The Reinvention Reset | Accenture

- 1. Oil and Gas Reinvention Index 2022 The reinvention reset From bold plans to pragmatic actions Oil and Gas Reinvention Index 2022

- 2. Oil and Gas Reinvention Index 2022 Oil and Gas Reinvention Index 2022 Meet the authors 2 Copyright © 2022 Accenture. All rights reserved. Special thanks to the following contributors: Pedro Beltramino, Piera Pedemonte, Mohd Arif and Gargi Chakrabarty. Muqsit Ashraf Lead – Strategy Muqsit leads Accenture Strategy, a multibillion-dollar business unit across more than 40 industries in over 120 countries that helps clients tap new market opportunities and execute large- scale transformation initiatives. He is also a member of Accenture’s Global Management Committee. Prior to this role, Muqsit led Accenture’s Energy industry sector, helping companies reinvent to improve returns and become more sustainable. Muqsit attended Yale University and now lives in Houston. in Houston. Aleek Datta Managing Director Strategy & Consulting, Energy Diana Alcala Senior Manager Strategy & Consulting, Energy Diana works with oil and gas companies across the value chain in the US and Latin America, helping them optimize operations, develop their digital strategies and prepare their talent and organizations for industry shifts. More recently, she has been advising oil and gas leaders on how to reinvent their companies for the energy transition, including integrating new businesses into their portfolios. Diana earned an MBA from the MIT Sloan School of Management and lives in Houston. Lasse Kari Senior Principal Accenture Research, Energy Lasse has 15 years of market and business research expertise in economic value modeling and indexing, along with global executive and consumer surveys. Most recently, his work has focused on the reinvention of the oil and gas industry, cross-sector energy transition topics and overall industrial decarbonization. Lasse speaks regularly at major industry events and is based in Düsseldorf. For more than 15 years, Aleek has been advising oil and gas leaders across the energy value chain on business strategy, large-scale transformation programs and enterprise innovation. He has a particular passion for helping energy leaders unlock and maximize the potential of their workforces. Aleek also leads Accenture’s Energy Industry Assets and Insights team, which is responsible for producing market-leading thought leadership. Aleek earned an MBA from Carnegie Mellon University and lives in London.

- 3. Oil and Gas Reinvention Index 2022 Oil and Gas Reinvention Index 2022 3 To address the structural shifts, challenges and disruptions roiling the energy industry, companies have no choice but to reinvent. This means reconsidering what they stand for. What they invest in. How they compete. And how they measure and deliver value to customers, investors and employees. We believe five areas—Competitiveness, Carbon, Connectivity, Customer and Culture—underpin reinvention in the energy industry. These 5C areas also provide a useful framework for transformation. Addressing them holistically is the only way energy companies can achieve a step change in reinvention across the entirety of their value chains. Copyright © 2022 Accenture. All rights reserved.

- 4. Oil and Gas Reinvention Index 2022 “5C”actions underpin a step change in reinvention 4 01 Competitiveness Shape a resilient portfolio and operating model, including ways of working, that achieve incremental returns through cycles Achieve carbon neutrality by transforming/shifting investments, operations and products Enable an intelligent and secure enterprise with end- to-end connectivity, optimization and autonomous capabilities Deliver superior (B2B and B2C) customer experiences through design, services and formats/channels Build a distinct purpose-led culture and employee experiences with an emphasis on innovation and agility 02 Carbon 03 Connectivity 04 Customer 05 Culture Copyright © 2022 Accenture. All rights reserved.

- 5. Oil and Gas Reinvention Index 2022 5 In 2022, Accenture carried out its 2nd annual Oil and Gas Reinvention Index research. We surveyed executives from 201 oil and gas companies around the world to understand the actions they are taking to meet the challenges of the energy transition, their progress toward reinvention and the outcomes they expect to achieve. For each company, we determined a Reinvention Index (RI) Score, composed of equally weighted scores from each of the 5Cs of reinvention. Based on this assessment, we were able to identify leaders (the 10% of companies leading the race to reinvention), as well as the laggards (the 25% that are not yet taking integrated actions). This report highlights the distinctions between the leaders and laggards we observed in 2022 and identifies the strategies and actions more likely to create a profitable, secure and sustainable future. Here’s what we found. Copyright © 2022 Accenture. All rights reserved.

- 6. Oil and Gas Reinvention Index 2022 6 Leaders The top 10% of companies—with an average Reinvention Index (RI) score of 63—are leaders in the reinvention race. They are taking decisive, holistic actions to bolster multiple capabilities across the value chain. 21 Followers Most companies fell in the middle of the pack. They are taking some steps to fundamentally change their business or operating model but falling short of true reinvention. 131 Laggards The bottom 25% of companies can be considered “laggards.” With an average RI score of 50, these companies are not yet taking integrated actions or making investments to build a balanced, profitable and sustainable future. 49 Copyright © 2022 Accenture. All rights reserved.

- 7. Oil and Gas Reinvention Index 2022 Oil and Gas Reinvention Index 2022 The reinvention priorities have generally remained the same The rankings of 5C priorities are fairly consistent among leaders and laggards—and quite similar to rankings from 2021. Competitiveness and carbon are the top priorities, with less attention paid to connectivity, customer or culture. We believe this poses an obstacle to achieving reinvention. Because each of the 5Cs is a critical component of reinvention, they should be prioritized equally. There are, however, some encouraging signs that leaders (and laggards, to a lesser extent) are recognizing that success amid long-term market disruptions will depend on a holistic and realistic approach to portfolio allocations, growth, digital innovation, organizational change and environmental, social and governance (ESG) performance. 7 In 2022, leaders and laggards have similar priorities Area in which organization is focusing its reinvention (weighted average) Leaders Laggards Last priority Top priority Competitiveness Carbon Connectivity Customer Culture Copyright © 2022 Accenture. All rights reserved.

- 8. Oil and Gas Reinvention Index 2022 Oil and Gas Reinvention Index 2022 Energy security is now top-of- mind, along with sustainability Given the events of the past year—notably, the war in Ukraine and subsequent threats to energy supplies in Europe—energy security is considered more important than energy sustainability by both leaders and laggards. But companies across the spectrum are increasing their focus on both security and sustainability. Leaders are taking a more balanced approach. Laggards are focused more strongly on energy security, despite citing carbon as the main driver of their reinvention strategies. 8 Energy sustainability 58% 12% 13% 75% 21% Energy security 22% Decreased focus Increased focus No change Change in focus on sustainability versus security Copyright © 2022 Accenture. All rights reserved.

- 9. Oil and Gas Reinvention Index 2022 Oil and Gas Reinvention Index 2022 The appetite for radical reinvention is waning One of the most surprising findings in our 2022 research shows that only half as many companies are pursuing radical reinvention compared to just a year ago. 9 The pace of radical reinvention has declined Fundamental changes Some changes Significant changes Radical reinvention 21% 43% 11% 45% 25% 38% 9% 8% 2022 2021 Extent of plans to reinvent company toward 2025 given macroeconomic shifts and energy transition (Percentage of total respondents) We believe the slowdown in reinvention plans is likely related to the uncertainty in global commodity prices and the newly recognized threat to energy security in parts of the world that have traditionally enjoyed energy access and affordability. These conditions, together with local factors such as extreme weather, have tempered companies’ boldest plans for reinvention. Copyright © 2022 Accenture. All rights reserved.

- 10. Oil and Gas Reinvention Index 2022 Oil and Gas Reinvention Index 2022 That’s not necessarily a bad thing. While energy companies may be responding to macro-economic shifts and energy transition pressures in the near term with less intensity than they did last year, the leaders especially are demonstrating a more holistic approach to reinvention. Rather than taking radical actions in one or two areas, they are taking more measured steps across all the 5C areas. 10 Nearly half of the companies we surveyed are planning to institute fundamental changes. And more than a third are planning to reinvent with what they consider to be “significant” changes, up from just a quarter last year. This is supported by the fact that nearly half of the companies we surveyed are planning to institute fundamental changes. And more than a third are planning to reinvent with what they consider to be “significant” changes, up from just a quarter last year. Copyright © 2022 Accenture. All rights reserved.

- 11. Oil and Gas Reinvention Index 2022 Expectations for returns are more achievable 11 One of the most interesting findings in last year’s survey was the extraordinary optimism leaders felt about their reinvention strategies. They believed their actions would drive margin improvements of at least 7%, revenue growth of at least 11%, and ESG improvements of 27%. Laggards were much more modest in their expectations. This year, all energy companies are rethinking the benefits of reinvention. We believe they are settling on more achievable expectations, borne of pragmatic and holistic actions 5% 2% 0% 2% 4% 6% 8% 11% 5% 0% 2% 4% 6% 8% 10% 12% 5% 3% 0% 2% 4% 6% 8% Minimum margin growth expected by respondents Minimum revenue growth expected by respondents Minimum ESG improvement expected by respondents Leaders Laggards Leaders Laggards Leaders Laggards 2022 1.5X Average expected margin growth 2.8X Average expected revenue growth 2.4X Average expected ESG improvement Copyright © 2022 Accenture. All rights reserved.

- 12. Oil and Gas Reinvention Index 2022 While their expectations for returns may be lower, energy companies are now benefitting from higher commodity prices and industry profitability over the past year. These factors are setting a higher baseline for returns. So even though energy companies are setting more modest expectations for measurable outcomes, the potential industry value that can be unlocked is enormous. 12 If all industry players were to achieve leaders-level ambitions, the industry value that could be generated may near $700 billion per year. Copyright © 2022 Accenture. All rights reserved.

- 13. Oil and Gas Reinvention Index 2022 Oil and Gas Reinvention Index 2022 So, what are the leaders doing differently this year in each of the 5C areas to further their reinventions and create a profitable, secure and sustainable future? 13 Copyright © 2022 Accenture. All rights reserved. Oil and Gas Reinvention Index 2022

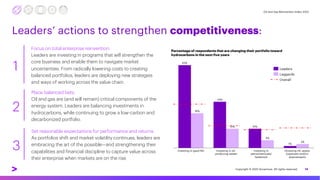

- 14. Oil and Gas Reinvention Index 2022 14 1 Focus on total enterprise reinvention. Leaders are investing in programs that will strengthen the core business and enable them to navigate market uncertainties. From radically lowering costs to creating balanced portfolios, leaders are deploying new strategies and ways of working across the value chain. 2 Place balanced bets. Oil and gas are (and will remain) critical components of the energy system. Leaders are balancing investments in hydrocarbons, while continuing to grow a low-carbon and decarbonized portfolio. 3 Set reasonable expectations for performance and returns. As portfolios shift and market volatility continues, leaders are embracing the art of the possible—and strengthening their capabilities and financial discipline to capture value across their enterprise when markets are on the rise. Leaders’ actions to strengthen competitiveness: Divesting HC assets (upstream and/or downstream) Percentage of respondents that are changing their portfolio toward hydrocarbons in the next five years 43% 10% Investing in gas/LNG Investing in oil- producing assets Investing in petrochemicals/ feedstock 24% 18% 10% 4% 1% 2% Leaders Laggards Overall Copyright © 2022 Accenture. All rights reserved.

- 15. Oil and Gas Reinvention Index 2022 1. Anticipate, don’t react. Leaders set ambitions targets, monitor and report on their emissions. They also take a balanced, holistic approach to investing in clean energy and decarbonization technologies. 2. Match investments to ambitions. Achieving net-zero targets by 2050 will require significant investments from the industry. Leaders are investing more than laggards in the development and deployment of decarbonization technologies like CCUS, biofuels and green hydrogen. But even they will need to dramatically increase their commitments. 3. Integrate solutions to accelerate results. Leaders know that no single low-carbon solution or decarbonization technology will result in a cleaner energy mix. They are focused on bringing multiple solutions together to amplify and accelerate their impact. 15 Leaders’ actions to position carbon as a strategic differentiator: Percentage of respondents that agree/strongly agree they undertake the following actions Leaders Laggards Overall 92% Have set net-zero targets Monitor carbon emissions Investing in reducing emissions 89% 30% Investing in carbon offsets Report carbon emissions 74% 80% 69% 80% 40% 76% 34% Copyright © 2022 Accenture. All rights reserved.

- 16. Oil and Gas Reinvention Index 2022 Oil and Gas Reinvention Index 2022 Embrace an end-to-end mindset. Effectively connecting and optimizing operations requires bringing various technologies together. Point solutions or a singular focus on, say, cloud will fail to generate the potential value of digital investments. Leaders are likely to leverage technologies across the digital landscape—from 5G to edge computing to AI—all while strengthening their data management and cybersecurity infrastructures. Don’t ignore frontier technologies. Virtual, augmented and extended reality, as well as the metaverse will drive the future evolution of connected operations. Energy companies that invest in these frontier technologies today will be well placed to take the lead in designing and developing infrastructures, optimizing workflows, and piloting new services or formats with customers or ecosystem partners. Focus on more than technology. Digital technologies are a critical element of connectivity. But so is talent. Leaders will prioritize investments in the right technologies—and in the skillsets needed to unlock those technologies’ full potential. 16 Leaders’ actions to strengthen connectivity: Copyright © 2022 Accenture. All rights reserved.

- 17. Oil and Gas Reinvention Index 2022 Commit to customer-centricity. Energy demand is evolving among business and individual customers. Leaders are better able to anticipate changes and engage with new customers in new ways and re-engage existing customers with new offerings and modes of interaction. 17 Leaders’ actions to strengthen customer experiences: Use digital to its full advantage. Leaders know that digital tools are key to engaging with customers—and digital expertise is necessary to bring together the data and analytics that can lead to better decisions about products and services, retail formats and demand drivers. Focus on customer satisfaction. Leaders are keenly focused on customer satisfaction. Other companies should follow their lead. By satisfying customers today, energy companies can build loyalty that will withstand future changes in demand and market downturns. Customer satisfaction Sales volumes 40% Revenue 95% 30% 25% 19% 3% Margin 8% 20% Percentage of respondents expecting >10% improvement over the next three years in Leaders Laggards Overall Copyright © 2022 Accenture. All rights reserved.

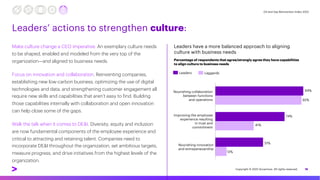

- 18. Oil and Gas Reinvention Index 2022 Make culture change a CEO imperative. An exemplary culture needs to be shaped, enabled and modeled from the very top of the organization—and aligned to business needs. Focus on innovation and collaboration. Reinventing companies, establishing new low-carbon business, optimizing the use of digital technologies and data, and strengthening customer engagement all require new skills and capabilities that aren’t easy to find. Building those capabilities internally with collaboration and open innovation can help close some of the gaps. Walk the talk when it comes to DE&I. Diversity, equity and inclusion are now fundamental components of the employee experience and critical to attracting and retaining talent. Companies need to incorporate DE&I throughout the organization, set ambitious targets, measure progress, and drive initiatives from the highest levels of the organization. 18 Leaders’ actions to strengthen culture: Leaders have a more balanced approach to aligning culture with business needs Percentage of respondents that agree/strongly agree they have capabilities to align culture to business needs Leaders Laggards 94% 51% Nourishing innovation and entrepeneuership Nourishing collaboration between functions and operations 12% Improving the employee experience resulting in trust and commitment 92% 74% 41% Copyright © 2022 Accenture. All rights reserved.

- 19. Oil and Gas Reinvention Index 2022 Oil and Gas Reinvention Index 2022 Radical reinvention revisited 19 Copyright © 2022 Accenture. All rights reserved.

- 20. Oil and Gas Reinvention Index 2022 20 We believe that radical transformation, typically limited to one or two areas within an organization, must evolve to a more balanced transformation across all 5C areas. Each area is a critical pillar of reinvention and should be prioritized equally. This is not yet happening. However, this year's analysis suggests that companies are beginning to rethink reinvention and embrace a more holistic approach that addresses the enterprise in its entirety. Here’s what we think energy companies should do next. Copyright © 2022 Accenture. All rights reserved.

- 21. Oil and Gas Reinvention Index 2022 Oil and Gas Reinvention Index 2022 Recommended actions for reinvention Be radical (but also holistic). Radical reinventions are bold. They are dynamic. And they lay the groundwork for exceptional potential returns within a defined area of transformation. Holistic reinventions, on the other hand, move the organization in lockstep to a resilient, agile, innovative and profitable future. A reinvention plan that is as broad as it is ambitious will set the next generation of industry leaders apart. 21 Balance the reinvention priorities. Energy companies are still prioritizing competitiveness and carbon as the pillars of their transformation programs. This is understandable. However, it may be shortsighted. We continue to believe that the most successful reinvention programs will balance their attention and investments across competitiveness, carbon, connectivity, customer and culture. The sooner that balance is achieved, the sooner energy companies will reap the benefits of total enterprise reinvention. Practically allocate investments—and day-to-day attention. In addition to balancing the 5C imperatives, energy companies should balance their actions and investments within each area. This year’s leaders exhibited that sort of evenhanded approach in the development of their low-carbon business assets, their efforts to manage emissions, their adoption of digital technologies and even their customer interactions. In other words, among leaders, a practical and measured approach to reinvention is becoming more evident in the day-to-day initiatives aimed at boosting performance in any (and all) of the 5C areas. Other companies should consider following their lead. Copyright © 2022 Accenture. All rights reserved.

- 22. Oil and Gas Reinvention Index 2022 Oil and Gas Reinvention Index 2022 Beareinventionleader 22 Copyright © 2022 Accenture. All rights reserved.

- 23. Oil and Gas Reinvention Index 2022 About the research In early 2021, Accenture conducted its inaugural Oil and Gas Reinvention Index research to understand the actions companies are taking to meet the challenges of the energy transition, their progress toward reinvention and the outcomes they expect to achieve. This initiative, comprising surveys and case study research, was updated in 2022 to track the industry’s reinvention progress over time. Survey The 2022 edition of Accenture Reinvention Index research included a survey of 201 c-suite executives from 201 companies. The survey collected data on: • Perceived need for reinvention and drivers of change • Current state of reinvention across the 5Cs: Competitiveness, Carbon, Connectivity, Customer and Culture • Future reinvention actions planned and anticipated future state • Expected value to be captured from reinvention Approach We aggregated the responses from each participant to arrive at a score for each company". Next, we defined and grouped companies into Reinvention leaders and laggards (i.e., those ahead in terms of their reinvention progress and those who are not changing or are changing slowly). Definitions We created a Reinvention Index (RI) Score, composed of equally weighted scores from each of the 5Cs of reinvention with a maximum score of 100. The top 10% of the companies on this score are leaders and the bottom 25% are laggards (last year’s edition considered top 10% and bottom 25%). Calculations We compared expected financial benefits of pursuing the 5Cs—measured by minimum expected improvement—and calculated the difference in performance between leaders and laggards. Responsible research methods Our research, and that of our partners in our ecosystem, employs ethical and responsible research methods. Respondents were anonymous and we commit to not using the data collected to personally identify the respondents and/or contact them. Copyright © 2022 Accenture. All rights reserved. 23

- 24. Oil and Gas Reinvention Index 2022 Survey demographics Responsible research methods Our research, and that of our partners in our ecosystem, employs ethical and responsible research methods. Respondents were anonymous and we commit to not using the data collected to personally identify the respondents and/or contact them. 5% 15% 50% 30% $100m-$499m $500m-$999m $1b-$10b >$10b 20% 6% 20% 20% 7% 6% 20% Chief Financial Officer Chief Innovation Officer Chief Marketing Officer Chief Strategy Officer CIO/CTO/CDO Chief Mobility Officer Chief Operating Officer CXO Title* Integrated Oil Company (IOC) Independent National Oil Company (NOC) Oilfield and Equipment Services (OFES) 80 81 20 20 40% 40% 10% 10% 4 company types N= % 8 Regions Australia/New Zealand Canada China Europe India Latin America Middle East USA N= % 2 32 6 70 13 10 20 48 1% 16% 3% 35% 6% 5% 10% 24% Revenue N=201 * Includes direct reports Copyright © 2022 Accenture. All rights reserved. 24

- 25. Oil and Gas Reinvention Index 2022 Oil and Gas Reinvention Index 2022 About Accenture Accenture is a global professional services company with leading capabilities in digital, cloud and security. Combining unmatched experience and specialized skills across more than 40 industries, we offer Strategy and Consulting, Interactive, Technology and Operations services— all powered by the world’s largest network of Advanced Technology and Intelligent Operations centers. Our 699,000 people deliver on the promise of technology and human ingenuity every day, serving clients in more than 120 countries. We embrace the power of change to create value and shared success for our clients, people, shareholders, partners and communities. Visit us at www.accenture.com. About Accenture Research Accenture Research shapes trends and creates data-driven insights about the most pressing issues global organizations face. Combining the power of innovative research techniques with a deep understanding of our clients’ industries, our team of 300 researchers and analysts spans 20 countries and publishes hundreds of reports, articles and points of view every year. Our thought-provoking research—supported by proprietary data and partnerships with leading organizations, such as MIT and Harvard—guides our innovations and allows us to transform theories and fresh ideas into real-world solutions for our clients. For more information, visit www.accenture.com/research. This content is provided for general information purposes and is not intended to be used in place of consultation with our professional advisors. Copyright © 2022 Accenture. All rights reserved. Accenture and its logo are trademarks of Accenture.