Tomasz Kozluk: Global development and Impacts of the war in Ukraine

- 1. 30 May 2022 Tomasz Kozluk OECD Department of Economics Global developments and Impacts of the War in Ukraine

- 2. 2 Global activity indicators continue to pick up but confidence has declined

- 3. 3 Russia faces a price shock and a sharp decline in commercial links Note: The price level series shows the cumulative impact of weekly consumer price inflation.. Source: Rosstat; and OECD calculations. Note: Flights refer to actual domestic and international commercial flights (as opposed to scheduled flights). Source: flightradar24.com; and OECD calculations.

- 4. 4 The zero-Covid policy has also resulted in a sharp slowdown in China Note: Figure shows actual domestic and international flights. Source: Radarbox

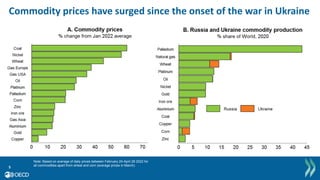

- 5. 5 Commodity prices have surged since the onset of the war in Ukraine Note: Based on average of daily prices between February 24-April 28 2022 for all commodities apart from wheat and corn (average prices in March).

- 6. 6 Fossil fuel prices have increased and become more volatile Oil Brent, USD/barrel Note: Latest data 3 May 2022. Source: Refinitiv. Gas EUR/MWh Note: Shows the evolution of TTF Neutral Gas Price for Europe and Henry Hub for the United States. Latest data 3 May 2022. Source: Refinitiv; and OECD calculations. Coal Newcastle (fob), USD/Mt Note: Figure shows weekly prices for Newcastle FOB 6000kcal/kg NAR. Newcastle refers to Newcastle, Australia. Latest data 29 April 2022. Source: IHS Markit; Argus.

- 7. 7 There are renewed signs of supply-chain disruptions Note: Defined as 100 minus the proportion of PMI survey respondents reporting that delivery times have stayed the same or become faster. Source: Markit; and OECD calculations. Note: Estimated proportion of goods waiting on container ships. Source: Kiel Trade Monitor.

- 8. 8 Inflationary pressures continue to broaden Note: Based on quarterly data for headline and core consumer price inflation. Personal consumption deflator in the United States, harmonized consumer prices in the EU economies and national consumer prices in other economies. Figures for 2022Q1 are OECD estimates for some countries. In right-hand panel, quarterly numbers are quarter-on-quarter changes at an annualised rate.

- 9. 9 Inflationary pressures could be stronger and longer lasting

- 10. 10 Financial market risks amidst widespread repricing: from high debt, elevated asset prices (especially housing) and potential capital flow movements Note: Fiscal year projections for India.

- 11. 11 The currencies of many commodity exporters have recently appreciated against the US dollar. Note: Changes between average bilateral USD exchange rate in January 2022 and average over April 1-14 2022. A positive number indicates a currency appreciation against the US dollar. Source: Refinitiv; and OECD calculations.

- 12. 12 Policy interest rates are now rising in many economies and market expectations of future policy rates have increased Note: Decomposition refers to changes between end-March and end-December 2021, and changes between end-December 2021 to April 14 2022. Source: Refinitiv; and OECD calculations. Source: Refinitiv; and OECD calculations.

- 13. 13 The consequences of the war are already weakening global growth and adding to inflation Note: Based on simulations with the NiGEM macroeconomic model of the combined effect of differences between commodity prices in the period from 24 February to 9 March and the January average, a 50% rouble depreciation against the US dollar, bilateral currency depreciations of 5% against the US dollar in Bulgaria, the Czech Republic, Hungary, Poland, Romania and Turkey, increases of 10 percentage points in policy interest rates and risk premia in Russia, higher risk premia in emerging-market economies, ex-ante declines of 15% and 40% respectively in domestic demand in Russia and Ukraine in 2022H1. Source: OECD calculations using the NiGEM global macroeconomic model. Simulated impact on GDP, first full year % Simulated impact on annual inflation % points

- 14. 14 A refugee crisis is underway Note: Asylum applicants are considered those who have submitted an application for international protection. The solid red bar is the estimated number of Ukrainian refugees between 24 February and 3 May 2022. Source: Eurostat; UNHCR; and OECD calculations. Refugee arrivals are surging Note: Figures as of 3 May 2022. Source: UNHCR; and OECD calculations. Eastern European countries have already received a large number of refugees Receiving countries of refugees fleeing Ukraine, ‘000s

- 15. 15 Summary of the outlook • The war in Ukraine has generated a major humanitarian crisis and changed economic prospects considerably. • A weaker recovery is now expected, and inflation pressures are higher and expected to last longer. • The prospects of a full recovery from the pandemic in many EMEs have receded further. • The war in Ukraine has pushed up commodity prices substantially and, together with disruptions in China, is adding to supply-chain pressures. • Uncertainty is high and there are substantial downside risks.

- 16. Thank you 16 Find out more about our work at: https://www.oecd.org/economic-outlook/ https://twitter.com/oecdeconomy eco.contact@oecd.org https://oecdecoscope.blog/