revenue.ne.gov tax current f_3800n

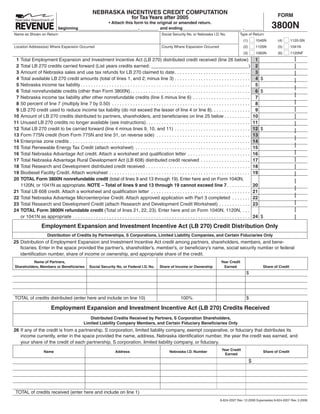

- 1. RESET PRINT SAVE NEBRASKA INCENTIVES CREDIT COMPUTATION FORM for Tax Years after 2005 3800N • Attach this form to the original or amended return. beginning , and ending , Name as Shown on Return Social Security No. or Nebraska I.D. No. Type of Return (1) 1040N (4) 1120-SN Location Address(es) Where Expansion Occurred County Where Expansion Occurred (2) 1120N (5) 1041N (3) 1065N (6) 1120NF 1 1 Total Employment Expansion and Investment Incentive Act (LB 270) distributed credit received (line 26 below) 2 2 Total LB 270 credits carried forward (List years credits earned: _____________________________________) 3 3 Amount of Nebraska sales and use tax refunds for LB 270 claimed to date . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 4$ Total available LB 270 credit amounts (total of lines 1, and 2; minus line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 5 Nebraska income tax liability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 6$ Total nonrefundable credits (other than Form 3800N) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 7 Nebraska income tax liability after other nonrefundable credits (line 5 minus line 6) . . . . . . . . . . . . . . . . . . . . . . 8 8 50 percent of line 7 (multiply line 7 by 0.50) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 9 LB 270 credit used to reduce income tax liability (do not exceed the lesser of line 4 or line 8). . . . . . . . . . . . . . . 10 10 Amount of LB 270 credits distributed to partners, shareholders, and beneficiaries on line 25 below . . . . . . . . . . 11 11 Unused LB 270 credits no longer available (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 12 $ Total LB 270 credit to be carried forward (line 4 minus lines 9, 10, and 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 13 Form 775N credit (from Form 775N and line 31, on reverse side) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 14 Enterprise zone credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 15 Total Renewable Energy Tax Credit (attach worksheet) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 16 Total Nebraska Advantage Act credit. Attach a worksheet and qualification letter . . . . . . . . . . . . . . . . . . . . . . . . 17 17 Total Nebraska Advantage Rural Development Act (LB 608) distributed credit received . . . . . . . . . . . . . . . . . . . 18 18 Total Research and Development distributed credit received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19 19 Biodiesel Facility Credit. Attach worksheet . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20 TOTAL Form 3800N nonrefundable credit (total of lines 9 and 13 through 19). Enter here and on Form 1040N, 1120N, or 1041N as appropriate. NOTE – Total of lines 9 and 13 through 19 cannot exceed line 7 . . . . . . . . . 20 21 21 Total LB 608 credit. Attach a worksheet and qualification letter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22 22 Total Nebraska Advantage Microenterprise Credit. Attach approved application with Part 3 completed . . . . . . . 23 23 Total Research and Development Credit (attach Research and Development Credit Worksheet) . . . . . . . . . . . . 24 TOTAL Form 3800N refundable credit (Total of lines 21, 22, 23). Enter here and on Form 1040N, 1120N, . . . 24 $ or 1041N as appropriate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Employment Expansion and Investment Incentive Act (LB 270) Credit Distribution Only Distribution of Credits by Partnerships, S Corporations, Limited Liability Companies, and Certain Fiduciaries Only 25 Distribution of Employment Expansion and Investment Incentive Act credit among partners, shareholders, members, and bene- ficiaries. Enter in the space provided the partner’s, shareholder’s, member’s, or beneficiary’s name, social security number or federal identification number, share of income or ownership, and appropriate share of the credit. Name of Partners, Year Credit Shareholders, Members or Beneficiaries Social Security No. or Federal I.D. No. Share of Income or Ownership Earned Share of Credit $ TOTAL of credits distributed (enter here and include on line 10) 100% $ Employment Expansion and Investment Incentive Act (LB 270) Credits Received Distributed Credits Received by Partners, S Corporation Shareholders, Limited Liability Company Members, and Certain Fiduciary Beneficiaries Only 26 If any of the credit is from a partnership, S corporation, limited liability company, exempt cooperative, or fiduciary that distributes its income currently, enter in the space provided the name, address, Nebraska identification number, the year the credit was earned, and your share of the credit of each partnership, S corporation, limited liability company, or fiduciary. Year Credit Name Address Nebraska I.D. Number Share of Credit Earned $ TOTAL of credits received (enter here and include on line 1) 8-624-2007 Rev. 12-2008 Supersedes 8-624-2007 Rev. 2-2008

- 2. LB 775 Credits Received Through Distribution Distributed Credits Received by Partners, S Corporation Shareholders, Limited Liability Company Members, and Certain Fiduciary Beneficiaries Only 27 If any of the credit is from a partnership, S corporation, limited liability company, exempt cooperative, or fiduciary that distributes its income currently, enter in the space provided the name, address, Nebraska identification number, the year the credit was earned, and your share of the credit of each partnership, S corporation, limited liability company, or fiduciary. Year Credit Name Address Nebraska I.D. Number Share of Credit Earned $ 27 TOTAL of your share of distributed credits................................................................................................... 28 28 Total distributed credits carried forward from earlier year(s)........................................................................ 29 29 Total amount of distributed credits available for use (line 27 plus line 28) ................................................... 30 30 Nebraska income tax liability after all other non-refundable credits............................................................. 31 31 Credits used to reduce income tax liability. Enter here and on line 13 ........................................................ 32 32 $ Total credits to be carried forward (line 29 minus line 31) ........................................................................... INSTRUCTIONS the taxpayer will be utilizing the carryforward period to claim SPECIAL INSTRUCTIONS FOR TAXPAYERS the credit calculated, the records supporting the original credit CLAIMING CREDIT UNDER EMPLOYMENT AND must be kept for a period of at least three years after the return INVESTMENT GROWTH ACT (LB 775) is filed in which the credit carryforward is used. If the business is using the Employment and Investment Growth Act credit to reduce its income tax liability, FAILURE TO MAINTAIN LB 270 INVESTMENT AND complete lines 27 through 32. Enter the amount of credit EMPLOYMENT LEVELS. A taxpayer is required to maintain being used from Form 775N, and from line 30, Form the levels of employment and investment that created the 3800N on line 13. The other lines on Form 3800N do not credit for at least two years after the year in which the credit have to be completed. If you are claiming credits from both was allowed. If a taxpayer fails to maintain the required levels the Employment and Investment Growth Act and other of employment and investment, the taxpayer will be subject to incentive programs contact Tax Incentives Group of the certain recapture provisions. Contact the Department’s Audit Nebraska Department of Revenue for instructions before Services area, (402) 471-5790, for further information. completing Form 3800N. SPECIFIC INSTRUCTIONS WHO MUST FILE. Every taxpayer must complete the LOCATION ADDRESS. List the business location in Nebraska Incentives Credit Computation, Form 3800N, in Nebraska where the investment and expanded employment order to use the credits allowed by the Employment Expansion occurred. This should include street address and city. Do and Investment Incentive Act (LB 270); the Employment and not include the company’s headquarters address unless this Investment Growth Act (LB 775); the Nebraska Advantage is either where the expansion occurred in Nebraska, or the Rural Development Act (LB 608); the Nebraska Advantage expansion was at multiple locations. Microenterprise Tax Credit Act; the Nebraska Advantage LINE 3. Enter the amount of Nebraska LB 270 sales and Research and Development Act; and to claim the Renewable use tax refunds claimed to date. This should include any Energy Tax Credit. The prior version of this form must be amounts claimed, even if the taxpayer has not yet received used to claim or amend LB 270 credits for tax year 2003 or the refund. earlier. New LB 270 credits may not be earned for tax year 2004 or after. LINE 11. Enter the total of any LB 270 credits included on line 4 that were earned five years ago and were not used on lines WHEN AND WHERE TO FILE. This computation must be 9 and 10, and any LB 270 credits that are no longer available completed and attached to the income tax return filed by an due to recapture. Attach schedule with explanation. individual, corporation, fiduciary, partnership, limited liability company, or S corporation for which a credit is claimed. LINE 12. Enter the difference between line 4, and the total of lines 9, 10, and 11. This is the amount of the unused credit that Partners, shareholders, members, or beneficiaries who are allowed any distributive credits from a partnership, can be carried over for five years after the year earned. S corporation, limited liability company, or fiduciary LINE 14. If you are not located in an enterprise zone, enter should complete lines 1 through 24 and the line 27 credit -0-. received information. A copy of the Form 3800N filed by LINE 15. Enter the total renewable energy tax credit from the partnership, S corporation, limited liability company, or attached worksheet. fiduciary must be attached to the taxpayer’s Form 3800N. These credits may only be used to reduce the taxpayer’s LINE 16. Enter the total Nebraska Advantage Act credit income tax liability. allowed by the qualification audit which is being used to RECORDS. All claimants must retain records for at least reduce income tax liability. Attach worksheet and a copy of three years after the filing of the return claiming the credit. If the Department’s qualification letter.

- 3. LINE 19. Contact the Department of Revenue for the the year credits were earned, and share of the credit for each worksheet and other documentation requirements for a credit partner, shareholder, member, or beneficiary (see line 25). The for investing in a biodiesel facility. Contact the Department at share of credit is determined by multiplying the total amount www.revenue.ne.gov, (800) 742-7474 (toll free in Nebraska to be distributed by the share of income or ownership of each and Iowa) or (402) 471-5729. partner, shareholder, member, or beneficiary. If credits earned in more than one year are distributed, complete a schedule LINE 21. Enter the total LB 608 credits allowed by the for each year. qualification audit for which a refund is being requested. LB 608 credits used by the entity actually earning the credit are CREDITS RECEIVED THROUGH DISTRIBUTION. not limited to the amount of Nebraska income tax liability on If you are filing Form 3800N to claim a credit distributed line 5. Attach a copy of the qualification letter received after from a partnership, S corporation, limited liability company, the Department’s qualification audit. or fiduciary that distributes its income currently, complete applicable section for the type of credits received. If you LINE 22. Enter the total Nebraska Advantage Microenterprise receive credits under both incentive programs, complete Tax credits claimed. Attach a copy of the approved application. lines 26 through 32. Credits distributed to individual partners, Complete Part 3 of the application and attach supporting shareholders, members, or beneficiaries are not refundable. documentation. They may only be used to the extent of the individual DISTRIBUTION OF CREDITS (LB 270 ONLY). Each recipient’s income tax liability. partnership, S corporation, limited liability company, and LINE 31. Credits used cannot exceed the lesser of line 29 fiduciary that distributes its income currently must enter the or line 30. name, address, social security or federal identification number,