Supplemental Second Quarter 2006 Financial Information

- 1. Supplemental Information Second Quarter 2006 This information is preliminary and based on company data available at the time of the presentation. It speaks only as of the particular date or dates included in the accompanying pages. Bank of America does not undertake an obligation to, and disclaims any duty to, correct or update any of the information provided. Any forward-looking statements in this information are subject to the forward-looking language contained in Bank of America's reports filed with the SEC pursuant to the Securities Exchange Act of 1934, which are available at the SEC's website (www.sec.gov) or at Bank of America's website (www.bankofamerica.com). Bank of America's future financial performance is subject to risks and uncertainties as described in its SEC filings.

- 2. Bank of America Corporation Consolidated Financial Highlights (Dollars in millions, except per share information; shares in thousands) Year-to-Date Second First Fourth Third Second June 30 Quarter Quarter Quarter Quarter Quarter 2006 2005 2006 2006 2005 2005 2005 Income statement Net interest income $17,406 $15,143 $8,630 $8,776 $7,859 $7,735 $7,637 Noninterest income 18,499 12,987 9,598 8,901 5,951 6,416 6,955 Total revenue 35,905 28,130 18,228 17,677 13,810 14,151 14,592 Provision for credit losses 2,275 1,455 1,005 1,270 1,400 1,159 875 Gains (losses) on sales of debt securities 5 984 (9) 14 71 29 325 Noninterest expense 17,641 14,076 8,717 8,924 7,320 7,285 7,019 Income tax expense 5,533 4,533 3,022 2,511 1,587 1,895 2,366 Net income 10,461 9,050 5,475 4,986 3,574 3,841 4,657 Diluted earnings per common share 2.25 2.21 1.19 1.07 0.88 0.95 1.14 Average diluted common shares issued and outstanding 4,636,959 4,081,921 4,601,169 4,666,405 4,053,859 4,054,659 4,065,355 Dividends paid per common share $1.00 $0.90 $0.50 $0.50 $0.50 $0.50 $0.45 Performance ratios Return on average assets 1.47 % 1.47 % 1.51 % 1.43 % 1.09 % 1.18 % 1.46 % Return on average common shareholders' equity 16.34 18.44 17.26 15.44 14.21 15.09 18.93 At period end Book value per share of common stock $28.17 $25.16 $28.17 $28.19 $25.32 $25.28 $25.16 Market price per share of common stock: Closing price $48.10 $45.61 $48.10 $45.54 $46.15 $42.10 $45.61 High closing price for the period 50.47 47.08 50.47 47.08 46.99 45.98 47.08 Low closing price for the period 43.09 43.66 45.48 43.09 41.57 41.60 44.01 Market capitalization 217,794 183,202 217,794 208,633 184,586 168,950 183,202 Number of banking centers - domestic 5,779 5,880 5,779 5,786 5,873 5,844 5,880 Number of ATMs - domestic 16,984 16,687 16,984 16,716 16,785 16,714 16,687 Full-time equivalent employees 201,898 178,107 201,898 202,503 176,934 177,539 178,107 Certain prior period amounts have been reclassified to conform to current period presentation. Information for periods beginning January 1, 2006 includes the MBNA acquisition; prior periods have not been restated. 1

- 3. Bank of America Corporation Supplemental Financial Data (Dollars in millions) Fully taxable-equivalent basis data Year-to-Date Second First Fourth Third Second June 30 Quarter Quarter Quarter Quarter Quarter 2006 2005 2006 2006 2005 2005 2005 Net interest income $17,966 $15,534 $8,926 $9,040 $8,102 $7,933 $7,828 Total revenue 36,465 28,521 18,524 17,941 14,053 14,349 14,783 Net interest yield 2.91 % 2.88 % 2.85 % 2.98 % 2.82 % 2.78 % 2.80 % Efficiency ratio 48.38 49.36 47.06 49.74 52.09 50.76 47.49 Reconciliation to GAAP financial measures Supplemental financial data presented on an operating basis is a basis of presentation not defined by accounting principles generally accepted in the United States (GAAP) that excludes merger and restructuring charges. We believe that the exclusion of merger and restructuring charges, which represent events outside our normal operations, provides a meaningful period-to- period comparison and is more reflective of normalized operations. Shareholder value added (SVA) is a key measure of performance not defined by GAAP that is used in managing our growth strategy orientation and strengthening our focus on generating long-term growth and shareholder value. SVA is used to evaluate the Corporation's use of equity (i.e. capital) at the individual unit level and is an integral component in the analytics for resource allocation. Using SVA as a performance measure places specific focus on whether incremental investments generate returns in excess of the costs of capital associated with those investments. Each business segment has a goal for growth in SVA reflecting the individual segment's business and customer strategy. Other companies may define or calculate supplemental financial data differently. See the tables below for supplemental financial data and corresponding reconciliations to GAAP financial measures for the quarters ended June 30, 2006, March 31, 2006, December 31, 2005, September 30, 2005 and June 30, 2005, and the six months ended June 30, 2006 and 2005. Reconciliation of net income to operating earnings Year-to-Date Second First Fourth Third Second June 30 Quarter Quarter Quarter Quarter Quarter 2006 2005 2006 2006 2005 2005 2005 Net income $10,461 $9,050 $5,475 $4,986 $3,574 $3,841 $4,657 Merger and restructuring charges 292 233 194 98 59 120 121 Related income tax benefit (108) (78) (71) (37) (19) (40) (41) Operating earnings $10,645 $9,205 $5,598 $5,047 $3,614 $3,921 $4,737 Reconciliation of average common shareholders' equity to average tangible common shareholders' equity Average common shareholders' equity $128,981 $98,842 $127,102 $130,881 $99,677 $100,974 $98,558 Average goodwill (66,160) (45,363) (66,226) (66,094) (45,305) (45,297) (45,379) Average tangible common shareholders' equity $62,821 $53,479 $60,876 $64,787 $54,372 $55,677 $53,179 Operating basis Diluted earnings per common share $2.29 $2.25 $1.22 $1.08 $0.89 $0.97 $1.16 Return on average assets 1.49 % 1.50 % 1.54 % 1.45 % 1.10 % 1.20 % 1.49 % Return on average common shareholders' equity 16.63 18.76 17.65 15.63 14.36 15.39 19.26 Return on average tangible common shareholders' equity 34.14 34.68 36.85 31.57 26.33 27.91 35.70 Efficiency ratio 47.58 48.54 46.01 49.19 51.66 49.92 46.67 Reconciliation of net income to shareholder value added Net income $10,461 $9,050 $5,475 $4,986 $3,574 $3,841 $4,657 Amortization of intangibles 881 412 441 440 196 201 204 Merger and restructuring charges, net of tax benefit 184 155 123 61 40 80 80 Capital charge (7,035) (5,392) (3,485) (3,550) (2,764) (2,799) (2,703) Shareholder value added $4,491 $4,225 $2,554 $1,937 $1,046 $1,323 $2,238 Certain prior period amounts have been reclassified to conform to current period presentation. Information for periods beginning January 1, 2006 includes the MBNA acquisition; prior periods have not been restated. 2

- 4. Bank of America Corporation Consolidated Statement of Income (Dollars in millions, except per share information; shares in thousands) Year-to-Date Second First Fourth Third Second June 30 Quarter Quarter Quarter Quarter Quarter 2006 2005 2006 2006 2005 2005 2005 Interest income Interest and fees on loans and leases $22,931 $16,374 $11,804 $11,127 $9,536 $8,933 $8,294 Interest and dividends on securities 6,135 5,329 3,121 3,014 2,815 2,793 2,796 Federal funds sold and securities purchased under agreements to resell 3,609 2,153 1,900 1,709 1,477 1,382 1,249 Trading account assets 3,175 2,608 1,627 1,548 1,585 1,550 1,426 Other interest income 1,572 939 845 727 605 547 502 Total interest income 37,422 27,403 19,297 18,125 16,018 15,205 14,267 Interest expense Deposits 6,515 4,545 3,508 3,007 2,476 2,471 2,363 Short-term borrowings 9,151 4,570 4,842 4,309 3,855 3,190 2,582 Trading account liabilities 1,113 1,038 596 517 619 707 611 Long-term debt 3,237 2,107 1,721 1,516 1,209 1,102 1,074 Total interest expense 20,016 12,260 10,667 9,349 8,159 7,470 6,630 Net interest income 17,406 15,143 8,630 8,776 7,859 7,735 7,637 Noninterest income Service charges 3,978 3,697 2,077 1,901 1,927 2,080 1,920 Investment and brokerage services 2,249 2,062 1,146 1,103 1,062 1,060 1,049 Mortgage banking income 226 410 89 137 215 180 189 Investment banking income 1,113 797 612 501 537 522 431 Equity investment gains 1,306 891 646 660 481 668 492 Card income 7,093 2,726 3,662 3,431 1,507 1,520 1,437 Trading account profits 1,975 907 915 1,060 299 557 222 Other income 559 1,497 451 108 (77) (171) 1,215 Total noninterest income 18,499 12,987 9,598 8,901 5,951 6,416 6,955 - Total revenue 35,905 28,130 18,228 17,677 13,810 14,151 14,592 Provision for credit losses 2,275 1,455 1,005 1,270 1,400 1,159 875 Gains (losses) on sales of debt securities 5 984 (9) 14 71 29 325 Noninterest expense Personnel 9,293 7,372 4,480 4,813 3,845 3,837 3,671 Occupancy 1,404 1,251 703 701 699 638 615 Equipment 660 594 316 344 305 300 297 Marketing 1,126 683 551 575 265 307 346 Professional fees 451 393 233 218 283 254 216 Amortization of intangibles 881 412 441 440 196 201 204 Data processing 819 732 409 410 394 361 368 Telecommunications 448 402 228 220 219 206 196 Other general operating 2,267 2,004 1,162 1,105 1,055 1,061 985 Merger and restructuring charges 292 233 194 98 59 120 121 Total noninterest expense 17,641 14,076 8,717 8,924 7,320 7,285 7,019 Income before income taxes 15,994 13,583 8,497 7,497 5,161 5,736 7,023 Income tax expense 5,533 4,533 3,022 2,511 1,587 1,895 2,366 Net income $10,461 $9,050 $5,475 $4,986 $3,574 $3,841 $4,657 Net income available to common shareholders $10,452 $9,041 $5,471 $4,981 $3,570 $3,836 $4,653 Per common share information Earnings $2.29 $2.25 $1.21 $1.08 $0.89 $0.96 $1.16 Diluted earnings $2.25 $2.21 $1.19 $1.07 $0.88 $0.95 $1.14 Dividends paid $1.00 $0.90 $0.50 $0.50 $0.50 $0.50 $0.45 Average common shares issued and outstanding 4,572,013 4,019,089 4,534,627 4,609,481 3,996,024 4,000,573 4,005,356 Average diluted common shares issued and outstanding 4,636,959 4,081,921 4,601,169 4,666,405 4,053,859 4,054,659 4,065,355 Certain prior period amounts have been reclassified to conform to current period presentation. Information for periods beginning January 1, 2006 includes the MBNA acquisition; prior periods have not been restated. 3

- 5. Bank of America Corporation Consolidated Balance Sheet June 30 March 31 June 30 (Dollars in millions) 2006 2006 2005 Assets Cash and cash equivalents $34,545 $32,575 $33,935 Time deposits placed and other short-term investments 14,652 11,157 9,682 Federal funds sold and securities purchased under agreements to resell 136,645 137,081 149,287 Trading account assets 134,708 117,181 126,658 Derivative assets 25,526 23,291 26,019 Securities: Available-for-sale 235,785 237,987 233,412 Held-to-maturity, at cost 61 86 174 Total securities 235,846 238,073 233,586 Loans and leases 667,953 619,525 529,428 Allowance for loan and lease losses (9,080) (9,067) (8,319) Loans and leases, net of allowance 658,873 610,458 521,109 Premises and equipment, net 9,334 9,267 7,602 Mortgage servicing rights (includes $3,083 and $2,925 measured at fair value at June 30 and March 31, 2006) 3,231 3,070 2,365 Goodwill 66,095 66,271 45,381 Core deposit intangibles and other intangibles 10,338 10,681 3,472 Other assets 115,400 115,975 87,243 Total assets $1,445,193 $1,375,080 $1,246,339 Liabilities Deposits in domestic offices: Noninterest-bearing $177,209 $179,358 $175,427 Interest-bearing 410,940 415,769 397,778 Deposits in foreign offices: Noninterest-bearing 6,765 6,874 6,102 Interest-bearing 81,951 80,448 56,110 Total deposits 676,865 682,449 635,417 Federal funds purchased and securities sold under agreements to repurchase 259,108 236,919 207,710 Trading account liabilities 57,486 51,100 61,906 Derivative liabilities 18,633 15,541 15,630 Commercial paper and other short-term borrowings 136,886 99,389 93,763 Accrued expenses and other liabilities (includes $395, $395 and $383 of reserve for unfunded lending commitments) 39,318 37,078 34,940 Long-term debt 129,056 123,178 95,638 Total liabilities 1,317,352 1,245,654 1,145,004 Shareholders' equity Preferred stock, $0.01 par value; authorized - 100,000,000 shares; issued and outstanding - 1,090,189 shares 271 271 271 Common stock and additional paid-in capital, $0.01 par value; authorized - 7,500,000,000 shares; issued and outstanding - 4,527,940,943; 4,581,317,964 and 4,016,703,839 shares 65,822 68,705 42,507 Retained earnings 73,393 70,204 64,154 Accumulated other comprehensive income (loss) (10,973) (8,981) (5,023) Other (672) (773) (574) Total shareholders' equity 127,841 129,426 101,335 Total liabilities and shareholders' equity $1,445,193 $1,375,080 $1,246,339 Certain prior period amounts have been reclassified to conform to current period presentation. Information for periods beginning January 1, 2006 includes the MBNA acquisition; prior periods have not been restated. 4

- 6. Bank of America Corporation Capital Management (Dollars in millions) Second First Fourth Third Second Quarter Quarter Quarter Quarter Quarter 2006(1) 2006 2005 2005 2005 Tier 1 capital $84,978 $83,174 $74,375 $73,572 $69,633 Total capital 114,738 111,422 99,901 99,531 95,760 Risk-weighted assets 1,019,828 984,190 901,469 889,643 853,086 Tier 1 capital ratio 8.33 % 8.45 % 8.25 % 8.27 % 8.16 % Total capital ratio 11.25 11.32 11.08 11.19 11.23 Tangible equity ratio(2) 3.76 4.04 4.26 4.41 4.38 Tier 1 leverage ratio 6.13 6.18 5.91 5.90 5.66 (1) Preliminary data on risk-based capital (2) Tangible equity ratio equals shareholders' equity less goodwill, core deposit intangibles and other intangibles divided by total assets less goodwill, core deposit intangibles and other intangibles. Share Repurchase Program 83.1 million common shares were repurchased in the second quarter of 2006 as a part of an ongoing share repurchase program. 182.7 million shares remain outstanding under the 2006 authorized program. 29.7 million shares were issued in the second quarter of 2006. 0.0821 Capital Management 5,000 9.00% 1,575 0.09 0.085 4,300 0.082 4,581 0.0821 4,528 1,550 4,500 0.0814,047 4,035 4,017 0.0806 4,000 0.085 (Shares in millions) 0.0825 8.48% 0.0821 0.082 0.08 0.081 4,013 1,525 0.0806 3,800 4,017 4,013 4,000 8.45% 4,000 8.48% 8.50% 0.08 0.0773 1,500 8.33% 8.27% 8.25% 0.075 3,300 3,500 0.075 8.16% 1,475 3,000 1,450 2,800 8.00% 0.07 37865 Jun-05 Dec-04 Dec-04 Sep-05 Mar-05 37956 Mar-05 Dec-05 Jun-05 38047 Jun-05 Mar-06 Sep-05 38139 Jun-06* Sep-05 Dec-05* Shares outstanding at period end end Shares outstanding at period end Shares outstanding at at period Shares outstanding period end Tier 1 capital ratio ratio Tier Tier capital ratio Tiercapital ratio 1 1 1 capital *Preliminary data on risk-based capital Information for periods beginning January 1, 2006 includes the MBNA acquisition; prior periods have not been restated. 5

- 7. Bank of America Corporation Core Net Interest Income - Managed Basis (Dollars in millions) Six Months Ended Second First Fourth Third Second June 30 Quarter Quarter Quarter Quarter Quarter 2006 2005 2006 2006 2005 2005 2005 Net Interest Income As reported (fully taxable-equivalent basis) $17,966 $15,534 $8,926 $9,040 $8,102 $7,933 $7,828 (1) Impact of market-based net interest income (790) (1,068) (379) (411) (421) (450) (520) Core net interest income 17,176 14,466 8,547 8,629 7,681 7,483 7,308 Impact of securitizations 3,435 261 1,710 1,725 11 52 106 Core net interest income - managed basis $20,611 $14,727 $10,257 $10,354 $7,692 $7,535 $7,414 Average Earning Assets As reported $1,236,848 $1,081,908 $1,253,895 $1,219,611 $1,145,550 $1,137,629 $1,118,518 Impact of market-based earning assets (347,108) (312,137) (357,549) (336,552) (329,299) (335,043) (338,530) Core average earning assets 889,740 769,771 896,346 883,059 816,251 802,586 779,988 Impact of securitizations 96,523 10,961 96,776 96,268 6,447 7,827 10,773 Core average earning assets - managed basis $986,263 $780,732 $993,122 $979,327 $822,698 $810,413 $790,761 Net Interest Yield Contribution As reported (fully taxable-equivalent basis) 2.91 % 2.88 % 2.85 % 2.98 % 2.82 % 2.78 % 2.80 % Impact of market-based activities 0.96 0.89 0.97 0.95 0.93 0.94 0.95 Core net interest yield on earning assets 3.87 3.77 3.82 3.93 3.75 3.72 3.75 Impact of securitizations 0.32 0.01 0.31 0.32 (0.02) (0.01) - Core net interest yield on earning assets - managed basis 4.19 % 3.78 % 4.13 % 4.25 % 3.73 % 3.71 % 3.75 % (1) Market-based Net Interest Income represents Net Interest Income from the Capital Markets and Advisory Services business within Global Corporate and Investment Banking. Certain prior period amounts have been reclassified to conform to current period presentation. Information for periods beginning January 1, 2006 includes the MBNA acquisition; prior periods have not been restated. 6

- 8. Bank of America Corporation Quarterly Average Balances and Interest Rates - Fully Taxable-equivalent Basis (Dollars in millions) Second Quarter 2006 First Quarter 2006 Second Quarter 2005 Interest Interest Interest Average Income/ Yield/ Average Income/ Yield/ Average Income/ Yield/ Balance Expense Rate Balance Expense Rate Balance Expense Rate Earning assets Time deposits placed and other short-term investments $16,691 $168 4.05 % $14,347 $139 3.92 % $13,696 $113 3.31 % Federal funds sold and securities purchased under agreements to resell 179,104 1,900 4.25 174,711 1,709 3.94 185,835 1,249 2.69 Trading account assets 133,556 1,712 5.13 133,361 1,623 4.89 134,196 1,454 4.34 Securities 236,967 3,162 5.34 234,606 3,043 5.19 227,182 2,825 4.98 Loans and leases (1): Residential mortgage 197,228 2,731 5.54 184,796 2,524 5.48 167,263 2,285 5.47 Credit card - domestic 64,980 2,168 13.38 68,169 2,180 12.97 52,474 1,481 11.32 Credit card - foreign 8,305 269 12.97 8,403 287 13.86 - - - Home equity lines 67,182 1,231 7.35 64,198 1,112 7.02 54,941 799 5.83 Direct/Indirect consumer 56,715 1,057 7.46 55,025 986 7.24 43,132 612 5.69 Other consumer(2) 10,804 294 10.95 10,357 272 10.59 6,968 155 8.96 Total consumer 405,214 7,750 7.66 390,948 7,361 7.60 324,778 5,332 6.58 Commercial - domestic 148,445 2,695 7.28 144,693 2,490 6.97 123,927 1,938 6.27 Commercial real estate 36,749 680 7.41 36,676 632 6.99 33,484 477 5.72 Commercial lease financing 20,896 262 5.01 20,512 247 4.82 20,446 252 4.93 Commercial - foreign 24,345 456 7.52 23,139 427 7.48 17,780 306 6.90 Total commercial 230,435 4,093 7.12 225,020 3,796 6.83 195,637 2,973 6.09 Total loans and leases 635,649 11,843 7.47 615,968 11,157 7.32 520,415 8,305 6.40 Other earning assets 51,928 808 6.24 46,618 718 6.22 37,194 512 5.52 Total earning assets (3) 1,253,895 19,593 6.26 1,219,611 18,389 6.08 1,118,518 14,458 5.18 Cash and cash equivalents 35,070 34,857 34,731 Other assets, less allowance for loan and lease losses 167,039 161,905 124,229 Total assets $1,456,004 $1,416,373 $1,277,478 Interest-bearing liabilities Domestic interest-bearing deposits: Savings $35,681 $76 0.84 % $35,550 $76 0.87 % $38,043 $52 0.54 % NOW and money market deposit accounts 221,198 996 1.81 227,606 908 1.62 229,174 723 1.27 Consumer CDs and IRAs 141,408 1,393 3.95 135,068 1,177 3.53 127,169 1,004 3.17 Negotiable CDs, public funds and other time deposits 13,005 123 3.80 8,551 70 3.30 7,751 82 4.22 Total domestic interest-bearing deposits 411,292 2,588 2.52 406,775 2,231 2.22 402,137 1,861 1.86 Foreign interest-bearing deposits (4): Banks located in foreign countries 32,456 489 6.05 30,116 424 5.71 25,546 294 4.61 Governments and official institutions 13,428 155 4.63 10,200 107 4.25 7,936 59 2.97 Time, savings and other 37,178 276 2.98 35,136 245 2.83 30,973 149 1.94 Total foreign interest-bearing deposits 83,062 920 4.44 75,452 776 4.17 64,455 502 3.13 Total interest-bearing deposits 494,354 3,508 2.85 482,227 3,007 2.53 466,592 2,363 2.03 Federal funds purchased, securities sold under agreements to repurchase and other short-term borrowings 408,734 4,842 4.75 399,896 4,309 4.37 323,916 2,582 3.20 Trading account liabilities 61,263 596 3.90 52,466 517 3.99 60,987 611 4.02 Long-term debt 125,620 1,721 5.48 117,018 1,516 5.18 96,697 1,074 4.45 Total interest-bearing liabilities (3) 1,089,971 10,667 3.92 1,051,607 9,349 3.60 948,192 6,630 2.80 Noninterest-bearing sources: Noninterest-bearing deposits 180,442 177,594 174,001 Other liabilities 58,218 56,019 56,456 Shareholders' equity 127,373 131,153 98,829 Total liabilities and shareholders' equity $1,456,004 $1,416,373 $1,277,478 Net interest spread 2.34 2.48 2.38 Impact of noninterest-bearing sources 0.51 0.50 0.42 Net interest income/yield on earning assets $8,926 2.85 % $9,040 2.98 % $7,828 2.80 % (1) Nonperforming loans are included in the respective average loan balances. Income on these nonperforming loans is recognized on a cash basis. (2) Includes consumer finance of $2,999 million and $3,012 million in the second and first quarters of 2006 and $3,212 million in the second quarter of 2005; foreign consumer of $7,798 million and $7,328 million in the second and first quarters of 2006, and $3,505 million in the second quarter of 2005; and consumer lease financing of $7 million and $17 million in the second and first quarters of 2006, and $251 million in the second quarter of 2005. (3) Interest income includes the impact of interest rate risk management contracts, which increased(decreased) interest income on the underlying assets ($54) million and $8 million in the second and first quarters of 2006, and $168 million in the second quarter of 2005. Interest expense includes the impact of interest rate risk management contracts, which increased interest expense on the underlying liabilities $87 million and $136 million in the second and first quarters of 2006, and $303 million in the second quarter of 2005. (4) Primarily consists of time deposits in denominations of $100,000 or more. Information for periods beginning January 1, 2006 includes the MBNA acquisition; prior periods have not been restated. 7

- 9. Bank of America Corporation Quarterly Average Balances and Interest Rates - Fully Taxable-equivalent Basis - Isolating Derivative Hedge Income/Expense (1) (Dollars in millions) Second Quarter 2006 First Quarter 2006 Second Quarter 2005 Interest Interest Interest Average Income/ Yield/ Average Income/ Yield/ Average Income/ Yield/ Balance Expense Rate Balance Expense Rate Balance Expense Rate Earning assets (2) Time deposits placed and other short-term investments $16,691 $181 4.36 % $14,347 $142 4.01 % $13,696 $114 3.33 % Federal funds sold and securities purchased under agreements to resell (2) 179,104 2,014 4.50 174,711 1,800 4.15 185,835 1,268 2.73 Trading account assets 133,556 1,712 5.13 133,361 1,623 4.89 134,196 1,454 4.34 Securities(2) 236,967 3,164 5.34 234,606 3,043 5.19 227,182 2,829 4.98 Loans and leases(3): Residential mortgage (2) 197,228 2,731 5.54 184,796 2,524 5.48 167,263 2,268 5.43 Credit card - domestic 64,980 2,168 13.38 68,169 2,180 12.97 52,474 1,481 11.32 Credit card - foreign 8,305 269 12.97 8,403 287 13.86 - - - Home equity lines 67,182 1,231 7.35 64,198 1,112 7.02 54,941 799 5.83 Direct/Indirect consumer 56,715 1,057 7.46 55,025 986 7.24 43,132 612 5.69 (4) Other consumer 10,804 294 10.95 10,357 272 10.59 6,968 155 8.96 Total consumer 405,214 7,750 7.66 390,948 7,361 7.60 324,778 5,315 6.56 Commercial - domestic (2) 148,445 2,619 7.08 144,693 2,379 6.66 123,927 1,721 5.57 Commercial real estate 36,749 680 7.41 36,676 632 6.99 33,484 477 5.72 Commercial lease financing 20,896 262 5.01 20,512 247 4.82 20,446 252 4.93 Commercial - foreign(2) 24,345 455 7.50 23,139 426 7.46 17,780 305 6.88 Total commercial 230,435 4,016 6.99 225,020 3,684 6.63 195,637 2,755 5.65 Total loans and leases 635,649 11,766 7.42 615,968 11,045 7.24 520,415 8,070 6.22 Other earning assets (2) 51,928 810 6.25 46,618 728 6.31 37,194 555 5.98 Total earning assets - excluding hedge impact 1,253,895 19,647 6.28 1,219,611 18,381 6.07 1,118,518 14,290 5.12 Net derivative income (expense) on assets (54) 8 168 Total earning assets - including hedge impact 1,253,895 19,593 6.26 1,219,611 18,389 6.08 1,118,518 14,458 5.18 Cash and cash equivalents 35,070 34,857 34,731 Other assets, less allowance for loan and lease losses 167,039 161,905 124,229 Total assets $1,456,004 $1,416,373 $1,277,478 Interest-bearing liabilities Domestic interest-bearing deposits: Savings $35,681 $76 0.84 % $35,550 $76 0.87 % $38,043 $52 0.54 % (2) NOW and money market deposit accounts 221,198 995 1.80 227,606 906 1.61 229,174 722 1.26 Consumer CDs and IRAs (2) 141,408 1,230 3.49 135,068 1,022 3.07 127,169 786 2.48 (2) Negotiable CDs, public funds and other time deposits 13,005 121 3.74 8,551 68 3.21 7,751 63 3.22 Total domestic interest-bearing deposits 411,292 2,422 2.36 406,775 2,072 2.07 402,137 1,623 1.62 (5) Foreign interest-bearing deposits : Banks located in foreign countries (2) 32,456 476 5.88 30,116 403 5.43 25,546 270 4.24 Governments and official institutions 13,428 155 4.63 10,200 107 4.25 7,936 59 2.97 Time, savings and other 37,178 276 2.98 35,136 245 2.83 30,973 149 1.94 Total foreign interest-bearing deposits 83,062 907 4.38 75,452 755 4.06 64,455 478 2.98 Total interest-bearing deposits 494,354 3,329 2.70 482,227 2,827 2.38 466,592 2,101 1.81 Federal funds purchased, securities sold under agreements (2) to repurchase and other short-term borrowings 408,734 5,021 4.93 399,896 4,375 4.43 323,916 2,479 3.07 Trading account liabilities 61,263 596 3.90 52,466 517 3.99 60,987 611 4.02 (2) Long-term debt 125,620 1,634 5.20 117,018 1,494 5.11 96,697 1,136 4.70 Total interest-bearing liabilities - excluding hedge impact 1,089,971 10,580 3.89 1,051,607 9,213 3.54 948,192 6,327 2.67 Net derivative (income) expense on liabilities 87 136 303 Total interest-bearing liabilities - including hedge impact 1,089,971 10,667 3.92 1,051,607 9,349 3.60 948,192 6,630 2.80 Noninterest-bearing sources: Noninterest-bearing deposits 180,442 177,594 174,001 Other liabilities 58,218 56,019 56,456 Shareholders' equity 127,373 131,153 98,829 Total liabilities and shareholders' equity $1,456,004 $1,416,373 $1,277,478 Net interest spread 2.39 2.53 2.45 Impact of noninterest-bearing sources 0.51 0.49 0.40 Net interest income/yield on earning assets - excluding hedge impact $9,067 2.90 $9,168 3.02 $7,963 2.85 Net impact of derivative hedge income (expense) (141) (0.05) (128) (0.04) (135) (0.05) Net interest income/yield on earning assets $8,926 2.85 % $9,040 2.98 % $7,828 2.80 % (1) This table presents a non-GAAP financial measure. The impact of interest rate risk management derivatives is shown separately. Interest income and interest expense amounts, and the yields and rates have been adjusted. Management believes this presentation is useful to investors because it adjusts for the impact of our hedging decisions and provides a better understanding of our hedging activities. The impact of interest rate risk management derivatives is not material to the average balances presented above. (2) Interest income excludes the impact of interest rate risk management contracts, which increased(decreased) interest income on time deposits placed and other short-term investments $(13) million, federal funds sold and securities purchased under agreements to resell $(114) million, securities $(2) million, commercial - domestic $76 million, commercial - foreign $1 million, and other earning assets $(2) million in the second quarter of 2006. Interest expense excludes the impact of interest rate risk management contracts which increased(decreased) interest expense on NOW and money market deposit accounts $1 million, consumer CDs and IRAs $163 million, negotiable CDs, public funds and other time deposits $2 million, banks located in foreign countries $13 million, federal funds purchased, securities sold under agreements to repurchase and other short-term borrowings $(179) million and long-term debt $87 million in the second quarter of 2006. Interest income excludes the impact of interest rate risk management contracts, which increased(decreased) interest income on time deposits placed and other short-term investments $(3) million, federal funds sold and securities purchased under agreements to resell $(91) million, commercial - domestic $111 million, commercial - foreign $1 million, and other earning assets $(10) million in the first quarter of 2006. Interest expense excludes the impact of interest rate risk management contracts which increased(decreased) interest expense on NOW and money market deposit accounts $2 million, consumer CDs and IRAs $155 million, negotiable CDs, public funds and other time deposits $2 million, banks located in foreign countries $21 million, federal funds purchased, securities sold under agreements to repurchase and other short-term borrowings $(66) million and long-term debt $22 million in the first quarter of 2006. Interest income excludes the impact of interest rate risk management contracts, which increased(decreased) interest income on time deposits placed and other short-term investments $(1) million, federal funds sold and securities purchased under agreements to resell $(19) million, securities $(4) million, residential mortgage $17 million, commercial - domestic $217 million, commercial - foreign $1 million and other earning assets $(43) million in the second quarter of 2005. Interest expense excludes the impact of interest rate risk management contracts which increased(decreased) interest expense on NOW and money market deposit accounts $1 million, consumer CDs and IRAs $218 million, negotiable CDs, public funds and other time deposits $19 million, banks located in foreign countries $24 million, federal funds purchased, securities sold under agreements to repurchase and other short-term borrowings $103 million and long-term debt $(62) million in the second quarter of 2005. (3) Nonperforming loans are included in the respective average loan balances. Income on these nonperforming loans is recognized on a cash basis. (4) Includes consumer finance of $2,999 million and $3,012 million in the second and first quarters of 2006, and $3,212 million in the second quarter of 2005; foreign consumer of $7,798 million and $7,328 million in the second and first quarters of 2006, and $3,505 million in the second quarter of 2005; and consumer lease financing of $7 million and $17 million in the second and first quarters of 2006, and $251 million in the second quarter of 2005. (5) Primarily consists of time deposits in denominations of $100,000 or more. Information for periods beginning January 1, 2006 includes the MBNA acquisition; prior periods have not been restated. 8

- 10. Bank of America Corporation Year-to-Date Average Balances and Interest Rates - Fully Taxable-equivalent Basis (Dollars in millions) Six Months Ended June 30 2006 2005 Interest Interest Average Income/ Yield/ Average Income/ Yield/ Balance Expense Rate Balance Expense Rate Earning assets Time deposits placed and other short-term investments $15,525 $307 3.99 % $14,010 $214 3.09 % Federal funds sold and securities purchased under agreements to resell 176,919 3,609 4.09 166,950 2,153 2.59 Trading account assets 133,459 3,335 5.01 126,017 2,657 4.23 Securities 235,793 6,205 5.27 215,940 5,385 4.99 (1) Loans and leases : Residential mortgage 191,046 5,255 5.51 172,639 4,699 5.45 Credit card - domestic 66,566 4,348 13.17 51,895 2,854 11.09 Credit card - foreign 8,354 556 13.41 - - - Home equity lines 65,698 2,343 7.19 53,219 1,491 5.65 Direct/Indirect consumer 55,875 2,043 7.35 42,380 1,184 5.63 (2) Other consumer 10,581 566 10.77 7,136 315 8.86 Total consumer 398,120 15,111 7.63 327,269 10,543 6.48 Commercial - domestic 146,580 5,185 7.13 123,865 3,892 6.34 Commercial real estate 36,713 1,312 7.20 33,252 907 5.50 Commercial lease financing 20,705 509 4.91 20,594 512 4.97 Commercial - foreign 23,745 883 7.50 17,676 564 6.44 Total commercial 227,743 7,889 6.98 195,387 5,875 6.06 Total loans and leases 625,863 23,000 7.40 522,656 16,418 6.32 Other earning assets 49,289 1,526 6.23 36,335 967 5.36 Total earning assets(3) 1,236,848 37,982 6.17 1,081,908 27,794 5.16 Cash and cash equivalents 34,964 33,065 Other assets, less allowance for loan and lease losses 164,486 124,407 Total assets $1,436,298 $1,239,380 Interest-bearing liabilities Domestic interest-bearing deposits: Savings $35,616 $152 0.86 % $37,525 $87 0.47 % NOW and money market deposit accounts 224,384 1,904 1.71 231,271 1,375 1.20 Consumer CDs and IRAs 138,256 2,570 3.75 123,101 1,969 3.23 Negotiable CDs, public funds and other time deposits 10,790 193 3.60 9,014 176 3.94 Total domestic interest-bearing deposits 409,046 4,819 2.38 400,911 3,607 1.81 (4) Foreign interest-bearing deposits : Banks located in foreign countries 31,292 913 5.88 23,824 554 4.69 Governments and official institutions 11,823 262 4.47 7,387 102 2.79 Time, savings and other 36,163 521 2.91 30,873 282 1.84 Total foreign interest-bearing deposits 79,278 1,696 4.32 62,084 938 3.05 Total interest-bearing deposits 488,324 6,515 2.69 462,995 4,545 1.98 Federal funds purchased, securities sold under agreements to repurchase and other short-term borrowings 404,339 9,151 4.56 300,331 4,570 3.07 Trading account liabilities 56,889 1,113 3.94 52,792 1,038 3.97 Long-term debt 121,343 3,237 5.34 96,434 2,107 4.37 Total interest-bearing liabilities (3) 1,070,895 20,016 3.76 912,552 12,260 2.71 Noninterest-bearing sources: Noninterest-bearing deposits 179,026 171,048 Other liabilities 57,124 56,666 Shareholders' equity 129,253 99,114 Total liabilities and shareholders' equity $1,436,298 $1,239,380 Net interest spread 2.41 2.45 Impact of noninterest-bearing sources 0.50 0.43 Net interest income/yield on earning assets $17,966 2.91 % $15,534 2.88 % (1) Nonperforming loans are included in the respective average loan balances. Income on these nonperforming loans is recognized on a cash basis. (2) Includes consumer finance of $3,005 million and $3,287 million; foreign consumer of $7,564 million and $3,519 million; and consumer lease financing of $12 million and $330 million for the six months ended June 30, 2006 and 2005. (3) Interest income includes the impact of interest rate risk management contracts, which increased(decreased) interest income on the underlying assets ($46) million and $589 million in the six months ended June 30, 2006 and 2005. Interest expense includes the impact of interest rate risk management contracts, which increased interest expense on the underlying liabilities $223 million and $807 million in the six months ended June 30, 2006 and 2005. (4) Primarily consists of time deposits in denominations of $100,000 or more. Information for periods beginning January 1, 2006 includes the MBNA acquisition; prior periods have not been restated. 9

- 11. Bank of America Corporation (1) Year-to-Date Average Balances and Interest Rates - Fully Taxable-equivalent Basis - Isolating Derivative Hedge Income/Expense (Dollars in millions) Six Months Ended June 30 2006 2005 Interest Interest Average Income/ Yield/ Average Income/ Yield/ Balance Expense Rate Balance Expense Rate Earning assets (2) Time deposits placed and other short-term investments $15,525 $323 4.20 % $14,010 $215 3.10 % Federal funds sold and securities purchased under (2) agreements to resell 176,919 3,814 4.33 166,950 2,119 2.55 Trading account assets 133,459 3,335 5.01 126,017 2,657 4.23 (2) Securities 235,793 6,207 5.27 215,940 5,392 5.00 (3) Loans and leases : Residential mortgage(2) 191,046 5,255 5.51 172,639 4,677 5.43 Credit card - domestic 66,566 4,348 13.17 51,895 2,854 11.09 Credit card - foreign 8,354 556 13.41 - - - Home equity lines 65,698 2,343 7.19 53,219 1,491 5.65 Direct/Indirect consumer 55,875 2,043 7.35 42,380 1,184 5.63 (4) Other consumer 10,581 566 10.77 7,136 315 8.86 Total consumer 398,120 15,111 7.63 327,269 10,521 6.46 (2) Commercial - domestic 146,580 4,998 6.87 123,865 3,259 5.31 Commercial real estate 36,713 1,312 7.20 33,252 907 5.50 Commercial lease financing 20,705 509 4.91 20,594 512 4.97 (2) Commercial - foreign 23,745 881 7.48 17,676 562 6.41 Total commercial 227,743 7,700 6.81 195,387 5,240 5.40 Total loans and leases 625,863 22,811 7.33 522,656 15,761 6.07 (2) Other earning assets 49,289 1,538 6.28 36,335 1,061 5.88 Total earning assets - excluding hedge impac 1,236,848 38,028 6.18 1,081,908 27,205 5.05 Net derivative income (expense) on assets (46) 589 Total earning assets - including hedge impact 1,236,848 37,982 6.17 1,081,908 27,794 5.16 Cash and cash equivalents 34,964 33,065 Other assets, less allowance for loan and lease losse 164,486 124,407 Total assets $1,436,298 $1,239,380 Interest-bearing liabilities Domestic interest-bearing deposits Savings $35,616 $152 0.86 % $37,525 $87 0.47 % (2) NOW and money market deposit accounts 224,384 1,901 1.73 231,271 1,357 1.20 (2) Consumer CDs and IRAs 138,256 2,252 3.28 123,101 1,435 2.35 (2) Negotiable CDs, public funds and other time deposits 10,790 189 3.53 9,014 128 2.87 Total domestic interest-bearing deposits 409,046 4,494 2.23 400,911 3,007 1.52 (5) Foreign interest-bearing deposits : Banks located in foreign countries(2) 31,292 879 5.66 23,824 470 3.97 Governments and official institution 11,823 262 4.47 7,387 102 2.79 Time, savings and other 36,163 521 2.91 30,873 282 1.84 Total foreign interest-bearing deposit 79,278 1,662 4.23 62,084 854 2.77 Total interest-bearing deposits 488,324 6,156 2.55 462,995 3,861 1.69 Federal funds purchased, securities sold under agreements to repurchase and other short-term borrowings(2) 404,339 9,396 4.68 300,331 4,316 2.90 Trading account liabilities 56,889 1,113 3.94 52,792 1,038 3.97 (2) Long-term debt 121,343 3,128 5.16 96,434 2,238 4.64 Total interest-bearing liabilities - excluding hedge impact 1,070,895 19,793 3.73 912,552 11,453 2.53 Net derivative (income) expense on liabilities 223 807 Total interest-bearing liabilities - including hedge impact 1,070,895 20,016 3.76 912,552 12,260 2.71 Noninterest-bearing sources Noninterest-bearing deposits 179,026 171,048 Other liabilities 57,124 56,666 Shareholders' equity 129,253 99,114 Total liabilities and shareholders' equity $1,436,298 $1,239,380 Net interest spread 2.45 2.52 Impact of noninterest-bearing sources 0.50 0.40 Net interest income/yield on earning assets - excluding hedge impact 18,235 2.95 % 15,752 2.92 % Net impact of derivative hedge income/(expense) (269) (0.04) (218) (0.04) Net interest income/yield on earning assets $17,966 2.91 % $15,534 2.88 % (1) This table presents a non-GAAP financial measure. The impact of interest rate risk management derivatives is shown separately. Interest income and interest expense amounts, and the yields and rates have been adjusted. Management believes this presentation is useful to investors because it adjusts for the impact of our hedging decisions and provides a better understanding of our hedging activities. The impact of interest rate risk management derivatives is not material to the average balances presented above. (2) Interest income excludes the impact of interest rate risk management contracts, which increased(decreased) interest income on time deposits placed and other short-term investments $(16) million, federal funds sold and securities purchased under agreements to resell $(205) million, securities $(2) million, commercial - domestic $187 million, commercial - foreign $2 million and other earning assets $(12) million for the six months ended June 30, 2006. Interest expense excludes the impact of interest rate risk management contracts which increased(decreased) interest expense on NOW and money market deposit accounts $3 million, consumer CDs and IRAs $318 million, negotiable CDs, public funds and other time deposits $4 million, banks located in foreign countries $34 million, federal funds purchased, securities sold under agreements to repurchase and other short-term borrowings $(245) million and long-term debt $109 million for the six months ended June 30, 2006. Interest income excludes the impact of interest rate risk management contracts, which increased(decreased) interest income on time deposits placed and other short-term investments $(1) million, federal funds sold and securities purchased under agreements to resell $34 million, securities $(7) million, residential mortgage $22 million, commercial - domestic $633 million, commercial - foreign $2 million and other earning assets $(94) million for the six months ended June 30, 2005. Interest expense excludes the impact of interest rate risk management contracts which increased(decreased) interest expense on NOW and money market deposit accounts $18 million, consumer CDs and IRAs $534 million, negotiable CDs, public funds and other time deposits $48 million, banks located in foreign countries $84 million, federal funds purchased, securities sold under agreements to repurchase and other short term borrowings $254 million and long-term debt $(131) million for the six months ended June 30, 2005. (4) Includes consumer finance of $3,005 million and $3,287 million; foreign consumer of $7,564 million and $3,519 million; and consumer lease financing of $12 million and $330 million for the six months ended June 30, 2006 and 2005. (5) Primarily consists of time deposits in denominations of $100,000 or more. Information for periods beginning January 1, 2006 includes the MBNA acquisition; prior periods have not been restated. 10

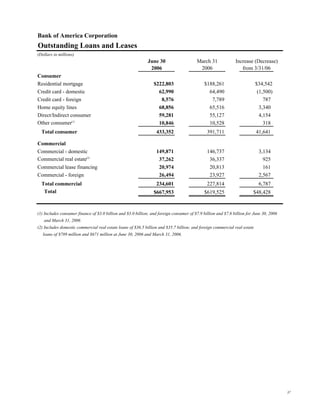

- 12. Bank of America Corporation Business Segment View Net Income Second Quarter 2006 Global Corporate and Investment Global Consumer and Small Business Banking Banking 31.3% 56.7% Global Wealth and Investment Management All Other 11.6% 0.4% Revenue* Second Quarter 2006 Global Corporate and Investment Banking 30.9% Global Wealth and Investment Management 10.5% All Other Global Consumer and Small Business 2.0% Banking 56.6% *Fully taxable-equivalent basis 11