Royal Dutch Shell plc CFO Simon Henry - Global Oil & Gas Conference - September 27, 2012

- 1. ROYAL DUTCH SHELL PLC GLOBAL OIL AND GAS CONFERENCE DEUTSCHE BANK LONDON LONDON SEPTEMBER 27, 2012 27 Copyright of Royal Dutch Shell plc 27 September 2012 1

- 2. ROYAL DUTCH SHELL PLC DEUTSCHE BANK LONDON SIMON HENRY CHIEF FINANCIAL OFFICER Copyright of Royal Dutch Shell plc 27 September 2012 2

- 3. DEFINITIONS AND CAUTIONARY NOTE Resources: Our use of the term “resources” in this presentation includes quantities of oil and gas not yet classified as SEC proved oil and gas reserves or SEC proven mining reserves. Resources are consistent with the Society of Petroleum engineers 2P and 2C definitions. The companies in which Royal Dutch Shell plc directly and indirectly owns investments are separate entities. In this presentation “Shell”, “Shell group” and “Royal Dutch Shell” are sometimes used for convenience where references are made to Royal Dutch Shell plc and its subsidiaries in general. Likewise, the words “we”, “us” Shell we , us and “our” are also used to refer to subsidiaries in general or to those who work for them. These expressions are also used where no useful purpose is served by identifying the particular company or companies. ‘‘Subsidiaries’’, “Shell subsidiaries” and “Shell companies” as used in this presentation refer to companies in which Royal Dutch Shell either directly or indirectly has control, by having either a majority of the voting rights or the right to exercise a controlling influence. The companies in which Shell has significant influence but not control are referred to as “associated companies” or “associates” and companies in which Shell has joint control are referred to as “jointly controlled entities”. In this presentation, associates and jointly controlled entities are also referred to as “equity-accounted investments”. The term “Shell interest” is used for convenience to indicate the direct and/or indirect (for example, through our 23% shareholding in Woodside Petroleum Ltd.) ownership interest held by Shell in a venture, partnership or company, after exclusion of all third-party interest. This presentation contains forward-looking statements concerning the financial condition, results of operations and businesses of Royal Dutch Shell. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. Forward-looking statements are statements of future expectations that are based on management’s current expectations and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in these statements. Forward-looking statements include, among other things, statements concerning the potential exposure of R t ti l f Royal D t h Sh ll t market risks and statements expressing management’s expectations, b li f estimates, f l Dutch Shell to k t ik d t t t i t’ t ti beliefs, ti t forecasts, projections and t j ti d assumptions. These forward-looking statements are identified by their use of terms and phrases such as ‘‘anticipate’’, ‘‘believe’’, ‘‘could’’, ‘‘estimate’’, ‘‘expect’’, ‘‘intend’’, ‘‘may’’, ‘‘plan’’, ‘‘objectives’’, ‘‘outlook’’, ‘‘probably’’, ‘‘project’’, ‘‘will’’, ‘‘seek’’, ‘‘target’’, ‘‘risks’’, ‘‘goals’’, ‘‘should’’ and similar terms and phrases. There are a number of factors that could affect the future operations of Royal Dutch Shell and could cause those results to differ materially from those expressed in the forward-looking statements included in this presentation, including (without limitation): (a) price fluctuations in crude oil and natural gas; (b) changes in demand for Shell’s products; (c) currency fluctuations; (d) drilling and production results; (e) reserves estimates; (f) loss of market share and industry competition; (g) environmental and physical risks; (h) risks associated with the identification of suitable potential acquisition properties and targets and successful negotiation and completion of such targets, transactions; (i) the risk of doing business in developing countries and countries subject to international sanctions; (j) legislative, fiscal and regulatory developments including potential litigation and regulatory measures as a result of climate changes; (k) economic and financial market conditions in various countries and regions; (l) political risks, including the risks of expropriation and renegotiation of the terms of contracts with governmental entities, delays or advancements in the approval of projects and delays in the reimbursement for shared costs; and (m) changes in trading conditions. All forward-looking statements contained in this presentation are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Readers should not place undue reliance on forward-looking statements. Additional factors that may affect future results are contained in Royal Dutch Shell’s 20-F for the year ended 31 December, 2011 (available at Shell s 20 F www.shell.com/investor and www.sec.gov ). These factors also should be considered by the reader. Each forward-looking statement speaks only as of the date of this presentation, 27 September 2012. Neither Royal Dutch Shell nor any of its subsidiaries undertake any obligation to publicly update or revise any forward-looking statement as a result of new information, future events or other information. In light of these risks, results could differ materially from those stated, implied or inferred from the forward-looking statements contained in this presentation. There can be no assurance that dividend payments will match or exceed those set out in this presentation in the future, or that they will be made at all. We use certain terms in this presentation, such as resources, that the United States Securities and Exchange Commission (SEC) guidelines strictly prohibit us from including in filings with the SEC. U.S. Investors are urged to consider closely the disclosure in our Form 20-F, File No 1-32575, available on the SEC website www.sec.gov. You can also obtain these forms from the SEC by calling 1-800-SEC-0330. Copyright of Royal Dutch Shell plc 27 September 2012 3

- 4. OVERVIEW Performance focus H1 ‘12 earnings $13 bln; EPS unchanged H1 ’12 asset sales $4 bln CONTINUOUS IMPROVEMENT Growth delivery GROWTH DELIVERY H1 ‘12 underlying production growth 4% 12 >20 projects under construction MATURE NEW OPTIONS PERFORMANCE FOCUS New growth options N th ti Expanding our opportunity funnel Frontier exploration build New integrated gas options Earnings CCS basis, earnings and EPS excluding identified items Copyright of Royal Dutch Shell plc 27 September 2012 4

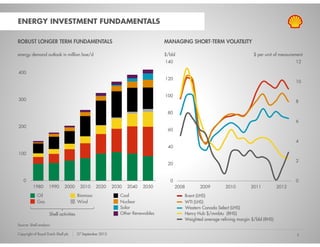

- 5. ENERGY INVESTMENT FUNDAMENTALS ROBUST LONGER TERM FUNDAMENTALS MANAGING SHORT-TERM VOLATILITY energy demand outlook in million boe/d $/bbl $ per unit of measurement 140 12 400 120 10 100 300 8 80 6 200 60 4 40 100 2 20 0 0 0 1980 1990 2000 2010 2020 2030 2040 2050 2008 2009 2010 2011 2012 Oil Biomass Coal Brent (LHS) Gas Wind Nuclear WTI (LHS) Solar Western Canada Select (LHS) Shell ti iti Sh ll activities Other Renewables Henry Hub $/mmbtu (RHS) Weighted average refining margin $/bbl (RHS) Source: Shell analysis Copyright of Royal Dutch Shell plc 27 September 2012 5

- 6. CONTINUOUS IMPROVEMENT DOWNSTREAM: MINIMIZING UNPLANNED DOWNTIME UPSTREAM: WELL AND RESERVOIR MANAGEMENT % Oil production in ‘000 boe per day 10 95 5 85 75 0 Implementation 2006 2007 2008 2009 2010 2011 1H2012 of structured WRM process Oil Products 20,000 bpd 20 000 b d Chemicals 65 55 EXTRACTING MORE VALUE 2002 2004 2006 2008 2010 2012 FROM OUR ASSETS Example: Oman Copyright of Royal Dutch Shell plc 27 September 2012 6

- 7. RECYCLING CAPITAL INTO NEW GROWTH DIVESTMENTS 2011 - 2012 H1 ACQUISITIONS 2011 - 2012 H1 ~$12 ~$6 billion billion Upstream Upstream Downstream Downstream Exit non-core positions Liquids-rich shales Strategic partnering; Prelude, Groundbirch Frontier exploration plays Refinery-to-terminal conversions LNG optionality RIGOROUS FOCUS ON CAPITAL EFFICIENCY 2012 DIVESTMENTS >$4 BLN Copyright of Royal Dutch Shell plc 27 September 2012 7

- 8. GROWTH DELIVERY RAMPING UP NEW PROJECTS ATHABASCA OIL SANDS, QATARGAS 4, PEARL GTL PEARL GTL PRODUCT SLATE BUILD-UP $ billion thousand boe/day 400 100% LPG NAPHTHA NAPHTHA NAPHTHA NAPHTHA GASOLINE GAS OIL NAPHTHA 200 GAS OIL 50% GAS OIL GAS OIL KEROSENE GAS OIL 0 0 BASE OIL BASE OIL BASE OIL KEROSENE PARAFFIN PARAFFIN BASE OIL 0% Typical complex -1 1 refinery -2 2 2009 2010 2011 2012 FOCUS SHIFTS FROM Capex DEVELOPMENT TO Production (RHS) COMMERCIAL PERFORMANCE Shell share Copyright of Royal Dutch Shell plc 27 September 2012 8

- 9. MAINTAINING GROWTH MOMENTUM CONVERTING RESOURCES TO PRODUCTION UPSTREAM INVESTMENT 2012 billion boe resources % 35 Longer-term upside Carmon Creek Geronggong BC-10 Ph. 3 (Massa) 25 Prelude FLNG AOSP debottl. Tempa Rossa NA tight gas Fram Europe Asia Pacific /shales Malikai Americas Other 15 Clair Ph2 AOSP debottl + Quest debottl. Schiehallion NA tight gas/shales Pearl GTL Pluto (Woodside) QatarGas-4 Harweel Schoonebeek NA tight gas/shales 5 Qarn Alam EOR Eagle Ford West Qurna 1 IPT 2010 2011 -5 On-stream Under Construction y Study Production ROBUST PROJECT FLOW + GROWTH OUTLOOK 8 BILLION BOE UNDER CONSTRUCTION ~4 MILLION BOED 2017-18 Copyright of Royal Dutch Shell plc 27 September 2012 9

- 10. GROWTH DELIVERY 2012+ MAINTAINING LNG LEADERSHIP AUSTRALIA – INDONESIA SHELL GLOBAL LNG CAPACITY + GROWTH million tonnes per annum Abadi FLNG 40 Greater Sunrise Prelude FLNG Wheatstone Browse & Prelude Pluto (Woodside) North West Shelf Gorgon T1-3 Arrow Wheatstone Gorgon 20 Production Under C t ti U d Construction Options 0 2012 1H ~2020+ ~21 MTPA ON-STREAM Onstream ~7 MTPA UNDER CONSTRUCTION Construction MATURING FUTURE OPTIONS Options Copyright of Royal Dutch Shell plc 27 September 2012 10

- 11. PRELUDE FLOATING LNG Copyright of Royal Dutch Shell plc 27 September 2012 11

- 12. SHELL UPSTREAM AMERICAS GROWTH TIGHT/SHALE DEEP-WATER AOSP Debottlenecking Carmon Creek North America North America tight gas Liquids rich shales Lowest cost gas + Growth focus Eagle Ford Mars B integration plays Mars-B development + Under Construction Cardamom Appomattox Eagleford development new options Options Stones Vito + new plays 2011 PRODUCTION HEAVY OIL BC-10 Phase 2 BC-10 Massa Ph 3 Debottlenecking mining options Deep water Tight/shale g / In-situ growth opportunities ii Heavy oil Copyright of Royal Dutch Shell plc 27 September 2012 12

- 13. CONTINUED BUILD IN GULF OF MEXICO GULF OF MEXICO: EAST GULF OF MEXICO: APPOMATTOX APPRAISAL MC 347 MC 348 MC 393 Ram-Powell NW Appraisal H2 ‘12 NE Appraisal Appomattox MC 348 & st Vicksburg y Discovery Mars M Ursa SW Appraisal Appomattox Vicksburg Discovery Appraisal Vito MC 391 MC 392 MC 393 H1 ‘13 DC 353 Well Penetrations 2012 Appraisal Shell Leases Oil Success 2012 Shell access Wet 0 1 Shell Production 0 50 Shell Leases Miles Hubs miles DISCOVERY FID START-UP Caesar Tonga Mars B Cardamom Stones LEADING DEEP WATER PLAYER Appomattox Vito GROWTH POTENTIAL 2005 2010 2015 2020 Copyright of Royal Dutch Shell plc 27 September 2012 13

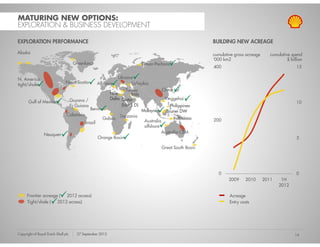

- 14. MATURING NEW OPTIONS: EXPLORATION & BUSINESS DEVELOPMENT EXPLORATION PERFORMANCE BUILDING NEW ACREAGE Alaska cumulative gross acreage cumulative spend ‘000 km2 $ billion Greenland Timan-Pechora Timan Pechora 400 15 N. America Ukraine Nova Scotia Albania Kalmykia tight/shale Turkey China Nile Iraq Guyana / Delta Qatar Yinggehai Gulf of Mexico 10 Fr Guiana (block D) Philippines Benin Malaysia Brunei DW Colombia Tanzania Gabon Indonesia 200 Brazil Australia offshore Australia CBM Neuquen Orange Basin 5 Great South Basin 0 0 2009 2010 2011 1H 2012 Frontier acreage ( 2012 access) Acreage Tight/shale ( 2012 access) Entry costs Copyright of Royal Dutch Shell plc 27 September 2012 14

- 15. NEW EXPLORATION POSITIONS NEW POTENTIAL: 2012 ACREAGE POSITIONS UKRAINE CHINA JAA Blocks Yuzivska Hainan (China) Ukraine Yuzivska Block Bl k 62/02 Block 62/17 Skifska Skifska 0 100 200 Kilometers Yuzivska – tight gas/shale Yinggehai Basin 7800 km2 onshore block, adds to existing JAA acreage ~6000 km2 multi-tcf tight/shale gas potential ca 100m water depths Skifska – Deepwater exploration 3D seismic planned for 2013 16,700 km2 frontier acreage, northern Black Sea Shell 100% in exploration phase; 49% in development phase, with CNOOC h h Shell 35% Copyright of Royal Dutch Shell plc 27 September 2012 15

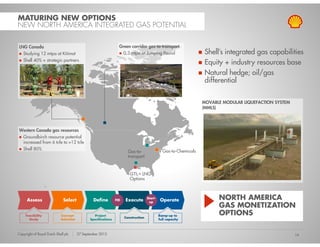

- 16. MATURING NEW OPTIONS NEW NORTH AMERICA INTEGRATED GAS POTENTIAL LNG Canada Green corridor gas-to-transport Studying 12 mtpa at Kitimat 0.3 mtpa at Jumping Pound Shell’s integrated gas capabilities Shell 40% + strategic partners Equity + industry resources base Natural hedge; oil/gas differential MOVABLE MODULAR LIQUEFACTION SYSTEM (MMLS) Western Canada gas resources Groundbirch resource potential increased from 6 tcfe to >12 tcfe Shell 80% Gas-to-Chemicals Gas-to- transport GTL+ LNG Options Assess Select Define FID Execute Start- up Operate NORTH AMERICA GAS MONETIZATION Feasibility Concept Project Construction Ramp-up to OPTIONS Study Selection Specifications full capacity Copyright of Royal Dutch Shell plc 27 September 2012 16

- 17. FINANCIAL FRAMEWORK NET DEBT AND GEARING CAPITAL INVESTMENT $ billion $ billion 30% 30 20% 2010 2011 H1 2012 20 Organic Investment 24 26 14 10% 10 Acquisitions Acq isitions 7 5 1 0% 0 Disposals (7) (7) (4) 2005 2006 2007 2008 2009 2010 2011 2012 Gearing (LHS) H1 Net Capital Investment 24 24 11 Net Debt (RHS) ( ) RDS VERSUS FTSE 100 Total dividend growth rate versus 2006 ~$32 BLN ORGANIC CAPEX $32 30% 2012 20% 10% MAINTAINING PRUDENT 0% BALANCE SHEET 2006 2007 2008 2009 2010 2011 2012 -10% H1 SELECTIVE PORTFOLIO BUILD -20% RDS dividend growth FTSE100 dividend growth Copyright of Royal Dutch Shell plc 27 September 2012 17

- 18. SUMMARY Performance focus H1 ‘12 earnings $13 bln; EPS unchanged H1 ’12 asset sales $4 bln CONTINUOUS IMPROVEMENT Growth delivery GROWTH DELIVERY Underlying production growth 4% >20 projects under construction MATURE NEW OPTIONS PERFORMANCE FOCUS New growth options N th ti Expanding our opportunity funnel Frontier exploration build New integrated gas options Earnings CCS basis, earnings and EPS excluding identified items Copyright of Royal Dutch Shell plc 27 September 2012 18

- 19. ROYAL DUTCH SHELL PLC DEUTSCHE BANK LONDON QUESTIONS & ANSWERS Copyright of Royal Dutch Shell plc 27 September 2012 19

- 20. ROYAL DUTCH SHELL PLC GLOBAL OIL AND GAS CONFERENCE DEUTSCHE BANK LONDON LONDON SEPTEMBER 27, 2012 27 Copyright of Royal Dutch Shell plc 27 September 2012 20