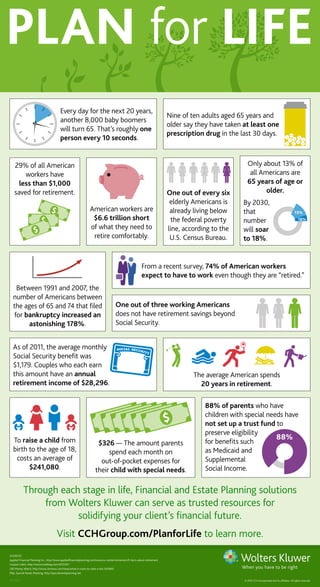

Plan for Life: Finance and Estate Planning [Infographic]

- 1. 2015-0242-5 © 2015 CCH Incorporated and its affiliates. All rights reserved. SOURCES: Applied Financial Planning Inc., http://www.appliedfinancialplanning.com/resource-center/retirement/9-facts-about-retirement Coupon Cabin, http://wscounselblog.com/2012/01/ CBS Money Watch, http://www.cbsnews.com/news/what-it-costs-to-raise-a-kid-241080/ M&L Special Needs Planning, http://specialneedsplanning.net Through each stage in life, Financial and Estate Planning solutions from Wolters Kluwer can serve as trusted resources for solidifying your client’s financial future. Visit CCHGroup.com/PlanforLife to learn more. Every day for the next 20 years, another 8,000 baby boomers will turn 65. That’s roughly one person every 10 seconds. Nine of ten adults aged 65 years and older say they have taken at least one prescription drug in the last 30 days. Between 1991 and 2007, the number of Americans between the ages of 65 and 74 that filed for bankruptcy increased an astonishing 178%. From a recent survey, 74% of American workers expect to have to work even though they are “retired.” One out of three working Americans does not have retirement savings beyond Social Security. One out of every six elderly Americans is already living below the federal poverty line, according to the U.S. Census Bureau. 29% of all American workers have less than $1,000 saved for retirement. American workers are $6.6 trillion short of what they need to retire comfortably. Only about 13% of all Americans are 65 years of age or older. By 2030, that number will soar to 18%. 13% 18% As of 2011, the average monthly Social Security benefit was $1,179. Couples who each earn this amount have an annual retirement income of $28,296. The average American spends 20 years in retirement. To raise a child from birth to the age of 18, costs an average of $241,080. $326 — The amount parents spend each month on out‑of‑pocket expenses for their child with special needs. 88% of parents who have children with special needs have not set up a trust fund to preserve eligibility for benefits such as Medicaid and Supplemental Social Income. 88%