Strategy 10

- 1. Slide 10.1 Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, © Pearson Education Limited 2011 Slide 10.1 Strategic Choices 10: Mergers, Acquisitions and Alliances

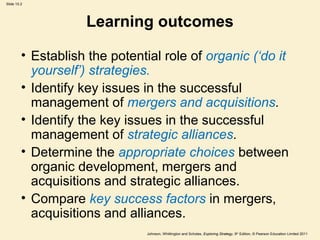

- 2. Slide 10.2 Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, © Pearson Education Limited 2011 Learning outcomes • Establish the potential role of organic (‘do it yourself’) strategies. • Identify key issues in the successful management of mergers and acquisitions. • Identify the key issues in the successful management of strategic alliances. • Determine the appropriate choices between organic development, mergers and acquisitions and strategic alliances. • Compare key success factors in mergers, acquisitions and alliances.

- 3. Slide 10.3 Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, © Pearson Education Limited 2011 Strategy methods Figure 10.1 Three strategy methods

- 4. Slide 10.4 Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, © Pearson Education Limited 2011 Organic development Organic development is where a strategy is pursued by building on and developing an organisation’s own capabilities. This is essentially the ‘do it yourself’ method.

- 5. Slide 10.5 Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, © Pearson Education Limited 2011 Advantages of organic development • Knowledge and learning can be enhanced. • Spreading investment over time – easier to finance. • No availability constraints – no need to search for suitable partners or acquisition targets. • Strategic independence – less need to make compromises or accept strategic constraints.

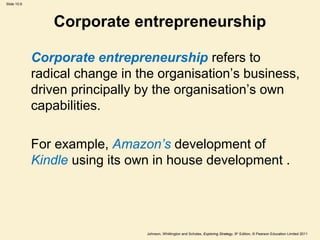

- 6. Slide 10.6 Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, © Pearson Education Limited 2011 Corporate entrepreneurship Corporate entrepreneurship refers to radical change in the organisation’s business, driven principally by the organisation’s own capabilities. For example, Amazon’s development of Kindle using its own in house development .

- 7. Slide 10.7 Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, © Pearson Education Limited 2011 Mergers and acquisitions •A merger is the combination of two previously separate organisations, typically as more or less equal partners. •An acquisition involves one firm taking over the ownership (‘equity’) of another, hence the alternative term ‘takeover’.

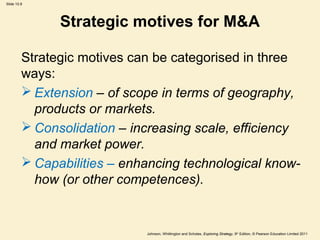

- 8. Slide 10.8 Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, © Pearson Education Limited 2011 Strategic motives for M&A Strategic motives can be categorised in three ways: Extension – of scope in terms of geography, products or markets. Consolidation – increasing scale, efficiency and market power. Capabilities – enhancing technological know- how (or other competences).

- 9. Slide 10.9 Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, © Pearson Education Limited 2011 Financial motives for M&A There are three main financial motives: Financial efficiency – a company with a strong balance sheet (cash rich) may acquire/merge with a company with a weak balance sheet (high debt). Tax efficiency – reducing the combined tax burden. Asset stripping or unbundling – selling off bits of the acquired company to maximise asset values.

- 10. Slide 10.10 Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, © Pearson Education Limited 2011 Managerial motives for M&A M&A may serve managerial self-interest for two reasons: Personal ambition – financial incentives tied to short-term growth or share-price targets; boosting personal reputations; giving friends and colleagues greater responsibility or better jobs. Bandwagon effects – managers may be branded as conservative if they don’t follow a M&A trend; shareholder pressure to merge or acquire; the company may itself become a takeover target.

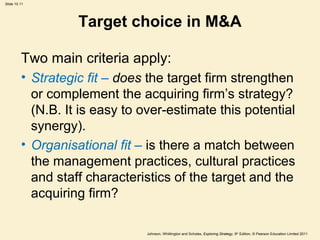

- 11. Slide 10.11 Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, © Pearson Education Limited 2011 Target choice in M&A Two main criteria apply: • Strategic fit – does the target firm strengthen or complement the acquiring firm’s strategy? (N.B. It is easy to over-estimate this potential synergy). • Organisational fit – is there a match between the management practices, cultural practices and staff characteristics of the target and the acquiring firm?

- 12. Slide 10.12 Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, © Pearson Education Limited 2011 Valuation in M&A Getting the offer price correct is essential: Offer the target too little, and the bid will be unsuccessful. Pay too much and the acquisition is unlikely to make a profit net of the original acquisition price. (‘the winner’s curse’). Acquirers do not simply pay the current market value of the target, but also pay a ‘premium for control’.

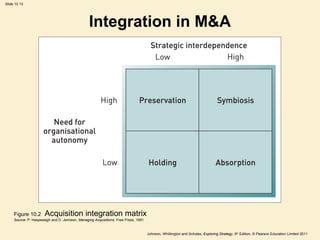

- 13. Slide 10.13 Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, © Pearson Education Limited 2011 Integration in M&A Figure 10.2 Acquisition integration matrix Source: P. Haspeslagh and D. Jemison, Managing Acquisitions, Free Press, 1991

- 14. Slide 10.14 Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, © Pearson Education Limited 2011 Integration in M&A Approaches to integration: • Absorption – strong strategic interdependence and little need for organisational autonomy. Rapid adjustment of the acquired company’s strategies, culture and systems. • Preservation – little interdependence and a high need for autonomy. Old strategies, cultures and systems can be continued much as before. • Symbiosis – strong strategic interdependence, but a high need for autonomy. Both the acquired firm and acquiring firm learn and adopt the best qualities from each other. • Holding – a residual category – with little to gain by integration. The acquisition will be ‘held’ temporarily before being sold on, so the acquired unit is left largely alone.

- 15. Slide 10.15 Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, © Pearson Education Limited 2011 Strategic alliances • A strategic alliance is where two or more organisations share resources and activities to pursue a strategy. • Collective strategy is about how the whole network of alliances of which an organisation is a member competes against rival networks of alliances. • Collaborative advantage is about managing alliances better than competitors.

- 16. Slide 10.16 Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, © Pearson Education Limited 2011 Types of strategic alliance There are two main kinds of ownership in strategic alliances: • Equity alliances involve the creation of a new entity that is owned separately by the partners involved. • Non-equity alliances are typically looser, without the commitment implied by ownership.

- 17. Slide 10.17 Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, © Pearson Education Limited 2011 Equity alliances • The most common form of equity alliance is the joint venture, where two organisations remain independent but set up a new organisation jointly owned by the parents. • A consortium alliance involves several partners setting up a venture together.

- 18. Slide 10.18 Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, © Pearson Education Limited 2011 Non-equity alliances • Non-equity alliances are often based on contracts. • Three common forms of non-equity alliance: Franchising. Licensing. Long-term subcontracting.

- 19. Slide 10.19 Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, © Pearson Education Limited 2011 Motives for alliances • Scale alliances – lower costs, more bargaining power and sharing risks. • Access alliances – partners provide needed capabilities (e.g. distribution outlets or licenses to brands) • Complementary alliances – bringing together complementary strengths to offset the other partner’s weaknesses. • Collusive alliances – to increase market power. Usually kept secret to evade competition regulations.

- 20. Slide 10.20 Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, © Pearson Education Limited 2011 Strategic alliance motives Figure 10.3 Strategic alliance motives

- 21. Slide 10.21 Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, © Pearson Education Limited 2011 Strategic alliance processes Two themes are vital to success in alliances: • Co-evolution – the need for flexibility and change as the environment, competition and strategies of the partners evolve. • Trust – partners need to behave in a trustworthy fashion throughout the alliance.

- 22. Slide 10.22 Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, © Pearson Education Limited 2011 Alliance evolution Figure 10.4 Alliance evolution Source: Adapted from E. Murray and J. Mahon (1993), ‘Strategic alliances: gateway to the new Europe’, Long Range Planning, vol. 26, p. 109. www.sciencedirect.com/science/journal

- 23. Slide 10.23 Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, © Pearson Education Limited 2011 Comparing acquisitions, alliances and organic development Figure 10.5 Buy, ally or DIY matrix

- 24. Slide 10.24 Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, © Pearson Education Limited 2011 Comparing acquisitions, alliances and organic development Four key factors in choosing the method of strategy development : • Urgency – internal development may be too slow, alliances can accelerate the process but acquisitions are quickest. • Uncertainty – an alliance means risks are shared and thus a failure does not mean the full cost is lost. • Type of capabilities – acquisitions work best with ‘hard’ resources (e.g. production units) rather than ‘soft’ resources (e.g. people). Culture clash is the big issue. • Modularity of capabilities – if the needed capabilities can be clearly separated from the rest of the organisation an alliance may be best.

- 25. Slide 10.25 Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, © Pearson Education Limited 2011 Key success factors Figure 10.6 Key success factors in mergers, acquisitions and alliances

- 26. Slide 10.26 Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, © Pearson Education Limited 2011 Summary (1) • There are three broad methods for pursuing strategy: mergers and acquisitions, strategic alliances and organic development. • Organic development can be either continuous or radical. Radical organic development is termed corporate entrepreneurship. • Acquisitions can be hostile or friendly. Motives for mergers and acquisitions can be strategic, financial or managerial.

- 27. Slide 10.27 Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, © Pearson Education Limited 2011 Summary (2) • The acquisition process includes target choice, valuation and integration. • Strategic alliances can be equity or non-equity. Key motives for strategic alliances include scale, access, complementarity and collusion. • The strategic alliance process relies on co- evolution and trust. • The choice between acquisition, alliance and organic methods is influenced by four key factors: urgency, uncertainty, type of capabilities and modularity of capabilities.

Editor's Notes

- Update slide to 9th Edition and new title Exploring Strategy