Retail banking

- 1. Retail Banking Prepared by Mr. S. B. Bansode

- 2. Unit I History, Definition, Role within the banking operation, Distinction between Retail and Corporate/Wholesale Banking Deposits and types of accounts, Payments services, Bill Pay, EFT, VISA, Smart Payment etc Remittance Services Collection and Clearance services.

- 3. Bank • A bank is a financial institution licensed to collect deposits and give loans to the customer. • There are several types of banks including retail, wholesale, commercial, and investment banks. • In most countries, banks are regulated by the national government or central bank.

- 4. History & Growth of Banking System in India • The Indian Banking System traces sack its history to 1786. When the first bank in India (The General Bank of India) Was established. From that year till today the journey of growth of the Indian Banking system can be divided into three phases. – Phase I (Early Phase from 1786 to 1969 of Indian Banks) – Phase II (Nationalisation of Indian Banks and upto 1991 prior to Indian Banking Sector Reforms) – Phase III (New Phase of Indian Banking System with the advent of Indian Financial and Banking Sector Reform After 1991)

- 5. Phase I (Early Phase from 1786 to 1969 of Indian Banks) • In the mid of 19th Century, the East India Company established – Bank of Bengal in 1809. – Bank of Bombay in 1840. – Bank of Madras 1843. • These Banks were initially independent units and were referred as the Presidency Banks. These three banks were later merged in 1920 as Imperial Bank of India, which had European shareholders. • Later in following banks established – 1865 Allahabad Bank – 1894 Punjab National Bank – 1906-1913 Bank of India, Central Bank of India, Bank of Baroda, Canara Bank, Indian Bank, Bank of Mysore. – 1935 RESERVE BANK OF INDIA

- 6. Phase II (Nationalisation of Indian Banks and upto 1991 prior to Indian Banking Sector Reforms) • In 1949, Banking Regulation Act enacted • After independence the Imperial Bank of India was nationalized under the state Bank of India Act of 1955 and become known as the state Bank of India for handling Central and State Government Banking transaction and functioning as the principle agent of RBI. • In 1959, Seven Subsidiaries of SBI were also nationalised. • On the date 19th July,1969, 14 major banks were nationalised. • In 1971 Credit Guarantee Corporation was created • In 1975 Regional Rural Bank (RRB) introduced. • On the date 15th April, 1980, 6 Banks with deposit over 200 carores were nationalised. These Six Banks are Andhra Bank, Corporation Bank, New Bank of India, Oriented Bank of Commerce, Punjab and Sindh Bank, Vijaya Bank.

- 7. Phase III (New Phase of Indian Banking System with the advent of Indian Financial and Banking Sector Reform After 1991) • Prior 1991, all the banks were state owned. In 1991 government opened the gate of liberalisation of banking practices as per the report of a banking committee set up under the chairmanship of Mr. M. Narsaimham. • Later on the year 1993, the government merged New Bank of India With Punjab National Bank. It was the only merger between nationalised banks and resulted in the reduction of the number of nationalised banks from 20 to 19. • Till now banking industries has changed tremendously with Retail Banking, shifting the universal Banking. E Banking and has customer satisfaction as the highest priority.

- 8. Meaning of Retail Banking • Retail banking, also known as consumer banking or personal banking, is banking that provides financial services to individual consumers rather than businesses. • Retail banks can be local community banks or the divisions of large commercial banks. • Services offered include savings and checking accounts, mortgages, personal loans, debit or credit cards, and certificates of deposit (CDs). • In the digital age, many fintech companies can provide all of the same services as retail banks through Internet platforms and Smartphone apps. • While retail banking services are provided to individuals in the general public, corporate banking services are only provided to small or large companies and corporate bodies.

- 9. Definition of Retail Banking • “Retail banking is intended to help consumers manage their money by giving them access to basic banking services, a source of credit, and financial advice. The general public can access a variety of services through a retail bank, including checking and savings accounts, mortgages, credit cards, foreign currency and remittance services, and automobile financing.” • “Retail banking is typically mass – market banking where individual customers use local branches of larger commercial banks. Services offered include savings and checking accounts, mortgages, personal loans, debit cards, credit cards and so”.

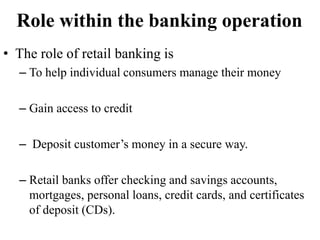

- 10. Role within the banking operation • The role of retail banking is – To help individual consumers manage their money – Gain access to credit – Deposit customer’s money in a secure way. – Retail banks offer checking and savings accounts, mortgages, personal loans, credit cards, and certificates of deposit (CDs).

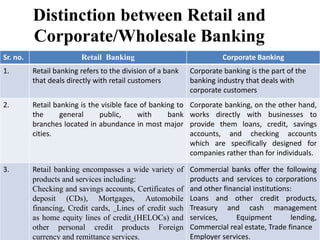

- 11. Distinction between Retail and Corporate/Wholesale Banking Sr. no. Retail Banking Corporate Banking 1. Retail banking refers to the division of a bank that deals directly with retail customers Corporate banking is the part of the banking industry that deals with corporate customers 2. Retail banking is the visible face of banking to the general public, with bank branches located in abundance in most major cities. Corporate banking, on the other hand, works directly with businesses to provide them loans, credit, savings accounts, and checking accounts which are specifically designed for companies rather than for individuals. 3. Retail banking encompasses a wide variety of products and services including: Checking and savings accounts, Certificates of deposit (CDs), Mortgages, Automobile financing, Credit cards, Lines of credit such as home equity lines of credit (HELOCs) and other personal credit products Foreign currency and remittance services. Commercial banks offer the following products and services to corporations and other financial institutions: Loans and other credit products, Treasury and cash management services, Equipment lending, Commercial real estate, Trade finance Employer services.

- 12. Sr. no. Retail Banking Corporate Banking 4. There are large volume of low transactions There are low volume of large transactions. 5. Take a fund from individual and invest it to small business It take a funds from large business and invest it back to business

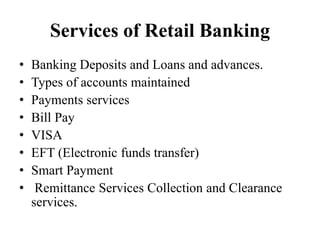

- 13. Services of Retail Banking • Banking Deposits and Loans and advances. • Types of accounts maintained • Payments services • Bill Pay • VISA • EFT (Electronic funds transfer) • Smart Payment • Remittance Services Collection and Clearance services.

- 14. Unit II Loans- Personal, Home, Vehicle, Education, Farm Equipment etc., Documentary Billing Collection Inter banking settlement for multiple accounts customers.

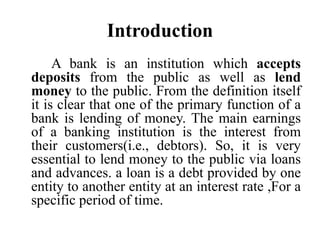

- 15. Introduction A bank is an institution which accepts deposits from the public as well as lend money to the public. From the definition itself it is clear that one of the primary function of a bank is lending of money. The main earnings of a banking institution is the interest from their customers(i.e., debtors). So, it is very essential to lend money to the public via loans and advances. a loan is a debt provided by one entity to another entity at an interest rate ,For a specific period of time.

- 16. Loans • A loan is the lending of money by one or more individuals, organizations, or other entities to other individuals, organizations • A loan is when money is given to another party in exchange for repayment of the loan principal amount plus interest. • PROCESS OF GRANTING A LOAN: – Loan application – Submission of Required documents – CIBIL check – Approval of loan • A loan may be secured by collateral such as a mortgage or it may be unsecured such as a credit card.

- 17. Types of Loan Bank Provides to Customers • Overdraft • Cash credit • Credit cards • Personal loan • Home loan • Vehicle loan • Education loan • Farm Equipment loan • Gold loan • Festival loans • Consumer loans • Gold loans • Loan against pension • Loans to doctors for Opening clinic

- 18. Personal Loan • Personal loans are loans that can be used to cover a number of personal expenses. • Personal loans can be secured, meaning you need collateral to borrow money, or unsecured, with no collateral needed. • Personal loans can vary greatly when it comes to their interest rates, fees, amounts, and repayment terms. • Personal loans are intended to meet any kind of personal expenses. The loan can be for any of the following purposes:- Family functions, Meeting travel expenses in India or abroad, Marriage expenses of children etc.

- 19. Home Loan • A house loan or home loan simply means a sum of money borrowed from a financial institution or bank to purchase a house. • Home loans consist of an adjustable or fixed interest rate and payment terms. • People generally take a home loan for either buying a house flat or a plot of land for construction of a house, or renovovation, extension and repairs to the existing house. • The property is mortgaged to the lender as a security till the repayment of the loan The bank or financial institution will hold the title or deed to the property till the loan has been paid back with the interest due for it. • There are also certain tax benefits available on your home loan under the Section 80EE of income tax act. However, the Income tax deduction can be claimed on home loaan interest by first time home buyers only.

- 20. Vehicle Loan • Vehicle loans particularly car loans are offered by all the banks in the country . the terms and conditions of vehicle loans vary from bank to bank . the purpose of vehicle loan is to finance for purchase of ; – a new car , bike , scooter , jeep or MUVs – a used car , bike , scooter , jeep (not more than 5 years old) – Take over of existing vehicle loan from other bank or financial institution.

- 21. Education Loan • The purpose of education loan is to provide better educational opportunity to bright and financially backward students and brings within their reach all types of education. • Education loans are provided for pursuing plus two, graduation courses, PG courses and other professional courses. • It can be availed for: – Tuition fees payable to college – Hostel fees – Examination/ library / laboratory fees – Purchase of books/equipment/instruments/uniforms – Travel expenses – Purchase of computer ,if it is necessary for completion of course. – Cost of two wheeler upto Rs 50,000

- 22. Farm Equipment Loan • It is always said that, most of the people India are depending agriculture or farming as their livelihood. So, it is very important to develop the rural sector. In order to fulfill that banks provides various credit facilities to the farmers. • The loans are provided for: – Purchase of asset like farm machinery, – bullocks, – Animals – Creation of assets such as poultry, dairy development etc. – For rural activities under agriculture, horticulture, plantation, animal husbandry fisheries etc.

- 23. Documentary Billing Collection Inter Banking Settlement for Multiple Accounts Customers • Documentary collection is method of trade finance in which an exporter's bank forwards documents to an importer's bank and collects payment for shipped goods. • Documentary collection is less common than advance cash payment and open account terms, particularly in countries with weak enforcement of contracts. • Documents against payment require the importer to pay the amount of the draft at sight. Documents against acceptance require payment by a specified date.

- 24. Unit III Forex and Trade Services: • Travelers Cheques • Foreign Currency Cash/Drafts • NRI Bank Accounts • Distribution channels • DEMAT operations

- 25. Travelers Cheques • On Jan. 1, 1772, the London Credit Exchange Company was the first business to issue traveler’s checks.In 1874 the Thomas Cook company issued circular notes that worked like traveler’s checks. • Traveler’s checks are a form of payment issued by financial institutions such as American Express. • These paper cheques are generally used by people when traveling to foreign countries. • They are purchased for set amounts and can be used to buy goods or services or be exchanged for cash. • If your traveler's check is lost or stolen it can readily be replaced. • Once widely used, traveler’s checks have largely been supplanted today by prepaid debit cards and credit cards. • A traveler’s check is for a prepaid fixed amount and operates like cash, so a purchaser can use it to buy goods or services when traveling. A customer can also exchange a traveler’s check for cash.

- 26. Where to Cash a Traveler's Cheque If you want to convert your traveler's cheque into cash (instead of spending them directly), you can often deposit them normally at your bank. Many hotel or resort lobbies will also provide this service to guests at no charge. American Express also provides a service to redeem traveler's checks that they issue online to be deposited into your bank account. The redemption application online should take less than 15 minutes to complete

- 27. Advantages and disadvantages of Traveler Cheque Sr. No. Advantages Disadvantages 1 Replaced if lost or stolen Outmoded 2 Widely accepted around the world Must have the physical check to use it 3 Convenient to use Incurs a fee to purchase 4 They don't expire Limited number of issuers today

- 28. Foreign Currency Cash/Drafts • Foreign drafts are generally used to send money to a foreign country. Foreign drafts mitigate the effects of exchange fees, and bank routing delays, so this method is cheaper and more efficient than sending the currency itself. • A foreign draft is a bank draft established at a foreign bank in order to pay a transaction in the foreign currency. • A foreign draft forgoes the need to purchase foreign currency or volunteer information required for an international wire. • Foreign drafts come with fees that must be paid to the foreign bank.

- 29. NON RESIDENT INDIAN(NRI) • UNDER I.T ACT, An Indian Citizen who stays abroad for employment/carrying on business outside India or stays abroad under circumstances indicating an intention for an uncertain duration of stay abroad is a nonresident. • Persons posted in U.N. Organizations and Officials deputed abroad by Central/State Governments and Public Sector undertakings on temporary assignments are also treated as non-residents. • An individual (whether Indian citizens or not) who is outside India and who comes on a visit to India in any previous year will be treated as "non- resident" in India if he stays in India in that previous year less than 182 days subject to the condition that during the preceding four previous years his stay in India does not amount to 365 days or more.

- 30. NRI Bank Accounts • An NRI Account refers to the accounts opened by a Non-Resident Indian (NRI) or a Person of Indian Origin (PIO) with a bank or financial institution which is authorised by the Reserve Bank of India (RBI), to provide various services. • To meet the specific needs of non-resident Indians related to their – remittances, savings, earnings, investments and repatriation, the Government of India introduced in 1970 Non-Resident (External) Account Rules which are governed by the Exchange Control Regulations. • The Foreign Exchange Management Act, 1999 determines the laws regulating foreign exchange and enlists the various deposit schemes available to Non Resident Indians. • NRI accounts are maintained by banks which hold authorised dealers' licences from the Reserve Bank of India. • All NRIs can open such accounts, with the exception of individuals residing in Pakistan and Bangladesh, who require special permission from the RBI. Joint accounts of two or more non-residents and nomination facility are permitted.

- 31. TYPES OF NRI Accounts • Here are the types of NRI Accounts that you can opt for, to meet your financial requirements. – Non-Resident External (NRE) Accounts – Non- Resident Ordinary (NRO) Accounts – Foreign Currency Non-Resident (FCNR) Accounts

- 32. Distribution channels • The channels are: 1. Branch Banking 2. Mobile Banking 3. ATM Channel of Banking 4. Mobile Banking or Phone Banking, Tele-Banking 5. PC Banking 6. Internet Banking, Online Banking, E-Banking.

- 33. DEMAT Account A Demat Account or Dematerialised Account provides the facility of holding shares and securities in an electronic format. During online trading, shares are bought and held in a Demat Account, thus, facilitating easy trade for the users. A Demat Account holds all the investments an individual makes in shares, government securities, exchange-traded funds, bonds and mutual funds in one place.

- 34. Types Of DEMAT Account • There are two types of DEMAT accounts— – Repatriable Demat Account Repatriable funds are deposited in a separate bank account known as the Non-Resident External Account (NRE account). Repatriable funds are those funds which can be transferred abroad. The investments made from these funds are maintained in a The Repatriable Demat account holds the investments made from repatriable funds. – Non-repatriable Demat Account Non-repatriable funds (funds which cannot be taken/transferred abroad) are deposited in a different bank account known as the Non Resident Ordinary Account (NRO account).The Non-repatriable Demat account holds the investments made from non-repatriable funds. Money can easily be transferred from an NRE to an NRO account. However, once the transfer is made, the repatriability is lost and the money cannot be transferred back to the NRE account.

- 35. Why DEMAT Account is important ? • DEMAT is a safe and convenient way to hold securities as it allows immediate transfer of securities. • No need of stamp duty on transfer of securities. • Purchase ,hold and sell of shares in electronic form. • Change in address recorded with DP gets registered with all companies in which investor holds securities electronically. Due to this the investor do not need to correspond with each of them separately. • Major reduction in paperwork involved in transfer of securities. • Elimination the risks such as Bad delivery, loss of certificates, delay & theft. • Automatic credit into DEMAT account of shares, arising out of bonus/split/consolidation/merger etc.

- 36. Unit IV Trends in Retailing ATMs, Internet Banking, Mobile banking, Credit Cards, Debit Cards, Prepaid Cards Private Banking and Wealth Management, Reverse Mortgage

- 37. Automated Teller Machine (ATM) • ATM stands for “Automated Teller Machine”. • An automated teller machine (ATM) or cash machine (in British English) is an electronic telecommunications device that enables customers of financial institutions to perform financial transactions, such as cash withdrawals, deposits, funds transfers, or account information inquiries, at any time and without the need for direct interaction with bank staff. • ATM is a computerized telecommunications device that provides the customers of a financial institution / bank with access to financial transactions in a public space without the need for a human clerk or bank teller round the clock (24 hrs a day) • Automated teller machines are electronic banking outlets that allow people to complete transactions without going into a branch of their bank. • To keep ATM fees down, use an ATM branded by your own bank as often as possible. • The first ATM in India Set up by the HSBC (The Hongkong and Shanghai Banking Corporation) in Mumbai in the year 1987. • John Shepherd-Barron (Indian) invented ATM Machine. • There are now more than 3.5 million ATMs in use across the world.

- 38. • Advantages of ATM – 24-hour access to cash – View Account Balances & Mini-statements – Transfer Funds between accounts – Change your PIN – Access to hard Cash Anywhere at Anytime – ATM machines are Cheaper to Maintain • Disadvantages of ATM – ATM machines can be targeted by criminals, robbers and hackers – ATM Machines May Malfunction – ATM machines Are Costly For The Users – Lack of Personal service – If you get a problem with your bank card, or forget your pin, you can’t withdraw your money – Cash withdrawal limits on ATM Machines – Banks have limited ATM Machine in rural areas

- 39. Internet Banking • Internet Banking allows you to conduct bank transactions online, instead of finding a bank and interacting with a teller. • In a broad sense, it is the use of electronic means to transfer funds directly from one account to another, rather than by cheque or cash. • A system of banking in which customers can view their account details, pay bills, and transfer money by means of the internet. • The remote delivery of new and traditional banking products and services through electronic delivery channels. • ICICI was the first bank to initiate the Internet banking revolution in India as early as 1997 under the brand name ‘Infinity’. • Access Internet Banking – Step 1: Access Internet Banking - Obtain your User ID and Passwords. – Step 2: Create your Own Unique User ID. – Step 3: Link the Account Number to your User ID how can use internet banking

- 40. • Services – Bill Payment – Credit Card – Insurance – Customer services – Recharging your prepaid phone – Shopping • Advantages of Internet Banking – Cost less – Transaction speed – Efficiency – Speed banking – Vast coverage • Issues with Internet Banking – Security – Learning difficulties – Lack of skilled personnel – Technical breakdowns – Long start up time – inexpensive

- 41. Mobile Banking • Mobile Banking is an application that lives on a mobile phone, which access and manipulates their bank accounts at anytime & anywhere. • Mobile Banking is a system that allows customers to perform a number of financial transactions through a mobile device. • Monitoring our Bank accounts through the Mobiles, is known as Mobile Banking. • Mobile Banking Services: – Balance Enquiry. – Mini Statement Enquiry. (Detail about last 5 transactions) – Cheque Status Enquiry. – Cheque Book Requests. – Fund Transfer between Accounts. – Credit/Debit Alerts. – Minimum Balance Alerts. – Bill Payment Alerts. – Utility Bill Payment. – ATM Location. – IMPS- Interbank Mobile Payment Service. – Manage self Accounts. – Mobile Top-up and DTH recharge. – UPI

- 42. • Advantages – Accessing the bank 24/7 – Optimizing your money – Strengthening security – Providing added controls – Offering clarity of where your financial data is going – Giving you tailored options • Disadvantages – Security – Fraudulent Bank Websites – Ignorance – Illiteracy – Poor infrastructure and reliable power – Customer give prefernce to Paper Money

- 43. Credit Cards • Pre-approved credit which can be used for the purchase of items now and payment of them later. • It is a plastic card having a magnetic strip, issued by a bank or business authorizing the holder to buy goods or services on credit. Also called charge cards. • The concept of using a card for was first described in 1887 by Edward Bellamy in his utopian novel Looking Backward. • The size of most credit cards is 85.60 × 53.98 mm

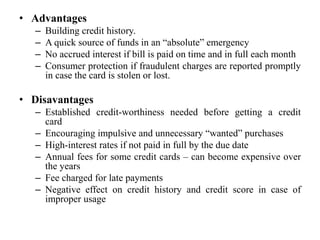

- 44. • Advantages – Building credit history. – A quick source of funds in an “absolute” emergency – No accrued interest if bill is paid on time and in full each month – Consumer protection if fraudulent charges are reported promptly in case the card is stolen or lost. • Disavantages – Established credit-worthiness needed before getting a credit card – Encouraging impulsive and unnecessary “wanted” purchases – High-interest rates if not paid in full by the due date – Annual fees for some credit cards – can become expensive over the years – Fee charged for late payments – Negative effect on credit history and credit score in case of improper usage

- 45. Debit Cards • Debit card is a plastic card with a magnetic stripe or a plastic smartcard with a chip. • It contains a unique card number and some security information. • Security is provided by the customer entering a personal identification number (PIN). • The first debit card may have hit the market as early as 1966 • The Bank of Delaware (USA) first piloted the card • It started to be popular In '90s when more and more ATMs are started • In 1990, debit cards were used in about 300 million transactions. • In 2009, prepaid and debit cards were used in 37.6 billion transactions.

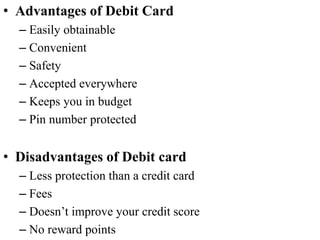

- 46. • Advantages of Debit Card – Easily obtainable – Convenient – Safety – Accepted everywhere – Keeps you in budget – Pin number protected • Disadvantages of Debit card – Less protection than a credit card – Fees – Doesn’t improve your credit score – No reward points

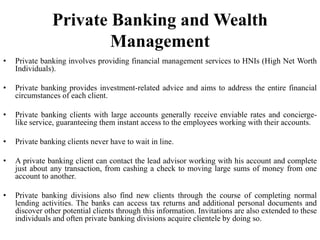

- 47. Private Banking and Wealth Management • Private banking involves providing financial management services to HNIs (High Net Worth Individuals). • Private banking provides investment-related advice and aims to address the entire financial circumstances of each client. • Private banking clients with large accounts generally receive enviable rates and concierge- like service, guaranteeing them instant access to the employees working with their accounts. • Private banking clients never have to wait in line. • A private banking client can contact the lead advisor working with his account and complete just about any transaction, from cashing a check to moving large sums of money from one account to another. • Private banking divisions also find new clients through the course of completing normal lending activities. The banks can access tax returns and additional personal documents and discover other potential clients through this information. Invitations are also extended to these individuals and often private banking divisions acquire clientele by doing so.

- 48. • Wealth management generally involves advice and execution of investments on behalf of affluent clients. • Private wealth management generally involves advice and execution of investments on behalf of affluent clients. Firms that specialize in these practices are the primary sources for clients looking to invest in a variety of funds and stocks. Wealth management advisors also help with financial planning, manage client portfolios and perform a variety of other financial services in relation to a client’s private financing choices. • A wealth management advisor sits down one-on-one with each client and discusses goals, comfort levels with risk and any other stipulations or restrictions the client may have in regard to the investment of his assets. • These advisors also cannot open banking accounts for clients, but they can assist them in determining the right kind of accounts to open at the bank of the client's choosing. • The advisor continues to manage the client’s money and utilizes investment products that coincide with the client's stipulations. • Wealth management employees, including financial advisors, provide advice to clients to help them improve their financial standing and assist clients in investing assets with the goal of generating high returns.

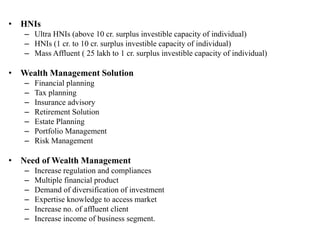

- 49. • HNIs – Ultra HNIs (above 10 cr. surplus investible capacity of individual) – HNIs (1 cr. to 10 cr. surplus investible capacity of individual) – Mass Affluent ( 25 lakh to 1 cr. surplus investible capacity of individual) • Wealth Management Solution – Financial planning – Tax planning – Insurance advisory – Retirement Solution – Estate Planning – Portfolio Management – Risk Management • Need of Wealth Management – Increase regulation and compliances – Multiple financial product – Demand of diversification of investment – Expertise knowledge to access market – Increase no. of affluent client – Increase income of business segment.

- 50. Reverse Mortgage • A reverse mortgage is a loan. • A reverse mortgage is a type of loan for seniors ages 62 and older. In case joint borrower the spouse age to be at least 55 years. • Property should be self occupied or self acquired. No any loan on this property. • Reverse mortgage loans allow homeowners to convert their home equity into cash income with no monthly mortgage payments. • Reverse mortgage payment is monthly, quarterly, half yearly, lump sum payment etc. • After the death of the customer bank can sell or auction customer property, if the customer’s legal heir paid loan amount then bank transfer property ownership to legal heir of customer.

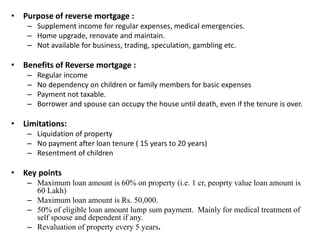

- 51. • Purpose of reverse mortgage : – Supplement income for regular expenses, medical emergencies. – Home upgrade, renovate and maintain. – Not available for business, trading, speculation, gambling etc. • Benefits of Reverse mortgage : – Regular income – No dependency on children or family members for basic expenses – Payment not taxable. – Borrower and spouse can occupy the house until death, even if the tenure is over. • Limitations: – Liquidation of property – No payment after loan tenure ( 15 years to 20 years) – Resentment of children • Key points – Maximum loan amount is 60% on property (i.e. 1 cr, peoprty value loan amount is 60 Lakh) – Maximum loan amount is Rs. 50,000. – 50% of eligible loan amount lump sum payment. Mainly for medical treatment of self spouse and dependent if any. – Revaluation of property every 5 years.

- 52. Thank You…