Presentations 2 q08

- 2. Not considering goodwill amortization Better mix led to a rise in net revenues by 14.5% quarter-on-quarter and 10.3% year-on-year - due to higher refractory sales in the domestic market and to the steel industry. Better mix led to a rise in net revenues by 14.5% quarter-on-quarter and 10.3% year-on-year - due to higher refractory sales in the domestic market and to the steel industry. Recovery of the gross margin and EBITDA margin reflect management´s continuous focus on cost and expense control. Recovery of the gross margin and EBITDA margin reflect management´s continuous focus on cost and expense control. Tax benefit resulting from mergers in 2008: Magnesita Refratários S.A.: 1Q08 partial and 2Q08 fully appropriated; Subsidiaries: partial, starting May 1, 2008. Tax benefit resulting from mergers in 2008: Magnesita Refratários S.A.: 1Q08 partial and 2Q08 fully appropriated; Subsidiaries: partial, starting May 1, 2008. Non-operating revenue of R$ 54.2 million from the sale of non-core assets Non-operating revenue of R$ 54.2 million from the sale of non-core assets Quarterly Net Income R$ million

- 3. Sales Volume Breakdown 1H07 Sales Volume Breakdown 1H07 Sales Volume Breakdown 1H08 Sales Volume Breakdown 1H08 (*) not including the non-recurring sale of 210,000 metric tons of magnesium silicate 194 kt 96 kt 39 kt 205 kt 82 kt 32 kt Other minerals 1H08 vs. 1H07 = -14.4% Total 1H08 vs. 1H07 = -3.0% Refractories 1H08 vs. 1H07 = + 5.7% 329 kt 320 kt

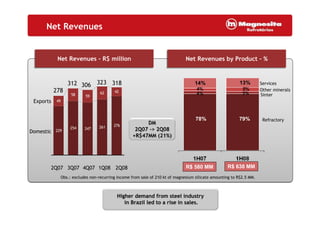

- 4. 229 254 247 261 276 49 58 59 62 42 2Q082Q07 3Q07 4Q07 1Q08 Exports Domestic 318306 323 278 312 Net Revenues Net Revenues - R$ millionNet Revenues - R$ million Net Revenues by Product – %Net Revenues by Product – % Higher demand from steel industry in Brazil led to a rise in sales. 78% 79% 3% 5% 13% 4% 4% 14% R$ 580 MM R$ 638 MM Services Refractory Sinter Other minerals Obs.: excludes non-recurring income from sale of 210 kt of magnesium silicate amounting to R$2.5 MM. DM 2Q07 -> 2Q08 +R$47MM (21%)

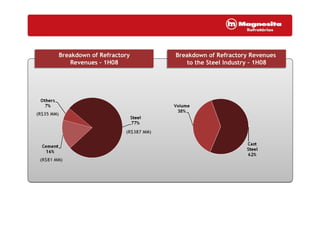

- 5. Breakdown of Refractory Revenues – 1H08 Breakdown of Refractory Revenues – 1H08 Breakdown of Refractory Revenues to the Steel Industry – 1H08 Breakdown of Refractory Revenues to the Steel Industry – 1H08 (R$387 MM) (R$35 MM) (R$81 MM)

- 6. 217.7 EBITDA – R$ millionEBITDA – R$ million EBITDA Margin – %EBITDA Margin – % 6 1Q 2Q 3Q 4Q +71% 188.5 EBITDA / EBITDA Margin

- 7. Raw Materials 32% Labor 28%Fuel 12% Depreciation 6% Industrial Maintenance 4% Energy 5% Others accounts 13% COGS – 1H08COGS – 1H08 Operating ExpensesOperating Expenses 2Q082Q07 3Q07 4Q07 1Q08 Administrative Sales 66 64 75 52 60 Costs 2008 administrative expenses increased because of non-recurring costs of mergers and restructuring of the Group’s companies. Year to date, costs have amounted to R$12.6 million.

- 8. Net Debt/EBITDA – R$ millionNet Debt/EBITDA – R$ million Obs.: 06.30.08 – annualized EBITDA was considered Debt The Company’s debt, which is composed by approximately 90% long-term, excluding cash and cash equivalent of R$ 542 million is equivalent to 1.4 time annualized EBITDA. The Company’s debt, which is composed by approximately 90% long-term, excluding cash and cash equivalent of R$ 542 million is equivalent to 1.4 time annualized EBITDA.

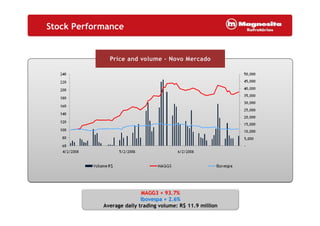

- 9. Stock Performance MAGG3 + 93.7% Ibovespa + 2.6% Average daily trading volume: R$ 11.9 million

- 10. Outlook Steel Strong signals for sustained growth, with confirmation of several expansion projects. Brazil has been consolidating as investment target and Magnesita is capable to respond to the needs of refractory products in this market. Steel Strong signals for sustained growth, with confirmation of several expansion projects. Brazil has been consolidating as investment target and Magnesita is capable to respond to the needs of refractory products in this market. Commodities • Booming demand mainly due to growing global economy, level of urbanization and industrialization in emerging markets. • Prices pressured by: energy, devaluation of the US currency, labor and inputs supply shortages, environmental concerns and export-barriers. • Production capacity is not sufficient (obsolete equipment, interruptions due to debottlenecking, longer lead times to build new production capacity. Consequence: Unbalanced supply and demand Commodities • Booming demand mainly due to growing global economy, level of urbanization and industrialization in emerging markets. • Prices pressured by: energy, devaluation of the US currency, labor and inputs supply shortages, environmental concerns and export-barriers. • Production capacity is not sufficient (obsolete equipment, interruptions due to debottlenecking, longer lead times to build new production capacity. Consequence: Unbalanced supply and demand Brumado Plant • Natural shield against pressures of magnesite sinter prices. Studies underway for expansion to supply both domestic and exports markets. Brumado Plant • Natural shield against pressures of magnesite sinter prices. Studies underway for expansion to supply both domestic and exports markets. Cement Market will remain heated due to higher credit availability. Cement Market will remain heated due to higher credit availability.