tax.utah.gov forms current tc tc-547

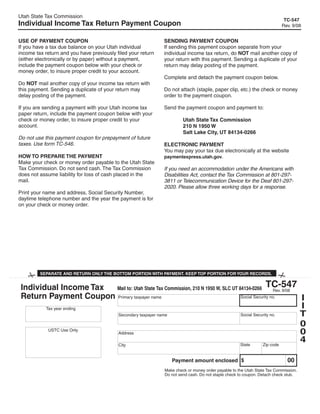

- 1. Utah State Tax Commission TC-547 Individual Income Tax Return Payment Coupon Rev. 9/08 USE OF PAYMENT COUPON SENDING PAYMENT COUPON If you have a tax due balance on your Utah individual If sending this payment coupon separate from your income tax return and you have previously filed your return individual income tax return, do NOT mail another copy of (either electronically or by paper) without a payment, your return with this payment. Sending a duplicate of your include the payment coupon below with your check or return may delay posting of the payment. money order, to insure proper credit to your account. Complete and detach the payment coupon below. Do NOT mail another copy of your income tax return with this payment. Sending a duplicate of your return may Do not attach (staple, paper clip, etc.) the check or money delay posting of the payment. order to the payment coupon. If you are sending a payment with your Utah income tax Send the payment coupon and payment to: paper return, include the payment coupon below with your check or money order, to insure proper credit to your Utah State Tax Commission account. 210 N 1950 W Salt Lake City, UT 84134-0266 Do not use this payment coupon for prepayment of future taxes. Use form TC-546. ELECTRONIC PAYMENT You may pay your tax due electronically at the website HOW TO PREPARE THE PAYMENT paymentexpress.utah.gov. Make your check or money order payable to the Utah State Tax Commission. Do not send cash. The Tax Commission If you need an accommodation under the Americans with does not assume liability for loss of cash placed in the Disabilities Act, contact the Tax Commission at 801-297- mail. 3811 or Telecommunication Device for the Deaf 801-297- 2020. Please allow three working days for a response. Print your name and address, Social Security Number, daytime telephone number and the year the payment is for on your check or money order. Clear form SEPARATE AND RETURN ONLY THE BOTTOM PORTION WITH PAYMENT. KEEP TOP PORTION FOR YOUR RECORDS. TC-547 Individual Income Tax Mail to: Utah State Tax Commission, 210 N 1950 W, SLC UT 84134-0266 Rev. 9/08 Return Payment Coupon Primary taxpayer name I Social Security no. I Tax year ending T Social Security no. 2008 Secondary taxpayer name 0 0 USTC Use Only Address 4 State Zip code City 00 Payment amount enclosed $ Make check or money order payable to the Utah State Tax Commission. Do not send cash. Do not staple check to coupon. Detach check stub.