Save 1,000 In 30 Days

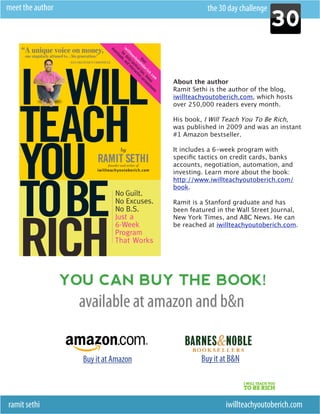

- 2. meet the author the 30 day challenge About the author Ramit Sethi is the author of the blog, iwillteachyoutoberich.com, which hosts over 250,000 readers every month. His book, I Will Teach You To Be Rich, was published in 2009 and was an instant #1 Amazon bestseller. It includes a 6-week program with specific tactics on credit cards, banks accounts, negotiation, automation, and investing. Learn more about the book: http://www.iwillteachyoutoberich.com/ book. Ramit is a Stanford graduate and has been featured in the Wall Street Journal, New York Times, and ABC News. He can be reached at iwillteachyoutoberich.com. Buy it at B&N Buy it at Amazon ramit sethi iwillteachyoutoberich.com

- 3. page 1 the 30 day challenge Tip #1 Pack lunches for the rest of the week This is Tip #1 of the 30 Day Challenge to save $1,000. The first tip is to go to the grocery store today and pack lunches for yourself all week. Sounds obvious, but below I’ll include some specific tips and social-psychological techniques to make this actually work. This tip reminds me of something I heard in college from a professor of mine, who made the point that lots of people look down on fields like communication and psychology because they seem self-evident. “Communication is measured by the usefulness of the theory, not the difficulty,” she told me. It’s easy to look down on tips like “pack your lunch” because it’s so obvious, but it actually works. How much you’re currently spending Let’s look how much NOT packing a lunch is costing you. I’ll assume you eat out 3 times per week for lunch. Current lunch spending: (Eat out 3x/week) * (4 weeks in a month) * ($12 each lunch net with tax) = $144 per month on eating out New spending to eat out: (Eat out 2x/week) * (4 weeks) * ($8 net with tax) = $64. New spending to pack lunches: (Pack lunch once/week) * (4 weeks) * ($5 cost per packed lunch) = $20. So $144 - $64 - $20 = $60 in savings. Because you can break down the variables above (# of times you eat out vs. amount you spend on each lunch vs. cost of packing your own lunch), you can tweak each of them. For example, maybe you want to eat out 4 times per week but it will only cost you $2 each time. In that case, enjoy the week-old rotten vegetables you’re buying. But if you tend to eat out at ramit sethi iwillteachyoutoberich.com

- 4. page 2 the 30 day challenge expensive restaurants with co-workers, maybe you limit it to once per week. Up to you. Note that I didn’t suggest going cold-turkey on eating out for lunch…because that will last about a week, then you’ll give up. This is the key point I made in Set smaller goals: impress friends, get girls, lose weight. You can get better sustainable change if you slowly optimize, rather than quitting cold turkey. Here’s the concrete tip for today: 1. Decide how many lunches you’re going to pack each week. More = save more money. 2. Go to the grocery store today. 3. Buy food for your lunches this week. If you want to shop for other stuff, that’s fine, but the purpose of this trip is to get food for your lunches. If you accomplish just that, you accomplished your goal. 4. Let’s say you decided to pack 3 lunches each week. Put 3 bags on your table and fill it with 3 bananas, 3 bags of chips, 3 whatever. This takes advantage of our laziness to pack lunch each day. Instead, by doing it this way, you batch the unpleasantness of preparing lunch. Now, each morning, just open up the fridge, take your bag, and you’re done. (Bonus tip: To psychologically commit yourself to actually taking the bag, write “Monday,” “Wednesday,” and “Thursday” on the bag.) 5. For the days you decided to go to lunch, GO! This month, I want you to be strategic about eating out, so it’s not just something you do because you forgot your lunch, shrugged your shoulders, and go drop $10 for your lack of planning. If you decide you’re eating out on Tuesday and Friday, enjoy it — you planned for it. 6. If a co-worker invites you to lunch, be prepared to say no. Try this: Thanks, I’d love to go, but I’m taking this 30-day challenge to save $1,000, so I’m not eating out as much. (This is related to inoculation theory in psychology.) 7. Be sure to read to the end of this post (”Last things to do”). Leave a comment describing how much you’re saving with this tip. ramit sethi iwillteachyoutoberich.com

- 5. page 3 the 30 day challenge Tip #2 Turn your thermostat down three degrees This is Tip #2 of the 30 Day Challenge to save $1,000. Today’s tip is to reduce your thermostat 3 degrees colder starting right now. Below, I’ll show you some additional math / tips to show you the effect this will have on your finances. This year, the Energy Information Administration projects that Americans will pay about 15% more in their heating bills this winter, because of colder weather and higher fuel costs. How much will you save? “The rule of thumb is that you can save about 3% on your heating bill for every degree that you set back your thermostat” full time, says Bill Prindle, deputy director for the nonprofit American Council for an Energy-Efficient Economy. To keep the math easy, let’s assume we can save 10% by cutting 3-4 degrees off the thermostat. Here are some sample savings. Note: The actual numbers for the heating bills were obtained very un-scientifically (too many variables to consider). San Francisco: $10 off a $100 bill Chicago: $20 off a $200 bill New York: $15 off a $150 bill Phoenix: You may not have a heating bill to save on… during the day will still probably be using your A/C. The same rules apply in this case, just in reverse. $10 off a $100 bill. How to make this tip actually work I can already hear the sighs of a thousand people: “But Ramit,” you might say, “I already know about this.” Then why don’t people do it? ramit sethi iwillteachyoutoberich.com

- 6. page 4 the 30 day challenge Because (1) it’s not sexy and novel, and (2) it only takes one cold day after work when you come home and say, “Forget it, I’m turning the heat up today.” And once you adjust your thermostat up, it never goes back down again. The trick is this: First, turn your thermostat way down when you go to work. That’s free money. Second, think about what causes you to turn the heat up. When you come home from work, the first thing you notice is probably how cold it is – and it’s just natural to walk over to the heater and turn the heat way up. Avoid this: Sure, turn up the heat to a reasonable temperature, but instead of blasting it at 75 degrees, keep warm slippers, a blanket, and a hat somewhere convenient right when you come home. Just put them right near the door. No more thinking – it’s just a natural part of coming home and putting your bag down. (Read more about barriers here.) I’m doing this at my house. As soon as I come home, there are slippers and a sweatshirt right near the door. Savings: $10-20 Bonus reading about thermostats I know, I know, what could be more exciting? Check out this page on Madison Gas and Electric for some common myths about your thermostat. ramit sethi iwillteachyoutoberich.com

- 7. page 5 the 30 day challenge Tip #3 Sell something on eBay today This is tip #3 from the 30 Day Challenge to Save $1,000. Today’s tip is to sell something from your house on eBay. But surprisingly, it doesn’t really matter what you sell. I’ve noticed lots of commenters saying how they’ve already cut down on lunches, heat, etc. So what can you do next? If you’re already being frugal, the next step is to make money. I want you to get there, and today’s tip is designed to be a gradual step to earning more. It’s specifically intended for two purpose: To symbolize to yourself that you can sacrifice by selling something, and to symbolize that you can make more money than your standard income. Once you do that, there are many other ways to generate income. Notice I didn’t say the point of this is to make money directly. That’s because you probably won’t make very much from selling a given item on eBay, and it’s frankly probably not worth your time to sell, pack, and ship a $10 item (read more). But that’s not the point. The point is the symbolism of cleaning your life and generating even a small amount more money than you normally earn. Everybody can sell something. Something you’ve been wanting to get rid of, or something you keep insisting you’ll use, but you know you really won’t. This tip applies to everyone. I used to work at a consumer-goods auction company (”You drop it off, we sell it on eBay”) and learned a couple things about selling. Do this: Set your item to sell for the minimum amount with no reserve. There are certain advantages to different sales lengths, but we don’t need to split hairs. For today’s purpose, set the length of the sale at 5 days so you can ramit sethi iwillteachyoutoberich.com

- 8. page 6 the 30 day challenge get quick feedback. And pick something that will sell for a decent amount — say, $10. No, nobody wants your grandma’s old sweater. Remember, the point of this is not to make money. It’s to psychologically commit yourself to saving money. It doesn’t matter if you make $10 or $300, but I want you to sell something at least $10. Then do it a few more times this month. Total savings: $40 to $100 Note: I did it, too! Here’s my eBay listing for e2c Shure headphones, which have just been laying around my house for a while. ramit sethi iwillteachyoutoberich.com

- 9. page 7 the 30 day challenge Tip #4 Involve your friends in your savings challenge This is tip #4 of the Save $1,000 in 30 Days Challenge. Today’s tip is to involve your friends and family in your money saving. Without this, you’ll have a tough time achieving your goals. For more people, the reason they fail to save money is not a lack of money-saving ideas — it’s themselves and their lack of discipline. By involving your friends, you eliminate that lack of discipline and give yourself automatic accountability and a built-in reason to win. Let’s take a look at this question, which came in from my post about turning the thermostat down: Anybody have any tips on how to do this with room mates if you and your room mates do not have the same goals? How do you talk them into wanting to put the thermostat down 3 degrees if it is going to possibly make them uncomfortable, or maybe they just do not want to substitute comfort for any dollar amount? Great question — and it doesn’t just apply to saving money by turning your thermostat down. What about if you want to eat out less this month? Or go out less? How do you enlist the help of your friends? Why your friends matter Getting your friends involved is important because your spending is based on your context. A lot of us like to think that we make our financial decisions individually. What an American, determinist perspective! But it’s not true. Our spending depends on those around us. For example, if you make $50,000/year, you probably hang out with others who make similar amounts and have similar spending patterns. If your friends shop a lot, and you’ve been accepted into that group of friends, chances are you shop too. Social influence is extremely powerful. ramit sethi iwillteachyoutoberich.com

- 10. page 8 the 30 day challenge Think about it: When was the last time you spent money because of friends? For me, it was this weekend, when I ate out. It was fun, it was social — but it was also financial. As you’ve been seeing from my tips over the last few days, the actual financial decisions are only a small part of your spending. A lot of it has to do with the psychology of spending. That’s why enlisting the help of your friends to achieve your goals this month is so important. I want to point you to an astonishing study that highlights the importance of your social network. In this case, it was for obesity: Obesity can spread from person to person, much like a virus, researchers are reporting today. When a person gains weight, close friends tend to gain weight, too. The answer, the researchers report, was that people were most likely to become obese when a friend became obese. That increased a person’s chances of becoming obese by 57 percent. “You change your idea of what is an acceptable body type by looking at the people around you,” Dr. Christakis said. Fascinating. I can’t speak authoritatively to the correlation between obesity and finance, but I’ve seen lots and lots of patterns between the two (e.g., here and here). I think that intuitively, we all recognize that a lot of our spending is a result of our friends and the people in our social network. You think your spending would stay the same if you hung around a bunch of immigrants, or people who make $400,000/year? Not a chance. How to enlist your friends’ help to save money We’ve already talked about why it’s important to enlist your friends’ help to save money. Without their help, you’ll still have the constant pressure to go out, buy new stuff, spend, or whatever your current spending patterns are. In other words, it will be you against the world. To help change that, there are two approaches you can take: 1. Enlist your friends to join the Challenge (cooperative approach) 2. Bet your friends you can hit your goals (adversarial approach) Enlist your friends to join the Challenge. For the person above who wanted to know how to get his roommates to be cool with turning the thermostat down, this is the approach I would take. Hey guys, I read this personal-finance blog iwillteachyoutoberich.com and he just announced a Save $1,000 in 30 Days Challenge. I don’t know about you guys, but I’m down to save $1,000. ramit sethi iwillteachyoutoberich.com

- 11. page 9 the 30 day challenge (Realistically, I think I can save $700 this month.) Would you guys be interested in joining in? If we can each participate, it would be a lot easier (e.g., we save on heat a little, clean the house ourselves, cook a little, and that saves hundreds right there). I took his first 3 days of tips and I’m already saving [$XXX]. What do you think? Check out the 30 day challenge here: http://www.iwillteachyoutoberich.com/blog/announcing-the-save-1000-in-30-days- challenge -[NAME] The chief benefits of this is that you get (1) social support and (2) economies of scale. If you’re all saving towards a common goal, you can eat rice and beans, and you’ll also be more likely to turn down the heat, not go out as much, etc. Personally, I’m doing this approach. Bet your friends you can hit your goals You guys know I love bets. Sites like Stickk.com are great because they give you an easy way to motivate yourself by publicly committing to a goal. There are thousands of psychology studies about commitment — specifically, public commitment — which is highly persuasive. If you tell a group of people that you’re going to stop smoking, or lose weight, or save money, you’re highly motivated to save face and hit that goal. I used this strategy successfully last year when I ran a weight challenge to gain weight. I’ve always been a slim guy so I decided to bulk up a little. I emailed my friends and got them involved: I bet that I would GAIN the weight, while I encouraged them to bet against me. I describe all the details in How I Gained 5 Pounds in One Week (check it out), but here’s the initial email I used to get my friends involved: ramit sethi iwillteachyoutoberich.com

- 12. page 10 the 30 day challenge The text I’d use for the Challenge is something like: Hey guys, I read this personal-finance blog iwillteachyoutoberich.com and he just announced a Save $1,000 in 30 Days Challenge. I’m taking the Challenge and trying to save $700 this month. Now, who wants to bet me I can’t do it? You can try anything you want — inviting me out to free meals, sending me sales, asking if I want to grab a drink. Whatever it is — do it. But you have to bet me $25, $50, or $75 that I won’t be able to hit my goal of saving $700 this month. In other words: I bet you that I can save $700. You bet $25, $50, or $75 that I CANNOT save that much money. I’ll provide weekly updates so you can track my spending. ramit sethi iwillteachyoutoberich.com

- 13. page 11 the 30 day challenge Let me know if you’re in by this Friday, November 7th. -[NAME] The key is to get your friends involved, whether they join the Challenge or bet against you. Get your co-workers involved, too: At PBwiki, we’ve done a hot-sauce-eating contest and a Biggest Weight Loser challenge. The result of getting your friends involved For my weight-gain challenge, once I bet my friends, I actually started caring less about my weight-gain bet itself, and more about showing my friends that I could do it. Whenever I felt like I couldn’t do it (not ANOTHER glass of milk), I knew I had to or I would lose to my friends — and that wasn’t gonna happen. Finally, by having weekly check-ins, I knew I had to hold myself accountable each Sunday. The same is true of saving money. For the challenge, my friends know I’m running this challenge, which means they’re open to hanging out at free places instead of expensive bars/restaurants this month. Plus, there’s the motivation aspect: If you set a goal of saving $300, or $500, or $1,000 this month, and you bet your friends publicly, you are GOING to find a way to make it happen. Don’t do this alone. Get others to help you and you’ll be even more successful. Total savings: $100-$500 ramit sethi iwillteachyoutoberich.com

- 14. page 12 the 30 day challenge Tip #5 Optimize your cellphone bill This is tip #5 of the Save $1,000 in 30 Days Challenge. Today’s tip is to optimize your cellphone bill. Many of us (including me) pick a cellphone plan, then never check to see if it’s the right one for us based on our usage. Because the average cellphone bill is about $50, that’s $600 per year of money you can optimize. Perfect. Today, I’m going to show you two ways to cut your cellphone bill: one easy, one hard. And remember, this tip doesn’t just apply to cellphones: You can optimize your spending on nearly any other subscription you’ve got. Optimizing your cellphone bill — the easy way First let me say, if you still have a landline, the easiest tip is to call your wireless company and bundle it all into one plan — or get rid of your landline altogether. Anyway, when I went to buy a new cellphone a couple months ago, I picked the unlimited everything plan — unlimited voice, unlimited data, unlimited text. I also set a 3-month check-in on my calendar to go back and analyze my spending patterns so I could cut back on my plan if needed. This is a technique I use a lot: With any usage-based services (e.g., web apps or cell plans), I’ll pay a little more up front so I can monitor my usage, then downgrade to the appropriate plan after 3 months. Analyzing your usage can be a pretty laborious task, but I use a site called Billshrink to do it for me automatically. Click here to see it. You’ll see from that slideshow that the top savings would net me $600+ per year. Pretty good. ramit sethi iwillteachyoutoberich.com

- 15. page 13 the 30 day challenge You should also know that, according to a recent survey by J.D. Power and Associates, “people who text message, e-mail, and download files on mobile phones spend $14 a month more than people who don’t.” Do you really need all that stuff? Could you try going a couple months without it? It pays to look at your actual usage and switch to a plan that better fits your needs. If you’re only using 150 text messages, you can probably downgrade to the “200 text messages/ month” plan. As you get used to the new limit, add a calendar reminder to check in on the 15th of each month and make sure you’re not wildly over for the first few months. Check out Billshrink here. Optimizing your cellphone — the harder (but more rewarding) way Cellphone companies have this wildly curious business model of acquiring tons of customers through very expensive means (e.g., national advertising), then churning through them by treating them horribly. Yet even they know that it’s cheaper to retain an existing customer than to acquire a new one. You can use this “customer acquisition cost” in your favor. Here’s how: 1. Find comparable plans for your usage on other cellphone networks. For example, I’m with AT&T, so I’ll investigate Verizon, T-Mobile, and Sprint by going to their websites. Write down how much they each cost, how many minutes you get, and any other benefits. 2. Call your current cellphone company. To make it easy, here are the phone numbers: AT&T: 1-800-331-0500 Verizon: 1-800-922-0204 TMobile: 1-800-T-MOBILE Sprint: 1-866-866-7509 3. First, be nice. Ask them what better plans they have to offer you. You: “Hi, I was looking at my plan and it’s getting pretty expensive. Could you tell me what other plans you have that would save me money?” Them: Blah blah same plans as on the website blah blah You: “What about any plans not listed on the website?” Them: No, what we have is listed on the website. Plus, you’re on a contract and have an early cancellation fee of $XXX ramit sethi iwillteachyoutoberich.com

- 16. page 14 the 30 day challenge You: “Well, I understand that, but I’d be saving $XXX even with that cancellation fee. Look, you know times are tough so I’m thinking of switching to [COMPETITOR COMPANY]. Unless there are any other plans you have…? No? Ok, can you switch me to your cancellation department, please?” Note: What you really want is to be switched to their “customer retention” department, which is the group that has the ability to retain you by giving you a bunch of free deals. You can either ask to be switched directly to the customer retention department, or play a game and hope that by asking for “cancellation,” you’re actually transferred to retention. Play around with a few phone calls and see what works best. When you get to the customer-retention department, ask for the same thing. This is when you pull out your competitive intel on the other services being offered. If Verizon is offering something for $10 less, tell them that. That’s $120 savings / year right there. But you can do more. You: “Listen, you know times are tough and I need to get a better deal to stick with you guys. You know and I know that your customer acquisition cost is hundreds of dollars. It just makes sense to keep me as a customer, so what can you do to offer me this plan for less money?” Notice that you didn’t say, “Can you give me a cheaper plan?” because yes/no questions always get a “no” answer when speaking to wireless customer-service reps. Ask leading questions. You also invoked the customer-acquisition cost, which is meaningful to retention reps. Finally, it really helps if you’re a valued customer who’s stuck around for a long time and actually deserves to be treated well. If you jump around from carrier to carrier, you’re not a worthwhile customer to carriers. One final thing: People get scared that if they go to the cancellation department and try to negotiate, they’ll get their account canceled without really wanting to do that. There are two things to remember about negotiating your wireless bill: (1) You have a MUCH stronger position if you’re actually willing to walk away and switch to another plan, and (2) your account will never get canceled until you say the final word. You can negotiate for 3 hours ramit sethi iwillteachyoutoberich.com

- 17. page 15 the 30 day challenge and walk away if you want. Use this technique on virtually any subscription you’re paying. Businesses want to keep customers and are willing to negotiate — but since most people don’t, they’re leaving money on the table. Total savings: $20-$600 ramit sethi iwillteachyoutoberich.com

- 18. page 16 the 30 day challenge Tip #6 Use gas prices to become your own hedge fund This is Tip #6 of the Save $1,000 in 30 Days Challenge Today is one of my favorite tips: To take the money you’re saving on gas and automatically hedge against any future increase in fuel prices. The term “fuel hedging” refers to airline companies’ tendency to try to protect themselves by estimating the price of jet fuel and locking in prices to protect themselves if prices go way up. The world’s best airline in fuel hedging is Southwest Airlines: “Using some simple and some complex investment strategies, Southwest has for a decade locked in the prices it pays for large amounts of jet fuel months and even years ahead of time. Its success at that has protected it from run-ups in crude oil prices and dramatically cut its fuel expenses. Since 1998, it has saved $3.5 billion over what it would have spent if it had paid the industry’s average price for jet fuel. That’s equal to about 83% of the company’s profits over the last 9½ years.” We can use a similar technique for our own personal finances — and my favorite part is, you can apply this to anything where the prices is variable. Here’s how to do it. How to use hedging for your personal finances When gas prices were at their highest in San Francisco, I was paying about $4.60/gallon, which was costing me about $60/week. But now, with a combination of lower gas prices and working at home once a week, I’m saving about $15/week off the peak. It’s really easy to ignore that and let the money stay in your checking account, where it will be inevitably spent on something useless. Instead, because gas prices have dropped, all of us are saving money compared to a few months ago. Now, you can create an automatic transfer of the money you’re saving and put it in a “fuel hedge” account to protect you when prices go higher. ramit sethi iwillteachyoutoberich.com

- 19. page 17 the 30 day challenge Here’s how I do it. 1. I set up a high-interest ING savings account, which lets me set up automatic transfers and create sub-accounts within my savings account. I use these sub-accounts for anything major I’m saving for (including a wedding, even though I’m not engaged — see why). To set up a sub-account, log into your account >> Open an account >> Orange Savings Account >> Orange Savings Account (from the drop-down). Create the nickname, etc, and you’re done. 2. I know I’m saving about $15/week, so I transfer that amount to my fuel hedge account. 3. If gas prices go up, you’ll have this money saved to use to hedge against the new higher gas prices. It will also give you time to either cut your costs or earn more to account for the higher gas prices. 4. I set a calendar reminder every 3 months to re-evaluate the price of gas and adjust my weekly savings amount. The reason I love this is you can apply it to anything you buy that gets more or less expensive. If you pay $100/month for heat in the winter and $20/month in the summer, can you pretend that you’re still paying $100/month in every month of the year and save $80/month during the summer months? Give it a shot — there’s a lot to be done with this tip. ramit sethi iwillteachyoutoberich.com

- 20. page 18 the 30 day challenge Tools I use I use a high-interest ING savings account to manage my savings and sub-savings accounts. It’s free to open, high-interest, and they don’t send me a bunch of crappy junk mail. It just works. I also use Mint to track my spending and get averages for my spending. I use Google Calendar to set reminders for myself in the future. Total savings: $20 to $120 per month ramit sethi iwillteachyoutoberich.com

- 21. page 19 the 30 day challenge Tip #7 Create a “no spending day” once a week This is tip #7 of the Save $1,000 in 30 Days Challenge. Today’s tip is to set at least one day per week on your calendar when you don’t spend one dollar. Do you think you could do it? Technically, even if you don’t open your wallet, you’re still spending money on things like rent/mortgage, car insurance, subscriptions, and Christmas gifts — you just didn’t count them. But that’s even more of a reason to create a “No spending” day on the money in your wallet: because you can actively control it. Today’s tip was submitted by Alexandra, from Wilmington, NC, who writes: We do a week with NO spending. We fill the car with gas and hit the grocery store on Sunday. Starting Monday, we cannot spend a CENT. Sort of a fun little challenge. And it is only for a week. So, if I see something I need or want, I can get it next week. No cheating. AMAZING results. The first time I did it, I was flabbergasted to have the same $20 bill in my wallet. I got very used to it and so it is a nice little “shot in the arm” technique. Kind of like a fast to begin a diet regime. Total Savings: $50-200 Alexandra’s tip is excellent because she uses the idea of time constraints to make ramit sethi iwillteachyoutoberich.com

- 22. page 20 the 30 day challenge the “no spending” idea more palatable. If you force yourself to do this only one day per week, you’ll look back the next week and realize it wasn’t so bad. (Notice she does it for a week, which you can work your way up to.) I remember a friend of mine once decided he wasn’t going to go out all weekend, and he donated the money to charity. You can do the same thing — but the key is adding to your calendar so you make it a consistent system, not an ad hoc whim. Total saved: $5 - $75 ramit sethi iwillteachyoutoberich.com

- 23. page 21 the 30 day challenge Tip #8 Implement the A La Carte Method This is Tip #8 of the Save $1,000 in 30 Days Challenge. Today, we’re going to implement the A La Carte Method to save money on the subscriptions you’re paying for. People spend an enormous amount on subscriptions without ever realizing it. Not only are the payments automatically sent, but it takes active effort — and acknowledging that you’ve been paying for something you don’t need — to cancel a subscription…which means it’s easier to do nothing than to cancel the subscription. Here’s a very conservative estimate of someone spending $1,824/year on subscriptions. I’ll tell you guys about a subscription I had to a marketing service. I signed up for it about 4 months ago to get the free trial and see if it was worthwhile, and it was pretty decent — but it cost $100/month. After about a month, I knew I wasn’t getting the value I needed out of it — but I couldn’t bring myself to cancel it. I put it in my calendar to cancel, but the day would come and go and I just didn’t do it. Then I would see a new email pop up in my inbox about some new stuff they had added, so I filed it under “Toread,” thinking I “really should” check this out. You know how you feel when you know you should do something, but just can’t bring yourself to do it? That’s exactly how I felt — until 3 months later, when I finally canceled it. Even though it cost me $300 more than it should have, it was a lesson well learned. Today’s tip, the A La Carte Method, is a way to avoid just that: The A La Carte Method takes advantage of psychology to cut our own spending…. cancel all the discretionary subscriptions you can: your magazines, annual Rhapsody plan, cable — even your gym. ramit sethi iwillteachyoutoberich.com

- 24. page 22 the 30 day challenge * Instead of paying for a ton of channels you never watch on cable, buy only the episodes you watch for $1.99 each off iTunes * * Buy a day pass for the gym each time you go (around $5-$10) * * Buy songs as you want them for $0.99 each from Amazon or iTunes Read about the A La Carte method in detail. Here’s what to do: Today, cancel enough subscriptions to equal $50. If you can do more, great. Here are links to common subscription items to target: Netflix: http://www.netflix.com: $9/month for basic unlimited. Downgrade to $5/month. Savings: $5-9/month. Tivo: http://www.tivo.com: $13/month. Cellphone: http://www.att.com/wireless or http://www.verizonwireless.com or http://www. tmobile.com or http://www.sprintpcs.com. Most people probably won’t cancel their phone, but as an example of optimizing your existing spending, you can save $20/month by going from Verizon’s second-lowest plan ($60) to their lowest plan ($40). We already talked about how to do this earlier in the challenge. Cable: http://www.comcast.net or http://www.timewarnercable.com or http://www. dishnetwork.com or http://www.rcn.com (Don’t want to cancel everything? At the very least, cancel the Premium channels and get basic cable.). Savings: $50/month for Time Warner Digital Cable. Amazon Prime: http://www.amazon.com (cancel Amazon Prime – plus, it will make you buy fewer books) - $79 annually or $7/month Magazines: Look in them and cancel them. Buy them off eBay or get them at the library. ramit sethi iwillteachyoutoberich.com

- 25. page 23 the 30 day challenge Other online services: http://www.audible.com or any other online services. Can you live without them? “But Ramit…!”: Common arguments against the A La Carte Method 1. “I already paid to buy a satellite dish! It will be a total waste of money if I cancel now.” That’s a sunk cost, so ignore it as much as possible. Cancel it for this month only. If you decide you really want it back, you can always re-initiate service in December. (Yes, you may have to pay an initiation fee if you actually restart the service. But I’m willing to bet that after you hit your financial goal this month, you’ll be extremely careful in adding expenses back to your life. Plus, you can probably get the fee waived.) 2. “I don’t have any subscriptions like this!” First off, I bet you do — just check your credit card statements. But if you really don’t, well, then this tip may not be right for you. But think how you can apply it elsewhere: Are there areas where you pay automatically, without thinking how much it costs you? This is a huge area to save money since monthly subscriptions add up quickly: One of my readers canceled one $30/month subscription and saved $360/year. Any other concerns? Please read the full A La Carte Method first. ramit sethi iwillteachyoutoberich.com

- 26. page 24 the 30 day challenge Tip #9 Only buy new things when replacing something old This is tip #9 of the Save $1,000 in 30 Days Challenge. Today’s tip is to keep an “Item Budget” in your house — and before you buy something new, you must get rid of something old. This tip was submitted by Evert from London, UK, who writes: When buying things like clothes, set a rule for yourself that you can only buy something new, to replace something you already have. For example, from a practical point of view, let’s say you need to have 15 business shirts. Set a ‘budget’ of having 15 shirts, and then when you want to buy one, first throw away (or give to charity) the worst of the other. Can’t make a choice which one to throw out? Guess what: you won’t need a new shirt. Before buying anything, think ‘how many of those do I need?’and ‘how many do I already have?’, then think again if you really need a new one. The same applies to electronics and all sorts of other stuff (want a Playstation 3? Sell the Wii / blueray player / old laptop / etc. ) Applying the rule will have two benefits: less drawers and closets of stuff you still want to keep but never use, and spending less money because you’re more conscious about what you already have. Ok, there are 2 things to note about this tip: First, this is the kind of tip that’s easy to gloss over (”yeah, yeah”) and not do anything about. But I think about this as an active barrier (learn more about barriers) — something you consciously add as a roadblock before you can buy something new. The psychology of having to open up your closet, decide what to give away, and get it to the nearest charity (or garbage can) is enough to stop many of us from buying something new. Plus, it just ramit sethi iwillteachyoutoberich.com

- 27. page 25 the 30 day challenge keeps things neater around the house. Second, this tip is starting to focus us more on being goal-driven: If you have a goal (”Save $1,000″ or “Only have 15 business shirts at any given time”), your decisions become a lot easier. ‘Should I get that shirt? Hmm…let me check my goals. Nope, if I buy that, I can’t save $1,000 this month, so forget about it.’ When you’re not goal oriented, it’s like a neanderthal walking into a crystal shop. Everything is shiny and you’ll buy anything indiscriminately. When you have a simple overarching goal, you have a rubric to measure your decisions against. (You should share this with anyone else in your family so they’re on board, too.) Personally, I had to buy a new coat last week to go to Chicago. As a result of this tip, I’ve taken out three old shirts from my closet to give away to charity. Total Saved: From $10 to god knows how much you would have bought otherwise. ramit sethi iwillteachyoutoberich.com

- 28. page 26 the 30 day challenge Tip #10 Use the free rewards from your credit card, car insurance, and workplace This is tip #10 of the Save $1,000 in 30 Days Challenge. Today’s tip is to use the perks offered by your car insurance, credit card, and even your job — the ones most people ignore. Think about the places you belong to as a member: your credit card, auto insurance, Costco, or your job. Each of these offers perks that most people ignore. But by simply being a member, you get perks that can add up to thousands of dollars each year. In fact, every time you make a major purchase, you should be checking these perks first. Here are some examples from my own memberships: #1: My car insurance offers discounts on most major retailers. I was already planning to buy flowers and get movie tickets next month, so I’m adding a calendar reminder to use these coupon codes then. ramit sethi iwillteachyoutoberich.com

- 29. page 27 the 30 day challenge #2: My Costco membership gives discounts on pharmacy drugs, buying cars, mortgages, roadside assistance, travel, car tires, and many business services. #3: My credit card offers discounts on most major retailers, plus discounts on concert tickets and a “Make a Wish” service, which recently got me orchestra tickets I couldn’t get anywhere else. #4: There’s more on your credit card, which is the BEST source of perks. All credit card include automatic extended warranties, travel insurance, car-rental discounts, and a bunch of other perks. Check out my appearance on CNBC, where I cover credit card perks in more detail. #5: Your workplace probably offers a bunch of perks that nobody takes advantage of. At PBwiki, we offer weekly massages, free food, free headphones, and if you want to take a co-worker out to lunch, we’ll cover it. At bigger companies, you may find perks like public- transit reimbursement and discounts on entertainment tickets/attractions. Most people don’t use the perks, so ask the HR person for a list of benefits you have available and use them! Here’s how to use this tip effectively: First, log in to see what your memberships offer you. If anything catches your eye, set a calendar reminder for when to log back in and use it (e.g., “Booking vacation in February — check Geico for discount”). Try to defer all major purchases until later (otherwise, how are you going to save $1,000?), but if you know how much ramit sethi iwillteachyoutoberich.com

- 30. page 28 the 30 day challenge you’ll save, feel free to count it towards the $1,000 Challenge. One final thing: This is a powerful tip because you can get discounts on places you already shop — especially for large purchases, which can save thousands per year. The first time I used my credit card’s travel rewards, I saved $600. Using my discounts, I’ve saved thousands on travel, auto purchases, computers, clothes, and home decorations. The key is that nobody is going to spoonfeed you the places to look. If your workplace doesn’t offer discounts, check your car insurance. If that doesn’t offer perks, check your credit card (it definitely will). Check your library. And your homeowner’s association. The more you check, the more you can save. Total Saved: $100 to $2,000. ramit sethi iwillteachyoutoberich.com

- 31. if you enjoyed these tips... I’ve launched The Scrooge Strategy, a subscription program with new savings tips — about one per week — so you can continue saving even more money. Perfect if you need ongoing strategies, tactics, and reminders about saving money As a member of The Scrooge Strategy, you’ll receive an email to you each week with a new savings tip. As with prior tips, it will include a fresh way of looking at saving money — not more of the same old boring tips that nobody listens to. As a member, you’ll be able to request a savings tip in your particular challenge area: Maybe it’s eating out, or shopping, or spending too much on electronics. I’m also including a panel of expert writers, who will help you save money and conquer that problem area. ese tips work I spend hours writing each tip, which tend to be 4-6 pages long. They include super-tactical tips with screenshots, phone numbers, call scripts, and my own tips on what to watch out for. As a member, you’ll get one tip per week — just enough to focus on for the week. Plus, each tip is a constant reminder to stay focused on cutting costs, earning more, and optimizing your spending. “It’s like having a smart, articulate, and inexpensive financial advisor that calls you all the time to check in.” –Matthew Earle, Boston, MA “Tips are excellent–I really like Ramit’s emphasis on psychology and it is slowly but surely making me think about purchases I make, especially unplanned ones.” –Kevin Foster, Blacksburg, VA “So far, for 2009 I will be saving $660.60 over the course of the year (and I’ve only made 2 changes so far)!” –Stacy Miller, St. Albans

- 32. What other people have said about my savings tips “What really sold me on The Scrooge Strategy is that the step-by-step guides make saving money so easy that I seriously have no excuse not to evaluate my financial goals. Sure, I’ve theoretically known that that I needed to shop around for car insurance… but did I ever get my Google on and actually do it? Not until you laid out a couple of links for me. That tip alone saved me $1800 annually — and BONUS — now I actually know what the hell my insurance covers.” –Lesly, Houston, TX and Scrooge Strategy member “You can save well over a couple thousand dollars just with this tip alone. That’s more than some people save in a whole year.” –Caleb “IT IS FANTASTIC! My husband just lost his job, but with the savings we’ve implemented so far, and the additional savings coming up soon, I don’t think we are going to be in danger of falling off that financial cliff that many families are teetering on right now…and I really do credit a lot of that to this program. Also…IT DOESN’T MATTER AT ALL whether you make a lot of money, or a little money, this is good information/knowledge for anyone if you are willing to just do it.” –Stacy Miller, St. Albans and a Scrooge Strategy member Sign up for the Scrooge Strategy at http://www.scroogestrategy.com

- 33. page 29 the 30 day challenge Tip #11 Never pay full retail price for clothes (or eyeglasses) again This is tip #11 of the Save $1,000 in 30 Days Challenge. Today’s tip is to never pay retail prices for clothes again using some sites you’ve heard of, and a bunch of sites I bet you haven’t. How much do you spend per year on clothes? Think carefully about that question — if you buy a $300 coat, for example, you’re spending a minimum of $25/month on clothes. I don’t even buy clothes that often and I easily spent over $1,000 on clothes last year. Now, if you’re a mom or on a strict budget, saving money on clothes is nothing new: You’ve already been checking price tags carefully. But many of my friends buy what they want, when they want it. While these tips are applicable to everyone, they get the most mileage if you’re buying expensive clothes. What you’ll see below is that you can actually get same clothes you buy at Macy’s — or better clothes — for a lower price. Let’s watch Paul Singh from Results Junkies talk about how he gets custom-made shirts (which would normally cost $200+) for $30 here. (He referred to CTshirts in the video. Sign up for their free newsletter, then wait a couple weeks until they email you about their monthly clearance specials.) There are also lots of other places where you can save money on clothes. Retail stores: Because I’m Indian, I love Ross and TJ Maxx. I just bought a Ralph Lauren coat at 50% off the other day. Even Target can have cool clothes. The funny thing is, as young ramit sethi iwillteachyoutoberich.com

- 34. page 30 the 30 day challenge people, we think shopping there is “weird” because, let’s face it, it’s mostly moms who shop there, and who wants to be caught buying a pair of pants at Target? This actually mirrors personal finance: Spend money on the things you love, but cut costs mercilessly on the things you don’t care about. For example, if you love a blazer at Macy’s, save up for it and buy it guilt-free…but cut costs mercilessly on pants if you don’t really care what they look like. You have to prioritize. Plus, for people who think it’s “weird” to shop at TJ Maxx: I can get over that weirdness when I’m saving $200 on clothes each time I go in there. Buying abroad: Recently, I detailed how I saved $700 buy buying a suit and eyeglasses in India. Good news: Instead of walking the streets of Rajouri Garden in Delhi, you can do all of those things from your computer. Zenni Optical offers eyeglasses at $25 (and they’re not the only one — search for “cheap eyeglasses“). You can get custom suits made for $200, and a local tailor in your neighborhood will make the final adjustments (search “cheap custom suits“). Buy clothes online: I know, I know, people have been telling me to buy clothes online for years, but I always have this nagging feeling that things will never fit. But when I saw the prices, I was saving 75% off buying it at stores — making it worth the experimentation. Plus, every retailer understands your hesitation to buy clothes online, so they make it insanely easy to return clothes. I like eBay and Overstock.com. Also try Shop It To Me, which lets you enter your size/style and you’ll get targeted emails about exactly the clothes you’re looking for. Frankly, I’d recommend trying buying clothes online once. Pick a brand whose size you know, and since returns are free, it’s literally no money out of your pocket if you don’t like it. Note: I have invites available for the invite-only site Gilt.com, which gives you access to high-end retailers (John Varvatos, Ted Baker, Chip & Pepper, etc) for steep discounts (i.e., hundreds of dollars off). If you want in, click here for an invite. Buying something expensive? Use the Savings Goal strategy. Finally, there’s one bonus tip for buying something nice: If I see an expensive coat or jacket I want, I can either drop the cash right then, or go home, decide if I really want it, and set up a savings plan. You can probably guess what I do most of the time. Here’s how: Remember how I wrote about my sub-savings accounts? ramit sethi iwillteachyoutoberich.com

- 35. page 31 the 30 day challenge Let’s say I want to buy a blazer that costs $200. I set up a “Clothing” sub-savings account and set up an automatic transfer of $100 each month into it and set up a calendar reminder to let me know when I’ve saved $200. This does two things: First, it forces me to save for any large purchase. Second, by the time the second month comes around, I sometimes realize I didn’t really need that thing anyway. You can use the Savings Goal strategy for any large purchase. Here’s the ING account I use. Be careful about buying clothes. People love to rationalize that they’re “investing” in their clothes for the long term, which is a complete lie because they keep buying stuff every year. Only buy something new when you get rid of something old. Pay for quality, but hold it (and wear it) for a long time. Cut costs on stuff that nobody sees, like your headbands or socks. And ask yourself if dressing in the newest Kenneth Cole shirt or Prada bag really gets you to your goals. Total saved: $50 to $500 ramit sethi iwillteachyoutoberich.com

- 36. page 32 the 30 day challenge Tip #12 How I’m saving $2,000+ on eating out in 2009 This is Tip #12 of the Save $1,000 in 30 Days Challenge. Today’s tip is to save money on eating out using services that offer incredibly steep discounts. I eat out a lot, so this one is saving me tons of money. You can get big discounts on eating out if you plan ahead and are willing to use coupons at a restaurant. If you live in a city and restaurants tend to be more expensive, saving 10% or 25% or 50% per meal — even once a week — can add up quickly. Here are the tips I’ve started using for a huge drop in my monthly spending on eating out. 1. Restaurant.com is offering 80% (!!) off its gift certificates. Note: This expires on 11/20/08 11/24/08. • Get $25 Restaurant.com gift certificates for $2 (no joke) • Get a 12-month Dinner of the Month Club membership for $24 Remember, those deals expire on 11/24. Use code “SURPRISE” to get the discounts. 2. The 2009 Entertainment Book Remember these from elementary school? They used to cost $40 and seemed unreasonably expensive… until I started having to buy my own food. I bought a ramit sethi iwillteachyoutoberich.com

- 37. page 33 the 30 day challenge copy of this a couple days ago after checking out the site to make sure their coupons were good for my area. I’m forcing myself to use at least two coupons per month — so if I’m planning to grab dinner with someone, I’ll consciously grab a coupon from this book (which I’m going to keep on my desk) and try to pick a restaurant that applies. Note: This works if you already eat out, but if you buy the book and then force yourself to use it — spending more than you normally would have — that’s probably not the best way to save money. Duh. These are $25, so check the coupons to see what it will take for you to save money. I ordered mine a couple days ago. Check out the Entertainment book site. 3. Along the lines of involving your friends in the 30 Day Challenge, here’s a tip I’m using to save money on eating out. The other day, one of my friends was talking about she loves to cook, but hates cleaning up. My eyes lit up because I don’t mind washing dishes, but I’m horrible at cooking. Could there be a win-win situation here? ramit sethi iwillteachyoutoberich.com

- 38. page 34 the 30 day challenge Everybody wins: We all get to hang out, eat food instead of letting it go rotten, and my friend doesn’t have to worry about cleaning up. If each meal saves a $20 dinner out and you do that three times/month, that’s $60/month. There are also a bunch of other coupon / eating services out there, so if you have suggestions, leave them in the comments. It depends how much you eat out, but to share my friends’ biggest expense, it’s eating out by far, so this tip alone will save most of them over $1,000 over the next year. If you eat out a lot, it’s even more. Total saved: $50 to $3,000 ramit sethi iwillteachyoutoberich.com

- 39. page 35 the 30 day challenge Tip #13 How to negotiate your car insurance This is Tip #13 of of the Save $1,000 in 30 Days Challenge. (See past tips.) Today’s tips is to negotiate your car insurance. Most of us pick a rate once, then never go back again. But if you do, you can save hundreds of dollars each year. First, check to see if you have the right amount of coverage. Nobody teaches us about this stuff, so when you bought car insurance, you may not have known which coverage options to choose. Second, figure out what kind of coverage you currently have and how much you’re paying. Don’t be lazy — do this. If you don’t have your current info in front of you, how can you hope to save? Either call your car insurance company or use their website. Third, it’s time to start shopping around. I prefer the phone because I can usually sweet- talk the rep into telling me about other deals that the websites don’t offer. Computers, however, seem to be immune to my charm. I made it easy for you. Here are the phone numbers of the big insurers: Geico: 1-800-861-8380 AAA: (866) 539-8033 Allstate: 866 704 9900 Progressive: 1-800-776-4737 State Farm: Sorry, despite getting good ratings in the comments below, THEY OFFER NO PHONE NUMBER. Anyway, you can get to their auto insurance site here. ramit sethi iwillteachyoutoberich.com

- 40. page 36 the 30 day challenge 21st Century Insurance: Don’t use this worthless insurance company. I used to use them, but they sent me multiple envelopes in the mail EVERY SINGLE WEEK until I finally canceled them. The rates were great, but the hassle wasn’t worth it. Fourth, be an expert caller by asking these questions. With each call, you should say, “AAA (or whoever) is offering to insure me for $XXX less” (silence). See what they do. (Note: Getting lower rates using this technique is much harder to do with car insurance companies than banks, so don’t expect very much from this.) How much would I save if I insure my car and house with you? What about renewal discounts? How long have I been a member with you? What can you offer me as a discount for long-term membership? Can I save money by pre-paying my entire year up front? Let’s check my car. I know other firms offer discounts for features like anti-lock brakes. What about you? What kind of low-mileage discounts do you offer? If I enrolled in a defensive-driving course, what kind of discount would you offer? Oh, really? Which courses qualify? What about discounts for my employer? (Tell them the specific name of your employer?) Some insurance companies offer discounts for low-risk occupations (engineers). What kind of competitive rates do you offer? Am I paying for roadside assistance? What other additional “benefits” am I paying for? (If you already pay for AAA, you don’t need roadside assistance through your car insurance. Also, check your credit card: They may offer roadside assistance (but call them and ask how much it really costs if you have to use it – some of their offers for “roadside assistance” really mean “we will assist you by calling someone for you and then charging you out the ass”). Can you walk me through the deductible changes I could make to save money? (Deductibles are what you pay before your insurance policy kicks in. By requesting higher deductibles, you can lower your costs substantially. For example, increasing your deductible from $200 to $500 could reduce your collision and comprehensive coverage cost by 15 to 30 percent. Going to a $1,000 deductible can save you more than 40%. Before choosing a higher deductible, be sure you have enough money set aside to pay it if you have a claim. More ramit sethi iwillteachyoutoberich.com

- 41. page 37 the 30 day challenge details here. AAA, Costco, credit cards, large employers, associations (AARP, teachers’ union): Many of these offer discounts on car insurance. Log onto their website and browse to “perks.” Read more ways to save on car insurance. It seems like a lot of work, but the savings are substantial. I took screenshots of the different rates that different insurance companies were offering me: http://www.slide.com/r/po2G3ec86z-1a7x8pDm-nnNsGjMtY8ty?previous_ view=TICKER&previous_action=TICKER_ITEM_CLICK&ciid=2738188573602328924 Well, as you can tell, that slideshow is completely worthless since you can’t see anything — but the difference between the lowest quote (Geico, which I use) and the highest (Progressive) is $734 per year. That’s a lot for a few phone calls. Don’t forget: Insurance is not a commodity. If you pick the cheapest provider to save $50/ year and they end up not fulfilling your claim — which you could have reasonably known by searching out reviews for the company — it’s your fault. Pick a good company because it can be worth thousands of dollars. As you’ve seen, “negotiating” your car insurance is mostly about keeping up with the changing rates and making sure you’re wringing every last benefit from your policy, so set a calendar reminder to do this once per year. Total savings: $25 to $100 per month ramit sethi iwillteachyoutoberich.com

- 42. page 38 the 30 day challenge Tip #14 Use self-persuasion to share how much you’ve saved so far This is Tip #14 of of the Save $1,000 in 30 Days Challenge. (See past tips.) Today’s tip is to write down how much you’ve saved so far, AND how you would motivate others to save money. (Skip to the survey here.) If this doesn’t seem like an obvious savings tip, let me share an experiment that social psychologist Kurt Lewin did to change behavior. In World War II, the United States was facing a serious shortage of meat. The Committee on Food Habits was charged with figuring out how to keep Americans healthy without the same meat they’d been accustomed to — and instead eating intestine and kidneys — so they asked Lewin to help. Lewin’s approach was brilliant. As Eliot Aronson writes in Age of Propaganda, Lewin convened groups of housewives, who at that time were the chief decisionmakers about food. He then split them into two groups: Group 1 received a 45-minute lecture, which “emphasized the importance of eating these meats for the war effort; it stressed the meats’ health and economic advantages…the lecture concluded with a testimonial from the speaker about her success in serving intestinal meats to her own family.” 3% of the attendees ended up serving intestinal meats to their families. Group 2, by contrast, spent the same amount of time discussing the problem of a meat shortage, but in this experimental condition, Lewin did something extraordinarily clever: He asked them, “Do you think ramit sethi iwillteachyoutoberich.com

- 43. page 39 the 30 day challenge that housewives like yourselves could be persuaded to participate in the intestinal meat program?” The women then discussed how that might happen. In this group, “32% of the housewives who had engaged in self-persuasion served their families intestinal meats.” That’s an astonishing difference, and I want to apply it here. Tell me how much you’ve saved, and how, together, we can persuade other people to save money. Please fill out the 3-minute survey here: Click here: How much have you saved so far in the 30 Day Challenge? As a thank-you, 10 random people who will out the survey will get to pick any book from the Giveaways section of my book site. I’ll ship it to you for free. ramit sethi iwillteachyoutoberich.com

- 44. page 40 the 30 day challenge Tip #15 Forget going to a bar — ask people over for dinner This is Tip #15 of of the Save $1,000 in 30 Days Challenge. (See past tips.) Today’s tip is to have people over to your house instead of meeting at a bar or a restaurant. I would enjoy this dinner party When I thought of this tip, the first thing I thought was, “Oh god, my mom is going to lecture me about how she’s been doing this for years.” But most people in their 20s who I know don’t have dinner parties. There’s not enough space, not enough furniture, and not enough dishes — not to mention that I don’t know how to cook worth a damn. But that’s when the haunting echo of my mom came into my mind, as she wordlessly forced me to ask myself one question: WWAID? ramit sethi iwillteachyoutoberich.com

- 45. page 41 the 30 day challenge What Would An Indian Do? This is one of the most cost- effective things you can do this month — even if you only do it once or twice. Let’s assume you spent $50 each time you go out, including gas, drinks, food, tips, tax, misc (valet / lending money you’ll forget to get back / buying gum). Changing your spending pattern for just one of those can save you hundreds per year. When you go out, the point is to hang out with your friends. Think back to just a few years ago, when you would drink out of a decomposing milk bottle and live in a 75-square-foot box with another human being. I’m sure you can suck it up and sit on a folding chair. But we have a bunch of excuses in our head as to why we can’t invite people over, so I thought I’d highlight something I read that opened my eyes. Here’s an excerpt on hosting people at your house from Never Eat Alone (the best book on building relationships and staying in touch with friends and business contacts): The author goes on to offer some great tips for having a few people over (check out the book). ramit sethi iwillteachyoutoberich.com

- 46. page 42 the 30 day challenge It can be a potluck. It can be a dinner party. It can be ordering pizza. But by staying home, you’ll avoid the ravages of tips, taxes, cabs, and marked-up drinks. One last thing to make your life easy: If you’re supplying the food, don’t try to be Mario Batali. Just buy some pre-packaged foods and take it one step at a time. On your fourth or fifth event, you can try cooking. Also, if you have a Trader Joe’s near your house and want see what kind of stuff you can make with their ingredients, go here: http://www. traderjoesfan.com/Trader_Joes/recipes/ Reader tips on saving money on eating out with friends: “Pre-eat. Before going to out to dinner with friends, I eat from what I already have at home. Then, when I go out with friends for dinner, I order soup or an appetizer. This way I’m still being social, and I get my fill, but I’m not blowing my budget. Or, instead of making dinner plans w/friends, make dessert plans. You’re still going out and being social, but again, not spending $14 + on dinner.” –Natalie Bradley, Washington DC “As an office, we decided that we were all spending too much on eating out, so we have been taking turns making things like casseroles and soups, and crock pot dishes to share. We have been doing this one to two times per week, which keeps us from eating out on those days, as well as this being an awesome opportunity to get new recipes and sample all different foods. There are 6 of us in the office, so we rotate, and it works out well. We even have recipes now that people look forward to because they are so delicious.” –Ashley Witmyer, Toledo, OH Total savings: $50 to $200 per month Links of interest Official USDA Food Plans: Cost of Food at Home at Four Levels ramit sethi iwillteachyoutoberich.com

- 47. page 43 the 30 day challenge Tip #16 Cancel any large purchases this month This is Tip #16 of of the Save $1,000 in 30 Days Challenge. (See past tips.) Today’s tip is to cancel/defer any large purchase you were planning for this month. You’re basically using time as a strategic barrier against yourself. It’s very simple: New lawn mower – wait . New TV – wait. New dishwasher — wait. You can set a calendar reminder to check on it in 30 days. A couple things will probably happen when you do this: First, prices will probably drop. Second, chances are you’ll realize you didn’t really need it — especially as your savings start to grow. How much easier do you think it’ll be to save once you have $1,000, or $5,000, sitting in your savings account? Let’s also take this tip from an iwillteachyoutoberich reader: “We have a coffee can at home that we put all of our change into. Even our kids help with this. If I have cash, I don’t ever pay for anything with exact change. All change that I get back goes straight to the coffee can. The entire family is excited about this saving’s idea because they know that we are going to use the money to go on a family vacation. It’s amazing how much more excited they become when they know the end result. On average, we save $600 a year in change.” Judy Schaffer, Mankato, MN Look beyond the obvious tip of saving change (which is a good one). The deeper point is to get your family/friends involved. If ramit sethi iwillteachyoutoberich.com

- 48. page 44 the 30 day challenge you’re canceling getting a new BBQ, get your family involved to show them why you’re doing it and what payoff they can expect. Maybe you take $10 (of the $200 you would have spent) and put it towards a vacation fund. The point is to borrow from each of these tips and tailor them for yourself. Total savings: $50 to $3,000 ramit sethi iwillteachyoutoberich.com

- 49. page 45 the 30 day challenge Tip #17 Buy generic for the stuff you don’t care about This is Tip #17 of of the Save $1,000 in 30 Days Challenge. (See past tips.) Today’s tip is to buy generics for the stuff you don’t care about — while continuing to buy brand-name for the stuff you do care about. When I was growing up, I was a pretty good kid, but I still remember one of the most annoying/bratty things I ever did. For some reason, I demanded that my mom buy me this expensive shirt (it was Ralph Lauren, I think). My mom tried to talk me out of it for HOURS, but I screamed and cried and she finally got it for me. The next day I wore it to school, where I was on lunch duty, and my dish that day was berry cobbler. Because I was a young and dumb, I thought it’d be fun to smack the cobbler with my spoon — which immediately turned my brand new shirt purple and ruined it forever. The cost difference between generics and brand-name goods can be significant when you add it up, but the differences in quality have been steadily dropping for years. Yet we tend to buy what we know, which is always amusing because I have friends who insist advertising does not affect them. They say this while eating Cheez-Its, holding a Starbucks frappuccino, and paying for their new Nike shoes with money from their Kenneth Cole wallet. When it comes to generics vs. brand-name goods, one of the most under-considered factors is prioritization. If you want to save $1,000 this month, you have to prioritize because you can’t have the best of everything. So buy brand-name for the stuff you care about, and cut costs mercilessly on commodities you don’t care about by buying generic. My friend Jim Blomo does this better than almost anyone else I know: I remember him calling me up a while ago, telling me he had just gotten another raise. “Awesome!” I said. Ironically, that was the same week he moved into an even cheaper place to live. Maybe it’s not actually that ramit sethi iwillteachyoutoberich.com

- 50. page 46 the 30 day challenge ironic. Whereas a lot of us take our new raises and spend it, really rich people take those raises, invest them, and continue living on the older wage that they’ve become accustomed to. He makes conscious choices about what he spends his money on. Jim has told me over and over that he doesn’t care much about living in a fancy place, so he saves money on that. He cooks at home when he can instead of eating out every day. But he loves outdoor stuff– biking, camping, travel. And so he splurges on those things. He has a top-of-the-line bike. He just got back from a week-long trip to New York, just for fun. Read more about Jim’s conscious spending. What could you de-prioritize? If I were to ask which of your purchases you don’t care about, what would you say? Would you say you don’t really care about your hair products? Or that you could probably live in a cheaper place? Maybe you’d say that you don’t need to eat fancy cheese. Most of us don’t think like this. We’re also hesitant to experiment with downgrading. “But Ramit,” you might say, “I need that shampoo. My hair goes crazy without it!” Maybe it does. Maybe not. But you won’t know until you test it by buying a less-expensive comparison shampoo and try it out. Until then, you’ll slavishly continue buying the more expensive goods. Combine all the name-brand things you buy and you could be overspending by thousands each year. (If you’re worried about the quality going down, think again: The world is full of people claiming they can tell the difference between things like wines, soft drinks, and shampoos, and when you run double-blind experiments, of course, they really can’t. More about them in my delicious/expertise bookmarks.) To put it bluntly, we can’t afford to buy the best of everything. When you buy, what can you cut costs on by buying generic? How I balance quality with generics For me, I do two things: First, I experiment regularly with the stuff I buy to see if I can downgrade. Recently, I bought generic Safeway sandwich cheese (those little orange squares). They tasted horrible, so I went back to buying Kraft cheese. That’s right, I live large. Second, when I buy something that I care about, I buy top-of-the-line products and hold them for a long time. But when I buy something I don’t care about, like shampoo or luggage, I cut costs mercilessly. Read more about in Conscious Spending: How My Friend Spends $21,000/year Going Out. ramit sethi iwillteachyoutoberich.com

- 51. page 47 the 30 day challenge I asked my researcher to go to Safeway and dig up some cost comparisons. Here’s just a sample of what he found: Ask yourself: • Can you really tell the difference between Cheerios ($5) and the generic version ($2.50)? Have you ever tried? • What about prescription drugs, batteries, or vitamins? How much could you save each month? • Would it be worth trying out some generics to see which you’d be willing to compromise on? Of course it would. Even if it costs a little extra to duplicate what you’ve got in generic, it’s a spend-once-save-forever proposition: If you save 50% on Cheerios for the rest of your life, that’s a lot more than the $2.50 you spent on trying it out. Some examples of areas you could save money: Toiletries, food, clothes (especially jeans, gloves, underwear, undershirts, slippers), stuff for your pet (I would rather feed my pet a box of napkins than buy Premium food….this may be why I don’t have a pet), and auto stuff. Try it today: You can’t get the best of everything. What can you compromise on? Total savings: $50 to $500 per month ramit sethi iwillteachyoutoberich.com

- 52. page 48 the 30 day challenge Tip #18 No Christmas gifts this year This is Tip #18 of of the Save $1,000 in 30 Days Challenge. (See past tips.) Today’s tip is to skip the expensive Christmas gifts this year — which cost the average American over $850 last year — and instead give something more meaningful this year. NoChristmasGiftsThisYear.com The economy is horrible. People are in debt and they’re losing jobs every day Yet there’s one sacred cow that we can’t seem to shake — no matter how bad things get. Christmas gifts: The things we love to complain about, but hate to be honest about. Can you even imagine calling your parents, or your girlfriend, or talking to your son about how you can’t afford to buy something this year? Of course not. And that’s how we incur exorbitant debt, starting off each new year on the wrong foot. Instead of planning to get ahead, we’re already clawing back from debt. Here’s an article Thomas Friedman at the New York Times just wrote: ramit sethi iwillteachyoutoberich.com

- 53. page 49 the 30 day challenge I go into restaurants these days, look around at the tables often still crowded with young people, and I have this urge to go from table to table and say: “You don’t know me, but I have to tell you that you shouldn’t be here. You should be saving your money. You should be home eating tuna fish. This financial crisis is so far from over. We are just at the end of the beginning. Please, wrap up that steak in a doggy bag and go home.” So I’ve come up with a site (along with my friends at Out:think) that I hope you can share with your friends and family. It’s free, and it’s very simple, but the point is to share the idea that you can do something for the people you love without spending money. In fact, I’m willing to bet they’ll respect you more if you look them in the eye and say, “Look, things are really tough this year. I can’t buy you a gift like I want to, but I’d love to help you out around the house or host a dinner so we can catch up.” There are so many other things you can do together, and you’ll see a small list of suggestions when you click below. I mean it when I say that money is only a very small part of being rich. And it’s an even smaller part of the holidays. I hope you like the site. Click here: NoChristmasGiftsThisYear. com Total savings: $50 to $1,000 ramit sethi iwillteachyoutoberich.com

- 54. page 50 the 30 day challenge Tip #19 Save Money, Eat Well and Look Hot in Less an an Hour This is Tip #19 of of the Save $1,000 in 30 Days Challenge. (See past tips.) This is a guest post by Susan Su. I’m a snob. I eat organic food, love designer clothes, buy premium pet food, and hate Old Navy. But, I’m also one of the cheapest people I know (apart from my Chinese mother - who is THE cheapest person I know, bar none). Ramit has written about swapping out name brands for generics, and many readers have commented on the low, low price of clothes at Target or Walmart. But, I am a strong believer in quality. A truly nice suit during a salary negotiation can give you the confidence and polish to push for a 10% pay hike. Stylish and professional office clothes can add a crucial accent to your earnest hard work and painstaking PowerPoints. Fresh, organic food can keep your family in robust good health and flourishing at jobs, school and life instead of feeling sluggish and ineffective. An investment in a sexy outfit can yield returns in a hot first date, or a long-lasting flame. So, how exactly do you indulge a champagne taste on a beer budget? CLOTHES Target never worked for me. The clothes were always the wrong shape and size, and wore out after only a few washes. Even though an item only cost me $20, I ramit sethi iwillteachyoutoberich.com

- 55. page 51 the 30 day challenge considered it $20 wasted when it was unwearable after the third week of ownership. For nice clothes, one trick I used to think was so smart was going to Nordstrom Rack. I bought a Michael Stars shirt (these normally start at $40 for a tank top, but are sparkly and fabulous) for $10. That was back when I was an AmeriCorps volunteer making $800 a month and living off of food stamps. $10, or three bakery scones as I like to think of it, was within my budget. However, once I made my debut in the world of private enterprise, and let my inner efficiency expert out to play, I realized that I do NOT have time to go down to Nordstrom Rack and paw through massive, disorganized piles of ugly, out-of-fashion clothing in order to find that one buttercup-yellow Michael Stars tee. I went a couple months ago on a Sunday after a long night of rest. Still, I left exhausted, empty-handed and pissed off after wasting and hour and a half rummaging and waiting in line at the fitting rooms. I left with the grumpy and self-destructive thought that next time I’d just buy full-price and be done with the chaotic likes of discount retailers. The beauty of buying full price, I always thought, was that all the arranging and selection is practically done for you — by all those people that the store or brand pays to look pretty, try to sell you things, and put clothes on mannequins in semi-creative ways. I hate paying for salaries (and other costs) that I don’t think are really adding major value to my core need - the need to buy pretty clothes and look awesome. There is, I discovered, a way to have it all. You can buy high quality, fashionable, well- organized and well-displayed clothes and spend less time than getting a mani-pedi. How? Do it on the Web! Here are the specific sites and services I love: Shop It To Me. When signing up for this automated personal (discount) shopper service, I selected the brands I like, the size I wear, and how often I wanted to receive email alerts. I was skeptical because I’ve signed up for SO many email alert type services that I promptly relegated to some obscure email filter. Why would this be any different? ramit sethi iwillteachyoutoberich.com

- 56. page 52 the 30 day challenge I found out when I got my first Shop It To Me SaleMail. Everything it suggested to me - an amalgam of sale items across the Web - played to my tastes (because I chose the brands), fit me (because I chose the size) and was available (as opposed to sold out) at a MAJOR discount. Most items have been half off or more. If the same item is available on two different sites for at two different levels of discount, Shop It To Me will include only the cheaper option in your SaleMail, automating all your time-consuming comparison shopping. The best part is that you can skim through the images in your SaleMail while having your morning whatever and click straight through to the retail site if you’re interested in making a purchase instead of wasting hours going to physical storefronts or even wasting hours at individual online shopping sites doing comparison shopping. Site: http://www.shopittome.com Items: Men’s and women’s clothes and shoes. Brands: Almost everything at almost all levels. Brands range from Louis Vuitton to Nike to Victoria’s Secret to Free People to The North Face to Tufi Duek … you get the idea. $$ Saved: I picked out a hypothetical full outfit from a recent SaleMail I received. $489 regular price total - $244.50 discount price total = $244.50 total, or a savings of exactly 50%. Time Saved: Estimated time to find same deals on Internet (incl. shopping around): 1 hr - Time it would take me to make purchase from SaleMail: 10 min = 50 min saved. ramit sethi iwillteachyoutoberich.com

- 57. page 53 the 30 day challenge 2. Amazon.com. Nope, they don’t just sell books anymore, and yep, shipping is still free on many items. Amazon has some great deals on brand-name clothes, like this James Perse sweater vest for 66% off (if that’s your style), but my favorite apparel item there is SHOES. I saved $50 on a pair of Palladium flats the other week. They were still full-price on Amazon’s sister company, Endless.com. The reason Amazon can sell stuff for less is because they are now an aggregator of items on the Web - not just a vertical retailer. As shown by Shop It To Me, aggregators save you money AND time because they do all that sifting for you. Site: http://www.amazon.com Items: Everything under the sun, including apparel items. Great for shoes, and way cheaper than Zappos. Brands: Most common brands are available here. Really unique, high-end, or fringe brands are rare, but a search only takes a minute. $$ Saved: My Palladium shoes cost $73 originally. I bought them for $22.99, a savings of 50.01 or 69%. I also got free shipping and didn’t have to talk to sales people. Time Saved: There’s a shoe store about 1.5 miles from my house that sells Palladium shoes. It would take me about 40 minutes to walk there and back + 15 minutes to buy the shoes, for a total of 65 minutes. It took me 5 minutes to buy the shoes online, for a savings ramit sethi iwillteachyoutoberich.com