The Surge: Summary of Mobile in Europe (EU5)

- 1. Where EU5 mobile is today “The surge” From communication to context

- 2. The 7th Mass Media

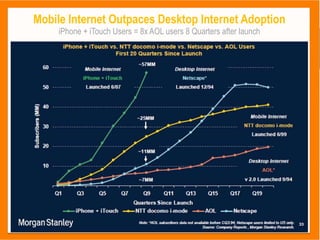

- 3. Mobile Internet Outpaces Desktop Internet Adoption iPhone + iTouch Users = 8x AOL users 8 Quarters after launch

- 4. Apps: from walled garden to open playground 43% off all mobile apps downloaded globally where for location based social networking services 150,998 Apple 19,897 Android Nokia 6,118 Blackberry 4,756 The Apps model has changed the value chain of mobile content… 1,452 Palm BEFORE End User Developer Publisher Aggregator Operator 693 Windows 20% 20% 20% 40% End User AFTER Developer Store Owner 70% 30% Source: ComScore Mobile Metrix+ Media Lense 2009 Metrix

- 5. The 3 Mobile Era’s Communication, Content, Context

- 6. The size of the EU5 mobile market Growth of mobile media and browsing Germany, France and UK are the most established mobile markets > substantial growth of mobile media in the next five years Italy has the potential to become a leading mobile market; high 3G adoption, propensity to browse mobile content and a user base that will migrate out of PAYG in the near future

- 7. Figures shaping mobile in Europe (EU5) The story behind the numbers 1,442 separate devices being used for Mobile media in EU5 iPhone only represents 9% of mobile media users in EU5 Nokia represents 34% of mobile media users, double the market share of its nearest rival Samsung with 18% INSIGHT: Lots of handsets but 20% of handsets account for 79% of mobile media users 27% of all 288 million EU5 consumers are mobile media users (browsed the internet from phone, dowloaded/used an app) 27% mobile media users, 15% only voice users, 58% SMS users with no mobile media Low mobile media usage when compared to the US (35%) 3G phone with unlimited data tarrifs represent only 5% in Europe, while 21% in the U.S INSIGHT: EU5 consumers with unlimited data plans are 196% more likely to use mobile media 84% of Italian mobile users (42 million) are Pay as you Go (PAYG) mobile users Considerably high when compared to EU5 average of 46%, 22% in France and 39% in Germany While PAYG has no impact on SMS or MMS mobile usage it does impact mobile media usage Italy is the exception, it is the same size market as UK, but a PAYG market and yet matches UK in mobile media consumption INSIGHT: While Germany and UK are the largest markets, consumers in Italy demonstrate willingess to spend on services and devices

- 8. Mobile is part of EU5 consumers daily media consumption The only “always on” device Information News Entertainment AFTER AT HOME GET UP WAY TO WORK WORK AT WORK TV RADIO NEWSPAPER ONLINE RADIO ONLINE MAGAZINE NEWSPAPE TV NEWSPAPE MOBILE RADIO R NEWSPAPE R MOBILE MAGAZINE R MOBILE MOBILE morning forenoon afternoon evening

- 9. Demographics of EU5 Mobile Media activities Average mobile media user is 33 years old and 40% are female Younger demographics create their own ringtones, use social networking services and listen to music Mobile Internet services (browsing, apps and e-mail) skew 65-70% male. Unlimited data plan subscribers average age 35. Source: ComScore Mobile Metrix+ Media Lense 2009 Metrix

- 10. Demographics of EU5 Mobile Media activities PC Internet versus Mobile Internet demographics The age comparison between PC and Mobile Internet users is indicative of the need for money when browsing on the mobile device (advanced device and data plans). Mobile social networkers has a more even gender than mobile browsers for news and info. Source: ComScore Mobile Metrix+ Media Lense 2009 Metrix

- 11. Growth of EU5 Mobile Media activities Social networking and apps are driving growth Social networking and apps are showing the highest gains with 106% and 64% Y/Y growth in users. GPS mapping will emerge as a key category given Google and Nokia recent announcement to offer service free of charge Source: ComScore Mobile Metrix+ Media Lense 2009 Metrix

- 12. Usage of mobile in the United Kingdom Top 10 Mobile Web Properties by Top 10 Mobile Web Properties by Unique Visitors in the UK (000) Time Spent (minutes) in the UK (000) 65% Google 10 = 70% of all and Facebook time spent it Google siteusers access Facebook 65% of mobile and through their mobile top 10 properties account for 70% of all time spent by mobile users phones every month Source: Comscore GSMA MMM December 2009

- 13. Usage of mobile in the United Kingdom Average Minutes per Usage Day Distribution of users and usage (minutes) by access device in between smart and non-smart the UK phones 66% more 51% of all time mobile users spend in average driven by Smartphone users which only time time on the four largest 66% more social media properties than fixed spent UKof overall mobile phone represent 29% users in the access users Source: Comscore GSMA MMM December 2009

- 14. Usage patterns of mobile phone users the United Kingdom Fastest growing UK mobile phone (all phone types) media activities (Q2/09 to Q3/09) 10.4 million Users using mobiles to access the internet , 21% of all mobile phones users 4.1 million Users using mobiles to download applications, 1 million users in Q3 when compared to Q2 Source: Nielsen Company

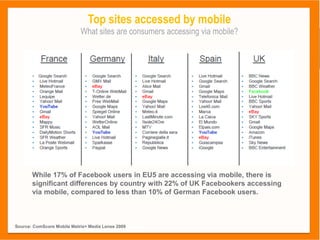

- 15. Top sites accessed by mobile What sites are consumers accessing via mobile? While 17% of Facebook users in EU5 are accessing via mobile, there is significant differences by country with 22% of UK Facebookers accessing via mobile, compared to less than 10% of German Facebook users. Source: ComScore Mobile Metrix+ Media Lense 2009 Metrix

- 16. The 4 future drivers of mobile in Europe Social networking and web based apps will drive growth 1. Accesability > Web based apps Web based apps such as HTML5 shaping the way mobile applications are built; low entry and based on Google supported HTML5 & Opera JavaScript as opposed to C++ based Windows Mobile, iPhone OS 2. Community > Proximity networks Proximity networks shaping the way users use their mobile to inform and update and recommend their peers and social group. Emerging segment it supports: Shout Out’ers 3. Location > Augmented reality Augmented reality shaping the behaviour of mobile phone users by turning their cameras into everything from surrounding readers to sign translator. Emerging segment it supports: Insightseer 4. Transaction > Point and find technology pay for products way usersofuse their mobile to Point and find technology shaping the identify, research and at point purchase. Emerging segment it supports: Mobile hunters