Q1 2009 Earning Report of Banco Bilbao Vizcaya

0 likes662 views

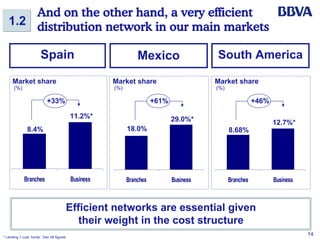

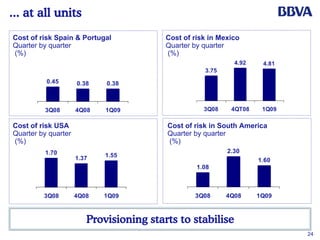

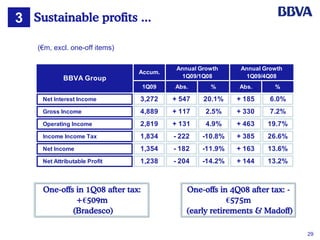

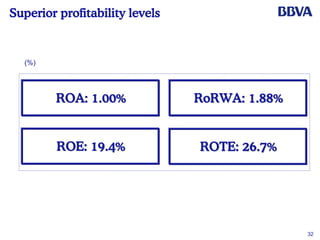

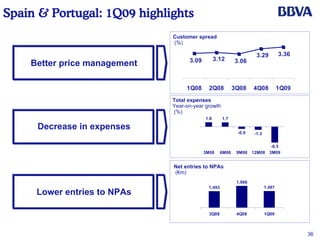

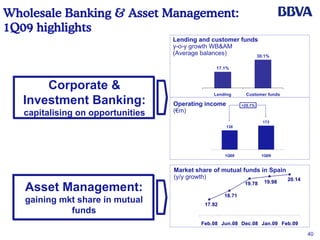

BBVA demonstrated the recurrent nature and sustainability of its business model in 2008. In the first quarter of 2009, BBVA continued its strong performance with recurrent operating income supported by recurrent revenues and greater efficiency. Risk management also remained prudent with lower entries to NPAs, provisioning in line with the second half of 2008, and ample generic provisions to cover losses.

1 of 48

Download to read offline

Recommended

CMC_Analysts_Presentation_FY_06

CMC_Analysts_Presentation_FY_06finance21 - Operating revenue for the quarter ended March 31, 2006 was Rs. 278 crore, up 34% from the previous quarter and 26% from the same quarter last year. Total revenue was Rs. 279 crore, up 32% and 25% respectively.

- Operating profit for the quarter was Rs. 16.6 crore, up 37% from the previous quarter. Profit before tax was Rs. 14.3 crore, up 8% from last quarter. Profit after tax was Rs. 9.9 crore, down 18% from last quarter.

- Manpower productivity improved 18% from the previous quarter.

Financial Analysis - OGX Petroleo e Gas Participacoes SA is an oil and gas…

Financial Analysis - OGX Petroleo e Gas Participacoes SA is an oil and gas…BCV OGX Petroleo e Gas Participacoes SA is a Brazilian oil and gas exploration and production company. It has no revenue or employees yet as it is still in the exploration and production stage. The majority of its shares are owned by Brazilian institutions and individuals. Analyst ratings on the company are mixed, with around half recommending a buy and the other half recommending a hold or sell. Target price estimates range significantly from $1.80 to $17.63.

Ubs Nordic Financials Sept 2009

Ubs Nordic Financials Sept 2009SEBgroup SEB has a strong competitive position as a long-term relationship bank in the Nordic region. The bank pursued a multi-disciplinary strategy in 2006 to stay ahead of market changes. Going forward, SEB believes structural trends around wealth management, demographics, and emerging markets remain valid opportunities despite regulatory uncertainty post-crisis. SEB is well positioned to leverage these trends through its existing franchises and relationships.

Financial Analysis - American International Group, Inc. is an internationa…

Financial Analysis - American International Group, Inc. is an internationa…BCV Financial Analysis - American International Group, Inc. is an international insurance organization serving commercial, institutional and individual customers. AIG provides property-casualty insurance, life insurance and retirement services.pdf

Swedbank’s second quarter 2011 results

Swedbank’s second quarter 2011 resultsSwedbank Swedbank reported net profit of SEK 3.4 billion for Q2 2011. Key highlights included a core Tier 1 capital ratio of 14.8% and return on equity of 14.4%. Business areas like Retail and Large Corporates & Institutions performed well, with improved results driven by higher net interest income. Expenses remained flat while lending and deposit volumes were stable year-to-date. Liquidity reserves were further increased and term funding issuance was on plan. Overall, asset quality improved but macroeconomic risks remained.

citigroup January 16, 2001 - Fourth Quarter Financial Supplement

citigroup January 16, 2001 - Fourth Quarter Financial SupplementQuarterlyEarningsReports Citigroup reported its quarterly financial results. Some key highlights:

- Core income for Q4 2000 was $3.331 billion, up 11% from Q4 1999.

- Net income for Q4 2000 was $2.84 billion, down 6% from Q4 1999 due to restructuring charges.

- Global Consumer segment revenues grew 9% to $10.243 billion in Q4 2000.

- Global Corporates and Institutions segment revenues grew 16% to $8.464 billion in Q4 2000.

SEB Morgan Stanley Conference April 2008

SEB Morgan Stanley Conference April 2008SEBgroup Per-Arne Blomquist, CFO of SEB, discusses maintaining growth while managing risks at a Morgan Stanley conference. He summarizes that SEB aims to [1] exploit long-term credit growth potential while maintaining strong asset quality, and [2] has built a balanced business platform through operational excellence initiatives that has delivered profitable growth. SEB will continue focusing on organic growth in core areas and making selective acquisitions to take advantage of growth opportunities.

3Q08 Earnings Presentation

3Q08 Earnings PresentationCR2 Cidade Paradiso (Nova Iguaçu, RJ) – Biggest Undertaking Residential of the Baixada Fluminense reported financial results for 3Q08 and 9M08. Key highlights included EPS of R$0.16 in 3Q08 and R$0.77 in 9M08, net profit before minorities of R$9.1 million in 3Q08 and R$41.0 million in 9M08. Total launches in 3Q08 were R$129 million with contracted sales of R$80 million and 794 units sold. The company has a strong balance sheet with R$87 million in cash and R$43 million in debt.

Press conference 2010 Q1

Press conference 2010 Q1SEBgroup 1) The document presents the quarterly results for 2010 of a bank. It highlights solid results given the current economic climate with lower provisions for credit losses and no new non-performing loans.

2) The bank saw a decline in income compared to previous periods but operating expenses also declined, leading to a higher operating profit. Net interest income decreased primarily from lower lending income.

3) The bank has initiated a Nordic growth plan to expand its corporate banking business across the Nordic region and strengthen its position through regional hubs in each country.

Supp slides q4_2012_v4_26_feb_1900h

Supp slides q4_2012_v4_26_feb_1900hdgiplcorponline Trina Solar held an earnings call to discuss its Q4 2012 and fiscal year 2012 performance. Key highlights included module and system shipments of 415MW and 1.6GW respectively. Revenue was $302.7 million for Q4 2012 and $1.3 billion for fiscal year 2012. Gross margins were low due to write-downs and provisions. The company provided guidance for Q1 2013 shipments of 420-430MW and fiscal year 2013 shipments of 2-2.1GW. Trina Solar has a strong balance sheet with $918 million in cash and manufacturing capacity of 2.4GW for modules and 2.4GW for cells. Regional sales breakdowns and commercial strategies were also discussed.

презентация для инвесторов, июнь 2010

презентация для инвесторов, июнь 2010evraz_company Evraz presented its investor presentation for June 2010. Some key points include:

- Evraz is a leading global steel and mining company with operations across Russia, Europe, North America and Asia.

- In the first quarter of 2010, Evraz saw increases in revenue, EBITDA, sales volumes and production compared to the prior year period.

- Evraz maintains a strong balance sheet with manageable debt maturity profile and adequate cash balances. The company focuses on cost leadership through vertical integration and efficiency.

2Q12 Presentation

2Q12 PresentationGafisa RI ! The document provides an overview of a company's 2Q12 and 1H12 results. It discusses financial performance including revenues, gross profit, EBITDA margins, and contributions by brand. Key highlights include consolidated revenues reaching $1.97 billion for 1H12, gross profit of $470.8 million for 1H12 representing a 24% margin, and EBITDA of $253.9 million for 1H12 representing a 13% margin. Legacy projects with lower margins are expected to be delivered in the short to mid-term, impacting overall margins.

Financial Analysis - National Oilwell Varco Inc. is a worldwide provider of e...

Financial Analysis - National Oilwell Varco Inc. is a worldwide provider of e...BCV Financial Analysis - National Oilwell Varco Inc. is a worldwide provider of equipment and components used in oil and gas drilling and production operations, oilfield services

W. R. berkley annual reports 2005

W. R. berkley annual reports 2005finance37 The 2005 annual report of W. R. Berkley Corporation summarizes their excellent financial results for the year, including record earnings, an outstanding return on capital, and a strengthened balance sheet. Their various business segments - including specialty, regional, alternative markets, reinsurance, and international markets - all produced strong growth and returns. The company's long-term decentralized strategy and focus on risk-adjusted returns has positioned them well for continued success.

GasLog Q3 2012 results presentation

GasLog Q3 2012 results presentationTradeWindsnews GasLog Ltd. reported financial results for the third quarter of 2012 with Adjusted EBITDA of $9.7 million and Adjusted Profit of $4.0 million. The company paid a quarterly dividend of $0.11 per share and its 8 new LNG carriers under construction remain on schedule and within budget. GasLog maintained 100% utilization of its vessels during the quarter and sees continued strong fundamentals in the LNG industry.

Financial Analysis - PetroChina Company Limited explores, develops, and produ...

Financial Analysis - PetroChina Company Limited explores, develops, and produ...BCV Financial Analysis - PetroChina Company Limited explores, develops, and produces crude oil and natural gas. The Company also refines, transports, and distributes crude oil and petroleum products

Financial Analysis - Assured Guaranty Ltd. provides financial guaranty insura...

Financial Analysis - Assured Guaranty Ltd. provides financial guaranty insura...BCV Financial Analysis - Assured Guaranty Ltd. provides financial guaranty insurance and reinsurance, as well as mortgage guaranty coverag

Meet Management 2012 Investor Handout

Meet Management 2012 Investor HandoutBayer This investor presentation provides an overview of Bayer Group's financial performance and outlook. It discusses Bayer's market leading positions, new product pipeline, and growth in emerging markets. The presentation summarizes Bayer's record sales and earnings in 2011, consistent strong cash generation from 2007-2011, and financial outlook for 2012. It anticipates global economic and political risks remaining high in 2012 and continued growth being driven by Asian emerging markets.

SEB Facts And Figures January March 2008

SEB Facts And Figures January March 2008SEBgroup SEB Group reported lower profits in Q1 2008 compared to Q1 2007 and Q4 2007. Net profit declined 43% year-over-year and 51% quarter-over-quarter due to lower net interest income and net financial income. Total operating income and net fee and commission income also declined. Asset quality remained stable with a low credit loss level of 0.13%. Return on equity fell to 9.6% from 19% in Q1 2007.

Financial Analysis - Banque Cantonale Vaudoise - Banque Cantonale Vaudoise (B...

Financial Analysis - Banque Cantonale Vaudoise - Banque Cantonale Vaudoise (B...BCV Financial Analysis - Banque Cantonale Vaudoise - Banque Cantonale Vaudoise (BCV) attracts deposits and offers retail, private, and corporate banking services. BCV operates primarily in the Canton of Vaud.pdf

ArcelorMittal Q3 2008 results

ArcelorMittal Q3 2008 resultsearningsreport 1) ArcelorMittal reported a 6.6% increase in EBITDA to $8.6 billion for Q3 2008 compared to Q2 2008, supported by its three-dimensional strategy.

2) In response to the current economic environment, ArcelorMittal is increasing planned production cuts to accelerate inventory reduction and increasing its management gains target to $5 billion through additional SG&A savings.

3) Guidance for Q4 2008 EBITDA is provided in the range of $2.5-3 billion, reflecting increased voluntary production cuts. The base dividend is maintained at $1.50 per share for 2009.

Apresentação resultados 2 q12

Apresentação resultados 2 q12LPS Brasil - Consultoria de Imóveis S.A. The document provides a summary of Lopes-LPS Brasil Consultoria de Imóveis S.A's 2Q12 presentation. It highlights include total real estate transactions of R$4.9 billion, of which R$1.2 billion was in the secondary market. Net revenue was R$109.2 million and EBITDA was R$42.3 million with a 39% margin. CrediPronto! origination grew 15% from 2Q11. In July 2012 they acquired LPS Raul Fulgêncio, a leading real estate company in Londrina. The presentation also provides breakdowns of transactions by market, region, income segment and homebuilder.

Banco ABC - 1st Quarter 2008 Results Presentation

Banco ABC - 1st Quarter 2008 Results PresentationBanco ABC Brasil The document provides an overview of Banco ABC Brasil's 1Q08 results. Key highlights include:

- Loan portfolio reached R$5.779 billion, up 15.8% from 4Q07 and 80.9% from 1Q07.

- 99.4% of loans rated AA-C, similar to prior periods.

- Net income up 106.4% to R$38 million from 1Q07.

- Moody's assigned investment grade ratings to Banco ABC Brasil of Baa2/P-2.

2Q12 Presentation

2Q12 PresentationBraskem_RI The document summarizes Braskem's 2Q12 earnings conference call. It notes that Braskem's EBITDA was R$845 million in 2Q12, up 7% from 1Q12, despite extraordinary effects of R$108 million. Braskem's market share of thermoplastic resins in Brazil expanded 3 percentage points to 71% in 2Q12. New projects such as PVC and butadiene were on schedule. Braskem is focused on expanding market share in Brazil and diversifying its feedstock and suppliers through projects such as acquiring a propylene splitter in the US. Braskem forecasts potential positive factors for 2H12 such as growth in emerging markets, but also

Financial analysis paladin energy ltd - paladin energy limited primarily ex...

Financial analysis paladin energy ltd - paladin energy limited primarily ex...BCV Paladin Energy Ltd is an Australian uranium mining company that primarily operates in Australia and Namibia. Some key points:

- Their main business segment is uranium mining, with 65% of sales coming from their operations in Namibia.

- Institutional investors own 35% of the company, with the largest shareholders being investment advisors and mutual fund managers.

- Analyst ratings are mixed with over 50% recommending a "buy" but targets prices ranging significantly from $0.95 to $3.38.

- The company has experienced declining margins and returns in recent years as the uranium market has weakened.

Presentation of Swedbank's second quarter 2012 results

Presentation of Swedbank's second quarter 2012 resultsSwedbank Presentation of Q2 2012 Results from the Analyst Conference by CEO Michael Wolf, CFO Göran Bronner and CRO Håkan Berg

"UBS Brazil 2006 - Seventh Annual CEO Conference

"UBS Brazil 2006 - Seventh Annual CEO ConferencePetrobras Petrobras presented its strategic plan and 4Q05 results. Key points include:

1) Investment plan of $56.4 billion from 2006-2010 to increase oil and gas production and expand downstream operations.

2) Domestic oil production is expected to grow 6.4% annually to reach 2.3 million bpd by 2010.

3) Natural gas sales in Brazil are projected to increase to 59 million cubic meters/day by 2010.

Q1 2009 Earning Report of Banco Santander

Q1 2009 Earning Report of Banco Santanderearningreport earningreport 1. Santander reported consistent results in Q1 2009, with attributable profit decreasing 5% year-over-year to EUR 2.096 billion. Excluding exchange rates, profit increased 9%.

2. Net interest income increased 18.8% excluding exchange rates, driven by spreads management in a low interest rate environment. Operating expenses increased 1.8% excluding exchange rates and perimeter changes, reflecting strict cost control.

3. Loan-loss provisions increased 67.8% excluding exchange rates to EUR 2.234 billion, but were lower than in Q4 2008 due to specific provisions. Generic provisions decreased as forecasted.

Q1 2009 Earning Report of Banco Santander

Q1 2009 Earning Report of Banco Santanderearningreport earningreport 1. Santander reported consistent results in Q1 2009, with attributable profit decreasing 5% year-over-year to EUR 2.096 billion. Excluding exchange rates, profit increased 9%.

2. Net interest income increased 18.8% excluding exchange rates, driven by spreads management in a low interest rate environment. Operating expenses increased 1.8% excluding exchange rates and perimeter changes, reflecting strict cost control.

3. Loan-loss provisions increased 67.8% excluding exchange rates to EUR 2.234 billion, but were lower than in Q4 2008 due to specific provisions. Generic provisions decreased as forecasted.

shaw group 8C04E297-E3DD-4F1E-8BB2-56C5BB51CEDA_SGR_AnnualShareholdersMeeting...

shaw group 8C04E297-E3DD-4F1E-8BB2-56C5BB51CEDA_SGR_AnnualShareholdersMeeting...finance36 The document summarizes The Shaw Group Inc.'s annual meeting for fiscal year 2008. It provides key financial results including record revenue, EBITDA, net income, and EPS. It also discusses major projects, growth in backlog to $15.6 billion, and guidance for fiscal year 2009 revenues of $7.1-7.3 billion and EPS of $2.50-2.70 per share.

More Related Content

What's hot (19)

Press conference 2010 Q1

Press conference 2010 Q1SEBgroup 1) The document presents the quarterly results for 2010 of a bank. It highlights solid results given the current economic climate with lower provisions for credit losses and no new non-performing loans.

2) The bank saw a decline in income compared to previous periods but operating expenses also declined, leading to a higher operating profit. Net interest income decreased primarily from lower lending income.

3) The bank has initiated a Nordic growth plan to expand its corporate banking business across the Nordic region and strengthen its position through regional hubs in each country.

Supp slides q4_2012_v4_26_feb_1900h

Supp slides q4_2012_v4_26_feb_1900hdgiplcorponline Trina Solar held an earnings call to discuss its Q4 2012 and fiscal year 2012 performance. Key highlights included module and system shipments of 415MW and 1.6GW respectively. Revenue was $302.7 million for Q4 2012 and $1.3 billion for fiscal year 2012. Gross margins were low due to write-downs and provisions. The company provided guidance for Q1 2013 shipments of 420-430MW and fiscal year 2013 shipments of 2-2.1GW. Trina Solar has a strong balance sheet with $918 million in cash and manufacturing capacity of 2.4GW for modules and 2.4GW for cells. Regional sales breakdowns and commercial strategies were also discussed.

презентация для инвесторов, июнь 2010

презентация для инвесторов, июнь 2010evraz_company Evraz presented its investor presentation for June 2010. Some key points include:

- Evraz is a leading global steel and mining company with operations across Russia, Europe, North America and Asia.

- In the first quarter of 2010, Evraz saw increases in revenue, EBITDA, sales volumes and production compared to the prior year period.

- Evraz maintains a strong balance sheet with manageable debt maturity profile and adequate cash balances. The company focuses on cost leadership through vertical integration and efficiency.

2Q12 Presentation

2Q12 PresentationGafisa RI ! The document provides an overview of a company's 2Q12 and 1H12 results. It discusses financial performance including revenues, gross profit, EBITDA margins, and contributions by brand. Key highlights include consolidated revenues reaching $1.97 billion for 1H12, gross profit of $470.8 million for 1H12 representing a 24% margin, and EBITDA of $253.9 million for 1H12 representing a 13% margin. Legacy projects with lower margins are expected to be delivered in the short to mid-term, impacting overall margins.

Financial Analysis - National Oilwell Varco Inc. is a worldwide provider of e...

Financial Analysis - National Oilwell Varco Inc. is a worldwide provider of e...BCV Financial Analysis - National Oilwell Varco Inc. is a worldwide provider of equipment and components used in oil and gas drilling and production operations, oilfield services

W. R. berkley annual reports 2005

W. R. berkley annual reports 2005finance37 The 2005 annual report of W. R. Berkley Corporation summarizes their excellent financial results for the year, including record earnings, an outstanding return on capital, and a strengthened balance sheet. Their various business segments - including specialty, regional, alternative markets, reinsurance, and international markets - all produced strong growth and returns. The company's long-term decentralized strategy and focus on risk-adjusted returns has positioned them well for continued success.

GasLog Q3 2012 results presentation

GasLog Q3 2012 results presentationTradeWindsnews GasLog Ltd. reported financial results for the third quarter of 2012 with Adjusted EBITDA of $9.7 million and Adjusted Profit of $4.0 million. The company paid a quarterly dividend of $0.11 per share and its 8 new LNG carriers under construction remain on schedule and within budget. GasLog maintained 100% utilization of its vessels during the quarter and sees continued strong fundamentals in the LNG industry.

Financial Analysis - PetroChina Company Limited explores, develops, and produ...

Financial Analysis - PetroChina Company Limited explores, develops, and produ...BCV Financial Analysis - PetroChina Company Limited explores, develops, and produces crude oil and natural gas. The Company also refines, transports, and distributes crude oil and petroleum products

Financial Analysis - Assured Guaranty Ltd. provides financial guaranty insura...

Financial Analysis - Assured Guaranty Ltd. provides financial guaranty insura...BCV Financial Analysis - Assured Guaranty Ltd. provides financial guaranty insurance and reinsurance, as well as mortgage guaranty coverag

Meet Management 2012 Investor Handout

Meet Management 2012 Investor HandoutBayer This investor presentation provides an overview of Bayer Group's financial performance and outlook. It discusses Bayer's market leading positions, new product pipeline, and growth in emerging markets. The presentation summarizes Bayer's record sales and earnings in 2011, consistent strong cash generation from 2007-2011, and financial outlook for 2012. It anticipates global economic and political risks remaining high in 2012 and continued growth being driven by Asian emerging markets.

SEB Facts And Figures January March 2008

SEB Facts And Figures January March 2008SEBgroup SEB Group reported lower profits in Q1 2008 compared to Q1 2007 and Q4 2007. Net profit declined 43% year-over-year and 51% quarter-over-quarter due to lower net interest income and net financial income. Total operating income and net fee and commission income also declined. Asset quality remained stable with a low credit loss level of 0.13%. Return on equity fell to 9.6% from 19% in Q1 2007.

Financial Analysis - Banque Cantonale Vaudoise - Banque Cantonale Vaudoise (B...

Financial Analysis - Banque Cantonale Vaudoise - Banque Cantonale Vaudoise (B...BCV Financial Analysis - Banque Cantonale Vaudoise - Banque Cantonale Vaudoise (BCV) attracts deposits and offers retail, private, and corporate banking services. BCV operates primarily in the Canton of Vaud.pdf

ArcelorMittal Q3 2008 results

ArcelorMittal Q3 2008 resultsearningsreport 1) ArcelorMittal reported a 6.6% increase in EBITDA to $8.6 billion for Q3 2008 compared to Q2 2008, supported by its three-dimensional strategy.

2) In response to the current economic environment, ArcelorMittal is increasing planned production cuts to accelerate inventory reduction and increasing its management gains target to $5 billion through additional SG&A savings.

3) Guidance for Q4 2008 EBITDA is provided in the range of $2.5-3 billion, reflecting increased voluntary production cuts. The base dividend is maintained at $1.50 per share for 2009.

Apresentação resultados 2 q12

Apresentação resultados 2 q12LPS Brasil - Consultoria de Imóveis S.A. The document provides a summary of Lopes-LPS Brasil Consultoria de Imóveis S.A's 2Q12 presentation. It highlights include total real estate transactions of R$4.9 billion, of which R$1.2 billion was in the secondary market. Net revenue was R$109.2 million and EBITDA was R$42.3 million with a 39% margin. CrediPronto! origination grew 15% from 2Q11. In July 2012 they acquired LPS Raul Fulgêncio, a leading real estate company in Londrina. The presentation also provides breakdowns of transactions by market, region, income segment and homebuilder.

Banco ABC - 1st Quarter 2008 Results Presentation

Banco ABC - 1st Quarter 2008 Results PresentationBanco ABC Brasil The document provides an overview of Banco ABC Brasil's 1Q08 results. Key highlights include:

- Loan portfolio reached R$5.779 billion, up 15.8% from 4Q07 and 80.9% from 1Q07.

- 99.4% of loans rated AA-C, similar to prior periods.

- Net income up 106.4% to R$38 million from 1Q07.

- Moody's assigned investment grade ratings to Banco ABC Brasil of Baa2/P-2.

2Q12 Presentation

2Q12 PresentationBraskem_RI The document summarizes Braskem's 2Q12 earnings conference call. It notes that Braskem's EBITDA was R$845 million in 2Q12, up 7% from 1Q12, despite extraordinary effects of R$108 million. Braskem's market share of thermoplastic resins in Brazil expanded 3 percentage points to 71% in 2Q12. New projects such as PVC and butadiene were on schedule. Braskem is focused on expanding market share in Brazil and diversifying its feedstock and suppliers through projects such as acquiring a propylene splitter in the US. Braskem forecasts potential positive factors for 2H12 such as growth in emerging markets, but also

Financial analysis paladin energy ltd - paladin energy limited primarily ex...

Financial analysis paladin energy ltd - paladin energy limited primarily ex...BCV Paladin Energy Ltd is an Australian uranium mining company that primarily operates in Australia and Namibia. Some key points:

- Their main business segment is uranium mining, with 65% of sales coming from their operations in Namibia.

- Institutional investors own 35% of the company, with the largest shareholders being investment advisors and mutual fund managers.

- Analyst ratings are mixed with over 50% recommending a "buy" but targets prices ranging significantly from $0.95 to $3.38.

- The company has experienced declining margins and returns in recent years as the uranium market has weakened.

Presentation of Swedbank's second quarter 2012 results

Presentation of Swedbank's second quarter 2012 resultsSwedbank Presentation of Q2 2012 Results from the Analyst Conference by CEO Michael Wolf, CFO Göran Bronner and CRO Håkan Berg

"UBS Brazil 2006 - Seventh Annual CEO Conference

"UBS Brazil 2006 - Seventh Annual CEO ConferencePetrobras Petrobras presented its strategic plan and 4Q05 results. Key points include:

1) Investment plan of $56.4 billion from 2006-2010 to increase oil and gas production and expand downstream operations.

2) Domestic oil production is expected to grow 6.4% annually to reach 2.3 million bpd by 2010.

3) Natural gas sales in Brazil are projected to increase to 59 million cubic meters/day by 2010.

Similar to Q1 2009 Earning Report of Banco Bilbao Vizcaya (20)

Q1 2009 Earning Report of Banco Santander

Q1 2009 Earning Report of Banco Santanderearningreport earningreport 1. Santander reported consistent results in Q1 2009, with attributable profit decreasing 5% year-over-year to EUR 2.096 billion. Excluding exchange rates, profit increased 9%.

2. Net interest income increased 18.8% excluding exchange rates, driven by spreads management in a low interest rate environment. Operating expenses increased 1.8% excluding exchange rates and perimeter changes, reflecting strict cost control.

3. Loan-loss provisions increased 67.8% excluding exchange rates to EUR 2.234 billion, but were lower than in Q4 2008 due to specific provisions. Generic provisions decreased as forecasted.

Q1 2009 Earning Report of Banco Santander

Q1 2009 Earning Report of Banco Santanderearningreport earningreport 1. Santander reported consistent results in Q1 2009, with attributable profit decreasing 5% year-over-year to EUR 2.096 billion. Excluding exchange rates, profit increased 9%.

2. Net interest income increased 18.8% excluding exchange rates, driven by spreads management in a low interest rate environment. Operating expenses increased 1.8% excluding exchange rates and perimeter changes, reflecting strict cost control.

3. Loan-loss provisions increased 67.8% excluding exchange rates to EUR 2.234 billion, but were lower than in Q4 2008 due to specific provisions. Generic provisions decreased as forecasted.

shaw group 8C04E297-E3DD-4F1E-8BB2-56C5BB51CEDA_SGR_AnnualShareholdersMeeting...

shaw group 8C04E297-E3DD-4F1E-8BB2-56C5BB51CEDA_SGR_AnnualShareholdersMeeting...finance36 The document summarizes The Shaw Group Inc.'s annual meeting for fiscal year 2008. It provides key financial results including record revenue, EBITDA, net income, and EPS. It also discusses major projects, growth in backlog to $15.6 billion, and guidance for fiscal year 2009 revenues of $7.1-7.3 billion and EPS of $2.50-2.70 per share.

shaw group 8C04E297-E3DD-4F1E-8BB2-56C5BB51CEDA_SGR_AnnualShareholdersMeeting...

shaw group 8C04E297-E3DD-4F1E-8BB2-56C5BB51CEDA_SGR_AnnualShareholdersMeeting...finance36 The document summarizes The Shaw Group Inc.'s annual meeting for fiscal year 2008. It provides key financial results including record revenue, EBITDA, net income, and EPS. It also discusses major projects, growth in backlog to $15.6 billion, and guidance for fiscal year 2009 revenues of $7.1-7.3 billion and EPS of $2.50-2.70 per share.

credit suisse Presentation slides

credit suisse Presentation slidesQuarterlyEarningsReports2 Credit Suisse reported strong results for the first half of 2004, with net income of CHF 3.318 billion. Private banking saw continued growth in net new assets and corporate and retail banking benefited from gains on interest rate derivatives. Wealth and asset management performed well due to private equity gains and steady fees. While revenues declined at Credit Suisse First Boston, expenses were reduced in line. The outlook remains dependent on economic and market conditions.

credit-suisse Presentation slides

credit-suisse Presentation slidesQuarterlyEarningsReports2 Credit Suisse reported strong full-year 2004 results with net income of CHF 5.6 billion and return on equity of 15.9%. Private Banking achieved a 21% increase in net income driven by asset-driven revenue generation and efficiency improvements. Institutional Securities demonstrated an improvement over 2003 driven by higher trading results, gains on investments, lower provisions for credit losses and lower income tax expense. The strategic plan will fully integrate banking activities into three distinct lines of business over the next 18 months to 2 years.

3Q07 Presentation

3Q07 PresentationParaná Banco The document presents results for the 3rd quarter of 2007 for a Brazilian bank. It summarizes key operational and financial highlights including:

- Originations increased 61.9% year-over-year while loan assignments to funds decreased 51.7%

- Total assets grew 102% to R$1.79 billion while equity increased 276% to R$781.24 million

- Net income increased 174% to R$21.38 billion compared to the prior year

- The credit portfolio grew 16% to R$1.08 billion including loans assigned to funds

- Franchise expansion became a new sales channel with over 50 units operating by the end of the quarter

.credit-suisse - Presentation

.credit-suisse - PresentationQuarterlyEarningsReports2 The document summarizes Credit Suisse's financial results for the first quarter of 2003. Key points include:

- Credit Suisse reported a net profit of CHF 652 million, compared to a net loss of CHF 950 million in the previous quarter.

- Credit Suisse Financial Services saw a net profit increase of 13% compared to the first quarter of 2002, driven by improved results across all business segments.

- Credit Suisse First Boston returned to profitability with a net operating profit of USD 292 million, up from USD 11 million the previous quarter, due to higher fixed income revenues and lower credit provisions.

credit-suisse Presentation slides

credit-suisse Presentation slidesQuarterlyEarningsReports2 The document provides Credit Suisse's second quarter 2008 results. It discusses solid profits despite difficult market conditions. All three divisions - Private Banking, Investment Banking, and Asset Management - were profitable in the quarter. Private Banking saw strong asset inflows while Investment Banking had immaterial writedowns. Credit Suisse maintained a strong capital position with a Basel II Tier 1 ratio of 10.2%. The document also provides updates on Credit Suisse's exposures and risk management across various business sectors.

credit suisse Presentation slides

credit suisse Presentation slidesQuarterlyEarningsReports2 Credit Suisse reported quarterly and year-to-date results for 2004. Net income for the third quarter was CHF 1,351 million, down 7% from the previous quarter. Several business divisions saw lower results due to reduced client activity and challenging market conditions. However, fixed income trading rebounded at Institutional Securities. Credit Suisse maintained strong capital ratios and continued favorable credit trends across its businesses.

Abengoa full 2011

Abengoa full 2011Frank Ragol Abengoa presented its 2011 earnings and provided an outlook for 2012. Key highlights included:

- Revenues increased 46% to 7,089 million euros and EBITDA grew 36% to 1,103 million euros in 2011.

- The company's backlog remained strong at 7.5 billion euros at the end of 2011.

- Abengoa is diversifying its business across regions and sectors through new projects in the solar, transmission, and water industries.

- The company aims to further reduce debt and continue growing through international expansion in 2012.

Santander Bank Annual Report 2011

Santander Bank Annual Report 2011 BANCO SANTANDER This annual report provides key figures and financial information for Grupo Santander for 2011. Some highlights include:

- Total assets increased 2.8% to €1,251,525 million

- Customer loans grew 3.6% to €750,100 million

- Attributable profit to the Group decreased 34.6% to €5,351 million

- The efficiency ratio improved to 44.9% from 43.3% the prior year

- Capital ratios like Core capital and Tier 1 both increased, with Core capital at 10.02%

citigroup October 16, 2008 - Third Quarter Press Release

citigroup October 16, 2008 - Third Quarter Press ReleaseQuarterlyEarningsReports Citigroup reported financial results for the third quarter of 2008. Net income decreased significantly compared to the third quarter of 2007, dropping from $2.2 billion to a $2.8 billion loss. Total revenues declined 23% versus the prior year. The provision for loan losses increased 86% to $9.1 billion due to higher credit costs. Expenses rose modestly while assets and loans declined year-over-year. Overall, Citigroup experienced weak results across business segments as the financial crisis impacted performance.

Ebay 2008 Q4 results

Ebay 2008 Q4 resultsearningsreport Q4 2008 financial results were down year-over-year due to difficult economic conditions. Revenue declined 7% to $2.04 billion, while EPS fell 9% to $0.41 per share. Free cash flow remained strong at $525 million. Marketplaces revenue declined 10% to $1.27 billion due to weaker global transaction volumes. PayPal revenue grew 11% to $623 million while total payment volume increased 14% to $16 billion. The company delivered solid results despite challenges in the global economy.

citigroup Financial Supplement July 18, 2008 - Second Quarter

citigroup Financial Supplement July 18, 2008 - Second QuarterQuarterlyEarningsReports - Citigroup reported a net loss of $2.5 billion in 2Q08, compared to net income of $6.2 billion in 2Q07, as revenues declined 29% while credit costs rose.

- Total revenues were $18.7 billion in 2Q08, down 29% from 2Q07, as non-interest revenues fell 71% due to losses in principal transactions and lower commissions and fees.

- Provisions for credit losses and benefits and claims increased to $7.2 billion in 2Q08 from $2.7 billion in 2Q07, driven by higher loan loss provisions.

- All business segments except Latin America reported lower net income, with Global Cards down

credit-suisse Presentation slides

credit-suisse Presentation slidesQuarterlyEarningsReports2 Credit Suisse reported strong results for the second quarter of 2006, with pre-tax income up 98% and net income up 68% compared to the previous year. Several business segments saw record results, including Investment Banking's combined underwriting and advisory revenues. Private Banking also had its best ever quarter for net new assets. Asset Management registered strong net new asset inflows while undergoing a realignment that included one-time costs. Overall, the results demonstrated continued progress in integrating the bank.

credit-suisse investors doc csg 3q2008

credit-suisse investors doc csg 3q2008QuarterlyEarningsReports2 Credit Suisse reported a loss in its third quarter 2008 results, driven by significant writedowns in its Investment Bank division. The Investment Bank suffered losses of CHF 3.2 billion due to writedowns of CHF 2.4 billion on exposures to leveraged finance, structured products and commercial mortgages. Trading losses were also incurred due to adverse market conditions in September. However, Credit Suisse's Wealth Management and Corporate and Retail Banking divisions performed resiliently. Credit Suisse also maintained a strong capital position and continued reducing risk exposures in challenging market conditions.

Electrolux Interim Report Q4 2010

Electrolux Interim Report Q4 2010 Electrolux Group Highlights of the fourth quarter of 2010. Net sales amounted to SEK 27,556m (28,215) and income for the period was SEK 677m (664), or SEK 2.38 (2.34) per share. Net sales increased by 1.6% in comparable currencies.

AREVA, Business & strategy overview - Appendix 1 - November 2009

AREVA, Business & strategy overview - Appendix 1 - November 2009AREVA The document provides an overview of AREVA's business and strategy. It includes financial data for 2008 and the first half of 2009, including revenue, operating income, net income, cash flow, debt, and key figures by business division. Performance declined in 2009 due to lower revenue and additional provisions for the OL3 project.

AREVA, Business & Strategy Overview - Appendix 1 - Novembre 2009

AREVA, Business & Strategy Overview - Appendix 1 - Novembre 2009AREVA The document provides an overview of AREVA's business and strategy as of November 2009. It includes key financial data for 2008 and the first half of 2009, including revenue, operating income, net income, cash flow, and debt. It also provides business details and outlook for AREVA's nuclear and renewable divisions. Financial results are reported by division and highlights include a 21% increase in backlog from 2008 to 2009 and a decline in net income attributable to equity holders.

More from earningreport earningreport (20)

Q3 Earning report of Daimler AG

Q3 Earning report of Daimler AGearningreport earningreport Daimler reported its Q3 2009 results, with the automotive market continuing to experience a slump. Key points include:

- Group sales were €19.3 billion in Q3, with an EBIT of €0.5 billion excluding special items.

- Mercedes-Benz Cars achieved a positive EBIT of €355 million in Q3 due to the availability of new models and cost measures.

- Daimler Trucks reported an EBIT loss of €127 million in Q3 due to weak demand and charges from repositioning.

- Daimler aims to further improve earnings in Q4 through new models and ongoing efficiency programs.

Q3 Earning Report of BB&T Corporation

Q3 Earning Report of BB&T Corporationearningreport earningreport A. Schulman reported fiscal fourth-quarter and full-year 2009 results, with strong margins and excellent liquidity. For the quarter, gross margins reached 16.3% compared to 12.1% last year. North America approached break-even despite lower volumes. Cash on hand exceeded $228 million with over $300 million available in credit lines. For the full year, net sales were $1.28 billion, down 35.5% from last year. Gross margins increased to 13.3% from 11.8% last year, and income from continuing operations was $11.2 million.

Q3 Earning Report of BB&T Corporation

Q3 Earning Report of BB&T Corporationearningreport earningreport BB&T Corporation presented its fourth quarter 2009 investor presentation. The presentation highlighted BB&T's strategic acquisition of Colonial Bank, which enhanced its franchise in key Southeastern markets. The Colonial transaction was deemed financially attractive and expected to be accretive to earnings, exceeding BB&T's merger criteria. BB&T has a proven track record of successfully integrating acquisitions and anticipated achieving annual cost savings of $170 million from the Colonial deal.

Q3 2009 Earning Report of Brown & Brown

Q3 2009 Earning Report of Brown & Brownearningreport earningreport Brown & Brown Inc. reported a 1% increase in net income for the third quarter of 2009 compared to the same period in 2008. Total revenue decreased 1% for the quarter. Net income for the first nine months of 2009 was up slightly compared to the same period last year, while total revenue increased slightly. The company stated that results reflected a challenging operating environment with declines in insurable exposure units and soft market rates.

Q3 2009 Earning Report of Boston Scientific Corporation

Q3 2009 Earning Report of Boston Scientific Corporationearningreport earningreport Boston Scientific reported financial results for the third quarter of 2009. Net sales increased 3% to $2.025 billion and adjusted EPS was $0.19. Reported GAAP EPS was $0.13. The company maintained its leadership in the worldwide DES market with a 41% share. Worldwide CRM product sales increased 8% and Endosurgery sales increased 8%. Guidance for Q4 2009 estimates net sales of $2.025-$2.125 billion and adjusted EPS of $0.17-$0.21. Full year 2009 guidance estimates net sales of $8.134-$8.234 billion and adjusted EPS of $0.75-$0.79.

Q3 2009 Earning Report of Boston Scientific Corporation

Q3 2009 Earning Report of Boston Scientific Corporationearningreport earningreport Boston Scientific reported financial results for the third quarter of 2009. Net sales increased 3% to $2.025 billion and adjusted EPS was $0.19. Reported GAAP EPS was $0.13. The company maintained its leadership in the worldwide DES market with a 41% share. Worldwide CRM product sales increased 8% and Endosurgery sales increased 8%. Guidance for Q4 2009 estimates net sales of $2.025-$2.125 billion and adjusted EPS of $0.17-$0.21. Full year 2009 guidance estimates net sales of $8.134-$8.234 billion and adjusted EPS of $0.75-$0.79.

Q3 2009 Earning Report of Atheros Communications, Inc.

Q3 2009 Earning Report of Atheros Communications, Inc.earningreport earningreport This document is Atheros Communications' quarterly report filed with the SEC for the quarter ended September 30, 2009. It includes Atheros' condensed consolidated financial statements, with assets of $676 million and liabilities of $103 million. It also provides management's discussion of the company's financial condition and operating results, and discusses risks including the economic downturn and competition in the wireless LAN market. The report includes certifications of the CEO and CFO regarding financial controls.

Q3 2009 Earning Report of Apple Inc.

Q3 2009 Earning Report of Apple Inc.earningreport earningreport - The document is Apple Inc.'s Form 10-Q quarterly report filed with the SEC for the quarter ended June 27, 2009.

- It provides Apple's condensed consolidated financial statements and notes to the financial statements for the quarter.

- The financial statements show that Apple's net sales increased 12% to $8.3 billion for the quarter compared to $7.5 billion in the same quarter the previous year, while net income increased 15% to $1.2 billion from $1.1 billion.

Q3 2009 Earning Report of Hancock Holding Company

Q3 2009 Earning Report of Hancock Holding Companyearningreport earningreport Hancock Holding Company announced its financial results for the third quarter of 2009. Net income increased 10.7% from the previous quarter to $15.2 million. Key factors were lower loan loss provisions and an expanded net interest margin. Non-performing assets rose slightly while net charge-offs decreased. Total assets declined 3.4% but the company remained well capitalized, with tangible equity ratio rising to 8.71%.

Q3 2009 Earning Report of Walgreen Co.

Q3 2009 Earning Report of Walgreen Co.earningreport earningreport This document provides an agenda and highlights for Walgreen Co.'s 4th quarter and fiscal year 2009 conference call with investors. It includes introductions, a discussion of 4Q and FY performance and strategies, financial results, and a Q&A session. Key metrics highlighted are 7.6% sales growth and a 1.5% decline in net earnings for 4Q, and 7.3% sales growth and a 7% decline in net earnings for FY2009. The document also outlines Walgreen's strategies around healthcare reform, the flu season, and expanding their business model.

Q3 2009 Earning Report of Infosys Technologies Ltd.

Q3 2009 Earning Report of Infosys Technologies Ltd.earningreport earningreport 1) Infosys Technologies reported financial results for the quarter ending September 30, 2009, with revenues of $1.154 billion, a 5.1% decline from the previous year. Net income was $317 million, a 0.9% decline.

2) For the quarter ending December 31, 2009, Infosys expects revenues between $1.155-1.165 billion, a 1.4-0.5% decline from the previous year, and earnings per share of $0.50, a 13.8% decline.

3) For the full fiscal year ending March 31, 2010, Infosys expects revenues between $4.60-4.62 billion, a 1

Q3 2009 Earning Report of Marriott International

Q3 2009 Earning Report of Marriott Internationalearningreport earningreport Marriott International reported financial results for the third quarter of 2009. Key highlights include:

- Revenue declined to $2.5 billion compared to $3 billion in Q3 2008 due to weaker demand.

- Net income declined 57% to $53 million compared to the prior year.

- REVPAR declined 23.5% worldwide and 20.6% in North America.

- The company added 79 new properties and expects to open over 33,000 new rooms in 2009.

Q3 2009 Earning Report of PepsiCo.

Q3 2009 Earning Report of PepsiCo.earningreport earningreport PepsiCo held its 2009 Q3 earnings call on October 8, 2009. In the call, PepsiCo reaffirmed its guidance for 2009 of mid-to-high single digit constant currency net revenue and core EPS growth. PepsiCo also set a 2010 target of 11-13% core constant currency EPS growth, assuming the closing of acquisitions of PBG and PAS in early 2010. PepsiCo reported 5% constant currency net revenue growth and 8% core constant currency EPS growth in Q3 2009. PepsiCo highlighted investments planned for 2010 in areas such as R&D, emerging markets, brands, IT infrastructure, sustainability, and developing its employees.

Q3 2009 Earning Report of Alcoa, Inc.

Q3 2009 Earning Report of Alcoa, Inc.earningreport earningreport - Alcoa held its 3rd quarter 2009 earnings conference call on October 7, 2009

- The call discussed Alcoa's financial results for the 3rd quarter of 2009 as well as the current state and outlook of the aluminum market

- Key highlights included income from continuing operations of $73 million, revenue up 9% sequentially, and initiatives offsetting currency and energy headwinds

Q3 2009 Earning Report of Pepsi Bottling Group

Q3 2009 Earning Report of Pepsi Bottling Groupearningreport earningreport The Pepsi Bottling Group reported third quarter 2009 results. Comparable diluted EPS was $1.06 and reported diluted EPS was $1.14. Currency neutral operating income grew 10% compared to the prior year on a comparable basis, while reported operating income declined 4% due to foreign exchange impacts. The company remains on track to achieve full-year 2009 guidance of $2.30-$2.40 diluted EPS at the high end of the range and has raised operating free cash flow guidance to approximately $550 million.

Q3 2009 Earning Report of Jean Coutu Group

Q3 2009 Earning Report of Jean Coutu Groupearningreport earningreport - Jean Coutu Group reported an increase in sales and revenues for the second quarter of 2010 compared to the same period last year. Total sales increased 7.7% to $549 million while revenues from franchising increased 7.3% to $608.7 million.

- Net earnings for the quarter were $14.9 million compared to a net loss of $39.1 million in the previous year. Earnings per share were $0.07 compared to a loss per share of $0.16 last year.

- Rite Aid also reported financial results for the second quarter, with revenues of $6.3 billion and a net loss of $116 million. Rite Aid revised its guidance

Q3 2009 Earning Report of Minerva plc

Q3 2009 Earning Report of Minerva plcearningreport earningreport Minerva plc presented preliminary results for the year ended 30 June 2009. Key points included successfully restructuring and extending £750 million in loan facilities with no scheduled maturities in the current or next fiscal year. Development projects such as The Walbrook and St. Botolphs were on time and on budget. Tenant interest was improving for office developments in London's financial district despite a difficult real estate market.

Q3 2009 Earning Report of Worthington Industries, Inc.

Q3 2009 Earning Report of Worthington Industries, Inc.earningreport earningreport This document is Worthington Industries' quarterly report filed with the SEC for the quarter ended August 31, 2009. It includes financial statements and notes for the quarter, as well as a discussion of financial results by management. Some key details include:

- Net sales for the quarter were $417.5 million, down from $913.2 million in the prior year quarter. The company reported a net loss of $4.5 million compared to net income of $79.7 million in the previous year.

- Inventories totaled $232.9 million as of August 31, 2009, down from $270.6 million as of May 31, 2009 as the company worked to reduce inventory levels.

Q3 2009 Earning Report of Walgreen

Q3 2009 Earning Report of Walgreenearningreport earningreport The document provides the agenda and highlights from Walgreen Co.'s 4th quarter and fiscal year 2009 conference call with analysts held on September 29, 2009. It discusses 4th quarter and fiscal year financial results including net sales growth of 7.6% and 7.3% respectively, adjusted earnings per share of $0.44 and $2.02, and prescription sales growth. The document also summarizes Walgreen's strategies around healthcare reform, the H1N1 flu pandemic, expanding health services and 90-day prescriptions to lower costs.

Recently uploaded (20)

Macroeconomic outlook 2025 - 2026 GET_UKR_FS_01_2025.pdf

Macroeconomic outlook 2025 - 2026 GET_UKR_FS_01_2025.pdfІнститут економічних досліджень та політичних консультацій Macroeconomic outlook

2025 - 2026

Strategic Resources March 2025 Corporate Presentation

Strategic Resources March 2025 Corporate PresentationAdnet Communications Strategic Resources March 2025 Corporate Presentation

Business Growth Analysis - Tata Consultancy Services | NSE:TCS | FY2024

Business Growth Analysis - Tata Consultancy Services | NSE:TCS | FY2024Business Analysis Qualitative Fundamental Analysis of Tata Consultancy Services (NSE:TCS) based on company's Annual Report of FY2024.

Get a sense of the potential growth that TCS can achieve in medium to long term. By understanding its values, business and plan (strategies & opportunities).

YouTube video: https://youtu.be/5Y_jk4tYgG8

--

Disclaimer:

We are not SEBI RIAs. This presentation is not an investment advice. It is only for study and reference purposes.

Exports fell by 8% yoy in January due to declining agricultural stocks. Forei...

Exports fell by 8% yoy in January due to declining agricultural stocks. Forei...Інститут економічних досліджень та політичних консультацій The Monitoring presents the analysis of Ukraine's exports and imports, key trends, and business impediments. In December 2024, exports increased by only 2% yoy, while in January 2025, they fell by 8% yoy due to declining agricultural stocks. The physical volumes of wheat, corn, and sunflower oil exports continue to decline, although export prices remain relatively high.

The Monitoring also includes an analysis of key impediments for exporters, such as labor shortages, rising raw material costs, and the impact of the energy situation. Special attention is given to the Comprehensive Economic Partnership between Ukraine and the UAE, which grants duty-free access for 96.6% of Ukrainian goods.

More details are available on the website.

Biography and Professional Career of Drew Doscher

Biography and Professional Career of Drew DoscherDrew Doscher Drew Doscher has demonstrated financial acumen and upheld a substantial ethical standard, earning him the reputation of “honest guy in a dishonest business.” His transparent dealings and leadership during crises, such as the Barclays-Lehman merger, have only bolstered his standing in the finance community.

Business Analysis - Suzlon Energy | NSE:SUZLON | FY2024

Business Analysis - Suzlon Energy | NSE:SUZLON | FY2024Business Analysis Qualitative Fundamental Analysis of Suzlon Energy share for future growth potential (based on the Annual Report FY2024)

Get a sense of the Suzlon Energy's business activities, by understanding its values, business and risks.

YouTube video: https://youtu.be/_b9Km8N3Y4I

--

Disclaimer:

We are not SEBI RIAs. This presentation is not an investment advice. It is only for study and reference purposes.

THSYU Launches Innovative Cryptocurrency Platform: A New Era of Secure and Ef...

THSYU Launches Innovative Cryptocurrency Platform: A New Era of Secure and Ef...Google THSYU, a trailblazer in the global cryptocurrency trading landscape, is thrilled to announce the launch of its cutting-edge trading platform. This innovative platform is meticulously designed to provide secure, efficient, and user-friendly trading solutions. With this development, THSYU solidifies its position in the competitive cryptocurrency market while demonstrating its commitment to leveraging advanced technology for the protection of user assets.

NITI AAYOG: INDIA'S POLICY THINK TANK

NITI AAYOG: INDIA'S POLICY THINK TANKSunita C This PowerPoint presentation provides a comprehensive overview of NITI Aayog, covering its structure, objectives, key functions, major initiatives, and future outlook. It also compares NITI Aayog with the Planning Commission, discusses challenges, and highlights its role in India's policy-making landscape. Ideal for academic, research, and policy discussions.

APMC and E-NAM: Transforming Agricultural Markets in India

APMC and E-NAM: Transforming Agricultural Markets in IndiaSunita C This presentation explores the Agricultural Produce Market Committees (APMCs) and the Electronic National Agriculture Market (e-NAM), highlighting their role in improving market efficiency, price discovery, farmer empowerment, and challenges in agricultural trade and supply chain management.

SSON Report Webinar Recap - Auxis Webinar

SSON Report Webinar Recap - Auxis WebinarAuxis Consulting & Outsourcing SSON Report Webinar Recap.pdf

Economic Revitalization for Pakistan: An Overview

Economic Revitalization for Pakistan: An OverviewVaqar Ahmed The "Draft Economic Agenda 2018" by SDPI outlined a framework for Pakistan's economic revitalisation, addressing deep-rooted structural issues.

The project work highlighted the country's persistent challenges: low productivity, inequitable distribution of wealth, environmental degradation, and a narrow tax base. It critiqued the prevailing growth model, which it argued has exacerbated inequalities and neglected human development.

The agenda advocated for a paradigm shift, emphasizing:

• Inclusive Growth: Prioritizing job creation, poverty reduction, and equitable access to resources, particularly for marginalized groups.

• Sustainable Development: Integrating environmental considerations into economic planning, promoting renewable energy, and addressing climate change impacts.

• Industrial Diversification: Moving away from reliance on traditional sectors, fostering innovation, and promoting value-added manufacturing.

• Human Capital Development: Investing in education, healthcare, and skills training to enhance productivity and competitiveness.

• Fiscal Reforms: Expanding the tax base, improving tax administration, and reducing reliance on external debt.

• Agricultural Transformation: Promoting sustainable agriculture, improving land management, and enhancing food security.

• Energy Security: Diversifying energy sources, promoting renewable energy, and improving energy efficiency.

• Regional Cooperation: Strengthening trade and economic ties with neighboring countries.

• Governance Reforms: Enhancing transparency, accountability, and citizen participation in economic decision-making.

The agenda proposed specific policy recommendations, including:

• Targeted investments in infrastructure, education, and healthcare.

• Incentives for small and medium enterprises (SMEs).

• Reforms to improve the ease of doing business.

• Measures to promote financial inclusion.

• Policies to address climate change and environmental degradation.

PFMS Public Finance Management System Presentation Dr. Konka BAMU

PFMS Public Finance Management System Presentation Dr. Konka BAMUPrakash Konka National Service Scheme Transaction on PFMS Portal

Macroeconomic outlook 2025 - 2026 GET_UKR_FS_01_2025.pdf

Macroeconomic outlook 2025 - 2026 GET_UKR_FS_01_2025.pdfІнститут економічних досліджень та політичних консультацій

Exports fell by 8% yoy in January due to declining agricultural stocks. Forei...

Exports fell by 8% yoy in January due to declining agricultural stocks. Forei...Інститут економічних досліджень та політичних консультацій