Sustainability reporting

- 1. SUSTAINABILITY REPORTING Prepared by: Hairul Izman Bin Hanafiah GA01848

- 2. Abstract Although companies are not required to provide separate reports on corporate social responsibility, demand for information from external stakeholders has led an increasing number of companies to issue separate sustainability reports. How does a company decide which sustainability initiatives to pursue? How is information about a company’s socially responsible activities gathered, assessed and disseminated? To provide some insight into these questions, I elaborate more to further in these slide.

- 3. Introduction Sustainability Reporting In 2006, Bursa Malaysia introduced a requirement for Main and ACE Market listed issuers to disclose their corporate social responsibility (“CSR”) activities or practices in annual reports. Organisations’ understanding of sustainability has evolved from no knowledge, to the development of new management models which integrate sustainability. stakeholders are increasingly interested in understanding the approaches of organisations in managing their economic, environment and social risks and opportunities. Increasing impacts from sustainability-related risks (e.g. scarcity of resources, changing social expectations and new legislative requirements in sustainability-related areas) are driving organisations to embed sustainability considerations in response to these risks and their challenges.

- 4. What is sustainability? "Development that meets the needs of the present without compromising the ability of future generations to meet their own needs.“ Brundtland Report of the World Commission on Environment and Development.

- 5. What is sustainability? Stakeholders (who may include investors, customers, employees, suppliers, NGOs, local communities, etc.) are now more aware of the impact that businesses have on the economy, environment and society. This impact may be positive or negative. Sustainability-related issues, therefore, can significantly affect an organisation’s risk profile, potential liabilities and its value. Hence, there is a need for the business community to respond appropriately.

- 6. Sustainability is one of Risk Management EES is one of risk management factor. Sustainability reporting may serve as a catalyst to prompt organisations to assess the EES risks that may impact their businesses. EES may help us: 1. reducing exposures to sustainability-related risks 2. staying ahead of emerging sustainability risks and disclosure regulations 3. reducing the cost of capital through a lower risk profile

- 7. Benefit of Sustainability Reporting Promoting innovation and attracting new customers As sustainability considerations increase, an organisation that recognises the opportunities and has the capacity to innovate will drive growth through new products, services and customers Maintaining a licence to operate refers to implicit community-approval of an organisation’s business operations can help organisations realise opportunities (e.g. the local community co- managing a project with the organisation) and manage risks to their business (e.g. boycotts or legal challenges).

- 8. Benefit of Sustainability Reporting Securing capital Traditionally, investors have looked at an organisation’s financial performance to drive their investment decisions In Malaysia, local investors are beginning to consider sustainability factors in their investment decision-making processes. mainstream research providers such as Bloomberg, MSCI, and Thomson Reuters have begun to offer sustainability performance analysis to the market, in particular investors. FTSE and Bursa Malaysia introducing an ESG Index for the Malaysian market called the FTSE4Good Bursa Malaysia Index which is part of the globally benchmarked FTSE4Good Index Series.

- 9. Benefit of Sustainability Reporting Improving productivity and cost optimisation sustainability efforts, s employee engagement go beyond basic compliance with labour standards can lead to longer-term benefits such as customer attraction, improved reputation, stronger operating margins, and optimised capital expenditure Enhancing brand value and reputation can create value by generating demand and securing future earnings for organisations Therefore, organisations will need to identify associated risks and opportunities and assess their impacts. Stakeholders respond positively to organisations that conduct themselves in a sustainable and ethical manner

- 10. HOW TO EMBED SUSTAINABILITY IN ORGANISATIONS? some key considerations for an organisation seeking to embed sustainability in its business strategy and leveraging sustainability to reduce risks and take advantage of business opportunities

- 11. Tone from the top Organisations with strong corporate governance culture will be better positioned to manage sustainability risks and opportunities. There is no standard ‘one size fits all’ approach to sustainability governance. Need to consider organisation’s culture, needs, sector, size, sustainability-related risks and opportunities, and maturity. to embed sustainability effectively, accountability should be at the highest level, i.e. the Board.

- 12. Identifying and prioritising material sustainability matters

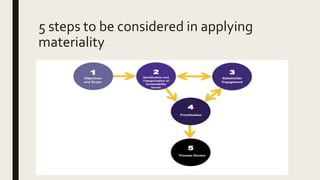

- 13. 5 steps to be considered in applying materiality

- 14. 5 steps to be considered in applying materiality PHASE 1: OBJECTIVESAND SCOPE you may consider the following: physical locations of the organisation (geographical boundary) entities within the organisation (organisational boundary) operations within or outside the organisation (including the entire value chain) PHASE 2: IDENTIFICATIONAND CATEGORISATIONOF SUSTAINABILITY ISSUES develop an initial list of relevant sustainability issues internal sources: Board or Board committee reports; risk management assessments and risk registers; and minutes of management meetings external sources: regulations; standards the underlying criteria for indices NGO reports; stakeholder feedback and complaints; media and external peer review.

- 15. 5 steps to be considered in applying materiality PHASE 3: STAKEHOLDER ENGAGEMENT

- 17. 5 steps to be considered in applying materiality PHASE 4: PRIORITISATION The two tests often used to determine this are impact to business and importance to stakeholders. Focus in ensuring the appropriate management, monitoring and disclosure of the matters PHASE 5: PROCESS REVIEW It is important that the process and outcome of your materiality assessment are reviewed and approved by the senior management. The outcome should also be approved by the Board as the Board is ultimately responsible for the information disclosed.

- 18. Managing material sustainability matters develop your position and response with respect to each material sustainability matter The response could be in the form of: developing policies and procedures implementing various initiatives, measures or action plans setting indicators, goals and targets and a timeframe and, where possible, setting longer term goals in line with the strategic objectives of your organisation implementing new, or changing existing systems, to capture, report, analyse, and manage data requirements associated with each material sustainability matter.

- 19. Communicating and providing credibility to your sustainability performance and disclosures In communicating your sustainability performance to the market, you are required to comply with the sustainability disclosure obligations as prescribed in the Listing Requirements. Assurance can be provided across different types of sustainability disclosures including: Data Narratives disclosures developed in accordance with standards and frameworks such as the GRI Guidelines data collection processes

- 20. WHATTO DISCLOSE UNDERTHE LISTING REQUIREMENTS The obligations under the Listing Requirements relating to sustainability are aimed at achieving the following objectives: improving the quality of sustainability-related practices and reporting of our listed issuers; aiding listed issuers to meet sustainability expectations of their stakeholders attracting funds with a sustainability focus into the Malaysian capital market facilitating more listed issuers to qualify for FTSE4Good Bursa Malaysia Index and other international sustainability indices.

- 25. Contents of the Sustainability Statement The principle of “balance” as per the GRI Guidelines, states that the sustainability report should reflect both the positive and negative aspects of the organisation’s sustainability performance to enable a reasonable assessment of the overall performance. Therefore, a Sustainability Statement should reflect the following qualities: Unbiased; and Avoids omissions or selective reporting (i.e. reporting only the positive aspects and not the negative aspects such as fines and contentious issues).

- 26. Contents of the Sustainability Statement The Sustainability Statement should contain adequate information to enable your stakeholders to have a clear understanding of the EES risks and opportunities which are material to your business and stakeholders. It should also include measures taken to mitigate the risks and take advantage of the opportunities. The Sustainability Statement should include the actions taken (and not just policies) and provide performance data, where possible, in relation to material sustainability matters. Information disclosed in the Sustainability Statement should be clear and easily understood, avoiding jargon, where possible. Further, the information should enable comparability, where possible, across time and possibly to other organisations. With increasing focus by investors on sustainability performance and how that is translated into value, you may want to quantify key impacts (positive or negative) of sustainability initiatives

- 29. Governance Structure “Governance structure” refers to the structures an organisation has in place to ensure accountability, oversight and review in the identification and management of sustainability matters i.e. who is responsible for the organisation’s sustainability performance and disclosures.

- 31. Scope “Scope” refers to the parameters or boundaries of the information being included in the Sustainability Statement.You could scope your disclosure based on: physical locations of the organisation (geographical boundary); entities within the organisation (organisational boundary); and operations within the entire value chain

- 33. What are material sustainability matters?

- 35. How material sustainability matters are identified and why they are important to the listed issuer

- 36. How material sustainability matters are managed including details on policies to manage these sustainability matters

- 37. How material sustainability matters are managed including details on measures or actions taken to deal with these sustainability matters

- 38. How material sustainability matters are managed including details on indicators relevant to these sustainability matters which demonstrate how the listed issuer has performed in managing these sustainability matters.

- 39. Type Of Sustainability Reporting Annual report with a narrative sustainability statement (no framework) This is the most straightforward option. You can include a narrative sustainability statement (as a separate section) that would cover the required disclosures that depend on your market and capitalisation. The advantage is that your sustainability information will get enough prominence and will be noticed by both internal and external users of the report. Due to the stakeholder-focused definition of materiality in the Guide, some of your sustainability information (e.g. on community projects) may be important to wider stakeholders, but not necessarily investors.

- 40. Type Of Sustainability Reporting Annual report with a narrative sustainability statement (GRI Guidelines) The proximity of the Guide and the GRI Guidelines in the definition of materiality drives us to a natural conclusion that Malaysian companies should adopt the latter as a reporting framework. However, neither the GRI Guidelines, nor any other framework, can be applied to just to a statement in the report, which means The GRI Contents Index will have to refer to information elsewhere (other sections of the annual report, website, presentations, etc.). You may need to gather and publish additional information to be able to tick all the GRI boxes. As an alternative, you can produce a standalone sustainability report in line with these guidelines and provide an extract of it in your annual report.

- 41. Type Of Sustainability Reporting Integrated report (<IR> Framework) Integrating sustainability into the core elements of the annual report in line with the <IR> Framework will help you provide meaning information to investors in one document, as well as trigger integrated thinking within your organisation and demonstrate market leadership. To meet the needs of other stakeholders, you could publish additional information on your website. The disadvantage of this approach is that sustainability disclosures might not be visible enough in the annual report for unexperienced users. To comply with Bursa Malaysia’s requirements, you can have a sustainability index referring to the provided disclosures in the integrated report and, if necessary, on the website.

- 47. Reference SUSTAINABILITY REPORTINGGUIDE KIT by KLSE http://www.bursamalaysia.com/misc/system/assets/15789/BURSA%20MALAYSIA%20SU STAINABILITY%20REPORTING%20GUIDE%20(final).pdf SUSTAINABILITY REPORTING IN MALAYSIA:WHICH FRAMEWORKTO CHOOSE? http://www.malaysiaplc.com/articles/sustainability/sustainability-reporting-in-malaysia- which-framework-to-choose/ Dated 8th February 2017 SustainabilityArticle by BlackSun PLC SUSTAINABILITY REPORT GENTING MALAYSIA BERHAD 2016 http://www.gentingmalaysia.com/wp- content/uploads/2017/03/170324_GentingMalaysia_SRFINAL.pdf