QIB Q2 2021: Investment Funds

- 1. Q2 Quarterly Investment Briefing Investment Funds Thursday 24th June #QIBriefing

- 2. QIB Guiding Principles Those who attend the Quarterly Investment Briefing share three common principles: • Whoever attends is an active or potentially active investor, or manager of investors – or enabler of investment activity. • Whatever is presented is informative, fact-based and regionally relevant. • We value the opportunity to learn equally with the opportunity to share.

- 3. Positive News $75m from Series C funding Insight Partners, Menlo Ventures, and Citi Ventures. Existing investor Goldman Sachs Asset Management also participated. $123m in total, 200 ppl with joint HQ in Bristol and Boston £3.1m to keep data safe from the next generation of quantum-computing enabled hackers £3m series A funding to accelerate the growth and impact of the Neighbourly platform

- 5. Agenda 12:35 – 12:45 Welcome and scene setting 12:45 - 13:30 Lightning Talks + Matt Penneycard, Ada Ventures + Matt Hicks, Williams Advanced Engineering + Sam Olof, Science Creates Ventures 13:30 - 13:45 Beauhurst data & who’s raising 13:45 - 14:30 Networking - 4 minute conversations

- 6. Raised successfully in Q2 2021 (49) South West Immersive Labs Provides online training services for businesses, focusing on gamification to teach cyber security. SageTech Medical Equipment Develops technology that recycles anaesthetic agents to reduce their environmental and financial impacts Cushon Operates a comparison website that lists a number of investment funds and ISAs + Neighbourly + Argonaute RNA + Anaphite + Mami Wata International + Bedfolk + INSPHERE KETS Quantum Security Develops technology using quantum key distribution to increase digital security. Cloud8 Develops white-label employee benefits software for employee benefit consultants Hybrid News Owns and operates a number of digital media outlets aimed at young people considering attending university abroad. Cornish Lithium Explores the potential for lithium mining in Cornwall

- 11. We find extraordinary talent in places that others aren’t looking. To deliver extraordinary returns to our investors.

- 12. We have the biggest and most diverse VC scout network in the world. We find and win competitive opportunities because our mindset and values align with the founders of the future.

- 13. So who are we? ● Experienced VCs who understand how the industry works and how it needs to change. ● Equal partnership with a combined 20 years of venture experience, in the US and UK. ● Six years working together in partnership. ● 4.3x TVPI & 31.8% IRR jointly, taking companies from pre-seed to exit many times over. We are hungry, humble and honest. Check Warner Matt Penneycard

- 14. £600,000 Average cheque size %11 Average ownership 45.6% IRR 1.3x TVPI Tracking top quartile US (Cambridge Associates) Portfolio gender diversity in founding teams women 60% – men 40% Ada Ventures Fund I (2019) - £38m ($50m), the story so far

- 15. We identify and invest in paradigm shifts in customer behaviour, creating new category leaders in multiple sectors Change Change Change Inclusive, diverse society, embracing individual identity Exclusive, white, western orientated society Decentralised, increased agency and autonomy Top down, hierarchical and centralised institutions Stakeholder capitalism Shareholder capitalism The past The future Eg from Ada Fund I

- 16. Our strategy gives us flexibility to capture opportunity across pre-seed and seed Pre-seed cheque Ada Ventures cheque £350-750k Round size £500k-1.5m Pre-money £2-4m Round buys 20-25% Ada Ventures ownership 10-15% Runway 18 months Seed cheque Ada Ventures cheque £1-3m Round size £2-4m Pre-money £6-10m Round buys 20-25% Ada Ventures ownership 10-15% Runway 18 months Ada Ventures leads rounds in the following two types, depending on the company. We target 10-15% ownership in the pre-seed round and seed round. We reserve 50% for follow-on. Full model & portfolio construction available in dataroom.

- 17. “Check and Matt were the first VCs we ever met and have helped us immeasurably during the last three years since meeting them. All VCs will tell you they’re founder friendly, all will tell you they deliver value far beyond the cash, many will tell you that your interests align. In reality, if you’re lucky, your VCs will share your vision and not get in your way. The promises of value adds rarely materialising, the founder friendliness only going as far as market competitiveness demands and only until the next round and next set of negotiations. Ada are the exception. Not because they recognise that your success is ultimately the best way to guarantee their success, but (or so it appears to me) because they are driven first by a deep desire to always do the right thing. Rare in life, I will say no more than that it is no less rare among venture capitalists. It’s my suspicion that it is this palpable decency, apparent to anyone that spends any time with Check and Matt, along with intelligence, industriousness, discretion, imagination, and above all ambition, that has resulted in them punching way above their weight in their network of large later round VCs, and in weight these VCs clearly place on their recommendation (they have introduced us to each of our subsequent investors which they have hand-picked for us to maximise our chances of success). In short there are no more committed, better networked, ambitious, savvy VCs out there. If you’re an LP you should be investing in them, if you’re a founder you should only take another VCs funds if you can’t get Ada’s.” We build deep, trusted relationships with extraordinary founders Martin Bysh - CEO & Co-founder, Huboo

- 18. Our unfair sourcing & DD advantage: Ada Scouts Our scout network reaches 10,000 founders across the UK & Europe 100 scouts representing diverse communities 20 operator angels Ada core team of 4 Expert network Steering Group LPs . Plus scouts in Oslo, Berlin, New York and Bucharest A selection of Ada’s scouts & angels 20% of Fund I investments are scout sourced Arfah Farooq Muslamic Makers Ash Philips Diffrent Nicole Crentsil Black Girl Fest David Fisayo Foundervine / Wealth8 Anjel Noorbakhsh Ashman Iranian Women's Association Andy Ayim Angel Investing school Rockman Law Cyber security / Kick Start Global Beth Glenfield Women Who Code, Belfast Esther Akpovi Gen Z/ Nottingham Luciana Carvalho Se LBTQ+ / VR/ AR Lubomila Jordanova Greentech Alliance

- 19. Our brand stands out and helps us attract founders, co-invest with the best & win deals at the margins 15k+ social followers on owned channels Scouts & angels give us additional reach Regularly write for Co-founder of Number 1 Diversity & Inclusion Organisation in Europe Featured on podcasts & in news Tier One Co-investors in Fund I. Leaders in Impact, D&I & Mental Health NPS of 95

- 20. Arlan Hamilton Founder, Backstage Capital Niklas Zennstrom Co-founder of Skype / Atomico Janne, Ilkke, Mikko Co-founders, Supercell Dame Cilla Snowball Ex-Group CEO AMV BBDO Wellcome Trust Taavet Hinrikus CEO TransferWise A selection of Ada’s Fund I LPs A selection of Ada’s expert network Gareth Nettleton CMO, Strava Alice Newton-Rex Product Lead Whatsapp, ex-CPO WorldRemit Our LPs and expert network comprises leaders from global tech Patrick Pichette ex-CFO, Google, Partner, Inovia Capital

- 21. Michelle Ashworth Head of Venture, Church Commissioners, Adviser, CDC Knightsbridge Advisers Marta Sjögren Ex-Partner Northzone Founder, Stealth Climate Co Charles Hudson Partner Precursor Ventures 15 years in VC Ed Zimmerman Partner Chair, Tech Group, Lowenstein Sandler LP in 150 VC funds, Angel in 150 startups across US, Europe, Africa Adj Prof Columbia Biz Portfolio Strategy Ser. A & Nordics San Francisco NYC We are supported by a diverse steering group

- 22. Some of our current portfolio

- 23. Thank You x

- 24. Matt Hicks Research Analyst Williams Advanced Engineering @WilliamsAdvEng

- 25. DRAFT FORESIGHT WILLIAMS TECHNOLOGY FUNDS June 2021 Quarterly Investment Briefing MATT HICKS Confidential

- 26. DRAFT

- 27. | 27

- 28. | 28 World leading technology and engineering service operation Relish solving the most difficult applied engineering challenges Established 2010 Spun out of Williams F1 Now independent HQ at Williams Campus in Oxfordshire 300 staff covering a range of disciplines

- 30. | Williams value add Disruptive and defensible technology Strong team with roadmap to commercialisation Large obtainable market £0.5-2.5m initial investments targeting potential for 10x return Strategy focused on early-stage hardware technology and industrial software 30

- 31. |

- 32. |

- 33. |

- 34. For further information, please contact: e: matthew.hicks@wae.com w: https://www.foresightwilliams.co.uk/

- 35. Sam Olof General Partner Science Creates Ventures @SCVDeeptech

- 48. Identifies 499 companies that have received Equity Investment in West of England

- 51. Total amount raised West of England Q1 -> Q2

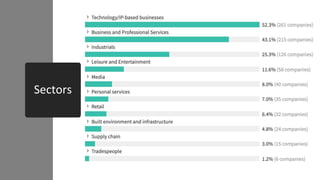

- 52. Sectors

- 53. Top Funders by number of fundraising

- 54. Top funders by value of fundraising

- 55. Raising equity funding Q1 2021 The activities of the Investment Activator Programme (and specifically the Silicon Gorge Pitch Competition, Quarterly Investment Briefing and Pitch Me events) do not give advice on the risks of investment and are not authorised to carry on investment business under the Financial Services and Markets Act 2000 (‘the Act’). Before investing in a project about which information is provided herein, potential investors are strongly recommended to take advice from a person authorised under the Act who specialises in advising on investments of this nature. Opportunities showcased here have been reviewed and selected NOT verified. An open call to anyone, not vetted or reviewed. 13 £4.7m Companies In total

- 56. Raising Q2 2021 – an open call £500k + Persona Education £500k Tackling the teenager wellbeing crisis with personality insights based social-emotional life skills e-learning for schools. Data Cubed £500k myDATA3 - the all-in-one-place business dashboard The activities of the Investment Activator Programme (and specifically the Silicon Gorge Pitch Competition, Quarterly Investment Briefing and Pitch Me events) do not give advice on the risks of investment and are not authorised to carry on investment business under the Financial Services and Markets Act 2000 (‘the Act’). Before investing in a project about which information is provided herein, potential investors are strongly recommended to take advice from a person authorised under the Act who specialises in advising on investments of this nature. Opportunities showcased here have been reviewed and selected NOT verified. LatchAid £500k Award-winning Femtech start-up using cutting-edge 3D technology and AI to support women through their breastfeeding and motherhood Service Robotics £600k GenieConnect® enables extended independent living for older adults receiving domiciliary care.

- 57. Raising Q2 2021 – an open call £300k+ Stratiphy £400k We're the world's first app to offer sustainable investment strategies. . Liketobe Ltd £350k Building an employer and provider network which helps them become more accessible digitally for both students and adults alike. The activities of the Investment Activator Programme (and specifically the Silicon Gorge Pitch Competition, Quarterly Investment Briefing and Pitch Me events) do not give advice on the risks of investment and are not authorised to carry on investment business under the Financial Services and Markets Act 2000 (‘the Act’). Before investing in a project about which information is provided herein, potential investors are strongly recommended to take advice from a person authorised under the Act who specialises in advising on investments of this nature. Opportunities showcased here have been reviewed and selected NOT verified. Vizniti Solutions £280k Solving current cloud platform challenges such as availability and security and enabling businesses to build their private cloud My Pet Partnership £300k Develops software to reduce costs and improve the quality, accessibility and affordability of veterinary healthcare. Greener Hours £300k A 'behaviour-first' solution to carbon reduction that educates, encourages and rewards people to use residential energy when it’s clean. Good with £300k Personalised Financial Education Virtual Assistant driven by innovative use of Financial Data.

- 58. Raising Q2 2021 – an open call £175k+ Ferryx £270k Innovative bacterial products for the treatment and prevention of gastrointestinal inflammation in people and animals. The activities of the Investment Activator Programme (and specifically the Silicon Gorge Pitch Competition, Quarterly Investment Briefing and Pitch Me events) do not give advice on the risks of investment and are not authorised to carry on investment business under the Financial Services and Markets Act 2000 (‘the Act’). Before investing in a project about which information is provided herein, potential investors are strongly recommended to take advice from a person authorised under the Act who specialises in advising on investments of this nature. Opportunities showcased here have been reviewed and selected NOT verified. Neuron Innovations Ltd £250k Provides revenue incentives to infrastructure operators to deploy 3rd party ground-based surveillance sensors. Internet Speed Monitor £175k Convenient physical device and cloud platform that helps consumers reclaim control of their internet service.

- 59. Review company investment summaries here: https://platform.investwest.online/groups/qib/signup/investor

- 60. Quarterly Investment Briefing For your diary: Thursday 23 September 12:30 People Powered Investment