Predictions for Digital 2012

- 3. Propel Executive Breakfast Predictions for 2012 Guy Phillipson, CEO Internet Advertising Bureau www.iabuk.net 12th January 2011

- 5. From last to first in 10 years 2011 - £4.6bn* 27% share 2001- £166m 1% share H1 H2 H1 H2 H1 H2 H1 H2 H1 H2 H1 H2 H1 H2 H1 H2 H1 H2 H1 H2 H1 H2 2001 2001 2002 2002 2003 2003 2004 2004 2005 2005 2006 2006 2007 2007 2008 2008 2009 2009 2010 2010 2011 2011 *based on H1 IAB/PwC ad spend figures and IAB H2 forecast

- 6. Increase in users in 2011 38.4m 40m Source: UKOM June 2010 and Dec 2011

- 8. “My Entertainment Anywhere” Time Spent Online 40% 60% My Entertainment Anywhere (Social, video & games) All Other Online Activity (Search, news, shopping, email etc) Source: UKOM June 2011

- 9. H1 2011 vs. H1 2010 Source: PwC / Internet Advertising Bureau / WARC

- 10. Online showing strongest growth Year on year growth for H1 2011 Source: PwC / Internet Advertising Bureau, The Advertising Association / WARC: WARC estimate for directories.

- 11. Online’s market share for H1 2011 27% % share of revenues for January to June 2011 Source: PwC / Internet Advertising Bureau / The Advertising Association / WARC

- 12. PRESS CUTTINGS

- 13. Share of spend by Consumer Goods advertisers is now 2nd place Source: PwC / Internet Advertising Bureau: IAB estimates for industry sector shares are based on categorised net revenue from media owners provided by PwC. Data excludes unclassified, multi-advertiser, recruitment and misc figures and covers 58% of online display revenues in H1 2011.

- 14. Video grows 100% year on year Source: PwC / Internet Advertising Bureau NB: Video includes pre/mid/post-roll, social video and other video. Social Video and other video included for the first time in H1 2011

- 15. Social media display up dramatically year on year 60%+

- 16. Source: IAB / PwC mobile display ad spend survey 2010

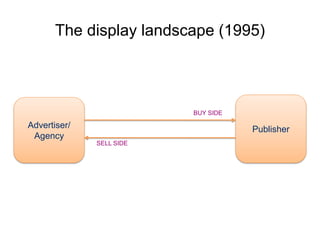

- 17. The display landscape (1995) BUY SIDE Advertiser/ Publisher Agency SELL SIDE

- 18. The display landscape today! Content Verification ATDs Ad Exchange Yield Optimiser Advertiser/ / Sell Publisher Agency Side Platforms (SSPs) DSP Ad Network Creative Data Optimiser optimisers Data Data Data exchanges suppliers aggregators

- 19. Expert Witnesses • Nick Roveta Go Viral/AOL • Tom Ollerton We are Social • Carl Uminiski Somo • Louisa Wong Amnet Group

- 20. Questions?

- 21. 2012 Video Predictions Nick Roveta

- 22. What goviral do Your videos Our audience Guaranteed engagement Branded Video content +37,000 publishing partners Cost per view (CPV)

- 23. Video metrics won’t be standardized Because the major players don’t need to speak the same language View Engagement Interaction Performance

- 24. Ad Selector will replace pre-roll in 2013 (so start testing now)

- 25. Video and Social will begin to Augment

- 26. 30% of Video Ads will be in Social Games 420 Million Monthly Active Facebook Users are Social Gaming 75% Of Facebook Audience 210 play Social Games Minutes are spent Social Gaming each month $3bn Industry in 2012 Sources : Morgan Stanley, emarketer, Facebook, Flurry

- 27. Mobile video ads will still disappoint… #1 47% Mobile App Category Of all Mobile App by downloads is Social Consumption is Social Gaming Gaming (Except in mobile gaming) Sources : Morgan Stanley, emarketer, Facebook, Flurry

- 28. Pre Roll will continue to dominate (Video budgets in 2012) 90% In Stream and Video banners 10% Other Source: AccuStream Research, Q4 2011

- 29. Video Ad Networks will be essential But MUST evolve model to survive Source: AccuStream Research, Q4 2011

- 30. Expect some network consolidation Small tech/talent acquisitions But no big buy outs Source: AccuStream Research, Q4 2011

- 31. Thanks

- 32. 5 Predictions for mobile in 2012 Presented by: Presented on: Carl Uminski 12th January 32 Somo Ltd - Copyright & Confidential

- 33. 1. Serious retail adoption 24%

- 34. 2. Rapid adoption of tablets £ ~5M = 46% iOS Mobile Browsing

- 35. 3. Augmentation of print media

- 36. 4. Synchronous use of TV

- 37. 5. Mobile Ad spend will explode (..again) Ad spend 1% time spent on mobile 10%

- 38. Thank you @uminski @somoagency

- 39. 39

- 41. Source: According to Econsultancy's 2011 Online Advertisers Survey Report 41

- 42. It is early days, but real time-bidding (RTB) is going to be as big an initiative in Europe as it is in the US, where we are seeing triple-digit increases in our ROI,” predicts Daphne Sacco, Director of Internet Marketing at eBay International. BSkyB has also been an early adopter of RTB in display advertising. In July 2010, it accounted for around 2% of Sky’s display adspend. By January 2011, this had grown to 18%. Matthew Turner, Head of Online Sales and marketing at Sky, hopes this will reach 50% by 2013. Source: Marketing Week article – “Why RTB is a game- changer for digital ads”, September 2011

- 44. 2. Re-engineering Business Models

- 46. 46