Term Paper Of Ifs

- 1. Term paper Of Financial institution & Services Topic: Analytical study of the impact of global financial crisis on Indian insurance industry. Submitted to: Submitted by: Ms. AVINASH KAUR AMIT KUMAR BBA-MBA (5th) Reg. no. 3020070044 Roll no. RR1709B34

- 2. INTRODUCTION TO INSURANCE INDUSTRY Insurance has a long history in India. Life Insurance in India was introduced in 1818 when Oriental Life Insurance Company began its operations. General Insurance was however a comparatively late entrant in 1850 when Triton Insurance company set up its base in Kolkata. History of Insurance in India can be broadly bifurcated into three eras: (a) Pre Nationalization (b) nationalization and c) Post nationalization. Life Insurance was the first to be nationalized in 1956. Life Insurance Corporation of India was formed by consolidating the operations of various insurance companies. General Insurance followed suit and was nationalized in 1973. General Insurance Corporation of India was set up as the controlling body with New India, United India, National and Oriental as its subsidiaries. The process of opening up the insurance sector was initiated against the background of Economic Reform process which commenced from 1991. For this purpose Malhotra Committee was formed during this year who submitted their report in 1994 and Insurance Regulatory Development Act (IRDA) was passed in 1999. Resultantly Indian Insurance was opened for private companies and Private Insurance Company effectively started operations from 2001. Insurance sector in India is governed by the insurance regulatory and development authority (IRDA) under insurance Act, 1938, the life insurance Act, 1956, the general insurance business Act, 1972, insurance regulatory and development authority Act, 1999, and some other related Act. Today India has a large number of population and there are huge market is untapped for insurance industry, so this industry has a great opportunity in India. Growth of Indian insurance business is more than 20 % annually. This industry contributes about 7% of country’s GDP. INDIAN INSURANCE MARKET At the present time, where LIC is having very big market over whole country, private insurance players are going very fast to cover Indian insurance market. Currently there are 80% of Indian population are untapped for insurance, so these companies are focusing on this point and going to tap the market for insurance. There are 23 private life insurance companies, 9 private non-life insurance companies & 6 public sector companies operating in India. The insurance market have witnessed dynamic changes which includes presence of a fairly large number of insurers both life and non-life segment. Most of the private insurance companies have formed joint venture partnering well recognized foreign players across the globe. There is pressure from both within the country and outside on the Government to increase the foreign direct investment (FDI) limit from the current 26% to 49%, which would help Joint Venture partners to bring in funds for expansion.

- 3. There are opportunities in the pensions sector where regulations are being framed. Less than 10 % of Indians above the age of 60 receive pensions. The IRDA has issued the first license for a standalone health company in the country as many more players wait to enter. The health insurance sector has tremendous growth potential, and as it matures and new players enter, product innovation and enhancement will increase. The deepening of the health database over time will also allow players to develop and price products for larger segments of society. The private sector controls over 26.18% of the life insurance market and over 26.53% of the non-life market, the public sector companies still call the shots. The country’s largest life insurer, Life Insurance Corporation of India (LIC), had a share of 64.82% in new business premium income in November 2008. ICICI Prudential Life Insurance Company continues to lead the private sector with a 7.26% market share in terms of fresh premium, whereas ICICI Lombard General Insurance Company is the leader among the private non-life players with 8.11% market share. ICICI Lombard has focused on growing the market for general insurance products and increasing penetration within existing customers through product innovation and distribution. There is so much competition in this sector at the present time. Every company is having different amount of premium on the same features of the products. PRESENT SCENARIO OF INSURANCE INDUSTRY India with about 200 million middle class household shows a huge untapped potential for players in the insurance industry. Saturation of markets in many developed economies has made the Indian market even more attractive for global insurance majors. The insurance sector in India has come to a position of very high potential and competitiveness in the market. Indians, have always seen life insurance as a tax saving device, are now suddenly turning to the private sector that are providing them new products and variety for their choice. Consumers remain the most important Centre of the insurance sector. After the entry of the foreign players the industry is seeing a lot of competition and thus improvement of the customer service in the industry. Computerization of operations and updating of technology has become imperative in the current scenario. Foreign players are bringing in international best practices in service through use of latest technologies. The insurance agents still remain the main source through which insurance products are sold. The concept is very well established in the country like India but still the increasing use of other sources is imperative. At present the distribution channels that are available in the market are listed below. Direct selling Corporate agents Group selling Brokers and cooperative societies Bancassurance

- 4. Customers have tremendous choice from a large variety of products from pure term (risk) insurance to unit-linked investment products. Customers are offered unbundled products with a variety of benefits as riders from which they can choose. More customers are buying products and services based on their true needs and not just traditional moneyback policies, which is not considered very appropriate for long-term protection and savings. There is lots of saving and investment plans in the market. However, there are still some key new products yet to be introduced - e.g. health products. The rural consumer is now exhibiting an increasing propensity for insurance products. A research conducted exhibited that the rural consumers are willing to dole out anything between Rs 3,500 and Rs 2,900 as premium each year. In the insurance the awareness level for life insurance is the highest in rural India, but the consumers are also aware about motor, accidents and cattle insurance. In a study conducted by MART the results showed that nearly one third said that they had purchased some kind of insurance with the maximum penetration skewed in favor of life insurance. The study also pointed out the private companies have huge task to play in creating awareness and credibility among the rural populace. The perceived benefits of buying a life policy range from security of income bulk return in future, daughter's marriage, children's education and good return on savings, in that order, the study adds. ROLE OF INSURANCE INDUSTRY IN A MODERN ECONOMY Promote financial stability and security at both the national and personal levels. Encourage productive Investments and Innovation through the mitigation of the financial consequences of financial misfortune. Mobilize savings. Contribute to an efficient use of capital based on insurers’ role as significant institutional investors. Buy Insurance Insurance Company Insured Individuals, Firm Pay Premium Pool created by Insured suffer Loss Premium Received Pay loss From pool GLOBAL FINANCIAL CRISIS The global financial crisis is really started to show its effect in middle of 2007 & in 2008. Around the world stock markets have fallen, large financial institutions have collapsed or been bought out, and governments in even the wealthiest nations have had to come up with rescue packages to bail out their financial systems. On the one hand many people are concerned that those responsible for the financial problems are the ones being bailed out, while on the other hand, a global financial meltdown will affect the

- 5. livelihoods of almost everyone in an increasingly inter-connected world. The problem could have been avoided, if ideologues supporting the current economics models weren’t so vocal, influential and inconsiderate of others’ viewpoints and concerns. The proximate cause of the current financial turbulence is attributed to the sub-prime mortgage sector in the USA. At a fundamental level, however, the crisis could be ascribed to the persistence of large global imbalances, which, in turn, were the outcome of long periods of excessively loose monetary policy in the major advanced economies during the early part of this decade. Global imbalances have been manifested through a substantial increase in the current account deficit of the US mirrored by the substantial surplus in Asia, particularly in China, and in oil exporting countries in the Middle East and Russia (Lane, 2009). These imbalances in the current account are often seen as the consequence of the relative inflexibility of the currency regimes in China and some other EMEs. According to Portes (2009), global macroeconomic imbalances were the major underlying cause of the crisis. These saving-investment imbalances and consequent huge cross-border financial flows put great stress on the financial intermediation process. The global imbalances interacted with the flaws in financial markets and instruments to generate the specific features of the crisis. Such a view, however, offers only a partial analysis of the recent global economic environment. The role of monetary policy in the major advanced economies, particularly that in the United States, over the same time period needs to be analyzed for a more balanced analysis. WORLD FINANCIAL SYSTEM IS AFFECTED A collapse of the US sub-prime mortgage market and the reversal of the housing boom in other industrialized economies have had a ripple effect around the world. Furthermore, other weaknesses in the global financial system have surfaced. Some financial products and instruments have become so complex and twisted, that as things start to unravel, trust in the whole system started to fail. THE SUBPRIME CRISIS The subprime crisis came about in large part because of financial instruments such as securitization where banks would pool their various loans into sellable assets, thus off-loading risky loans onto others. (For banks, millions can be made in money-earning loans, but they are tied up for decades. So they were turned into securities. The security buyer gets regular payments from all those mortgages; the banker off loads the risk. Securitization was seen as perhaps the greatest financial innovation in the 20th century.) CAUSES OF SUBPRIME CRISIS Banks borrowed more money to lend out so they could create more securitization. Some banks didn’t need to rely on savers as much then, as long as they could borrow from other

- 6. banks and sell those loans on as securities; bad loans would be the problem of whoever bought the securities. Some investment banks like Lehman Brothers got into mortgages, buying them in order to securitize them and then sell them on. Some banks loaned even more to have an excuse to securitize those loans. Running out of whom to loan to, banks turned to the poor; the subprime, the riskier loans. Rising house prices led lenders to think it wasn’t too risky; bad loans meant repossessing high-valued property. Subprime and “self-certified” loans (sometimes dubbed “liar’s loans”) became popular, especially in the US. Some banks evens started to buy securities from others. Collateralized Debt Obligations, or CDOs, (even more complex forms of securitization) spread the risk but were very complicated and often hid the bad loans. High street banks got into a form of investment banking, buying, selling and trading risk. Investment banks, not content with buying, selling and trading risk, got into home loans, mortgages, etc. without the right controls and management. When people did eventually start to see problems, confidence fell quickly. Lending slowed, in some cases ceased for a while and even now, there is a crisis of confidence. Some investment banks were sitting on the riskiest loans that other investors did not want. Assets were plummeting in value so lenders wanted to take their money back. But some investment banks had little in deposits; no secure retail funding, so some collapsed quickly and dramatically. GLOBAL FINANCIAL CRISIS AND INDIA The global financial crisis is already causing a considerable slowdown in most developed countries. Governments around the world are trying to contain the crisis, but many suggest the worst is not yet over. Stock markets are down more than 40% from their recent highs. Investment banks have collapsed, rescue packages are drawn up involving more than a trillion US dollars, and interest rates have been cut around the world in what looks like a coordinated response. Leading indicators of global economic activity, such as shipping rates, are declining at alarming rates. The financial market crisis has led to the collapse of major financial institutions and is now beginning to impact the real economy in the advanced economies. As this crisis is unfolding, credit markets appear to be drying up in the developed world.

- 7. India, like most other emerging market economies, has so far, not been seriously affected by the recent financial crisis in developed economies. In my remarks today, I will, first, briefly set out reasons for the relative resilience shown by the Indian economy to the ongoing international financial markets’ crisis. This will be followed by some discussion of the impact till date on the Indian economy and the likely implications in the near future. I then outline our approach to the management of the exposures of the Indian financial sector entities to the collapse of major financial institutions in the US. Orderly conditions have been maintained in the domestic financial markets, which is attributable to a range of instruments available with the monetary authority to manage a variety of situations. Finally, I would briefly set out my thinking on the extent of vulnerability of the Asian economies, in general, to the global financial market crisis.

- 8. FINANCIAL GLOBALIZATION: THE INDIAN APPROACH The Indian economy is relatively open economy, despite the capital account not being fully open. The current account, as measured by the sum of current receipts and current payments, amounted to about 53 per cent of GDP in 2007-08, up from about 19 per cent of GDP in 1991. Similarly, on the capital account, the sum of gross capital inflows and outflows increased from 12 per cent of GDP in 1990-91 to around 64 per cent in 2007-08. With this degree of openness, developments in international markets are bound to affect the Indian economy and policy makers have to be vigilant in order to minimize the impact of adverse international developments on the domestic economy. The relatively limited impact of the crisis in financial markets of the advanced economies in the Indian financial markets, and more generally the Indian economy, needs to be assessed in this context. Whereas the Indian current account has been opened fully, though gradually, over the 1990s, a more calibrated approach has been followed to the opening of the capital account and to opening up of the financial sector. This approach is consistent with the weight of the available empirical evidence with regard to the benefits that may be gained from capital account liberalization for acceleration of economic growth, particularly in emerging market economies. The evidence suggests that the greatest gains are obtained from the opening to foreign direct investment, followed by portfolio equity investment. The benefits emanating from external debt flows have been found to be more questionable until greater domestic financial market development has taken place. Accordingly, in India, while encouraging foreign investment flows, especially direct investment inflows, a more cautious, nuanced approach has been adopted in regard to debt flows. Debt flows in the form of external commercial borrowings are subject to ceilings and some end-use restrictions, which are modulated from time to time taking into account evolving macroeconomic and monetary conditions. Similarly, portfolio investment in government securities and corporate bonds are also subject to macro ceilings, which are also modulated from time to time. Thus, prudential policies have attempted to prevent excessive recourse to foreign borrowings and dollarization of the economy. In regard to capital outflows, the policy framework has been progressively liberalized to enable the non-financial corporate sector to invest abroad and to acquire companies in the overseas market. Resident individuals are also permitted outflows subject to reasonable limits. The financial sector, especially banks and insurance business is subject to prudential regulations, both in regard to capital and liquidity. As the current global financial crisis has shown, liquidity risks can rise during a crisis and can pose serious downside risks to macroeconomic and financial stability. The Reserve Bank had already put in place steps to mitigate liquidity risks at the very short-end, risks at the systemic level and at the institution level as well. Some of the important measures by the Reserve Bank in this regard include, 1. Restricting the overnight unsecured market for funds to banks and primary dealers (PD) as well as limits on the borrowing and lending operations of these entities in the overnight inter-bank call money market.

- 9. 2. Large reliance by banks on borrowed funds can exacerbate vulnerability to external shocks. This has been brought out quite strikingly in the ongoing financial crisis in the global financial markets. Accordingly, in order to encourage greater reliance on stable sources of funding, the Reserve Bank has imposed prudential limits on banks on their purchased inter-bank liabilities and these limits are linked to their net worth. Furthermore, the incremental credit deposit ratio of banks is also monitored by the Reserve Bank since this ratio indicates the extent to which banks are funding credit with borrowings from wholesale markets (now known as purchased funds). 3. Asset liability management guidelines for dealing with overall asset-liability mismatches take into account both on and off balance sheet items. Finally, guidelines on securitization of standard assets have laid down a detailed policy on provision of liquidity support to Special Purpose Vehicles (SPVs). EFFECTS OF GLOBAL FINANCIAL CRISIS IN INDIAN ECONOMY Initial impact of the sub-prime crisis The initial impact of the sub-prime crisis on the Indian economy was rather muted. Indeed, following the cuts in the US Fed Funds rate in August 2007, there was a massive jump in net capital inflows into the country. The Reserve Bank had to sterilize the liquidity impact of large foreign exchange purchases through a series of increases in the cash reserve ratio and issuances under the Market Stabilization Scheme (MSS). With persistent inflationary pressures emanating both from strong domestic demand and elevated global commodity prices, policy rates were also raised. Monetary policy continued with pre-emptive tightening measures up to August 2008. The direct effect of the sub-prime crisis on Indian banks/financial sector was almost negligible because of limited exposure to complex derivatives and other prudential policies put in place by the Reserve Bank & other regulatory bodies. The relatively lower presence of foreign banks in the Indian banking sector also minimized the direct impact on the domestic economy. The larger presence of foreign banks can increase the vulnerability of the domestic economy to foreign shocks, as happened in Eastern European and Baltic countries. In view of significant liquidity and capital shocks to the parent foreign bank, it can be forced to scale down its operations in the domestic economy, even as the fundamentals of the domestic economy remain robust. Thus, domestic bank credit supply can shrink during crisis episodes. For instance, in response to the stock and real estate market collapse of early 1990s, Japanese banks pulled back from foreign markets – including the United States – in order to reduce liabilities on their balance sheets and thereby meet capital adequacy ratio requirements. Econometric evidence shows a statistically significant relationship between international bank lending to developing countries and changes in global liquidity conditions, as measured by spreads of interbank interest rates over overnight index swap (OIS) rates and U.S. Treasury bill rates. A 10 basis-point increase in the spread between the London Interbank Offered Rate (LIBOR) and the OIS sustained for a quarter, for example, is predicted to lead to a decline of up to 3 percent in international bank lending to developing countries (World Bank, 2008).

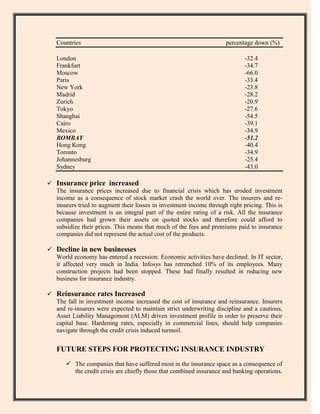

- 10. Trade and trade prices Growth in India has increased imports and pushed up the demand for copper, oil and other natural resources, which has led to greater exports and higher prices, including from African countries. Eventually, growth in China and India is likely to slow down, which will have knocked on effects on other poorer countries. Remittances Remittances to India have decline. There were fewer economic migrants coming to India when was in a recession, so fewer remittances and also probably lower volumes of remittances per migrant. Foreign direct investment (FDI) and equity investment These will come under pressure. While 2007 was a record year for FDI to India equity finance is under pressure and corporate and project finance is already weakening. The proposed Xstrata takeover of a South African mining conglomerate was put on hold as the financing was harder due to the credit crunch. There are several other examples e.g. in India. IMPACT OF GLOBAL FINANCIAL CRISIS ON INSURANCE INDUSTRY Insurance of individuals and business firms makes up one of the most interesting and important transactions. The World economy is facing the worst financial crisis. The financial crisis that started from mortgage home loan left no industry untouched by its effects. Manufacturing, Banks, Travels and Tourism and even the Insurance Industry was affected by the financial crisis. Insurance industry is considered to be the backbone of an economy. Its strategic importance is incomparable. The financial crisis led the world’s largest Insurance Company “American International Group” (AIG) almost to the verge of bankruptcy. The government had to bail out the largest insurer Claims increased: The default from the borrowers will increase the claim amount. As the financial crisis was deepening, more banks and financial organizations and manufacturing units did face crisis or closures which affected the insurance industry. Demand for re-insurance increased: Leading figures in the international reinsurance market say the financial crisis will increase the demand for reinsurance, given the erosion of many insurers’ capital. Investment Income decreased: The financial crisis has decreased the investment income of insurance companies. The following table shows the downfall in various stock markets of the world.

- 11. Countries percentage down (%) London -32.4 Frankfurt -34.7 Moscow -66.0 Paris -33.4 New York -23.8 Madrid -28.2 Zurich -20.9 Tokyo -27.6 Shanghai -54.5 Cairo -39.1 Mexico -34.9 BOMBAY -51.2 Hong Kong -40.4 Toronto -34.9 Johannesburg -25.4 Sydney -43.0 Insurance price increased The insurance prices increased due to financial crisis which has eroded investment income as a consequence of stock market crash the world over. The insurers and re- insurers tried to augment their losses in investment income through right pricing. This is because investment is an integral part of the entire rating of a risk. All the insurance companies had grown their assets on quoted stocks and therefore could afford to subsidize their prices. This means that much of the fees and premiums paid to insurance companies did not represent the actual cost of the products. Decline in new businesses World economy has entered a recession. Economic activities have declined. In IT sector, it affected very much in India. Infosys has retrenched 10% of its employees. Many construction projects had been stopped. These had finally resulted in reducing new business for insurance industry. Reinsurance rates Increased The fall in investment income increased the cost of insurance and reinsurance. Insurers and re-insurers were expected to maintain strict underwriting discipline and a cautious, Asset Liability Management (ALM) driven investment profile in order to preserve their capital base. Hardening rates, especially in commercial lines, should help companies navigate through the credit crisis induced turmoil. FUTURE STEPS FOR PROTECTING INSURANCE INDUSTRY The companies that have suffered most in the insurance space as a consequence of the credit crisis are chiefly those that combined insurance and banking operations.

- 12. This is where regulators and supervisors will be alert in the future. Insurance companies branching out into risky ventures (such as banking or financial guarantees business) or other riskier players (such as banks or financial guarantors) moving into insurance, creating possible transmission mechanisms previously unnoticed. It is of particular importance that the new solvency II framework is implemented without delay. It will introduce a holistic view for all business, investment and operational risks of an insurance company and it places a strong focus on the quality of internal risk management. From an economic point of view, Solvency II offers the best possible regulatory framework to diligently implement the lessons learnt from the crisis and to ensure the sector’s long-term viability.