UBS Global Financial Services Conference

- 1. Bank of America Global Consumer & Small Business Banking Liam McGee President, Global Consumer & Small Business Banking UBS Financial Services May 13, 2008

- 2. Forward Looking Statements This presentation contains forward-looking statements, including statements about the financial conditions, results of operations and earnings outlook of Bank of America Corporation. The forward-looking statements involve certain risks and uncertainties. Factors that may cause actual results or earnings to differ materially from such forward-looking statements include, among others, the following: 1) projected business increases following process changes and other investments are lower than expected; 2) competitive pressure among financial services companies increases significantly; 3) general economic conditions are less favorable than expected; 4) political conditions including the threat of future terrorist activity and related actions by the United States abroad may adversely affect the company’s businesses and economic conditions as a whole; 5) changes in the interest rate environment reduce interest margins and impact funding sources; 6) changes in foreign exchange rates increases exposure; 7) changes in market rates and prices may adversely impact the value of financial products; 8) legislation or regulatory environments, requirements or changes adversely affect the businesses in which the company is engaged; 9) changes in accounting standards, rules or interpretations, 10) litigation liabilities, including costs, expenses, settlements and judgments, may adversely affect the company or its businesses; 11) mergers and acquisitions and their integration into the company; and 12) decisions to downsize, sell or close units or otherwise change the business mix of any of the company. For further information regarding Bank of America Corporation, please read the Bank of America reports filed with the SEC and available at www.sec.gov. 2

- 3. Positioned for Success • Differentiators – Strong balance sheet and liquidity – Unparalleled distribution – Leading positions in key products – Diverse income sources – Most recognized brand • Managing near-term challenges – Economic pressure – Housing market • Solid business trends: deposits and consumer lending • Investing in growth opportunities – Deposits and debit card – Consumer lending – Distribution network – Mass affluent segment and affinity banking 3

- 4. Differentiators Unparalleled Franchise Leader in Customer Relationships • 59 million consumer and small business households • 78% of U.S. population in footprint • 87% of diverse HHs in footprint Leader in Distribution • 15 of 20 fastest growing states • 17%+ retail deposit market share in top 30 markets • 6,100 banking centers, 18,500 ATMs • #1 Online and Mobile Banking Leader in Brand • Recently named the #1 global financial services brand 4

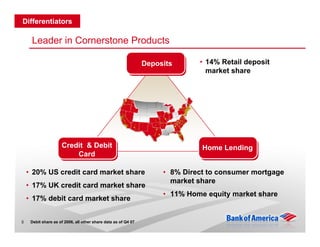

- 5. Differentiators Leader in Cornerstone Products Deposits • 14% Retail deposit market share Credit & Debit Home Lending Card • 20% US credit card market share • 8% Direct to consumer mortgage market share • 17% UK credit card market share • 11% Home equity market share • 17% debit card market share 5 Debit share as of 2006, all other share data as of Q4 07

- 6. Differentiators Business Mix (in millions) 2007 Net Income Deposits Card Services $5,227 $3,712 56% 39% Consumer ALM/Other Real Estate $120 $371 1% 4% 6

- 7. Differentiators Geographic Diversity 1 Retail Deposit Share 28% 25% 24% 24% 23% 23% 23% 21% 17% 17% 16% 15% 12% 10% 10% 4% hia s co ele DC o it go ork ton ore nix llas n ta i le am tro ieg elp st o cis att an ica ng oe wY us ltim Da De Mi nD ilad ran Bo Se Atl sA Ch Ph Ho Ba Ne nF Sa Ph Lo Sa 1 Source: June 2007 FDIC /(MSA defined geographies) 7 Chicago and Detroit include the impact of the LaSalle acquisition

- 8. Differentiators Positioned to Capture Growth United States Source: “Retail Banking: Facing the Future” 8 Boston Consulting Group, November 2007

- 9. Navigating the Current Environment 9

- 10. Current Environment • View of economy • Economic cycle • Impact on Bank of America customers and businesses 10

- 11. Current Environment Changing Trends in Consumer Purchasing Total Debit and Credit Purchase Volume YoY Growth of Necessary vs. Discretionary Spend per Account (Proforma, in $Bns) Necessary R 12.3% CAG 13.3% $412 $384 $327 $190 $169 Debit 7.6% $142 Credit Total 4.4% $215 $222 $185 $102 3.7% 3.4% $50 Discretionary $52 0.5% FY05 FY06 FY07 Q1 08 Q1 07 Q2 07 Q3 07 Q4 07 Q1 08 • Total volume growth continues to show stable, long-term growth • Spending on necessities has increased dramatically in the last two quarters driven by higher fuel and food prices CAGR for Debit is 15.6% and CAGR for Credit Card is 9.6%. Both include LaSalle 11 Necessary includes Fuel, Grocery and Utilities (which also includes Phone and Cable) Discretionary includes Retail, Travel and Entertainment and Services

- 13. Current Environment Select Portfolio Characteristics – 1Q08 Residential Mortgage - $266 billion Average refreshed FICO 734 Average refreshed LTV 62% More than 90% refreshed LTV 10% Performing well against the environment and peer comparisons Residential mortgage trended statistics 1Q07 2Q07 3Q07 4Q07 1Q08 30+ DPD % 1.02% 1.18% 1.44% 1.64% 1.56% Net c/o % 0.01% 0.02% 0.02% 0.04% 0.10% Allowance for credit losses 0.10% 0.07% 0.07% 0.08% 0.15% 13

- 14. Current Environment Select Portfolio Characteristics – 1Q08 Managed Consumer Credit Card - $184 billion Average refresehed FICO 685 Performing well but experiencing upward loss pressure centered in housing depressed states Managed consumer credit card trended statistics 1Q07 2Q07 3Q07 4Q07 1Q08 30+ DPD % 5.32% 5.08% 5.24% 5.45% 5.61% Net loss % 4.73% 5.02% 4.67% 4.75% 5.19% Allowance for credit losses 4.99% 4.69% 4.32% 4.16% 4.81% US and foreign consumer card excluding business 14

- 15. Current Environment Select Portfolio Characteristics – 1Q08 Home equity - $ 118 billion Average refreshed FICO 717 Average refreshed CLTV 74% More than 90% refreshed CLTV 26% Rising losses driven by high CLTV and concentration in housing depressed states Home equity trended statistics 1Q07 2Q07 3Q07 4Q07 1Q08 30+ DPD % 0.64% 0.72% 0.96% 1.26% 1.33% Net c/o % 0.08% 0.12% 0.20% 0.63% 1.71% Allowance for credit losses 0.16% 0.26% 0.40% 0.84% 2.15% 15

- 16. Current Environment Housing Affected Geographies Driving Losses • Combined loan to value of more than 90%, on a refreshed basis, represents: – 26% of outstanding balances – 82% of 1Q08 net charge-offs • In 1Q08 California and Florida combined represent: – 40% of outstandings – 52% of delinquencies – 62% of charge-offs 16

- 17. Current Environment Select Portfolio Characteristics – 1Q08 Small Business - $ 20 billion Rising losses driven by weakened economy and earlier vintages Credit card represents approximately half the portfolio Small business trended statistics 1Q07 2Q07 3Q07 4Q07 1Q08 30+ DPD % 3.70% 3.96% 4.58% 5.29% 6.09% Net c/o % 4.20% 4.80% 5.38% 5.82% 7.21% Allowance for credit losses 4.29% 5.34% 6.44% 7.02% 10.11% 17

- 18. Current Environment Lending Strategy Consistent but Evolving • Near-term management – Tightened underwriting standards – Significantly reduced LTVs with particular focus on housing stressed markets – Managing lines aggressively – Expanding customer assistance and collections 18

- 19. Deposits, Credit Card and Consumer Real Estate 19

- 20. Deposits New Relationships and Balance Growth Deposit Household Growth (GAAP, in MMs) Average Retail Balances & Spreads (GAAP, $Bns) Consumer Market Market Share: 26.5% 27.5% 29.2% 29.1% Share: 14.1% 13.2% 13.0% 13.9% 14.0% AGR 6.2% C GR 5.9% CA 3.3 3.3 3.0 2.7 $521 $482 $509 $444 $463 24.0 23.8 22.1 21.1 2.64% 2.85% 2.76% 2.55% 2.10% FY05 FY06 FY07 Q1 08 FY05 FY06 FY07 Q407 Q108 Consumer Small Business Balances Margin CAGR reflects Q1‘05 to Q1‘08 average retail balances. HH market share based on Claritas, Q108 based on estimate 20 Balance market share based on FDIC Summary of Deposits, Q108 based on estimate Both market shares based on BAC retail footprint

- 21. Deposits Managing for Growth and Profitability BAC Deposits Growth vs. Industry (Proforma) 10.8% 10.1% BAC Industry Fed Funds Rate 7.0% 6.1% 5.8% 4.6% 3.0% 2.3% 1.0% 0.9% 1.2% -0.7% 2004 2005 2006 2007 4Q07 1Q08 BAC growth vs. Industry is based on data from the Federal Reserve. 21 Proforma for MBNA

- 22. Deposits Continuing Success in Revenue and Earnings (in billions) Earnings for GCSBB Deposits Fee Income C AGR CAG R 8.5% 11.6% $8.2 $7.2 $2.2 $17.6 $6.5 $16.7 $1.9 $14.9 $1.6 Debit Card 11.3% Service Charges CAGR $8.4 $7.7 $6.0 $6.7 $5.3 $5.0 $2.1 $0.6 $4.1 $1.6 $1.6 FY05 FY06 FY07 Q108 FY05 FY06 FY07 Q108 Revenue NIBT 22 Deposits Revenue and NIBT exclude residual net interest income

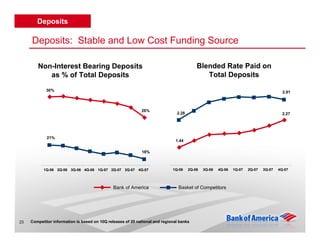

- 23. Deposits Deposits: Stable and Low Cost Funding Source Non-Interest Bearing Deposits Blended Rate Paid on as % of Total Deposits Total Deposits 30% 2.91 26% 2.28 2.27 21% 1.44 18% 1Q-06 2Q-06 3Q-06 4Q-06 1Q-07 2Q-07 3Q-07 4Q-07 1Q-06 2Q-06 3Q-06 4Q-06 1Q-07 2Q-07 3Q-07 4Q-07 Bank of America Basket of Competitors 23 Competitor information is based on 10Q releases of 20 national and regional banks

- 24. Deposits Mass Affluent: Opportunity for Future Growth Segmentation of Retail Deposit HHs 75% % of BAC HHs Share of Deposits Wallet 75% • Mass affluent customers account for 23% of deposit 43% households. • They hold more than $500 billion 20% off-us deposits. 10% 13% 10% 1% <$100K $100K-500K $500K - $3MM $3MM+ Household Investable Assets Based on internal data and analysis of off-us deposits as of June 2007 Retail Deposits based on FDIC-insured; Money funds and non-insured portion of Jumbo CDs not 24 included Consumer deposits only, excludes small business products and households.

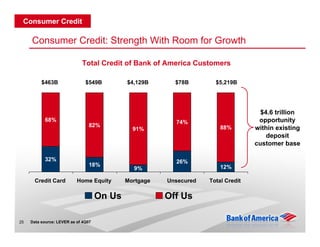

- 25. Consumer Credit Consumer Credit: Strength With Room for Growth Total Credit of Bank of America Customers $463B $549B $4,129B $78B $5,219B $4.6 trillion 68% 74% opportunity 82% 91% 88% within existing deposit customer base 32% 26% 18% 12% 9% Credit Card Home Equity Mortgage Unsecured Total Credit On Us Off Us 25 Data source: LEVER as of 4Q07

- 26. Consumer Credit Credit Card Business Positioned to Grow • World class products • Broader distribution capabilities • Affinity marketing 26

- 27. Consumer Credit Superior Product Suite Non Rewards Rewards Customer Affluent Offerings Teachers Special Interest Sports 27 Alumni

- 28. Consumer Credit Affinity Partnerships Are Growing • New products, distribution and marketing create new growth opportunities with longstanding partners • Affinity portfolio continues to demonstrate superior credit quality Launch Recent Success NEA 1983 41% consumer loan growth since 2005 27% increase in new card acquisition over 2006 Ducks Unlimited 1986 20% card loan growth Tripled new account acquisition year-over-year GMAC 2004 49% card loan growth 43% increase in new card accounts 28

- 29. Consumer Credit Affinity Banking: A Growing New Distribution Channel • 20% of all new deposit accounts are affinity related • More than 160 signed groups representing more than 120 million names • Launched 125 groups, including – All 30 MLB teams – NFL brand and 4 teams – NASCAR and 9 drivers – Habitat for Humanity • Endorsed products include credit card, checking, debit, money market, CD and savings 29

- 30. Consumer Credit Leveraging Channel Diversity to Balance Growth and Profitability 18% $300 16% $250 14% 12% 10.5% 9.9% $200 10% 9.6% $150 8% 7.1% 5.7% 6% $100 3.9% 4% $50 2% 0% $0 Stores/Online Customer Direct Affinity/Cobrand Mail Direct Mail Yr2 NCL 5 Yr Avg RAM Cost to Acquire (Pre-Tax) 30

- 31. Consumer Credit Consumer Real Estate • Cornerstone relationship products • Direct to Consumer approach • Countrywide SHOW SUCCESS OF BUSINESS 31

- 32. Consumer Credit Mortgage: Growing Relationship Share Percentage of BAC deposit customers BAC direct-to-consumer market share who originate mortgages with us 15% 15% 14% 8% 8% 7% 11% 6% 6% 10% 5% 9% 3Q06 4Q06 1Q07 2Q07 3Q07 4Q07 3Q06 4Q06 1Q07 2Q07 3Q07 4Q07 Purchase mortgages only 32

- 33. Consumer Credit Countrywide SHOW SUCCESS OF BUSINESS 33

- 34. Positioned for Success • Differentiators – Strong balance sheet and liquidity – Unparalleled distribution – Leading positions in key products – Diverse income sources – Most recognized brand • Managing near-term challenges – Economic pressure – Housing market • Solid business trends: deposits and consumer lending • Investing in growth opportunities – Deposits and debit card – Consumer lending – Distribution network – Mass affluent segment and affinity banking 34