Reserve Bank Of India : Role ,Functions Structure and Management

- 1. Financial Markets & Intermediaries Reserve Bank of India • Functions & Role • Organization • Management Presented By, Binto Mathachan

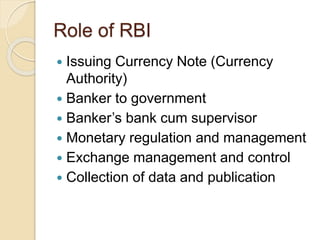

- 2. Role of RBI Issuing Currency Note (Currency Authority) Banker to government Banker’s bank cum supervisor Monetary regulation and management Exchange management and control Collection of data and publication

- 3. Reserve Bank Of India(RBI) Apex financial system of the nation’s monetary system RBI-India’s central bank-established 1st April 1935 under RBI Act 1934 Central office at Mumbai (Initially established in Kolkata) Present Governor Raghuram Govinda Rajan

- 4. Cntn Miscellaneous development & promotional activities Agricultural finance Industrial Finance Export Finance Credit Control function ◦ Qualitative Functions ◦ Quantitative Functions (Bank Rate , SLR,CRR etc.)

- 5. Main Functions of RBI RBI carries all typical functions along with variety of developmental and promotional functions to perform their roles To formulate ,implement and monitor monetary policy To setting up of parameters for banking operations To facilitate and promote orderly development of foreign exchange market in India To issue and exchange or destroy currency and coins not fit for circulation

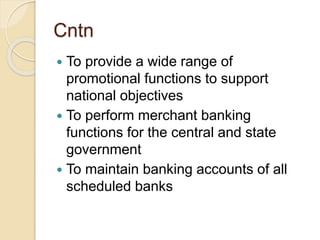

- 6. Cntn To provide a wide range of promotional functions to support national objectives To perform merchant banking functions for the central and state government To maintain banking accounts of all scheduled banks

- 7. Organizational Structure of RBI RBI is a corporate body , where Ministry of Finance owns directive rights . Managed by Central Board of Directors and four local boards of directors

- 8. Organizational Structure of RBI

- 9. Organization and Management of RBI Central Board – Appointed / Nominated by central government for a period of 4 years – Should meet at least 6 times in an year and once in 3 months Official Directors - Governor and not more than 4 deputy directors Non official Directors – 15 in number . Ten director from various fields and one government official are nominated by government and 4 directors from 4 local boards • Local Boards – 4 Local board region ( Mumbai, Kolkata, Chennai, New Delhi consist of 5 members appointed by central government for a period of 4 years

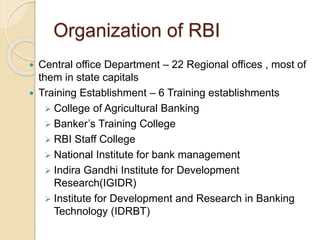

- 10. Organization of RBI Central office Department – 22 Regional offices , most of them in state capitals Training Establishment – 6 Training establishments College of Agricultural Banking Banker’s Training College RBI Staff College National Institute for bank management Indira Gandhi Institute for Development Research(IGIDR) Institute for Development and Research in Banking Technology (IDRBT)