Royal Dutch Shell plc third quarter 2017 results webcast presentation

- 1. Royal Dutch Shell November 2, 2017 Royal Dutch Shell plc November 2, 2017 Third quarter 2017 results Re-shaping Shell, to create a world-class investment case #makethefuture

- 2. Royal Dutch Shell November 2, 2017 Jessica Uhl Chief Financial Officer Royal Dutch Shell

- 3. Royal Dutch Shell November 2, 2017 3 Definitions & cautionary note Underlying operating cost is defined as operating cost less identified items. A reconciliation can be found in the quarterly results announcement. Divestments. A reconciliation can be found in the quarterly results announcement. The companies in which Royal Dutch Shell plc directly and indirectly owns investments are separate legal entities. In this presentation “Shell”, “Shell group” and “Royal Dutch Shell” are sometimes used for convenience where references are made to Royal Dutch Shell plc and its subsidiaries in general. Likewise, the words “we”, “us” and “our” are also used to refer to subsidiaries in general or to those who work for them. These expressions are also used where no useful purpose is served by identifying the particular company or companies. ‘‘Subsidiaries’’, “Shell subsidiaries” and “Shell companies” as used in this presentation refer to companies over which Royal Dutch Shell plc either directly or indirectly has control. Entities and unincorporated arrangements over which Shell has joint control are generally referred to as “joint ventures” and “joint operations” respectively. Entities over which Shell has significant influence but neither control nor joint control are referred to as “associates”. The term “Shell interest” is used for convenience to indicate the direct and/or indirect ownership interest held by Shell in a venture, partnership or company, after exclusion of all third- party interest. This presentation contains forward-looking statements concerning the financial condition, results of operations and businesses of Royal Dutch Shell. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. Forward-looking statements are statements of future expectations that are based on management’s current expectations and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in these statements. Forward-looking statements include, among other things, statements concerning the potential exposure of Royal Dutch Shell to market risks and statements expressing management’s expectations, beliefs, estimates, forecasts, projections and assumptions. These forward-looking statements are identified by their use of terms and phrases such as ‘‘anticipate’’, ‘‘believe’’, ‘‘could’’, ‘‘estimate’’, ‘‘expect’’, ‘‘goals’’, ‘‘intend’’, ‘‘may’’, ‘‘objectives’’, ‘‘outlook’’, ‘‘plan’’, ‘‘probably’’, ‘‘project’’, ‘‘risks’’, “schedule”, ‘‘seek’’, ‘‘should’’, ‘‘target’’, ‘‘will’’ and similar terms and phrases. There are a number of factors that could affect the future operations of Royal Dutch Shell and could cause those results to differ materially from those expressed in the forward-looking statements included in this presentation, including (without limitation): (a) price fluctuations in crude oil and natural gas; (b) changes in demand for Shell’s products; (c) currency fluctuations; (d) drilling and production results; (e) reserves estimates; (f) loss of market share and industry competition; (g) environmental and physical risks; (h) risks associated with the identification of suitable potential acquisition properties and targets, and successful negotiation and completion of such transactions; (i) the risk of doing business in developing countries and countries subject to international sanctions; (j) legislative, fiscal and regulatory developments including regulatory measures addressing climate change; (k) economic and financial market conditions in various countries and regions; (l) political risks, including the risks of expropriation and renegotiation of the terms of contracts with governmental entities, delays or advancements in the approval of projects and delays in the reimbursement for shared costs; and (m) changes in trading conditions. No assurance is provided that future dividend payments will match or exceed previous dividend payments. All forward-looking statements contained in this presentation are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Readers should not place undue reliance on forward-looking statements. Additional risk factors that may affect future results are contained in Royal Dutch Shell’s 20-F for the year ended December 31, 2016 (available at www.shell.com/investor and www.sec.gov ). These risk factors also expressly qualify all forward looking statements contained in this presentation and should be considered by the reader. Each forward-looking statement speaks only as of the date of this presentation, November 2, 2017. Neither Royal Dutch Shell plc nor any of its subsidiaries undertake any obligation to publicly update or revise any forward-looking statement as a result of new information, future events or other information. In light of these risks, results could differ materially from those stated, implied or inferred from the forward-looking statements contained in this presentation. This presentation may contain references to Shell’s website. These references are for the readers’ convenience only. Shell is not incorporating by reference any information posted on www.shell.com. We may have used certain terms, such as resources, in this presentation that the United States Securities and Exchange Commission (SEC) strictly prohibits us from including in our filings with the SEC. U.S. investors are urged to consider closely the disclosure in our Form 20-F, File No 1-32575, available on the SEC website www.sec.gov.

- 4. Royal Dutch Shell November 2, 2017 4 Summary Q3 2017 – cash momentum Underlying CCS earnings $4.1 billion CFFO excl. working capital $10 billion Free cash flow $3.7 billion Q317 dividend $0.47 per share Q3 2017 – 4 quarters rolling CFFO excl. working capital $40 billion Cash dividend covered Balance sheet: 25.4% gearing Leader: value + influence Reducing our carbon intensity Shared value with society World-class investment case FCF/share + ROCE growth Conservative financial management

- 5. Royal Dutch Shell November 2, 2017 5 Q3 2017 Portfolio highlights Prelude sail away – arrived in Australia Appomattox hull arrival USGC Mexico – Retail country entryGbaran-Ubie – Phase 2

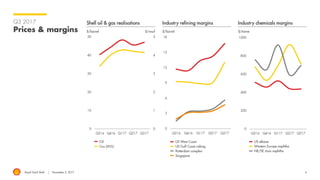

- 6. Royal Dutch Shell November 2, 2017 Q3 2017 Prices & margins $/barrel Shell oil & gas realisations $/barrel Industry refining margins $/tonne Industry chemicals margins US ethane Western Europe naphtha NE/SE Asia naphtha US West Coast US Gulf Coast coking Rotterdam complex Singapore Oil Gas (RHS) 6 $/mscf

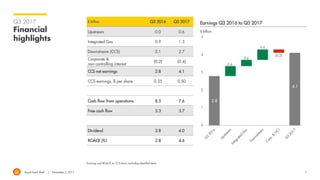

- 7. Royal Dutch Shell November 2, 2017 7 Q3 2017 Financial highlights Earnings and ROACE on CCS basis, excluding identified items $ billion Earnings Q3 2016 to Q3 2017$ billion Q3 2016 Q3 2017 Upstream 0.0 0.6 Integrated Gas 0.9 1.3 Downstream (CCS) 2.1 2.7 Corporate & non-controlling interest (0.2) (0.4) CCS net earnings 2.8 4.1 CCS earnings, $ per share 0.35 0.50 Cash flow from operations 8.5 7.6 Free cash flow 3.3 3.7 Dividend 3.8 4.0 ROACE (%) 2.8 4.6

- 8. Royal Dutch Shell November 2, 2017 8 Q3 2017 Cash momentum Earnings on CCS basis, excluding identified items Cash flow from operations excluding working capital Cash flow from operations excluding working capital – 4 quarters rolling (RHS) Strong cash flow momentum continued from 2016 into 2017 CFFO excluding working capital (4 quarters rolling): $40 billion @ $51/bbl Average Brent oil price - 4 quarters rolling ($/bbl) Earnings $ billion $ billion $107 $51

- 9. Royal Dutch Shell November 2, 2017 3.00 3.50 9 Q3 2017 Oil and gas production + LNG liquefaction volumes Million boe per day Upstream + Integrated Gas – oil & gas Million tonnes LNG liquefaction volumes 3.25 3.75 4.00

- 10. Royal Dutch Shell November 2, 2017 10 Q3 2017 Earnings $ billion Earnings Q3 2016 to Q3 2017

- 11. Royal Dutch Shell November 2, 2017 11 Financial and competitive performance Chemicals Earnings and ROACE on CCS basis, excluding identified items; source: company reports, Shell analysis Chemicals peer group: XOM, LBI, DOW, RDS. Q3 2017 competitor data not yet available $ billion Earnings – Chemicals % Competitive performance – ROACE 4Q rolling Improve base business Expand current base portfolio Adding to portfolio - growth Average Brent oil price (RHS)Earnings Average: $104 Average: $49 $/barrel 13Q1 17Q214Q1 15Q1 16Q1 CHEMICALS Shell Peer group

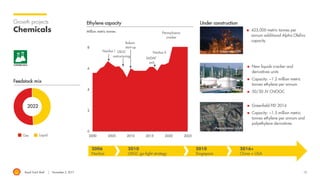

- 12. Royal Dutch Shell November 2, 2017 Under construction 12 Growth projects Chemicals Million metric tonnes Ethylene capacity Nanhai II Pennsylvania cracker USGC restructuring Nanhai I Bukom start-up 12 Geismar, USA Nanhai, China Pennsylvania, USA 425,000 metric tonnes per annum additional Alpha Olefins capacity New liquids cracker and derivatives units Capacity: ~1.2 million metric tonnes ethylene per annum 50/50 JV CNOOC Greenfield FID 2016 Capacity: ~1.5 million metric tonnes ethylene per annum and polyethylene derivatives 2006 Nanhai 2010 USGC go-light strategy 2010 Singapore 2016+ China + USA LiquidGas 2022 Feedstock mix CHEMICALS SADAF exit

- 13. Royal Dutch Shell November 2, 2017 13 Q3 2017 Cash performance + Divestments Divestments: table D of Q3 2017 Quarterly Results Announcement; Integrated gas split out from Upstream from 2011 onwards $ billion Sources and uses of cash – 17Q3 4Q rolling $ billion Interest paid Debt repayments & other financing Divestments Downstream/Corporate Upstream Integrated gas Divestments 2016 – 2017 to date: Completed: $20 billion Announced: $2 billion In progress: >$5 billion

- 14. Royal Dutch Shell November 2, 2017 14 Q3 2017 Net debt + Dividend $ billion Dividend + gearing UPSTREAM IG DOWNSTREAM /CORPORATE S&P credit rating upgrade: A+ $ billion Net debt + gearing Dividend Buy-backs Gearing (RHS) % -$10 billion Net debt % Gearing (RHS)

- 15. Royal Dutch Shell November 2, 2017 15 Cash flow priorities 2016-18 Priorities for cash Debt reduction Dividends Buy-backs & capital investment 1 2 3 Divestments Reduce capital investment Reduce operating costs Deliver new projects

- 16. Royal Dutch Shell November 2, 2017 16 Summary Q3 2017 – cash momentum Underlying CCS earnings $4.1 billion CFFO excl. working capital $10 billion Free cash flow $3.7 billion Q317 dividend $0.47 per share Q3 2017 – 4 quarters rolling CFFO excl. working capital $40 billion Cash dividend covered Balance sheet: 25.4% gearing Leader: value + influence Reducing our carbon intensity Shared value with society World-class investment case FCF/share + ROCE growth Conservative financial management

- 17. Royal Dutch Shell November 2, 2017 17 Questions & Answers Jessica Uhl Chief Financial Officer Royal Dutch Shell November 2, 2017

- 18. Royal Dutch Shell November 2, 2017 Royal Dutch Shell plc November 2, 2017 Third quarter 2017 results Re-shaping Shell, to create a world-class investment case #makethefuture

- 19. Royal Dutch Shell November 2, 2017 Q4 2017 Outlook Q4 – Q4 OUTLOOK: Year-ago baseline reflects Shell’s earnings seasonality Integrated gas Gorgon and portfolio impacts: positive impact of ~90 kboe/d Upstream Divestment impact: reduction of ~250 kboe/d Maintenance: negative impact of ~40 kboe/d Lower production in the Netherlands (NAM) and improved security situation in Nigeria are expected to be largely offsetting Downstream Refinery availability to increase Chemicals availability to increase Divestment impacts: reduction of ~250 thousand b/d in oil products sales volumes Corporate segment Net charge of $350 – 450 million excluding identified items and the impact of currency exchange rate effects 2017 OUTLOOK: Shell earnings sensitivity: Brent: $10/bbl Brent +/- ~$5 billion earnings per annum, of which: Upstream +/- ~$3 billion; Integrated Gas +/- ~$2 billion (4-6 month LNG price lag versus Brent) Henry Hub: $1/mmbtu +/- ~$250 million earnings per annum 19

- 20. Royal Dutch Shell November 2, 2017 20 Q3 2017 Upstream results – cash flow momentum Earnings on CCS basis, excluding identified items $ billion Earnings Q3 2016 to Q3 2017 $ billion Cash flow momentum Earnings Cash flow from operations excluding working capital Cash flow from operations excluding working capital – 4-quarters rolling (RHS) $ billion $51$42 Average Brent oil price - 4 quarters rolling ($/bbl) 0.5 0

- 21. Royal Dutch Shell November 2, 2017 21 Q3 2017 Integrated Gas results – cash flow momentum Earnings on CCS basis, excluding identified items $ billion Earnings Q3 2016 to Q3 2017 $ billion Cash flow momentum Earnings Cash flow from operations excluding working capital Cash flow from operations excluding working capital – 4-quarters rolling (RHS) $ billion

- 22. Royal Dutch Shell November 2, 2017 22 Q3 2017 Downstream results – cash flow momentum Earnings on CCS basis, excluding identified items $ billion Earnings Q3 2016 to Q3 2017 $ billion Cash flow momentum $ billion Earnings Cash flow from operations excluding working capital Cash flow from operations excluding working capital – 4-quarters rolling (RHS)

- 23. Royal Dutch Shell November 2, 2017