Rbi ppt

- 1. MONETARY POLICY 2011-12 Repo rate hiked by 50 bps from 6.75% to 7.25% Reverse Repo rate hiked by 50 bps from 5.75% to 6.25% (dependent variable on the Repo rate – 100 bps below the Repo rate) CRR kept unchanged at 6% SLR kept unchanged at 24% GDP growth projection for FY 2011-12 placed at around 8% (in the range of 7.4% and 8.5%)

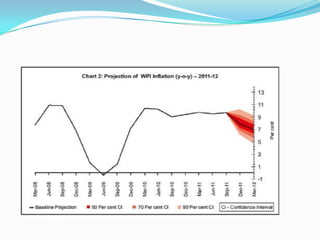

- 2. CONT- FY 2011-12 March end WPI inflation baseline projection placed at 6% with an upward bias M3 growth projected at 16%, deposit growth at 17% and non-food credit growth at 19% Bank rate kept unchanged at 6%. MSF introduced at 1% above the Repo rate (8.25%) LAF corridor width set at 200 bps (with base at reverse repo – 6.25% & ceiling at MSF – 8.25%) MP 2011-12.docx

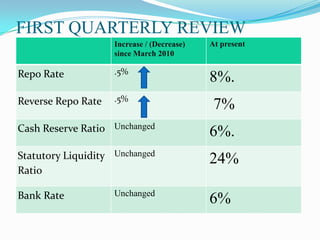

- 3. FIRST QUARTERLY REVIEW Increase / (Decrease) At present since March 2010 Repo Rate .5% 8%. Reverse Repo Rate .5% 7% Cash Reserve Ratio Unchanged 6%. Statutory Liquidity Unchanged 24% Ratio Bank Rate Unchanged 6%

- 4. KEY FEATURES GDP growth projection for FY 2011-12 kept unchanged at around 8% Inflation projection for March end FY 2011-12 revised upwards to 7% from 6%

- 5. SECOND QUARTERLY REVIEW Increase / (Decrease) At present Repo Rate .25% 8.5% Reverse Repo Rate .25%. 7.5% Cash Reserve Ratio Unchanged 6% Statutory Liquidity Unchanged 24% Ratio Bank Rate Unchanged 6%

- 6. KEY FEATURES RBI lowered the growth forecast for 2011-12 from 8% to 7.6% (in line with our expectations) Inflation forecast is kept at 7% by Mar-12 end. Money supply and Credit growth maintained at 15.5% and 18% respectively Depreciation of the rupee has emerged as another risk for inflation. Indian economy continued to face suppressed inflation as prices are administered in petroleum sector.

- 8. Increase / (Decrease) At present Repo Rate Unchanged 8.50% Reverse Repo Unchanged 7.50% Rate Cash Reserve .50% 5.50% Ratio Statutory Unchanged 24.00% Liquidity Ratio Bank Rate Unchanged 6.00%

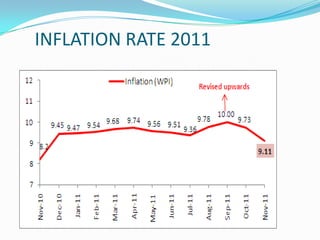

- 9. KEY FEATURES The drop in November 2011 WPI inflation to 9.11%, mainly due to softening in food inflation (4.35% for the week ended December 3, 2011) GDP growth rate has fallen to 6.9% from 7.7%(expected in Q2) Due to sharp moderation in industrial growth to -5.1% The fiscal deficit at 74.4% of budgeted 2011-12 was significantly higher than 42.6% in 2010-11

- 10. CONT- FDs (Fixed Deposits) are offering interest in the range of 7.25% - 9.40% p.a. Projection of GDP growth for 2011-12 is revised downwards from 7.6% to 7%. In reducing the CRR,INR 320 bn of primary liquidity will be injected into the banking system

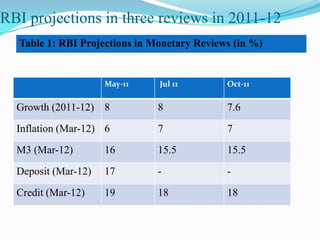

- 12. RBI projections in three reviews in 2011-12 Table 1: RBI Projections in Monetary Reviews (in %) May-11 Jul 11 Oct-11 Growth (2011-12) 8 8 7.6 Inflation (Mar-12) 6 7 7 M3 (Mar-12) 16 15.5 15.5 Deposit (Mar-12) 17 - - Credit (Mar-12) 19 18 18

- 14. PRESENTATION BY