smurfit stone container 2Q06_EN_2

- 1. For Immediate Release NEWS Contact: John Haudrich (investors), 314-746-1266 Stephanie Meiners (investors) 314-746-1211 Tom Lange (media) 314-746-1236 Mylene Labrie (Canadian media) 514-864-5103 www.smurfit-stone.com SMURFIT-STONE REPORTS SECOND QUARTER RESULTS Chicago, July 26, 2006 — Smurfit-Stone Container Corporation (Nasdaq: SSCC) today reported a net loss available to common stockholders of $44 million, or $0.17 per diluted share, for the second quarter of 2006. These results compare with net income available to common stockholders of $1 million or breakeven on a diluted share basis for the second quarter of 2005. Second quarter 2006 results include: • A loss of $0.07 per diluted share on the early extinguishment of debt related to the sale of the consumer packaging segment, • A loss of $0.04 per diluted share from non-cash foreign currency charges, and • A restructuring charge of $0.03 per diluted share primarily related to the closure of corrugated container facilities. Sales for the three month period were $1.76 billion, flat with the second quarter of 2005. For the first half of 2006, Smurfit-Stone reported a net loss available to common stockholders of $108 million, or $0.42 per diluted share, compared to a year ago net loss of $18 million, or $0.07 per diluted share. Sales for the first half of the year were $3.5 billion, consistent with the first half of 2005. The results of operations from the consumer packaging segment have been reclassified as discontinued operations for all periods presented. Net sales for this segment were $391 million and $787 million, respectively, for the three and six months ended June 30, 2006. Commenting on the second quarter, Patrick J. Moore, chairman and chief executive officer, said, “Favorable market conditions, increased containerboard production and higher average prices for our products drove the improvement in our results from the first quarter. Excluding unusual items, adjusted net loss per diluted share was $0.03, consistent with our prior guidance. Our mills ran at full capacity during the second quarter. Average per-day box shipments were up from the same period last year, despite the closure of seven box plants since the second quarter of 2005. Moreover, the sale of our consumer packaging segment for $1.04 billion was an important milestone, thereby allowing us to focus on our core business.”

- 2. — Page 2 — Smurfit-Stone’s containerboard and corrugated containers segment reported a second quarter 2006 operating profit of $118 million, up from a profit of $10 million in the first quarter and $94 million in the second quarter of 2005. The company’s average domestic kraft linerboard price increased 10.1 percent from the prior quarter and its corrugated container average price increased 4.3 percent on a sequential basis. Total reported debt at the end of the quarter was $3,815 million, a decrease of $904 million since March 31, 2006, largely due to the application of the consumer packaging segment sale proceeds. The company benefited $45 million from cost reduction efforts under its strategic initiatives in the second quarter compared to cost levels prior to the commencement of the initiatives. Cumulative 2006 initiative benefits from cost reduction efforts total $78 million. Benefits were primarily driven by facility closures, including two containerboard mills and seven corrugated facilities. As a result of these activities and improved productivity, since June 2005 total headcount has been reduced by over 2,500, or more than 9 percent, excluding the headcount reduction associated with the sale of consumer packaging. Commenting on the outlook, Moore said, “I’m optimistic about the outlook for our business. Solid demand for our products and low containerboard inventory levels should drive continued average price improvement for the balance of 2006 versus the first half. While recycled fiber prices and transportation costs are expected to increase, many input costs will likely moderate. We are encouraged by the initial progress on our strategic initiatives, and I look forward to a return to profitability in the third quarter 2006.” Smurfit-Stone management will discuss its second quarter 2006 financial performance via live webcast, including a slide presentation, at 8:00 a.m. CDT (9:00 a.m. EDT) on Wednesday, July 26. The webcast will be archived to the investors’ page of the company website, www.smurfit-stone.com. ### Smurfit-Stone Container Corporation (Nasdaq: SSCC) is the industry’s premier integrated paperboard and paper- based packaging manufacturer. Smurfit-Stone is a leading producer of containerboard, including white top linerboard and recycled medium, kraft paper, corrugated containers, point-of-purchase displays, and solid bleached sulfate. The company is one of the world’s largest collectors and marketers of recovered fiber. Smurfit-Stone operates approximately 200 facilities located primarily in the U.S., Canada and Mexico, and employs approximately 27,000 people. This press release contains statements relating to future results, which are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those projected as a result of certain risks and uncertainties, including but not limited to changes in general economic conditions, continued pricing pressures in key product lines, seasonality and higher recycled fiber and energy costs, as well as other risks and uncertainties described in “forward-looking statements” in the company’s annual report on form 10-K for the year ended December 31, 2005, as updated from time to time in the company’s Securities and Exchange Commission filings. In this press release, certain non-U.S. GAAP financial information is presented. A reconciliation of those numbers to U.S. GAAP financial measures is included in the attached schedules.

- 3. SMURFIT-STONE CONTAINER CORPORATION CONSOLIDATED BALANCE SHEETS (In millions) June 30, December 31, 2006 2005 Assets (Unaudited) Current assets Cash and cash equivalents……………………………………………… $ 9 $ 5 Receivables, net…………………………………………………………… 283 224 Retained interest in receivables sold (Note 1)………………………… 132 139 Inventories………………………………………………………………… 553 734 Prepaid expenses and other current assets…………………………… 50 82 Total current assets………………………………………………… 1,027 1,184 Net property, plant and equipment…………………………………………… 3,804 4,245 Timberland, less timber depletion…………………………………………… 43 44 Goodwill………………………………………………………………………… 2,873 3,309 Other assets…………………………………………………………………… 306 332 $ 8,053 $ 9,114 Liabilities and Stockholders' Equity Current liabilities Current maturities of long-term debt…………………………………… $ 30 $ 35 Accounts payable………………………………………………………… 582 654 Accrued compensation and payroll taxes……………………………… 158 186 Interest payable…………………………………………………………… 79 97 Income taxes payable…………………………………………………… 14 17 Current deferred taxes…………………………………………………… 16 15 Other current liabilities…………………………………………………… 132 184 Total current liabilities………………………………………………… 1,011 1,188 Long-term debt, less current maturities……………………………………… 3,785 4,536 Other long-term liabilities……………………………………………………… 1,158 1,123 Deferred income taxes………………………………………………………… 318 385 Stockholders' equity Preferred stock…………………………………………………………… 91 89 Common stock…………………………………………………………… 3 3 4,026 4,009 Additional paid-in capital………………………………………………… (1,954) (1,846) Retained earnings (deficit)……………………………………………… (385) (373) Accumulated other comprehensive income (loss)…………………… Total stockholders' equity…………………………………………… 1,781 1,882 $ 8,053 $ 9,114 Note 1: At June 30, 2006 and December 31, 2005, $655 and $592 million, respectively, of receivables had been sold under two accounts receivable programs, of which the company retained a subordinated interest. The off-balance sheet Stone Receivables Corporation debt and funding received from the Canadian accounts receivable program totaled $527 million and $472 million, respectively as of those dates. See our Annual Report on Form 10-K for the year ended December 31, 2005 for further description of these programs.

- 4. SMURFIT-STONE CONTAINER CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except per share data) (Unaudited) Three Months Ended Six Months Ended June 30, June 30, 2006 2005 2006 2005 Net sales…………………………………………………………………………………… $ 1,765 $ 1,760 $ 3,494 $ 3,469 Costs and expenses Cost of goods sold…………………………………………………………………… 1,513 1,524 3,102 3,023 Selling and administrative expenses………………………………………………… 170 164 343 330 Restructuring charges………………………………………………………………… 13 3 22 4 Gain on sale of assets………………………………………………………………… (1) (24) Income from operations………………………………………………………… 70 69 51 112 Other income (expense) Interest expense, net………………………………………………………………… (96) (86) (188) (172) Loss on early extinguishment of debt……………………………………………… (28) (28) Other, net (Note 1)…………………………………………………………………… (20) 1 (23) (2) Loss from continuing operations before income taxes……………………… (74) (16) (188) (62) Benefit from income taxes………………………………………………………………… 30 6 73 25 Loss from continuing operations………………………………………………… (44) (10) (115) (37) Discontinued operations Income from discontinued operations, net of income tax provision of $3 and $9 for the three and six months ended June 30, 2006, and $9 and $16 for the three and six months ended June 30, 2005……………… 4 14 14 25 Loss on sale of discontinued operations, net of income tax provision of $175… (1) (1) Net income (loss)………………………………………………………………… (41) 4 (102) (12) Preferred stock dividends and accretion………………………………………………… (3) (3) (6) (6) Net income (loss) available to common stockholders………………………… $ (44) $ 1 $ (108) $ (18) Basic and diluted earnings per common share Loss from continuing operations………………………….…………………… $ (0.18) $ (0.05) $ (0.47) $ (0.17) Discontinued operations………………………….……………………………… 0.01 0.05 0.05 0.10 Net income (loss) available to common stockholders………………………… $ (0.17) $ 0.00 $ (0.42) $ (0.07) Weighted average shares outstanding…………………………………………………… 255 255 255 254 Note 1: 2006 includes non-cash foreign currency losses of $14 million for the 2nd quarter and $12 million year-to-date. 2005 includes non-cash foreign currency gains of $5 million for the 2nd quarter and $4 million year-to-date.

- 5. SMURFIT-STONE CONTAINER CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) (Unaudited) Six Months Ended June 30, 2006 2005 Cash flows from operating activities Net loss…………………………………………………………………………………………………… $ (102) $ (12) Adjustments to reconcile net loss to net cash provided by (used for) operating activities Gain on disposition of discontinued operations……………………………………………… (174) Loss from early extinguishment of debt……………………………………………………… 28 Depreciation, depletion and amortization…………………………………………………… 199 207 Amortization of deferred debt issuance costs………………………………………………… 5 4 Deferred income taxes………………………………………………………………………… 91 (27) Pension and postretirement benefits………………………………………………………… 17 (20) Gain on sale of assets………………………………………………………………………… (24) Non-cash restructuring charges……………………………………………………………… 10 2 Non-cash stock-based compensation………………………………………………………… 12 5 Non-cash foreign currency (gains) losses…………………………………………………… 12 (4) Change in current assets and liabilities, net of effects from acquisitions and dispositions Receivables and retained interest in receivables sold………………………………… (61) (44) Inventories………………………………………………………………………………… 33 (1) Prepaid expenses and other current assets…………………………………………… (1) 1 Accounts payable and accrued liabilities………………………………………………… (62) (45) Interest payable…………………………………………………………………………… (18) 1 Other, net………………………………………………………………………………………… 11 (2) Net cash provided by (used for) operating activities………………………………………………… (24) 65 Cash flows from investing activities Expenditures for property, plant and equipment……………………………………………………… (139) (139) Proceeds from property disposals and sale of businesses………………………………………… 949 6 Payments on acquisitions……………………………………………………………………………… (5) Net cash provided by (used for) investing activities………………………………………………… 810 (138) Cash flows from financing activities Proceeds from long-term debt………………………………………………………………………… 72 Net borrowings (repayments) of long-term debt……………………………………………………… (756) 7 Debt repurchase premiums……………………………………………………………………………… (24) Preferred dividends paid………………………………………………………………………………… (4) (4) Proceeds from exercise of stock options……………………………………………………………… 2 1 Deferred debt issuance costs…………………………………………………………………………… (2) Net cash provided by (used for) financing activities………………………………………………… (782) 74 Increase in cash and cash equivalents………………………………………………………………… 4 1 Cash and cash equivalents Beginning of period……………………………………………………………………………………… 5 6 End of period………………………………………………………………………………………………$ 9 $ 7

- 6. SMURFIT-STONE CONTAINER CORPORATION SELECTED FINANCIAL HIGHLIGHTS (In millions, except per share data) (Unaudited) 2006 2005 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr Year 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr Year Net sales……………………………………………$ 1,729 $ 1,765 $ 3,494 $ 1,709 $ 1,760 $ 1,696 $ 1,647 $ 6,812 Income (loss) from operations……………………$ (19) $ 70 $ 51 $ 43 $ 69 $ (271) $ (94) $ (253) Net income (loss) available to common stockholders……………………… $ (64) $ (44) $ (108) $ (19) $ 1 $ (229) $ (92) $ (339) Diluted loss per common share…………….…. $ (0.25) $ (0.17) $ (0.42) $ (0.07) $ - $ (0.90) $ (0.36) $ (1.33) Total reported debt ……………………………… $ 4,719 $ 3,815 $ 3,815 $ 4,633 $ 4,579 $ 4,543 $ 4,571 $ 4,571 Capital expenditures …………………………… $ 56 $ 83 $ 139 $ 66 $ 73 $ 62 $ 75 $ 276 Pension contributions…………………………… $ 18 $ 45 $ 63 $ 47 $ 45 $ 48 $ 34 $ 174 Three Months Ended June 30 Six Months Ended June 30 Containerboard Containerboard & Corrugated & Corrugated Containers Reclamation Other Total Containers Reclamation Other Total 2006 Segment Results Revenues……………………………………… $ 1,677 $ 88 $ 1,765 $ 3,323 $ 171 $ 3,494 Segment profit (loss)………………………… $ 118 $ 4 $ (196) $ (74) $ 128 $ 8 $ (324) $ (188) 2005 Segment Results Revenues……………………………………… $ 1,661 $ 99 $ 1,760 $ 3,270 $ 199 $ 3,469 Segment profit (loss)………………………… $ 94 $ 6 $ (116) $ (16) $ 160 $ 12 $ (234) $ (62) Three Months Six Months Ended Ended June 30 June 30 Discontinued Operations Consumer Packaging 2006 Segment Results Revenues…………………………………. $ 391 $ 787 Segment Profit……………………………. $ 12 $ 28 Income from discontinued operations…. $ 7 $ 23 2005 Segment Results Revenues………………………………….. $ 393 $ 777 Segment Profit……………………………. $ 21 $ 36 Income from discontinued operations…. $ 23 $ 41

- 7. SMURFIT-STONE CONTAINER CORPORATION STATISTICAL INFORMATION 2006 2005 1st Qtr 2nd Qtr 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr Containerboard and Corrugated Container Segment Containerboard System North American Mill Operating Rates (containerboard only)………… 96.9% 100.0% 87.9% 92.0% 93.6% 97.3% North American Containerboard Production - M Tons………………… 1,771 1,860 1,751 1,852 1,799 1,813 Year over Year Avg. Domestic Linerboard Price Change…………… -0.5% 9.9% 25.2% 15.7% -7.4% -10.1% Sequential Avg. Domestic Linerboard Price Change……………….. 10.1% 10.1% -0.1% -0.3% -8.3% -1.2% Pulp Production - M Tons………………………………………………. 145 136 141 139 145 138 SBS/Bleached Board Production - M Tons…………………………… 72 77 65 72 76 70 Kraft Paper Production - M Tons………………………………………… 54 47 52 50 48 54 Corrugated Containers North American Shipments - BSF ……………………………………… 20.1 20.2 19.6 20.4 20.6 20.0 Per Day North American Shipments - MMSF ………………………… 314.4 320.1 315.6 318.5 321.7 334.0 Year over Year Avg. Corrugated Price Change……………………… -2.5% 3.5% 9.3% 6.5% -1.0% -3.8% Sequential Avg. Corrugated Price Change…………………………… 3.3% 4.3% 1.9% -1.7% -2.7% -1.3% Other Operations Fiber Reclaimed and Brokered - M tons…………………………………… 1,666 1,630 1,636 1,662 1,604 1,599

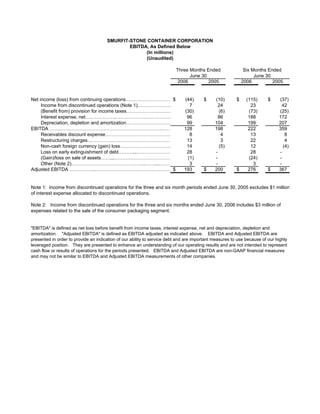

- 8. SMURFIT-STONE CONTAINER CORPORATION EBITDA, As Defined Below (In millions) (Unaudited) Three Months Ended Six Months Ended June 30 June 30 2006 2005 2006 2005 Net income (loss) from continuing operations…………………………$ (44) $ (10) $ (115) $ (37) Income from discontinued operations (Note 1)………………… 7 24 23 42 (Benefit from) provision for income taxes………………………… (30) (6) (73) (25) Interest expense, net……………….……………………………… 96 86 188 172 Depreciation, depletion and amortization………………………… 99 104 199 207 EBITDA …….……………………………………………………….…… 128 198 222 359 Receivables discount expense…………………………………… 8 4 13 8 Restructuring charges…………….……………………………… 13 3 22 4 Non-cash foreign currency (gain) loss…………………………… 14 (5) 12 (4) Loss on early extinguishment of debt………...………………… 28 - 28 - (Gain)/loss on sale of assets……...……………………………… (1) - (24) - Other (Note 2)………………………………………..……...……… 3 - 3 - Adjusted EBITDA ……………..………………………………………… $ 193 $ 200 $ 276 $ 367 Note 1: Income from discontinued operations for the three and six month periods ended June 30, 2005 excludes $1 million of interest expense allocated to discontinued operations. Note 2: Income from discontinued operations for the three and six months ended June 30, 2006 includes $3 million of expenses related to the sale of the consumer packaging segment. quot;EBITDAquot; is defined as net loss before benefit from income taxes, interest expense, net and depreciation, depletion and amortization. quot;Adjusted EBITDAquot; is defined as EBITDA adjusted as indicated above. EBITDA and Adjusted EBITDA are presented in order to provide an indication of our ability to service debt and are important measures to use because of our highly leveraged position. They are presented to enhance an understanding of our operating results and are not intended to represent cash flow or results of operations for the periods presented. EBITDA and Adjusted EBITDA are non-GAAP financial measures and may not be similar to EBITDA and Adjusted EBITDA measurements of other companies.

- 9. SMURFIT-STONE CONTAINER CORPORATION ADJUSTED NET LOSS PER DILUTED SHARE (Unaudited) Three Months Ended Six Months Ended June 30 June 30 2006 2005 2006 2005 Net loss per diluted share available to common stockholders (GAAP) ……………….. $ (0.17) $ - $ (0.42) $ (0.07) $ 0.07 $ - $ 0.07 $ - Loss on early extinguishment of debt ……………………..….…..………………… Non-cash foreign currency (gains) losses ………………..…........……………….. $ 0.04 $ (0.01) $ 0.03 $ (0.01) (Gain) on sale of assets / loss on sale of discontinued operations ……………… $ - $ - $ (0.05) $ - Restructuring charges ……………………………………………………………..…. $ 0.03 $ 0.01 $ 0.05 $ 0.01 Adjusted net loss per diluted share available to common stockholders (exclusive of loss on early extinguishment of debt, non-cash foreign currency (gains) losses, (gain) on sale of assets/loss on sale of discontinued operations, and restructuring charges) $ (0.03) $ - $ (0.32) $ (0.07) Adjusted net loss per diluted share available to common stockholders (exclusive of loss on early extinguishment of debt, non-cash foreign currency (gains) losses, (gain) on sale of assets/loss on sale of discontinued operations, and restructuring charges) is a non-GAAP financial measure. The company’s management believes this non- GAAP financial measure provides investors, potential investors, security analysts and others with useful information to evaluate the performance of the business because it excludes gains and losses that management believes are not indicative of the ongoing operating results of the business. In addition, this non-GAAP financial measure is used by management to evaluate the operating performance of the company. The presentation of this additional information is not meant to be considered in isolation or as a loss per diluted share as determined in accordance with GAAP.