Service Providers and the Cloud OTT Surge

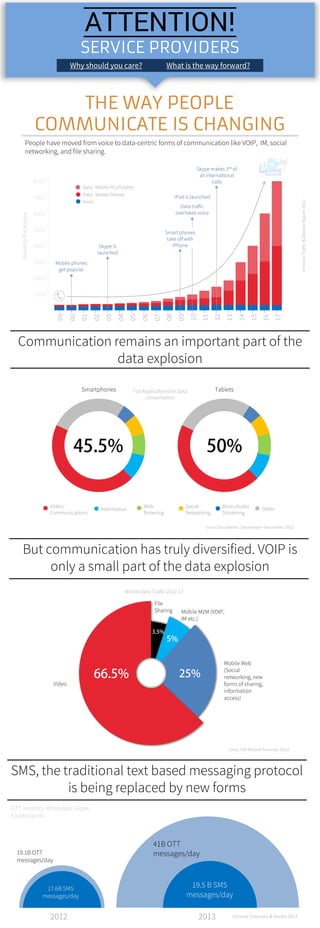

- 1. THE WAY PEOPLE COMMUNICATE IS CHANGING People have moved from voice to data-centric forms of communication like VOIP, IM, social networking, and file sharing. MonthlyPetabytes 1000 2000 3000 4000 5000 6000 7000 8000 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 Voice Data : Mobile Phones Data : Mobile PCs/Tablets Mobile phones get popular Skype is launched Data traffic overtakes voice Smart phones take off with iPhone iPad is launched Mobile Web (Social networking, new forms of sharing, information access) Video Mobile M2M (VOIP, IM etc.) File Sharing Mobile Data Traffic 2012-17 But communication has truly diversified. VOIP is only a small part of the data explosion Communication remains an important part of the data explosion Top Applications for data consumption Smartphones Tablets Video/ Communications Information Web Browsing Social Networking Music/Audio Streaming Other ErricsonTraffic&MarketReport2012 Cisco Data Meter, September–December 2012 Cisco VNI Mobile Forecast 2013 SMS, the traditional text based messaging protocol is being replaced by new forms 19.1B OTT messages/day 17.6B SMS messages/day 41B OTT messages/day 19.5 B SMS messages/day OTT vendors: WhatsApp, Skype, Facebook etc. 2012 2013 Informa Telecoms & Media 2013 ATTENTION! SERVICE PROVIDERS Why should you care? What is the way forward? Skype makes 3rd of all international calls

- 2. WHY SHOULD CARRIERS CARE? Carrier data revenues haven’t kept up with data growth As mobile data surges, carrier revenues from data are growing As the world enters the data era, the strategic dynamics of the market are changing. 30,000 40,000 50,000 60,000 70,000 80,000 90,000 08 09 10 11 12 13E THE GOOD NEWS THE BAD NEWS Voice revenues are declining faster than data revenue growth DataRevenuesUSDM $45 $10 08 09 10 11 12 1307 14 ChetanSharmaConsulting2013 (minus) ARPU Data ARPU gained in Q4 2012 Voice ARPU lost in Q4 2012 Carriers are conceding ground to OTT (Over the top) and VAS (value added services) providers $55 Voice Data Overall APRU Traffic Revenues Voice era Data era 85% of the traffic in the 4 major mobile networks is pure data but it only accounted for 39% of all mobile data revenues. Chetan Sharma Q4 2011 Nokia-Siemens;IBMInstitutefor BusinessValueanalysis Users Carrier Users Carrier 48¢ 64¢ Access Voice SMS Access Voice SMS Marketsandmarkets.com,Gartner Carriers have a smaller share of a growing revenue pie Carriers yesterday Carriers today Carriers face lower switching barriers and increased churn as they no longer control their customer’s data Back Carrier OTT Application Customer’s Data Apple, Microsoft, Google, Skype etc. OTT Application Customer’s Data SWITCHINGCOST LOYALTY Psst..i’ll give you a cheaper deal Customers follow their data

- 3. © 2013 WHAT IS THE WAY FORWARD? As the boundaries between voice, messaging, and platforms get blurred, carriers need a fundamental shift in strategy Prepare for the 4th revenue wave Chetan Sharma Consulting 2013 Netrevenue Subscriber penetration 0-25% 25-70% 70-90% 90+% US The 2st Revenue Wave – Messaging is no longer sufficient 2010 2011 2012 2016 8.7 B 54 B 23 B 13.9 B SMS Revenues Lost (Billion) Ovum2012 The 3st Revenue Wave – Access will not last much longer Netrevenue Subscriber smartphone penetration 0-25% 25-70% 70-90% 90+% US Enter the 4th Revenue Wave – OTT Value Added Services Voice Access Messaging Enterprise Cloud Consumer Cloud Mobile Advertising Transpo- rtation Hospitality Wellness _ _ Today Tomorrow ARPU RevenueinBillions Service/Application areas Operator’sdilemma:The4th waveChetanSharma2012 “It is becoming clear that the (carrier’s) long-term value will be in the portfolio of value -added services (VAS).” The 1st Revenue Wave – Voice is no longer sufficient HyperOffice lets you launch key OTT services under your own brand & keep your customer’s data HyperOffice is an award winning leader in cloud communication and collaboration since 2002 Benefits Leverage HyperOffice technology to enter key OTT markets Cloud based enterprise UCC Social VOIP/Web Conferencing Consumer Cloud Who? White labeling: Build your own brand Deploy in the HyperOffice cloud or your own cloud Best in market margins 1.240.428.1700 x 107 Back Contact us