/c • 1.10% administration charges on total wages payable by the employer • 0.50% EDLI is calculated on total EDLI slab (Rs. 6500) wages and payable by employer towards EDLI fund • 0.01% EDLI administration charges on total EDLI is payable by employer

- 17. BENEFITS: • employees can take advances/withdrawal the PF in case of retirement, medical care, housing, for the education of children, etc… • up to 90% of amount can be withdrawn at the age of 54 years or before one year of actual retirement. (Form 19) • PF amount of deceased person is payable to his nominees/legal heirs • equal contribution by the employer • present interest rate 8.6% • PF a/c can be transferred if employee changed from one establishment to other where PF facility is available

- 18. The employee’s provident funds act 1952 • • • INTEREST: Interest is credited to member PF a/c on monthly running balance Interest rate is fixed by the central govt. in consultation with the central board of trustees of EEPF every year of march/ April Interest rate is fixed i.e.8.6% (1) ** Sub-Para (6) was added to Para (60). As per this interest shall not be credited to the account t of the employee from the date on which it has become inoperative. An account becomes inoperative under Para.72(6), if no claim has been made within three years from the date it becomes payable. (2) ** Para 72(6) of P.F. Scheme 1952, The existing sub-Para (6) permits transfer of certain sums , incapable of being paid to the employee/legal heirs either for want of address or for want of receiving a claim for the same, to an inoperative account if no claim has been preferred within 3 years of from the date on which the amount becomes payable. After the amendment, the period of thirty six months (but not three years) needs to be computed from the date of preferring an application for withdrawal under Para s (69) or (70).

- 19. NOMINATION: • The member can nominate to any person/ persons to receive amount in case of his death (Form 2, revised) • The details provided by the member is maintained at the regional provident fund office which is used at time of death of the member

- 20. ANNUAL STATEMENT OF ACCOUNTS: • After the close of each year of contribution, annual account sent to each member through establishment where the member was last employed through form 23 • Form 23 shows the opening balance at the beginning of the year, amount contributed, interest credited at the end of the period and the closing balance at the end • If any error is noticed in the form 23, the member shall bring the same to the noticed of PF officer through the employer within 6 months from the date of receipt of statement

- 21. FULL SETTLEMENTS: • PF a/c settled immediately under the circumstances :- retirement after 58 years - retirement on account of permanent incapacity - termination of service on retrenchment - voluntary retirement scheme - permanent migration from India to settle abroad/taking employment - for female employee leaving service for getting married • PF a/c settled after two months under the circumstances:- from resignation of service

- 22. ADVANCES/WITHDRAWALS: Type of benefits Terms & conditions % of share of amount 5 yrs. Of membership of the fund(min. bal. in member’s a/c should be Rs. 1000/-) 36 months wages (basic & D.A.) or member’s own share & co’s share of cont. 10 yrs. Membership of the fund & member should have taken loan from govt. body 36 months wages (basic & D.A.) or member’s own share & co’s share of cont. Advance from the fund for illness viz. hospitalization for more than a month, major surgical operation or suffering from T.B. etc. Stay in hospital at least for a month Stay in hospital at least for a month Advance from the fund for marriage of self/son/daughter/ sister/brother etc. 7 yrs. Membership of the fund (min. bal. in member a/c should be Rs. 1000/-) 50% of member contribution own share of Advance from the fund education of daughter/ son 7 yrs. Membership of the fund (min. bal. in member a/c should be Rs. 1000/-) 50% of member contribution own share of Withdrawal from the fund: 1) For purchase of house 2) Construction of house Advance from the repayment of loan fund for for Grant of advance in abnormal condition.(natural calamities etc.) a) Certificate of damage from appropriate authority. b) State govt. declaration Rs.500/- or 50% of member own share of contribution. (to apply within 4 months.)

- 23. EMPLOYER‟S ROLE AND RESPONSIBILITY: MONTHLY RETURNS: - Filing monthly PF returns with EPFO with in 15 days of close of each month - Provide a list of new employees joined in the establishment during the preceding month and are qualified to become the member of the fund (Form5) -Provide the list of employees leaving service during the preceding month (Form-10) -Employer should file the “nil” return of there is no new employee or no employee leaving the service during the preceding month -Provide the total no of member last month, joined member and resigned member during the preceding month, and total no. of present subscriber to the fund (Form-12A)

- 24. ANNUAL RETURNS: -Employer shall send to commissioner within one month of close of the year, a consolidated annual contribution statement (Form-6A) and individual employee sheet (Form-3A) showing the contribution made by the employee and the employer during the year PENALITY: -17-37% interest is payable for the delayed period in remitting contribution/ administration charges depending upon the delayed period EXEMPTION: -Employer can get the exemption from the scheme if the similar/better benefits are provided other than the scheme by forming a VPF trust which will work under the rule and regulation of EPFO

- 25. EMPLOYEE‟S ROLE AND RESPONSIBILITY: • Provide details for self and nominees (Form-2) for PF & pension scheme at the time of joining of establishment • In case of already have a PF a/c , apply for transfer of previous a/c to present a/c • If willing to contribute more, inform to employer to deduct the same from salary (VRS) • VPF can be 100% of salary • Understand that employer is not liable to contribute to VPF • understand EPFO don‟t have any agent/Middleman

- 27. INTRODUCTION: Family Pension Scheme, 1971: (on or before the 15.11.1995) If member is alive, no pension If member is not alive, pension to spouse only Pension amount was also very small as the contribution collected to the scheme is only 3.34% (1.67%x2) of the wages This scheme ceased when the EPS-95 came into existence. Employees Pension Scheme, 1995 (after the 15.11.1995) If member is alive, pension to member If member is not alive, pension to spouse and 2 children below 25 years of age This scheme is applicable to all members who joined EPF after 15.11.1995

- 28. EPS, 1995 offers pension on disablement, widow pension, and pension for nominees. It is financed by diverting 8.33% of employer‟s monthly contribution from the EPF (restricted to 8.33% of 6500 or Rs. 541) and govt. contribution of 1.17% of the worker‟s monthly wages. The purpose of the scheme is to provide for: 1) Superannuation Pension: member who has rendered eligible service of 20 yrs. And retires on attaining the age of 58 yrs. 2) Retiring Pension: member who has rendered eligible service of 20 yrs. and retires or otherwise ceases to be in employment before attaining the age of 58 yrs. 3) 4) Permanent Total Disablement Pension Short Service Pension: member has to render eligible service of 10yrs. And more but less than 20 yrs.

- 29. Pension Benefits Lifelong pension is available to the member and upon his death members of the family are entitled for the pension. The monthly retiring pension is decided on the basis of „pensionable Service‟ and „pension Salary‟ and is worked out as follows: Monthly Pension = (pensionable Salary x pensionable Service) / 70 • • Pensionable Salary is the average contributing Salary immediately Preceding 12 months from the date of exit from the scheme, normally this would be limited to RS. 6500/Pensionable Service can not exceed 35 yrs.

- 32. Employee’s pension scheme, 1995 • • • • APPLICATION: It is compulsory for all the member who has become the member of EPF scheme Facts: A employee can start receiving the pension under EPS only after rendering a minimum service of 10 yrs. And attaining the age of 58/ 50 yrs. After 50 yrs. And before 58 yrs. Early pension is payable subject to discounting factor @ 3% for every year falling short of 58 years. In case of death/disablement, the above restrictions doesn’t apply. Para (20) of Pension scheme 1995 , As per Para (1) & (2) of Para (20) the employer has to submit a consolidated return of the employees entitled to become members and a return of employees leaving service in physical form to the commissioner . Now Para (5) has been added after Para (4) whereby such returns shall be submitted in electronic form in the format prescribed by the Commissioner.

- 33. THE EMPLOYEES DEPOSIT-LINKED INSURANCE SCHEME, 1976

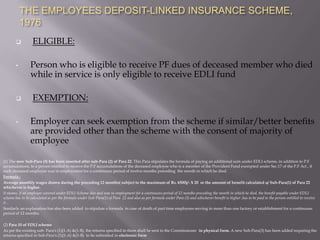

- 34. THE EMPLOYEES DEPOSIT-LINKED INSURANCE SCHEME, 1976 • • • • • • APPLICATION: It is compulsory for all the members who are the member of PF scheme Life insurance benefits (death coverage) of the employees is available under this scheme while in service CALCULATION: It is calculated on EDLI slab-RS. 6500 1.10% administration charges on total wages payable by the employer towards EPF subject to minimum Rs. 5/0.50% EDLI is calculated on total EDLI slab (Rs. 6500) wages and payable by employer towards EDLI fund 0.01% EDLI administration charges on total EDLI is payable by employer subject to minimum Rs. 2/- (1) Para 22 of EDLI: Pre-amendment position: A person entitled to receive P.F accumulations of a deceased member of a fund or Provident fund exempted under Sec.17 of the P.F Act, is also entitled to receive an amount which is equal to the average of the balances in the P.F account of the member during the preceding 12 months or during the period of membership of the deceased employee whichever is less. If such average balance exceeds Rs.35000/, he is entitled to receive Rs35000/+ 25% of the amount in excess of RS. 35000/- subject to the maximum of Rs 65000/After-amendment position: Now after the amendment, the ceiling limits of the average balance of Rs.35000/- has been revised up to Rs.50000/- and in case the average balance exceeds Rs 50000/- the person is entitled to receive an additional 40% of the amount in excess of Rs 50000/- instead of the previous 25% subject to the maximum of Rs.100000/(Rs. one lakh)

- 35. THE EMPLOYEES DEPOSIT-LINKED INSURANCE SCHEME, 1976 • • ELIGIBLE: Person who is eligible to receive PF dues of deceased member who died while in service is only eligible to receive EDLI fund EXEMPTION: Employer can seek exemption from the scheme if similar/better benefits are provided other than the scheme with the consent of majority of employee (1) The new Sub-Para (3) has been inserted after sub-Para (2) of Para 22. This Para stipulates the formula of paying an additional sum under EDLI scheme, in addition to P.F accumulations, to a person entitled to receive the P.F accumulations of the deceased employee who is a member of the Provident Fund exempted under Sec.17 of the P.F Act , if such deceased employee was in employment for a continuous period of twelve months preceding the month in which he died. Formula : Average monthly wages drawn during the preceding 12 months( subject to the maximum of Rs. 6500)/- X 20 or the amount of benefit calculated u/ Sub-Para(1) of Para 22 whichever is higher. It means, if an employee covered under EDLI Scheme dies and was in employment for a continuous period of 12 months preceding the month in which he died, the benefit payable under EDLI scheme has to be calculated as per the formula under Sub-Para(1) of Para 22 and also as per formula under Para (3) and whichever benefit is higher ,has to be paid to the person entitled to receive it . Similarly an explanation has also been added to stipulate a formula in case of death of part time employees serving in more than one factory or establishment for a continuous period of 12 months. (2) Para 10 of EDLI scheme As per the existing sub- Para's (1)(1-A) &(1-B), the returns specified in them shall be sent to the Commissioner in physical form. A new Sub-Para(3) has been added requiring the returns specified in Sub-Para's (1)(1-A) &(1-B) to be submitted in electronic form

- 36. Form 13 (revised) • for transferring the scheme from one establishment to another covered PF act/ pension scheme Form 14 • Application for financing a life insurance policy out if PF a/c Form 19 • to be submitted by a member to withdraws his PF dues on leaving service/ retirement/ termination Form 20 • In case of death of a member, this for is used by the nominee/ family member to claim his PF accumulation Form 31 • For the use of PF member to take advances/ withdrawal as prescribed in this form

- 37. Form 10 C • To be submitted by member to withdraw pension scheme fund Form 10 D • Application of pension(In case of death) • To be submitted by first claimant – - member - widow/ widower - orphan - nominee Form 5 (I.F.) • In case of EDLI, To be submitted by the person eligible to receive the PF A/c dues of the deceased member who died while in service

- 39. FORMS & CHALLAN DESCRIPTION Sr No. Form/Other Information 1 PF Employee Cont. @ 12.00% 2 PF Employer Cont. @ 13.61% Description @ 12% of Basic Paid Entire Cont. of 12% goes to Employee PF A/c @ 12% of Basic Paid towards Employer PF Cont. goes in 2 parts: 8.33% goes to Employer’s Pension A/c 3.67% goes to Employer PF Cont. A/c @ 1.61% towards Admin Charges as under: 1.1% of Basic – PF Admin. Charges 0.5% of Basic – EDLI Charges 0.01% of Basic – EDLI Admin. Charges 3 PF A/c Challan – A/c I Employee PF (12%) + Employer PF Cont.(3.67%) 4 PF A/c Challan – A/c II Employer Cont towards Admin Charges (1.1%) of Basic 5 PF A/c Challan – A/c X Employer Cont towards Pension (8.33%) of Basic 6 PF A/c Challan – A/c XXI Employer Cont towards EDLI Charges (0.5%) of Basic 7 PF A/c Challan – A/c XXII Employer Cont towards EDLI Admin. Charges (0.01%) of Basic 8 Form 5 (Monthly Return) Details of Employees joined during the month like PF A/c No., Name of Employee, and Father/Husband Name & Date of Joining the Company & PF. 9 Form 10 (Monthly Return) Details of Employees left during the month like PF A/c No., Name of Employee, and Father/Husband Name & Date of Leaving the Company & PF. 10 Form 12-A (Monthly Return) Details of Contribution Paid during the month thru PF Cont. challan along with Receipted Triplicate copy of the challan. 11 Inspection Book PF Inspector records his observations during the time of inspection.