Stader Labs pitch deck

- 2. Make staking mainstream (1B+ users) Vision

- 3. Assumes LUNA at $60 Numbers as of Dec 15th 2021 are round to the nearest integer We are off to a flying start: Launched on Terra and reached USD 400 M TVL in a month 23 Nov’21 23 Dec’21 Daily TVL since the launch Growth in numbers Users Twitter 0 LUNA 5M+ LUNA

- 4. Strong founder market fit with experience in Staking Amitej G V S (Co-founder & CEO) Sidhartha D (Co-founder & CTO) Dheeraj B (Co-founder & Terra Head) Vijay N (Head of Product) Gautam M (Head of Strategy & Expansion) <<Founders Other leaders

- 5. Backed by some of the best VC funds, globally Strategic Round Seed Round

- 6. Value locked in Proof of Stake networks has grown exponentially Jan'20 Apr'21 200 150 100 50 0 $Bn In 15 months Growth rate: 2

- 7. 100M token holders <1M delegators But <1% stake among 100M token holders 3 https://www.stakingrewards.com/

- 8. 4

- 9. Because it’s hard to discover and requires skills / time to evaluate staking opportunity ? 1. Validator discovery 2. Delegation decision 3. Portfolio mgmt. Where to delegate? (for CEXs, Funds) How to evaluate? How to track? What are the Risks vs Returns? When to re-stake/ redeploy? Whom to delegate? 5 4. Operational complexity Manual re-investment flow Claiming Air-Drops from each protocol

- 10. ...And staking is capital inefficient Liquidity Locked for 20-30 days Derivatives No way to hedge/ speculate Can’t leverage staked assets $ 6

- 11. Stader helps delegators find the best staking opportunity 7 Fixing the staking process by aiding Discovery Removing friction and automating tasks for Convenience Risk/yield trade-offs Optimization Curation of best-in class validators Indices of best validators, with auto compounding, one-click airdrop claims Innovative staking derivatives What we are building Why we are building it

- 12. 10 We make money two ways Commission on Staking rewards: Distribution commission: $ $$ $$$ Making staking easier and more convenient Liquidity and algorithmic strategies Derivatives on top of staking $

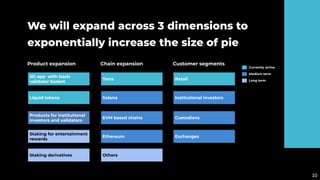

- 13. We will expand across 3 dimensions to exponentially increase the size of pie 10 SD app with basic validator basket Product expansion Liquid tokens Products for institutional investors and validators Staking for entertainment rewards Staking derivatives Terra Chain expansion Solana EVM based chains Ethereum Others Retail Customer segments Institutional investors Custodians Exchanges Currently active Medium term Long term

- 14. Find out more Stader Labs - Litepaper Stader Labs Stader Labs – Medium Stader Labs (@staderlabs)