secondary market

- 1. Secondary market Aksansha Bhambri Akash Gupta Akash Kher Akshainarayan Iyenger Abhishek Naha Ankit Pachauri Akshit Jain Aman Swarup Anuj Kakkar Ali Mavil

- 2. Primary Market PRIMARY MARKET • Company requires Money/Capital for operations • So, Company sell their shares directly to public • Selling of shares for the 1st time is IPO(Initial Public Offering) • Selling of Shares for the 2nd and 3rd time is called FPO(Follow on Public Offering) Company- Requires money/capital Money/Capital (In form of Equity/debts) Selling of Shares(In terms to increase the value of equity)- Value of Shares decided by the company People(Institution/ Individual)

- 3. Secondary Market • People invest in share to get the profit in future by selling them. • Company listed its shares on Stock Exchange and provide the opportunity to sell them on profit for investors(IPO/FPO). • Trading of shares by the general people • Process is Secondary Market • Majority of trading done in Secondary Market IPO/FPO (Sell the shares using Stock Exchange platform) Selling of shares(Price Decided by Law of Demand & Supply) General Public Secondary Market

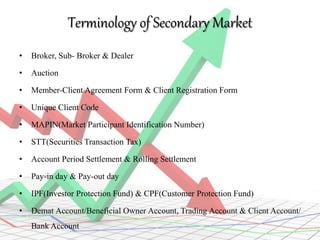

- 4. Terminology of Secondary Market • Broker, Sub- Broker & Dealer • Auction • Member-Client Agreement Form & Client Registration Form • Unique Client Code • MAPIN(Market Participant Identification Number) • STT(Securities Transaction Tax) • Account Period Settlement & Rolling Settlement • Pay-in day & Pay-out day • IPF(Investor Protection Fund) & CPF(Customer Protection Fund) • Demat Account/Beneficial Owner Account, Trading Account & Client Account/ Bank Account

- 5. PRODUCTS DEAL IN THE SECONDARY MARKET • Equity Shares • Government securities • Debentures • Bond • Bonus Shares • Preferred Stock/ Preference shares • Cumulative Preference Shares • Cumulative Convertible Preference Shares • Participating Preference Share • Commercial Paper Use in India Not use In India

- 6. Features of Secondary Market • It creates liquidity • It comes after primary market • It has a particular place • It encourages new investments • Aids in financing the industry • Ensure safe and fare dealing(Media Broadcasting)

- 7. Functions of Secondary Market • Provides regular information about the value of security • Help to observe prices of bond and their interest rates • Offers to investors liquidity for their assets • Secondary market bring together many interested parties. • It keeps the cost of transactions low LIQUIDITY: The main function of stock market is to provide ready market for sale and purchase of securities. The presence of stock exchange market gives assurance to investors that their investment can be converted into cash.

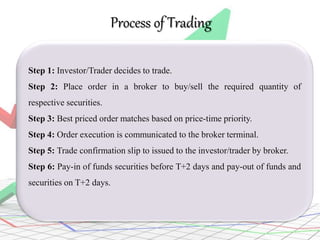

- 8. Process of Trading Step 1: Investor/Trader decides to trade. Step 2: Place order in a broker to buy/sell the required quantity of respective securities. Step 3: Best priced order matches based on price-time priority. Step 4: Order execution is communicated to the broker terminal. Step 5: Trade confirmation slip to issued to the investor/trader by broker. Step 6: Pay-in of funds securities before T+2 days and pay-out of funds and securities on T+2 days.