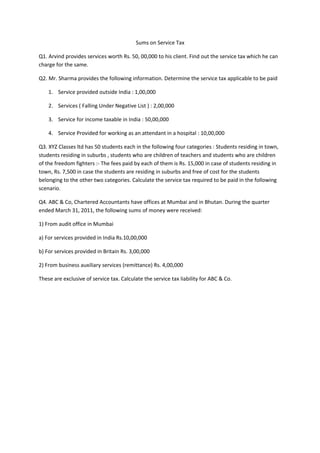

Sums on service tax

- 1. Sums on Service Tax Q1. Arvind provides services worth Rs. 50, 00,000 to his client. Find out the service tax which he can charge for the same. Q2. Mr. Sharma provides the following information. Determine the service tax applicable to be paid 1. Service provided outside India : 1,00,000 2. Services ( Falling Under Negative List ) : 2,00,000 3. Service for income taxable in India : 50,00,000 4. Service Provided for working as an attendant in a hospital : 10,00,000 Q3. XYZ Classes ltd has 50 students each in the following four categories : Students residing in town, students residing in suburbs , students who are children of teachers and students who are children of the freedom fighters :- The fees paid by each of them is Rs. 15,000 in case of students residing in town, Rs. 7,500 in case the students are residing in suburbs and free of cost for the students belonging to the other two categories. Calculate the service tax required to be paid in the following scenario. Q4. ABC & Co, Chartered Accountants have offices at Mumbai and in Bhutan. During the quarter ended March 31, 2011, the following sums of money were received: 1) From audit office in Mumbai a) For services provided in India Rs.10,00,000 b) For services provided in Britain Rs. 3,00,000 2) From business auxiliary services (remittance) Rs. 4,00,000 These are exclusive of service tax. Calculate the service tax liability for ABC & Co.