Principle of maximum social advantage

- 1. Principle of Maximum Social Advantage By Humsi Singh

- 2. Introduction Public Finance and Principles Public finance is the study of the role of the government in the economy. It is the branch of economics which assesses the government revenue and government expenditure of the public authorities and the adjustment of one or the other to achieve desirable effects and avoid undesirable ones. A principle is a concept or value that is a guide for behavior or evaluation. In law, it is a rule that has to be or usually is to be followed, or can be desirably followed, or is an inevitable consequence of something, such as the laws observed in nature or the way that a system is constructed. Public Finance Principles

- 3. Dalton’s Principle of Maximum Social Advantage Key terms... Public Expenditure and revenue Marginal Social Sacrifice Marginal Social Benefit Public expenditure is spending made by the government of a country on collective needs and wants such as pension, provision, infrastructure, etc Government revenue is money received by a government. Marginal Social Sacrifice (MSS) refers to that amount of social sacrifice undergone by public due to the imposition of an additional unit of tax. While imposition of tax puts burden on the people, public expenditure confers benefits. The benefit conferred on the society, by an additional unit of public expenditure is known as Marginal Social Benefit (MSB).

- 4. British Economist- Hugh Dalton Economist behind the theory of Principle of Maximum Social Advantage Edward Hugh John Neale Dalton, Baron Dalton, PC was a British Labour Party economist and politician who served as Chancellor of the Exchequer from 1945 to 1947. According to Hugh Dalton, "The best system of public finance is that which secures the maximum social advantage from the operations which it conducts." His 'Principle of Maximum Social Advantage (MSA)' is the fundamental principle of Public Finance.

- 5. Explanation of the Principle The PMSA implies that public expenditure is subject to diminishing marginal social benefits. And taxes are subject to increasing marginal cost. A rational state seeks to maximise the net social advantage of its fiscal operations. The social net advantage is maximum when the aggregate social benefits resulting from public expenditure is maximum and the aggregate social sacrifice involved in raising the public revenue is minimum.

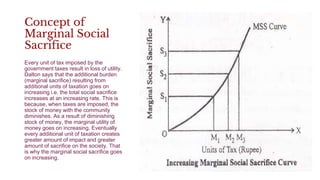

- 6. Concept of Marginal Social Sacrifice Every unit of tax imposed by the government taxes result in loss of utility. Dalton says that the additional burden (marginal sacrifice) resulting from additional units of taxation goes on increasing i.e. the total social sacrifice increases at an increasing rate. This is because, when taxes are imposed, the stock of money with the community diminishes. As a result of diminishing stock of money, the marginal utility of money goes on increasing. Eventually every additional unit of taxation creates greater amount of impact and greater amount of sacrifice on the society. That is why the marginal social sacrifice goes on increasing.

- 7. Concept of Marginal Social Benefit Just as the marginal utility from a commodity to a consumer declines as more and more units of the commodity are made available to him, the social benefit from each additional unit of public expenditure declines as more and more units of public expenditure are spent. In the beginning, the units of public expenditure are spent on the most essential social activities. Subsequent doses of public expenditure are spent on less and less important social activities. As a result, the curve of marginal social benefits slopes downward from left to right

- 8. Point of Maximum Social Advantage Social advantage is maximised at the point where marginal social sacrifice cuts the marginal social benefits curve.This is at the point P. At this point, the marginal disutility or social sacrifice is equal to the marginal utility or social benefit. Beyond this point, the marginal disutility or social sacrifice will be higher, and the marginal utility or social benefit will be lower.

- 9. Assumptions of the Principle • All taxes result in sacrifice and all public expenditures lead to benefits. • Public revenue consist of only taxes and no other sources of income to the government. • The government has no surplus or deficit budget but only balanced budget. • Public expenditure is subject to diminishing marginal social benefit and taxes are subject to increasing marginal social sacrifice.

- 10. Limitations of the Principle • Difficult to measure marginal utility and disutility. • Difficult to assess the capacity of the people. • Difficult to know about likings and dislikings of the people.

- 11. Conclusion what we have learnt... The Principle of Maximum Social Advantage states that public finance leads to economic welfare when public expenditure & taxation are carried out up to that point where the benefits derived from the MU (Marginal Utility) of expenditure is equal to (=) the Marginal Disutility or the sacrifice imposed by taxation.

- 12. Thank You!!! Any Questions? ● Drop your questions in the comment section below ● For any further queries log on to www.saartechnosoft.com