Presentation for WiMAX Forum Regional Focus: Russia and CIS

- 1. Soyuz Telecom Population Density And The Potential For Making A Profit: Assessing The WiMAX Opportunity In Metropolitan And Rural Areas Of Russia & The CIS WiMAX Forum Regional Focus: Russia & CIS 18th – 19th November 2009, Marriot Hotel, Moscow

- 2. Soyuz Telecom In Brief New innovative broadband wireless player on the Russian telecom market, focused on delivering high quality broadband services for residential and small business customers using the WiMAX technology (802.16e) Founded in 2007 by ZAO Soyuz - the reputable first joint stock company in Russia Uniquely positioned with extensive, nationwide frequency allocation in the 2.5 GHz spectrum for cities with population of up to 100k inhabitants (covering in total approx. 30 million inhabitants) Focused on locations (smaller cities) where access to true broadband services is scarce and where competition in broadband is limited (both from wireline and wireless operators) The company secured already all necessary licenses and permission to offer a suite of telecom services ranging from voice to broadband access Company is currently in advanced stage of preparation to multi-region network rollout and introduction of services

- 3. Goals Of The Company Soyuz Telecom plans to become a leading provider of broadband internet access services in small cities across the Russian Federation By leveraging the powerful WiMAX technology the company aims to differentiate against competitors offering unique portable broadband services with competitive prices and parameters (like speeds, volume, network availability) Soyuz Telecom aims to start commercial activities in 2010 and gain significant market position in the target areas after 24 months of operation Establish co-operation with other local and regional operators, especially with those having own infrastructure and backhaul capabilities in various regions of the Russian Federation to optimize costs for traffic transport and extend inter-carrier relationships

- 4. What Do We Know About WiMAX ? The technology of choice to provide wireless broadband services Source: WiMAX Forum

- 5. Technology Attributes Mobile WiMAX release 1.0 Key Technology Attributes First to Market with Channel Peak DL Spectral Efficiency: 5.9 bps/Hz Peak UL Spectral Efficiency: 1.5 bps/Hz Mobility Support up to120 km/hr All-IP End-to-End Network Fractional Frequency Reuse Global Roaming Up to 3x Higher Spectral Efficiency than EV-DO or HSPA 100+ Release 1.0 Certified Devices by Year End 2008 Mobile WiMAX release 1.5 Key Feature & Air Interface Enhancements Backwards Compatible with Mobile WiMAX Release 1.0 Profiles for 700 MHz FDD Profiles in Selected Bands Up to 20 MHz Channel BW with Peak DL Rate >144 mbps Band AMC2 Support with MIMO BS Configurations Support for Closed Loop (4x2) MIMO Support for Multi-Hop Relays & Femto Cells Reduced Link-Layer Latency Higher VoIP Capacity Mobile WiMAX release 2.0 Key Feature & Air Interface Enhancements Based on IEEE 802.16m Backwards Compatible with Mobile WiMAX Release 1.5 & 1.0 Higher Channel and VoIP Capacity DL: >350 Mbps with (4x2) or (4x4) MIMO & 20 MHz Channel BW Higher User Data Rates with Advanced MIMO Configurations at the Mobile Station including: (1x4), (2x2), and (2x4) MIMO Improved Link Budget & Cell Edge Speed Link Layer Latency<10 ms, Hand-Off<30 ms Release 1.0 First Commercial Deployments Release 1.5 Certification Testing 2008 2009 2010 2011 Release 2.0 Expected Product Availability Release 1.5 Expected Product Availability Source: WiMAX Forum

- 6. Delivery Of Broadband Source: WiMAX Forum Suitable to deliver true broadband experience for the end users

- 7. Broadband Comparison Russia is among the top 15 broadband communities worldwide Penetration level still leaves a lot of potential for growth In terms of broadband subscriber growth Russia is among the top 5 leaders globally In order to keep the pace of growth penetration has to take up also in smaller cities of the country’s regions

- 8. Snapshot O f Some Regions (1) Internet Users (% of population) Enormous potential for growth Internet usage even below all-Russia average Very high Interne t penetration in Moscow, due to best infrastructure and highest purchasing power Nort h -Western region better positioned as including St. Petersburg Other region visibly below, leaving a lot of space for future growth

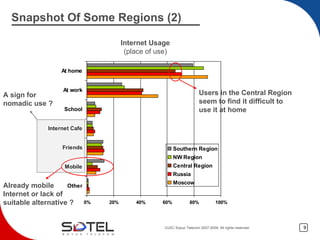

- 9. Snapshot Of Some Regions (2) Internet Usage (place of use) Already mobile Internet or lack of suitable alternative ? Users in the Central Region seem to find it difficult to use it at home A sign for nomadic use ?

- 10. Snapshot Of Some Regions (3) Position of the Regional Incumbents on the Broadband Market Central Region* N-W Region Southern Region Covered population – 18.5m 4.38 POTS lines 4.04m POTS subscribers (21%) 0.35m ADSL subscribers (1.8%) Covered population – 27m 7m POTS lines 6.6m POTS subscribers (24%) 0.5m ADSL subscribers (2%) * without Moscow Covered population – 13.5m 5.1m POTS lines 4.4m POTS subscribers (32%) 0.81m ADSL subscribers (6%)

- 11. WiMAX Business Case WiMAX coverage in a chosen oblast: 27 cities with less than 100k inhabitants each total population of 1.27m average size of a city – 47k inhabitants Service mix and target market desktop portable (from 1st year) and nomadic broadband Internet access Fair Use Policy (FUP) voice services (using VoIP technology) dedicated for residential customers, SOHO and SME Urban rollout scenario, with sub-urban type of environment

- 12. WiMAX Business Case Results (1) CAGR=74% CAGR=220%

- 13. WiMAX Business Case Results (2) 80% 86% 11% 12%

- 14. WiMAX Business Case Results (3) EBITDA stabilizes on a 40%+ level Break-even in 3rd year of operation

- 15. WiMAX Business Case Results (4) Mixed coverage and capacity driven deployment suitable for the mid term

- 16. WiMAX Business Case Results (5) The rollout: in total 28% - 2nd most important portion of the CAPEX Including IP equipment Back-office systems account for 21%

- 17. WiMAX Business Case Results (6) 64% 14% 7% 4% 6% 5% of total network opex Breakdown of traffic costs: backhaul – 77% transport – 12% upstream – 11%

- 18. WiMAX Business Case Results (7) 72% of non-network opex, encompasses maintenance of back-office HW and SW

- 19. WiMAX Business Case Results (8) Variable voice costs growth from 4% to 44% in the cost structure Role of SAC relatively lower, but still very important position Cost of customer retention starts to play role already in the m i d-term !

- 20. WiMAX Business Case Results (9) Conclusions Market offers many opportunities for deployment of wireless broadband networks Demand for broadband access in place Control the deployment costs (site acquisition, permission process, build out, etc.) Costs of RAN constitute large part of deployment – negotiate well with the suppliers and/or organize financing structure to optimize the initial cash-out Management of backhaul network crucial to control transport costs. Use wireless backhaul or own network whenever possible or introduce frame arrangements to buy bulk capacity End user device prices will be main driver of the subscriber acquisition costs (SAC). Participate in buying consortium and CPE promotion programs to optimize performance MARKET CAPEX OPEX

- 21. THANK YOU FOR ATTENTION