Ratio analysis Accounting Help

- 1. Who is interested in company’s Annual Accounts? Who? Why? What do they want to know? 1) Shareholders 2) ? 3) ? Name 10 altogether!

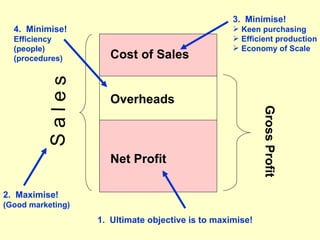

- 3. Cost of Sales Sales Overheads Gross Profit Net Profit

- 4. Sales = £1000 C.O.S. Sales = COS + O’Heads £400 + N. Profit Overheads G. Profit = O’Heads £300 + N. Profit Net Profit £300

- 5. Sales = £225m C.O.S. £153m Gross Profit Gross Profit % £72m 72 x 100 = 32% 225

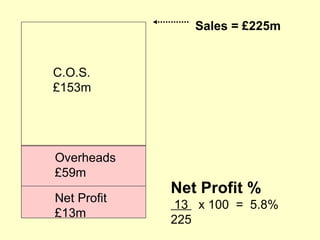

- 6. Sales = £225m C.O.S. £153m Overheads £59m Net Profit % Net Profit 13 x 100 = 5.8% £13m 225

- 7. Sales = £225m C.O.S. £153m Overheads Expenses/Sales % £59m 59 x 100 = 26.2% 225 Net Profit £13m

- 8. Note GP% = NP% + Expenses/Sales% 32% = 26.2% + 5.8% Bigger Expenses means smaller NP GP% indicates how well COS being controlled NP% indicates how well Expenses being controlled

- 9. 3. Minimise! 4. Minimise! Keen purchasing Efficiency Efficient production (people) Economy of Scale (procedures) Sales Cost of Sales Overheads Gross Profit Net Profit 2. Maximise! (Good marketing) 1. Ultimate objective is to maximise!

- 10. 25% SELLING MARK PRICE UP £1-25 MARGIN 20% COST (to us) £1-00 Mark Up = “Gross Profit” as a % of Cost Margin = “Gross Profit” as a % of Selling Price

- 11. Answering Ratio Questions in exam 1) Write formula 2) Do calculation 3) Is bigger or smaller better? (If you are comparing ratios…) 4) Which ratio is better? Last year’s ratio or this year’s? Company A or company B? 5) What may have caused ratio to be good or bad? 6) How to improve a poor ratio? 7) Can’t make final judgment if industry norms unknown